November’s COP22 climate summit of Marrakech gave climate policy fresh tailwind, after the blow of Donald Trump’s election. Even without a strong global treaty, national climate policies are multiplying?—?at least a certain type of policies. While the policy that economists often recommend?—?putting a price on greenhouse gas emissions?—?remains patchy, as a recent Worldbank report shows, subsidies for renewable energy are booming: no fewer than 145 countries support renewables today.

Germany’s Energiewende is a prominent, but not the only example: Obama’s Clean Power Plan features renewables as a centerpiece of climate policy, India’s National Solar Mission includes a 100 GW solar power target. In addition China is said to be considering a 200 GW target, and Morocco has announced the building of the largest solar power facility on the planet. Nearly half of all newly added electricity generation capacity was based on renewables. In ten countries, wind and sun deliver more than 10% of electricity consumed. These includes Denmark (43%), Portugal (24%) and Spain (23%).

Many hope that wind and solar power will eventually become economically competitive on large scale, leading the way to a global low-carbon economy. Are these hopes justified?

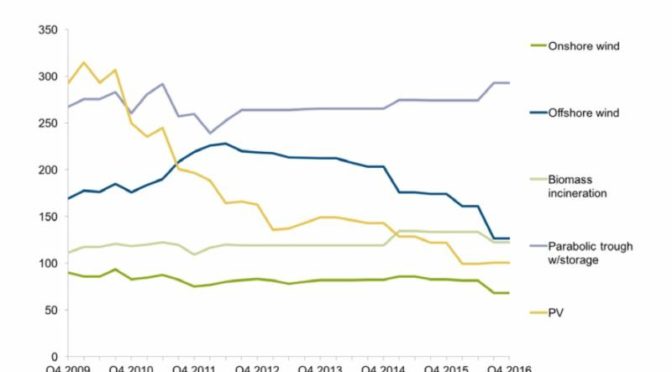

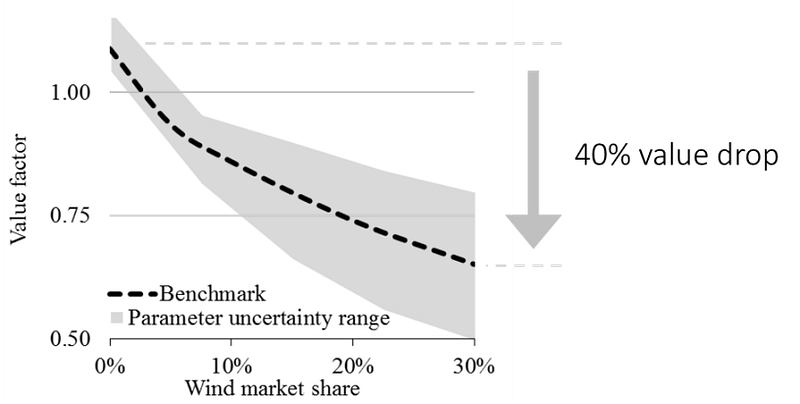

On the cost side, the economics of renewables look impressive. The costs of wind power have dropped significantly. On average, wind now generates electricity at $70–80 per Megawatt-hour (MWh) globally, as reported by the two international think tanks IRENA and IEA. Ten years ago, a roof-top solar module for a single family home cost more than $50,000?—?today it sells for less than $14,000. (America’s LBNL and Germany’s Fraunhofer ISE provide more data.) Germany, which receives less solar radiation than southern Canada, now generates solar power at $90 per MWh. The United Arab Emirates have tendered a solar power station for $58 per MWh and recent auctions in Chile, Peru and South Africa have resulted in even lower prices.

In some countries, wind and solar power are now cost-competitive with coal- and natural gas-fired power plants, even when carbon emissions are not priced. However, cost structures are very country-specific, and cost-competitiveness is not universal. Renewables tend to be cheaper where it is windy or sunny, where investors have access to low-cost finance, where fossil fuels are pricy, and where emissions are priced. In many places, however, coal-fired power plants remain the cheapest option for producing electricity, driving the renaissance of coal. Still, for renewables to have caught up with fossil plants in cost terms represents a huge success for wind and solar power.

Costs are, however, only one side of the competitiveness equation. The other is value. Merely comparing electricity generation costs between different plant types is misleading, as it ignores the fact that the economic value of electricity from different power stations is not the same. This is because on wholesale markets the price of electricity fluctuates from hour to hour (or even minute to minute). Some power plants produce electricity disproportionally at times of high prices (so called “peaking” plants), while others produce constantly at low prices (“base load” plants). This little detail has striking consequences for the economics of wind and solar power. Paul Joskow and Michael Grubb observed this a while ago.

