The combination of the fall in electricity demand, due to the beginning of the holiday period of August, and a higher wind and solar energy production favoured the decrease in the prices of the European electricity markets, despite registering a slight increase in gas prices and CO2 emission rights.

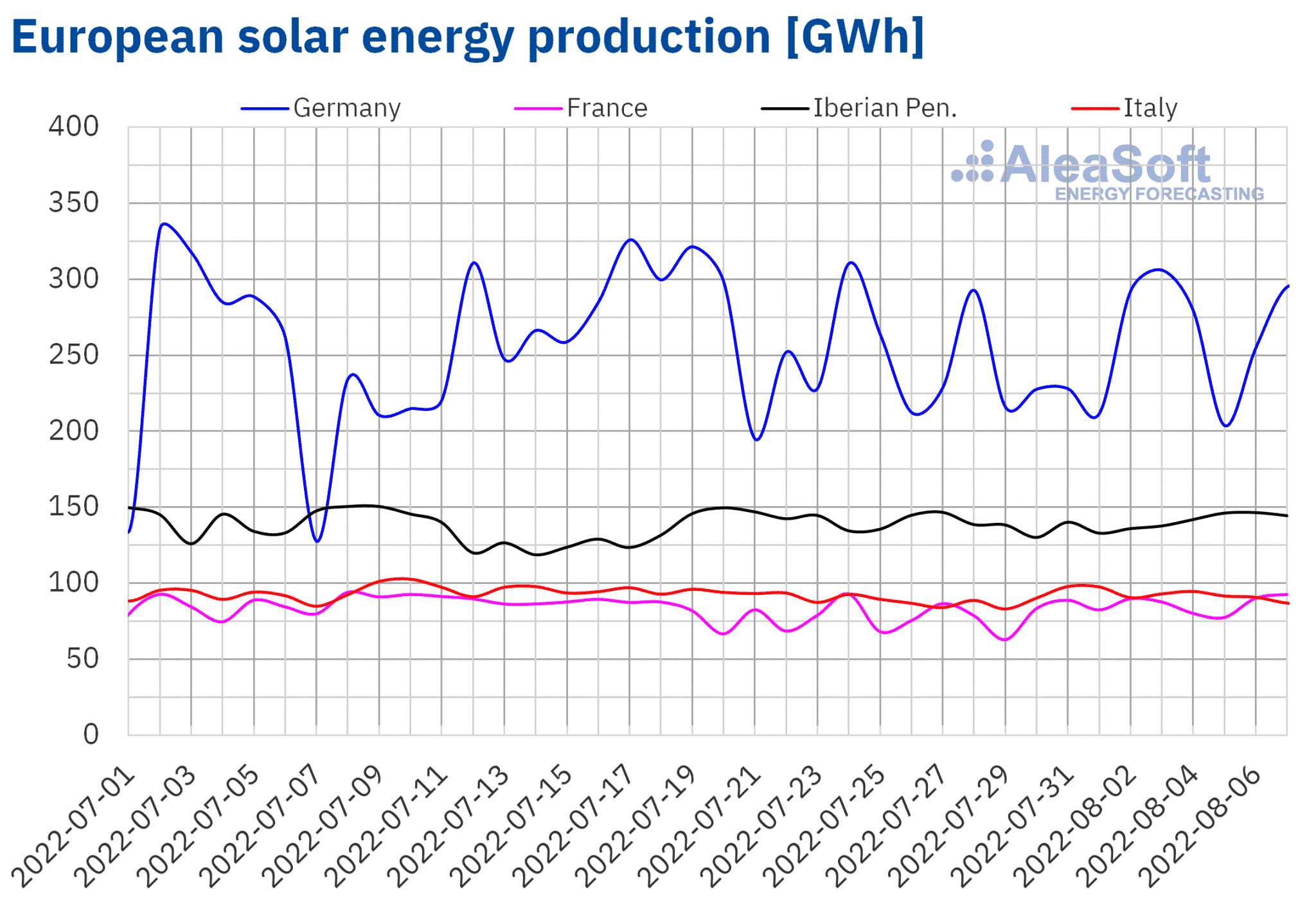

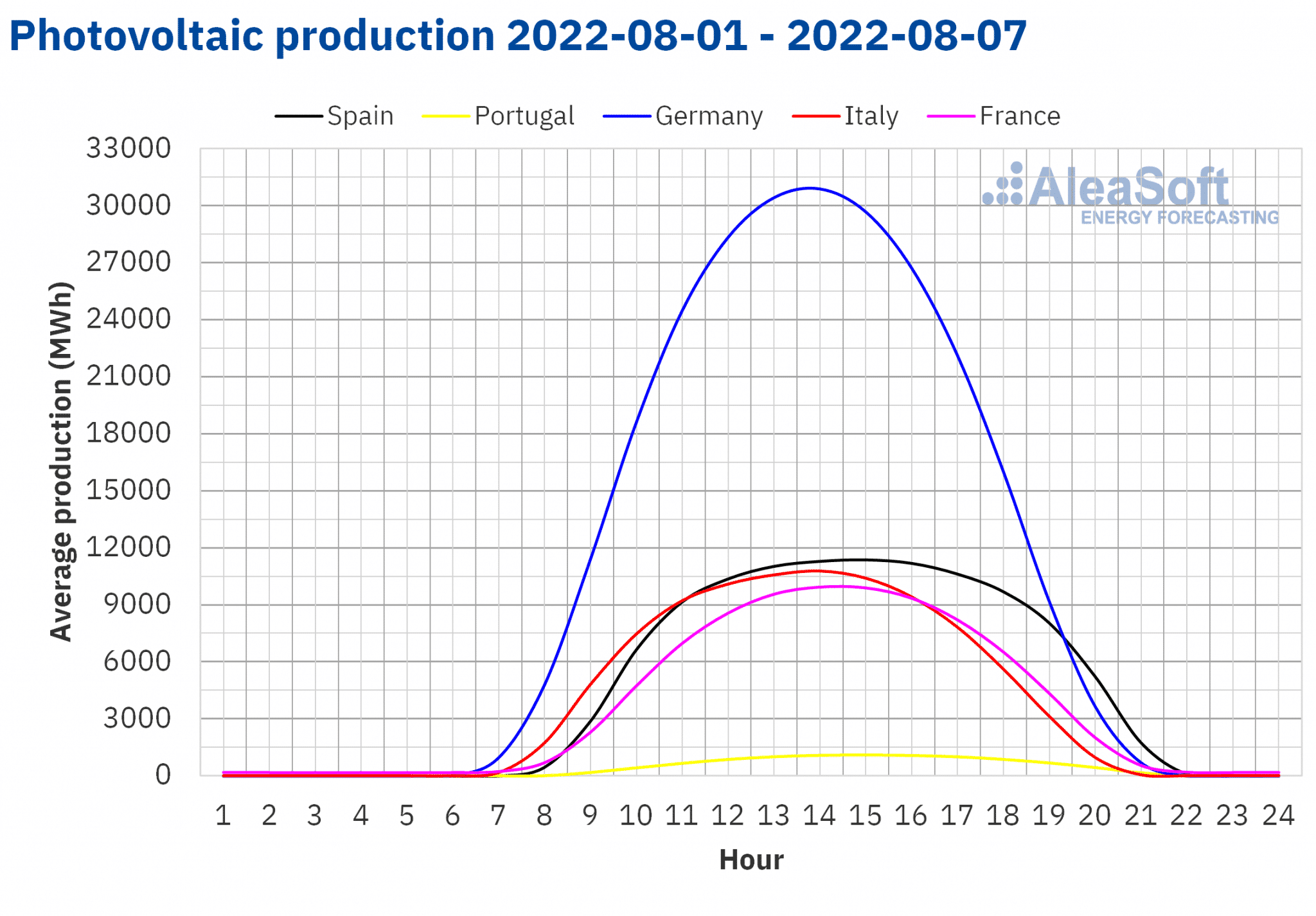

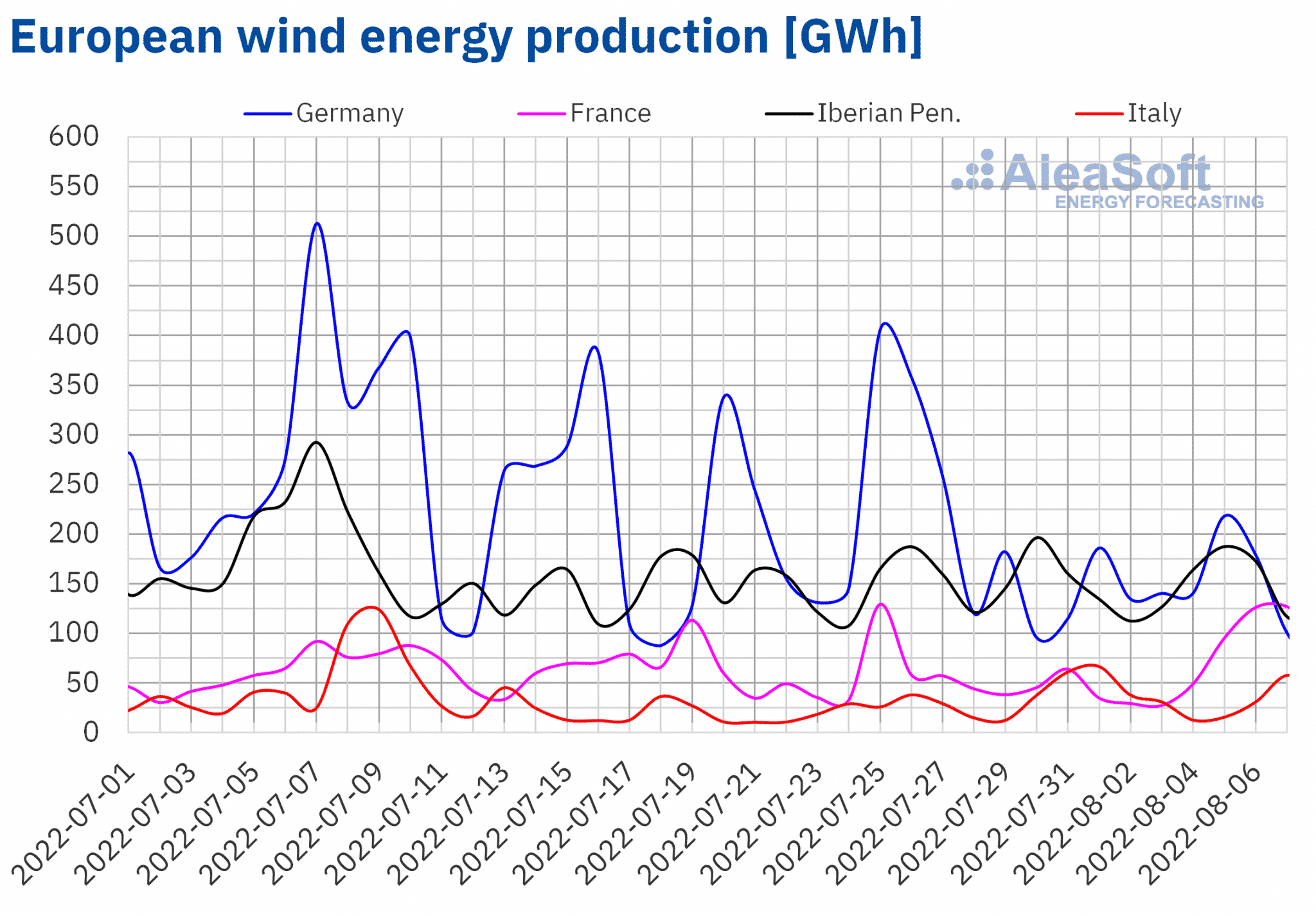

Photovoltaic and solar thermoelectric energy production and wind energy production

During the first week of August, the solar energy production increased compared to the previous week in all the markets analysed at Aleasoft Energy Forecasting except in the Portuguese market, in which production fell by 10%. The largest increases were of 10%, registered in the markets of France and Germany. In Spain and Italy the increase was 2% and 4%, respectively.

