In the third week of March, gas prices fell, dragging European electricity markets prices, which moved away from the highs registered in the second week of the month. Even so, the weekly average exceeded €200/MWh in most markets. During the weekend, when the demand is lower, negative prices were reached in some markets due to high renewable energy production. Brent futures prices also fell while CO2 futures prices rose.

Photovoltaic and solar thermal energy production and wind energy production

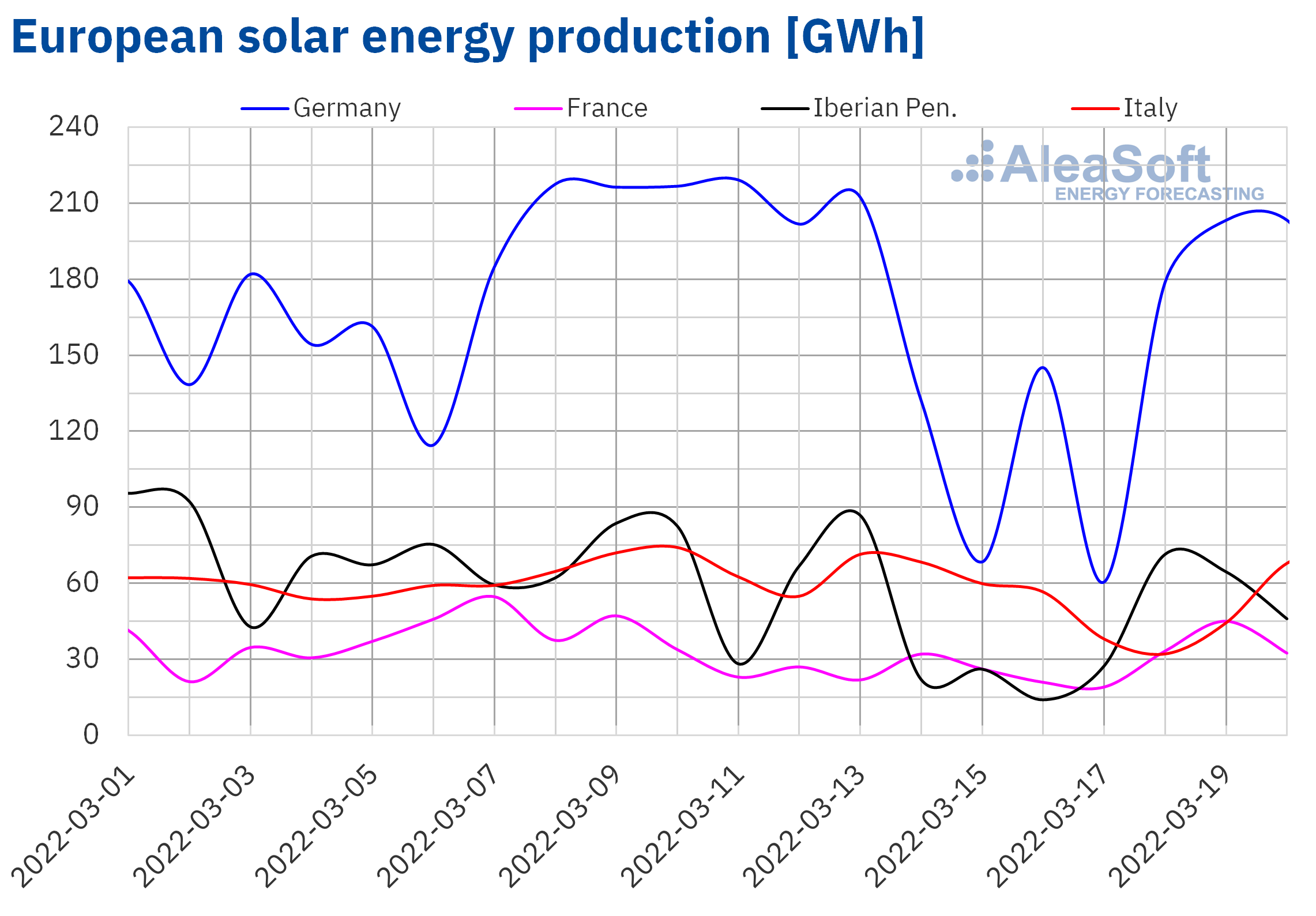

The third week of March ended with a reduction in the solar energy production in all markets analysed at AleaSoft Energy Forecasting, compared to the previous week. The largest reductions in production were registered in the Iberian market and in the German market, which fell by 42% and 33% respectively. Although solar energy production in Germany fell for the whole week, during the weekend it exceeded 200 GWh each day, values that are among the seven highest of the year. On the other hand, in the Italian market the decrease was 20% and in the French market 15%.

