Vietnam is one of the most efficient power market in Southeast Asia, driven by low-cost resources such as hydro and coal. The country has achieved almost 99 percent electrification with relatively low cost in comparison to neighboring countries, leading it to be a net energy exporter. With energy demand projected to increase by more than 10 percent annually in the next five years and required power capacity to double; the government is moving forward to develop the renewable energy sources to ensure energy security and addressing the growing power demand.

RELATED: Pre-Investment, Market Entry Strategy Advisory Services from Dezan Shira & Associates

RELATED: Pre-Investment, Market Entry Strategy Advisory Services from Dezan Shira & Associates

Current supply and future demand

Supply

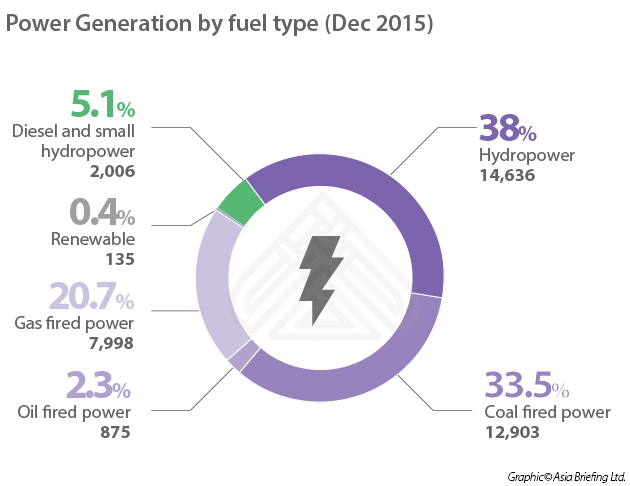

Energy sources are diverse in Vietnam, ranging from coal, oil, natural gas, hydropower, and renewable energy. According to the 2016 Vietnam Electricity Annual Report, hydropower and coal fired power led amongst the power generation sources. Renewable energy, which includes wind, biomass, and solar accounted for less than half a percent of power generated in the country.

Demand

With growing industrialization and modernizing of the economy, energy demand is predicted to increase by over 10 percent annually during 2016-2020 and by eight percent per annum during 2021-2030. Electricity consumption is projected to increase four-fold by 2030 compared to 2014.

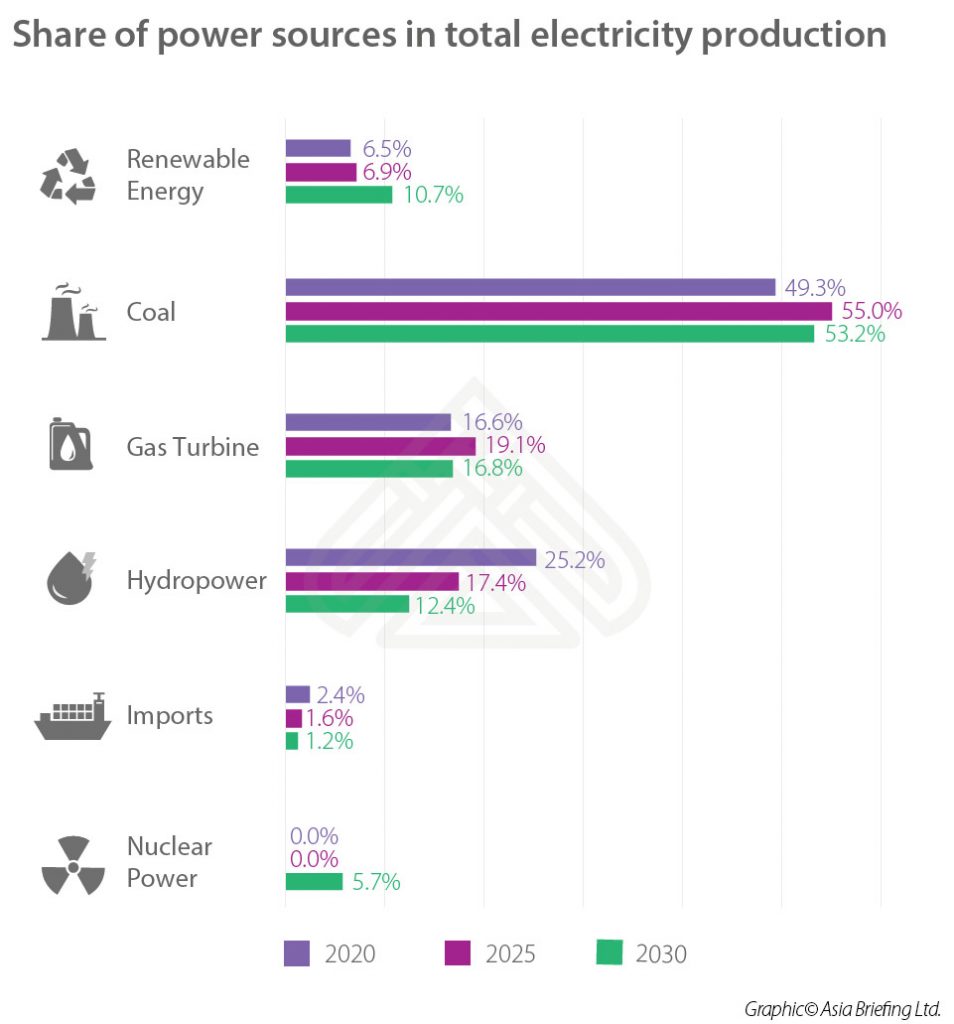

In the short term, coal and hydro will continue to be major sources of electricity but under the government’s Power Development Plan, share of nuclear energy and renewable energy especially solar and wind will be increased in total electricity production.