For the second week of August, the AleaSoft Energy Forecasting forecasts indicate a reduction in production in Spain and Italy, as well as an increase in the German market.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

The wind energy production during the week of August 1 increased by 15% compared to the previous week in the Italian market. In the French market there was an increase of 12% while, on the contrary, in the German market it fell by 28% and in the Iberian Peninsula it fell by 11%.

For the week that began on August 8, the AleaSoft Energy Forecasting forecasts expect a general increase in wind energy production in the analysed markets. Except in the Spanish market, where a significant reduction in wind energy generation is expected.

Source: Using data AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

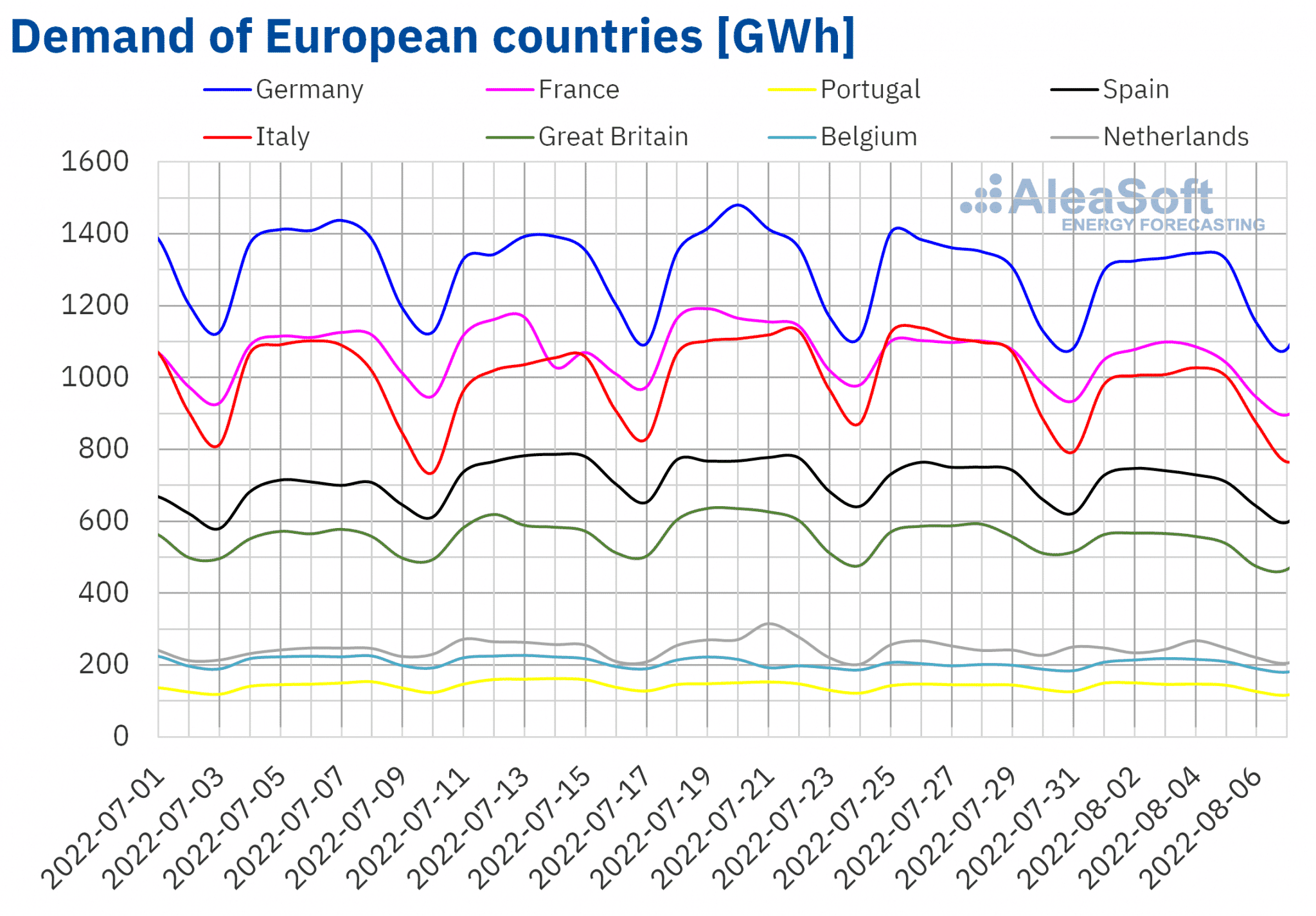

Electricity demand

During the first week of August, the electricity demand decreased compared to the previous week in most of the analysed European markets. The biggest drop was registered in the Italian market, of 7.7%. The markets of Great Britain and the Netherlands were the second and third markets with the greatest decreases, of 4.7% and 4.0% in each case. In the markets of France, Spain, Germany and Portugal, the falls were between 2.7% in France and 0.3% in Portugal. The exception was the Belgian market, where demand increased by 3.9% for this period.

For the week of August 8, the AleaSoft Energy Forecasting forecasts estimate that the demand will increase in most European markets. On the contrary, in the markets of Spain and France, demand is expected to continue to decline, in the case of Spain for the fourth consecutive week and in France for the third week.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