For the fourth week of March, AleaSoft Energy Forecasting’s forecasts indicate an increase in the solar energy production of the markets of Spain, Germany and Italy.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

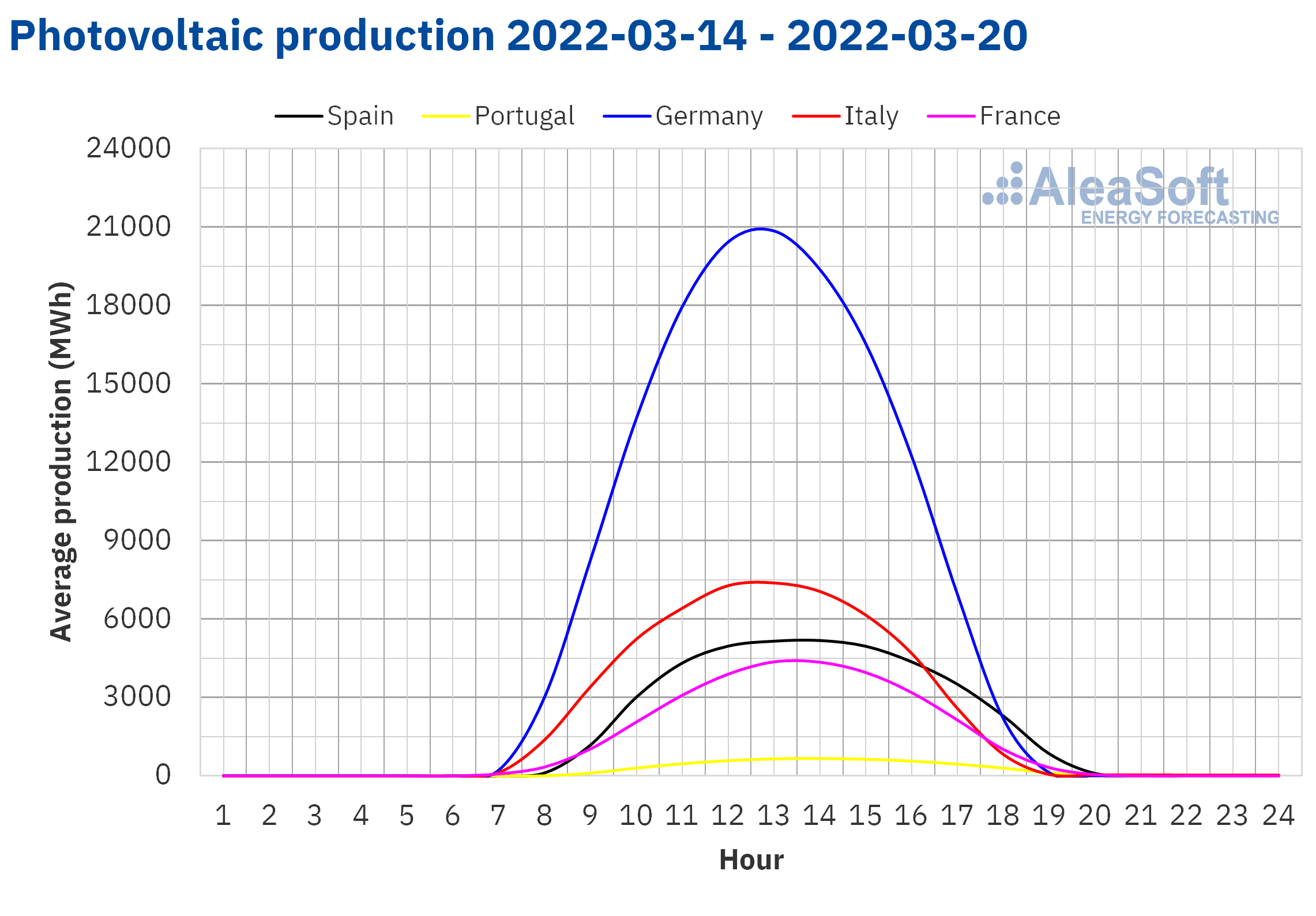

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

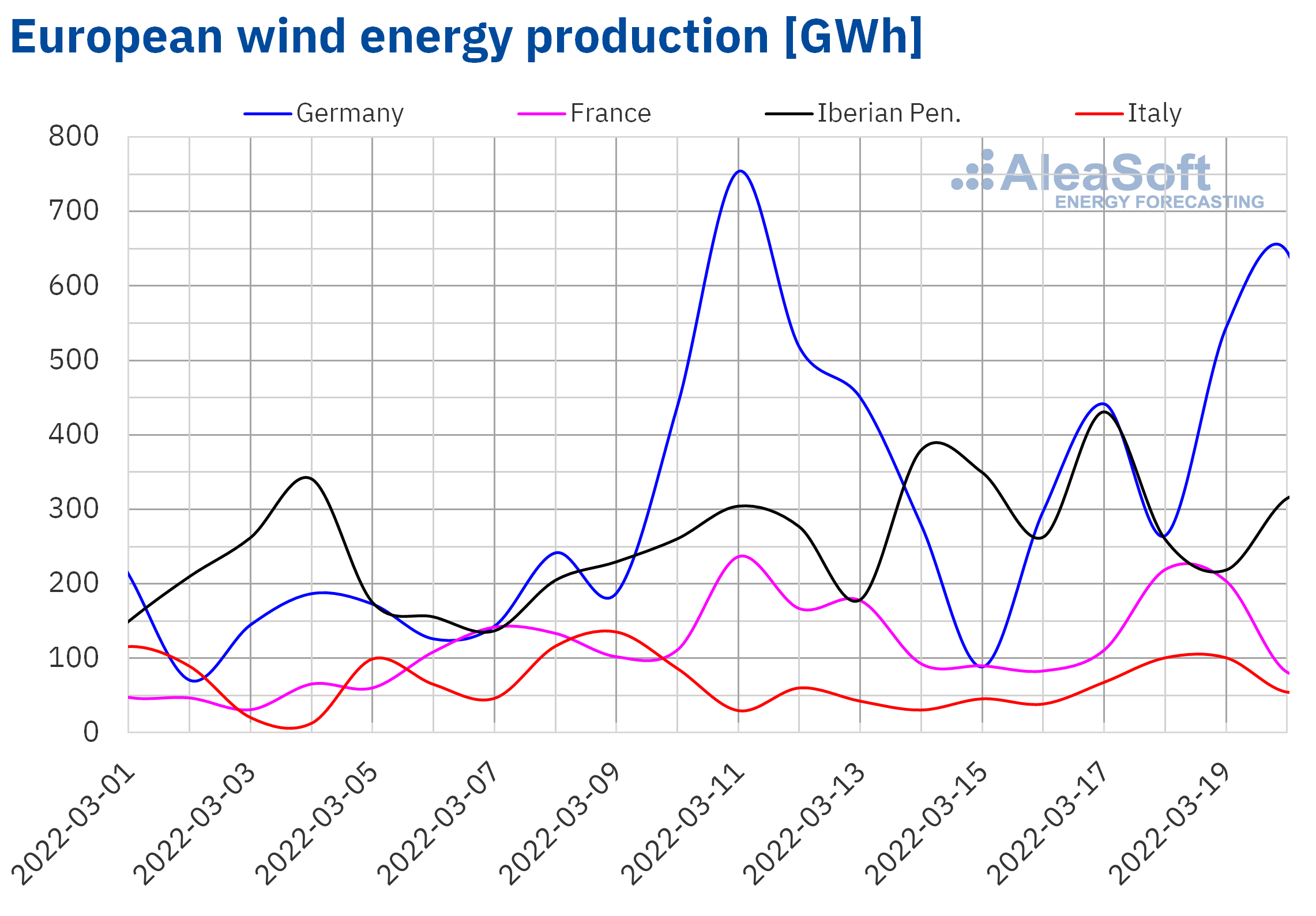

In the week that began on Monday, March 14, the wind energy production increased by 39% in the Iberian Peninsula, compared to the previous week. On the contrary, the production with this technology fell in the rest of the markets analysed at AleaSoft Energy Forecasting between 6.3% of the German market and 18% of the French market. In the case of the German market, although the total production for the week was lower than that of the previous week, the production increased over the weekend, exceeding 500 GWh on Saturday and 600 GWh on Sunday.

