Why is Bill Gates backing a Concentrated Solar Power company? What is oil major ENI doing with a CSP start-up? Why has Zurich airport agreed to purchase aviation fuel from a solar thermal company? Why are investors purchasing operating Concentrating Solar Power plants?

Many investors have written-off CSP in favour of investments PV and wind. This may prove to be short-sighted. As the market for utility scale storage accelerates in response to the increasing penetration of intermittent renewables (such as PV and wind), CSP will be increasingly recognised for its most important attribute: low cost thermal storage. Further developments may position CSP technologies as the low-cost producer of green hydrogen and synthetic fuels.

What is CSP? In simplest terms, CSP systems harvest solar energy by concentrating it. The concentrated heat of the sun can then be used for industrial processes or to generate electricity. Heat is easy and cheap to store for long periods: think of a thermos keeping your coffee piping hot all day.

Delingha 50MW CSP project, by SUPCON SOLAR China (7 hours of storage)

While on a “name-plate” capacity basis PV and wind may appear to be cheaper than CSP, such comparisons are mis-leading as industry insiders relentlessly communicate. This is because most CSP plants incorporate thermal storage, and if the value of the storage is taken into account, in many cases CSP remains competitive with PV and wind, especially for longer storage durations. Indeed, many industry participants see CSP evolving into more of a storage asset rather than a generation asset.

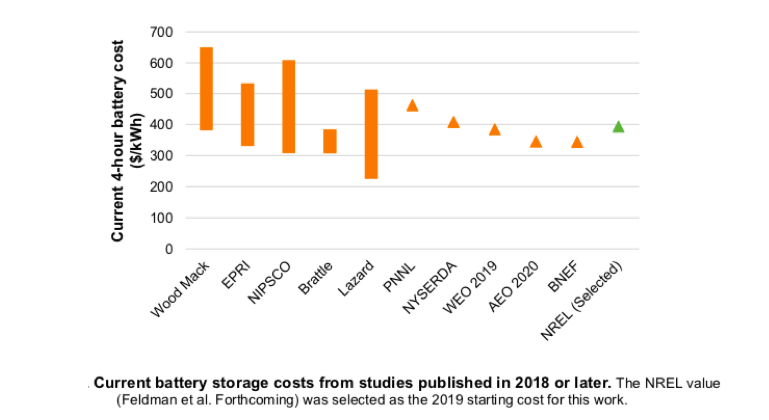

A new trend in CSP plant design is to hybridise with PV, with PV providing cheap power during daylight hours, and CSP being used to provide the energy for cheap storage to be released and delivered as electricity in the evening and nights[i]. Other hybrid PV/CSP designs include using excess electricity generated by PV during solar peaks to further heat co-located CSP molten salt systems [ii]. In Spain, there are plans to retrofit existing CSP plants which were built without storage, with PV-enhanced molten salt storage systems.[iii] Industry participants estimate the incremental cost of adding molten salt storage to a CSP plant to be around $20 to $30 per KWh, which represents a fraction of the cost of adding the same capacity using batteries (estimated by NREL[iv] at around $400 per KWh for a 4 hour utility-scale battery in a study published in June 2020[v]. See Figure 1 below). Even considering a speculative cost of $100 per KWh on the horizon for automotive batteries[vi], and taking into account the efficiencies of converting thermal power back into electrical power, solar thermal storage remains cheaper.

Figure 1 Cost of Utility Scale Battery Storage (June 2020 estimates)

Source: https://www.nrel.gov/docs/fy20osti/75385.pdf

Even with declining battery storage prices, CSP with thermal storage is likely to remain cheaper for long duration utility scale storage, and this is likely to remain the case for the foreseeable future. The possible cost reduction pathways for both technologies was analysed extensively by NREL which concluded: “If three hours of storage is the desired or optimal level, PV tends to produce a lower projected LCOE; if nine hours of storage is the desired or optimal level, CSP tends to have a lower projected LCOE[vii].” [LCOE = levelized cost of electricity = net present cost over lifetime of plant][viii]

