In the second week of February, spot and futures European electricity markets prices had a mostly downward behaviour. The drop in gas prices as well as lower demand and higher solar energy production in most markets favoured this trend. During the week negative hourly prices were registered in the Belgian market and the lowest since the first half of January in the Iberian and Italian markets. CO2 and Brent prices continued to rise.

Photovoltaic and solar thermal energy production and wind energy production

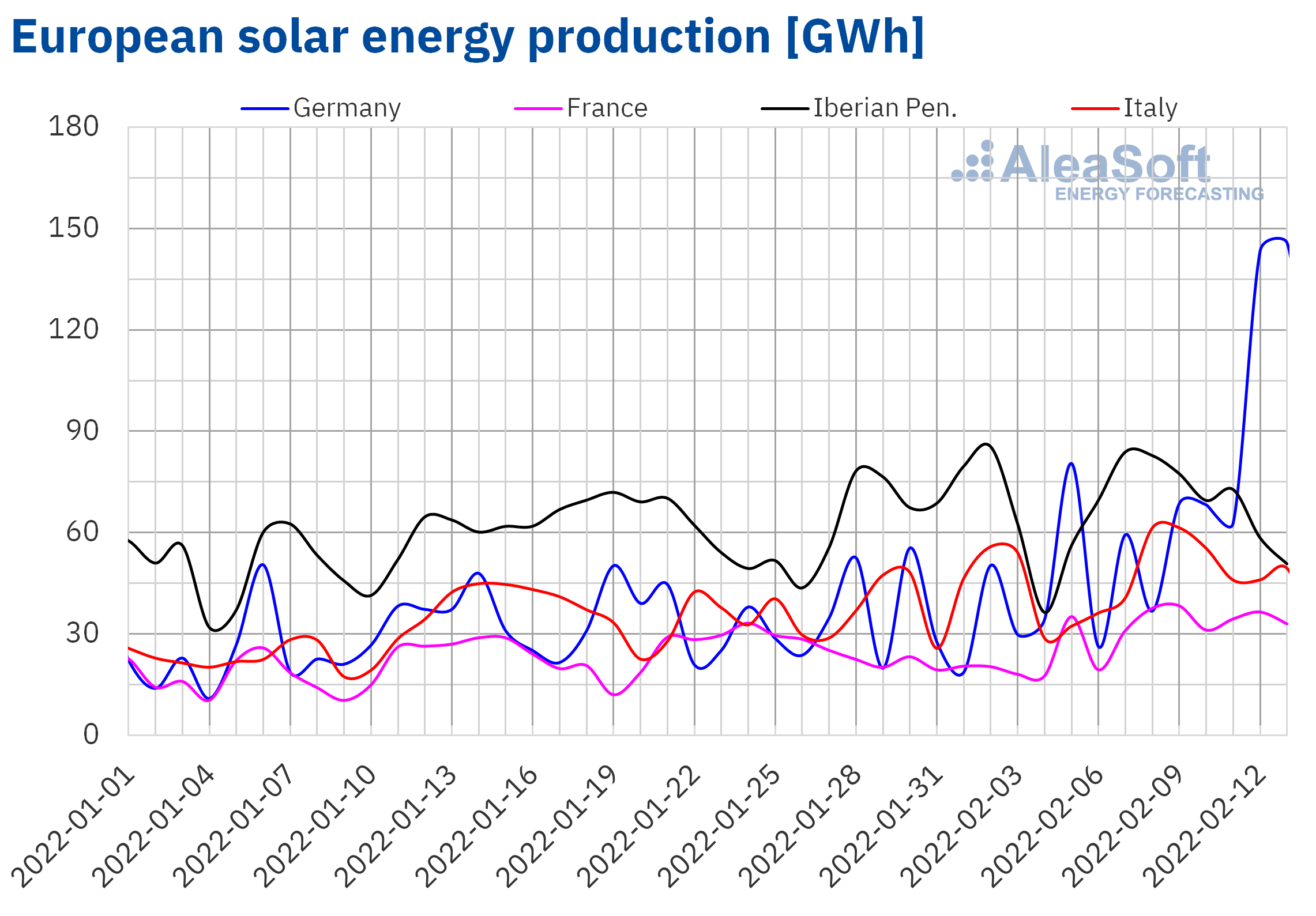

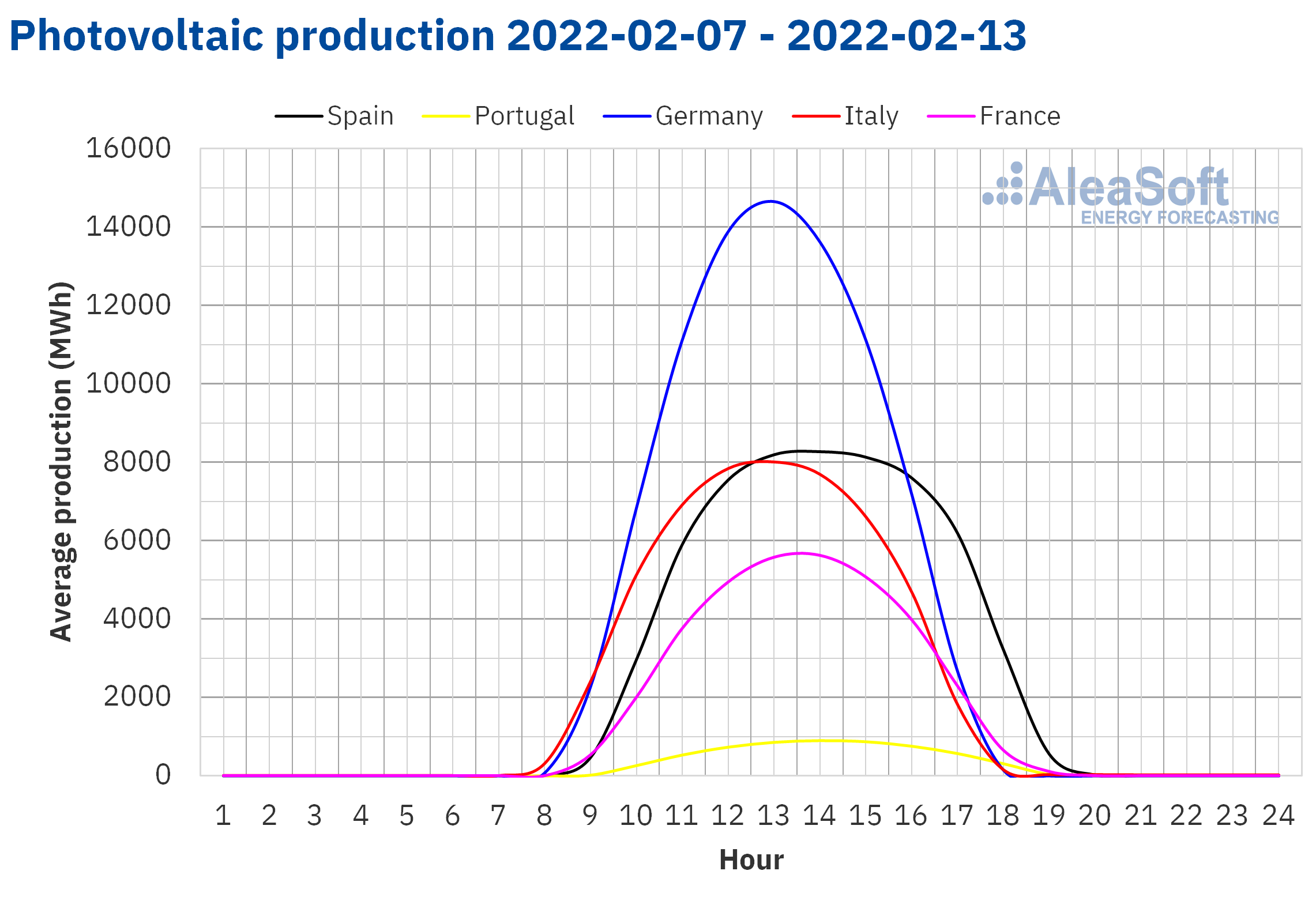

The solar energy production in the week of February 7 increased in most of the European markets analysed at AleaSoft Energy Forecasting, compared to the week that preceded it. In the German market, the largest increase in production with this technology, of 119%, was registered, which was largely due to the production registered over the weekend, which exceeded 140 GWh on both Saturday and Sunday, more than double what was produced on average the rest of the days of the week and the highest daily productions of 2022 so far. It was followed by the markets of France, Italy and Spain with increases of 61%, 29% and 9.8% respectively. On the contrary, in the Portuguese market a reduction of 2.5% was registered.

For the third week of February, the AleaSoft Energy Forecasting’s forecasts indicate that the solar energy production will decrease in the markets of Italy, Spain and Germany.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

