In the second week of May, the rise in temperatures led to a drop in demand in most of the European markets. The solar energy production increased in general in correspondence with the increase in solar radiation at this time. These factors and gas prices lower than those of the previous week allowed electricity markets prices to fall. Negative prices were registered in the markets of Belgium and the Netherlands. Electricity futures also fell.

Photovoltaic and solar thermal energy production and wind energy production

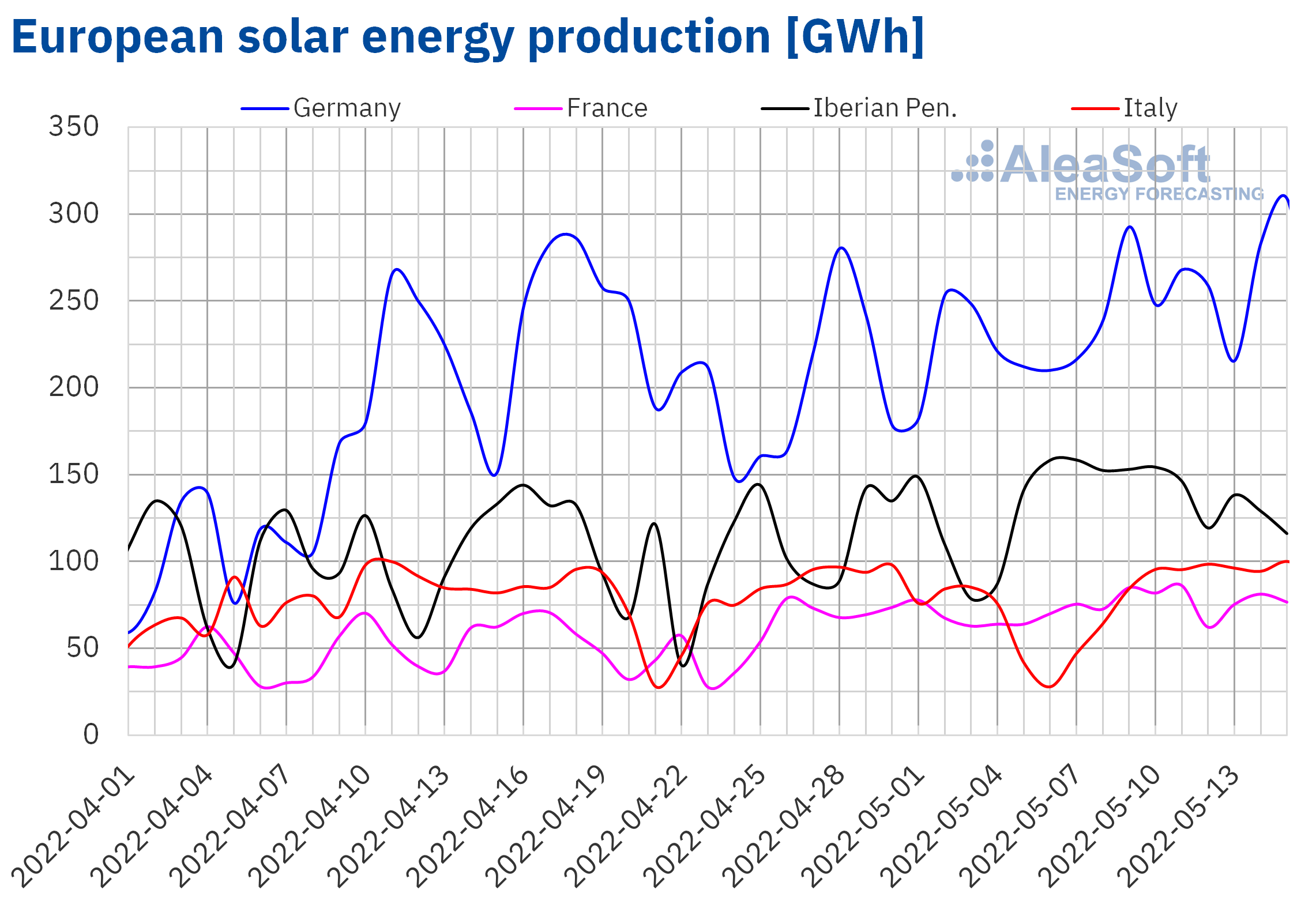