Renewable energy – current state and potential

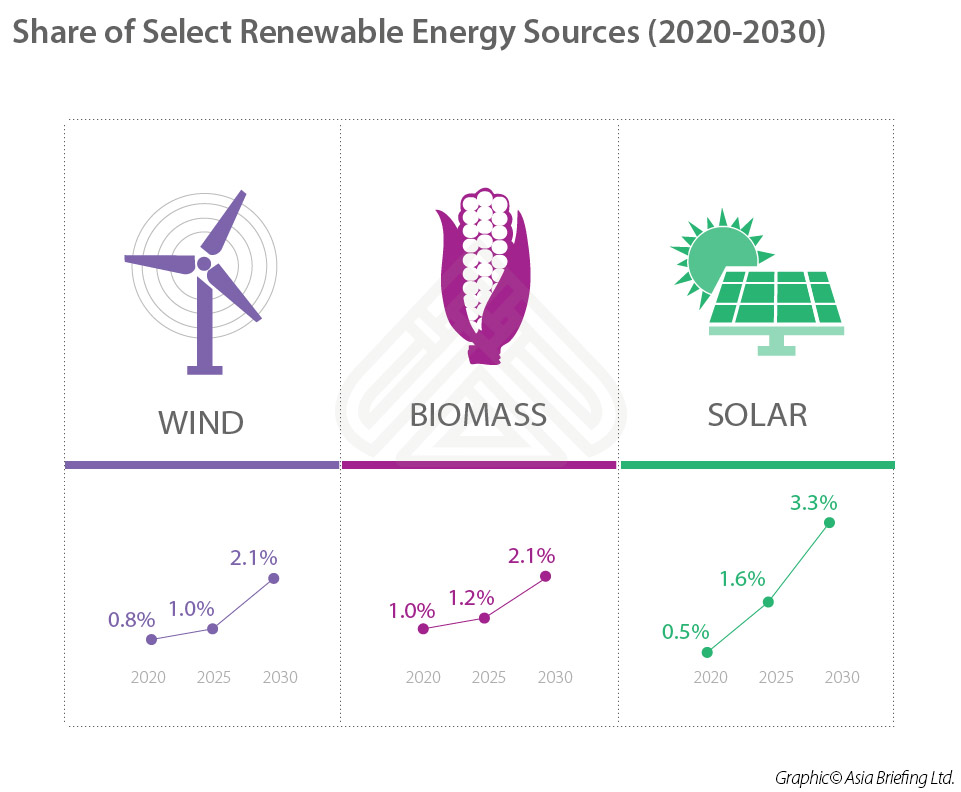

At present, hydropower holds the largest share amongst all renewable energy sources, followed by wind and biomass. Solar energy, biogas, and waste-to-energy technologies are picking up slowly while geothermal energy and tidal energy are in a very early stage. In the government’s recently revised Power Development Plans, the government has laid out their goals for the renewable energy until 2030.

Current state and potential

- Small Hydro – Small Hydropower projects account for 1914 MW of total energy with a potential of further 7,000 MW.

- Wind Energy – At present, wind energy provides 146 MW of energy with a total potential of 8,000 MW for areas with wind of >=6m/s. For winds below 6m/s, the energy potential is much larger.

- Biomass – Total biomass potential stands at 2000 MW, with current installed capacity accounting for 352 MW.

- Solid wastes – Solid wastes have a potential of 320 MW, but energy generated currently from solid wastes is at a nascent stage, accounting for a mere 2.4 MW.

- Solar – Solar energy has a potential of 4-5 kWh/m2, depending on the area allocated for solar panels. Currently, only four MW is generated by households and pilot projects.

- Geothermal – There are over 300 hot mineral water resources with the potential of generating 200 MW of power.

RELATED: Vietnam’s Solar Power Policy

Recent Investments

Private sector investments continue to rise steadily in the electricity market. Most of the investments are in the form of build-operate-transfer projects (BOT), where a foreign investor builds a power generation project, operates it for a period, and then transfers it to the Vietnamese government. There is no restriction on foreign ownership for such projects. With continued liberalization of policies, Vietnam has seen a steady increase in foreign investment in power projects. The total capacity of foreign-invested power producers accounted for 2,800 megawatts in 2015.

In one of the most recent investments, General Electric (GE), Mainstream Renewable Power, and Phu Cuong Group are working together on a 800 MW wind farm in the Soc Trang province. The agreement worth up to $2 billion was signed in early June 2017. Other recent investors include US based AES Corporations, Vietnamese firm Xuan Thien Daklak, Long Thanh Infrastructure Development and Investment Company, Japanese firm Fujiwara, and South Korea’s Solar Park Global investing in renewable energy projects worth US$45 million to US$ 2.2 billion.