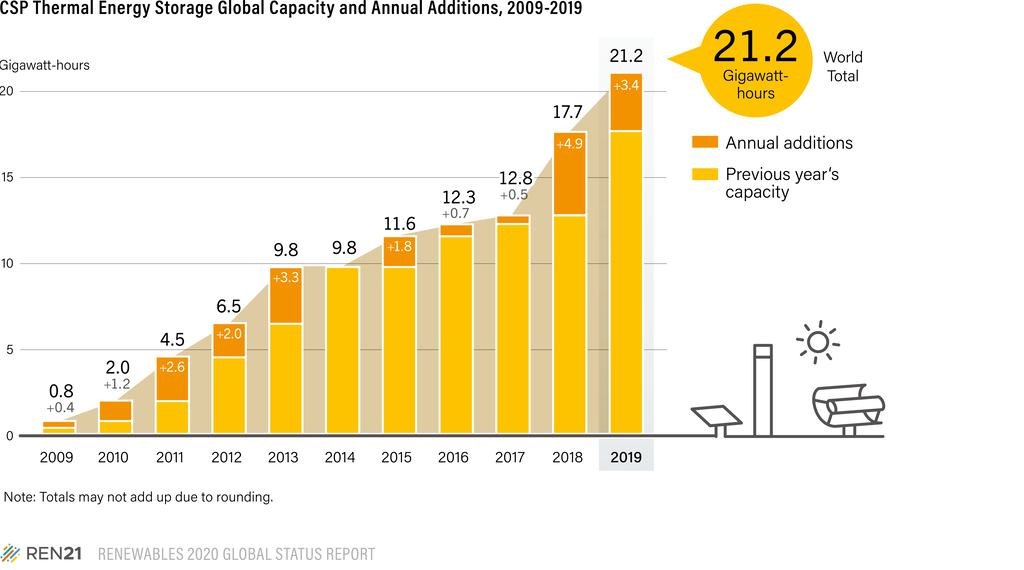

Low cost utility scale CSP storage seems to be a well-kept secret in the renewables industry. With all of the talk and press reports about utility scale battery storage over the past few years, few observers seem to understand the position and attractiveness of CSP thermal storage. In reality, there is already about twice as much grid connected CSP thermal storage as there is battery storage (21.2 GWh of CSP vs. 10 to 12 GWh of battery storage depending on who is counting). And more CSP storage is currently added on an annual basis than battery storage (3.4 GWh of CSP vs. 2.9 GW of batteries – or just over 1 GWh if you discount behind-the-meter storage). See Figures 2 and 3 below.

Figure 2. There is currently more CSP thermal storage connected to the grid than battery storage.

Figure 3. More CSP storage is currently added to the grid annually than battery storage.

IEA, Annual energy storage deployment, 2013-2019, IEA, Paris https://www.iea.org/data-and-statistics/charts/annual-energy-storage-deployment-2013-2019-2

Batteries are likely to close the gap with CSP storage as there is a large pipeline of utility scale battery storage projects, especially in the USA. But this is not changing because battery storage is becoming cheap enough to compete with CSP storage. Rather it is because CSP deployment is limited by geography.

