Important rises in European electricity futures markets in the first week of July.

In the first week of July, European electricity futures prices for the next quarter and year rose in most markets, boosted by the increase in gas prices. In the case of France, where a significant part of the nuclear park is expected to be stopped until the end of the year, futures for the fourth quarter exceeded €900/MWh. In the spot markets, prices also increased in most markets. Solar energy production records were registered in France.

Photovoltaic and solar thermal energy production and wind energy production

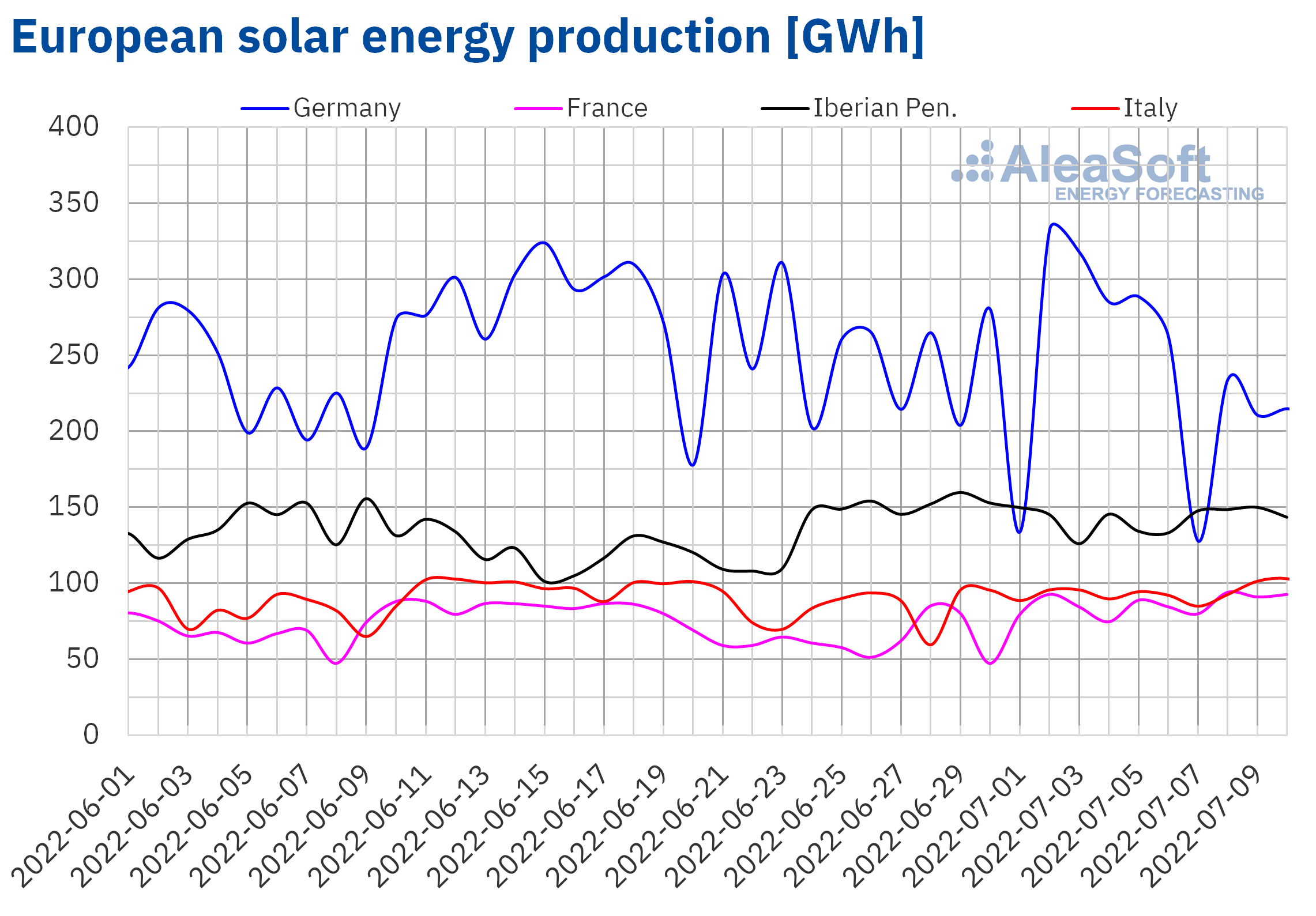

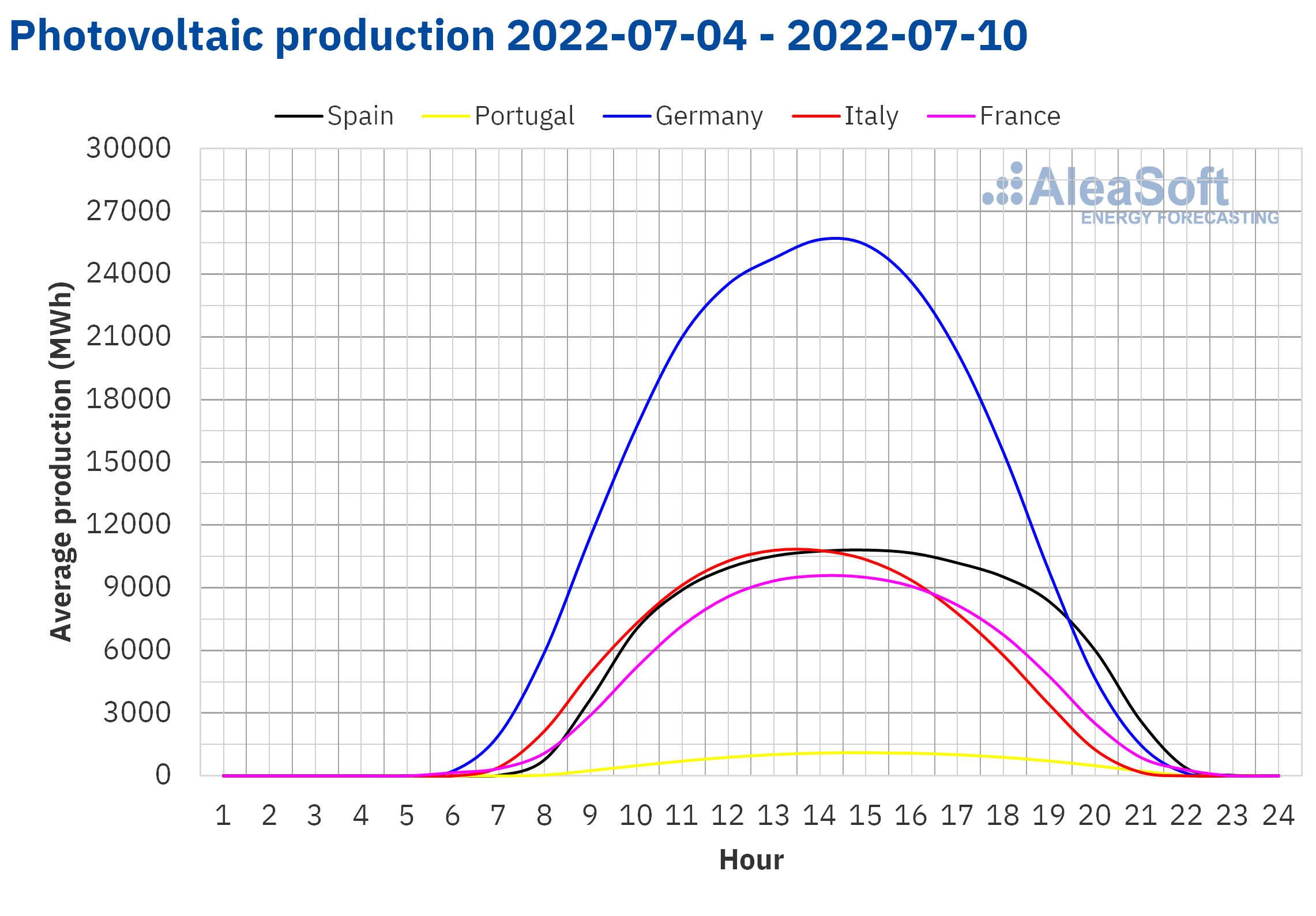

In the first week of July, the solar energy production registered in France, of 604 GWh, was the highest in its history, increasing by 14% compared to the previous week. Also in this market, on July 8, the daily production record, of 94 GWh, was registered, as well as the hourly record, at 13:00, when 10 584 MWh were generated with solar energy.

