Prices of all European electricity markets rose in the second week of November after several weeks in which declines prevailed. The increase in demand and the fall in wind energy production led to these increases in a week in which, on average, gas and CO2 prices were higher than those of the previous week. At the beginning of the third week of the month, the increases continued and the second highest hourly price in the history of the British market was reached.

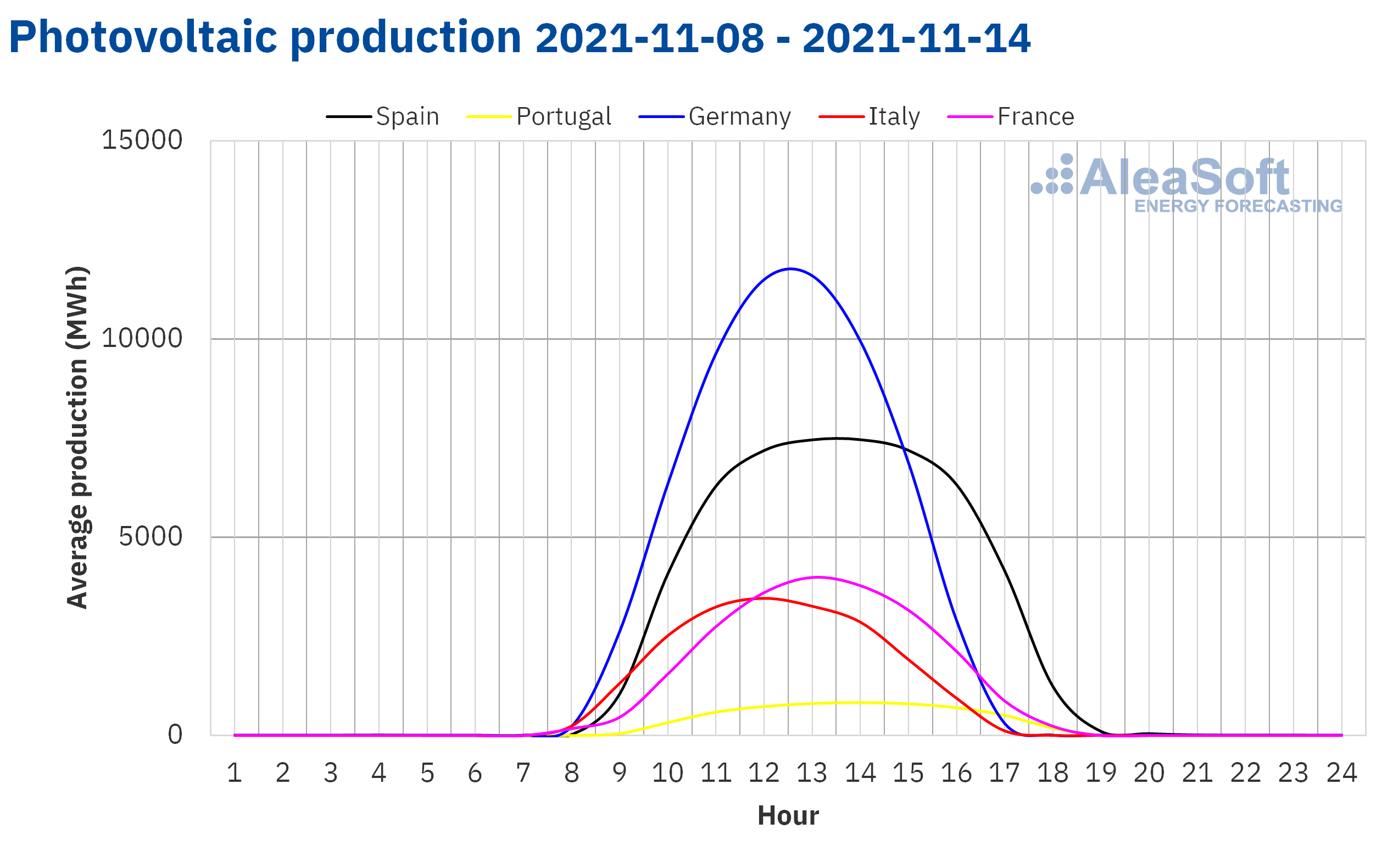

Photovoltaic and solar thermal energy production and wind energy production

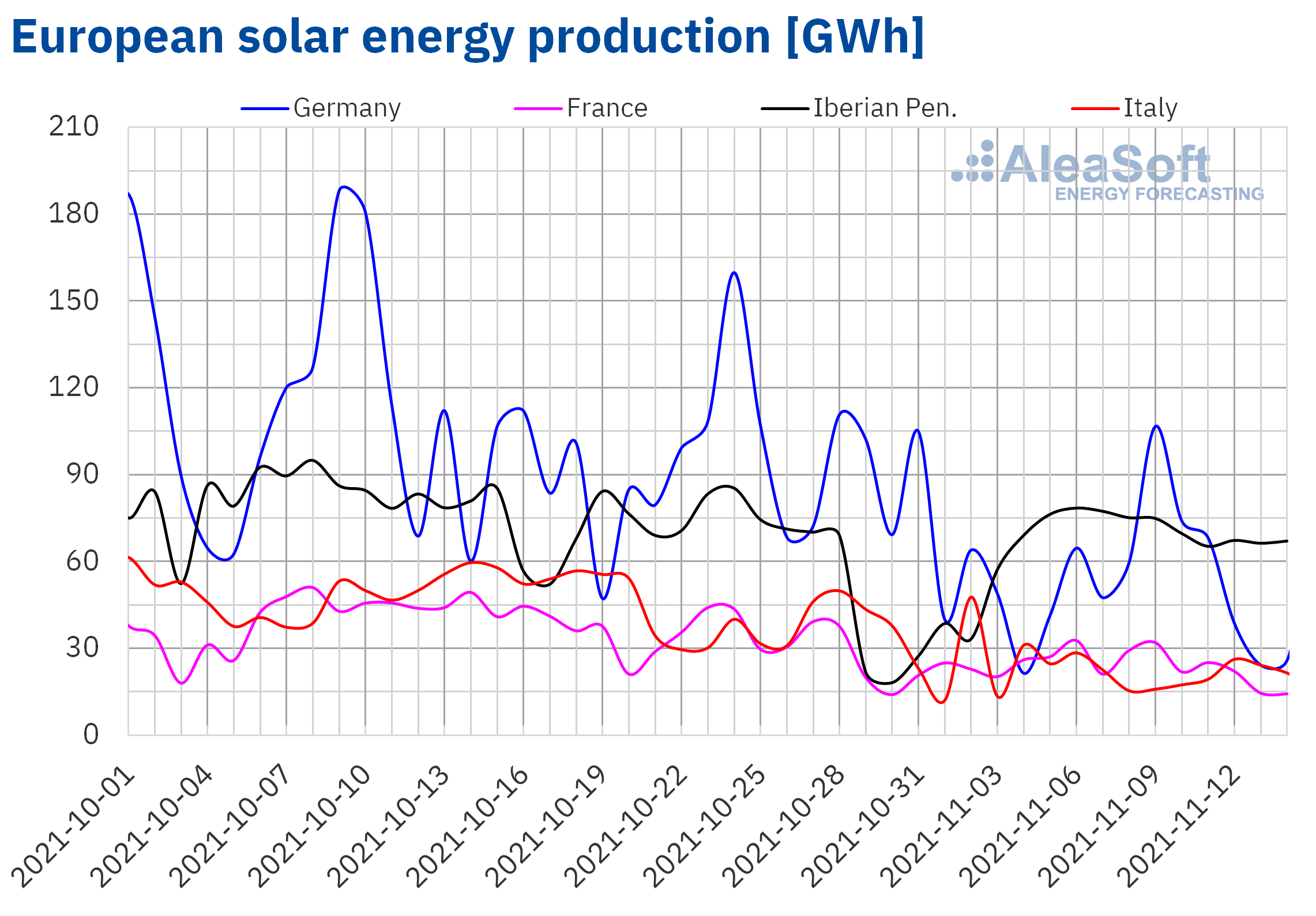

In the second week of November, the solar energy production increased by 21% in the German market and 13% in the Iberian market compared to the production of the previous week. However, in the markets of France and Italy, the generation with this technology decreased by 9.0% and 22% respectively in the same analysed period.