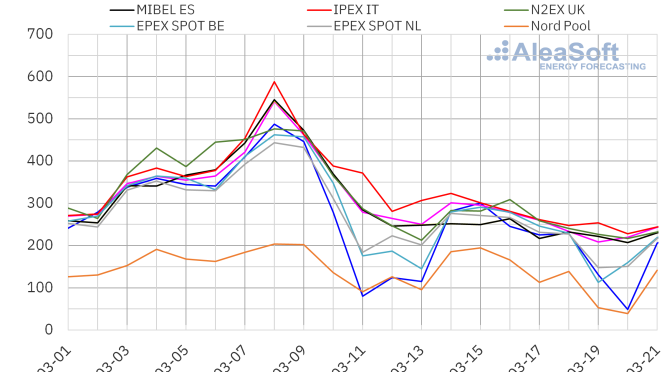

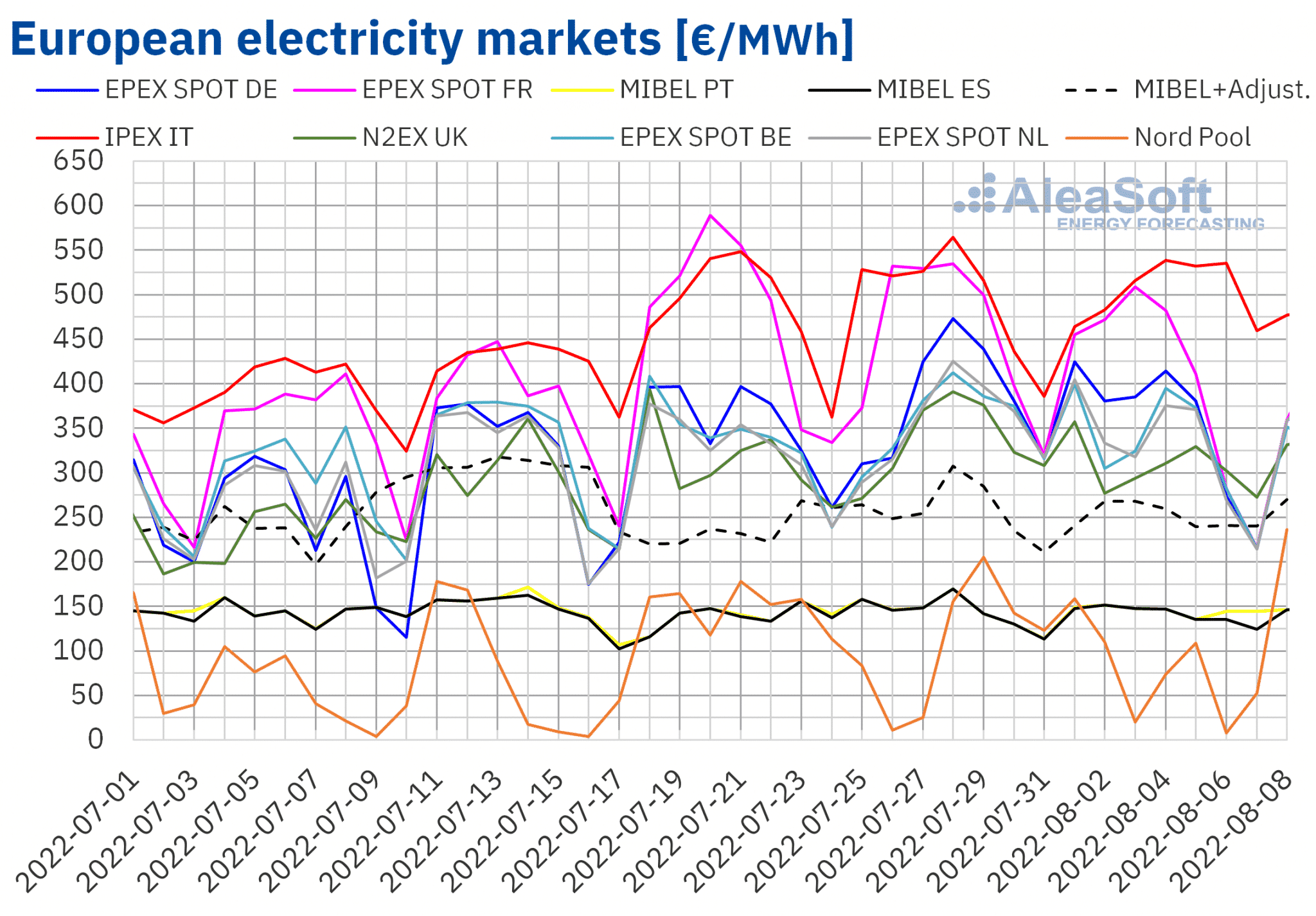

European electricity markets

In the first week of August, the prices of most of the European electricity markets analysed at AleaSoft Energy Forecasting decreased compared to the previous week. The exceptions were the MIBEL market of Portugal and the IPEX market of Italy, with increases of 1.1% and 1.5%, respectively. On the other hand, the biggest drop in prices was that of the Nord Pool market of the Nordic countries, of 29%, followed by the 11% drop of the EPEX SPOT market of France. On the other hand, the smallest decrease, of 1.8%, was that of the MIBEL market of Spain. In the rest of the markets the price decreases were between 7.1% of the EPEX SPOT market of Germany and 8.6% of the N2EX market of Great Britain.

During the analysed period, the highest average of €504.10/MWh was registered in the Italian market, followed by that of the French market, of €403.80/MWh. On the other hand, the Nord Pool market was the one with the lowest weekly average, of €76.00/MWh, followed by the markets of Spain and Portugal, with values of €141.22/MWh and €145.57/MWh, respectively. In the rest of the markets, the prices were between €306.25/MWh in the British market and €353.31/MWh in the German market.

Although the MIBEL market prices were the second and third lowest, part of the consumers must pay a higher price as compensation for the gas price limitation applied in this market. In the Spanish market, the average of this price was €250.93/MWh in the week of August 1, 2.7% lower than the previous week.

Regarding hourly prices, between Tuesday, August 2 and Saturday, August 6, hourly prices above €600/MWh were registered in the Italian market during the hours between approximately 6:00 p.m. and 10:00 p.m. In addition, in the case of France, hourly prices above €600/MWh were also registered on August 2 and 3.

In contrast, on the afternoon of Tuesday, August 2, two hours with negative prices were registered in the Belgian market, of €?37.56/MWh and €?2.01/MWh, that were reached between 2:00 p.m. and 4:00 p.m. Also, in the Dutch market, on Wednesday, August 3, the price reached €0.00/MWh between 1:00 p.m. and 2:00 p.m.

During the week of August 1st, in most markets, demand decreased, while wind energy production and solar energy production increased compared to the previous week. This, together with the drop in coal and Brent prices, despite the slight increase in gas prices and CO2 emissions, favoured the drop in prices in the European electricity markets.