Also in Italy, the solar energy production increased compared to the last week of June, by 6.3% in this case, and on July 10 the second highest solar energy production in its history, of 103 GWh, was registered.

In the markets of Germany, Spain and Portugal, the solar energy production fell in the week of July 4, by 7.2%, 2.8% and 2.6%, respectively.

According to the AleaSoft Energy Forecasting’s forecasts, in the week of July 11, the solar energy production is expected to increase in Germany and Italy, but it will decrease again in Spain.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

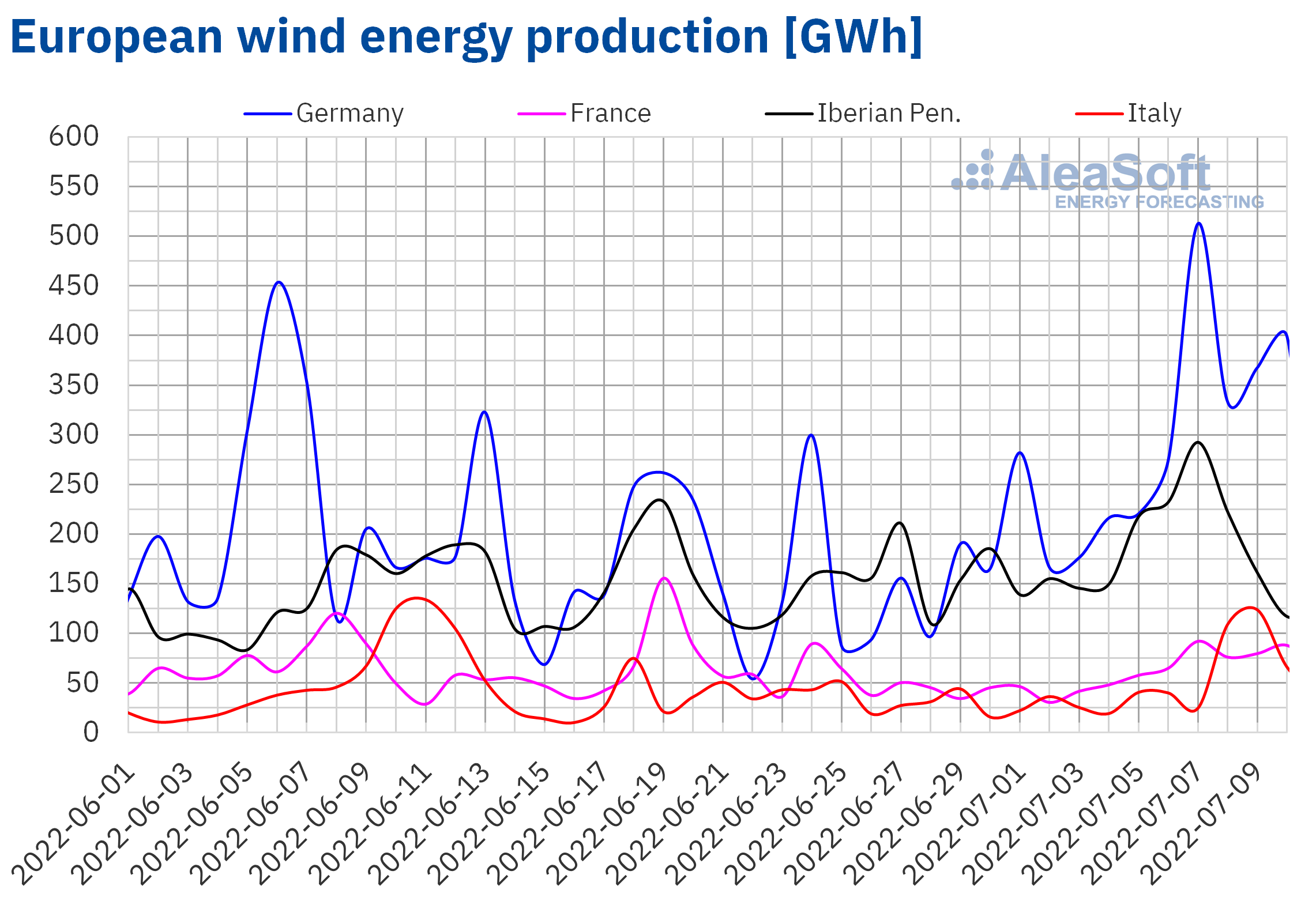

In the case of wind energy production, in the week of July 4 there was an increase compared to the production of the previous week in most markets analysed at AleaSoft Energy Forecasting. The increases were between 40% of Spain and 108% of Italy. However, in Portugal, the production with this technology fell by 23% compared to the week of June 27.