For the week that began on March 21, the AleaSoft Energy Forecasting’s forecasts indicate a reduction in wind energy production in all analysed markets, except in the Italian market.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

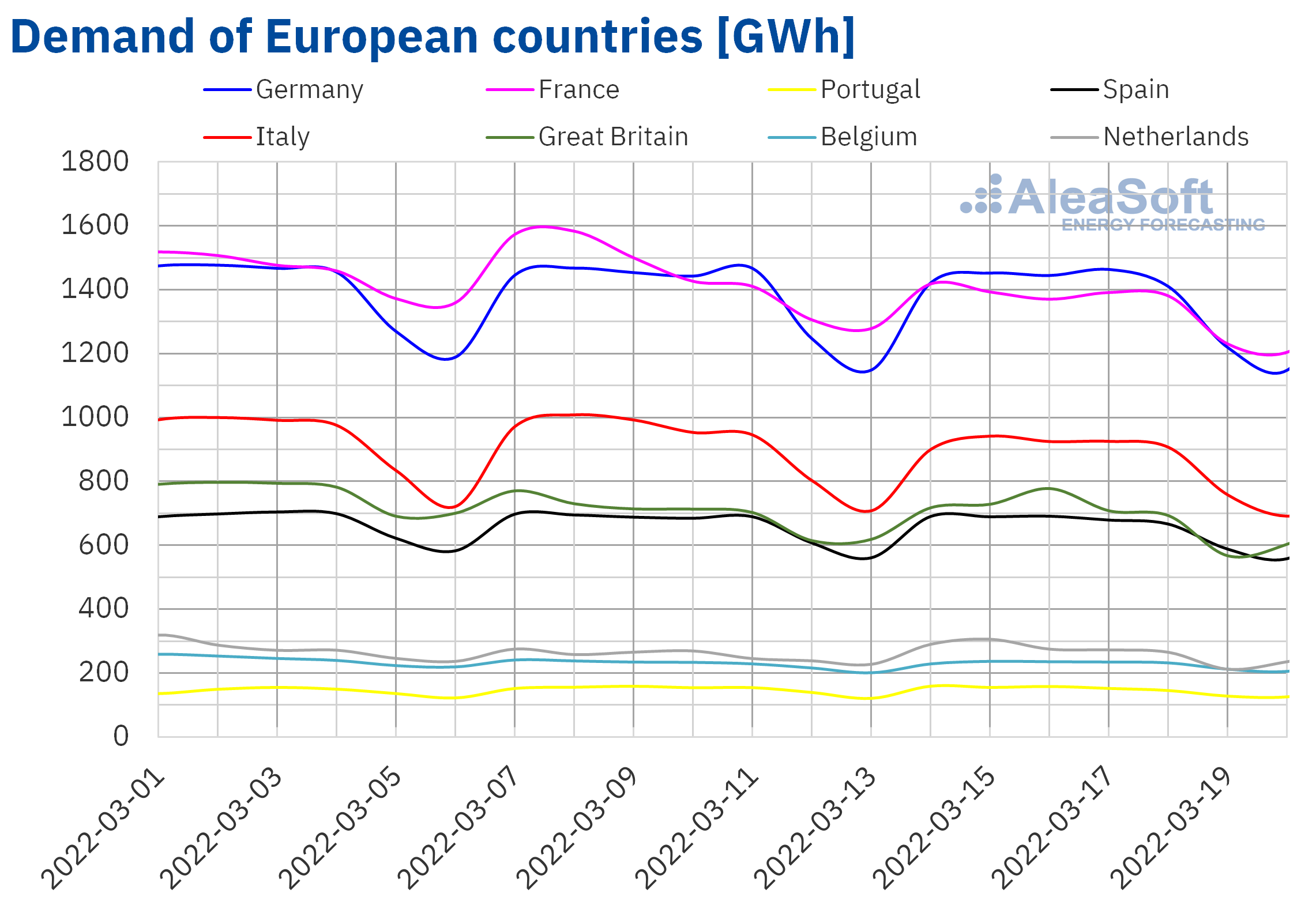

Electricity demand

In the week of March 14, the electricity demand decreased in the vast majority of the European electricity markets analysed at AleaSoft Energy Forecasting compared to the second week of the month. The largest variation was registered in the French market, with a drop of 6.8%, followed by the 5.2% drop of the Italian market. While, in the markets of Germany and Portugal the decrease was 1.2% in each case and in the markets of Spain and Great Britain, the decreases were 1.3% and 1.4% respectively. The smallest variation in demand was registered in the Belgian market, with a drop of 0.5%. The decreases in demand in most markets were favoured by less cold temperatures. The exception was the market of the Netherlands, where the demand increased by 4.3%.

For the week of March 21, the AleaSoft Energy Forecasting’s demand forecasting indicates an increase in the markets of Portugal and Germany. On the other hand, in the rest of the analysed markets, the demand is expected to decrease.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

