Around the world, there is a palpable sense of urgency to accelerate the energy transition. With millions of citizens participating in the #FridaysForFuture movement and still more facing intensifying natural hazards like typhoons, droughts and hurricanes, climate change has become an indisputable condition of our modern world.

Wind and renewable energy have achieved strong progress in cost reduction and deployment so far, however their adoption has not been fast enough to slow the rate of carbon emissions. Despite the critical need to integrate renewable energy into our energy systems, challenges such as incumbent interests, regulatory frameworks and market design are holding back the growth of wind power.

Let’s explore the factors that are holding back South East Asia’s wind energy potential, and why we must urgently do everything we can to remove these obstacles for the future of the region.

1. South East Asia’s Insatiable Energy Demand

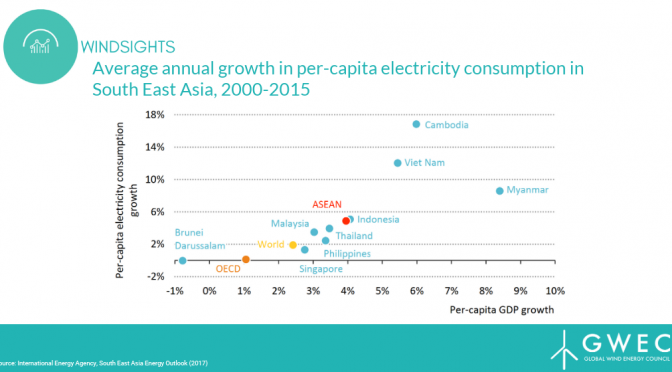

As a highly populous region of rising economic growth, South East Asia has pushed up electricity demand at an annual average rate of 6.1 per cent since 2000 – twice the world average. Power demand has roughly tripled over this period and, in particular, per-capita electricity consumption grew robustly in Cambodia, Indonesia, Myanmar and Vietnam (Figure 1).

Figure 1: Average annual growth in per-capita electricity consumption in South East Asia, 2000-2015

As energy demand rises, fossil fuels continue to dominate the generation mix with coal-fired generation in South East Asia growing at an annual average rate of 9.8 per cent and increasing its share in the mix to around one-third in 2016, from one-fifth in 2000 (Figure 2). While electricity generation has more than doubled since 2000, the ratio of renewable to non-renewable generation remains largely the same (Figure 2).

Figure 2: Power generation mix in South East Asia1

Studies show that warming seas can compound the duration and intensity of natural disasters like typhoons. In recent years, South East Asia’s vulnerability to the hazards of climate change has been experienced with devastating and fatal impact, as seen with Typhoon Haiyan and Tropical Storm Nock-ten.

It is proven that the impacts of pollution will accelerate climate change, endangering lives and sustainable development unless nations act now to make a fundamental difference in global efforts to limit warming. “Due to rapid urbanisation coupled with the current energy policies, most countries in the region risk committing to highly polluting electricity generation, transport and industry,” said Dr Ernest Moniz, former United States Energy Secretary in June 2019, during the Ecosperity Conference.

These trends of growing power demand, intensifying natural disasters and urbanisation present an unambiguous argument for South East Asian nations to scale up clean energy and integrate renewables into their sustainable development pathways.

“South East Asia will reap large economic and sustainable development benefits by keeping warming below 1.5°C,” said Bill Hare, CEO of Climate Analytics and co-author of the report Decarbonising South & South East Asia?. The report estimates that total global benefits will exceed US$20 trillion, with the poorest countries benefiting the most.