The AleaSoft Energy Forecasting’s forecasts indicate that in the second week of July the wind energy production will drop in all analysed European markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

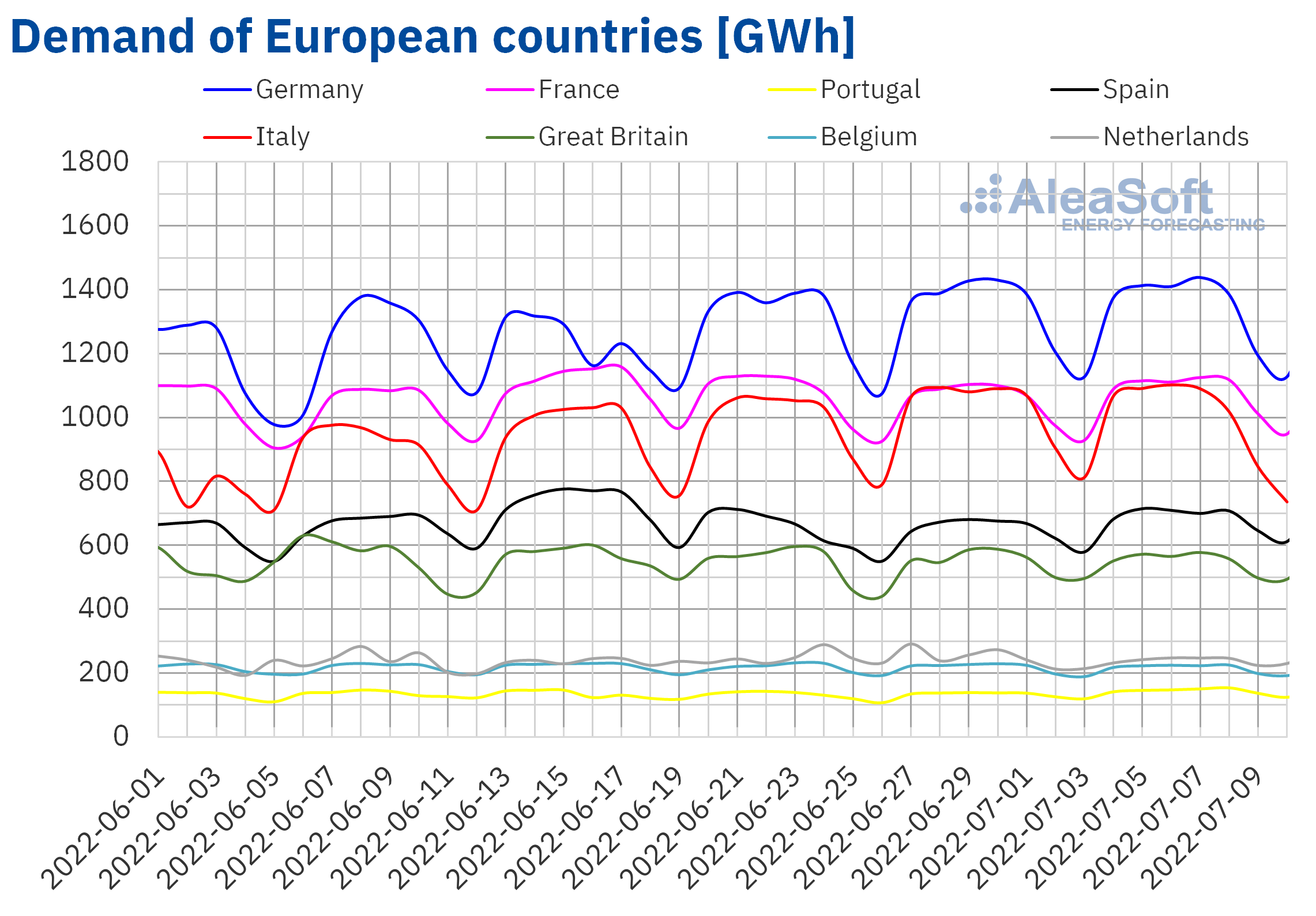

Electricity demand

In the first week of July, the electricity demand behaved heterogeneously in the analysed European markets compared to the previous week. On the one hand, in the markets of Portugal, Spain, France and Germany, the demand increased. The largest increases, 7.4% and 5.1%, were registered in the markets of Portugal and Spain, respectively. In the French market the rise was 2.6% and in the German market 0.2%. These increases were favoured by the increase in average temperatures, mainly in Portugal and Spain, where they rose by more than 2.5 °C during this period.

On the other hand, the demand fell in the markets of Great Britain, Belgium, Italy and the Netherlands. The largest declines were registered in the markets of the Netherlands and Italy, with falls of 3.3% and 2.3% in each case. In the British market the drop was 0.4% and in that of Belgium it was 0.6%.

For the week of July 11, the AleaSoft Energy Forecasting’s forecasts estimate that the demand will have a varied behaviour in the European markets. In the markets of Spain, the Netherlands, Portugal and Great Britain, it is expected to increase, while in the markets of Italy, Germany, France and Belgium, the electricity demand is expected to be lower than that registered during the week of July 4.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

