The Shams 1 CSP project has three main partners – the UAE sustainable technology firm Masdar, the Spanish concentrated solar power company Abengoa Solar, and the French-energy giant Total.

The largest solar array in the Middle East will be inaugurated today in a remote corner of Abu Dhabi as the UAE takes a major step towards a renewable energy future.

Today’s opening of the Shams 1 concentrated solar power plant will mark the culmination of the largest renewable energy project in the Middle East.

Costing Dh2.2m to build, the plant in Madinat Zayed in Abu Dhabi’s Western Region, will generate 100 megawatts (MW) of clean and sustainable energy – enough to power 20,000 homes, and the biggest step so far toward’s Abu Dhabi’s goal of getting seven per cent of its energy from renewable sources by 2020.

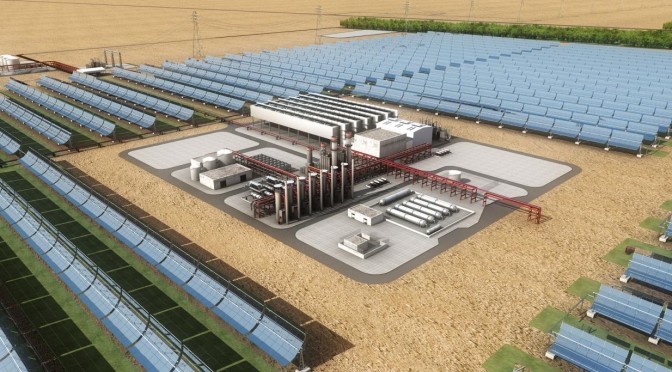

The project has been huge. Shams 1 has 258,048 parabolic trough mirrors, 192 solar collector assembly loops with eight solar collector assemblies per loop, 768 solar collector assembly units and 27, 648 absorber pipes.

But more than any of that, the plant is an integral part of Abu Dhabi’s 2030 Vision, with its goals of diversifying the region’s energy mix and building a knowledge-based economy.

“Shams 1 fits into Masdar’s goals, and Masdar fits into Abu Dhabi’s broader energy story,” said Bader Al Lamki, director of clean energy at Masdar, the Mubadala company that owns 60 per cent of the Shams Power Company.

“This country has been demonstrating leadership in supplying energy to the world for the past five to six decades.

“Hydrocarbons will diminish one day and it is important that we diversify the mix. Abu Dhabi has been a leader in this field, and we would like to continue in that role on the global stage.”

Masdar, funded through the Abu Dhabi government’s investment arm Mubadala, has a controlling 60 per cent stake in the venture, with 20 per cent each owned by Abengoa and Total.

Eighty per cent of the Dh2.2billion of funding has come from 10 banks, including five European banks, three Japanese banks and National Bank of Abu Dhabi and Union National Bank locally.

“It is a flagship project by itself, but also a reference point for more projects within this region,” said Bader Al Lamki, director of Masdar’s clean energy unit.

“There has been increased attention to renewables since we embarked on the project. It is a true demonstration of partnership, in the sense that we have implemented this on the ground with Total and Abengoa.”

According to Yousif Al Ali, general manager of Shams Power Company, Masdar, a government entity, is mandated to “develop the renewable energy sector in Abu Dhabi”.

The company, he said, is “involved in the whole value chain of the sector”.

Shams Power Company was set up as a special purpose vehicle to deliver the project. “Masdar also have an investment arm where we invest in companies who have promising technologies, and we ourselves develop technology,” he added.

Through the Masdar Institute, the company aims to continue developing local expertise in its various degree programmes.

The presence of two major energy companies has been a huge boost to the project, Mr Al Ali says. “Total have a long history and track record in the region working as a partner of Abu Dhabi and the UAE,” he said. “They have extensive experience with operation and maintenance.

“Then there is Abengoa [Solar] who are the leaders of developing [concentrated solar power, or CSP]. They are specialised people in this technology”

The company has a presence in 14 countries, having developed 26 CSP plants worldwide, and employs more than 1,200 people.

They include two commercial solar towers in Spain and one under construction in South Africa.

Abengoa designed the CSP structure at Shams 1.

The German company Schott designed and built the 27,648 absorber pipes that take the heat from the parabolic mirrors, and then feed it into the power plant.

The 258,048 mirrors themselves were sourced from another German company, Flabeg, which has been developing the technology since the 1970s.

And crucial elements came from local firms, including the fabrication of the single most expensive part of the plant – the heat transfer fluid and booster heaters that improve the efficiency of the plant’s steam turbine. “Something we are proud of in this project is that most of the contracts were given to local contractors,” Mr Al Ali said.

There is also a gas supply agreement with Adnoc, a connection agreement with Transco and a land agreement with Adfec.

The gas is used when the Abu Dhabi grid needs support at night. A small amount is also used within the operation to make the plant the most efficient concentrated solar plant in the world.

Other components include the solar steam generator from the engineering and construction firm Foster Wheeler, an air cooled condenser from GEA Group, and the steam turbine from MAN Group.

And the relationships cultivated for this project could lead to future collaborations.

Earlier this year, Jean-Marc Otero Del Val, the vice president of Total’s new-energy division, was keen to point out the trust developing between his company and Masdar.

“We have developed trust between the two organisations,” he said.

“Both Masdar and Total have agreed to deepen their relationship and explore other avenues of cooperation in the UAE and outside the UAE.”

Total has been a presence in the region since 1939, and has been examining solar power technology for 25 years.

It owns a 60 per cent share of the American renewables company SunPower, and said it is now the world’s third largest solar energy operator.

