Prices of all European electricity markets rose in the fourth week of November and the weekly average, above €200/MWh in most of them, was the highest in the history in almost all markets. There are several factors that led to the increases, despite the fact that wind energy production increased in most markets: increased demand due to the drop in temperatures, lower nuclear energy contribution in some countries and high gas and CO2 prices, the latter registering records.

Photovoltaic and solar thermal energy production and wind energy production

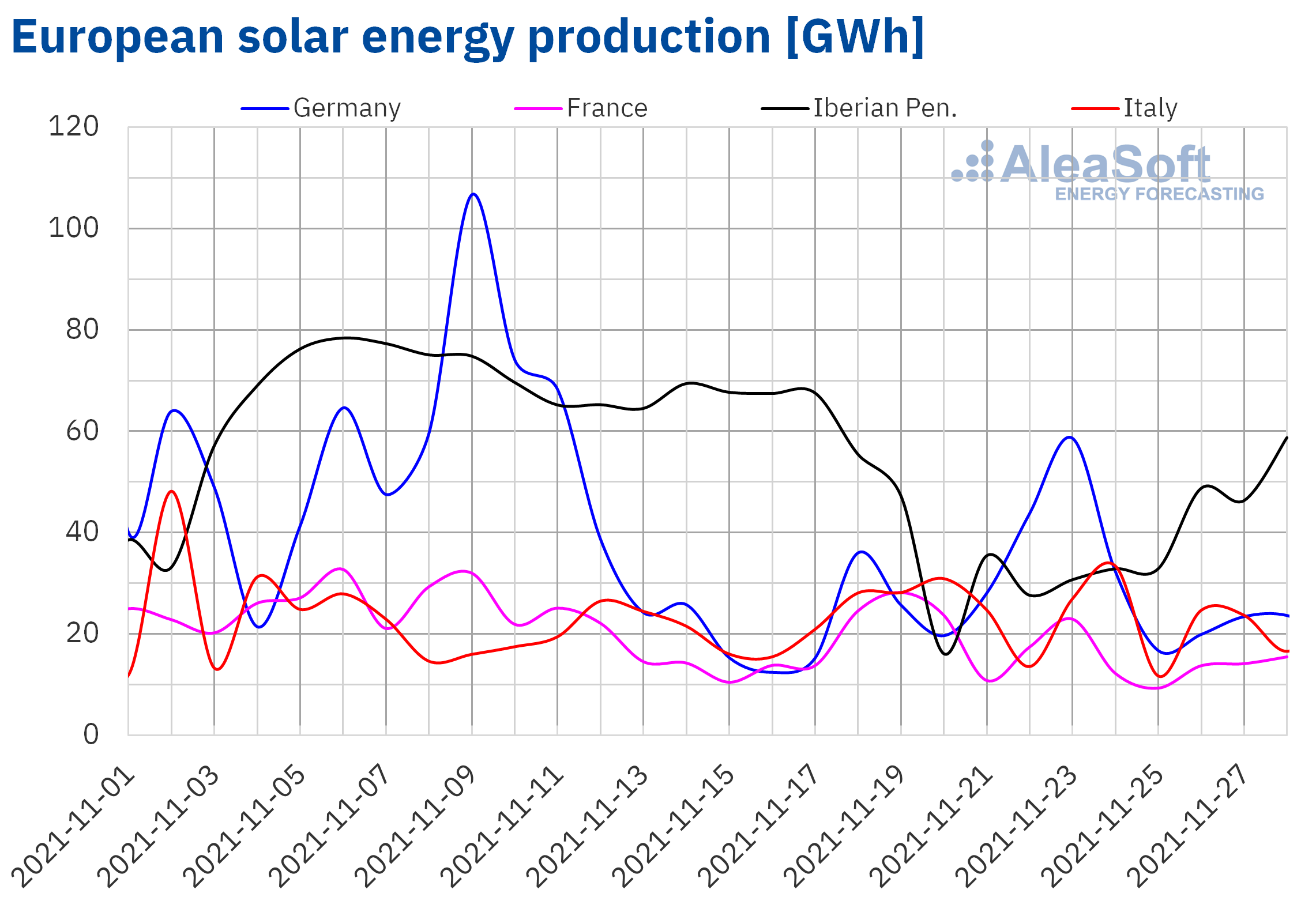

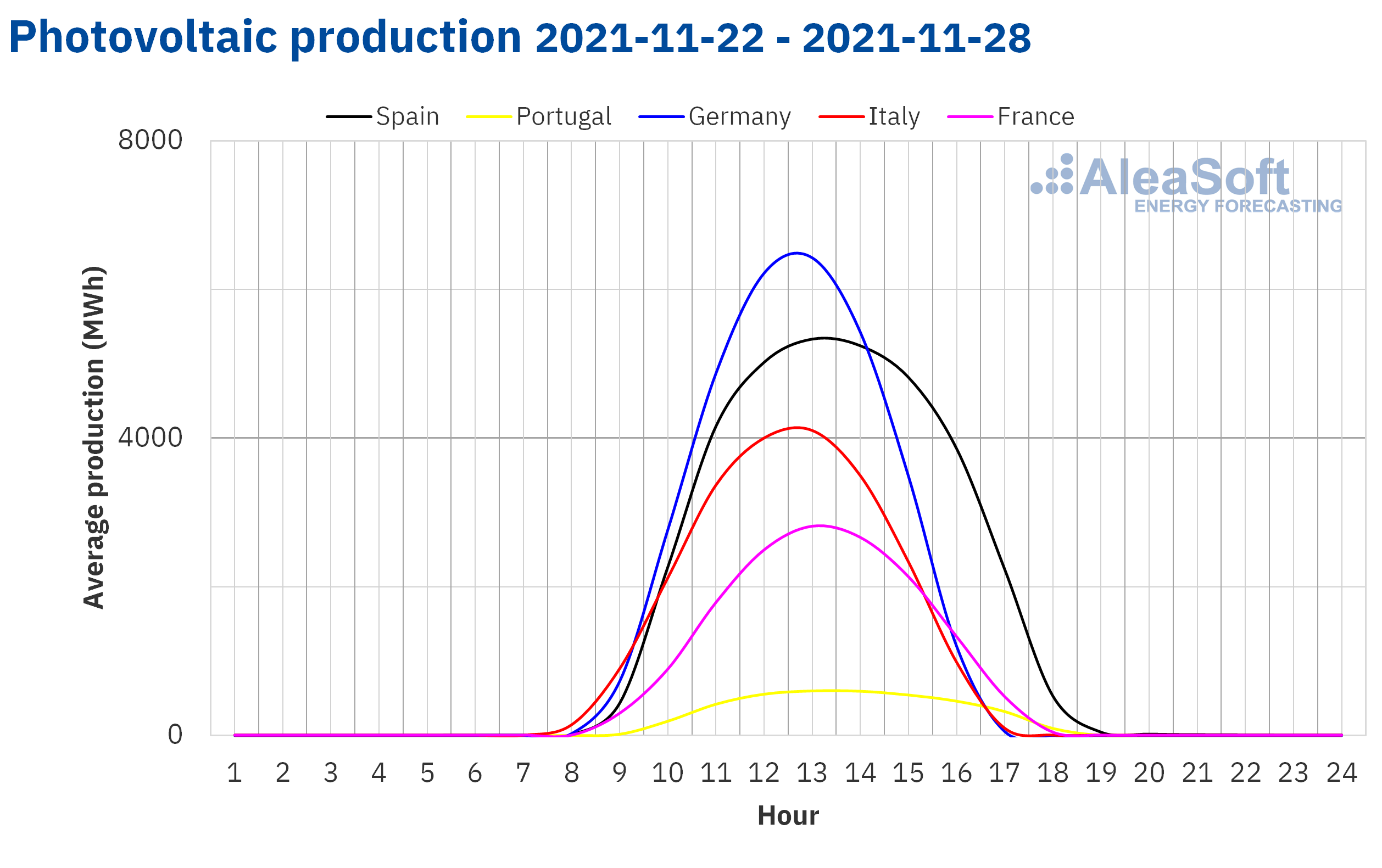

In the fourth week of November, the solar energy production increased by 43% in the German market compared to the previous week. On the contrary, in the rest of the European markets analysed at AleaSoft Energy Forecasting, the generation with this technology decreased in the same period. In the Iberian market, the production fell by 22%, while in the markets of France and Italy the decreases were 16% and 8.4% respectively.