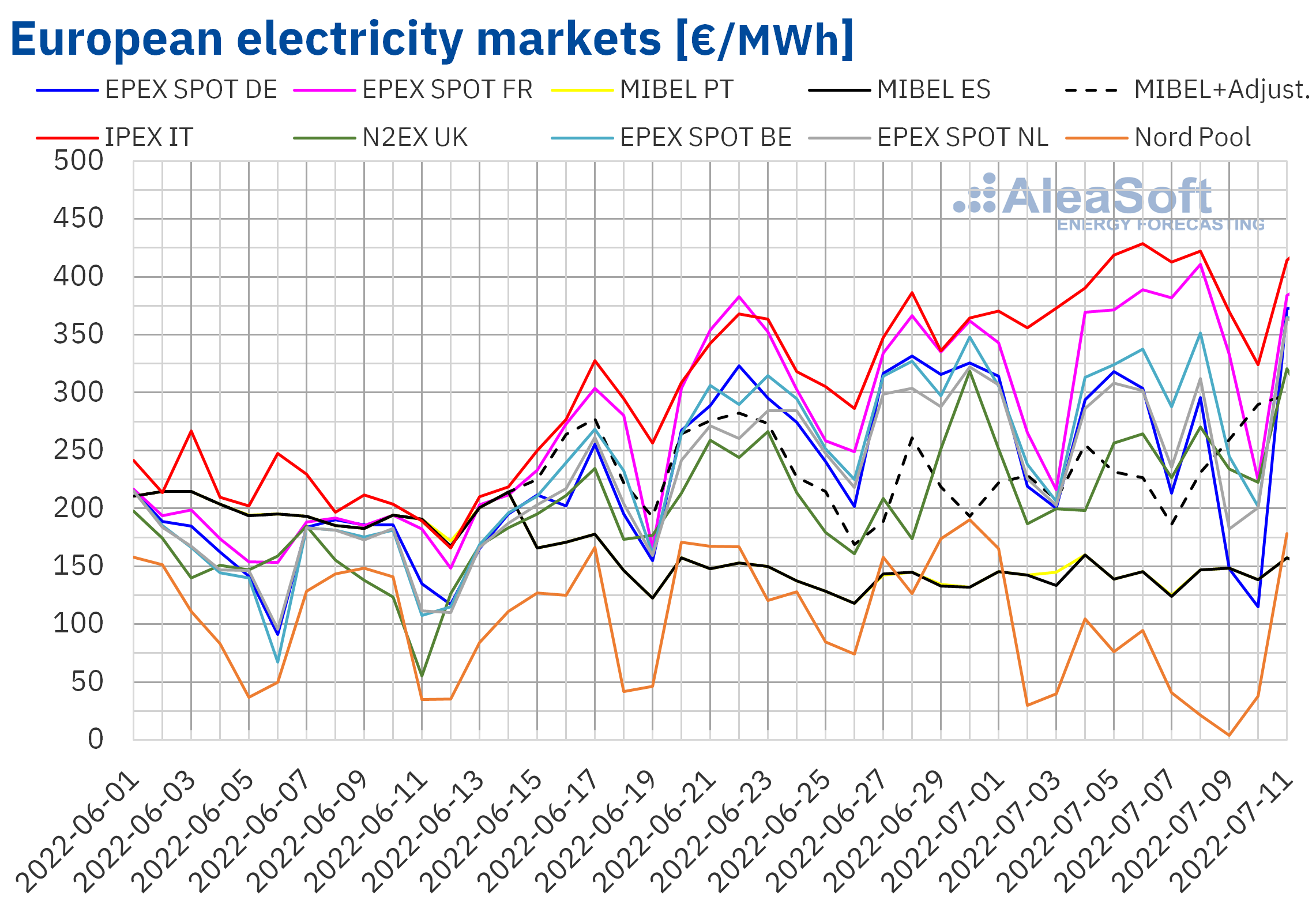

European electricity markets

In the week of July 4, prices of most European electricity markets analysed at AleaSoft Energy Forecasting increased compared to the previous week. However, in the Nord Pool market of the Nordic countries, the EPEX SPOT market of Germany and the EPEX SPOT market of the Netherlands, decreases of 57%, 17% and 6.2% respectively were registered. On the other hand, the largest rise in prices was that of the EPEX SPOT market of France, of 12%. On the contrary, the smallest increase, of 1.2%, was that of the EPEX SPOT market of Belgium. In the rest of the markets, the price increases were between 1.7% of the MIBEL market of Portugal and 9.2% of the IPEX market of Italy.

In the first week of July, the differences between the highest and lowest average prices of the analysed electricity markets exceeded €300/MWh. The highest averages, of €395.28/MWh and €354.26/MWh, corresponded to the Italian market and the French market, respectively. On the other hand, the lowest weekly average, of €54.25/MWh, was that of the Nord Pool market. In the rest of the markets, prices were between €143.22/MWh of the Spanish market and €294.50/MWh of the Belgian market.

Regarding hourly prices, the highest in the first week of July were registered in the Italian market, in which they exceeded €500/MWh. On July 5 at 20:00, a price of €515.00/MWh was reached, the highest in this market since March. On the other hand, in the market of the Netherlands, two hours with negative prices were registered on Saturday, July 9, in the afternoon. The lowest price, of ?€30.66/MWh, was reached at 15:00 and it was the lowest price in the Dutch market since the first half of June.

