In the first week of January, European electricity markets prices increased compared to the previous week and in most cases the average exceeded €150/MWh, despite the fact that negative hourly prices were registered in some markets at the beginning of the week. Electricity futures rose in most markets. The increase in demand and the high gas and CO2 prices are the main causes of the rises, in a week in which the renewable energy contribution was higher in general.

Photovoltaic and solar thermal energy production and wind energy production

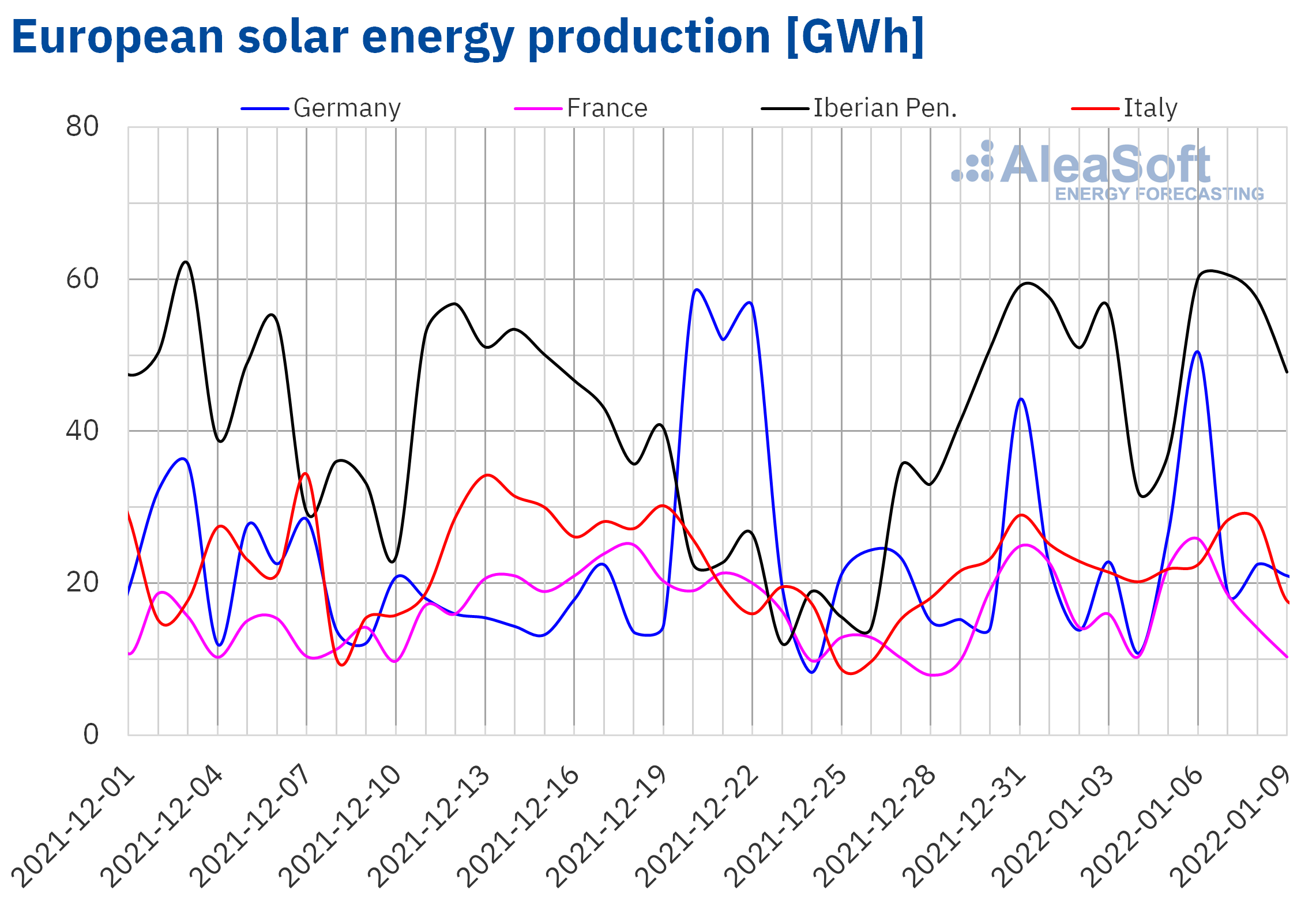

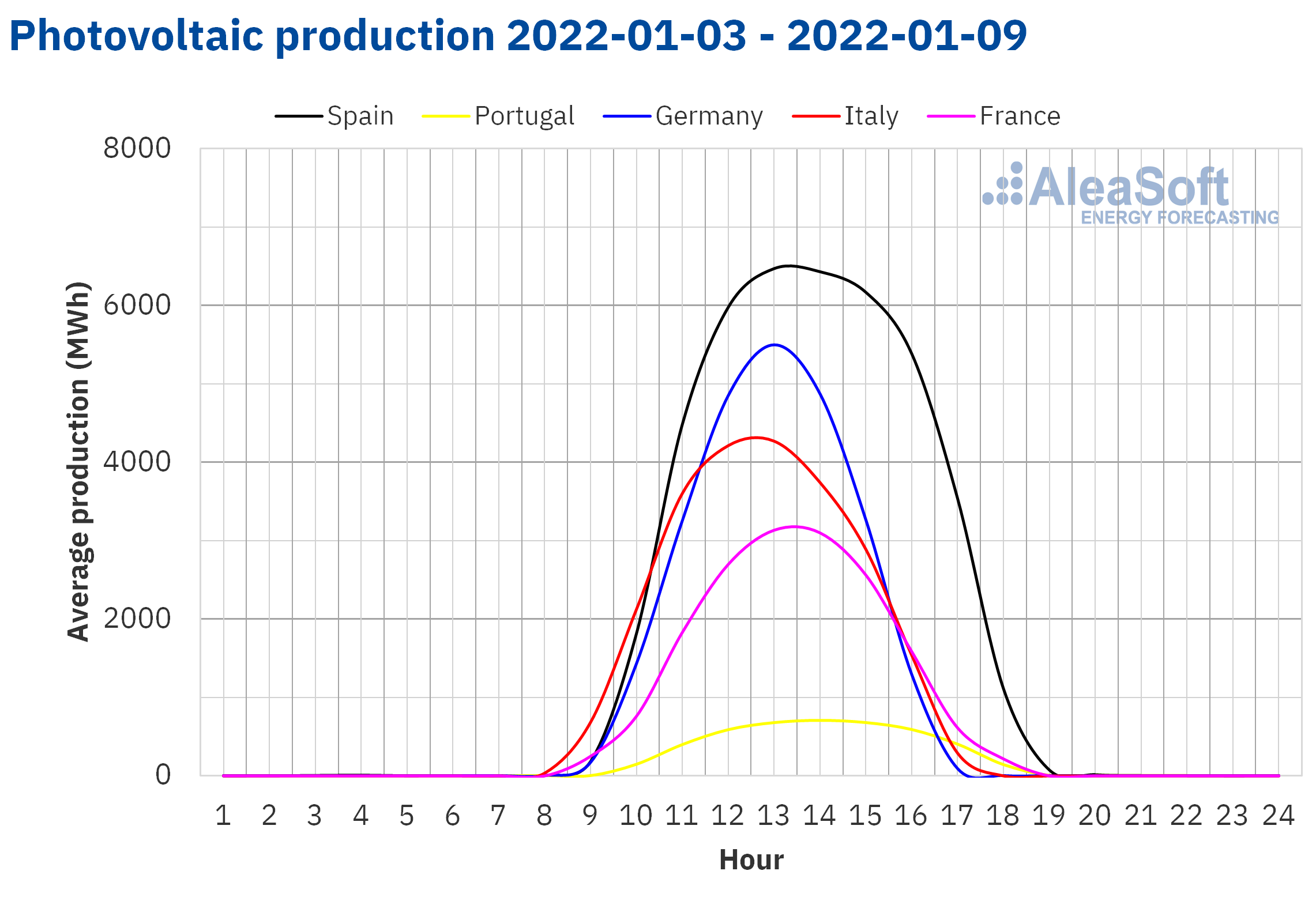

In the week of January 3, the solar energy production increased in a generalised way in all European markets analysed at AleaSoft Energy Forecasting compared to the week of December 27. The largest increase was registered in the German market, with a rise of 17%. In the French market and the Iberian Peninsula the increases were 7.9% and 7.0% respectively, while in the Italian market there was the lowest variation, of 3.2%.