For the third week of November, the AleaSoft Energy Forecasting’s solar energy production forecasting indicates a recovery in the Italian market compared to the previous week. On the other hand, in the markets of Germany and Spain, a lower production is expected.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

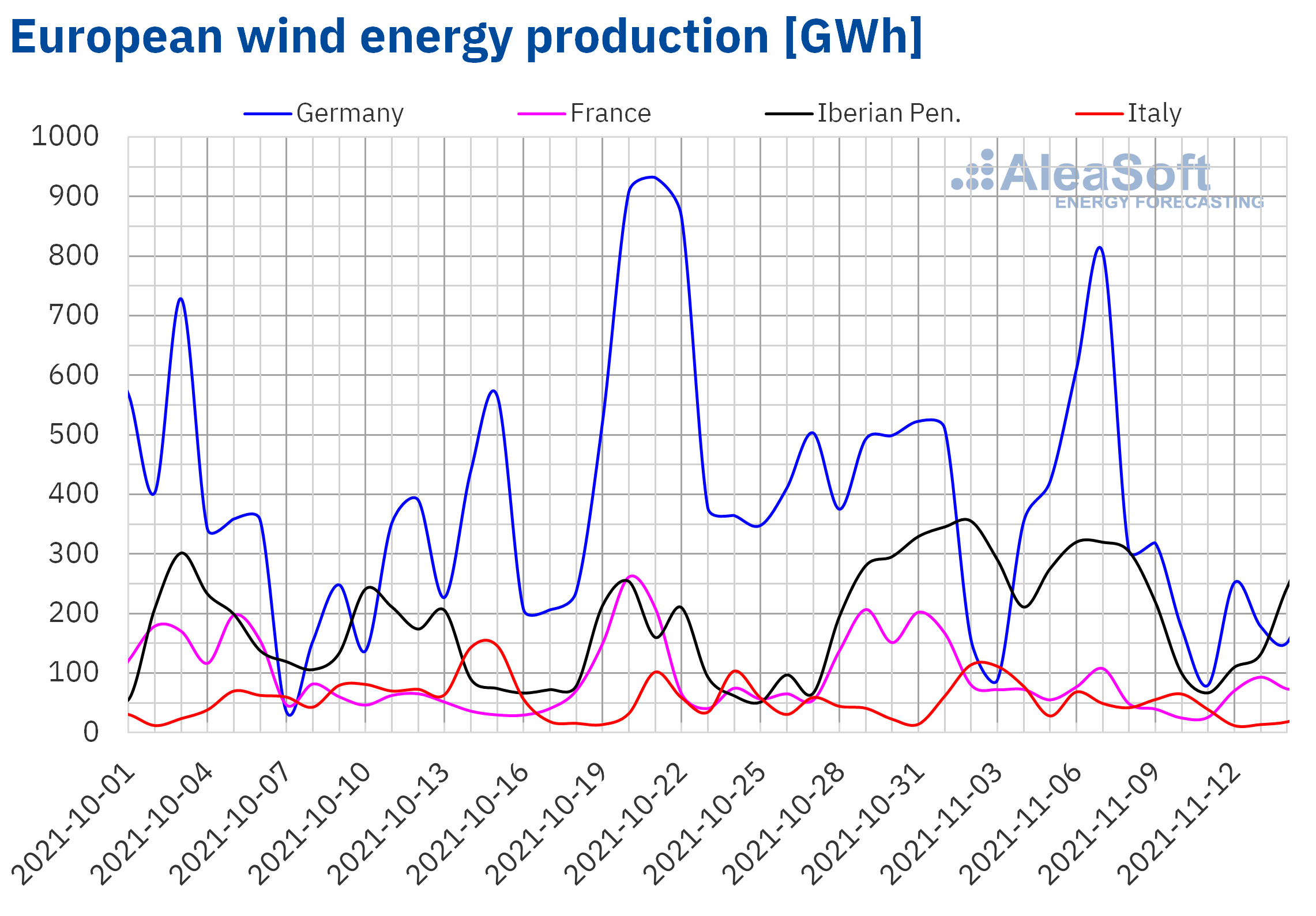

The wind energy production decreased in a generalised way in all the analysed markets during the week of November 8 compared to the first week of the month. The Italian market was the one with the greatest decrease in the generation with this technology, of 52%, followed by the decrease of 50% of the German market. In the Iberian and French markets, the production fell by 44% and 40% respectively.

