In addition to the tensions between supply and demand during the recovery from the crisis, fuels prices are exposed to the global geopolitical situation. In Europe, military tensions between Russia and NATO around Ukraine are driving gas prices, and indirectly electricity markets, into a prolonged high prices and macrovolatility situation.

Geopolitical tensions between Russia, Ukraine and NATO have been making headlines in the media in recent weeks. The news of escalation and de?escalation of the conflict follow each other day after day, flooding stock markets and markets with uncertainty. And energy markets are no exception. Gas prices in recent months have been registering great volatility.

The energy prices crisis

Everything started in the first half of 2021, when world oil and gas prices began an upward trend due to the increase in demand after the 2020 crisis due to the COVID?19 pandemic and while the production was still carrying imbalances caused by the distortions in the world economy.

At that time, Europe began to fear for the levels of gas reserves that did not allow calmly facing the security of supply during the winter. Russia, as the main supplier of gas to Europe, put quite pressure when it came to supplying the necessary gas to raise the reserves levels. At that time, the completion of the construction of the Nord Stream 2 gas pipeline and its commissioning seemed to be the definitive solution to the rise in prices and its commissioning was expected before the end of the year.

But by then, what started as a tension between supply and demand for gas had already escalated to levels of geopolitical conflict practically worldwide where the United States exerted pressure to hinder the start of operations of Nord Stream 2, which now, at mid?February 2022, despite being fully completed, has not yet obtained authorisation from Germany to start operating.