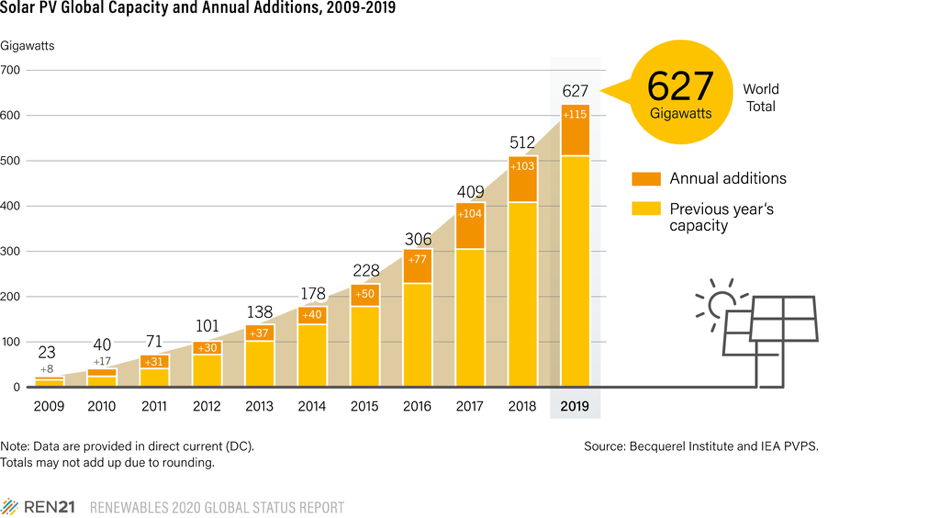

CSP needs high levels of intense sunshine year-round to function economically. This limits deployment to “sunbelt” regions such a southwestern United States, southern Europe, MENA, southern Africa, parts of Latin America, parts of China and Australia. This limitation (and also the fact that PV is far more granular, faster and simpler to install, and can be deployed in very small increments) has curtailed CSP growth compared to PV. Figures 4 and 5 below show that there is 100X more PV installed in the world today than CSP, and that annual installations of CSP are running at under half of a percent of the PV installation volume.

Figure 4. PV market was 115GW in 2019, with a total installed base of 627GW.

Figure 5. CSP market was only 600MW in 2019, with a total installed base of 6.2GW.

Figure 6. The Sun Belt (areas in pink, red and orange are most suitable for CSP)

Source: https://globalsolaratlaspink, .info/map?c=11.523088,8.4375,2&s=-72.395706,91.757813&m=site

So the CSP market weighs in at half a percent of the size of the global PV market and is limited by geography. Why even bother? Isn’t it obvious that PV has outcompeted CSP, end of story?

Not quite. As explained earlier, CSP is not directly comparable to PV because of the availability of cheaper storage. As grids become more saturated with renewables, storage will become a critical factor in achieving further decarbonisation. Also, it is important to understand that the CSP industry, even with a small fraction of the volume of PV, is almost keeping up in terms of cost reductions. See Figure 7 below.

Figure 7. At a fraction of the volume of PV, the CSP industry has made impressive cost reductions.

Many attribute the continued relative cost-competitiveness of the CSP industry to new entrants from China, and the stimulus provided by the CSP pilot program in China (20 projects and 1.35GW)[ix]. But it is also the result of innovations and experience curve cost reductions from market participants from the US and Europe[x].

So what’s the future for CSP?

Low hanging fruit for CSP market participants is firstly the retrofit of existing CSP plants with new or additional thermal storage, and secondly the development of hybrid plants offering “base-load” power at an optimised cost by taking advantage of low-cost PV for dispatch during the day, and by taking advantage of low cost CSP thermal storage for dispatch at night. This is already happening in Morocco[xi] and is likely to become the norm in Spain, especially since the government has included 5 GW of CSP in its energy transition plan to 2030[xii].

Another opportunity would be to transport cheaply stored solar energy from the resource rich regions to the points of consumption at the time it’s most valuable. In this case, thermal storage backed baseload power from CSP or hybrid CSP plants can be transported by HVDC (High Voltage Direct Current) or UHVDC (Ultra HVDC) transmission lines from the solar resource rich regions. For example, it would probably be cheaper (for French and German consumers) to have Spain and Portugal (or MENA) host “CSP batteries” which would back up renewables in France and Germany than for these countries to deploy vast amounts of batteries locally. Another option is to use CSP in high solar radiation regions to generate hydrogen, an innovative technological solution that promises to be much cheaper than trying to use locally produced “green” hydrogen as a storage medium, as is currently contemplated in these countries[xiii]. In the past, there has not been an appropriate regulatory frame in place to allow such a trade; however, a pathway may be opening with the new EU market design rules adopted earlier this year by the European Parliament. Under the new rules, there will be a cross-border market for capacity payments, and a limit on carbon emissions of supported capacity.[xiv]

These themes are not new (see Desertec[xv], TuNur[xvi]), but they have become more imperative as countries attempt deeper decarbonisation, and need to overcome the intermittency of “conventional” renewables which do not incorporate storage.

So far this has proven to be a difficult pathway for governments, which prefer investing in domestic solutions whenever possible, as interests for local employment and industrial participation compete with consumer and industrial interest in lower prices for clean energy. The urgency of finding effective climate change solution may change the balance of this equation as the evidence of climate change has an increasingly visible impact, with real economic consequences.

