During the first quarter of 2022, European energy markets were influenced by the effects of the Russian invasion of Ukraine. Record gas prices were registered that caused hourly, daily, monthly and quarterly historical maximums in several electricity markets. Brent futures registered the highest prices since July 2008 and CO2 futures increased in the whole of the first three months of the year. Solar energy production increased in a generalised way.

Photovoltaic and solar thermal energy production and wind energy production

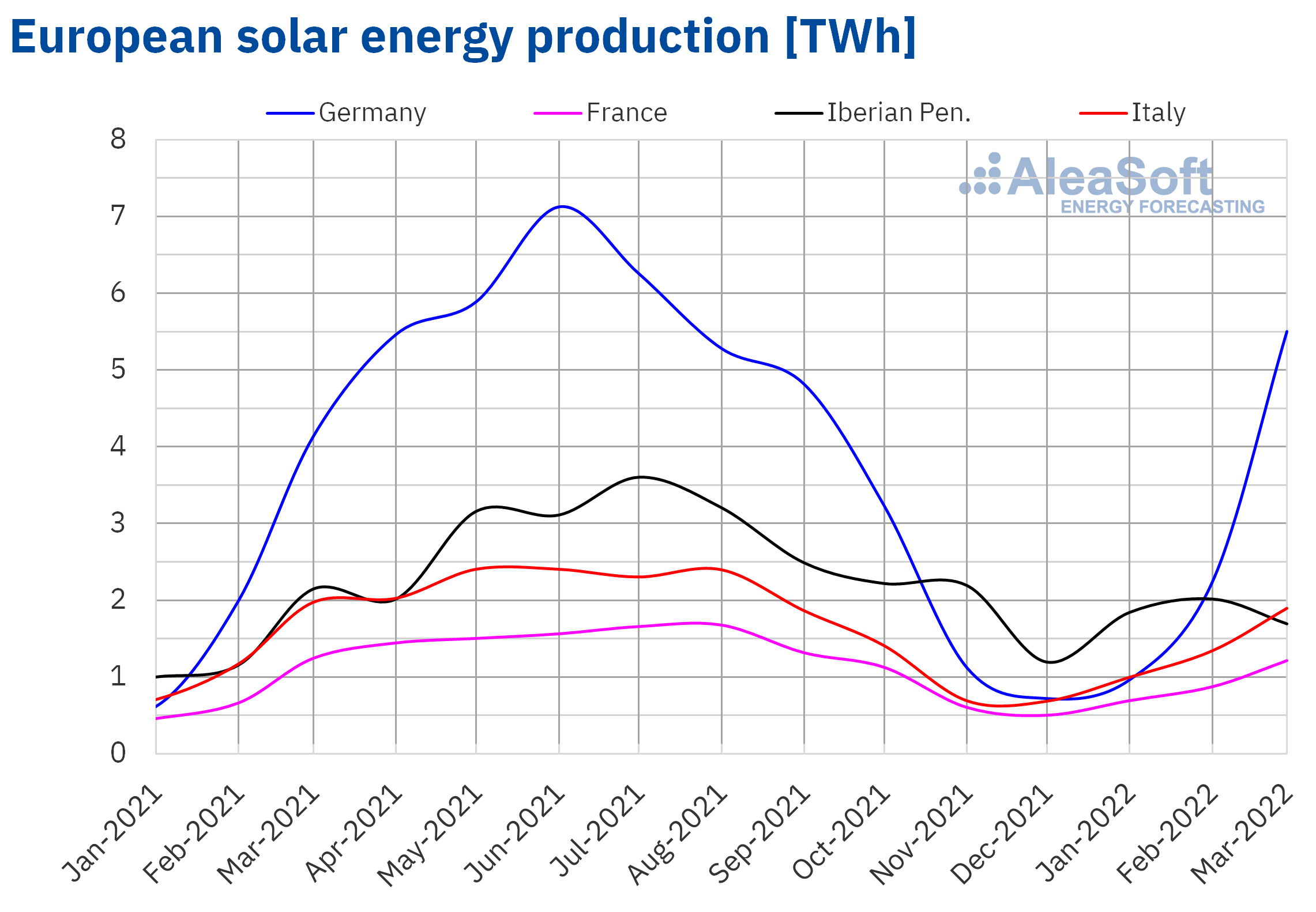

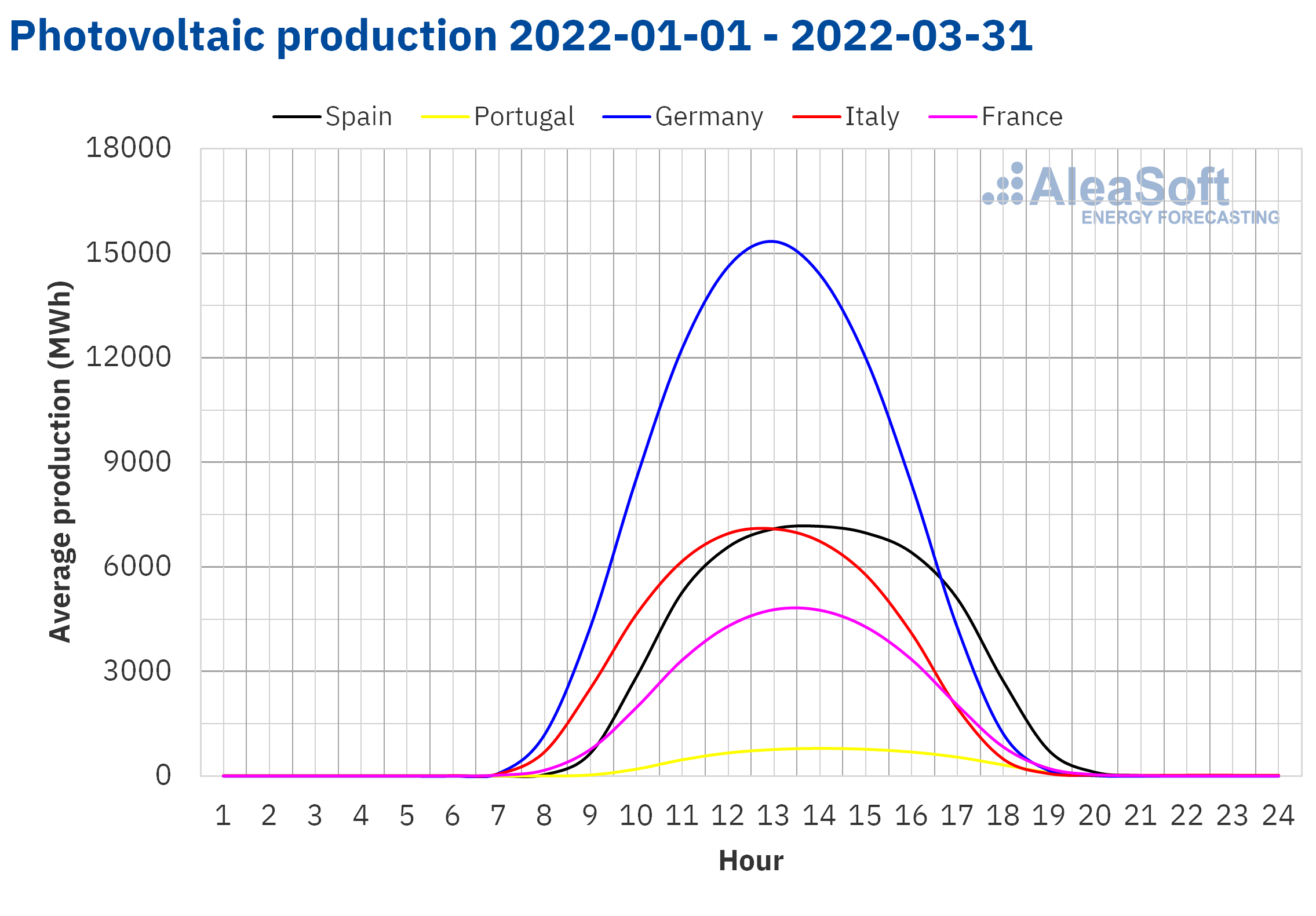

The solar energy production increased in a generalised way in the first quarter of 2022 in the European electricity markets analysed at AleaSoft Energy Forecasting, both year?on?year and compared to the last quarter of 2021. In the year?on?year analysis, the increases were between 9.9 % of the Italian market and 67% of the Portuguese market. In the comparison with the fourth quarter of 2021, the increase in solar energy production was between 10% of the Spanish market and 71% of the German market, due to the greater difference in solar radiation between the solstices in more northern latitudes.

During the first quarter of 2022, the solar photovoltaic energy capacity in Mainland Spain increased by 343 MW, 2.3%, to 15 183 MW, while the solar thermal energy capacity remained unchanged. In the case of Portugal, the solar energy capacity increased by 94 MW, 7.3%, to a total of 1388 MW. This increase in installed solar energy capacity in Portugal favoured the fact that on April 2 the highest solar energy production in the history of this market to date, of 9.7 GWh, was registered.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