For the week that begins on Monday, January 10, the AleaSoft Energy Forecasting’s solar energy production forecasting indicates that the production with this technology will be higher than that registered during the previous week for the markets of Germany, Italy and Spain.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

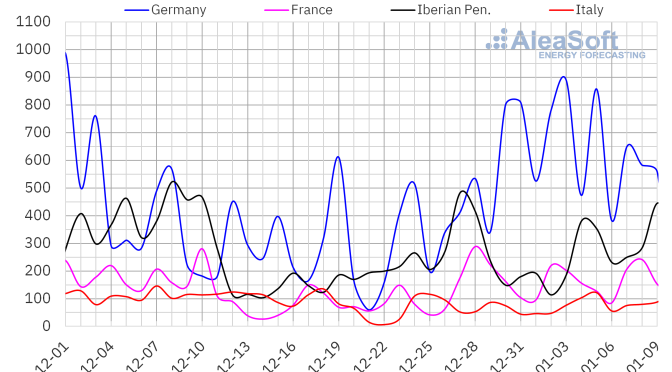

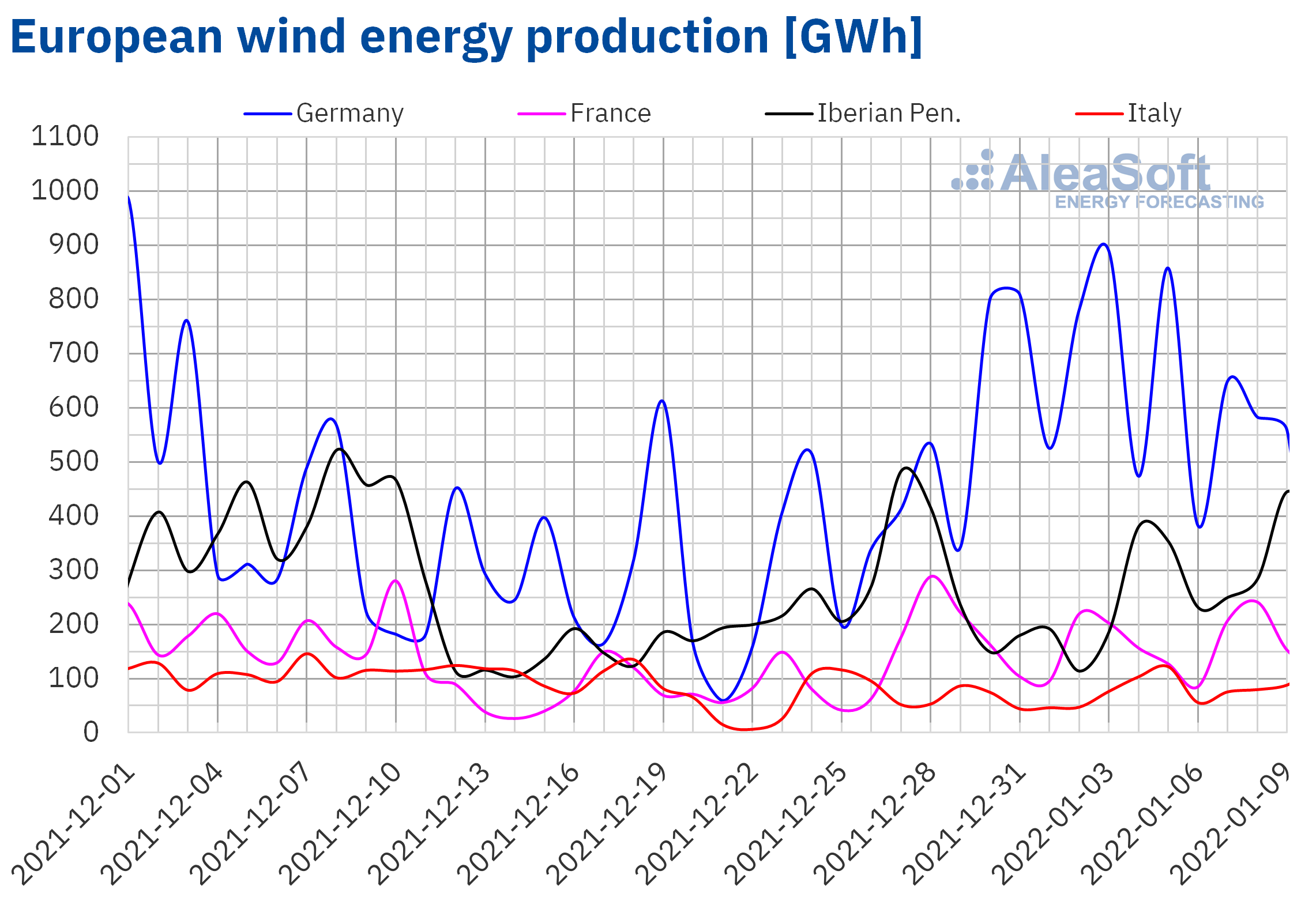

During the first week of January, the wind energy production increased by 49% in the Italian market, followed by the 21% increase in the Iberian Peninsula, compared to the previous week. The German market registered the smallest increase, of 4.5%. However, in the French market, the production with this technology decreased by 7.6%.

For the second week of January, the AleaSoft Energy Forecasting’s wind energy production forecasting indicates a general decrease in production with this technology in all analysed markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