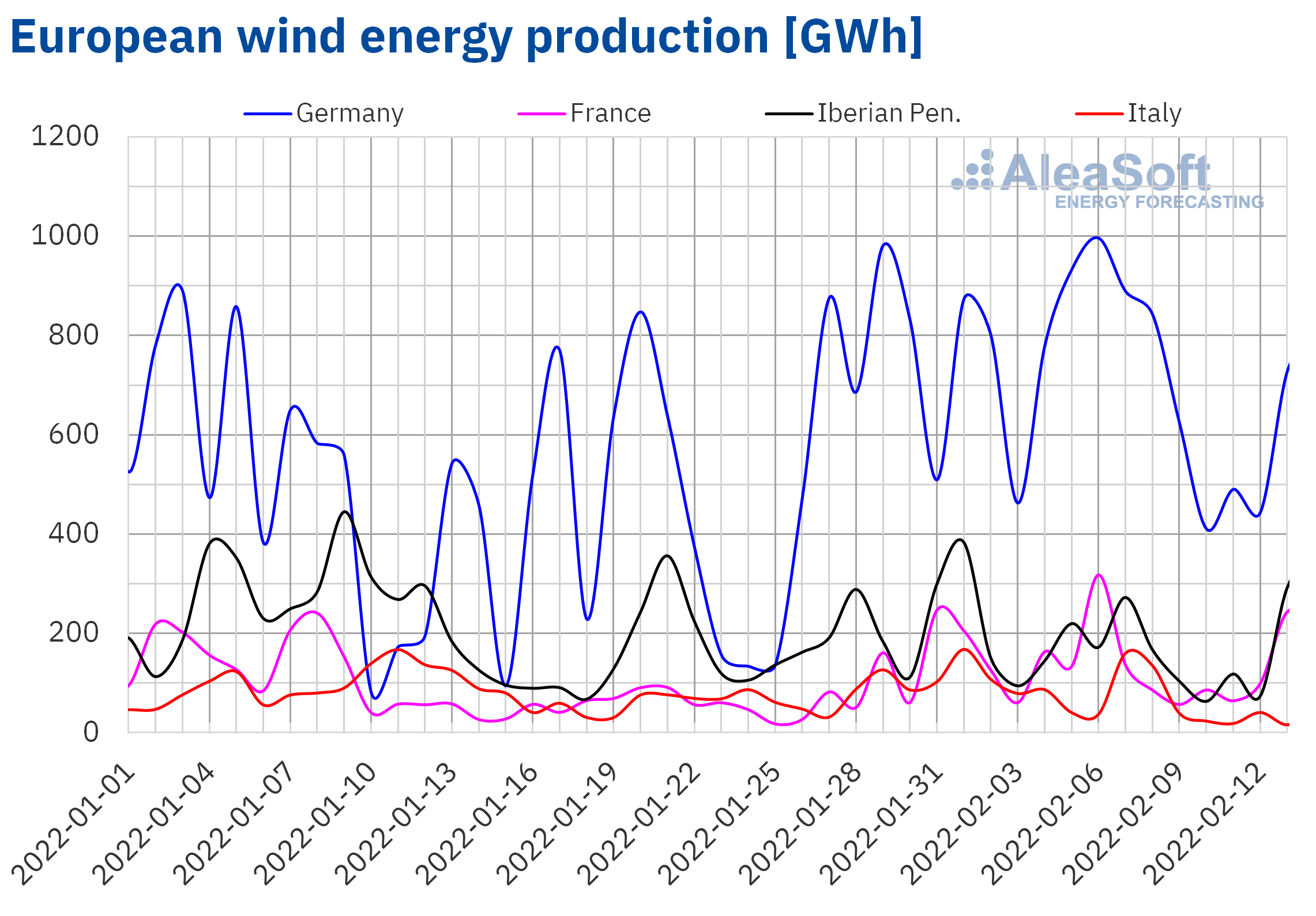

The wind energy production decreased in a generalised way in the analysed markets during the second week of February, compared to the previous week. The greatest variation occurred in the French market, with a decrease of 38%, followed by the Italian market, with a decrease of 30%. In the Iberian market and the German market, the production with this technology fell by 25% and 17% in each case.

For the week of February 14, the AleaSoft Energy Forecasting’s forecasts indicate that the wind energy production will be higher than that registered during the previous week in most of the analysed markets, although it is expected that it will drop again in the Italian market.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

