Hydrogen has the potential to help decarbonize many of the sectors and applications that depend on emissions-intensive fossil fuels, including fossil gas. Clean hydrogen[i] projects are therefore increasingly talked about and also piloted in several countries to support their decarbonization goals.

Hydrogen is expected to be an important piece of the clean technology toolkit as it has the potential to help decarbonize the hardest-to-abate uses such as heavy industry (e.g., iron and steel, chemicals), long-haul aviation, and maritime shipping. Globally, the iron and steel sector accounted for approximately 5%, chemicals for 4%, aviation for 2%, and maritime shipping for 2% of net global greenhouse gas emissions. These emissions will need to be cut significantly if the world is to meet its net-zero emissions ambitions by mid-century.

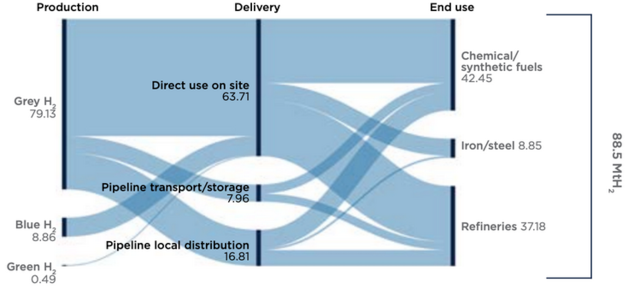

According to the International Energy Agency’s (IEA) Global Hydrogen Review, in 2020 hydrogen demand stood at around 90 million tonnes (Mt) (see image below) this includes about 18.6 Mt as a by-product in refineries. Hydrogen was produced mainly from fossil fuels, resulting in about 900Mt of CO2 emissions, almost as large as Japan’s carbon emissions in 2020. Green hydrogen (produced via electrolysis of water using 100% renewable electricity) accounted for a mere 0.1% of global hydrogen production.

Recently, there has been significant interest from industry, policymakers, and energy-transition analysts to explore the potential role of clean hydrogen as an alternative to fossil fuels, as it could reduce emissions from energy-intensive sectors. Some of the largest energy-consuming countries have waded with vigor into the hydrogen production and end-use dialogue. With so much interest in this emerging technology, countries planning to ramp up hydrogen deployment must ensure investments are efficient, well-regulated, and meaningfully advance climate goals.

Hydrogen production and use must be well regulated

Hydrogen is currently seeing significant political and business interest, with the number of policies and projects expanding rapidly. According to the IEA, in late 2021 the announced hydrogen electrolyser -project pipeline reached over 260 GW globally. However, as enabling measures required for hydrogen projects are evolving, few projects have reached a final investment decision (FID).

As clean hydrogen production and use ramp up, it will be vital for policymakers and the private sector to ensure that all hydrogen deployment supports stated climate goals cost-effectively, protects communities’ health and that all known risks are effectively addressed. For example, hydrogen infrastructure, just like fossil gas infrastructure, can be prone to leakage. This infrastructure could include compressors, liquefiers, storage tanks, geologic storage facilities, pipelines, trucks, trains, ships, and fueling stations. It’s therefore vital that, as hydrogen is increasingly used in new applications, rigorous national and global safety standards are implemented to minimize the occurrence of accidents and emissions leakage.

Recent scientific research shows that hydrogen could have a higher warming impact than previously estimated. The Environmental Defense Fund estimates that hydrogen emissions could have up to 60 times more warming impact than an equal amount of CO2 over a 10-year period. It is therefore critical that policymakers and regulators address potential hydrogen leakage with urgency and develop and adopt solutions and practices that rigorously measure and minimize any leaks across its value chain. An early area to tackle is the up-and-coming conversation on hydrogen blending in existing fossil gas infrastructure, which is prone to significant leakage.

Hydrogen blending in existing fossil gas infrastructure is a risky and inefficient venture

Currently, fossil gas utilities are promoting hydrogen as a technology that will support their existing business models while meeting regulatory and policy goals to cut emissions. However, the proposals for injecting and blending hydrogen into existing gas pipelines are not without risks.

For starters, blending hydrogen in gas pipelines raises safety concerns. The California Public Utilities Commission (CPUC) recently released a study on hydrogen blending as part of its plans to consider renewable hydrogen as a component in California’s decarbonization strategy. The CPUC study concludes that blending hydrogen at shares over as little as 5% in existing fossil gas pipelines begins posing safety risks, including increased chances of leaks and degrading of steel pipelines.

An analysis published by the Fraunhofer Institute in early 2022 suggests similar warning signs around the prospect of blending hydrogen into fossil gas distribution systems across Europe. They find that hydrogen blending is an inefficient use of limited European green hydrogen resources. In fact, hydrogen delivers three times less energy relative to fossil gas. This means that a higher hydrogen-fossil gas mix is needed to deliver the same amount of energy to the end consumer, which significantly dilutes the emissions reductions of using hydrogen. The study suggests that a far more cost-effective strategy to achieve emissions reductions is instead to directly use green hydrogen in sectors that cannot be easily electrified, for example, steel and chemical feedstocks.