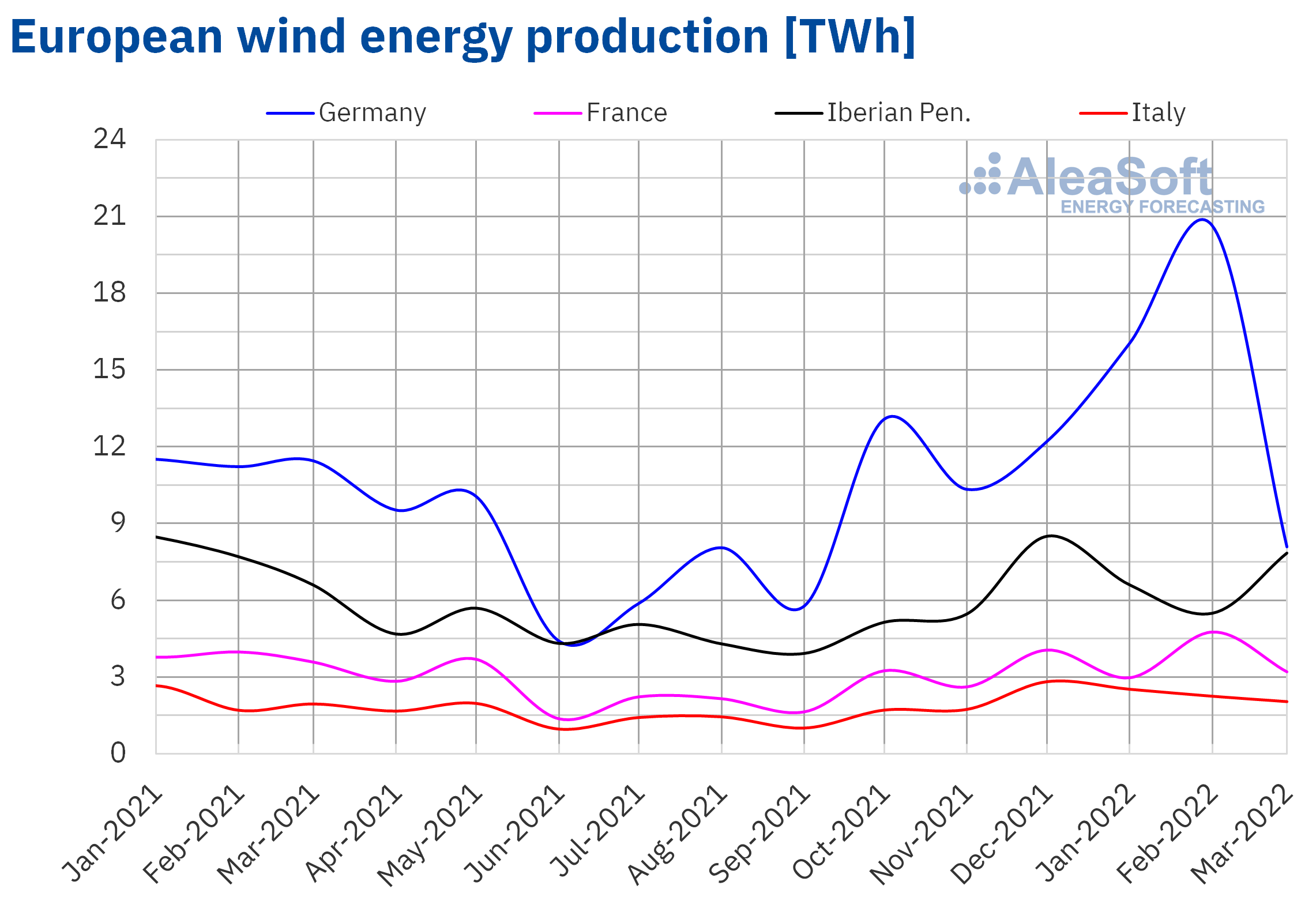

In the case of the wind energy production, in the first quarter of 2022 there was a year?on?year increase in the markets of Germany and Italy, of 31% and 8.0% respectively. In the rest of the markets, the production with this technology was lower than that of the first quarter of 2021, with decreases that were between 3.6% of France and 13% of Spain.

If the wind energy production of the first quarter of this year is compared with that of the last quarter of the previous year, it increased in all the analysed markets except in the Iberian Peninsula. The largest increase was registered in the German market and was 26%. In the Spanish and Portuguese markets, the decreases were 5.9% and 6.0%, respectively.

In the whole of the first three months of 2022, in Mainland Spain, 291 MW of wind energy were installed, with the current capacity being 28 063 MW, an increase of 1.0%, and in Portugal the installed capacity of this technology did not vary in the first quarter of the year.