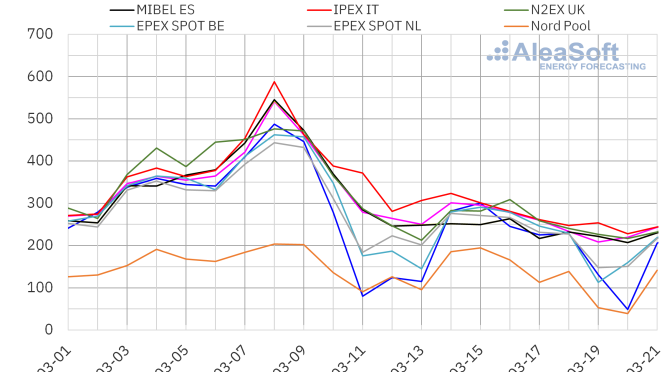

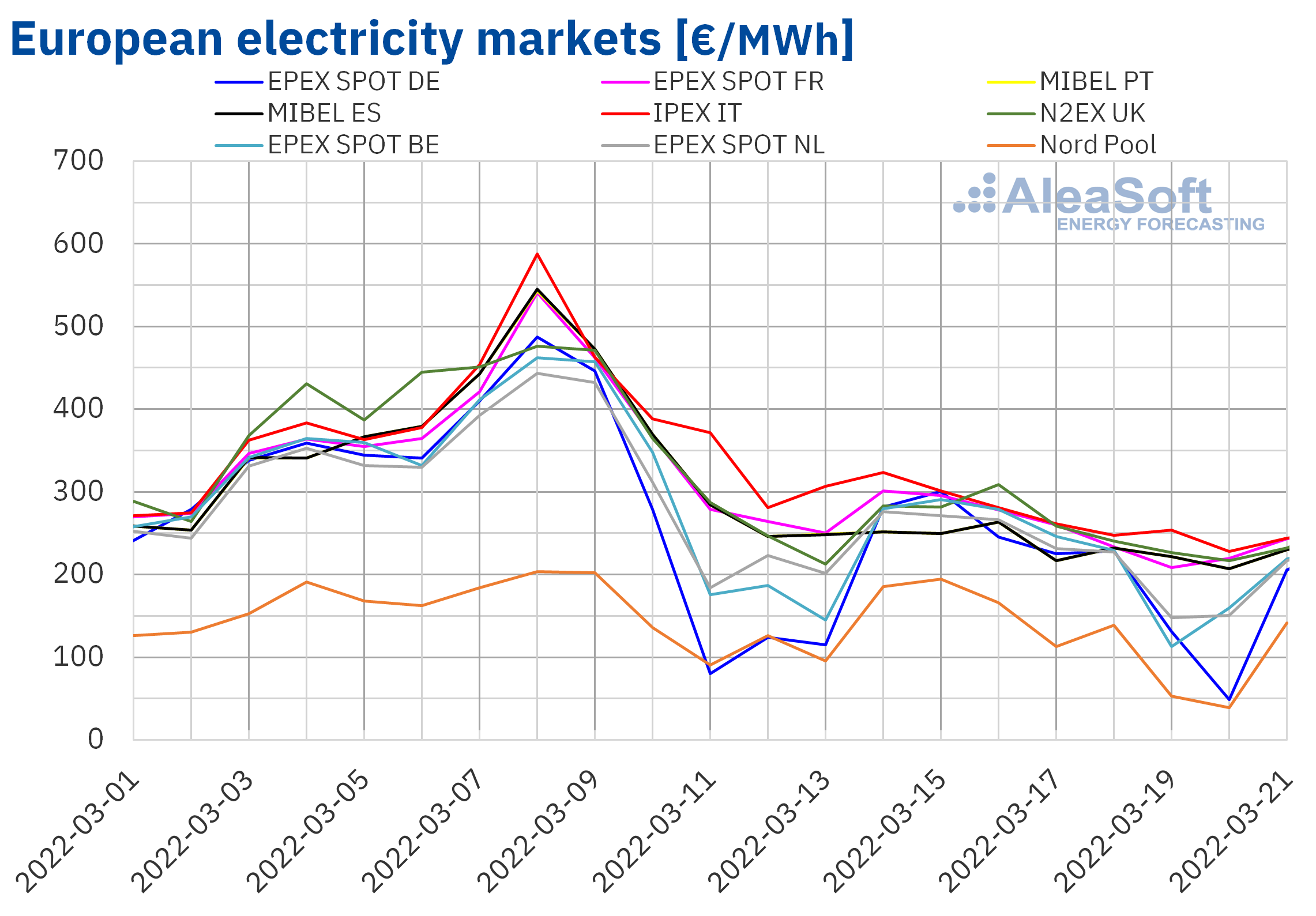

European electricity markets

In the week of March 14, the prices of all European electricity markets analysed at AleaSoft Energy Forecasting decreased compared to the previous week. The largest drop in prices was that of the MIBEL market of Spain and Portugal, 37% in both cases. On the other hand, the smallest decrease was that of the Nord Pool market of the Nordic countries, of 14%. In the rest of the markets, the price decreases were between 25% of the EPEX SPOT market of Germany and 34% of the IPEX market of Italy.

In the third week of March, the average prices were lower than €275/MWh in all analysed electricity markets, although in almost all cases they exceeded €200/MWh. The exception was the Nord Pool market with a weekly average of €126.99/MWh. On the other hand, the highest average was that of the Italian market, which reached a value of €270.86/MWh. In the rest of the markets, the prices were between €208.80/MWh of the German market and €259.46/MWh of the N2EX market of the United Kingdom.

On the other hand, on March 19 and 20, negative hourly prices were registered in the market of the Netherlands. There were also negative prices on March 19 in Belgium and on March 20 in Germany. The lowest hourly prices since the first half of August 2021 were reached in all three markets. These negative hourly prices were favoured by the drop in demand over the weekend and higher wind energy production in this period in countries such as Germany.

During the week of March 14, the 36% drop in gas prices favoured the drop in prices in the European electricity markets. The decline in demand in most countries also contributed to this trend. In addition, in the case of the MIBEL market, the increase in wind energy production in the Iberian Peninsula also allowed the largest price decreases to be reached in this market.

The AleaSoft Energy Forecasting’s price forecasting indicates that the week of March 21 the European electricity markets prices might continue to fall.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