During the week of July 4, the rise in gas prices compared to the previous week led to an increase in prices of most European electricity markets, despite the increase in wind energy production. On the other hand, the limit on gas prices applied in the MIBEL market allowed its prices to be among the lowest in Europe. However, in this market, part of the demand must pay a higher price as compensation for the limitation of the gas price, which in the case of Spain is regulated in Royal Decree?law 10/2022. For these consumers, the average price for the week of July 4 was €240.02/MWh, 11% higher than that of the previous week.

The AleaSoft Energy Forecasting’s price forecasts indicate that in the week of July 11 European electricity markets prices might increase in general, influenced by the general decrease in wind energy production, as well as by the high gas prices. In addition, in some markets the demand might increase due to the rise in temperatures.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

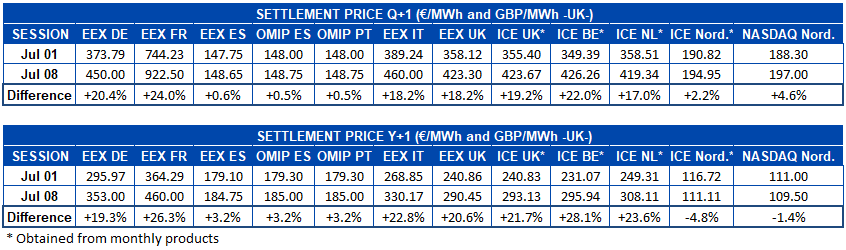

Electricity futures

During the first week of July, electricity futures prices for the last quarter of 2022 registered a marked upward trend. The EEX market of France, where an important part of the nuclear park is expected to be stopped until the end of the year, was the protagonist of historic price increases. Comparing the settlement prices of the sessions of July 1 and 8, there was a 24% rise in the French market, marking the historical price of €922.50/MWh. Similar increases in percentage terms were registered in the EEX market of Germany, Italy and the United Kingdom, and in the ICE market of the United Kingdom, Belgium and the Netherlands. On the other hand, the rises were less notable in the ICE market and the NASDAQ market of the Nordic countries, with increases of 2.2% and 4.6% respectively. However, what is really remarkable is the marked effect that the Iberian exception has on this product in the EEX market of Spain and in the OMIP market of Spain and Portugal, where prices rose by only 0.6% in the case of the EEX market and 0.5% in the case of the OMIP market for both countries.

