In the third quarter of 2022, the solar energy production increased in all analysed European markets compared to the same quarter of 2021. The largest increase, of 42%, was reached in the markets of France and Portugal. The increase in installed photovoltaic capacity in this period reached 28% in Spain and 46% in Portugal. In the case of the wind energy production, the highest year?on?year increase, of 15%, was registered in the Spanish market.

Solar photovoltaic and thermoelectric energy production and wind energy production

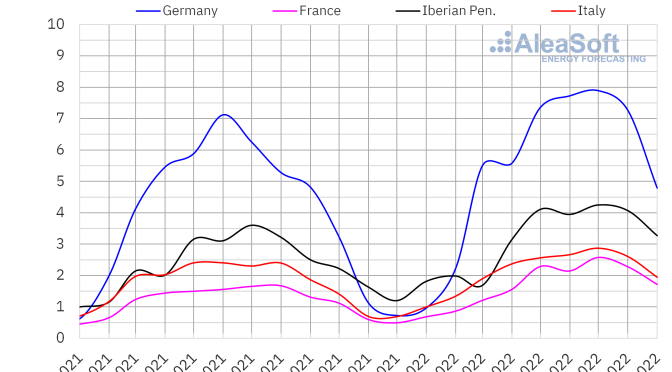

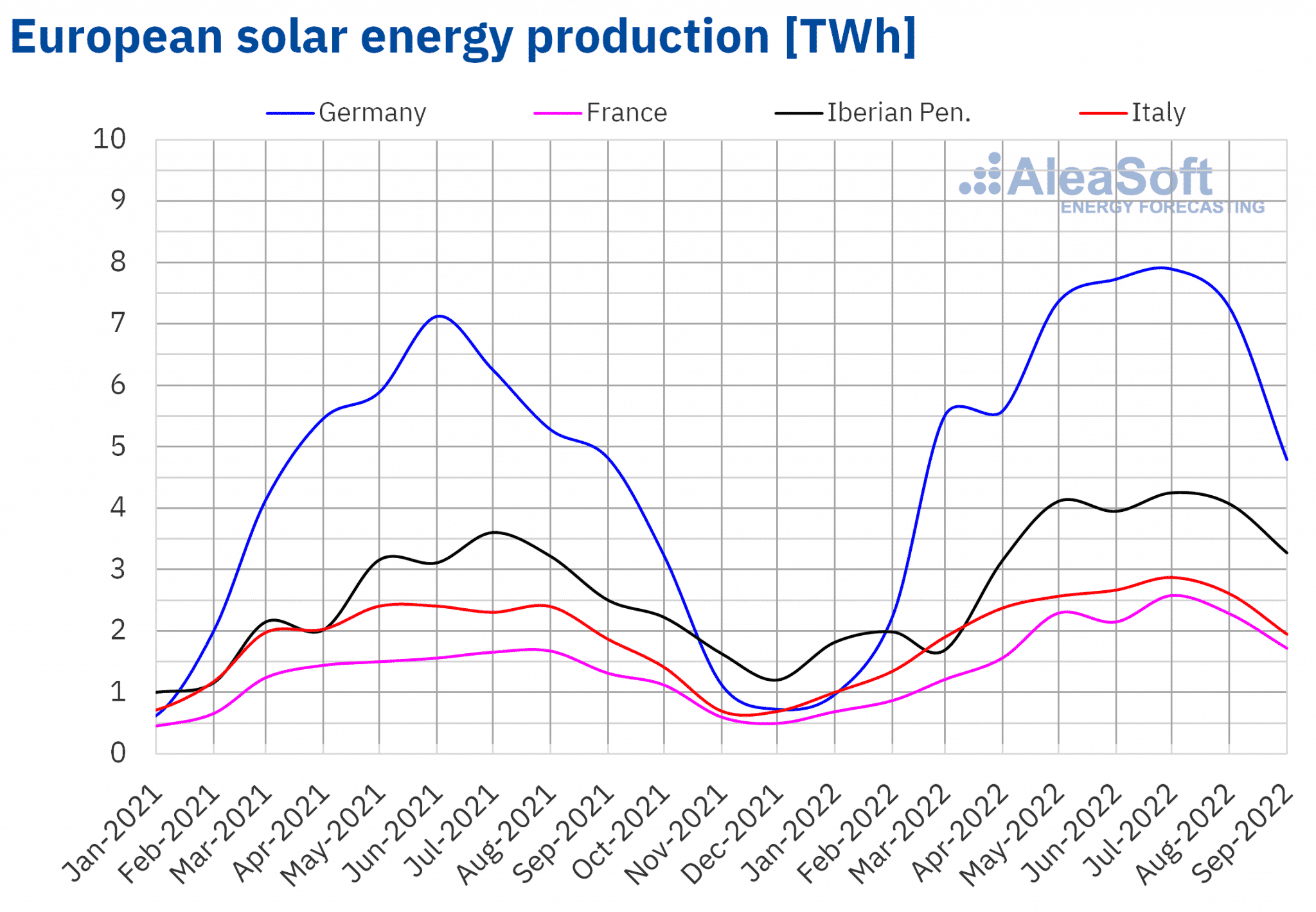

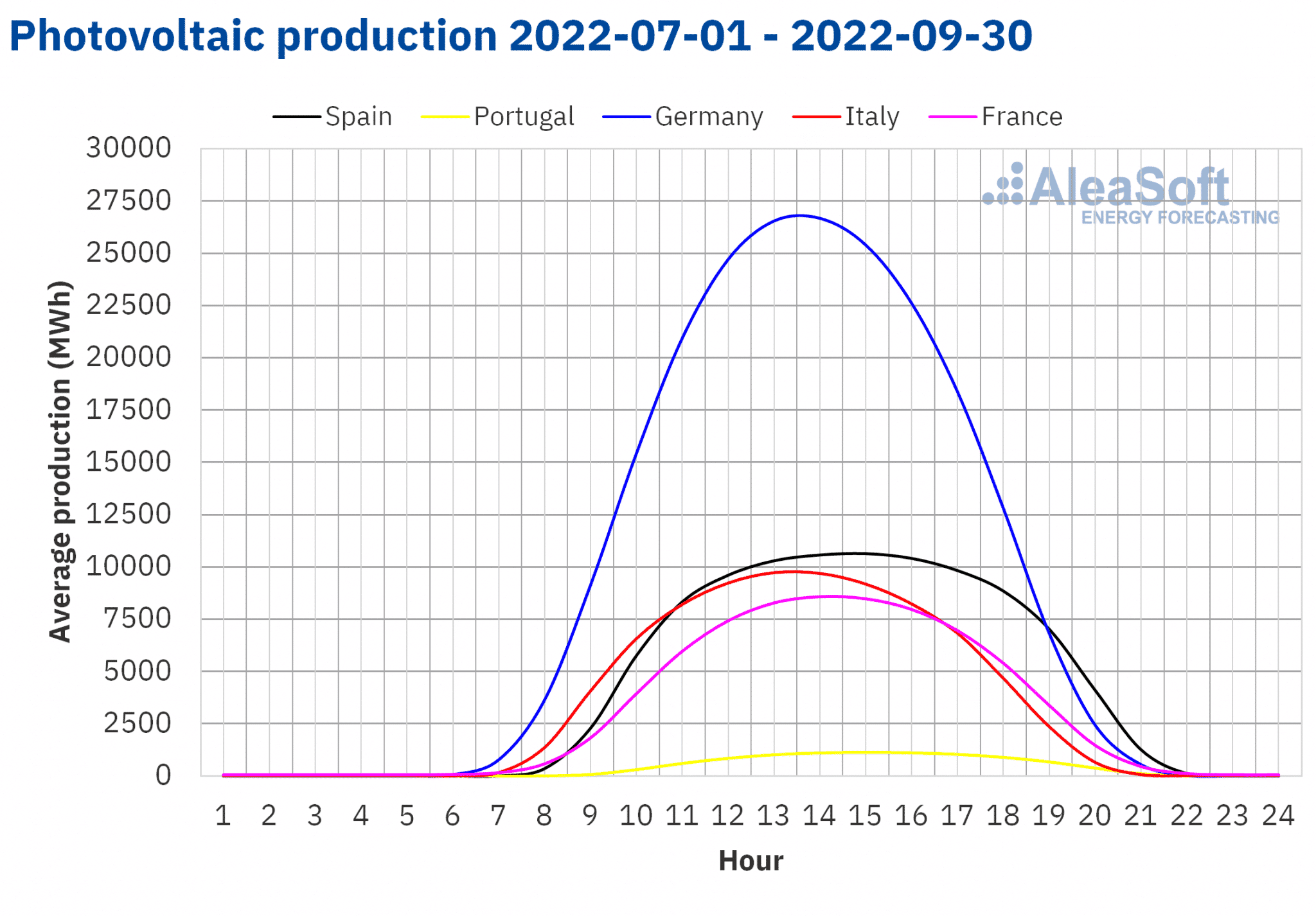

The solar energy production increased in a generalised way in the third quarter of 2022 in the European electricity markets analysed at AleaSoft Energy Forecasting compared to the third quarter of 2021. The increases were between 13% of the Italian market and 42% of the French and Portuguese markets. This year?on?year growth in solar energy production was determined by the increase in the installed capacity of this technology. The installed solar photovoltaic capacity in Mainland Spain increased by 28% compared to that installed at the end of the third quarter of 2021. In the case of Portugal, the year?on?year increase in installed solar capacity was 46%.

But, in the comparison with the second quarter of 2022, increases were only registered in the French and Portuguese markets, of 6.2% and 4.9% respectively. In the rest of analysed markets, the solar energy production fell between 1.5% of the Spanish market and 6.5% of the German market. During the third quarter of 2022, the solar photovoltaic capacity in Mainland Spain increased by 790 MW, 4.8%, to 17 306 MW, while the solar thermoelectric capacity remained unchanged. In the case of Portugal, the solar capacity increased by 109 MW, 7.1%, to a total of 1655 MW.

On the other hand, in the month of July 2022, historical maximums of solar energy production were reached in all analysed markets. The highest production was registered in the German market, where a record figure of 7896 GWh was reached.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