For the week of November 15, the AleaSoft Energy Forecasting’s wind energy production forecasting indicates a recovery in generation with this technology in all the analysed markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

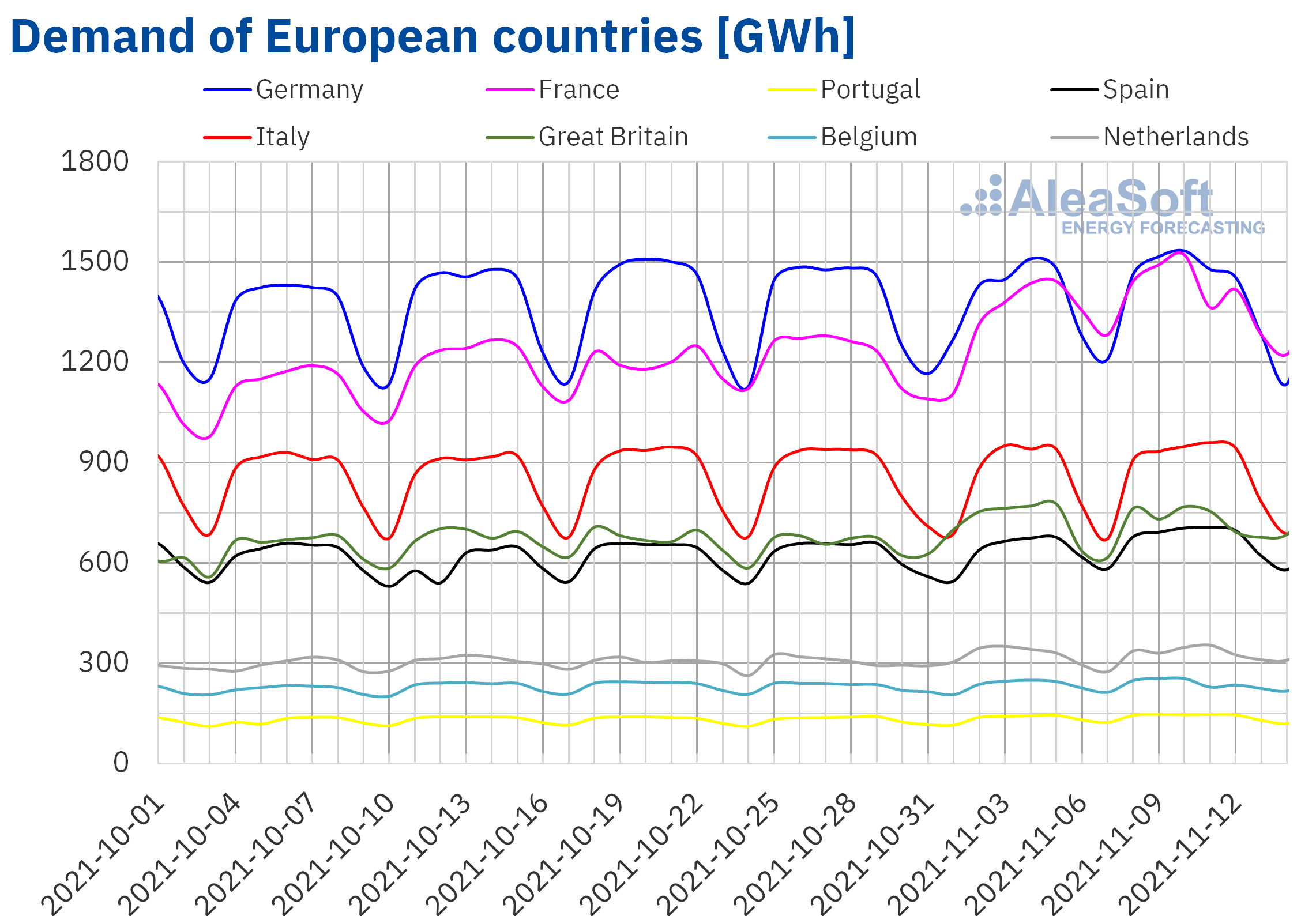

Electricity demand

The electricity demand rose in a generalised way in all European electricity markets during the week of November 8 compared to the previous week. The main factors behind these increases were the effect of the November 1 holiday, All Saints’ Day, on the demand of the previous week and the drop in temperatures in most markets. In the markets of Spain and Italy the variations were 6.3% and 5.4%, respectively. When correcting the effect of the November 1 holiday, the increase in the Spanish market was 3.6%. Other important increases were registered in the French and Portuguese markets, with growths of 4.6% and 4.5%, in that order. In the rest of the markets the increases were in the range between 1.1% and 2.4%.

The demand is expected to increase in most markets during the week of November 15, according to the AleaSoft Energy Forecasting’s demand forecasts. However, similar values to those of the previous week are expected to be registered in the markets of Germany and Spain.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