For the week of November 29, the AleaSoft Energy Forecasting’s solar energy production forecasting indicates a recovery in the Spanish and Italian markets compared to the previous week. However, a lower production with this technology is expected in the German market.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

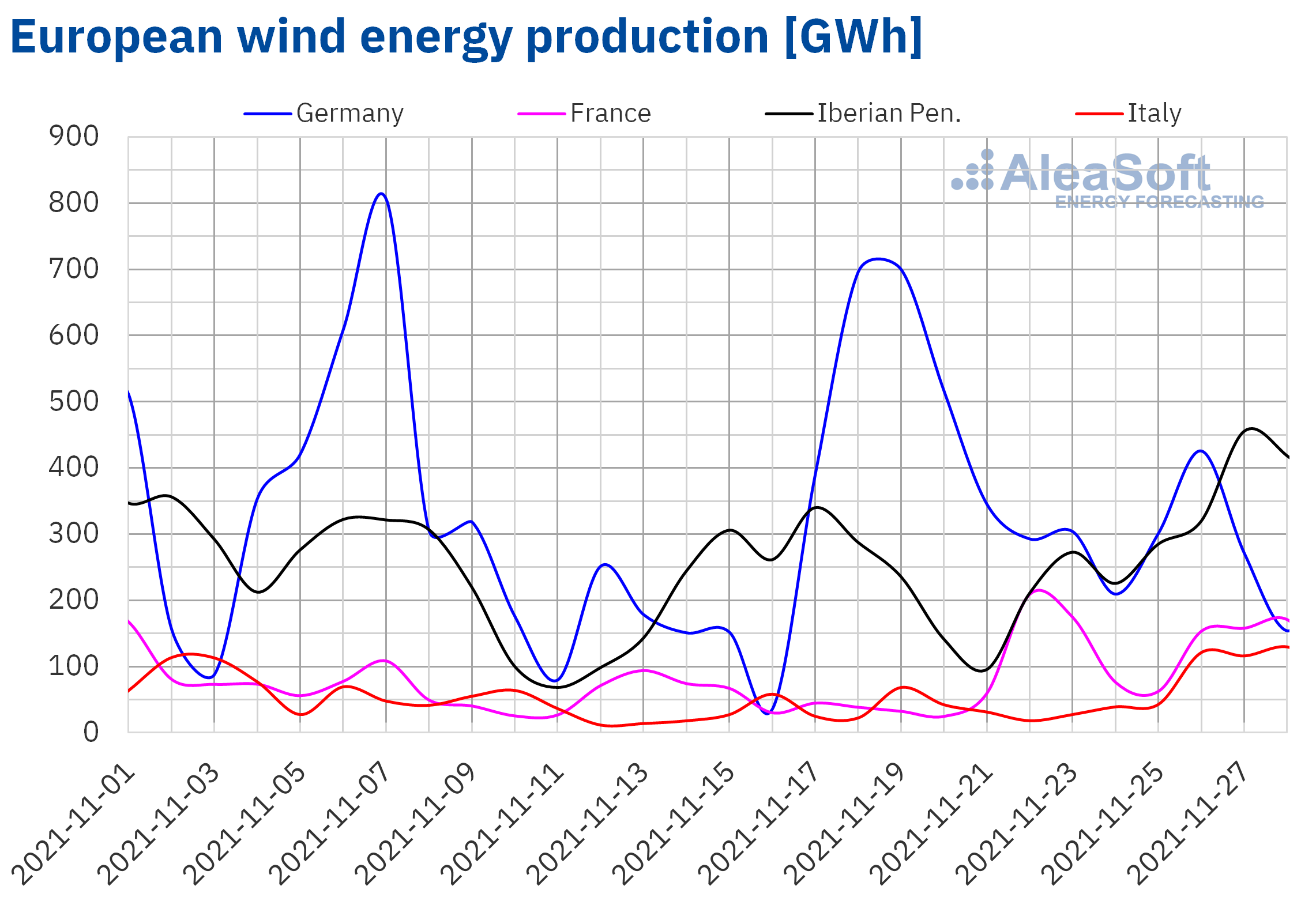

During the week of November 22, the wind energy production increased in most of the analysed European markets compared to the third week of November. The French market registered a notable increase of 240%, followed by the 79% increase of the Italian market and the 31% increase of the Iberian market, in which on Sunday, November 27, the highest wind energy production in Spain since the end of January of this year was registered. The exception was the German market, where the wind energy production fell by 31% in the same period.

For the week of November 29, the AleaSoft Energy Forecasting’s wind energy production forecasting indicates an increase in generation with this technology in the markets of Germany and Italy, while for the rest of the markets it is expected that the wind energy production will be lower than that registered during the previous week.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