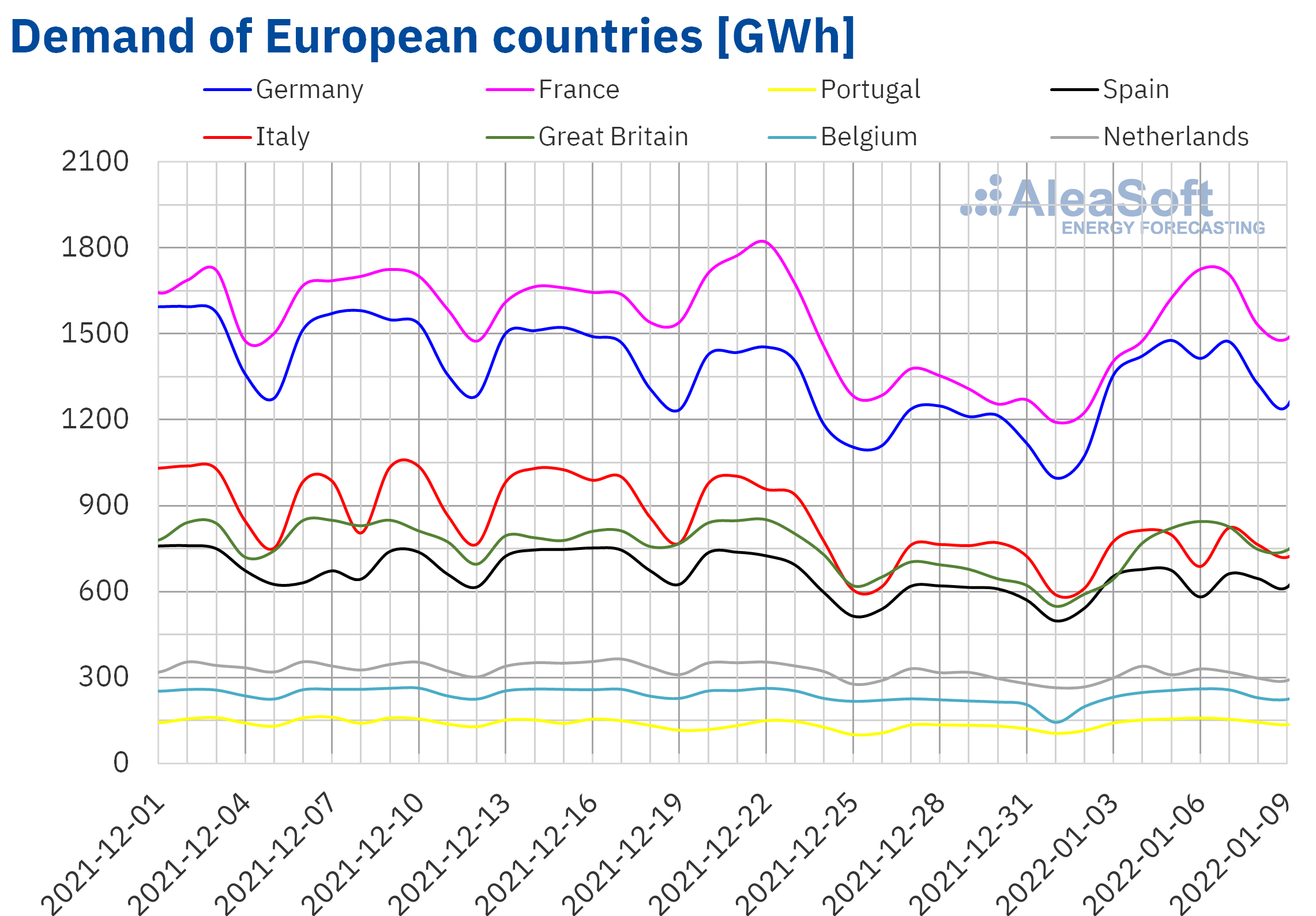

Electricity demand

In the first week of 2022, the electricity demand increased in a generalised way in the European electricity markets compared to the last week of 2021. These increases were higher than 19% in most markets, due to lower labour during holidays late 2021 and early 2022. In addition, the decline in average temperatures, which fell to 5.7 °C in the Belgian market, favoured the increases in demand.

The French and British markets stood out above the rest, where the demand increased by 22% and 20% respectively. Correcting for the effects of holidays, the corresponding increases in these markets were 6.0% and 4.7%. On the other hand, in the Iberian Peninsula the increases were 19% and 11% in the markets of Portugal and Spain, respectively. When correcting the effect of labour on demand, the increases in these markets were 2.5% and 4.3%, respectively.

The AleaSoft Energy Forecasting’s demand forecasting indicates that it will continue to rise in the European markets during the week of January 10, favoured by the falls in average temperatures, which will maintain their decreasing trend.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