The price forecasts by AleaSoft Energy Forecasting indicate that in the second week of August the prices of most European electricity markets could continue to fall, influenced by the increase in wind energy production in most markets.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

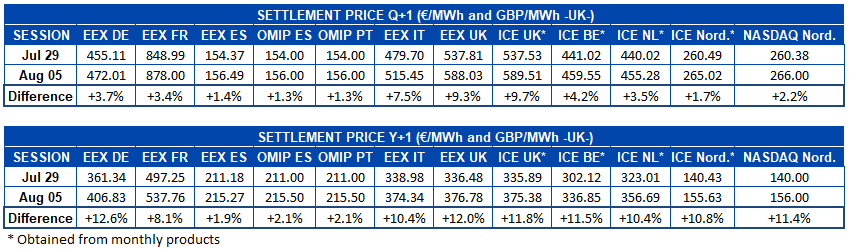

Electricity futures

The first week of August ended with increases in the futures prices for the last quarter of 2022, in the markets analysed at AleaSoft Energy Forecasting. When analysing the settlement prices of the sessions of July 29 and August 5, increases are observed ranging from 1.3% registered in the OMIP market of Spain and Portugal for both countries, up to 9.7% of the ICE market of United Kingdom.

Regarding the electricity futures for the calendar year 2023, the behaviour was similar. In this case, the biggest increase was registered in the EEX market of Germany, with an increase of 13%. Meanwhile, in the EEX market of Spain, the prices of this product rose by 1.9%, being the smallest increase of the markets analysed during this period.