In the first quarter of the year, the days with the highest wind energy production in history so far were registered in Germany and France. In the case of Germany, this happened on February 17, when the production with this technology totalled 1054 GWh, and in France, a day earlier, with 325 GWh.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

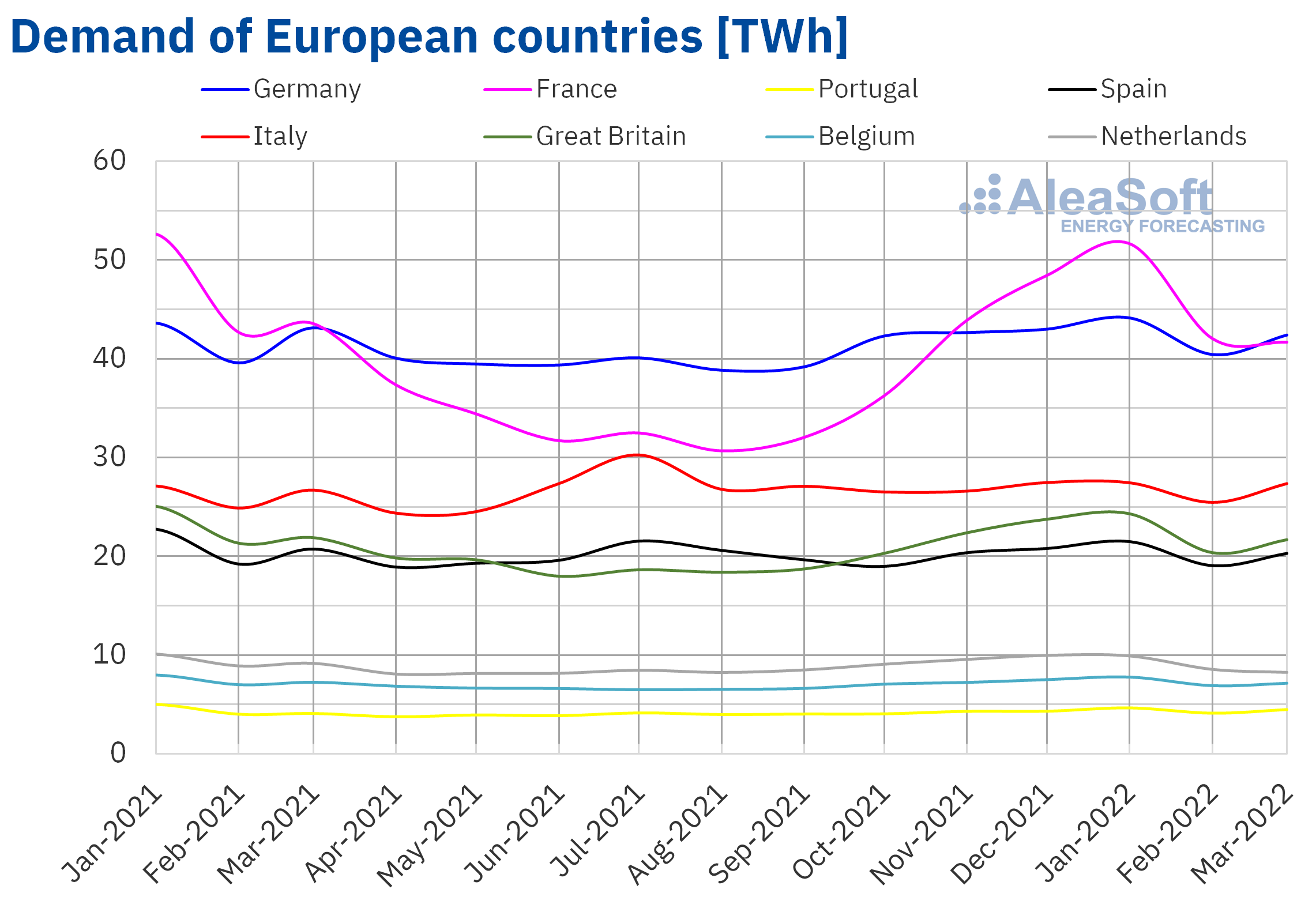

Electricity demand

The electricity demand had a mostly downward behaviour in the first quarter of 2022 compared to the same quarter of the previous year in the European markets. The largest decrease was registered in the market of the Netherlands, with a drop of 5.2% compared to the first quarter of 2021. Both in this market and in the market of the Great Britain, where the demand fell by 2.8% in the first quarter of the year, the downward trends of the last four years continued in year?on?year terms. In the markets of Spain, France and Belgium, the decreases were 2.9%, 2.5% and 1.8% in each case. These decreases were mainly favoured by less cold average temperatures during this quarter compared to those registered during the same quarter of the previous year. On the other hand, in the markets of Italy, Portugal and Germany, the demand behaved upwards, with increases of between 0.5% of Germany and 2.0% of Italy.

