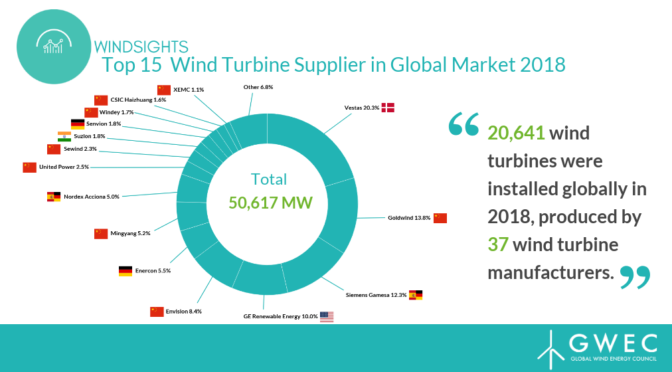

GE Renewable Energy retained fourth place by taking advantage of stronger performance in the US market, where it recaptured the title as the No.1 supplier. Envision replaced Enercon in fifth place, mainly due to its strong growth in China and the sharp drop of installations in Enercon’s domestic German market in 2018.

Chinese suppliers Mingyang, United Power and Sewind moved up to seventh, ninth and tenth respectively, which can be largely attributed to stable performances in their home markets. Suzlon dropped out of the top 10 turbine supplier ranking in 2018, primarily a result of reduced installations, by up to one third, in its home market of India.

Senvion fell three positions to 12th, with new installations in Germany in 2018 halving compared to the previous year. Chinese suppliers CSIC Haizhuang and XEMC remained in the top 15, however both of them lost market share in 2018.

The report is being published as part of GWEC’s new Market Intelligence service and is the update of FTI Consulting’s Global Wind Market Update – Supply Side Analysis that FTI Intelligence granted GWEC the Intellectual Property Rights on 3 April 2019.

The full report is exclusively available for GWEC members and is available in the Market Intelligence Members Area on the GWEC website. The final report includes more than 30 tables and figures charting the evolution of global wind power markets on the supply side.

Appendix:

Top 15 wind turbine suppliers in annual global market in 2018:

- Vestas

- Goldwind

- Siemens Gamesa

- GE Renewable

- Envision

- Enercon

- Mingyang,

- Nordex Acciona

- United Power

- Sewind

- Suzlon

- Senvion

- Windey

- CSIC Haizhuang

- XEMC