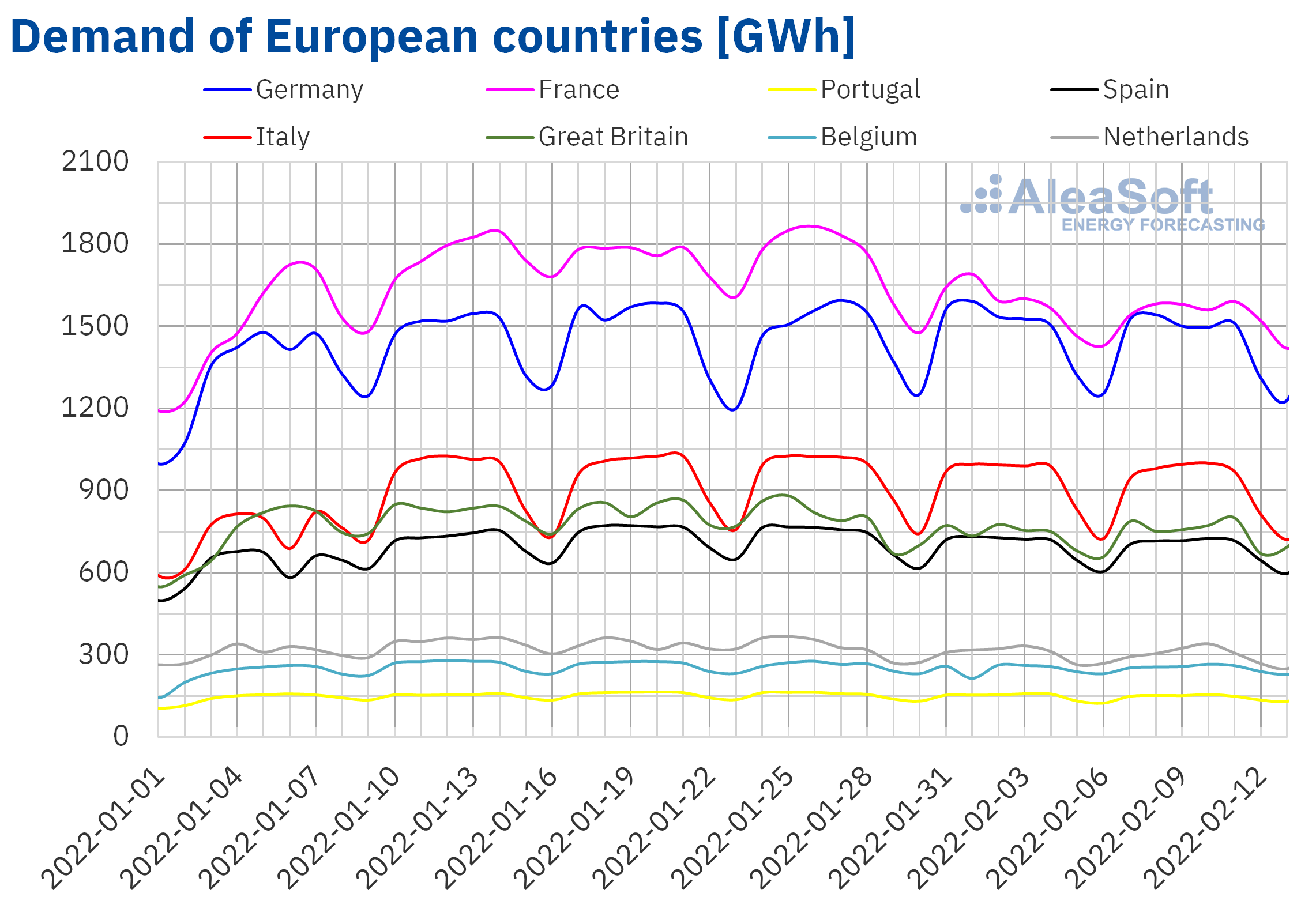

Electricity demand

The electricity demand decreased in most European markets during the second week of February compared to the previous week. The falls were below 2.0% in all cases and the most significant were 1.9% in the Dutch market and 1.8% in the French market. Similarly, in the German market the decrease was 1.7%, while in the Spanish market it was 1.1%.

On the other hand, in the markets of Great Britain and Belgium, increases in demand were registered, of 2.1% in both cases, favoured by the drop in temperatures of almost 1.0 °C.

For the week of February 14, the AleaSoft Energy Forecasting’s demand forecasting indicates that there will be falls in some markets, led by the French market, and recoveries will be registered in other markets, especially in the Portuguese.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