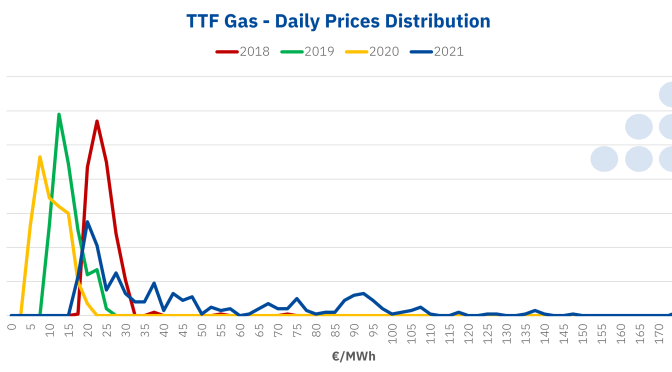

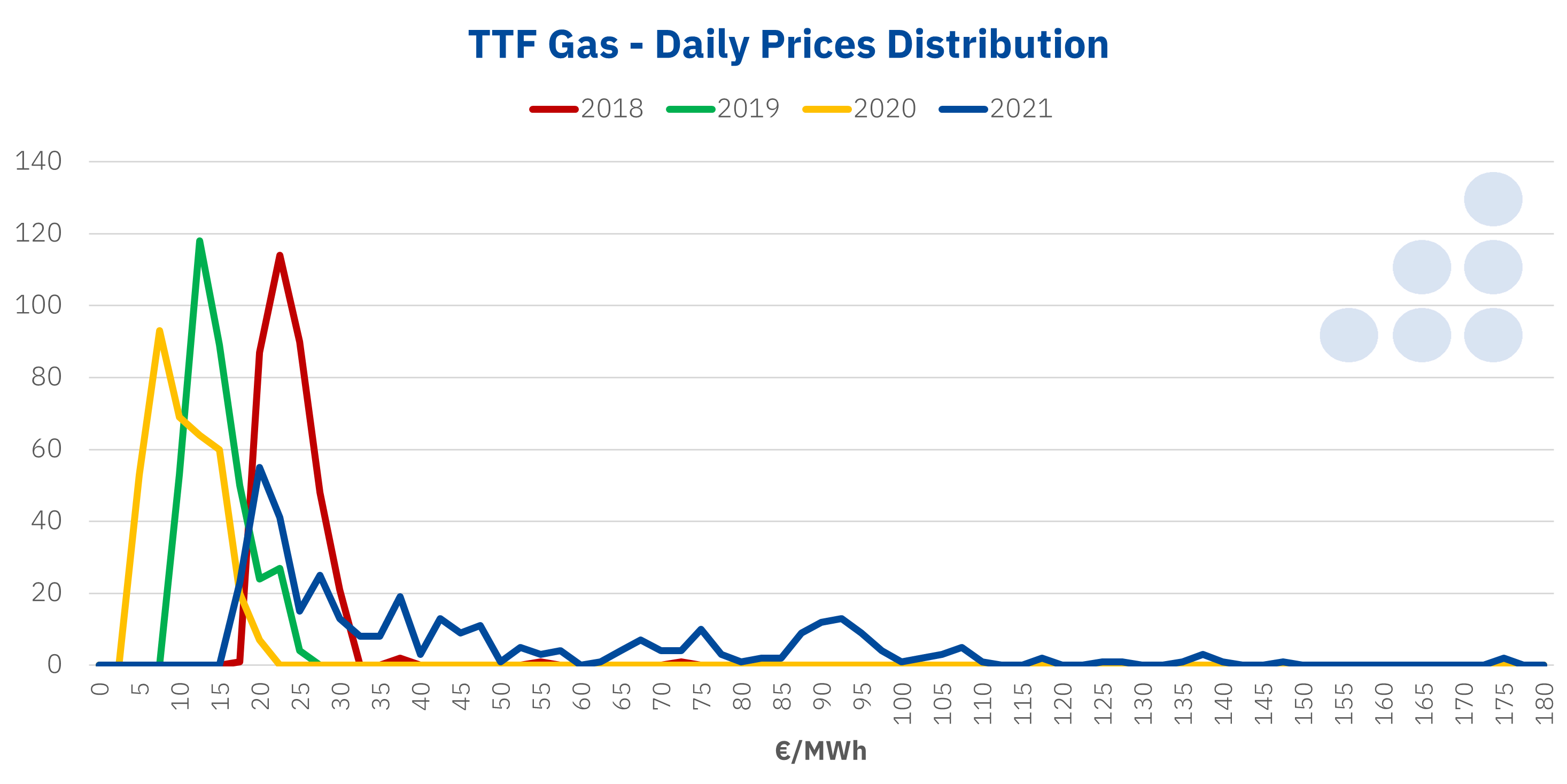

The escalation of tension has continued with NATO and Russian troop movements around Ukraine. The continuous news about the arrival or withdrawal of troops has been shaking gas markets prices that ended 2021 and started 2022 in a situation of macrovolatility. The following graph illustrates the situation of gas prices in the TTF market in 2021 compared to the previous three years. It can be clearly seen how in 2021 the price level was much higher and these were extremely more volatile than usual, with prices reaching €175/MWh.

Source: Prepared by AleaSoft Energy Forecasting using data from EEX.

CO2 prices have not been a mere spectator

In addition to the escalation in prices and the volatility registered in the gas markets in Europe, CO2 emission rights prices have also had a very similar behaviour: price rise and volatility. The behaviour of CO2 prices is usually linked to gas prices, but the component of speculation that this emissions market has should be added. A market designed so that prices go up to incentivise decarbonisation has attracted a lot of investment whose sole objective is buying to sell when prices go up.