This brings us to another evolutionary pathway for CSP. Hybrid CSP with ample thermal storage plants may become the least cost producers of “green” hydrogen, as they allow expensive electrolysers to operate 24/7 thus maximising the utilisation factor. The green hydrogen can be subsequently transported to points of use (ie. to non-sunbelt regions), either in its natural form (via pipelines), or be used as a feedstock for synthetic fuels, which would then be transported conventionally by tanker ships. In the latter case, the CSP plant can provide process heat for direct air capture of CO2 (the second feedstock after hydrogen required for synthetic fuels), further reducing the cost of synthetic fuel manufacture.

The CSP industry is taking this a step further. Using technology which has already been validated in the laboratory[xvii], and which is now moving towards pilot production, CSP is being used for the thermochemical production of hydrogen from water, which may offer major cost reductions for green hydrogen production compared to electrolysis[xviii].

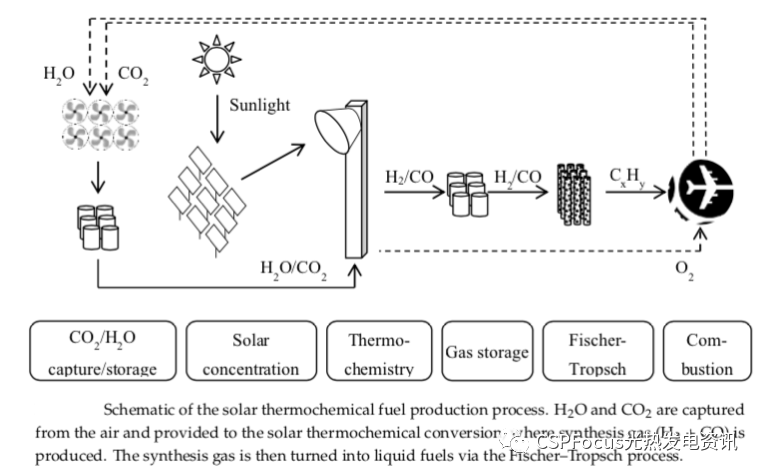

Synhelion uses solar heat to convert water and CO2 into synthetic fuels – so-called solar fuels. Solar radiation from the mirror field is absorbed in the receiver and converted into high-temperature process heat (>1000°C), which drives a thermochemical reactor to produce syngas. The syngas is then processed by standard gas-to-liquids technology into fuels. The integrated thermal energy storage enables continuous 24/7 fuel production. The solutions of Synhelion combine state-of-the-art solar tower systems with proprietary high-temperature thermochemical processes for the production of solar fuels[xix].

Figure 8 below explains the basics of the thermochemical reaction. Other companies pursuing a similar strategy include Heliogen, which is backed by Bill Gates (Gates Ventures).

Source: https://www.mdpi.com/1996-1073/13/4/802/htm

Synhelion recently announced its first commercial pilot facility, with an off-taker for the produced fuel[xx]:

The test operation is expected to yield synthetic fuel from as early as around 2023. The recently signed declaration of intent is a commitment by Flughafen Zürich AG to buy from Synhelion at cost price the entire available annual volume of sustainable fuel produced in the test facility[xxi].

The benefits of this CSP application are obvious: the production of synthetic fuel from air, water and the sun, with zero carbon footprint means no transport issues, and no storage issues, as synthetic fuels can be transported stored with the existing fossil fuel infrastructure. Perhaps it is this longer-term possibility of re-purposing existing infrastructure that is driving ENI’s collaboration with Synhelion[xxii].

Synthetic fuels from CSP thermochemical reactors represent an extremely interesting pathway for the decarbonisation of the aviation industry. Much work has recently been initiated to electrify small aircraft and to develop hydrogen as a fuel for larger aircraft. What is becoming increasingly clear is that using hydrogen as a decarbonisation vector for larger aircraft represents major economic, technological and regulatory challenges which may take decades to overcome. Using zero carbon synthetic fuels may offer a much cheaper and quicker solution to decarbonisation of larger aircraft, with the huge advantage of being able to use the existing fleet and fuelling infrastructure.

