The Clean Power Quarterly 2021 Q4 Market Report, released today by the American Clean Power Association (ACP), shows the U.S. surpassed more than 200 gigawatts (200,209 MW-ac) of total operating utility-scale clean power capacity in 2021, but significant policy issues continue to hold back growth for the industry and threaten the country’s ability to meet emissions goals.

“Surpassing over 200 gigawatts of clean energy is a significant milestone for the United States and shows that we can achieve even more with strong public policy support for the industry,” said Heather Zichal, ACP CEO. “Although the U.S. has reached this incredible achievement, more needs to be done, at a faster pace, to reach the climate goals and targets our country needs to achieve. We urge Congress to take action to create a clean energy future that will help create more good-paying American jobs and combat the climate crisis.”

During 2021 there was a three percent decline for clean energy installations compared to 2020’s record year. Over 11.4 gigawatts of projects, originally expected to come online in 2021, slipped to 2022 or 2023 due to a variety of issues. For the solar sector this was due to trade policies and lack of regulatory certainty impacting the availability of solar panels coming into the country. The wind sector faced policy uncertainty, including the expiration of tax credits for wind projects.

The pace of installations fell significantly short of what is required to achieve a net zero emissions goal. While 27.7 GW is the second largest year on record for combined wind, solar and energy storage installations, it is only 45% of what’s required to stay on track for an emissions-free power sector.

2021 New Capacity Additions

Throughout 2021, the renewable energy sector installed 27.7 gigawatts (27,723 MW) of new utility-scale wind, solar, and energy storage capacity, with 10,520 MW being installed in the fourth quarter. These clean power projects represent $39 billion in investments across the sector.

- Wind power capacity installations for 2021 totaled 12,747 MW for the year, with 5,409 MW brought online in the fourth quarter.

- The solar sector overall installed 12,364 MW for the year, including 3,937 MW added in the fourth quarter.

- Battery storage installations totaled 2,599 MW in 2021, outpacing 2020 by over 1,500 MW. During the fourth quarter, 1,173 MW of battery storage projects were brought online, the first quarter ever to pass 1 gigawatt of new installations.

1,000 Clean Power Projects: Powering Jobs and Economic Growth

There are now over 1,000 clean energy projects under development across the country, totaling 120,171 MW of new capacity in the development pipeline. This includes 37,802 MW under construction and 82,369 MW in advanced development.

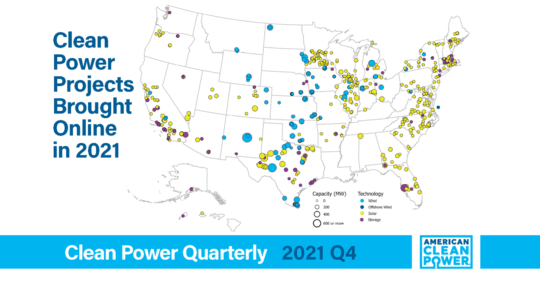

Despite unclear policy headwinds, U.S. project owners commissioned 606 new project phases across 43 states during 2021, including 168 projects in the fourth quarter.

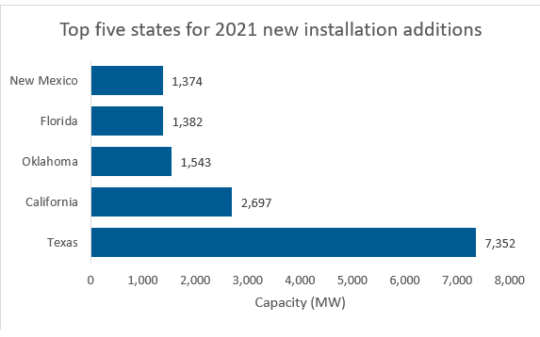

The top five states for new installation additions in 2021 include:

- Texas (7,352 MW),

- California (2,697 MW),

- Oklahoma (1,543 MW),

- Florida (1,382 MW) and

- New Mexico (1,374 MW)

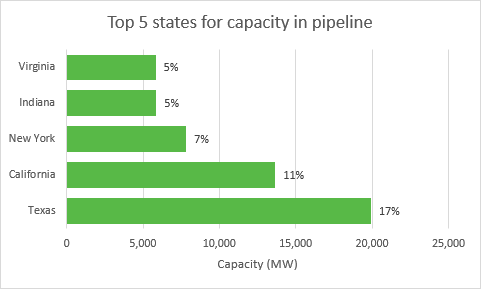

The top five states for clean power development (by percent of projects under construction or advanced development) include:

- Texas (17 percent)

- California (11 percent)

- New York (7 percent)

- Indiana (5 percent)

- Virginia (5 percent)

Clean Power Procurement and Market Trends

2021 was a record year for clean energy procurement, with 28 GW of power purchase agreements (PPAs) signed in 2021. For perspective, 28 GW of clean energy exceeds the electricity demand of the entire U.S. federal government.

Growth for clean energy is due to several factors, including strong continued demand from consumers. Corporate buyers surpassed utilities in clean energy procurement for the first time, announcing deals totaling over 14 GW in 2021. Utilities signed contracts for over 10 GW of wind, solar, and battery storage.

During the fourth quarter, corporate customers signed onto 1,871 MW of power purchase agreements. Pfizer was the top corporate offtaker during the quarter with 310 MW announced, followed by Meta Platforms (Facebook) with 285 MW, and PepsiCo announcing 72.5 MW.

Utilities made up 35 percent of the announced PPA capacity during the quarter, with 19 utilities signing contracts representing a total capacity of 1,994 MW. The 2021 fourth quarter utility PPA announcements were led by Public Service Company of Colorado (350 MW), Entergy Louisiana (250 MW), and Consumers Energy (225 MW).

Solar was the dominant technology for utility PPA announcements, accounting for over 70 percent of the new capacity announced.

Despite record demand, power purchase agreement prices for future projects increased nearly 6 percent in the quarter, with supply chain constraints, commodity price increases, expiring tax credits and trade barriers all weighing on project economics. Solar PPA prices increased 5.7 percent, while wind prices increased 6.1 percent. According to market data year-over-year, the average overall PPA price increased by 15.7 percent.

Despite some of these increases, renewable energy is one of the most affordable ways to generate electricity and reduce carbon pollution. Clean energy technology has improved dramatically over the past decade with solar costs down 90 percent since 2009 and wind costs down 70 percent.

Link to the full report: https://cleanpower.org/resources/clean-power-quarterly-report-q4-2021

For more information contact:

Jason RyanSenior Media Relations Manager