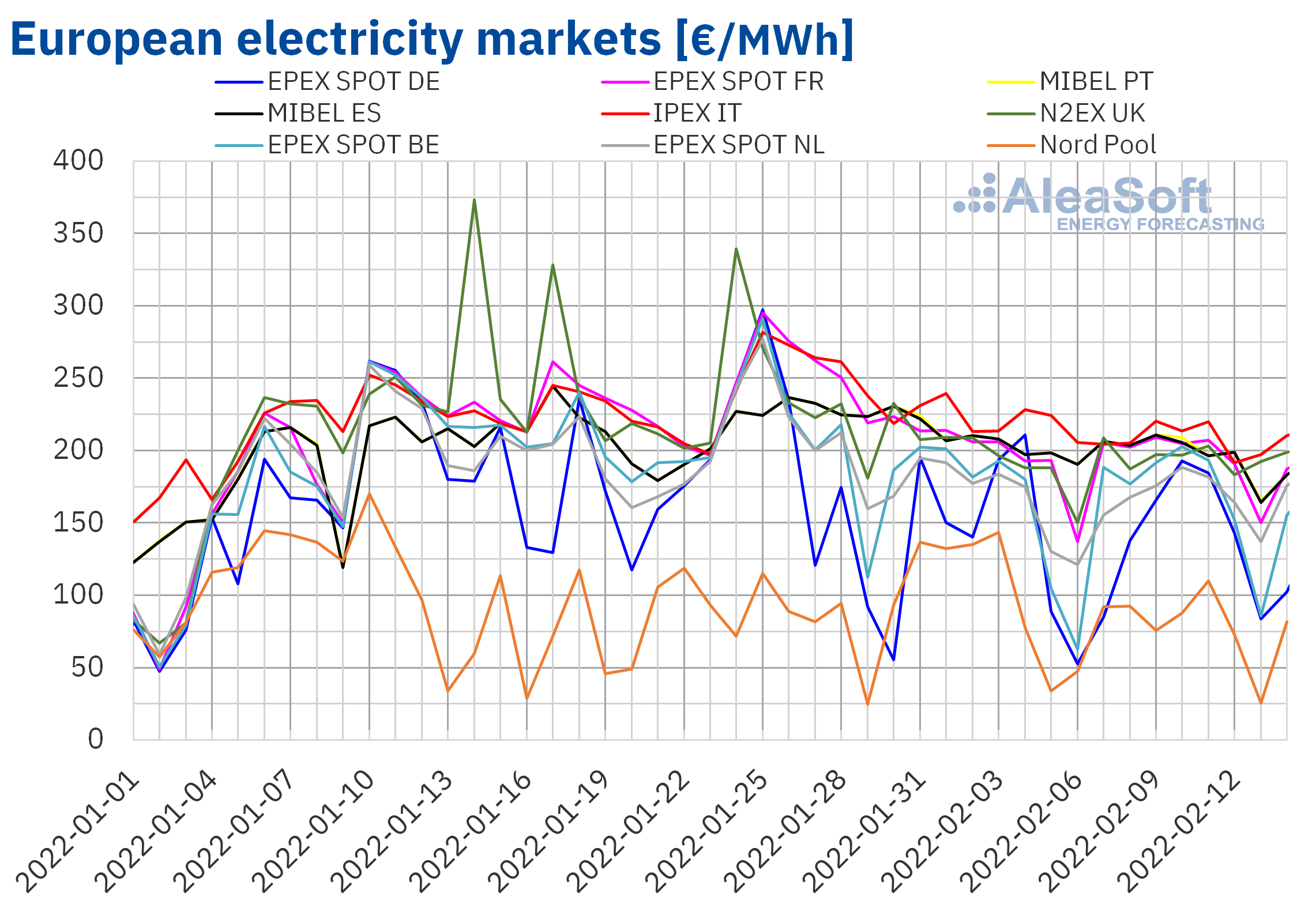

European electricity markets

In the week of February 7, the prices of most of the European electricity markets analysed at AleaSoft Energy Forecasting fell compared to the previous week. The exceptions were the EPEX SPOT market of France, the N2EX market of the United Kingdom and the EPEX SPOT market of Belgium, with increases of 0.6%, 1.6% and 5.9%, respectively. On the other hand, the largest drop in prices was that of the Nord Pool market of the Nordic countries, of 21%. In contrast, the smallest decrease was that of the EPEX SPOT market of the Netherlands, of 0.3%. In the rest of the markets, the price decreases were between 3.1% of the MIBEL market of Portugal and 6.7% of the IPEX market of Italy.

In the second week of February, only the Italian market price exceeded €200/MWh, reaching a value of €207.43/MWh. On the other hand, the lowest weekly average price, of €79.48/MWh, was that of the Nord Pool market. In the rest of the markets, the prices were between €141.77/MWh of the German market and €198.66/MWh of the Portuguese market.

During the second week of February, negative hourly prices were only registered in the Belgian market, at dawn of February 13. That day, moreover, the lowest hourly prices since the first half of January were reached in the Spanish and Portuguese markets. In addition, on February 7, the lowest hourly price since the first week of January was registered in the Italian market.