2. As Renewables Become More Competitive, Coal Still Dominates

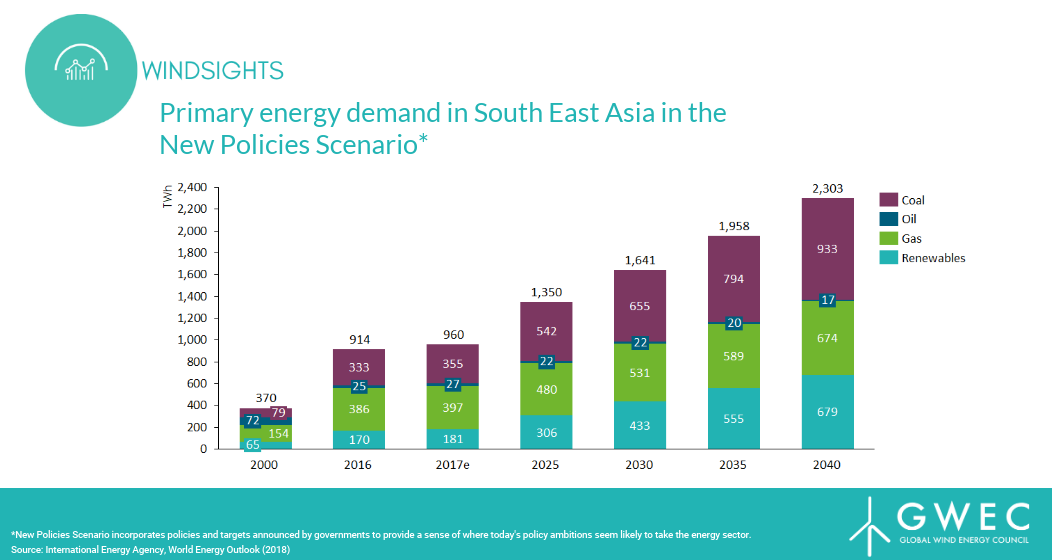

The over-reliance on coal stems from widely accepted thinking that coal is the cheapest option for power, with renewables typically dismissed as uncompetitive. This has subdued the outlook for wind and renewable energy in the region, despite enormous and largely untapped potential. The International Energy Agency (IEA), for instance, predicts that coal will retain its dominant position in the energy mix and account for almost 40 per cent of the growth in primary energy demand between 2017 and 2040, shown in Figure 3 below.

Figure 3: Primary energy demand in Southeast Asia in the New Policies Scenario

In

their efforts to fuel economic growth and raise living standards, South

East Asia must tread carefully to foster a sustainable development

pathway, as individual nations and as a region. The continued reliance

on incumbent fuels, with coal use almost tripling to 2040, leaves a

small amount of headroom for integration of renewable energy.

This

situation, if left unchanged, will result in a globally significant

increase in greenhouse gas emissions. There is an urgent need for local

policy efforts which incentivise renewables-based capacity, including

through ambitious targets, feed-in tariffs, tax breaks and soft loans.

And

while coal remains a crutch of energy systems in South East Asia,

renewable energy has achieved tremendous cost reductions and is now

cheaper than electricity produced from new coal power plants.

According

to BloombergNEF and Lazard, the Levelised Cost of Electricity (LCOE,

lifetime costs divided by energy production) for coal ranges from 60

USD/MWh to 160 USD/MWh, depending on the specific market. Onshore wind

has an LCOE of less than half that of coal: 29 USD/MWh to 59 USD/MWh,

depending on the market.

Due to technological breakthroughs and

large-scale deployment, renewables such as wind power are now cheapest

across more than two-thirds of the world, according to BloombergNEF New Energy Outlook 2019. BloombergNEF further predicts that wind and solar will undercut coal and gas in price almost everywhere by 2030.

3. Coal is Cheap… But only due to Stubborn Fossil-Fuel Subsidies

Fossil fuel subsidies are prevalent in six countries in South East Asia: Brunei Darussalam, Indonesia, Malaysia, Myanmar, Thailand and Vietnam. These subsidies artificially lower end-user prices to below international market levels and below the full cost of supply.