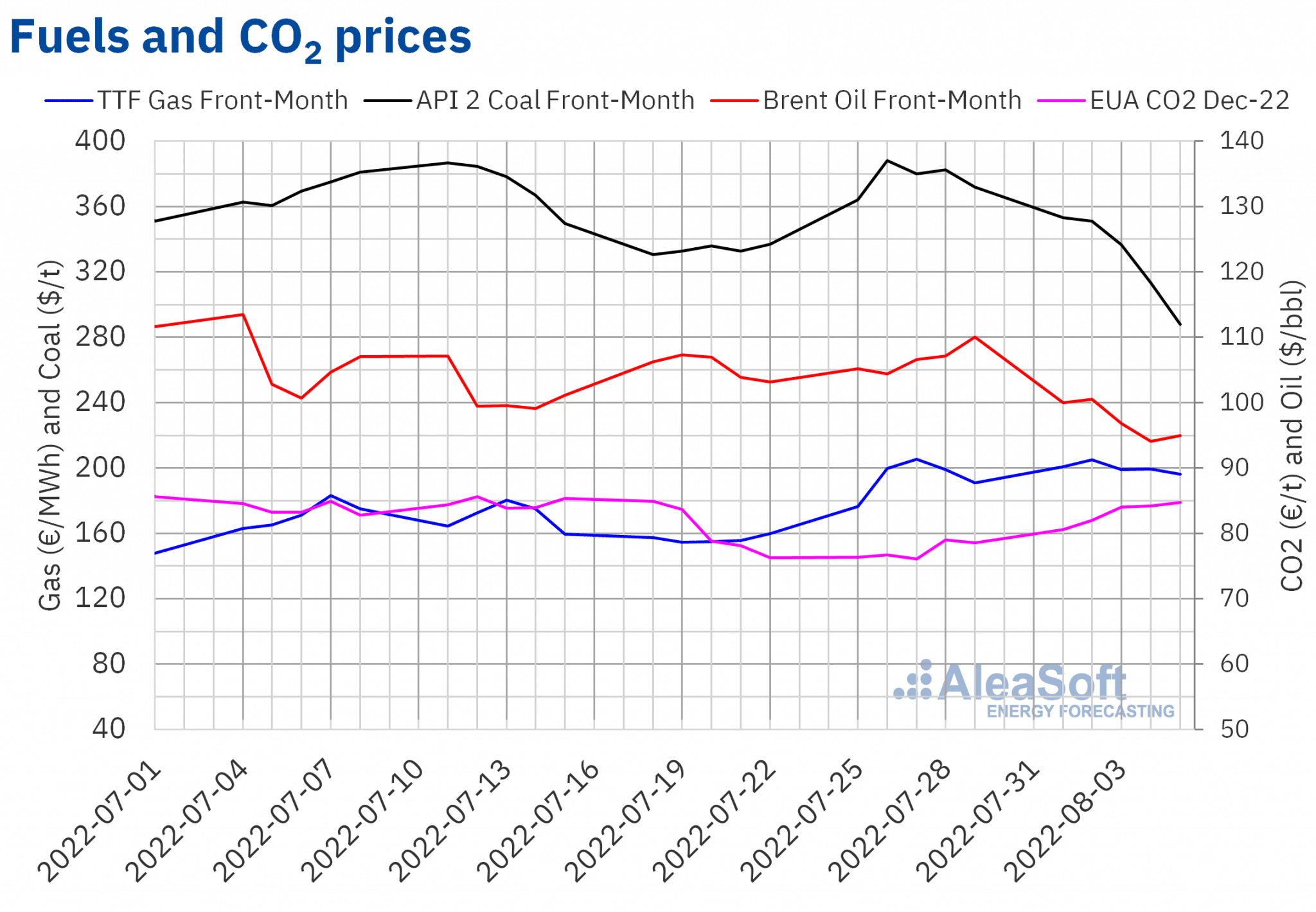

Brent, fuels and CO2

The settlement prices of the TTF gas Front-Month futures in the ICE market during the first week of August registered increases compared to the previous week. The week began with a settlement price in its first session of €200.79/MWh. The highest price of the week was reached on Tuesday, August 2, with €205.17/MWh and finally ended the week with a settlement price of €196.32/MWh in the session of August 5. This price represents a rise of 2.8% compared to the last settlement price of the previous week.

The API 2 coal futures prices registered a drop of 23% in the week from August 1 to 7 compared to the previous week if the settlement prices of the last sessions of each week are compared. With a marked downward behaviour throughout the week, the settlement price of the last market session was $287.85/t, a price that is more than $80/t below the price of the previous Friday, 29 of July. The decreases in coal prices are fundamentally due to a healthy supply outlook, with the high stock in ports and lower demand.

Brent oil futures for the next month in the ICE market registered a predominantly downward trend during the first week of August, although with two slight increases in the sessions of August 2 and 5. The settlement price of the session on Friday, August 5, was $94.92/bbl. This price represents a decrease of 14% compared to the settlement price of the last session of the previous week.

Regarding the settlement prices of CO2 emission rights futures in the EEX market for the reference contract of December 2022, during the first week of August they remained below €85/t, although with an upward trend. On Friday, August 5, the maximum weekly settlement price of €84.77/t was reached, which was 7.8% higher than that of the previous Friday. This upward trend in CO2 emission rights is favoured in part by the 50% reduction in auction volumes during the month of August.

Soruce: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the renewable energy projects financing