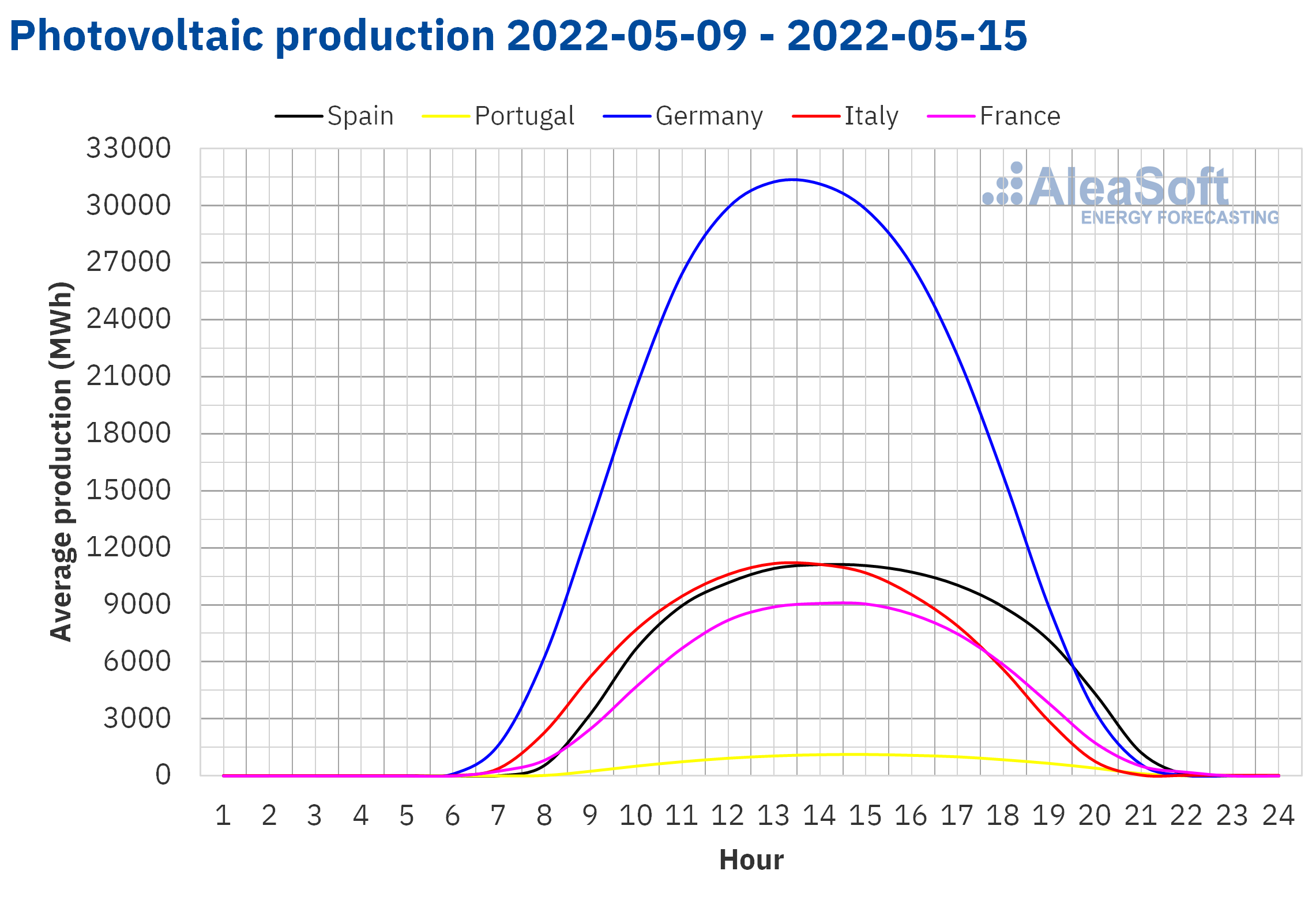

The second week of May ended with an increase in solar energy production in all markets analysed at AleaSoft Energy Forecasting, compared to the previous week. The largest increase was 56% and was registered in the Italian market. In this market on May 15, around 100 MWh were produced with solar energy, this being the highest daily production since July 19, 2014. The increases in solar energy production in the French and German markets with respect to the previous week were 15% and 17% respectively. In the Iberian Peninsula, production grew by 8%.