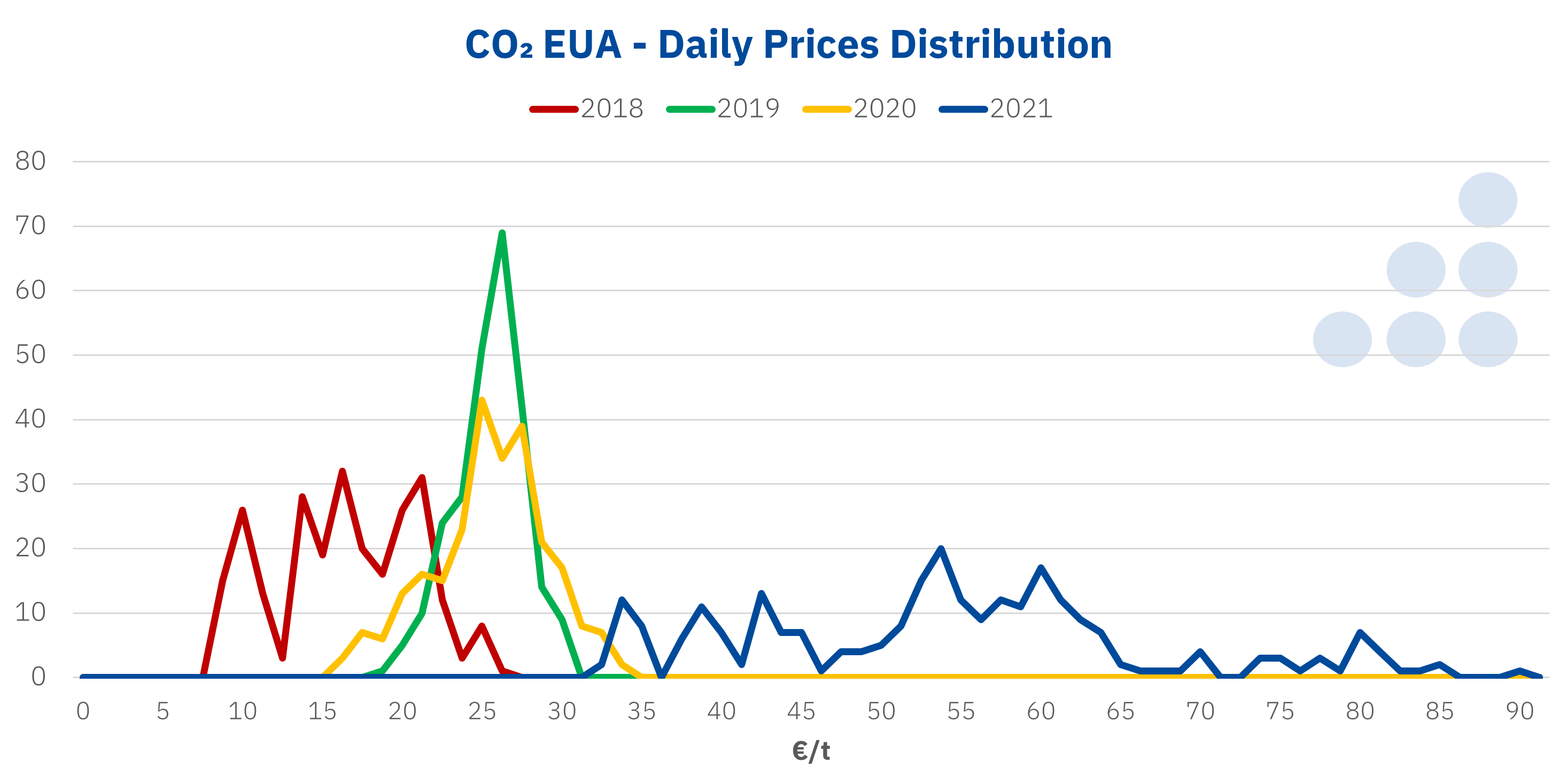

If we analyse the price distribution of CO2 emission rights in the European Union during 2021 compared to the previous three years, as for gas prices, 2021 was characterised by high prices and macrovolatility of CO2, with prices that reached €90 per ton.

Source: Prepared by AleaSoft Energy Forecasting using data from EEX.

The impact on electricity markets prices

The situation of macrovolatility in the gas and CO2 markets is also having a significant impact on electricity markets throughout Europe, which are highly influenced by gas and CO2 prices. At these price levels, a 5% increase in gas prices leads to an increase in electricity markets prices of around 4%. Similarly, in the current situation, a 5% increase in CO2 prices translates into an increase of close to 1% in electricity prices.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the renewable energy projects financing

The next webinar organised by AleaSoft Energy Forecasting within its series of monthly webinars will take place on March 17 and will include the presence of speakers and participants at the analysis table from EY, to discuss current issues of the energy sector in Europe such as the regulatory novelties, renewable energy projects financing, PPA, self?consumption and portfolio valuation.