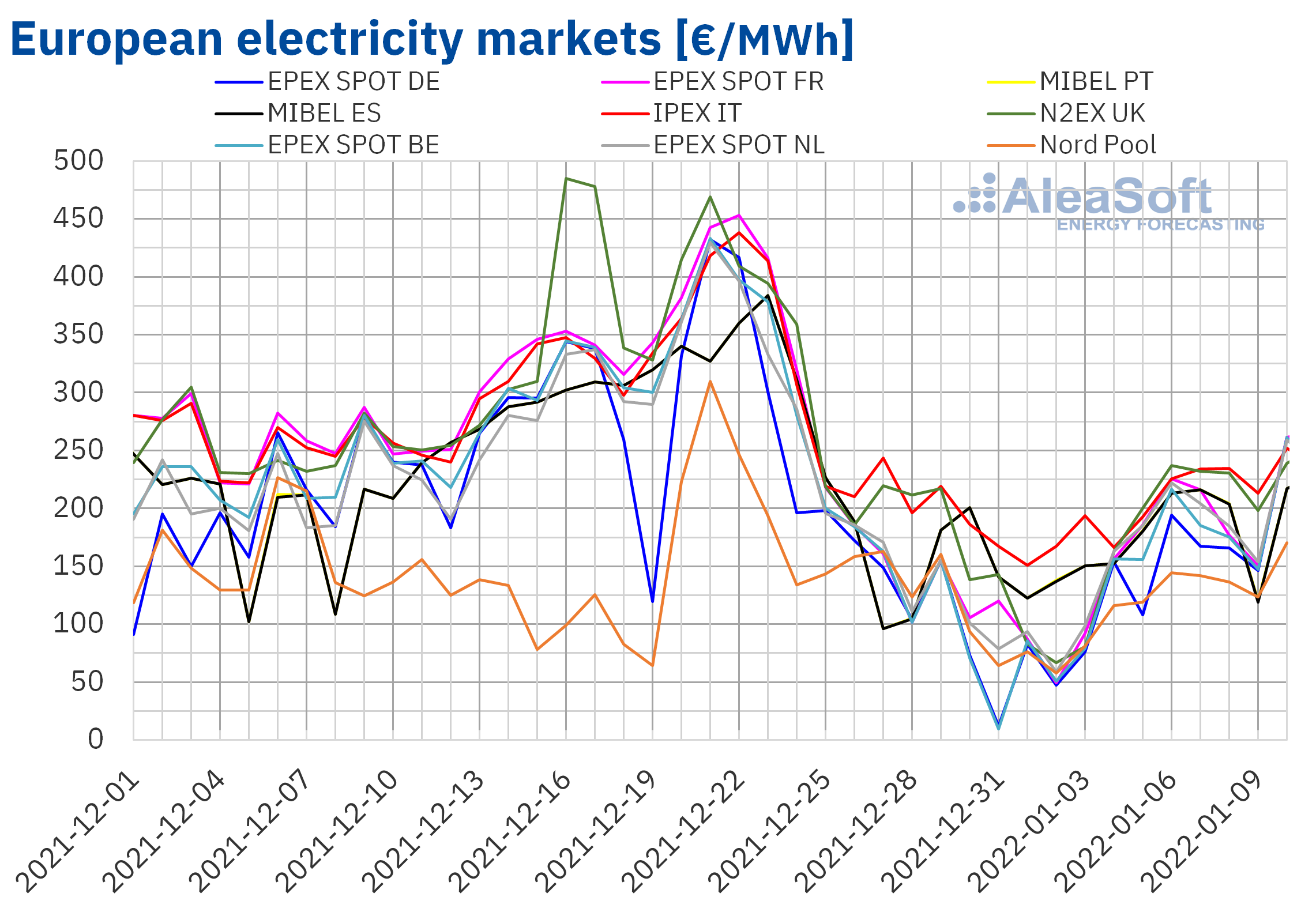

European electricity markets

In the week of January 3, prices of all European electricity markets analysed at AleaSoft Energy Forecasting increased compared to the previous week. The largest price rises were those of the EPEX SPOT market of Belgium and Germany, of 75% and 62% respectively. On the other hand, the smallest increases were that of the IPEX market of Italy, of 9.7% and that of the Nord Pool market of the Nordic countries, of 17%. In the rest of the markets, the increases were between 24% of the N2EX market of the United Kingdom and 57% of the EPEX SPOT market of the Netherlands.

In the first week of January, almost all analysed markets reached weekly average prices above €150/MWh. The exceptions were the Nord Pool market and the German market, with averages of €123.19/MWh and €144.52/MWh respectively. On the other hand, the highest weekly average price, of €208.53/MWh, was that of the IPEX market. In the rest of the markets, prices were between €159.45/MWh of the Belgian market and €191.59/MWh of the British market.

Regarding hourly prices, negative hourly prices were registered on January 3 in the German, Belgian, British and Dutch markets. In the markets of Germany and the Netherlands, prices were not so low since the beginning of October 2021. In the case of the British market, there were also negative prices on January 1. That day, at 8:00, the lowest hourly price in the history of the market, of -£50.00/MWh, was registered.

Regarding daily prices, in the first days of 2022, daily prices below €50/MWh were only reached in the German and French markets on January 2. In the case of the French market, the price of that day, of €49.12/MWh, was the lowest since mid?August 2021.

During the week of January 3, the increase in demand in all analysed electricity markets compared to the previous week favoured the rise in prices, despite the general increase in solar energy production and the increase in wind energy production in most markets. On average, gas prices fell compared to those of the previous week, but they continue at high levels, and CO2 prices rose, both factors remaining as the main causes of the price increases in electricity markets.