For the third week of May, the AleaSoft Energy Forecasting’s forecasts indicate a reduction in solar energy production in the markets of Spain, Germany and Italy.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

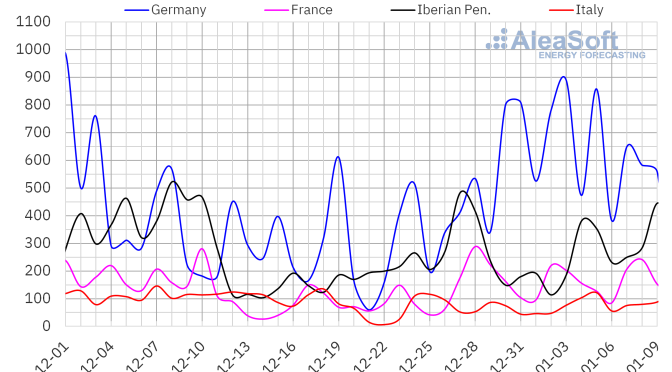

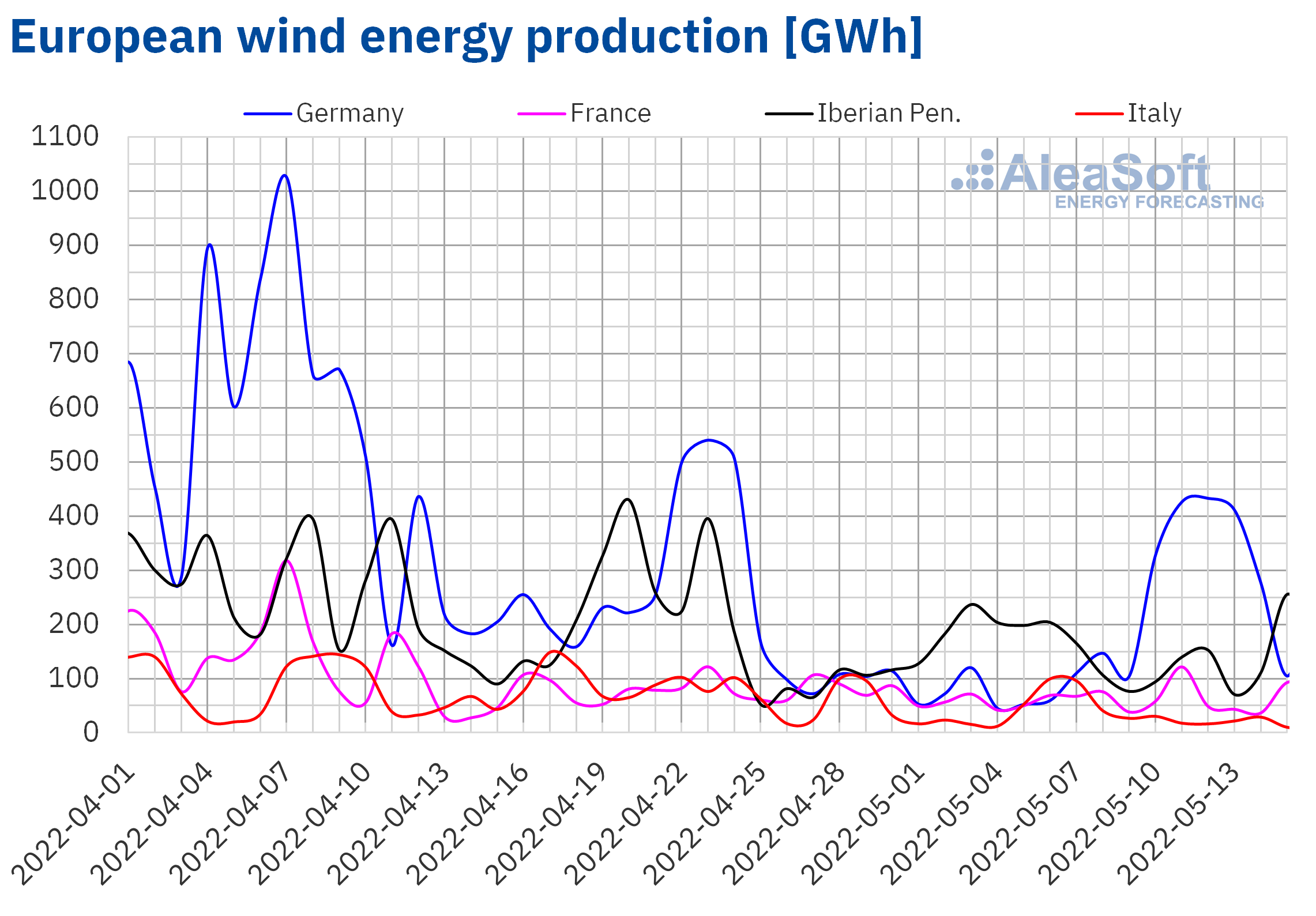

In the week that began on May 9, in the German market the wind energy production was more than three times higher than that registered in the previous week, after it fell significantly compared to the previous weeks. However, in the French market the increase was only 1.8% and in the rest of the markets analysed at AleaSoft Energy Forecasting, the production with this technology decreased between 30% and 55%.

For the week of May 16, the AleaSoft Energy Forecasting’s forecasts indicate an increase in wind energy production in all analysed markets except in the French market.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