Aviation industry participants (and especially aviation fuel suppliers) should take note of a recently published study on the potential and costs of CSP thermochemical production of synthetic fuels to replace all fossil fuels in aviation.[xxiii]

Who should consider CSP investments now and why?

As energy storage moves towards the centre stage in the energy transition, CSP is likely to re-emerge as a key technology, offering opportunities to lower transition costs in sunbelt countries. As the green hydrogen economy gathers momentum, CSP may present one of the lowest cost solutions, especially if new thermochemical solar reactors are rapidly commercialised. Solar thermochemical “neo-refinery” complexes may become a key attribute of the energy transition, and a realistic replacement for the petroleum industry.

Smart investors are beginning to understand that the full value of storage and the future potential of CSP infrastructure might not be fully priced in existing CSP assets (which are based solely on existing, risk adjusted, feed-in tariffs or PPA cash flows). Revenue potential for low cost, high value storage additions, and possibility of incremental revenues for industrial heat, hydrogen or synthetic fuel production “add-ons” is not yet widely understood. Investors also are only just beginning to understand the duration of properly maintained CSP assets, and the fact that they are highly likely maintain value even after the expiry of their feed-in tariffs or PPAs, whether as storage assets or (with receiver upgrades) as neo-refineries of synthetic fuels.

Rationale for CSP investments

1. Infrastructure / energy transition investors:

Long term “future-proof” energy transition assets. Opportunities to upgrade, retrofit, and add storage. CSP plants have proved to be extraordinarily durable and robust (with some notable recent exceptions[xxiv]). Most of the SEGS plants built in the US the late 1980s and early 1990s are still operational today[xxv].

2. Oil & Gas industry:

Positioning for low cost synthetic fuel manufacturing and low-cost green hydrogen production. There will eventually be a “land grab” for the best CSP sites. Oil & Gas majors are best positioned to build CSP plants and neo-refineries in harsh remote regions, and transport and distribute sun-fuels.

3. Electrical utilities, transmission, and distribution operators:

Access to storage technology, eventually low cost green hydrogen production. Regulatory constraints aside, major electrical utilities and grid operators need to consider CSP as storage where available.

By Kevin Sara

The author is the founder and Chairman of Nur Energie Limited, an independent developer of solar power plants, including CSP. Nur is currently developing a 50MW CSP plant with 5 hours of thermal storage on the island of Crete.

The author wishes to thank all of the reviewers of an earlier draft of this article. You know who you are. I am grateful for your input, comments and encouragement.

Any further comments, corrections, objections, and suggestions are most welcome.

A PDF version of the article is available at: http://www.nurenergie.com/index.php/news/139/65/Why-Invest-in-CSP

ENDNOTES:

[i] https://reneweconomy.com.au/vast-plans-600m-baseload-solar-thermal-plant-for-mt-isa-96076/

[ii] https://www.solarpaces.org/morocco-pioneers-pv-to-thermal-storage-at-800-mw-midelt-csp-project/

[iii] https://www.solarpaces.org/spains-first-csp-to-get-novel-thermalelectric-storage-retrofit/

[iv] NREL: National Renewable Energy Laboratory (Golden, Colorado)

[v] https://www.nrel.gov/docs/fy20osti/75385.pdf

[vi] https://cleantechnica.com/2019/11/24/tesla-cybertruck-battery-price-dive/

[vii] https://www.nrel.gov/docs/fy16osti/66592.pdf

[viii] https://en.wikipedia.org/wiki/Levelized_cost_of_energy

[ix] https://www.eawag.ch/fileadmin/user_upload/tx_userprofiles/upload/binzchri/Gosens-2020-China_s_role_in_CSP_accepted_01.pdf

[x] https://analysis.newenergyupdate.com/csp-today/dubai-csp-technology-inventions-accelerate-industry-cost-reductions

[xi] https://www.solarpaces.org/morocco-pioneers-pv-to-thermal-storage-at-800-mw-midelt-csp-project/

[xii] https://www.evwind.es/2020/07/16/gonzalo-martin-general-secretary-of-protermosolar-i-am-fully-confident-that-spain-can-once-again-become-the-world-concentrating-solar-power-leader/75801

[xiii] Many argue that electricity for green hydrogen will be “free” since it will use excess wind and solar energy that would have to be curtailed in any case. But this is creative accounting as someone is paying for the used wind, solar and transmission infrastructure. Furthermore, economic use of electrolysers is likely to be sub-optimal, if used only periodically.