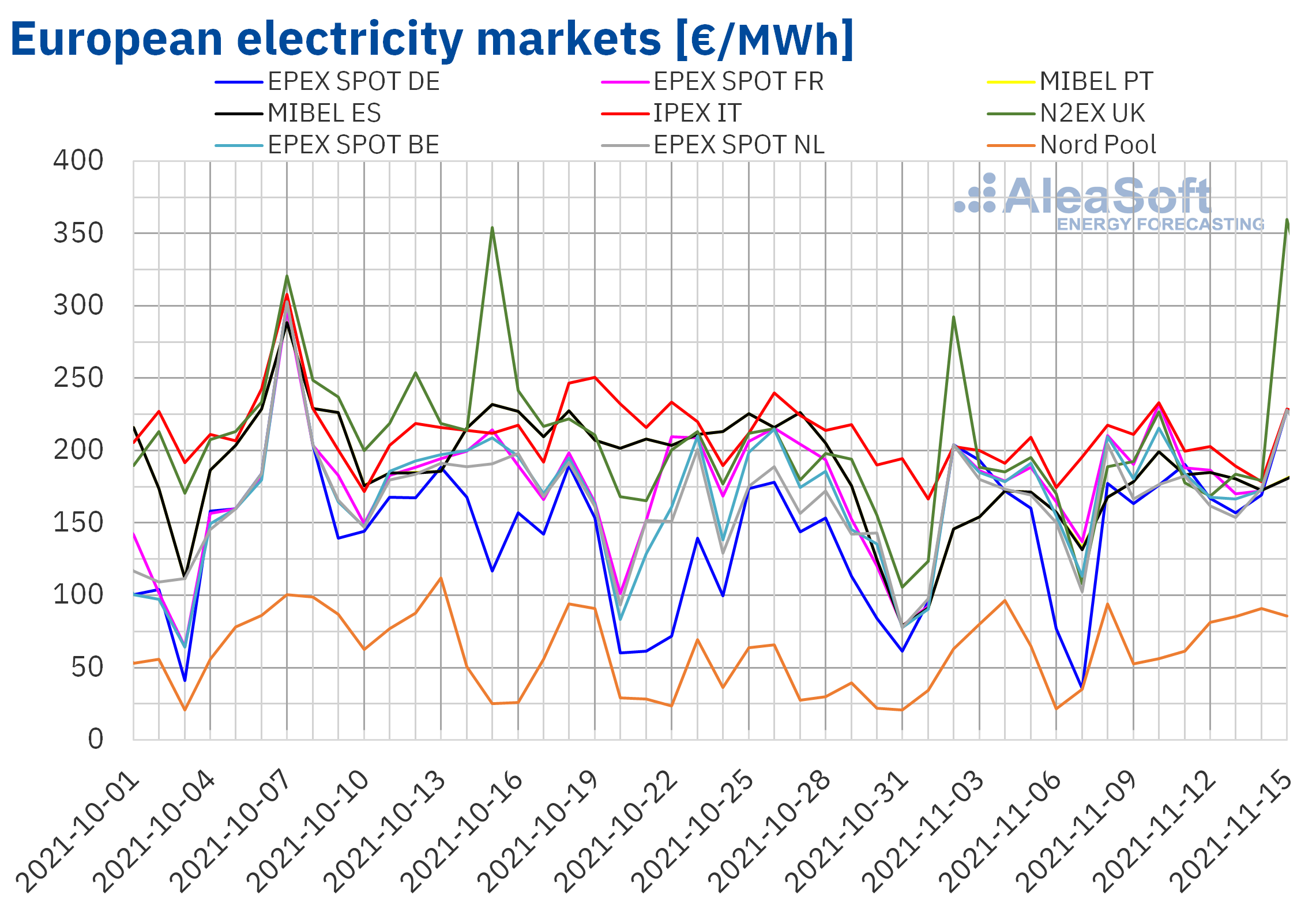

European electricity markets

In the week of November 8, prices of all the European electricity markets analysed at AleaSoft Energy Forecasting increased compared to the previous week. The largest price rise was that of the Nord Pool market of the Nordic countries, of 32%, followed by that of the EPEX SPOT market of Germany, of 28%. On the other hand, the lowest price increase was that of the N2EX market of the United Kingdom, of 4.3%, followed by the 6.9% increase of the IPEX market of Italy. In the rest of the markets, price increases were between 13% of the EPEX SPOT market of the Netherlands and 24% of the MIBEL market of Spain and Portugal.

In the second week of November, the highest weekly average price was that of the IPEX market, of €204.55/MWh, while the lowest average was that of the Nord Pool market, of €74.45/MWh. In the rest of the markets, prices were between €171.48/MWh of the EPEX SPOT market of Germany and €192.74/MWh of the EPEX SPOT market of France.

The highest daily price of the week, of €232.94/MWh, was reached on Wednesday, November 10, in the Italian market. In contrast, the lowest daily price of the week, of €52.47/MWh, was registered on Tuesday, November 9, in the Nord Pool market. On the other hand, in the British market, the price of November 15, of £307.70/MWh, was the highest since mid?September.

Regarding hourly prices, on Monday, November 8, at 18:00, a price of €129.92/MWh was reached in the Nord Pool market, the highest since February in this market. In the case of the N2EX market, on November 15, at 18:00 CET, a price of £2000.05/MWh was reached. This price was the highest since £2500.01/MWh registered on September 15 at 20:00 CET, and the second highest in the history.