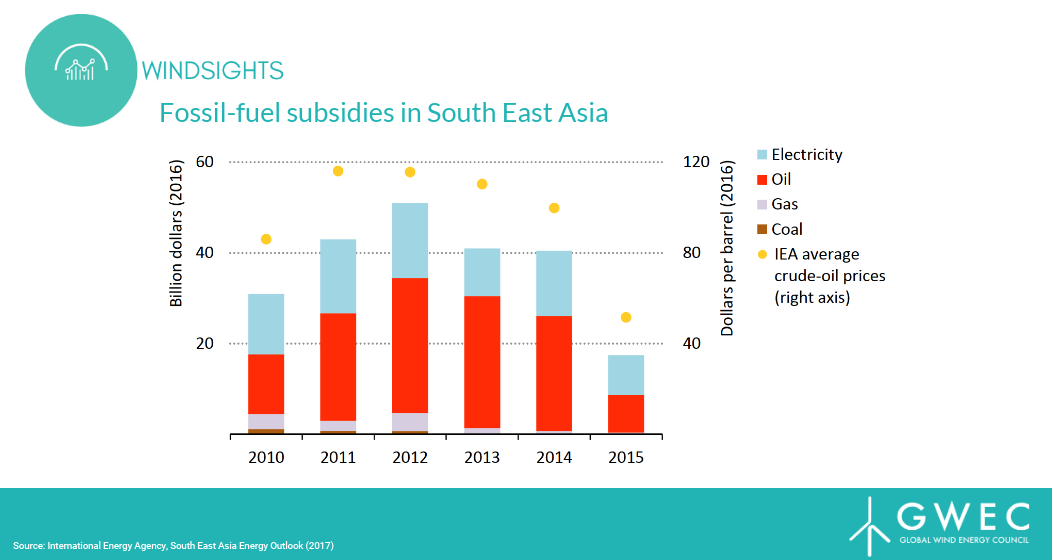

Figure 4: Fossil-fuel subsidies in Southeast Asia

A gradual phase-out of fossil-fuel subsidies is reflected in Figure 4. But in practice, fossil fuel subsidies have not been efficient for three reasons: 1) they disproportionally benefit wealthier segments of society; 2) they encourage wasteful energy consumption and 3) artificially low electricity prices will discourage private investment in the power sector, as returns are dampened.

Not only are fossil fuel subsidies creating unequal playing fields in the energy sector of markets across South East Asia, hampering investment in low-carbon technologies like wind power, but they distort the electricity market in ways that are counterproductive to a just energy transition.

4. Coal is Cheap… But Bears Socio-Economic and Health Burdens

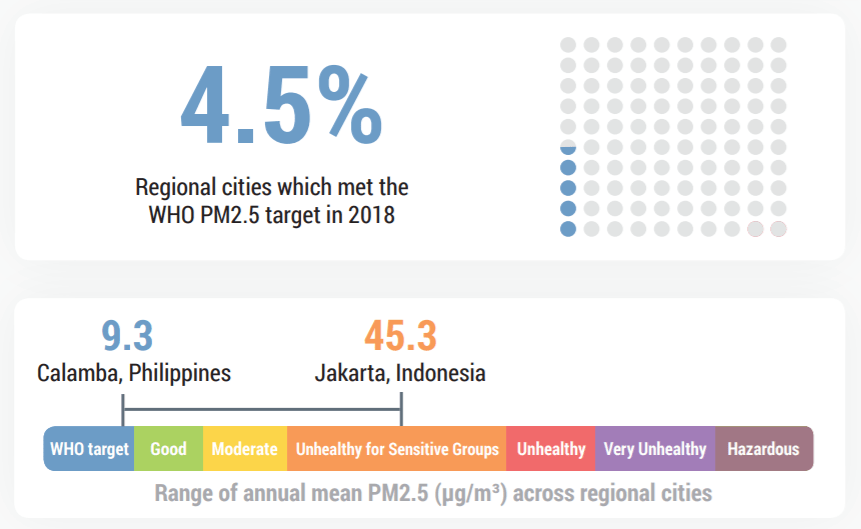

The 2018 World Air Quality Report shows that 95.5 per cent of people in South East Asia live in areas where air quality exceeds World Health Organization limits (Figure 5). Pollution, smog and exposure to emissions are a reality of the region – but one with dire consequences.