The next webinar organised by AleaSoft Energy Forecasting and AleaGreen with the current analysis and perspective of the energy markets in Europe will be held on September 15. On this occasion, which will be the 25th edition of these webinars, Jorge Simão, COO at OMIP, and Pablo Villaplana, COO at OMIClear, will participate to analyse the importance of forward markets and hedging for development of renewable energies. In the subsequent analysis table, moderated by Antonio Delgado Rigal, CEO of AleaSoft Energy Forecasing, Fernando Soto, General Director of AEGE, will also participate to inform and resolve doubts about the renewable PPA auctions with electro-intensive. In addition, as usual, Oriol Saltó i Bauzà, Associate Partner at AleaGreen, will analyse the evolution and perspectives of the energy markets.

Registration is also open for the October edition, number 26th, where guest speakers from Deloitte will participate. In October, the markets will already be in a critical situation in terms of gas supply. This situation will be analysed during the webinar, in addition to the outlook for the entire winter.

For those who could not participate live, the recording of the latest edition of the monthly webinars held on July 14 with the participation of guest speakers from H2B2, África Castro, Head of Business Development, and Anselmo Andrade, Integrated Product Director, can be requested here. On that occasion, the topic to be analysed regarding the vision of the future of energy in Europe was green hydrogen as a strategic vector in the energy transition. The participants showed how electrolyser projects for hydrogen production can be individually adapted to the particular characteristics of each purpose, whether to produce hydrogen with surpluses from a photovoltaic or wind energy power plant, or to produce hydrogen for the transportation or for industry using energy from the grid, either for seasonal energy storage. They also highlighted the need for aid and clear and stable regulation for the development of renewable hydrogen.