The AleaSoft Energy Forecasting’s prices forecasting indicates that the week of January 10, prices might continue to increase in the European electricity markets, favoured by the drop in temperatures and wind energy production.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

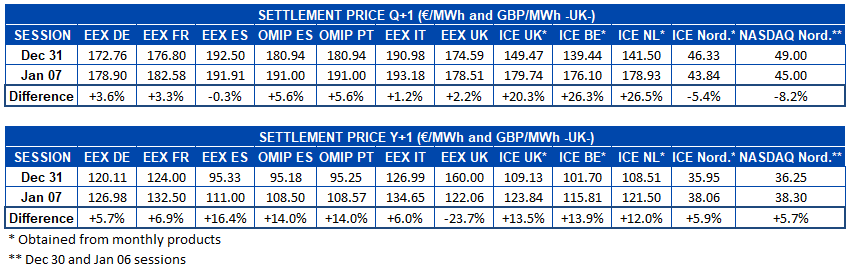

Electricity futures

Electricity futures for the second quarter of the year ended the first week of 2022 with prices higher than those of the previous week in most European markets analysed at AleaSoft Energy Forecasting, with the exceptions of the EEX market of Spain and the region of the Nordic countries. The ICE market and the NASDAQ market of that region settled their last session of the week with prices that were 5.4% and 8.2% lower, respectively, compared to those of the last sessions of the previous week. On the other hand, the EEX market of Spain registered the lowest variation in this product during the analysed period, with a 0.3% decrease. In the rest of the markets, prices increased, being the ICE markets of Belgium and the Netherlands those that registered the greatest increases, with rises of more than 26% in both cases.

On the other hand, with respect to the product of the calendar year 2023, prices increased after the end of the first week of 2022, except in the EEX market in the United Kingdom, where there was a 24% drop. In the rest of the markets, prices increased, with the EEX market of Spain being the one with the highest increase, with 16%, followed by the OMIP market of Spain and Portugal, with a 14% increase in prices of both countries.