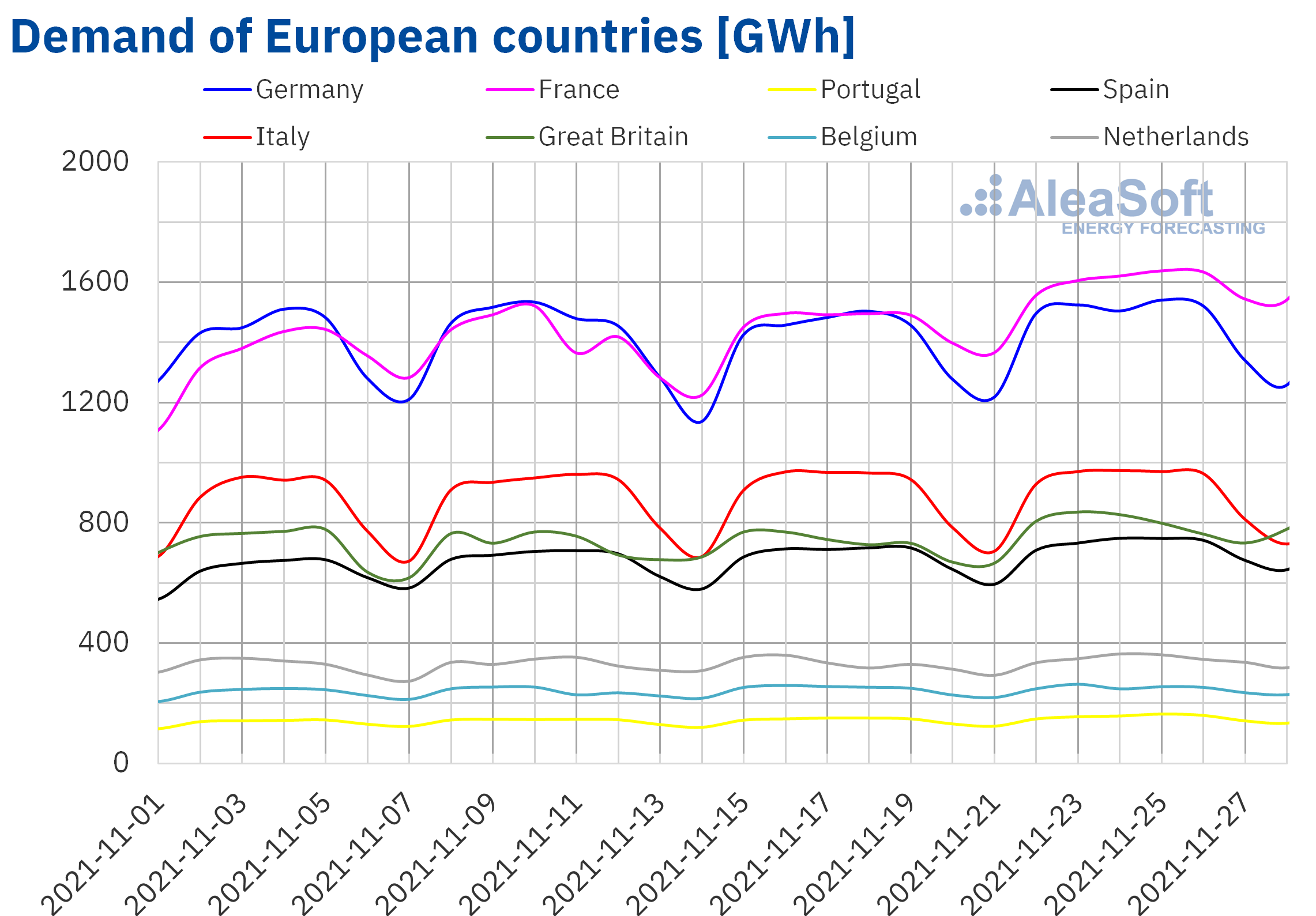

Electricity demand

The electricity demand increased in a generalised way in the European electricity markets during the week of November 22 compared to the previous week. The main factor behind the rise was the drop in average temperatures in most markets, which fell by more than 3.5 °C in the markets of Great Britain, the Netherlands, Germany and Belgium. The most significant increases in demand were registered in France and Great Britain, with values of 9.4% and 9.1%, respectively. Behind in this list of increases were the markets of Portugal, the Netherlands and Spain, where the demand rose by 6.4%, 4.7% and 4.5%, respectively. In the rest of the markets the increases were lower than 4.0%.

For the week of November 29, the demand is expected to continue increasing in most of the electricity markets of Europe, according to the AleaSoft Energy Forecasting‘s demand forecasts.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