And not least, the UAE government has a major part to play in the future success of Shams 1, providing a green payment scheme to Shams to supplement the payment of electricity by Abu Dhabi Water and Electricity Authority to buy the energy produced.

The UAE is currently the world’s third-largest oil exporter, and is heavily reliant on burning gas to produce its own energy. With an expanding population, demand for that electricity is likely to continue to rise.

When fully operational, the plant, spanning 2.5 square kilometres, will displace a CO2 equivalent to planting 1.5 million trees, or taking about 15,000 cars off the road.

And the marketplace is becoming far more open to this kind of venture, despite its higher initial costs.

“We’ve seen renewables achieving great parity in this region and across the world,” said Mr Al Lamki. “This is a sector that is going to grow with time. Costs are decreasing and the value proposition is not just driven by cost, but also driven by the opportunity itself.

There are significant long-term economic benefits to investing in such technology. “By increasing the penetration of renewables, you can reduce the amount of exposure to imported fuels, be it liquid hydrocarbons or gas, and by doing so the business case is becoming more attractive because you avoid importing at market price.”

But there is much further to go. To meet the 7 per cent target would take 15 CSP plants like Shams 1.

And renewable is just part of the story. By 2020, about a quarter of the country’s energy is expected come from nuclear power.

“In Abu Dhabi we will have an energy mix, we’ll have the concentrated solar power part – Shams 1 – and we can also execute photovoltaic projects and we are studying the potential for wind projects as well,” said Yousif Ali, general manager of Shams Power Company.

He explained that this plant is one of the biggest solar thermal plants in the world. “Shams 1 is part of Abu Dhabi’s renewables target for 2020. This is the first commercial plant to contribute to this figure.

“CSP plants are not as simple as wind turbines or photovoltaic technology. It’s a very complex project – it’s not easy to build a plant like this, that’s why it has taken this long.”

In the future Masdar is keen to undertake new challenges, not just in the UAE, but also across the globe.

“Masdar are part of the Valle 1 and 2 projects in Spain, we are also a partner in the London Array, the biggest wind farm in the world, which will start operations soon.

“We are building a wind farm in the Seychelles, and are ready to complete a 15MW photovoltaic project in Mauritania.”

“In the UAE Shams 2 and 3 are still under feasibility studies. We are analysing different technology – the market is changing but we always try to get the best for Abu Dhabi,” Mr Ali added.

Mr Al Lamki said Masdar’s aims are becoming reality.

“The 2030 vision is actually being implemented, and the reasons for it are starting to become more evident by virtue of our projects on the ground, and in human capital.

“Local people have taken an interest in the sector and now have become experts.”

It caps a year that has seen membership of the industry’s solar trade body double on a rising tide of investment in renewables.

The Shams-1 concentrated solar plant (CSP) now feeds 100 megawatts of green electricity into the grid, generated by its huge curved mirrors that cover 2.5 square kilometres of desert near the town of Madinat Zayed.

It is the first in a series of renewable energy projects that will produce 7 per cent of Abu Dhabi’s electricity by 2020, according to government plans.

“The project represents the first major step in diversifying the UAE’s energy supply – extending the life of the UAE’s hydrocarbon resources and supporting our long-term energy and economic security,” said Sultan Al Jaber, the chief executive of Masdar, the Mubadala unit that holds a controlling stake in Shams-1.

The plant is a joint venture between Masdar, the French oil company Total and the Spanish solar player Abengoa. It will produce enough power to supply 20,000 homes in the emirate and will be followed by Noor-1, a 100MW photovoltaic plant.

Noor is currently in the so-called value engineering stage, where Masdar is negotiating costs with bidders. Once an agreement has been struck, it will be submitted to the Executive Council for approval.

Photovoltaic plants are cheaper and quicker to construct, whereas CSP plants deliver a more stable and sustained flow of electricity. The Executive Council is also deciding on a 30MW Masdar wind farm project in Sir Bani Yas.

Shams heralds a solar push across the Middle East.

Dubai has followed Abu Dhabi’s lead with plans to produce 1,000MW in the Mohammed bin Rashid Al Maktoum Solar Park by 2030. Saudi Arabia, meanwhile, is gearing up for a massive solar programme that aims for 41 gigawatts of generation capacity by 2032. The tenders for the first few hundred megawatts of the programme are imminent, according to industry sources.

Morocco has awarded the first contracts for the 500MW Ouarzazate complex, as Rabat targets 6,000MW of renewable energy by 2020. Jordan and Oman also have solar ambitions.

The growth of solar power in the region will benefit the UAE, said Vahid Fotuhi, the president of the Emirates Solar Industry Association (Esia).

“The UAE is becoming a bit of a hub for the solar industry in the Gulf,” he said, pointing out that Esia membership had doubled to 100 companies in the last year.

Economies will over time also benefit from increasing local content of solar arrays. Oil and gas producing countries will be able to export a greater share of their production, as fewer fossil fuels are burned in conventional power plants, adds Mr Fotuhi.

Masdar is an active investor abroad. The company now has stakes in about 9 per cent of global CSP solar power generation, according to figures by Bloomberg New Energy Finance, as Masdar is a minority partner in the TerraSol Energy joint venture that generates 120MW in Spain.

The Mubadala unit has also invested in the London Array, the world’s largest offshore windfarm, and has renewable energy projects in Mauritania and the Seychelles.

Its partnership with Total, which holds a 20 per cent stake in Shams, could be a recurrent feature in Masdar’s growth plans.

“We have developed trust between the two organisations,” Jean-Marc Otero del Val, vice president at Total’s new energy division, told The National in January. “Both Masdar and Total he agreed to deepen their relationship and explore other avenues of cooperation in the UAE and outside the UAE.”