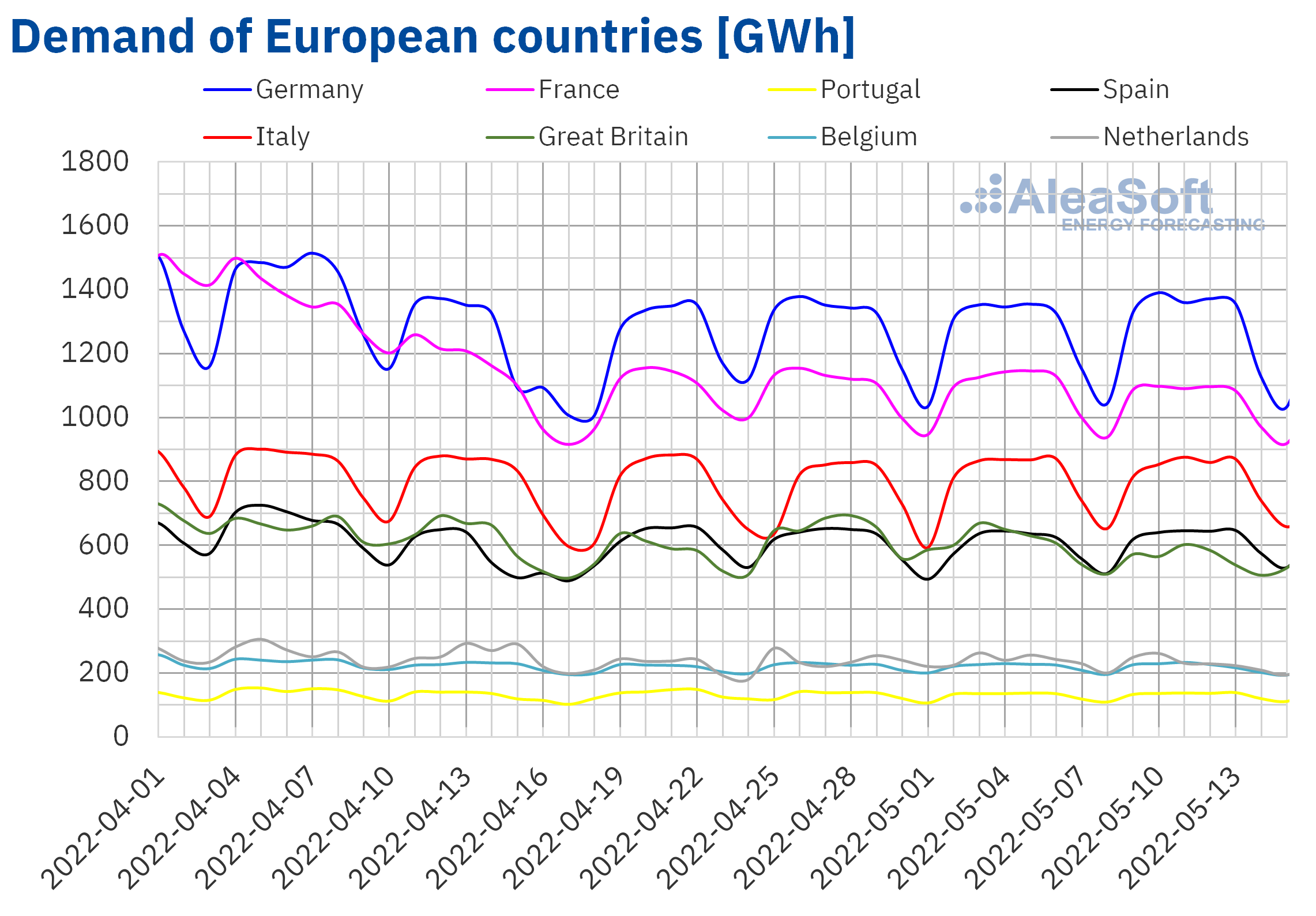

Electricity demand

During the week of May 9, the electricity demand behaved mostly downwards in the European markets analysed at AleaSoft Energy Forecasting compared to the previous week. For the second consecutive week, the largest decrease was registered in the British market, with a drop of 7.3%. In the markets of the Netherlands and France, the demand decreased by 3.5% and 3.1% respectively, while in the markets of Belgium and Italy the decreases were 0.4% and 0.1% in each case. The increase in temperatures during the period was what favoured the decreases in demand. On the other hand, in the Spanish market, the demand increased by 2.7%, partly because in the previous week, Monday, May 2, was a holiday in some autonomous communities. In the German and Portuguese markets, the demand also increased, by 0.9% and 0.8% respectively.

For the third week of May, the AleaSoft Energy Forecasting’s forecasts indicate a recovery in demand in most analysed markets. However, in the markets of Germany and Belgium, the demand is expected to fall.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