Comparing the demand during the first quarter of the year with respect to the last quarter of 2021, the market of the Netherlands was also the one with the largest decrease in the period, of 6.6%. Likewise, in the markets of Germany, Italy and Great Britain, the demand fell by 0.8%, 0.4% and 0.1% respectively. On the contrary, the markets of France and Portugal registered the largest increases, of 5.3% and 4.6% in each case. In the Spanish market, the demand increased by 1.4%, while in the Belgian market there was the smallest increase, of 0.1%.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

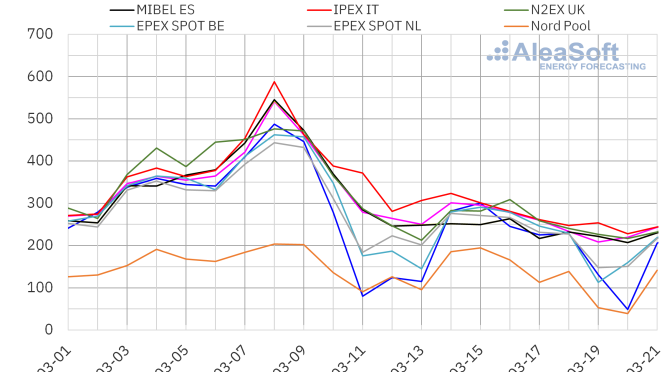

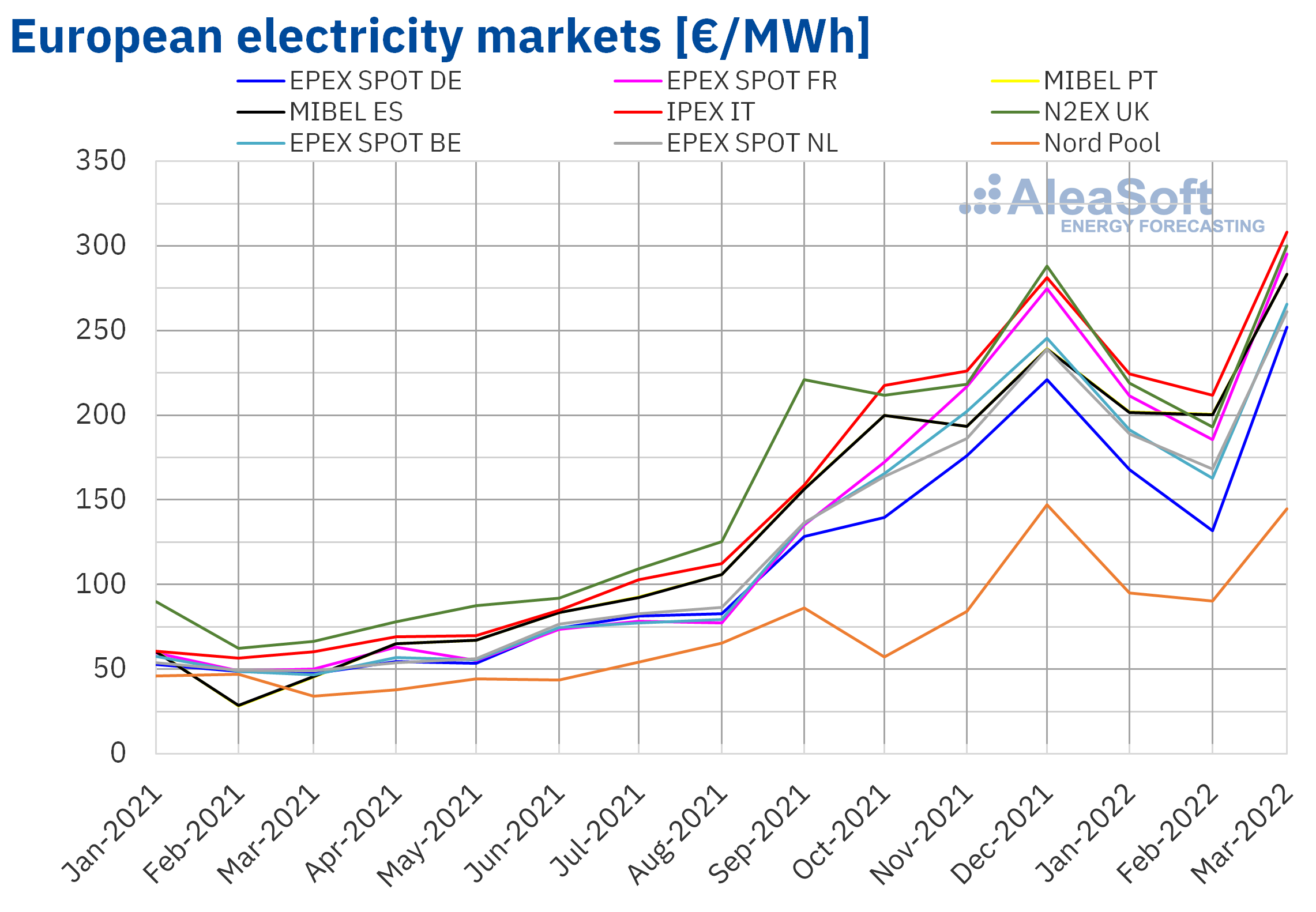

European electricity markets

In the first quarter of 2022, the quarterly average price was above €205/MWh in almost all European electricity markets analysed at AleaSoft Energy Forecasting. The exceptions were the Nord Pool market of the Nordic countries and the EPEX SPOT market of Germany, with averages of €110.60/MWh and €185.49/MWh, respectively. In contrast, the highest quarterly average price, of €249.27/MWh, was that of the IPEX market of Italy, followed by that of the N2EX market of the United Kingdom, of €238.79/MWh. In the rest of the markets, the averages were between €207.45/MWh of the EPEX SPOT market of the Netherlands and €232.20/MWh of the EPEX SPOT market of France.

Compared to the fourth quarter of 2021, in the first quarter of 2022 the average prices increased in almost all European electricity markets analysed at AleaSoft Energy Forecasting. The exception was the British market, with a slight decrease of 0.3%. The highest price rise, of 15%, was registered in the Nord Pool market, while the smallest increase was that of the Belgian market, of 1.8%. The rest of the markets had price increases between 3.1% of the Italian market and 8.7% of the MIBEL market of Spain and Portugal.