Figure 5: Collective results of 145 PM2.5 monitors in Southeast Asia by World Health Organisation

“Some three million deaths a year are linked to exposure to outdoor air pollution,” according to the UN, drawing on data from 3,000 sites across the world. And nearly two-thirds of these fatalities occur in South East Asia and the Western Pacific regions.

South East Asia is at a crucial crossroads, facing a choice to build and sustain major low-carbon energy infrastructure and systems in a bid to develop sustainably and safeguard quality of life in the long term; otherwise, its cities face worsening pollution and following in the footsteps of a Los Angeles or Beijing saddled with an air pollution epidemic.

5. Coal is Cheap… But Leaves Stranded Assets

South East Asia’s most populous nations – Indonesia, Vietnam and the Philippines – are pumping US$120 billion into coal-fired power plants that are under construction or planned, according to a recent study by London-based Carbon Tracker Initiative. Wind and solar investments are still a fraction of this.

While the build rate of coal-fired power plants is slowing globally, existing and newly built plants are consistently underutilised and represent an enormous stranded asset risk estimated at hundreds of billions of dollars. In South East Asia alone, it is estimated by Carbon Trust that up to US$60 billion of coal-fired power generation assets may be stranded in the next 10 years.

Furthermore, according to the Institute for Energy Economics and Financial Analysis (IEEFA), Chinese institutions are financing or have committed to finance more than one-quarter of the 399 GW of coal plants currently under development worldwide. That is the same for Japan, which supports going green at home while funding coal-fired power projects overseas that would not meet its own emissions standards.

Figure 6: Japanese public finance agencies’ overseas coal financing by country (2013-2019)

Institutions

like Mizuho, MUFG and ICBC have lost touch not only with the social and

financial realities of climate change, and should keep pace with their

global peers such as Natixis and Standard Chartered which have ceased

financing new coal-fired power plants.

This means that coal assets

are not economically viable over the long-term. With global coal-fired

power capacity on track to peak shortly, according to Carbon Brief, the

time is well past for investors to exit coal financing, everywhere. What

was once a blue chip is now a red flag.

6. Driving Deployment of Wind Energy

According to KPMG, wind power has the potential to increase its contribution to global electricity demand by nine times by 2040 (growing from its present 4 per cent to 34 per cent). Its deployment could account for 23 per cent of the necessary reduction in carbon emissions by 2050: 5.6 billion tons of CO2, equivalent to the annual emissions of the 80 most polluting cities. This reduction would have real benefits for society, saving up to four million lives a year and reducing health-related costs by up to US$3.2 trillion a year.

The potential for these achievements in South East Asia is outlined in the ambitious targets for renewable energy, which have been set by the region’s governments (Figure 7). While countries are falling behind in their aims, “the will to make things work is present, and roadblocks are slowly but surely being cleared,” said Andrew Affleck, founder and managing director, Armstrong Asset Management.

Figure 7: Renewable energy targets of South East Asia countries by 2020

Affleck adds that South East Asian governments can improve their chances of achieving these targets by adjusting the pricing of fossil fuels through carbon pricing and lowered fuel subsidies, as well as upfront grants and interest-free loans to accelerate investments in renewables, which will help to diminish inequalities in the energy market.

Indeed, for South East Asia, any decisions made now will change the course of millions of lives in the region. Divesting from coal is only one part of the challenge. Reducing reliance on coal must happen in tandem with providing a positive policy environment for wind and renewables to integrate in energy systems. Access to sufficient financing and necessary adaptions to market design (e.g. equal market access, transparent and predictable procurement processes, secure dispatch processes, a pipeline of grid infrastructure) will be required to grow the share of wind and renewable energy across the region.

In order to accelerate the deployment and integration of wind and renewables, South East Asian governments should refocus on the design of their energy markets, current allocation mechanisms and whether a roadmap is in place to ensure sufficient infrastructure and transmission investments. This is necessary to ensure a smooth phaseout of coal, reduce the risk of stranded assets, enhance the share of renewable energy in the generation mix and safeguard a pathway to sustainable development.

Karin Ohlenforst, Director of Marketing Intelligence, and Shuxin Lim, Marketing and Communications of GWEC Asia