During the week of November 8, the increase in European electricity markets prices was favoured by various factors. On the one hand, there was a general increase in demand. On the other hand, the average price of gas and CO2 emission rights increased compared to that of the previous week. In addition, there was a general decline in wind energy production in Europe. In the case of France and Italy, the solar energy production also fell. In Spain, during the last days of the week, the nuclear energy production decreased due to the start of recharging operations at the Cofrentes nuclear power plant.

The AleaSoft Energy Forecasting’s price forecasts indicate that in the week of November 15, prices might continue to increase in most European markets, influenced by the increase in demand and the decrease in solar energy production in some markets.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

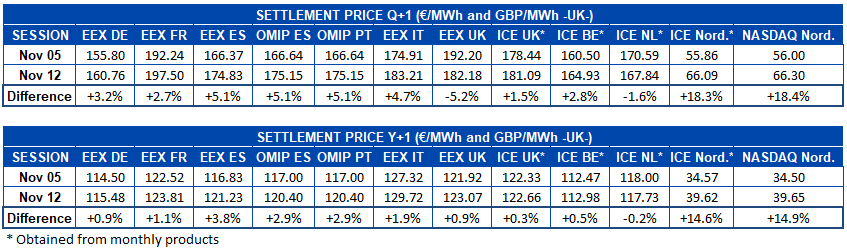

Electricity futures

Electricity futures prices for the next quarter registered increases in most of the European electricity markets analysed at AleaSoft Energy Forecasting if the settlement prices of November 12 are compared with those of the 5th of the same month. The NASDAQ market of the Nordic countries was where the largest rises occurred, with an increase of 18% between the sessions of November 5 and 12. However, the ICE market of the Netherlands and the EEX market of the United Kingdom were the exceptions and in them there were price drops during this same period, of 1.6% and 5.2% respectively.