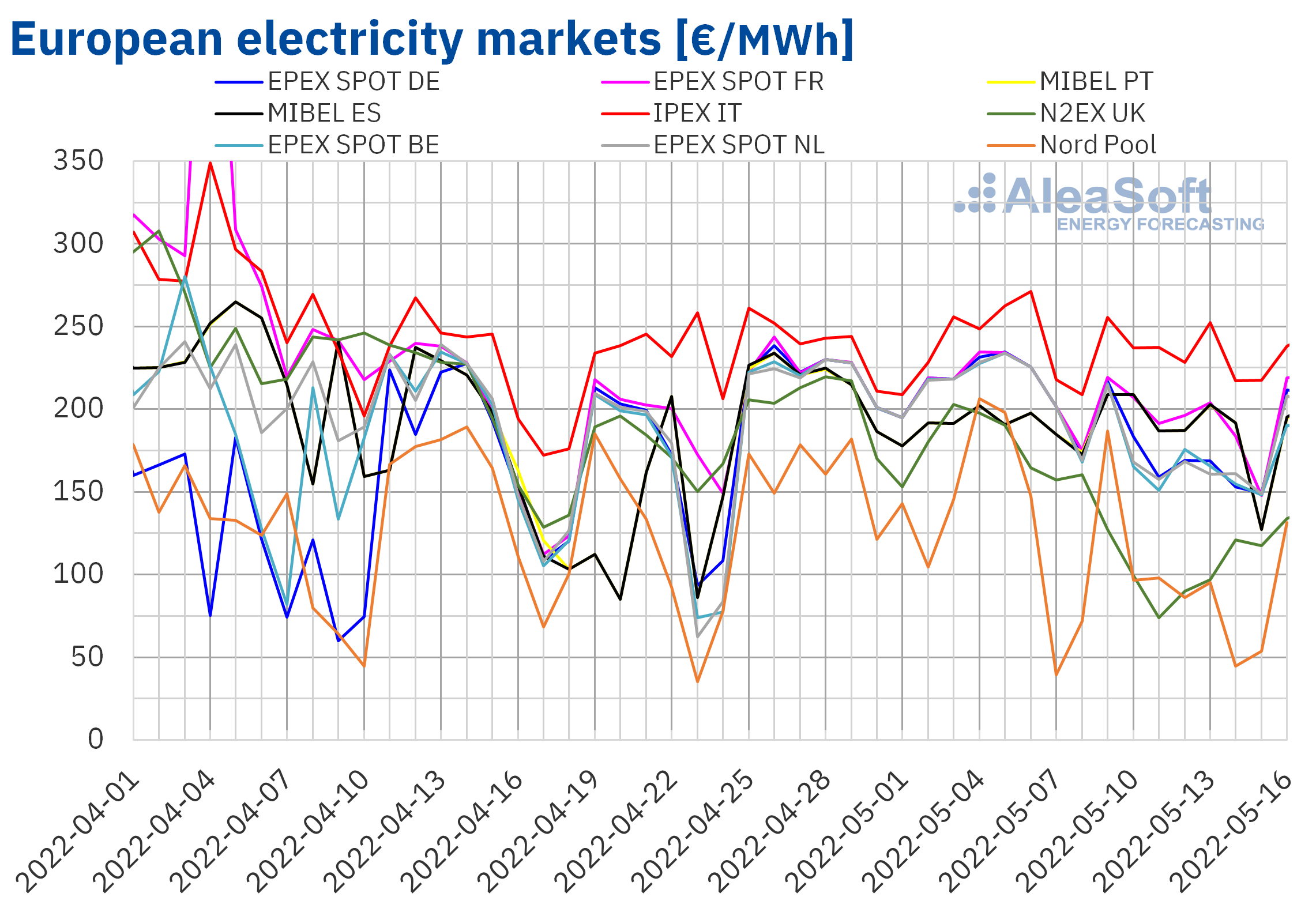

European electricity markets

In the week of May 9, prices of all European electricity markets analysed at AleaSoft Energy Forecasting decreased compared to the previous week. The largest drop was that of the N2EX market of the United Kingdom, of 42%. On the other hand, the smallest decrease, of 1.3%, was that of the MIBEL market of Spain, followed by the 1.5% decrease of the Portuguese market. In the rest of the markets, the price decreases were between 2.8% of the IPEX market of Italy and 28% of the Nord Pool market of the Nordic countries.

In the second week of May, average prices were below €195/MWh in almost all analysed electricity markets. The exception was the Italian market with a weekly average of €235.05/MWh. On the other hand, the lowest weekly average, of €94.33/MWh, was registered in the Nord Pool market. In the rest of the markets, prices were between €103.64/MWh of the N2EX market and €192.75/MWh of the French market.

Regarding hourly prices, on May 11, in the EPEX SPOT market of Belgium, negative values were reached from 13:00 to 16:00, while in the Netherlands, negative hourly prices were reached on May 13 and 14 in the afternoon. On the other hand, in the Nord Pool market, on Saturday, May 14, a price of €4.97/MWh was reached from 14:00 to 15:00, which was the lowest since the first half of November 2021. In the case of the Iberian market, on Sunday, May 15, there were hourly prices below €1.20/MWh from 15:00 to 18:00. During the first two hours, the registered price was €1.03/MWh, the lowest since April 10.

During the week of May 9, the decrease in demand in most markets and the drop in gas prices compared to the previous week favoured the fall in prices in the European electricity markets. The general increase in solar energy production and the significant increase in wind energy production in the German market also contributed to this trend. Although in the Spanish, Italian and Portuguese markets the decrease in wind energy production led to the smallest price decreases occurring in these markets.

The AleaSoft Energy Forecasting’s price forecasting indicates that in the week of May 16 prices might increase in the European electricity markets influenced by the decrease in solar energy production and the increase in demand in most markets.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