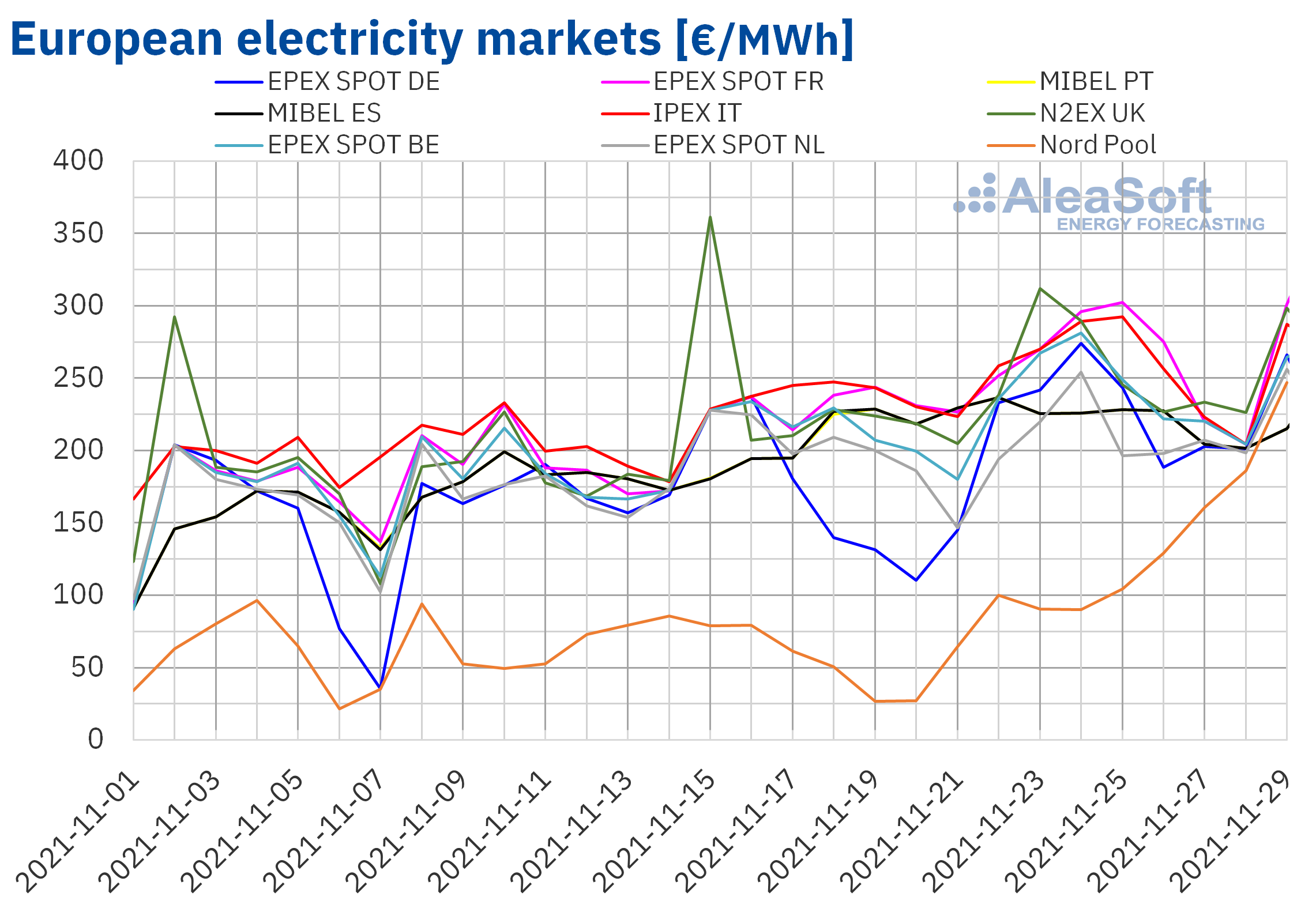

European electricity markets

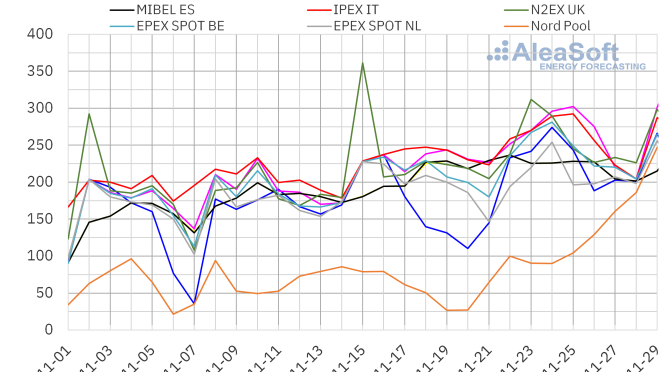

In the week of November 22, prices of all European electricity markets analysed at AleaSoft Energy Forecasting increased compared to the previous week. The largest price increase was that of the Nord Pool market of the Nordic countries, of 122%, followed by that of the EPEX SPOT market of Germany, of 35%. On the other hand, the lowest price increases were those of the MIBEL market of Spain and Portugal, of 5.2% and 5.3% respectively. In the rest of the markets, the price increases were between 5.5% of the EPEX SPOT market of the Netherlands and 12% of the EPEX SPOT market of Belgium and France.

In the fourth week of November, almost all analysed markets reached weekly average prices above €200/MWh. The exception was the Nord Pool market, which had the lowest average, of €122.93/MWh. On the other hand, the highest weekly average price, of €259.93/MWh, was that of the EPEX SPOT market of France. In the rest of the markets, prices were between €209.66/MWh of the market of the Netherlands and €256.29/MWh of the IPEX market of Italy. These weekly averages were historical records in all markets, except in the N2EX market of the United Kingdom. In this market, the price of the week of November 22 was the second highest, after the maximum of the week of September 13, of £267.87/MWh.

During the week of November 22, the general increase in demand due to the low temperatures favoured the increase in prices, despite the increase in wind energy production in most markets. On the other hand, the levels of nuclear energy production in countries such as France and Spain were lower than usual, since several plants were stopped for maintenance work and refuelling. This, together with the rise in gas and CO2 emission rights prices, which also contributed to the increase in European electricity markets prices.