In the negotiations of the product for next year 2022 there were also increases in most markets, the ICE market of the Netherlands being the only one in which prices fell, registering a moderate decrease of 0.2%. On the other hand, in the rest of the markets, prices rose, the NASDAQ market being again the one with the highest increase, when the session of last Friday, November 12, settled with a price 15% higher than that of the previous Friday, November 5.

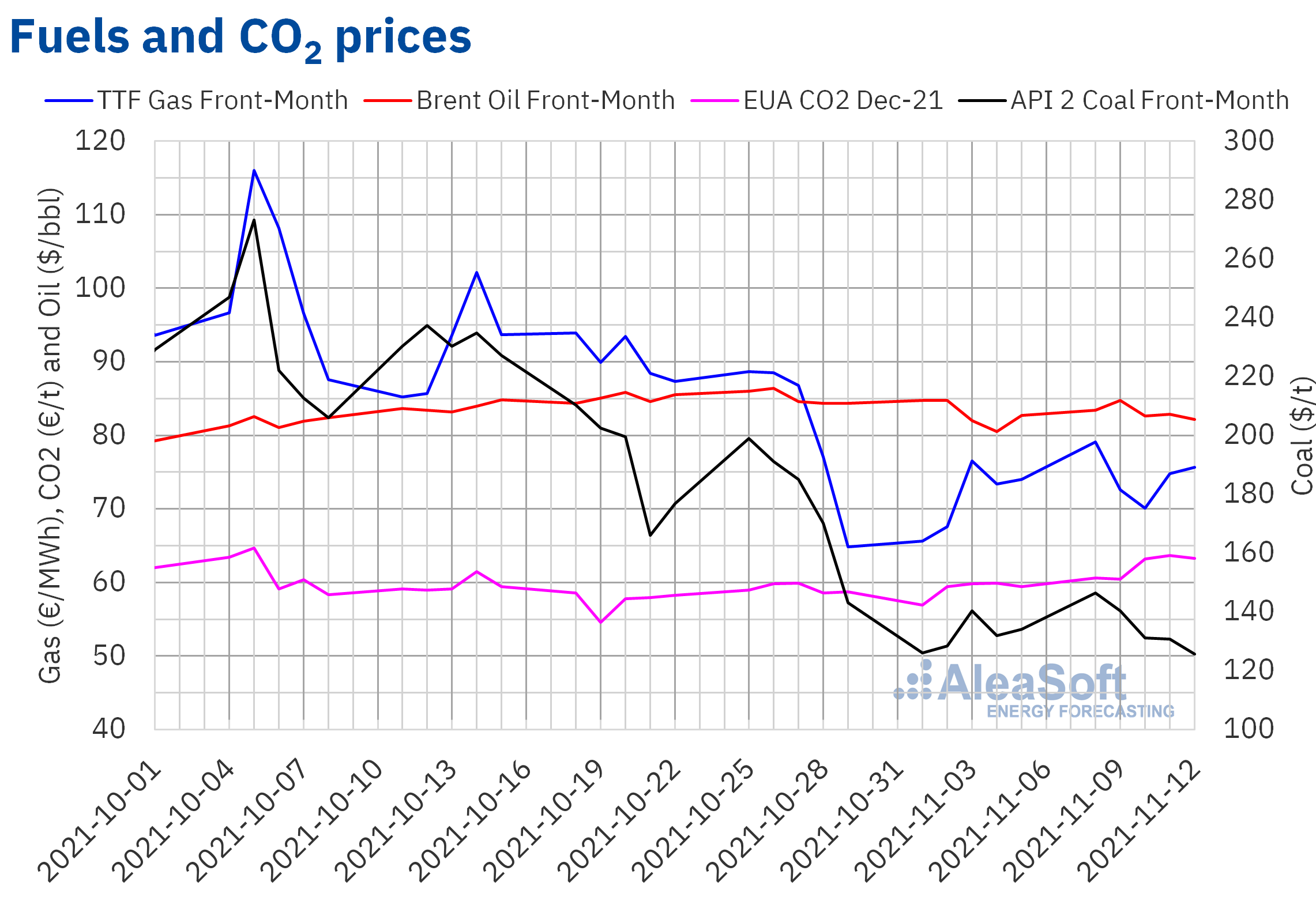

Brent, fuels and CO2

Settlement prices of Brent oil futures for the Front?Month in the ICE market began the second week of November with increases. This recovery in prices led to the registering of the maximum settlement price of the week, of $84.78/bbl, on Tuesday, November 9, which was 0.1% higher than that of the previous Tuesday. However, the following days of the week, prices were below $83/bbl. On Friday, November 12, the minimum settlement price of the week, of $82.17/bbl, was registered, which was 0.7% lower than that of the previous Friday.

In the second week of November, COVID?19 infections continued to increase in Europe and more countries began to take measures to try to stop them, so there continues to be concern about the effects of the evolution of the pandemic on the demand. In addition, on Thursday OPEC downgraded its forecast for demand for 2021, based on the fact that in the third quarter the demand in China and India was lower than expected. On the other hand, the possibility of the United States using its reserves to prevent prices from continuing to rise had its downward influence on Brent oil futures prices at the end of the week.

As for settlement prices of TTF gas futures in the ICE market for the Front?Month, the second week of November they remained above €70/MWh. The maximum settlement price of the week, of €79.07/MWh, was reached on Monday, November 8. This price was 21% higher than that of the previous Monday. Subsequently, prices fell to register their minimum value of the week on Wednesday, of €70.12/MWh. But Belarus’ threats to cut off the gas flow from Russia to Europe favoured that prices rose again. The decrease in gas flow from Norway also contributed to this trend. Thus, the settlement price of Friday, November 12, was €75.68/MWh, 2.2% higher than that of the previous Friday and the weekly average was 4.2% higher than that of the previous week.