In the case of electricity futures for the next year 2023, a predominantly upward behaviour was also registered, although with the exceptions of the ICE market and the NASDAQ market of the Nordic countries, where prices fell by 4.8% and 1.4% respectively in the analysed period. The Iberian region also had relatively smaller increases than the rest of the markets, with prices rising by 3.2% in the EEX market of Spain and the OMIP market of Spain and Portugal, while in the rest of the markets the increases were between 19% and 29%.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

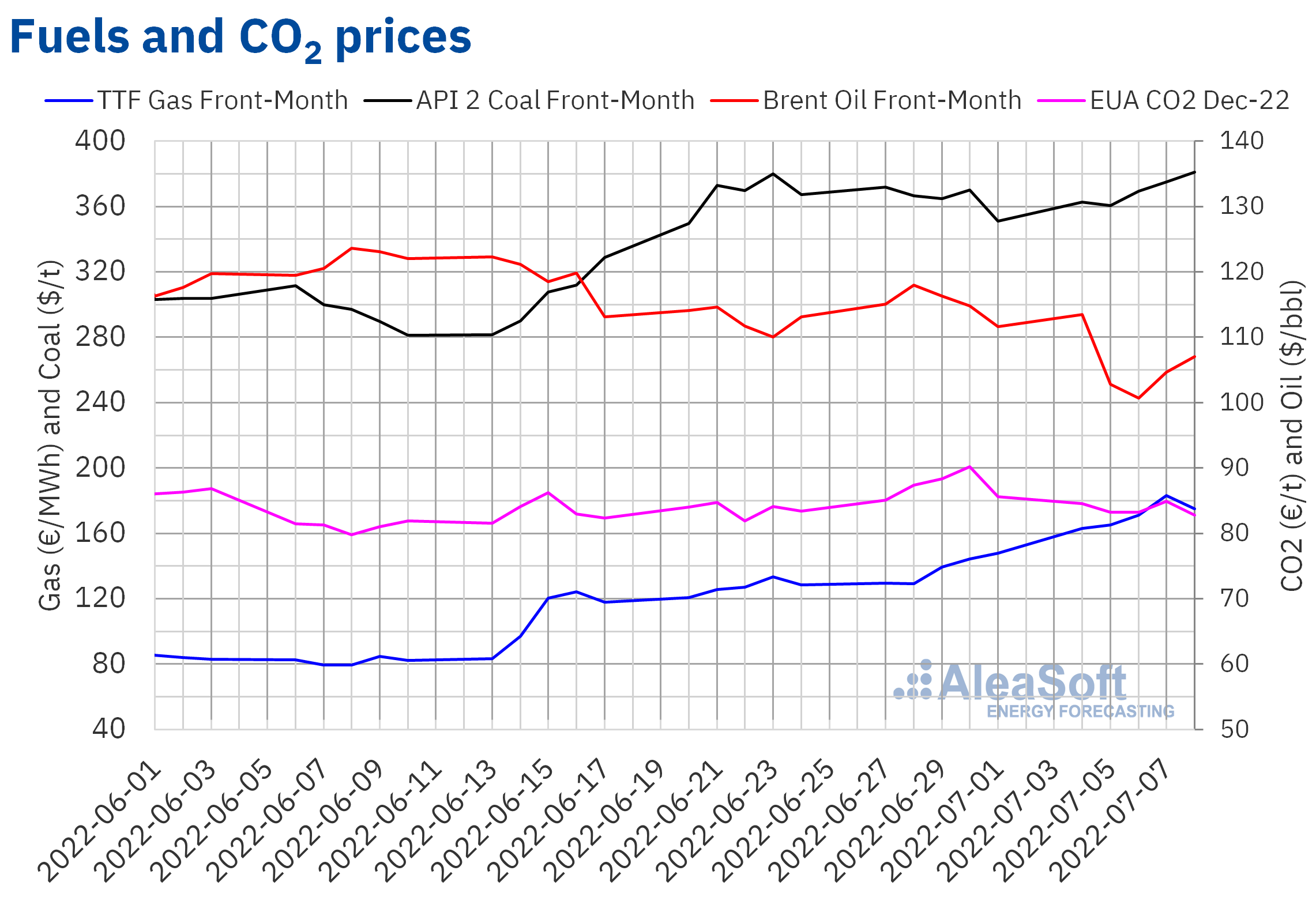

Brent, fuels and CO2

Brent oil futures for the Front?Month in the ICE market began the first week of July with a settlement price of $113.50/bbl on Monday, July 4, which was the maximum of the week. However, the rest of the week, settlement prices remained below $110/bbl. The weekly minimum, of $100.69/bbl, was registered on Wednesday, July 6, and was 13% lower than that of the previous Wednesday. On Thursday and Friday, prices recovered until reaching a settlement price of $107.02/bbl on Friday, July 8, still 4.1% lower than that of the previous Friday.

The fear of a possible recession favoured the fact that prices of the first week of July remained below those of the same days of the previous week. In addition, the new coronavirus outbreaks in China also exerted their downward influence on prices.

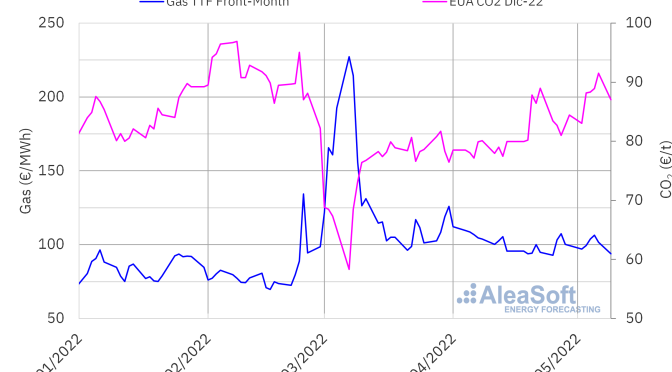

As for settlement prices of TTF gas futures in the ICE market for the Front?Month, in the first week of July, they were higher than €160/MWh. Prices increased until reaching a maximum of €183.18/MWh on Thursday, July 7. This price was 27% higher than that of the previous Thursday and the highest since March 8. However, on Friday the settlement price fell by 4.4% compared to the previous day and it was €175.21/MWh.