AleaSoft Energy Forecasting’s price forecasts indicate that in the week of November 29, prices may continue to increase in most European markets. But, in the case of Germany and Italy, prices may fall favoured by the increase in wind energy production in these markets.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

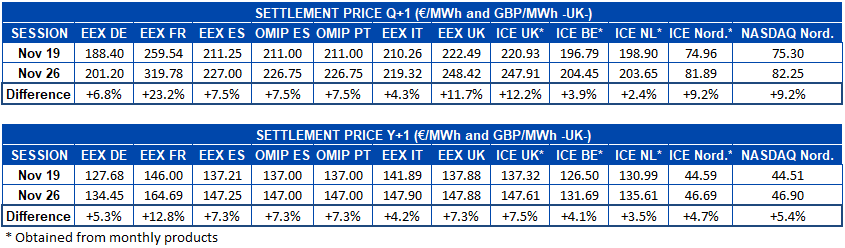

Electricity futures

Once again, there were increases in prices of the last market session in electricity futures for the first quarter of 2022. If the settlement prices of Friday, November 26, are compared with those of Friday, November 19, they increased in all European markets analysed at AleaSoft Energy Forecasting. The EEX market of France led the rises, with a 23% increase and the second largest increase was the ICE market of the United Kingdom, with a 12% increase. The ICE market of the Netherlands was the one in which the settlement price changed the least between these sessions, with a rise of 2.4%.

Compared to the yearly product of 2022, there was also a general increase and it was also led by the EEX market of France, with 13%. Likewise, the ICE market of the Netherlands had the lowest percentage increase, of 3.5%. However, in absolute terms the ICE market and the NASDAQ market of the Nordic countries were those with the lowest increase, with a difference of €2.10/MWh and €2.39/MWh respectively between the analysed sessions.

