Energy storage has rapidly evolved from a niche application just a few years ago into an increasingly cost competitive and fast-growing technology that complements wind and solar. And two new national lab reports find storage growth is poised to explode.

Grid-scale U.S. energy storage capacity could increase five-fold by 2050 according to the latest report from NREL’s Storage Futures Study (SFS), Economic Potential of Diurnal Storage in the U.S. Power Sector.

The SFS is a multiyear research project that explores how advancing energy storage technologies could impact the deployment of utility-scale storage and adoption of distributed storage, including impacts to future power system infrastructure investment and operations.

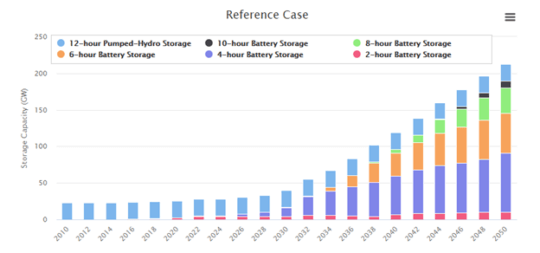

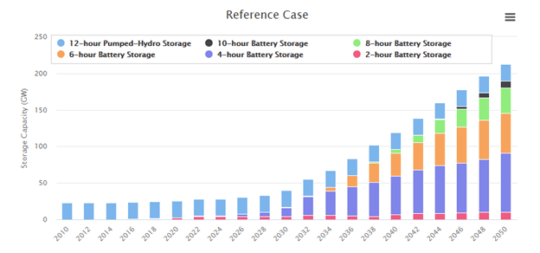

Across all scenarios in the study, utility-scale diurnal energy storage (up to 12-hours) deployment grows significantly through 2050, totaling over 125 gigawatts (GW) of installed capacity in the modest cost and performance assumptions—a more than five-fold increase from today’s total. Today’s energy storage is mostly comprised of around 23 GW of pumped hydro and 1.6 GW off battery storage. Pumped hydro is not expected to see any growth, but battery storage is charging up for a big take off.

Depending on cost and other variables, all storage deployment could total as much as 680 GW by 2050 – with 100 percent of that growth from battery energy storage. Initially, the new storage deployment is mostly shorter duration (up to 4 hours) and then progresses to longer durations (up to 12 hours) as deployment increases, mostly because longer-duration storage is currently more expensive. In 2030, annual deployment of battery storage reaches up to 30 GW across the scenarios. By 2050, annual deployment may reach up to 77 GW.

Energy storage already filling up the Interconnection queues

Market activity is already bearing out high-growth battery energy storage scenarios throughout U.S. interconnection queues. These queues are essentially a waiting list of proposed power projects seeking a grid connection in coming months and years. While many projects that apply for interconnection are not subsequently built, data from these queues nonetheless provide a good general indicator for mid-term trends in market, developer and investor interest.

In a recent report separate from the NREL energy storage study, the Lawrence Berkeley National Laboratory (NBNL) compiled and analyzed data from all seven Independent System Operators (ISOs) and Regional Transmission Organizations (RTOs), in concert with 35 non-ISO utilities, representing an estimated 85 percent of all U.S. electricity load. NBNL’s analysis shows there is an estimated 200 GW of storage capacity in the over 750 GW of generation in the interconnection queues.

Notably, clean power also represents most of the generation waiting for potential connection with solar at 462 GW and wind with 209 GW. Hybrids now comprise a large – and increasing – share of proposed projects: 159 GW of solar hybrids (primarily solar+battery) and 13 GW of wind hybrids are currently active in the queues.

A big reason why there is so much solar plus storage in the interconnection queues is that solar PV generation has a strong relationship with time-shifting services. The NREL storage study finds that more PV generation makes peak demand periods shorter and decreases how much energy capacity is needed from storage. That increases the value of storage capacity and effectively decreases the cost of storage by allowing shorter-duration batteries to be a competitive source of peaking capacity. The study also finds that over time the value of energy storage in providing peaking capacity increases as load grows and existing generators retire.

For more information on NREL’s energy storage study, see the following link. To join a webinar from 9 to 10 a.m. MT on Tuesday, June 22, click on the following link to register.