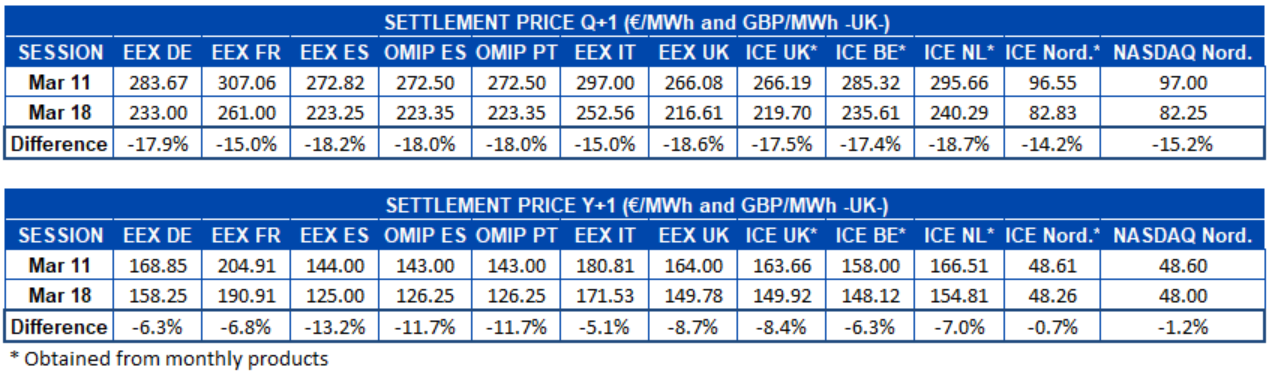

Electricity futures

At the end of the third week of March, the electricity futures prices for the second quarter registered decreases in all European markets analysed at AleaSoft Energy Forecasting. The most pronounced decline occurred in the ICE market of the Netherlands, which settled the session on March 18 with a price 19% lower than that of the previous Friday, March 11. It is also closely followed by the EEX market of the United Kingdom, with a decrease of 18% between those sessions. The smallest drop was registered in the ICE market of the Nordic countries, where the price fell by 14%.

As for the futures for the next year 2023, the behaviour was also generally downward. In this case, the Iberian Peninsula led the reductions, with the EEX market of Spain being the one with the largest decrease, with 13%, followed by the OMIP market of Spain and Portugal, in which prices fell by 12% in both cases. Also in this case, the ICE market of the Nordic countries registered the smallest decrease, with a difference of ?0.7%.