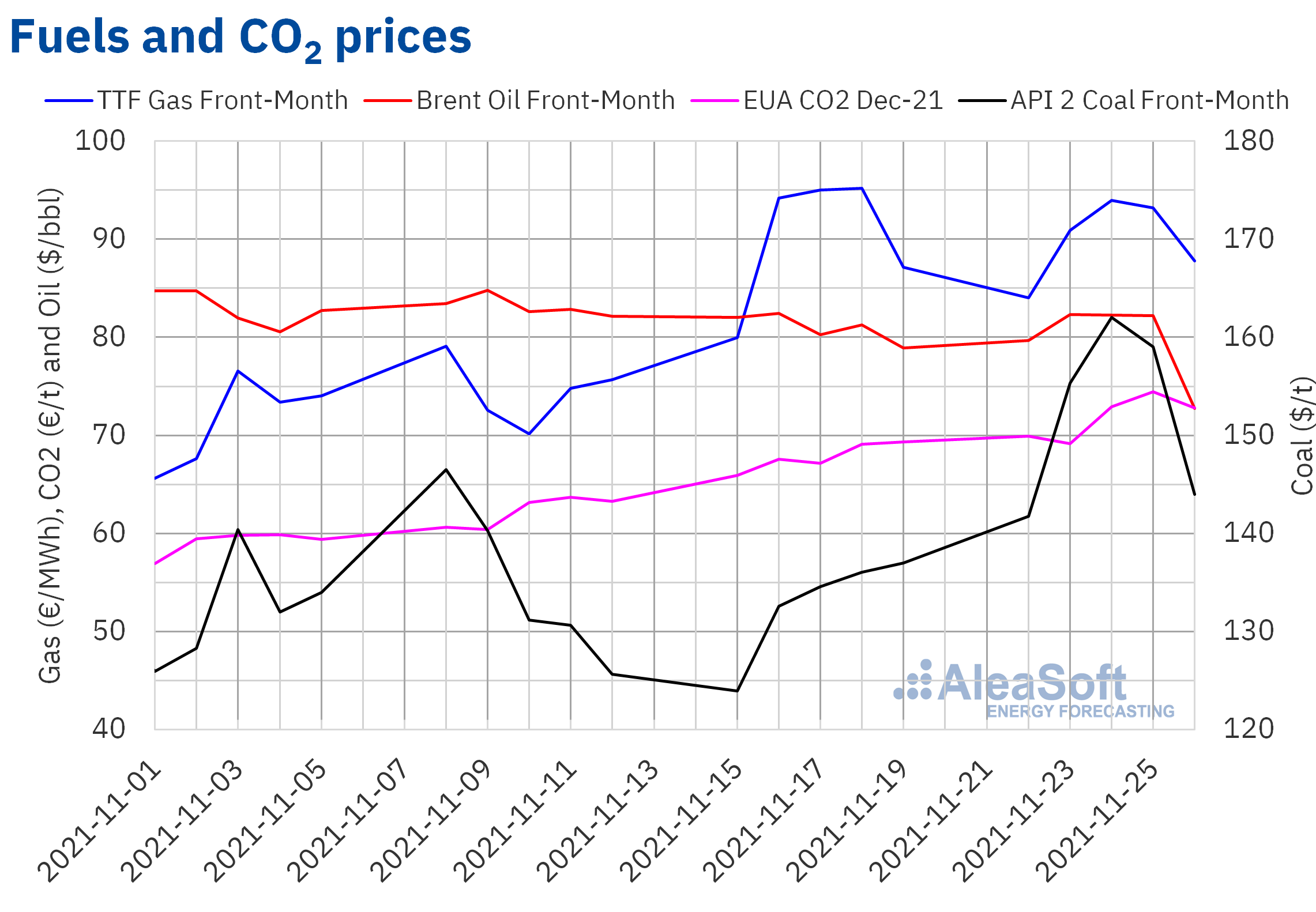

Brent, fuels and CO2

Brent oil futures prices for the Front?Month in the ICE market began the fourth week of November with increases. Thus, on Tuesday, November 23, they reached the maximum settlement price of the week, of $82.31/bbl. On Wednesday and Thursday, settlement prices fell slightly, still remaining above $82.20/bbl. But on Friday, November 26, there was a 12% drop compared to the previous day. That day, a settlement price of $72.72/bbl was registered, which was 7.8% lower than that of the previous Friday and the lowest since mid?September.

The increase in COVID?19 infections in Europe and the fact that more and more countries adopt confinement measures to try to stop the spread of the disease continued to exert its downward influence on prices in the fourth week of November. The news about the detection of the new Omicron variant of the coronavirus favoured the fall in prices of Friday, November 26. The restrictions adopted by many governments to try to prevent the arrival of the new variant in their countries may affect the recovery of the demand.

As for TTF gas futures prices in the ICE market for the Front?Month, they started the fourth week of November with decreases. The settlement price of Monday, November 22, of €84.02/MWh, was the lowest of the week, but it was still 5.1% higher than that of the previous Monday. Later, prices recovered and on Wednesday, November 24, the maximum settlement price of the week, of €93.98/MWh, was reached. In this case, the price was 1.1% lower than that of the same day of the previous week. In the last sessions of the fourth week of November, prices fell again to €87.77/MWh of Friday, November 26. News about the new variant of the coronavirus favoured these price declines.

