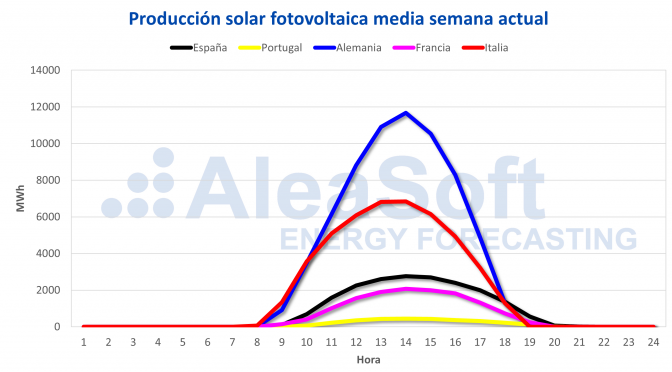

Solar energy production has fallen during the first three days of this week in Germany and Spain and in Italy it has remained at levels similar to those of last week. This decline in solar production coupled with the general decline in wind power production on the continent and the increase in demand in several countries has caused prices to rise in most markets. In the futures markets of Brent, gas, coal and CO2 the general behavior has been downward with some point increase.

Solar photovoltaic and concentrated solar power production, wind energy production and electricity demand

Solar production, which includes photovoltaics and solar thermal in the case of Spain, decreased in Germany and Spain during the first three days of this week compared to last week’s average, 21% and 30% respectively. In the case of Italy, the variation in that period was only 1.9%. In AleaSoft, solar production in Italy and Germany for the current week is expected to be lower than the week of October 14. If you compare the period between October 1 and 23 of this year with respect to days 1 and 23 of the same month of 2018, this is being a difficult month for solar production in Germany, as it has dropped 25% . On the contrary, the analysis of the same period in Italy and Spain yields positive data: production has increased by 12% and 23% respectively.

In the renewable auctions last week in Germany, a capacity of 150 MW of solar technology was auctioned and the lowest price of the winning bids for the energy produced was € 45.90 / MWh. The solar auction was characterized by the large number of offers submitted, 153, which added a volume of 648 MW.

During the first three days of this week the average wind production fell in all the European countries analyzed compared to last week’s average. The largest decrease occurred in France, 47%. The productions in the Iberian Peninsula and in Germany have been well below, 36% and 43% less. In AleaSoft it is expected that in the whole of the current week the production with this technology in Germany will end up being superior to that registered last week. For the rest of the countries, production is expected to be lower. So far this month, wind production has been much higher in France and Germany compared to that recorded between October 1 and 23 last year, becoming more than double in the French case. In Italy, production has also increased in October this year, taking this period from last year as a reference. On the contrary, in the Iberian Peninsula, production has decreased by 8%.

In the case of Germany’s wind farm auction last week, the winning bids, which totaled a volume of 204 MW, did not cover the auctioned capacity of 675 MW, reaching a price of € 62.00 / MWh for the energy produced.

In the first three days of this week, the increase in electricity demand in France stands out by 7.9% compared to the same period last week. On the contrary, in the rest of the countries the variations were between? 3.4% of Portugal and 3.0% of Belgium.

Spain peninsular, photovoltaic and solar thermal production and wind power production

The average solar production in peninsular Spain from last Monday to Wednesday decreased by 30% compared to last week’s average. For the current week in AleaSoft it is expected to end up being similar to the one recorded the previous week.

In the case of wind production in Spain, it was also lower at the beginning of this week compared to the average of last week, registering a decrease of 39%. In AleaSoft it is expected that the production of this week’s set will be lower than that of last week. This month has not been favorable for production with this technology in Spain, if you compare the production registered until October 23 with the same period of 2018.

During the first three days of this week, electricity demand in mainland Spain has risen 1.8% higher compared to the first three days of the previous week. In this week as a whole, demand in mainland Spain should increase compared to last week, according to AleaSoft estimates.

Unit 2 of the Almaraz nuclear power plant remains disconnected from the power grid. This week nuclear production remains at 143 GWh per day, similar to last week.

The level of hydroelectric reserves is currently 7 621 GWh, an increase of 57 GWh compared to the previous week. The current reserves constitute 33% of the total capacity of 23,281 GWh, according to data from the latest Hydrological Bulletin of the Ministry for Ecological Transition.

The average price of the first four days of this week for most European electricity markets has risen compared to last week, with the exception of the IPEX market in Italy and the N2EX market in Great Britain, which experienced a decrease of 17% and 3.7% respectively. The rest of the countries presented increases of between 2.0% corresponding to the Nord Pool market of the Nordic countries and 11% of the MIBEL market in Spain and Portugal. This behavior is related to a general decrease in wind production and solar production in some countries, as well as the decrease in temperatures in most of Europe, which has favored the increase in electricity demand in several countries. Italy has been the only country where temperatures have risen slightly which has lowered demand. This, together with a slight increase in solar production, has helped lower prices in the Italian market.