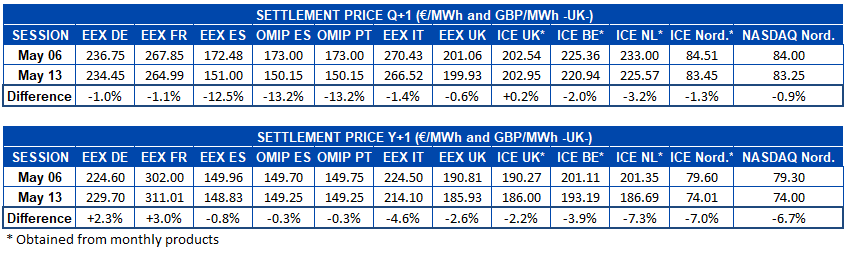

Electricity futures

In the second week of May, falls in electricity futures prices for the next quarter were registered in almost all European electricity markets. Between the sessions of May 6 and May 13, the ICE market of the United Kingdom was the only one of those analysed at AleaSoft Energy Forecasting in which prices increased, although even in its case, the increase was only 0.2%. In the rest of the markets, prices fell, with the drop in the OMIP market of Spain and Portugal being the most pronounced, falling by more than 13%. It was closely followed by the EEX market of Spain, with almost 13%. One of the main reasons for these drops in the Iberian region is that last Friday, May 13, the Spanish and Portuguese governments announced a temporary limit on gas prices in the Iberian market. In the rest of the markets, the decreases were below 4%.

As for electricity futures prices for the year 2023, there were also declines in most markets between the analysed dates. However, in this case the exceptions were the EEX market of Germany and France, in which the price increased by 2.3% and 3.0% respectively. In the rest of the markets, prices fell between 0.3% marked in the OMIP market of Spain and Portugal and 7.3% registered in the ICE market of the Netherlands.