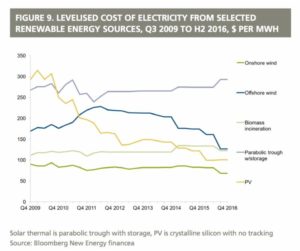

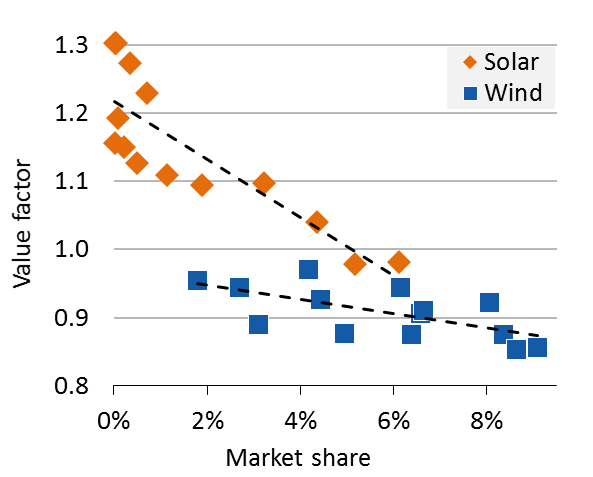

On the value side, the outlook for renewables is less rosy. For the first wind turbine built in a country, the market value of wind power, i.e. its per-MWh revenue, is about the same as that of a base load (fossil fuel) plant. Hence it is fair to compare generation costs of a wind turbine with that of a coal plant, as both produce electricity of the same economic value. The market value of wind power, however, declines as it gains market share. For example, a recent study shows that German wind-powered electricity has already become 10% less valuable than that from other generators. The reason for the value drop is simple economics: during windy hours, the excess supply of renewable-based electricity depresses the power price. This is precisely when renewables generate most electricity, disproportionally earning low prices?—?a “self-cannibalization effect”. In a sense, wind power becomes a victim of its own success.

It is worse for solar power, which has lost more than 20% of its value. The drop in value of solar is steeper, because its output is concentrated in fewer hours of the year, mostly summer mid-days.

When Cyclone Niklas passed over Europe, it brought record wind power in-feed?—?and zero or even negative electricity price across Europe’s power exchanges. At this point in time, wholesale electricity was worthless. The same had happened when Elon and Ole had passed through. When strong winds coincide with a clear sky and solar power generation is strong, prices nowadays drop to zero even during mid-day, when electricity demand is high.

In Germany, solar power currently has 6% of the market share, and wind power 14%. Computer models show that the value drop will continue as renewables keep growing. (See the excellent studies by Alan Lamont, and Andrew Mills and Ryan Wiser, among others.) We estimate that if wind power supplies a third of all electricity, each MWh produced by wind turbines will be worth around 40% less than that of the first wind turbine. The value drop is a general phenomenon, rather than a transitory event or a German special case. Neither is it the consequence of a flawed design of electricity markets.

We draw two conclusions from this analysis. First, the role of wind and solar power is likely to be smaller than some enthusiasts believe. However, we should be very clear about one point: the value drop does not imply that renewables have no future. In a recent paper on Northwestern Europe, we estimate that wind and sun will produce three times more electricity than today, even without subsidies. Decarbonizing the power system will require a suite of low-emission technologies. Pricing emissions, both greenhouse gases and local pollutants, is a good way to incentivize the transformation.

This leads to the second conclusion: more work lies ahead of us. The journey towards mainstream renewable energy is not over?—?it has just begun, and it requires continued effort and ingenuity. Competitive large-scale renewables deployment not only depends on further lowering of generation costs, but also on transforming the entire power system. A flexible power system cannot prevent the value drop, but it can help to mitigate it. Long-distance power lines and electricity storage play a role, but don’t hope for Tesla’s Powerwall which is still far too expensive to solve the issue. Other options are likely to be more important in the coming decades: harvesting hydro power flexibility; making existing power plants more flexible; and constructing wind turbines that produce more constant electricity.

Lion Hirth

Lion Hirth, Neon Neue Energieökonomik

Dr. Lion Hirth is an energy economist and expert in the economics of wind and solar power, power market modelling, and balancing markets. The new energy landscape requires new ways of analysis and consulting and Lion is providing such services, based on big data and sound economics.