[xiv] https://ec.europa.eu/commission/presscorner/detail/en/IP_19_1836

[xvi] https://www.tunur.tn Note that the author is the founder of TuNur and remains a Director and a significant shareholder.

[xvii] https://cordis.europa.eu/project/id/654408 and https://www.sun-to-liquid.eu

[xviii] https://www.solarpaces.org/csp-efficient-solar-split-h2o-hydrogen/

[xx] What is not discussed in the article is the possibility of upgrading fossil fuels, which Synhelion believes is a very attractive short/midterm option. For example, upgrading of natural gas via solar-driven reforming processes yields synthetic fuels (e.g. Jet, Diesel, MeOH, or gasoline) with substantially lower CO2 emissions than oil-based fuels but at similar cost. According to Synhelion, solar gasification and CH4-cracking are attractive intermediate steps to bridge the gap until the H2O/CO2 splitting technologies are more fully developed and costs become more acceptable. The commercial pilot will be based on solar upgrading. Source: Synhelion, personal communication to the author, 4 Aug 2020.

[xxi] https://synhelion.com/zurich-airport-commits-to-eth-spin-off-for-co2-reduction/

[xxii] https://www.eni.com/en-IT/media/press-release/2019/06/eni-and-synhelion-team-up-to-produce-low-emission-fuel-using-renewable-energy.html

[xxiii] “The solar thermochemical fuel pathway offers the possibility to defossilize the transportation sector by producing renewable fuels that emit significantly less greenhouse gases than conventional fuels over the whole life cycle. Especially for the aviation sector, the availability of renewable liquid hydrocarbon fuels enables climate impact goals to be reached. In this paper, both the geographical potential and life-cycle fuel production costs are analyzed. The assessment of the geographical potential of solar thermochemical fuels excludes areas based on sustainability criteria such as competing land use, protected areas, slope, or shifting sands. On the remaining suitable areas, the production potential surpasses the current global jet fuel demand by a factor of more than fifty, enabling all but one country to cover its own demand. In many cases, a single country can even supply the world demand for jet fuel. A dedicated economic model expresses the life-cycle fuel production costs as a function of the location, taking into account local financial conditions by estimating the national costs of capital. It is found that the lowest production costs are to be expected in Israel, Chile, Spain, and the USA, through a combination of high solar irradiation and low-level capital costs. The thermochemical energy conversion efficiency also has a strong influence on the costs, scaling the size of the solar concentrator. Increasing the efficiency from 15% to 25%, the production costs are reduced by about 20%. In the baseline case, the global jet fuel demand could be covered at costs between 1.58 and 1.83 €/L with production locations in South America, the United States, and the Mediterranean region” See https://www.mdpi.com/1996-1073/13/4/802

[xxiv] While the “1st generation” CSP plants built in California in the 1980s and 1990s, and “2nd generation plants built primarity in Spain in the 2000s have proved to be exceptionally durable and performant, some of the more recently constructed “3rd generation plants” have experienced teething and ramp-up issues (especially those using novel designs). These “3rd generation” issues and proposed remedies are explored extensively in the following NREL report: https://www.nrel.gov/docs/fy20osti/75763.pdf

[xxv] http://www.investor.nexteraenergy.com/investor-materials/supplemental-resources

Other consulted sources:

REN 21 energy storage chapter: https://www.ren21.net/gsr-2020/chapters/chapter_06/chapter_06/

REN 21 CSP chapter: https://www.ren21.net/gsr-2020/chapters/chapter_03/chapter_03/#sub6

https://globalsolaratlas.info/map?c=11.523088,8.4375,2&s=-72.395706,91.757813&m=site

https://www.iea.org/reports/energy-storage

https://www.nrel.gov/docs/fy20osti/75763.pdf (best practices)

https://www.irena.org/publications/2019/Dec/Renewable-energy-auctions-Status-and-trends-beyond-price

https://www.solarpaces.org/csp-european-energy-transition/

https://www.sciencedirect.com/science/article/pii/S0038092X18310211

Kevin Sara