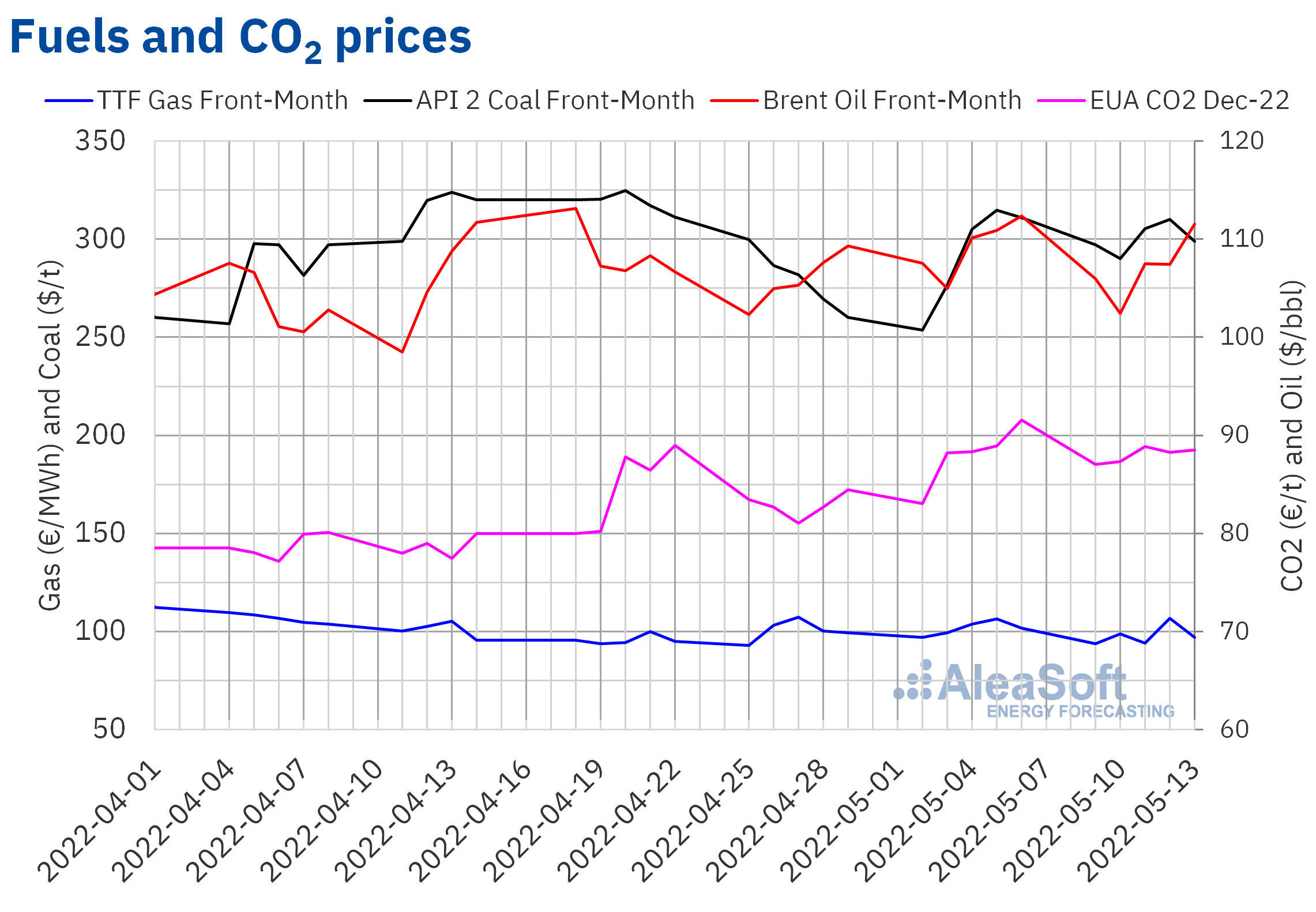

Brent, fuels and CO2

Brent oil futures for the Front?Month in the ICE market, during the second week of May, registered lower settlement prices than those of the same days of the previous week. The minimum settlement price of the week, of $102.46/bbl, was registered on Tuesday, May 10, and it was 2.4% lower than that of the previous Tuesday. On the other hand, the maximum settlement price of the week, of $111.55/bbl, was reached on Friday, May 13.

In the second week of May, concerns about the supply of oil from Russia continued, favouring prices remaining above $100/bbl. But on the other hand, the lockdowns in China due to the COVID?19 outbreaks continue to threaten the recovery in demand. Meanwhile, the European Union is negotiating possible sanctions on the import of Russian oil, for which Russia would have to find other costumers.

As for settlement prices of TTF gas futures in the ICE market for the Front?Month, almost the entire second week of May remained below €100/MWh. The exception was the settlement price of Thursday, May 12, of €106.70/MWh. This price was 0.2% higher than that of the same day of the previous week and the highest since the end of April. The rise, of 13% compared to the previous day, was favoured by fears of reductions in the supply of gas from Russia to Germany. However, gas flows continued, allowing prices to fall again to €96.88/MWh on Friday. In the week as a whole, settlement prices were 3.6% lower than those of the previous week.

Regarding CO2 emission rights futures in the EEX market for the reference contract of December 2022, on Monday, May 9, they registered a settlement price of €87.02/t, which was €4.52/t lower than that of the last session of the previous week. Although this price was still 4.8% higher than that of the previous Monday. Subsequently, prices increased until reaching the maximum settlement price of the week, of €88.84/t, on Wednesday, May 11. After registering a slight decrease on Thursday, on Friday prices continued to increase to €88.49/t. But this price was 3.3% lower than that of the previous Friday.

