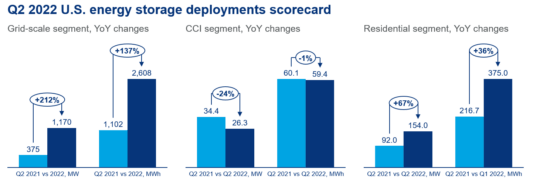

The U.S. energy storage market set a new record in the second quarter of 2022, with grid-scale installations totaling 2,608 megawatt hours (MWh) – the highest installed capacity for any Q2 on record, according to a new report released today.

According to Wood Mackenzie, a Verisk business (Nasdaq: VSK), and the American Clean Power Association’s (ACP) latest U.S. Energy Storage Monitor report released today, grid-scale storage was boosted by a series of deployments in Texas, with the state contributing 60% of installed capacity this quarter. However, challenges to the sector remain due to delays.

“Despite impressive growth, the U.S. grid-scale energy storage pipeline continues to face rolling delays into 2023 and beyond. More than 1.1 gigawatts (GW) of projects originally scheduled to come online in Q2 were delayed or cancelled, although 61% of this capacity, 709 megawatts (MW), is still scheduled to come online in Q3 and Q4 of 2022,” said Vanessa Witte, senior analyst with Wood Mackenzie’s energy storage team.

“Supply chain issues, transportation delays and interconnection queue challenges were the main drivers behind delays in the commercial operations date (COD) for many projects,” Witte added.

Given the prevalence of hybrid deployment between storage and solar, ongoing trade issues negatively impacting the solar industry contributed to headwinds for energy storage deployment. Namely, the current enforcement of the Uyghur Forced Labor Prevention Act (UFLPA), recently enacted by U.S. Customs and Border Protection (CBP).

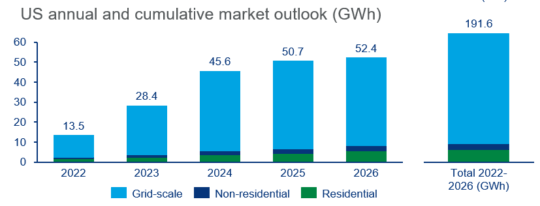

The U.S. Congress passed a solar investment tax credit (ITC) extension and standalone storage ITC as part of the Inflation Reduction Act. This critical piece of legislation will support all segments of the energy storage industry, increasing deployment of solar-plus-storage systems while also incentivizing standalone facilities. As a result, Wood Mackenzie forecasts 59.2 GW of energy storage capacity to be added through 2026.

“The U.S. energy storage industry is reaching maturity,” said Jason Burwen, Vice President of Energy Storage at ACP. “Energy storage is now regularly being installed at over a gigawatt per quarter. In addition, Texas overtaking California this quarter should serve as a reminder that generators, customers, and grid operators in all geographies are increasingly relying on energy storage. Combined with the tailwinds of newly available tax credits from the Inflation Reduction Act, the question for investors and grid operators now is not whether to deploy storage, but how much storage to deploy – and how fast.”

Residential storage also had its strongest quarter to date with 375 MWh installed in Q2, beating the previous quarterly record of 334.1 MWh in Q1 2022.

Demand is rising in the residential segment with over 150 MW of residential storage installed for the first time, but ongoing supply shortfalls and rising prices have suppressed deployment. New solar installers continue to add storage to their product offerings, despite ongoing procurement issues.

“The solar ITC extension is good news for the residential storage industry, preventing a drop in residential solar-plus-storage installations that would have otherwise arrived in 2024. The standalone storage ITC will also boost storage retrofits on homes with existing solar,” said Chloe Holden, research analyst at Wood Mackenzie, and one of the authors of the report.

Community, commercial and industrial (CCI) storage continues to lag behind other market segments, with only 59.4 MWh of CCI storage installations seen this quarter, making it the lowest quarter recorded for MWh capacity since 2019.

“Market players look forward to the emergence of a more diverse market, but current deployment remains limited to a few policy leaders in California, New York and Massachusetts,” Holden added.

[Source: Wood Mackenzie]

[Source: Wood Mackenzie]