Offshore wind energy is now contributing more and more to the growth of the wind industry and the energy transition globally. Since 2013, the wind turbines market has grown by an average of 21% each year, with more than 4 GW of new wind farm capacity installed each year in 2017 and 2018, making up 8% of the total new installations during both years. Based on GWEC’s Market Outlook, the share of the new offshore wind power capacity will increase to 10% and higher going forward, with Global Wind Energy Council Market Intelligence expecting more than 6 to 8GW of new capacity to be installed each year.

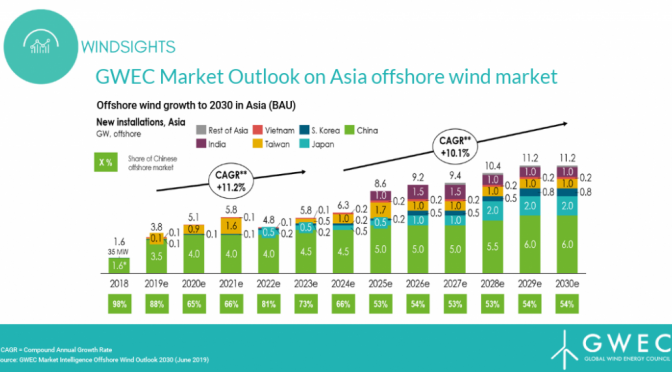

While much of the current installations are coming from mature markets such as Europe, where there were 18 GW installed capacity by the end of 2018, most of the new growth will come from emerging markets. Asia is set to become a leader in offshore wind, with 100 GW of offshore capacity to be installed until 2030. China will make up most of this capacity, even taking over the leading position from Europe, while other Asian markets such as Taiwan, Japan, South Korea and India will also become increasingly important in the coming years.

It is clear

that markets across the world are now opening their eyes to the huge

business and investment opportunities that offshore wind can offer,

creating thousands of jobs and helping to contribute to their climate

goals in the process. The industry is continuing to make significant

strides on cost-competitiveness, with an average LCOE of $50/MWh being

within reach.

On top of this, floating offshore wind is becoming more

and more cost-competitive with pilot projects being developed globally.

This will be a game-changing technological development that can add

even more capacity in the years to come. Combined with, GWEC’s

expectations that the government of existing offshore markets will

increase their targets and volumes towards 2030 means that offshore wind

growth shows no signs of slowing down with GWEC Market Intelligence

forecasting an upside scenario of over 220GW by 2030.

To take the offshore wind market global and to support the creation of a global offshore wind energy industry, it is crucial that governments and investors show long term commitment. This will be necessary so that we can continue to reduce costs across all areas such as technology, financing, and project planning using the experience of mature markets such as Europe.

Although there is no “copy and paste” solution for opening a new offshore wind market, we can learn from how other markets overcame their own challenges and consider this within the unique context of an emerging market. This is especially relevant when setting up a supply chain, as it is essential to carefully evaluate the existing industry footprint in a market for the cheapest and most efficient solution. Regional solutions such as in Europe have proven to be successful while seeking country-specific set-up requires governments to commit to high volumes over a long period of time. In every case, project developers, investors and operators must adapt to the rapidly evolving technology for the industry to create an efficient and global supply chain that can support the growth of the market.

Looking beyond 2030, Global Wind Energy Council expects that offshore wind will play a significant role in the energy transition. As more and more markets enter the offshore industry and innovative technology such as floating solutions became mainstreamed, offshore wind will only continue to become more and more cost competitive. With its large scale, offshore wind has the real opportunity to replace traditional energy sources, contributing to a global green economy.