The evolution of CO2 emission rights prices in the third week of May might be influenced by the vote on Tuesday, May 17, by the Environment Committee of the European Parliament on the proposal to reform the emission rights market.Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the renewable energy projects financing

On May 12, the 22nd edition of the AleaSoft Energy Forecasting’s monthly webinars was held. The speakers were Oriol Saltó i Bauzà and Alejandro Delgado, both Associate Partners at AleaGreen, and three experts with extensive experience in the energy sector joined the analysis table of the Spanish version of the webinar: Alberto Ceña Lázaro, CEO of BEPTE, S.L., Antonio Canoyra Trabado, associate professor at the Department of Electric Power at the Comillas Pontifical University (ICAI), and Francisco Del Río, energy management expert. In the webinar AleaGreen was presented, the new division of Alea Business Software S.L specialised in long?term energy markets reports, and the importance of 30?year hourly forecasting for PPA and portfolio valuation was discussed. An issue that aroused much interest and debate was the limitation of the gas price in the Iberian electricity market offers and the consequences that this measure may have. In addition, the usual analysis of the evolution of the European energy markets and their prospects in the mid? and long?term was carried out and the AleaApp platform for the compilation, visualisation and analysis of the main variables of the markets was shown. Those interested can request the recording to know in detail all the analysed topics.