South America has a lot of sun and a lot of space, and solar energy has grown from a small player to the main driver of generation growth in several countries in the region (making their already clean grids even cleaner). Today we look at the grids of Chile, Brazil, and Colombia, all of which have already made solar a cornerstone of their generation or are working to do so in the near future.

Just as with EV adoption, photovoltaic solar deployment varies greatly in South America: some countries have just started deploying it, while others have made it a core part of their systems for nearly a decade. But all (or at least most) are advancing rapidly towards its massive deployment. Chile is the main player in the region as far as solar goes, so we will start with its latest mega-project: the Kimal-Lo Aguirre HVDC line.

Chile to build 1,350 km Kimal–Lo Aguirre HVDC transmission line, the third one on the continent

Chile’s history with photovoltaic solar generation started back in 2013, when the first 8 MW were installed. Thanks to government support, this number rose quickly, surpassing 1 GW (1000 MW) in 2016 and reaching an impressive 9.3 GW in 2023! Another 4 GW are expected to be deployed in 2024.

Currently, solar generation accounts for 27% of Chile’s total nominal capacity, and thanks to its sunny nature, it accounted for 19% of the 83,600 GWh of electricity generated through 2023. This was also the first year that Chile’s renewable generation (solar + hydro + wind) surpassed all fossil fuel generation.

Due to the speed of solar PV deployment and the particular geography of the country (with most solar resources located in the desert north), Chile is at a crossroad. It’s losing a lot of energy in the sunniest portion of the day because the grid is no longer able to transport the amount of electricity being produced, and yet, it’s deploying even more solar generation in the years to come. To solve this, the government decided to build the first high-voltage direct current (HVDC) transmission line on the continent outside of Brazil: the 1,350 km long Kimal–Lo Aguirre Line, which is expected to be online by 2029.

Solar and wind deployment are increasing, and Chile started taking storage seriously in 2022 (with 3,000 MWh planned by the end of 2024), so it’s expected that by the time this line is completed, the large majority of fossil fuel generation — if not all — will go offline.

Brazil’s solar investments accelerate, expecting to reach 25% of generation capacity in late 2024

Brazil commands the largest generation capacity in the whole region: nearly 200 GW. But the surprising thing is that this is a nearly completely clean grid, with renewable generation accounting for 85% of this capacity! Hydroelectric generation is dominant, but solar and wind have grown rapidly and biomass remains a significant source as well.

(This means an EV in Brazil will make an oversized impact in emissions. Good thing the market is booming!).

The country is a regional juggernaut, but even accounting for its size, its position worldwide regarding solar deployment is impressive. Globally, Brazil has the sixth most solar energy deployed in total (37 GW), and the fourth most deployed in 2023 (12 GW), only behind the US, Germany, and China. By 2024, it’s expected that another 8 GW will be added, reaching 45 GW, or nearly 20% of the country’s total generation capacity.

Over 100 GW of capacity will start construction in the following years, but there’s no precise information on when that capacity will come online. What we know for sure is that at this point, Brazil is not too far from 100% renewable generation, and as solar prices come down, deployment should accelerate even more.

Brazil already has two operational HVDC lines (the only ones in the continent until Chile’s Kimal–Lo Aguirre is finished), so it should be able to build the infrastructure to transport cheap solar energy from the sunny center of the country to the populated south and southeast.

Colombia’s energy auction ends up with solar PV gaining 99% of generation

Colombia’s geography is a paradise of high mountains and steep slopes, a curse and a blessing that has made the country highly dependent on hydroelectric generation. For the last few decades, every time there’s been a drought because of El Niño (a climatic phenomenon that causes higher rains in Peru and Ecuador, and lower in Colombia and Panama), the country has been near a blackout, but none has actually materialized after the ones that happened in 1992.