During the week of February 7, there was a general decrease in wind energy production and the average price of CO2 emission rights increased. However, despite this, the decrease in demand in most markets and the increase in solar energy production in almost all, as well as the decrease in gas prices, favoured the price decreases in the European electricity markets.

The AleaSoft Energy Forecasting’s price forecasting indicates that in the week of February 14, prices might decrease in most European electricity markets, favoured by the recovery of the wind energy production.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

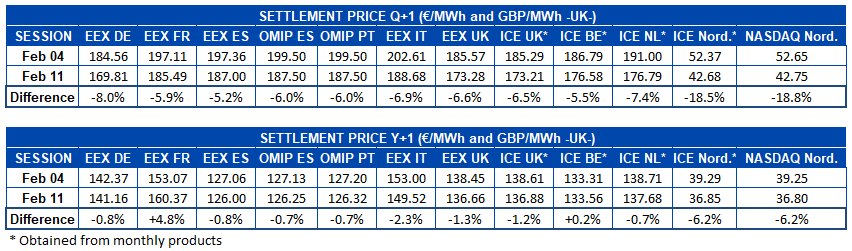

Electricity futures

In the second week of February, electricity futures prices for the next quarter registered decreases in all European markets analysed at AleaSoft Energy Forecasting, if the settlement prices of the session of February 11 are compared with those of the session of the previous Friday, February 4. In the NASDAQ and ICE markets of the Nordic countries the largest decreases were registered, with decreases of 19% in both cases. In the rest of the analysed markets, the decreases were between 5.2% and 8.0%.