In the first week of July, strikes in Norway’s oil and gas sector exerted their upward influence on prices. On the other hand, the gas supply from Russia through the Nord Stream 1 gas pipeline is expected to be interrupted from July 11 due to maintenance work. The supply cut should last ten days. However, in Germany there is a fear that this cut will last longer than expected. This situation may also contribute to the increase in prices in the coming days.

Regarding settlement prices of CO2 emission rights futures in the EEX market for the reference contract of December 2022, during the first week of July they remained below €85/t. On Thursday, July 7, the weekly maximum settlement price, of €84.92/t, was reached, which was 5.8% lower than that of the previous Thursday. But on Friday the price fell by 2.5% to €82.79/t, which was the weekly minimum settlement price.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the renewable energy projects financing

Next Thursday, July 14, at 10:00 CET, the webinar of AleaSoft Energy Forecasting and AleaGreen “Prospects for energy markets in Europe. Vision of the future: green hydrogen” will take place. On this occasion, there will be the participation of speakers from H2B2 who will analyse the prospects for green hydrogen as a strategic vector, the business models that will allow its development to be carried out, as well as the existing aid and regulation. In addition, as usual, the evolution of the European energy markets in recent weeks and the prospects for the coming months will be analysed.

The long?term price curves forecasts of AleaSoft Energy Forecasting and AleaGreen for the European markets, updated at the beginning of the third quarter of 2022, are already being sent. These long?term forecasts with hourly granularity for the 30?year horizon are necessary for PPA, renewable energy assets valuation, cogeneration and for the development of batteries. Until July 15, a special promotion of these forecasts is available.