Regarding settlement prices of CO2 emission rights futures in the EEX market for the reference contract of December 2021, the second week of November they remained above €60/t. The maximum settlement price of the week, of €63.70/t, was reached on Thursday, November 11. This price was 6.4% higher than that of the previous Thursday and the highest since the first week of October. In this way, the weekly average of settlement prices stood at €62.24/t, being 5.3% higher than that of the first week of November.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe

On November 11, the AleaSoft Energy Forecasting’s webinar “Prospects for European energy markets in the global energy crisis” was held, in which speakers from Engie Spain also participated. The analysed topics were the evolution and prospects for the European energy markets in the current context of energy crisis, the financing of renewable energy projects, in particular PPA, and the implications for the sector of Royal Decree?laws 17 and 23 approved in Spain in September and October 2021. Clients and those interested in forecasts of AleaSoft Energy Forecasting can request the recording at this link.

The next AleaSoft Energy Forecasting’s webinar will be held on January 13, 2022, with the participation of speakers from PwC Spain. This webinar will be the continuation of the one held on January 14, 2021, with the same guests, in which the PPA market was analysed from the point of view of consumers. In the webinar, the usual analysis of the evolution of the energy markets will be carried out, focusing on prospects for 2022.

On November 16, at 16:30, the conference “Guidelines to understand the electricity price. Impact of wind energy on the electricity price” organised by AEE will be held in GENERA 2021, in which the CEO of AleaSoft Energy Forecasting, Antonio Delgado Rigal, will participate as a panellist, together with Yolanda Cuéllar Salinas, Director of Market Operation at OMIE, Adolfo de Rueda Villén, Director of Electricity Markets at Endesa and Antonio Gómez, Director of Regulation and Legal Advice at Villar Mir Energía.

At AleaSoft Energy Forecasting, studies, analyses and reports are being carried out for hybrid systems of renewable energy and energy storage, which aim to define strategies to optimise their operation to maximise and estimate their income, also taking into account the long?term hourly market price forecasting.