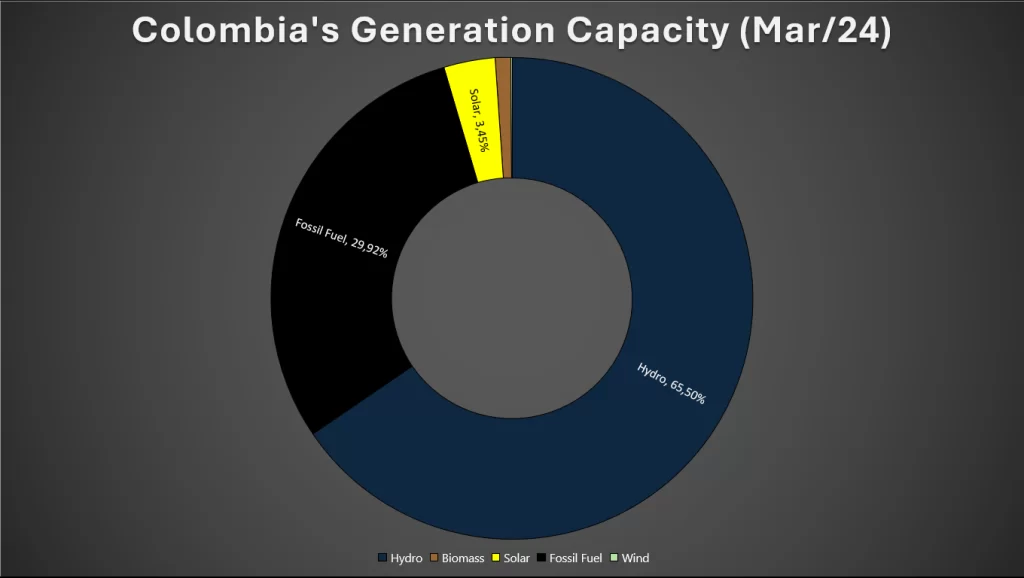

In order to deal with the risk of blackouts, the Colombian government has created a system of “dependable” thermal generation that’s only used to guarantee enough water during the dry season. This is why, unlike most other countries, thermal generation plants have very low capacity factors and normally amount for less than 20% of total generation despite being nearly 30% of the installed capacity.

Now, this “dependable” system is based upon energy auctions, done every two years on average, and ever since the 2019 auction, solar PV (and to a lesser degree wind) has started to increase in importance, winning 99% of all energy auctioned in the latest one! (That was February 2024.) To be clear, this is a free market environment where solar has been making inroads thanks mainly to its low prices.

Now, unlike Chile and Brazil, Colombia is a latecomer to solar energy, with only 9 MW deployed prior to 2019. Solar deployment was delayed during the pandemic, amounting to only 700 MW (cumulative) last month, but the auctioned farms are still being built and expected to come online in three years at most.

Just as with the vehicle market, Colombia’s grid is minuscule for a country its size (probably due to most of the population not needing AC): only 17.8 GW of generation capacity is currently available in the country, and wind energy, despite large projects being built, is basically non-existent for now:

Despite its capacity being only half of Chile’s, Colombia did manage to generate nearly as much energy as Chile did in 2023: 80.6 GWh, 77% of which was renewable. Normally it would’ve been higher, but in the second half of the year, fossil fuel generation ramped up due to the impending drought.

As of April 2024, solar generation accounts for some 6% of electricity, but due to the “dependable energy auctions” I mentioned earlier, capacity is expected to increase eightfold in the next three years. Large wind projects are also expected to come online in the following years (though licensing has been much harder for them), and it’s expected most generation should become renewable by the end of the decade, even if fossil fuel plants are kept as part of generation capacity. However, there have been recent comments regarding the unreliability of solar and the need to auction more energy to thermal generation “just in case”… because, of course, storage doesn’t exist and can never be used as an alternative, right?

Oh, and BTW, I did some quick math and I’m all but certain that if all solar energy being deployed was online today, the country would’ve been able to deal with the drought with 90% or so less fossil fuel.

The sun shines in South America

By and large, South American countries are relatively sunny, relatively sparsely populated, and relatively stable, so as solar prices come down, expect solar deployments to increase dramatically even in countries that — for now — have been laggards in this transition. And with solar coming in, fossil fuels will start to go out.

Challenges will arise, of course, but I remain optimistic. Storage is getting cheaper (and that solves most of the issues), and South American countries are heavily reliant on hydroelectric power, which can be easily ramped up and down and — as such — stands as a decent complement to solar and wind power. Uruguay is already fully renewable electricity-wise, and by 2030, I believe there will be more South American countries joining this exclusive club. What do you guys think?

Juan Diego Celemín Mojica, cleantechnica.com