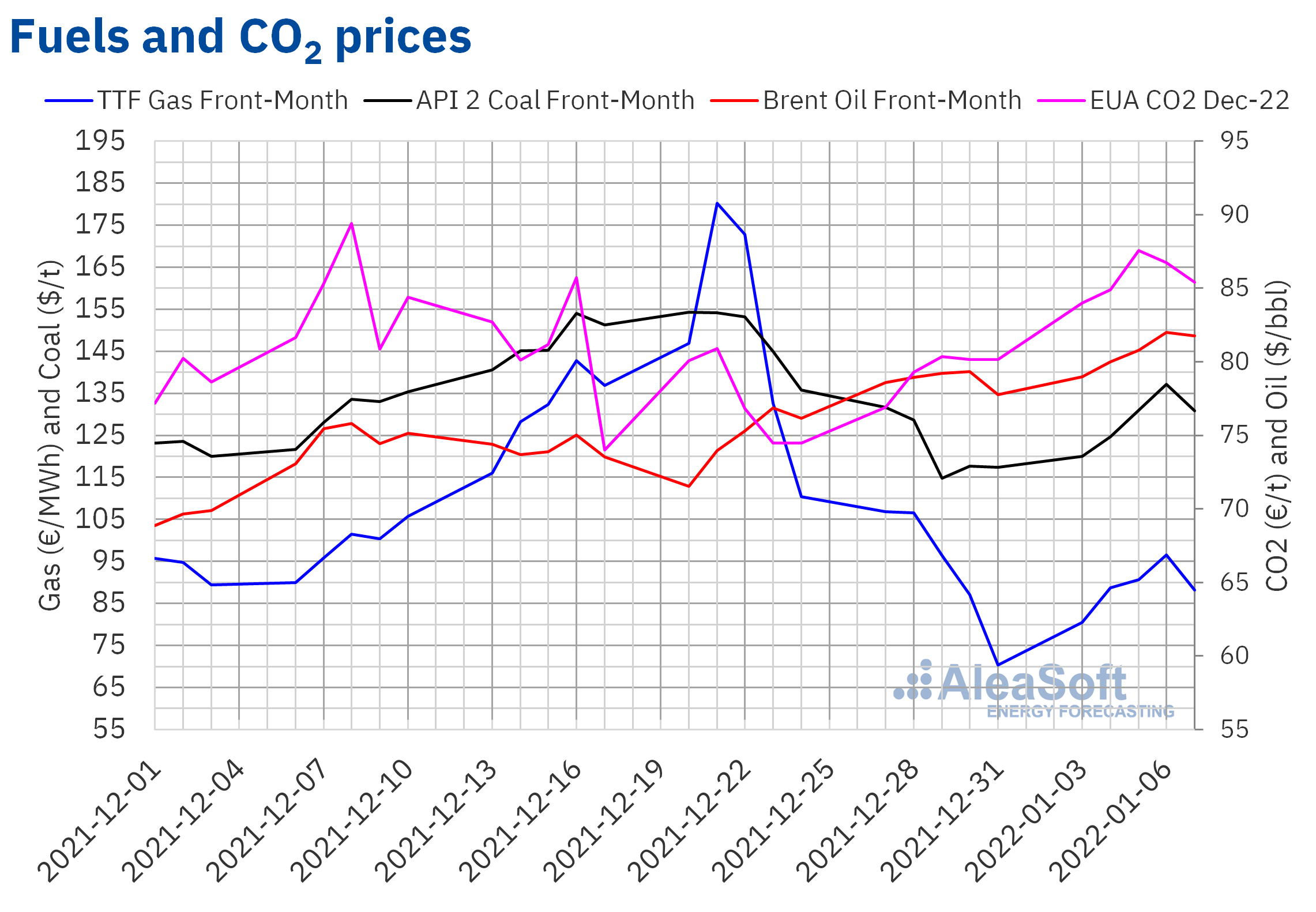

Brent, fuels and CO2

Settlement prices of Brent oil futures for the Front?Month in the ICE market during the first week of January exceeded $80/bbl for the first time since the end of November. On Thursday, January 6, the maximum settlement price of the week, of $81.99/bbl, was reached. This price was 3.4% higher than that of the previous Thursday.

Supply problems in Kazakhstan and Libya exerted their upward influence on prices in the first week of January. However, Kazakhstan might progressively regain supply levels in the coming days. On the other hand, the appearance of new cases of COVID?19 in China causes concern due to its effect on demand, since this country is the largest importer of crude in the world. Also in India, coronavirus infections are increasing and the number of infections remains high in many other countries. A possible increase in mobility restrictions might exert a downward influence on prices in the coming days.

As for TTF gas futures prices in the ICE market for the Front?Month, during the first week of January they remained below €100/MWh. On Monday, January 3, the minimum settlement price of the week, of €80.43/MWh, was registered. This price was 25% lower than that of the previous Monday. The following days of the week, prices increased until reaching the maximum settlement price of the week, of €96.50/MWh, on Thursday, January 6. On Friday, prices fell again and the settlement price was €88.17/MWh. However, this price was still 25% higher than that of the previous Friday.

Regarding CO2 emission rights futures in the EEX market for the reference contract of December 2022, during the first week of January, they remained above €84/t. The first three days of the week, prices rose until reaching a settlement price of €87.58/t on Wednesday, January 5. This price was 9.0% higher than that of the previous Friday and the highest since the second week of December. The shortage of supply of CO2 emission rights favoured this behaviour. But, subsequently, prices fell and the settlement price of Friday, January 7, was €85.41/t. In the second week of January, the new auctions might exert their influence on the evolution of prices.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the renewable energy projects financing

At AleaSoft Energy Forecasting a special promotion is being carried out in January for contracting long?term prices forecasting of multiple European markets, which is an essential input in the financial models for the renewable energy projects financing, especially in the current situation of macrovolatility in European energy markets. The forecasts are hourly and cover a horizon of 30 years, in addition to including bands corresponding to the 15th and 85th percentiles and the price captured by wind and photovoltaic energy.

Next Thursday, January 13, a webinar will be held at AleaSoft Energy Forecasting, with the participation of speakers from PwC Spain. In this first webinar of the year, prospects for European energy markets in 2022 and how the regulatory and the electricity market situation impacts on the development of PPA will be analysed.