If the average prices of the first quarter of 2022 are compared with those registered in the same quarter of 2021, the prices increased significantly in all markets. The highest price rise was that of the Iberian market, of 407%, while the lowest increase was that of the Nordic market, of 162%. In the rest of the markets, the price increases were between 226% of the British market and 338% of the French market.

With these price increases, in the first quarter of 2022, the quarterly average prices reached historical highs in all analysed markets, except in the British market. In this market, the average was the second highest in history after that reached in the previous quarter. In addition, after the monthly averages fell in February, the March prices were historical highs in most markets, with values between €250/MWh and €308/MWh, and increases of more than 40% compared to February.

Daily and hourly record prices were also registered in the first quarter of 2022. In most markets, the prices of March 8 were the highest in at least the last ten years, as in the case of Spain, Portugal and Italy, where prices exceeded €540/MWh and reached €587.67/MWh in the case of Italy. Regarding the hourly prices, on Tuesday, March 8, from 7:00 p.m. to 8:00 p.m., an hourly price of €700.00/MWh was reached in the markets of Germany, Belgium, Spain, France and the Netherlands. This price was the highest in history in the Spanish market and at least since April 2011 in the Netherlands. In the German and Belgian markets it was the highest price since the end of April 2008 and March 2011, respectively.

In the analysed period, the quarterly prices of gas and CO2 emission rights reached record values. This favoured the increase in European electricity markets prices, despite the general increase in solar energy production and in wind energy production in some markets.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

