GE announced an agreement with the Powering Australian Renewables Fund (PARF) to supply and install 123 wind turbines for the Coopers Gap wind farm project at Cooranga North, 250 kilometres north-west of Brisbane. PARF is a partnership between AGL Energy Limited (AGL) (20 percent) and Queensland Investment Corporation (QIC) (80 percent, on behalf of clients the Future Fund and the QIC Global Infrastructure Fund).

Upon completion in 2019, the 453 MW wind farm will produce approximately 1,510,000 MWh of renewable energy annually – enough to power the equivalent of more than 260,000 average Australian homes and reduce CO2 emissions by 1,180,000 tonnes each year.

Coopers Gap Wind Farm is a landmark project for GE. It will be the largest wind farm in the country on completion, and GE’s first wind project in Queensland. It is the second major renewables project that GE and AGL have announced this year, following the Silverton Wind Farm in western New South Wales.

Geoff Culbert, President & CEO, GE Australia, New Zealand & Papua New Guinea, said: “We are proud to be working with AGL to support Australia’s transition to a cleaner, modern energy system.

“AGL’s commitment to a lower emissions future is clear. The company announced earlier this year it would ramp up investment in renewable energy and decarbonise its generation by 2050. This wind farm represents a significant step towards that goal and we are proud to be a part of that,” he said.

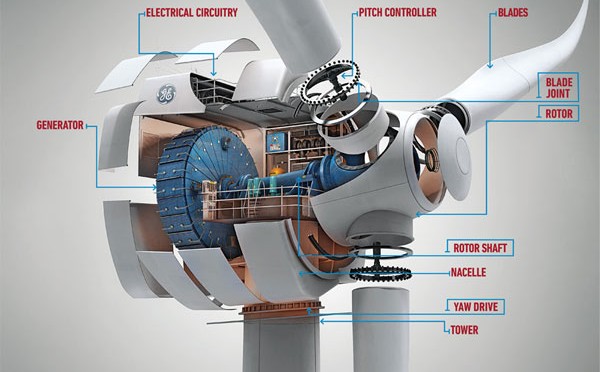

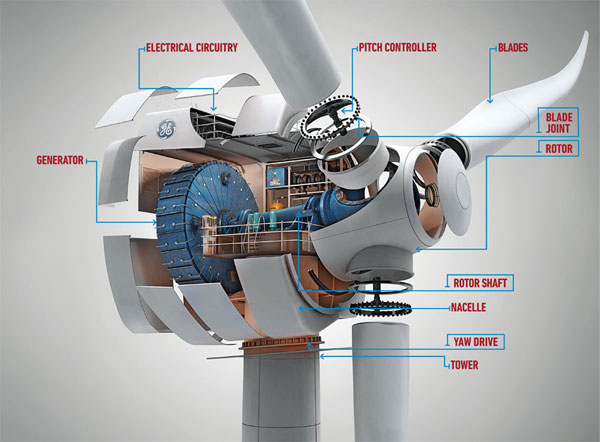

GE will deliver 91 of its 3.6 MW turbines with 137m rotors, and 32 of its 3.8 MW turbines with 130m rotors. GE will also undertake a 25-year full service agreement to maintain the windfarm over its lifetime.

AGL Managing Director & CEO, Andy Vesey, said: “More than 800 MW of projects have now been vended into PARF in its first 12 months of operation, following the earlier transactions involving the Silverton wind farm project and Nyngan and Broken Hill solar plants in New South Wales. The strong support we have received from our equity partners and lenders for these projects is testament to the readiness of the private sector to invest in Australia’s energy transformation.

“Certainty on energy policy, including the implementation of the recommendations of the Finkel Review, will enable more projects of this kind to go ahead and help place downward pressure on energy prices by increasing supply,” he said.

The project is expected to create up to 200 jobs during the peak of construction, and an additional 20 ongoing operational jobs. The construction firm CATCON will be responsible for the wind farm’s construction.

Pete McCabe, President & CEO of GE Renewable Energy’s Onshore Wind business, said: “Australia is a great market for wind. After the US, it is GE’s second largest region globally for renewable energy. While we see lots of opportunities in Australia, we need to continue to have policy certainty to drive investment.”

The Coopers Gap development is GE’s fifth wind farm project to begin construction in Australia in 2017. On completion in 2019, GE will be responsible for a fleet of wind turbines with a capacity of almost 1.4 GW.

GE Renewable Energy is a $10 billion start-up that brings together one of the broadest product and service portfolios of the renewable energy industry. Combining onshore and offshore wind, hydro and innovative technologies such as concentrated solar power and more recently turbine blades, GE Renewable Energy has installed more than 400+ gigawatts capacity globally to make the world work better and cleaner. With more than 22,000 employees present in more than 55 countries, GE Renewable Energy is backed by the resources of the world’s first digital industrial company. Our goal is to demonstrate to the rest of the world that nobody should ever have to choose between affordable, reliable, and sustainable energy.

AGL is committed to helping shape a sustainable energy future for Australia. We operate the country’s largest electricity generation portfolio, we’re its largest ASX-listed investor in renewable energy, and we have more than 3.6 million customer accounts. Proudly Australian, with more than 180 years of experience, we have a responsibility to provide sustainable, secure and affordable energy for our customers. Our aim is to prosper in a carbon-constrained world and build customer advocacy as our industry transforms. That’s why we have committed to exiting our coal-fired generation by 2050 and why we will continue to develop innovative solutions for our customers.

QIC is a global diversified alternative investment firm offering infrastructure, real estate, private equity, liquid strategies and multi-asset investments. It is one of the largest institutional investment managers in Australia, with $82 billion (at 30 June 2017) in funds under management, offering infrastructure, real estate, private equity, liquid strategies and multi-asset investment services. QIC has over 700 employees and serves more than 110 clients including governments, pension plans, sovereign wealth funds and insurers, spanning Australia, Europe, Asia, Middle East and the US. Headquartered in Brisbane, Australia, QIC also has offices in New York, San Francisco, Los Angeles, London, Sydney, and Melbourne.

The Future Fund is Australia’s sovereign wealth fund, investing for the benefit of future generations of Australians. The Future Fund was established in 2006 to accumulate financial assets to offset the Australian Government’s unfunded superannuation liability from 2020. The role of the Future Fund is to generate high, risk adjusted returns over the long-term. It operates independently from Government. As at 30 September 2016, the value of the Future Fund was $125 billion.