Regarding CO2 emission rights futures in the EEX market for the reference contract of December 2021, during the fourth week of November they registered settlement prices above €69/t. On Thursday, November 25, the maximum settlement price of the week of €74.46/t was reached, which was a new price record for these futures.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe

In the current scenario of high prices in the spot and futures electricity markets, the need to have short? and mid?term market prices forecasts that allow detecting opportunities when defining and carrying out the energy purchase and sale strategy and in the bids preparation becomes more evident.

The prospects for European energy markets from 2022 will be one of the topics that will be analysed at the next AleaSoft Energy Forecasting’s webinar, which will be held on January 13, 2022. This webinar will be the continuation of the one held on January 14, 2021 and, as on that occasion, there will be the participation of speakers from PwC Spain to analyse how the regulatory and electricity market situation impacts the development of PPA, both off?site and on?site.

On December 1 and 2, the V National Renewable Energy Congress of the Asociación de Empresas de Energías Renovables (APPA) will be held, of which AleaSoft Energy Forecasting is a sponsor. Within the framework of this event, on the 1st the table “Volatility in wholesale markets: present and future” will be held, in which Antonio Delgado Rigal, CEO of AleaSoft Energy Forecasting, will participate, along with Yolanda Cuéllar, Director of Market Operation at OMIE, Olivier Potart, Head of Power Price Forecasting at DNV and José Ángel Castro, Director of Energy Engineering and Energy Management at ENCE.