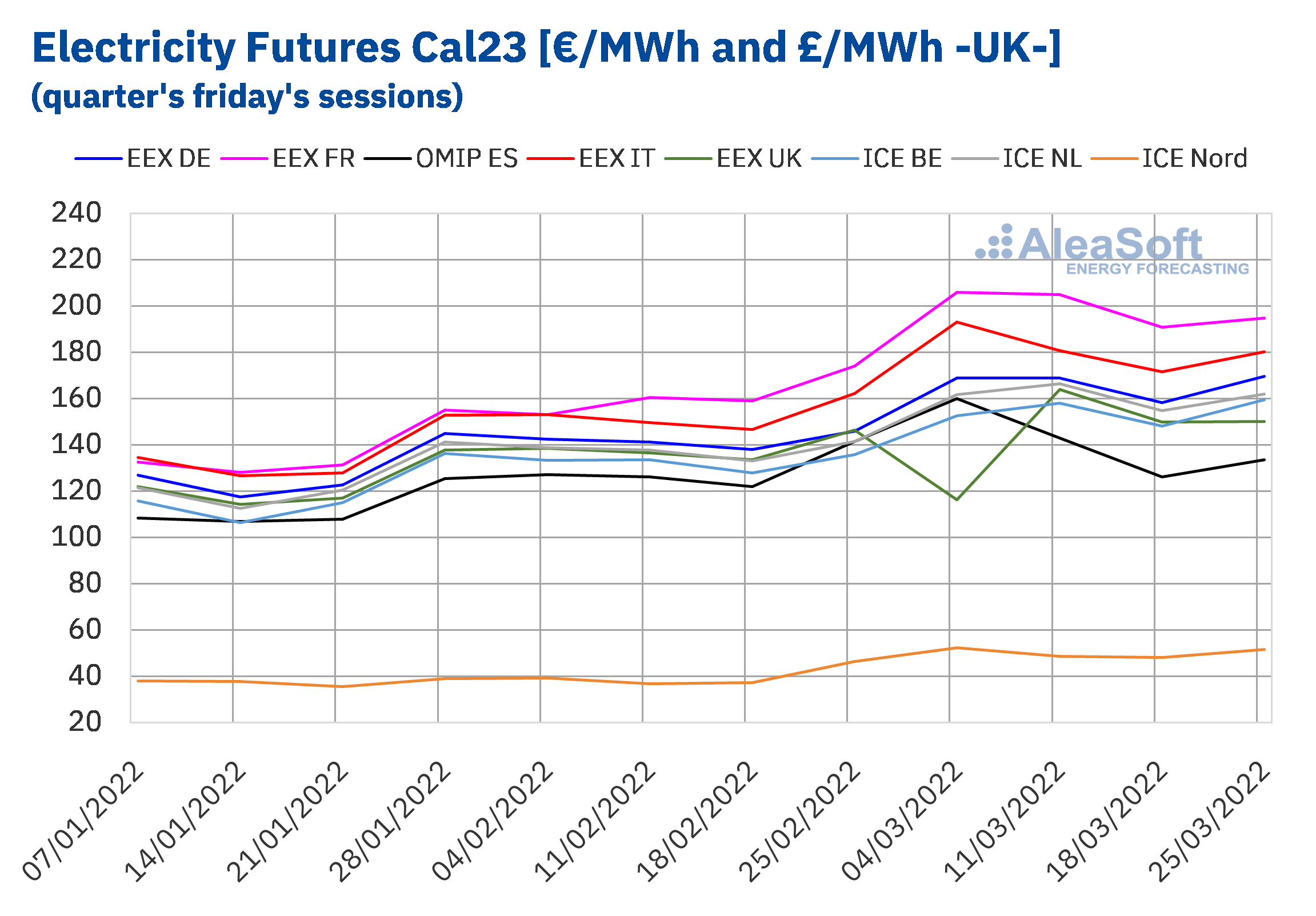

Electricity futures

During the first quarter of 2022, the electricity futures prices for the next year 2023 registered a predominantly upward behaviour. When comparing the sessions of January 7 and March 25, in the electricity futures markets analysed at AleaSoft Energy Forecasting, there was an average growth in settlement prices of 31%.

The EEX market of France was the one with the largest increase in settlement prices during the period, rising 47%. On the other hand, in the EEX market of Spain, the registered growth was the lowest of those analysed, of 20%.

Source: Prepared by AleaSoft Energy Forecasting using data from EEX, OMIP and ICE.

The separation between the markets prices also increased throughout the period. The ICE market of the Nordic countries, as usual, moves in figures much lower than the rest. However, leaving the Nordic region aside, the standard deviation between the prices of the other markets more than doubled.