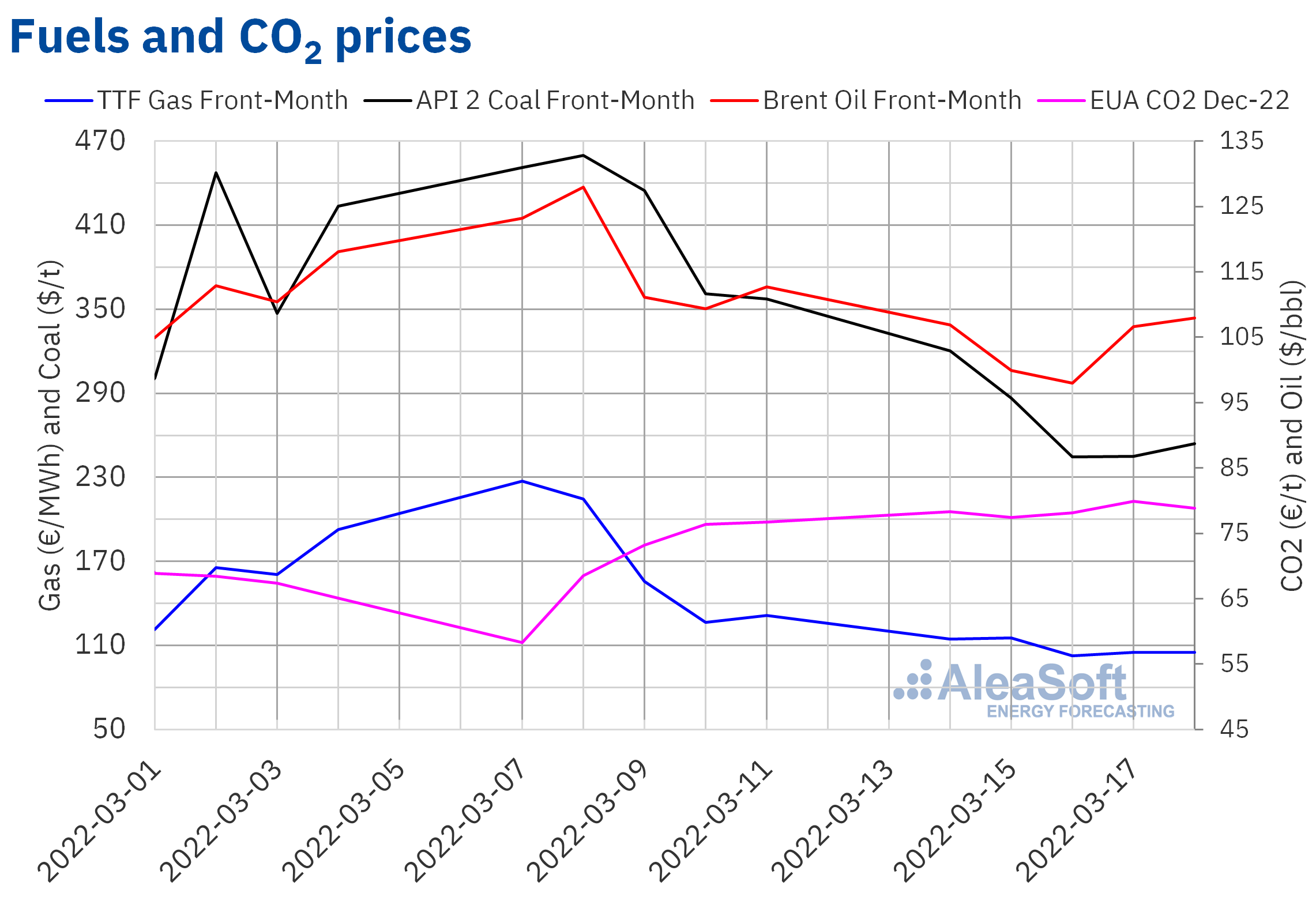

Brent, fuels and CO2

Brent oil futures for the Front?Month in the ICE market began the third week of March with price declines until reaching the weekly minimum settlement price, of $98.02/bbl, on Wednesday, March 16. This price was 12% lower than that of the previous Wednesday and the lowest since the last week of February. However, on Thursday prices started to recover. On Friday, March 18, the weekly maximum settlement price, of $107.93/bbl, was reached, which was still 4.2% lower than that of the previous Friday.

In the third week of March, the evolution of the Brent oil futures prices continued to be influenced by the evolution of the war in Ukraine and the expectations about the supply of oil from Russia. But, fears of a drop in demand due to the new confinements in China due to COVID?19 contributed to the decline in prices at the beginning of the week.

As for the TTF gas futures in the ICE market for the Front?Month, during the third week of March, they registered settlement prices lower than those of the previous week, although they remained above €100/MWh. The weekly minimum settlement price, of €102.62/MWh, was reached on Wednesday, March 16. This price was 34% lower than that of the previous Wednesday and the lowest in March so far. On the other hand, the weekly maximum settlement price, of €115.44/MWh, was registered on Tuesday, March 15, which was 46% lower than that of the previous Tuesday.

Uncertainty about gas supply from Russia continued to influence TTF gas futures prices during the third week of March. Meanwhile, member countries of the European Union continued to search for alternatives to Russian gas.

Regarding the settlement prices of CO2 emission rights futures in the EEX market for the reference contract of December 2022, in the third week of March they were higher than those of the same days of the previous week. Prices stabilised around €78.53/t. The maximum settlement price of the week, of €79.89/t, was reached on Thursday, March 17. This price was 4.6% higher than that of the previous Thursday and the highest in March so far.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the renewable energy projects financing

On March 17, the 20th edition of the monthly webinars that are being carried out at AleaSoft Energy Forecasting was held. Speakers from EY participated in the meeting and the situation of the European energy markets after the Russian invasion of Ukraine, the regulation of the Spanish energy sector, the renewable energy projects financing and the main considerations to be taken into account in the portfolio valuation were analysed. Regarding the financing of renewable energies, the importance of the long?term hourly prices forecasting when estimating the captured price and the expected income for the plant for the preparation, negotiation and closing of PPA contracts was highlighted. Customers or those interested in the AleaSoft Energy Forecasting’s forecasts can request the recording of the webinar at this link.

The next AleaSoft Energy Forecasting’s webinar will be held on April 21 and speakers from ASEALEN, the Spanish Association for Energy Storage, will participate in it, who will analyse the vision of the future of energy storage. In addition, the usual analysis of the evolution of the European energy markets will be carried out.