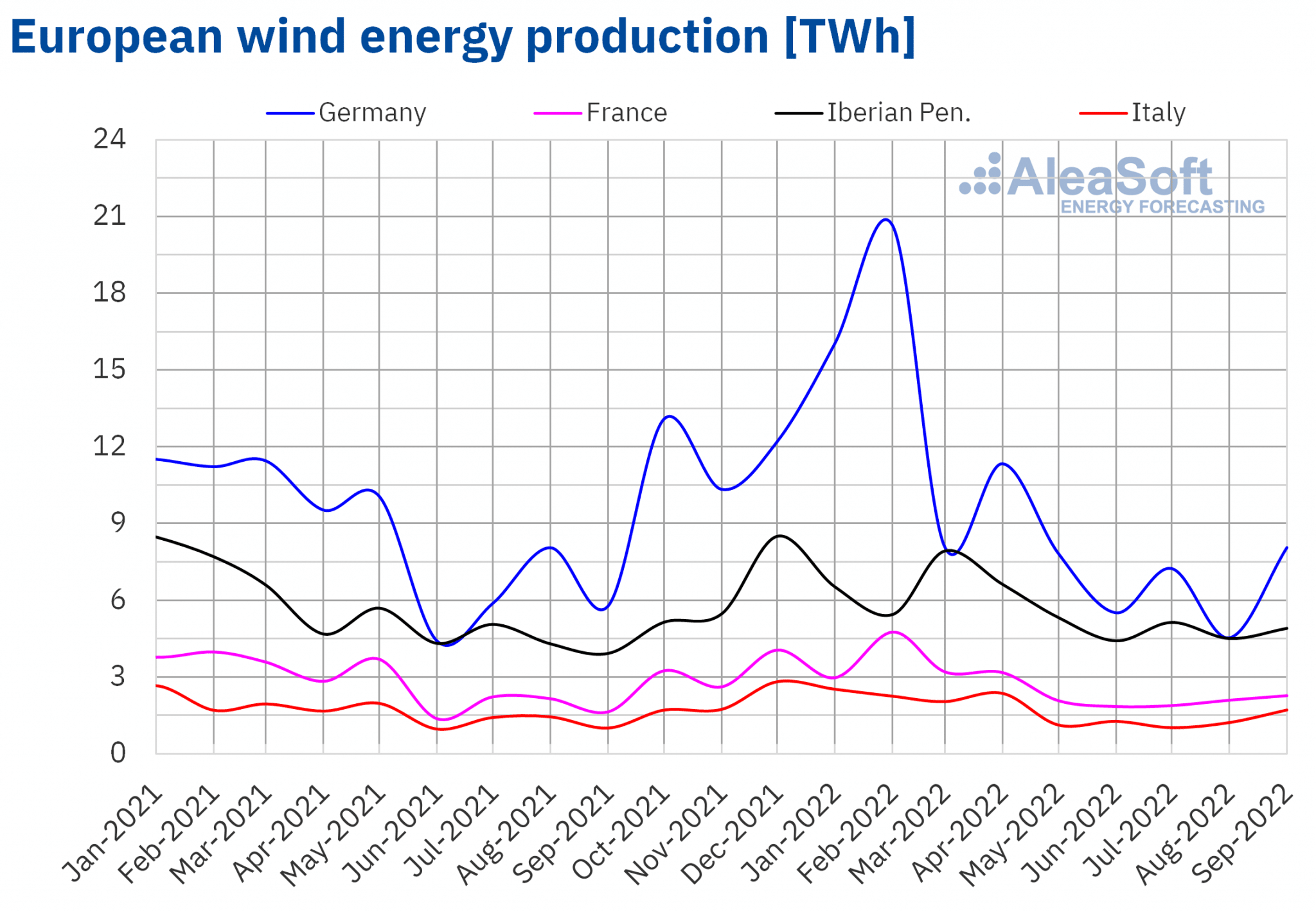

In the case of the wind energy production, in the third quarter of 2022 there was a year?on?year decrease of 3.8% in the Portuguese market. In the rest of markets, the production with this technology was higher than that of the third quarter of 2021, with increases that were between 0.7% of Germany and 15% of Spain.

If the wind energy production of the third quarter of this year is compared with that of the previous quarter, it decreased in all analysed markets, following the seasonal evolution of the wind resource. The largest decrease was registered in the German market and it was 22%, while the smallest was that of the Spanish market, of 12%.

According to REE data, in the months of July, August and September 2022 as a whole, the installed wind capacity in Mainland Spain did not increase, remaining at 28 946 MW. In Portugal, according to data from the operator REN, the installed capacity of this technology did not change either in the third quarter of the year, remaining at 5389 MW.

On the other hand, with respect to the installed capacity at the end of the third quarter of 2021, increases were registered in both Spain and Portugal. In Spain the increase was 5.1%, while in Portugal it was 2.8%.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the renewable energy projects financing

At the beginning of the fourth quarter of 2022, at AleaSoft Energy Forecasting and AleaGreen, the long?term price curve forecasting reports for all European electricity markets will be updated. One of the distinctive features of these reports is the hourly forecasting for the entire forecast horizon, which spans up to 30 years, something that is essential for portfolio valuation and audits. A personalised special promotion of these reports is currently being offered for some European markets.