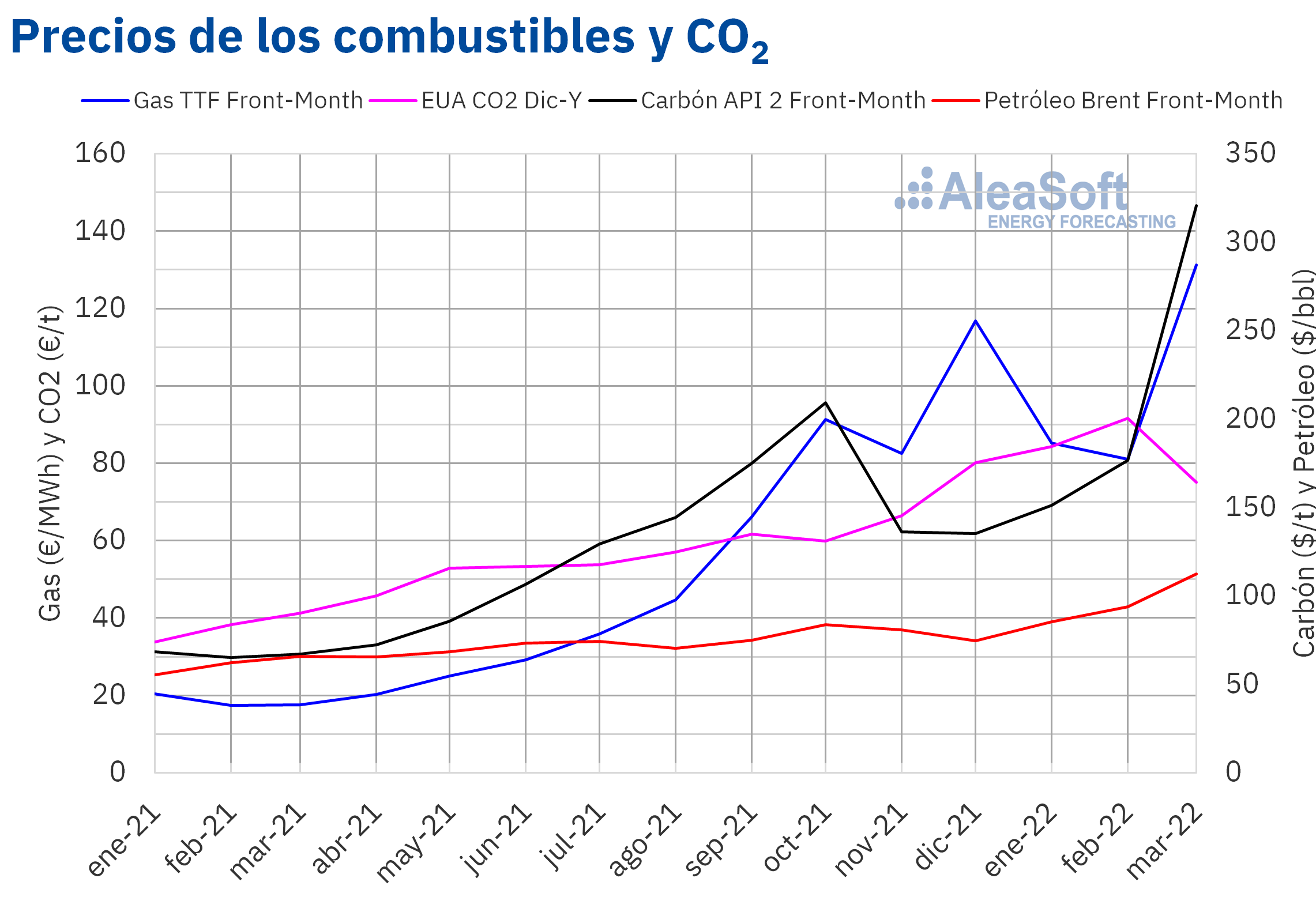

Brent, fuels and CO2

Brent oil futures for the Front?Month in the ICE market registered a quarterly average price of $97.90/bbl in the first quarter of 2022. This value is 23% higher than that reached by the Front?Month futures for the fourth quarter of 2021, of $79.64/bbl. It is also 60% higher than that corresponding to the Front?Month futures traded in the first quarter of 2021, of $61.32/bbl.

For most of the first quarter of 2022, Brent oil futures prices were influenced by the evolution of the conflict between Russia and Ukraine. The sanctions against Russia and fears of interruptions in supply due to the war favoured the increase in prices. On Tuesday, March 8, a historical maximum settlement price of $127.98/bbl was reached, the highest since July 2008. However, in the last days of the quarter, concerns about the effects of the pandemic on the demand reappeared due to the new confinements in China, which caused prices to fall to around $110/bbl.

As for the TTF gas futures in the ICE market for the Front?Month, the average value registered during the first quarter of 2022 was €100.71/MWh. Compared to that of the Front?Month futures traded in the fourth quarter of 2021, of €96.59/MWh, the average increased by 4.3%. If compared to the Front?Month futures traded in the first quarter of 2021, when the average price was €18.40/MWh, there was a 447% rise.

The evolution of the TTF gas futures prices was also influenced by the conflict between Russia and Ukraine. The fear of interruptions in the supply of gas from Russia favoured the increase in prices, reaching a historical maximum of €227.20/MWh on Monday, March 7.

Regarding CO2 emission rights futures in the EEX market for the reference contract of December 2022, they reached an average price in the first quarter of 2022 of €83.21/t, 20% higher than those of the previous quarter for the reference contract of December 2021, of €69.15/t. If compared to the average of the first quarter of 2021 for the reference contract of December of that year, of €37.93/t, the average of the first quarter of 2022 was 119% higher.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the renewable energy projects financing

With the start of the second quarter of the year, at AleaSoft Energy Forecasting the long?term price curves forecasts for all European markets are being updated, in which the consequences of the Russian invasion of Ukraine in the energy markets and the economy in general will be taken into account. The main characteristics of this service is the fact that the market price forecasting is hourly over the 30?year horizon, it includes the annual confidence bands, corresponding to the 15th and 85th percentiles, and the price captured by solar photovoltaic energy and wind energy.

In addition, to follow the latest news on the energy markets, the next AleaSoft Energy Forecasting’s webinar will be held on April 21. In the webinar, the usual analysis of the evolution of the European energy markets and their prospects for the coming months will be carried out. In addition, energy storage will be analysed, which will play a fundamental role during the energy transition together with renewable energies.