Barriers to development

Although the foreign and domestic investment is on the rise in the renewable energy sector, much more needs to be done. In spite of the liberalization of the policies in the last few years, investors are facing numerous obstacles such as:

- Lack of sufficient funding

- Low tariffs coupled with high investment costs in newer technologies

- Lack of qualified human resources

- Underdeveloped supporting industries

Regulatory Framework

In 2016, the government approved the Revised National Power Development Master Plan for the 2011- 2020 Period, with a vision for 2030. The plan aims to increase the share of renewable energy to around seven percent in 2020 and above 10 percent in 2030 and reduce the use of imported coal-fired electricity to ensure energy security, climate change mitigation, environmental protection, and sustainable socio-economic development.

Until 2020, 2025, and 2030, the government aims to increase the power plants capacity to 60,000 MW, 96,500 MW, and 129,500 MW respectively.

Feed in tariffs

Feed-in-tariffs in Vietnam is one of the lowest in the world. Electricity of Vietnam (EVN) purchases all power from renewable projects. Tariff is currently set for biomass, wind, waste-to-energy, and solar projects.

- Wind – VND equivalent of 7.8 US cents/kWh

- Solid waste-to-energy – VND equivalent of 7.28 US cents/kWh to 10.05 US cents/kWh

- Solar – VND equivalent of 9.35 US cents/kWh

- Biomass – VND equivalent of 7.34 US cents/kWh to 7.55 US cents/kWh

- Small hydropower (below 30 MW) – Avoided cost tariff is set at around 5 US cents/kWh, depending on season and daily peaks.

Investment Considerations

Vietnam would be requiring around USD 8 billion/year until 2020 and USD 10.8 billion/year from 2021 to 2030 for grid expansion (excluding BOT) and development of power sources. With such high capital requirements, the government has allowed 100 percent foreign ownership of Vietnamese companies in the energy sector. Foreign investors can choose among permitted investment forms; 100 percent foreign invested company, joint venture or public private partnership (“PPP”) in the form of BOT contract. With low feed-in-tariffs and high production costs, PPP is the most effective means of entering the market to minimize risks.

Renewable energy projects benefit from import duty exemption for imported goods to establish fixed assets, materials, and semi-finished products. Tax holidays are applicable in the case of corporate tax, which is 0 percent for the first four years, followed by a 50 percent reduction in the next nine years. Financial incentives also include preferential credit loans, land use, and fees for environmental protection activities.

To ensure consistent returns for investors, the government has also approved electricity prices (avoided-cost tariffs, Feed-in Tariff) for on-grid renewable energy, including standardized power purchase contracts (20 years) for each renewable power type. EVN, the sole buyer of electricity in Vietnam has also been mandated to prioritize renewable energy in grid connection, dispatch, and purchasing electricity at approved tariffs.

Recommendations

Vietnam has immense potential for wind and solar-based projects and is sufficient enough to address the growing power demands. However, low feed-in-tariffs (FIT) have deterred foreign investors due to large investment costs. For project to be feasible, investors believe FIT should be increased to 10.4 US cent/kWh for wind projects and 15 US cent/ kWh for solar power. Apart from FIT’s, negotiating standard power purchasing agreements (PPA) with EVN, the sole buyer of power is time-consuming, which leads to an increase in the total project costs. PPA negotiations have to be more efficient to reduce overall costs to investors due to delays. In addition, relevant government authorities should reduce timeline in formulation of guidelines and regulatory approvals, which in some cases has been years. Lack of clarity and delays in approvals often leads to execution delays or complete abandonment of projects.

Additionally, quality and sourcing of data for renewable energy sub-sectors has to improve to ensure clarity for investors about available locations, infrastructure capabilities, and government’s targets. As the renewable energy sector picks up pace in the coming decade, the government should continue to focus on developing the human resource capability. In the last few years, EVN has been conducting various training programs for technical experts, typically for power plants and similar training should be introduced for the renewable energy sub-sectors as well, in order to meet up with new requirements.

Last but not the least, supporting industries plays a crucial role in development and quicker adoption of renewable energy technologies. The government should promote domestic SMEs through capital subsidy and incentives such as tax breaks and preferential loans. A competitive supporting industry will help in reducing the tariff and investment costs for renewable projects, which are cost-intensive.

About Us Vietnam Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Eurasia, including ASEAN, China, India, Indonesia, Russia & the Silk Road. For editorial matters please contact us here and for a complimentary subscription to our products, please click here. Dezan Shira & Associates provide business intelligence, due diligence, legal, tax and advisory services throughout the Vietnam and the Asian region. We maintain offices in Hanoi and Ho Chi Minh City, as well as throughout China, South-East Asia, India, and Russia. For assistance with investments into Vietnam please contact us at vietnam@dezshira.com or visit us at www.dezshira.com |

By: Dezan Shira & Associates

Editor: Koushan Das