GE unit GE Energy Financial Services is continuing its expansion into the Japanese solar photovoltaic (PV) market.

GE Energy Financial Services is continuing its expansion into the Japanese renewable energy power market, completing its second solar project financing transaction with Pacifico Energy, a Tokyo-based utility-scale solar project developer and subsidiary of Virginia Solar Group. GE Energy Financial Services invested alongside Virginia Solar Group in Mimasaka Musashi, a 42-megawatt (DC) photovoltaic solar power project under construction in the prefecture of Okayama. Financing for the project was completed on a non–recourse project finance basis and was supported by a JPY ¥13 billion credit facility from the Bank of Tokyo–Mitsubishi UFJ and Chugoku Bank. Additional financial details were not disclosed.

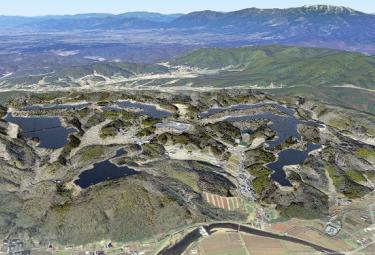

Located on the site of a former golf course, Mimasaka is expected to reach commercial operations in the third quarter of 2016 and sell its power to Chugoku Electric through a 20-year power purchase agreement at a fixed tariff rate. Pacifico Energy is managing construction and operations, Toyo Engineering Corporation is the construction company on the project, and photovoltaic panels and inverters are supplied by Yingli Green Energy and TMEIC, a Toshiba and Mitsubishi joint venture.

Japan’s regulatory policies and feed-in tariff attract investments in solar power, which support the country’s efforts towards achieving a diversified power mix. Sushil Verma, a managing director and Japan business leader at GE Energy Financial Services said: “We are committed to building a long-term relationship with Pacifico Energy and helping Japan meet its renewable energy targets.”

Nate Franklin, partner at Virginia Solar Group added, “We are excited about partnering again with GE on a second project. This investment helps Mimasaka achieve its goal of transforming itself into a zero emission city.” By 2020, Japan aims to have 20 percent of its power generated from renewable sources.

GE Energy Financial Services has made equity and debt investment commitments of USD $1.8 billion in more than one gigawatt of solar power projects worldwide, and plans to continue to invest over USD $1 billion annually. Mimasaka Musashi is the third Japan solar project GE Energy Financial Services has invested in this year. The company invested in Pacifico Energy’s Kumenan solar project in June, and in September GE helped finance Japan’s largest solar project, which is being built in Setouchi City.

Pacifico Energy has started construction on 75 megawatts (DC) of solar power projects in Japan in 2014 and is set to start construction in early 2015 on another 149 megawatts (DC). The company currently has 300 megawatts (DC) in the first stage of development.

Founded in 2012 to help meet Japan’s domestic energy needs, Pacifico Energy is a Japanese power plant development company focused on solar photovoltaic projects. Pacifico Energy covers all aspects of solar power plant development, including permitting, design, financing, construction, and asset management. Based in Tokyo, Pacifico Energy’s strength is in its team and investment partners consisting of professionals with deep solar industry and energy experience.

Pacifico Energy is owned by investor group Virginia Solar and affiliated with the Jamieson Group, a California based oil & gas/real estate enterprise with annual revenues of over USD $800 million.

GE Energy Financial Services—GE’s energy investing business—works as a builder, not just a banker, to help meet the world’s power and fuel needs. We offer more than money—expertise—for essential, long-lived and capital-intensive power, oil and gas infrastructure—GE’s core business. Drawing on GE’s energy technical know-how, financial strength and risk management, we see value where others don’t and take on our customers’ toughest challenges with flexible equity and debt transaction structures. Based in Stamford, Connecticut, GE Energy Financial Services holds approximately USD $16 billion in assets.