As for futures prices for the year 2023, the behaviour was different, although mostly decreases were registered. Similarly to the case of futures for the next quarter, the largest drop in prices occurred in the NASDAQ and ICE markets of the Nordic countries, of 6.2% in both cases between the analysed sessions. On the contrary, in the EEX market of France, the settlement price of Friday, February 11, was 4.8% higher than that of the previous Friday. In the rest of the markets, the variations were between ?2.3% of the EEX market of Italy and 0.2% of the ICE market of Belgium.

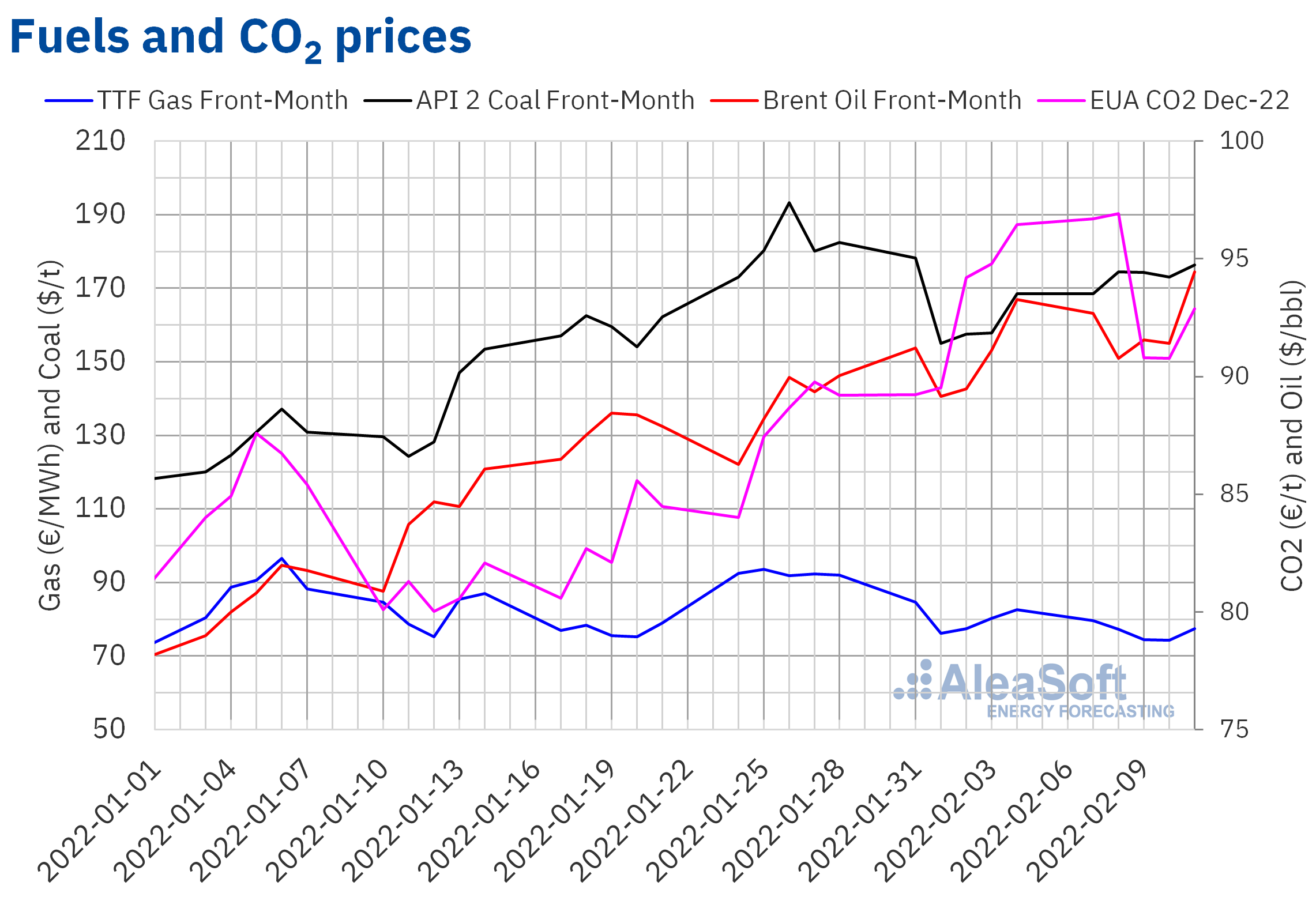

Brent, fuels and CO2

Brent oil futures prices for the Front?Month in the ICE market remained above $90/bbl during the second week of February. The weekly maximum settlement price, of $94.44/bbl, was reached on Friday, February 11, increasing by 3.3% compared to the previous day. This price was the highest since October 1, 2014.

In the second week of February, data on inflation in the United States, statements by its president pledging to curb rising energy prices and a stronger dollar exerted their downward influence on prices at times. However, the fear of OPEC+’s difficulties in meeting its production targets had the opposite effect on the evolution of prices. In addition, warnings that a possible invasion of Ukraine by Russia could be imminent favoured the rise in prices on Friday, February 11, due to fears of supply disruptions.

As for TTF gas futures prices in the ICE market for the Front?Month, during the second week of February they remained below €80/MWh. Prices fell until reaching a settlement price of €74.35/MWh, on Thursday, February 10. This price was 7.3% lower than that of the same day of the previous week and the lowest so far this year. However, on Friday prices began to recover and a settlement price of €77.43/MWh was reached, which was still 6.3% lower than that of the previous Friday.

Forecasts of mild temperatures and an increase in the number of liquefied gas shipments arriving in Europe allowed gas futures prices to decline for most of the second week of February. However, the possibility of Russia invading Ukraine soon favoured the recovery in prices at the end of the week.

Regarding CO2 emission rights futures prices in the EEX market for the reference contract of December 2022, they began the second week of February with increases until reaching a record settlement price of €96.93/t on Tuesday, February 8. However, subsequently, prices fell until reaching the weekly minimum settlement price, of €90.78/t, on Thursday, February 10, after a member of the European Parliament made a call to define a stronger mechanism to control prices of this market.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the renewable energy projects financing