Globally, countries are moving ahead with announcing national policies and support mechanisms for the burgeoning hydrogen sector. We highlight some important examples in the table below.

| Table: Hydrogen Support Policies Across Key Country/Region | |

| United States | The U.S. produces about 10 Mt of hydrogen annually. Most of this hydrogen is produced from fossil gas (grey hydrogen). Grey hydrogen is largely produced through the steam methane reforming process and electrolysis-based production facilities for green hydrogen are growing slowly. The 2021 Infrastructure Investment and Jobs Act authorized the U.S. Department of Energy (DOE) to spend $8 billion on the development of regional ‘hydrogen hubs’ to stimulate a national hydrogen economy. In 2021, the DOE also launched the ‘Hydrogen Shot’ looking to reduce the cost of clean hydrogen by 80% to $1 per 1 kilogram in 1 decade. Recently the Department of Energy approved a $504 Mn loan guarantee for the Utah-based Advanced Clean Energy Storage project. The project is currently the single largest green hydrogen storage hub planned globally. The project plans to capture excess renewable energy and store it as hydrogen, then deploy it as fuel for the Intermountain Power Agency’s project — a hydrogen-capable gas turbine combined cycle power plant that aims to incrementally be fueled by 100% clean hydrogen by 2045. |

| Europe | Hydrogen currently accounts for about 2% of Europe’s energy consumption and is primarily used to produce chemical products, such as plastics and fertilizers. Almost all (96%) of this hydrogen production is from fossil gas. In 2020, as part of the European Green Deal, the EU published its 2050 vision document on how to decarbonize different sectors over time. The vision document was revised and updated under the ‘Fit for 55 package’ in 2021 to set a 40-GW electrolyser capacity target by 2030, producing 10 Mt of renewable hydrogen annually. In response to the Russia-Ukraine crisis, the EU published the REPowerEU plan in May 2022. Under this plan, it called for a ‘Hydrogen Accelerator’. The regional goal was revised upwards to produce 10 Mt and import 10 Mt of renewable hydrogen in the EU by 2030. Further, an Electrolyser Partnership was launched to support the commitment by the EU industry to increase its hydrogen electrolyser manufacturing capacity ten-fold by 2025. In July 2022, the EU green-lighted the “IPCEI Hy2Tech” scheme to support research, innovation, and industrial deployment in the hydrogen technology value chain. Hy2Tech is expected to help unlock around $9 billion in private investments and lead to 41 projects across 15 member states. In addition, multiple industry players are setting up projects to set the course for a more climate-friendly hydrogen-based energy supply in the short to medium term. |

| Asia-Pacific | Currently, China is the world’s largest hydrogen producer. In March 2022, China released its long-term plan for hydrogen, covering the period of 2021–2035. The China Hydrogen Alliance projects China’s hydrogen demand to reach 35 million tons by 2030, representing at least five percent of the country’s energy supply, before increasing to 60 million tons to make up 10 percent of the energy supply by 2050. Japan aims to become the first hydrogen economy globally, and has recognized hydrogen as a major tool for decarbonizing its economy while sustaining its industrial competitiveness. In March 2019, Japan released its 3rd Strategic Roadmap for Hydrogen and Fuel Cells. Japan is looking to fund projects to establish a large-scale hydrogen supply chain ($2.7 billion allocated) and has allocated $700 million to green hydrogen production. It has also signed long-term agreements to import hydrogen from Australia. Australia announced its National Hydrogen Strategy in 2019 intending to become a “major player” in global hydrogen production and trade by 2030. The detailed State of Hydrogen report published in 2021 laid out the government’s range of support policies for hydrogen exports. Australia is assessing large Asian markets as the focus for its hydrogen exports. In June 2022, South Korea’s government passed the revised “Hydrogen Law”. By 2035, the country aims to blend a fuel mix of 30% hydrogen at all its gas-fired power plants, and 20% ammonia at more than half of its coal power stations as early as 2030. In February 2022, India unveiled its ‘Green Hydrogen Policy’ roadmap, offering incentives for investors to produce the fuel at low costs and help the national shift away from its reliance on fossil fuels. According to the India Hydrogen Alliance, several public and private sector actors are working toward creating a domestic supply chain to reach an installed electrolyser capacity of 25 GW producing 5 Mt of green hydrogen by 2030. |

Hydrogen production and use must not further entrench global fossil fuel use. Hydrogen’s decarbonization pathway from the current minuscule 0.1% of green hydrogen share to a 100% non-fossil-based hydrogen value chain needs a long-term strategy and policy guidance. Governments and industries must begin this shift now.

Overall green hydrogen can play a key role in decarbonizing hard-to-abate sectors, including fertilizer, maritime shipping, and steel. An evidence-based deployment of green hydrogen could deliver real climate benefits and reduce dependence on fossil fuels. However, it will be vital for policymakers and the private sector to:

- Target hydrogen deployment in applications that may not have other viable solutions—notably, hard-to-electrify applications; and

- Adopt the strictest standards and principles relating to hydrogen deployment and investments in infrastructure to avoid hydrogen becoming a significant climate and public health risk.

[i] Clean hydrogen: The 2021 U.S. Infrastructure Investment and Jobs Act Act defines ‘clean hydrogen’ as hydrogen produced with a carbon intensity equal to or less than 2 kilograms of CO2-equivalent produced at the site of production per kilogram of hydrogen produced (kg-CO2/kg-H2). It is often used as a catch-all term that ropes in a range of technologies that could enable emissions reductions.

Shruti Shukla

International Energy Advocate, International Program

Ade Samuel

LNG Policy Analyst, International Program