The group of markets with lower prices, during the first four days of this week, has reached average prices between € 43.94 / MWh of the EPEX SPOT market in France and € 37.79 / MWh of the Nord market Pool, which has been the market with the lowest prices in Europe. This market presented a price of € 4.93 / MWh lower than the following market with the lowest prices, the EPEX SPOT market in the Netherlands, which averaged € 42.72 / MWh.

As regards the group of markets with the highest prices, this week has been led by the IPEX market in Italy which, despite the experienced price decline, continues to be the market with the highest average price in Europe, with a value from € 49.44 / MWh.

Iberian Market

The average price between October 21 and 24 in the MIBEL market in Spain was € 48.72 / MWh and that of the MIBEL market in Portugal was € 48.83 / MWh. The MIBEL markets in Portugal and Spain were the second and third markets, respectively, with the highest average prices in Europe, behind the IPEX market in Italy.

However, the average price of both markets exceeded that of Italy on October 21, positioning itself as the highest-priced in Europe. On that day, the price of the MIBEL market in both countries reached € 54.34 / MWh, a value of € 3.17 / MWh higher than the IPEX market in Italy, of € 51.17 / MWh. The main cause was an exceptionally low wind production in the Iberian Peninsula, 32 GWh.

For the following days, the prices of the MIBEL market in Spain and Portugal decreased and remained below the price of the IPEX market in Italy, thanks to an increase in wind energy production.

Electricity futures

The European electricity futures markets analyzed by AleaSoft present, for the most part, a drop in prices so far this week. For the next quarter product, only the ICE and NASDAQ markets in the Nordic countries have registered increases of 1.4% and 0.7% respectively. The rest of the markets have experienced declines compared to the closing price on Friday, October 18, between 0.5% and 3.6%. This last value is that of the ICE market in Great Britain, which is the one that shows the greatest change in recent days.

The price drop also extends to the product of the 2020 calendar year. In this case, the prices of Nordic electricity futures also fall in the NASDAQ market, although not in the ICE market, which shows a 0.2% rise. The percentage values ??of decreases are from the least pronounced, precisely 0.1% of the NASDAQ market in the Nordic countries to a 3.4% decrease in the Italian EEX market for this product.

Brent, fuels and CO2

The prices of Brent oil futures for the month of December in the ICE market this week have experienced an upward trend. Although a price of $ 58.96 / bbl was recorded on Monday, October 21, 0.8% lower than the closing price of Friday, October 18, of $ 59.42 / bbl, as of that day prices have has been increasing In this way, the closing price of Thursday, October 24, was $ 61.67 / bbl. These increases respond to the fact that OPEC and its allies are considering agreeing production cuts at a meeting in December and the significant reductions in US oil reserves published on Wednesday. However, in AleaSoft it is expected that in the coming days until the end of the month prices could fall again.

The prices of TTF gas futures in the ICE market for the month of November have fallen continuously during the week, although on Thursday, October 24, they recovered 1.6% and closed at € 15.66 / MWh. On Monday, October 21, a closing price of € 15.61 / MWh was recorded, 2.2% lower than the closing price of the previous Friday, of € 15.97 / MWh. On Tuesday, October 22, the price decline was more discreet, of 0.1%. On the other hand, the price drop on Wednesday, October 23 was a bit higher, 1.2%, reaching a value of € 15.42 / MWh, which is the lowest price recorded in this October. The high levels of gas reserves and wind generation have conditioned the evolution of early week prices. In the coming days, gas prices could continue to fall if forecasts of higher wind power production are met by the end of the week.

The prices of API 2 coal futures in the ICE market for the month of November this week have continued with the downward trend that began on Monday of the previous week, October 14. After the declines experienced since the previous week, the closing price of Monday, October 21, was already $ 60.40 / t. Throughout the week these daily price reductions have continued, until yesterday, October 24, a closing price of $ 58.40 / t was reached, which is the lowest value of this October. As in the case of gas, prices could continue to fall this week. Although the decrease in temperatures in the next week would allow to stop this downward trend both in the case of coal and gas.

The CO2 emission rights futures in the EEX market for the December 2019 reference contract, started this week with a closing price of € 25.94 / t, 0.3% above the value of the previous Friday , of € 25.87 / t, and 7.4% higher than that of Monday of last week. However, on Tuesday, October 22, prices began to fall, with a 1.0% decrease from the previous day. On Wednesday, October 23, the price drop was even greater, 3.5% compared to the price on Tuesday, reaching a value of € 24.76 / t, 5.9% lower than the previous Wednesday, 16 October, when the highest price was recorded so far this month, of € 26.31 / t. However, yesterday, October 24, prices rose 2.7% and closed at € 25.44 / MWh. The uncertainty surrounding Brexit is driving this price evolution. Next week the key date of October 31 will be reached, on which Brexit could occur, if the agreement to postpone this date is not approved before. In this case, it is expected that the prices of the CO2 emission rights futures will drop. Meanwhile, the next few days the evolution of prices may vary depending on the news that is published regarding this topic.