Last Thursday, February 10, the AleaSoft Energy Forecasting’s webinar “The macrovolatility of energy markets in Europe. Benefits of PPA for large and electro?intensive consumers” was held, in which Fernando Soto, Director?General of AEGE, and Juan Puyol, Deputy Director at Cesce, participated in the analysis table of the Spanish version of the webinar. Customers and those interested in the forecasts of AleaSoft Energy Forecasting can request the recording of the webinar at this link.

The webinar analysed the evolution and prospects for the European energy markets, how the macrovolatility situation is affecting large and electro?intensive consumers, what strategies they can follow to minimise the effects of this situation, what services AleaSoft Energy Forecasting offers that contribute to risk management and the energy transition and the coverage offered by Cesce to electro?intensive companies when signing a renewable PPA.

Regarding the energy purchasing strategy that large and electro?intensive consumers can carry out, in the webinar it was commented that it is important that it is based on diversification. In other words, it is about placing portions of energy using different instruments in different horizons, for example, in PPA or self?consumption at the long?term, buying the energy in the futures markets at the mid?term and leaving a part to buy in the spot market, at more short?term. In order to responsibly execute an energy purchase or sale strategy, it is necessary to have markets prices forecasts in all horizons that allow taking advantage of the most advantageous opportunities that arise for each of the time horizons at each moment.

The next AleaSoft Energy Forecasting’s webinar already has a date, it will be on March 17. Speakers from the consulting firm EY will participate in the webinar and the topics that were analysed in the previous webinar with speakers from this company will be updated, among which are the main novelties in the regulation of the Spanish energy sector, the renewable energy projects financing and the importance of PPA and self?consumption. In addition, the main considerations to be taken into account in the portfolios valuation will be analysed, as well as the usual analysis of the evolution and prospects for the energy markets.