As offshore wind continues to accelerate growth into new markets, the industry must keep looking to the future and anticipate growth to avoid any potential bottlenecks and be able to fulfil a growing demand for offshore wind. One potential bottleneck which could slow offshore wind installation is the availability of vessels that are critical for offshore wind turbines installation execution, which is why GWEC Market Intelligence has published its first ever Global Offshore Wind Turbine Installation Vessel Database as an important resource for the industry.

A fleet of different vessels support a variety of activities around an offshore wind farm, from seabed survey, to installation of foundations, turbines, and substations, to subsea cable laying, to operation and maintenance over the lifetime of the farm. This new database provides an overview of the offshore wind turbine installation vessels globally, providing a regional and country breakdown for key offshore wind markets.

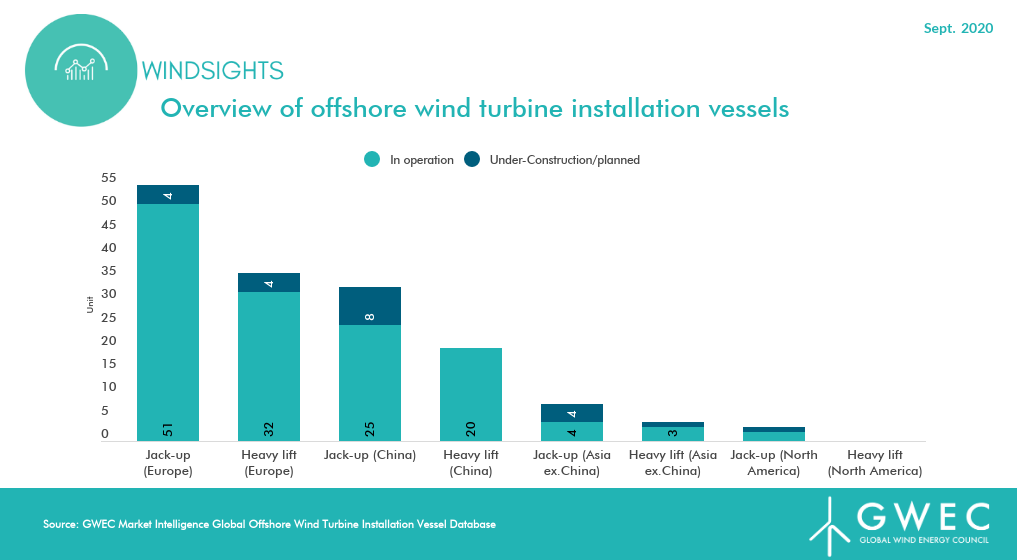

According to GWEC Market Intelligence, there are 137 vessels worldwide, of which 82 are jack-up vessels and 55 are heavy lift vessels, that have participated in offshore wind turbine installation work. Of these vessels, 61 per cent are located in Europe and the remaining 39% are located in China, which is no surprise considering these are currently the largest offshore wind markets globally.

In addition, 16 tailor-made jack-up vessels are under construction or in the pipeline, of which four are booked by Europe vessel operators, eight by Chinese companies, three by Japanese firms and one by American operator. A further five tailor-made offshore wind heavy lift vessels are currently under construction as of Q3 2020, of which four vessels have been ordered by European companies and one has been ordered by a joint venture company based in Taiwan.

While Europe has sufficient vessel capacity at present to fulfil the region’s annual installation levels, there are concerns that vessel availability in China may present itself as a bottleneck considering the current installation rush to connect offshore projects to the grid before the end of 2021 to receive the Feed-in-Tariff. With this installation rush, over 10 GW of offshore wind capacity is under construction right now, but current vessel availability in China can only support 6 GW of installations per year. Other emerging offshore wind markets such as the United States, Vietnam, Japan, South Korea, and Taiwan will be able to meet offshore wind demand using vessels from Europe at present, although they will need to begin looking to construct their own vessels as installations are expected to increase in these markets over the coming decade.

Looking to the future, offshore wind turbines are expected to increase significantly in size including the weight of nacelle, tower and foundation as well as the hub height, and vessels will need to adapt accordingly to be able to install these larger turbines to avoid future bottlenecks. Currently, only 9 vessels globally are able to support installation of turbines greater than 10 MW, and this will need to change quickly as there is more demand for these larger and more powerful turbines across the world.

The full database and analysis, which includes breakdown by vessel type and region, is available exclusively for GWEC Members and GWEC Market Intelligence subscribers in GWEC’s Members Area.

About GWEC Market Intelligence

GWEC Market Intelligence provides a series of insights and data-based analysis on the development of the global wind industry. This includes a market outlook, country profiles and policy updates, deep-dives on the offshore market, among other insights.

GWEC Market Intelligence derives its insights from its own comprehensive databases, local knowledge and leading industry experts.