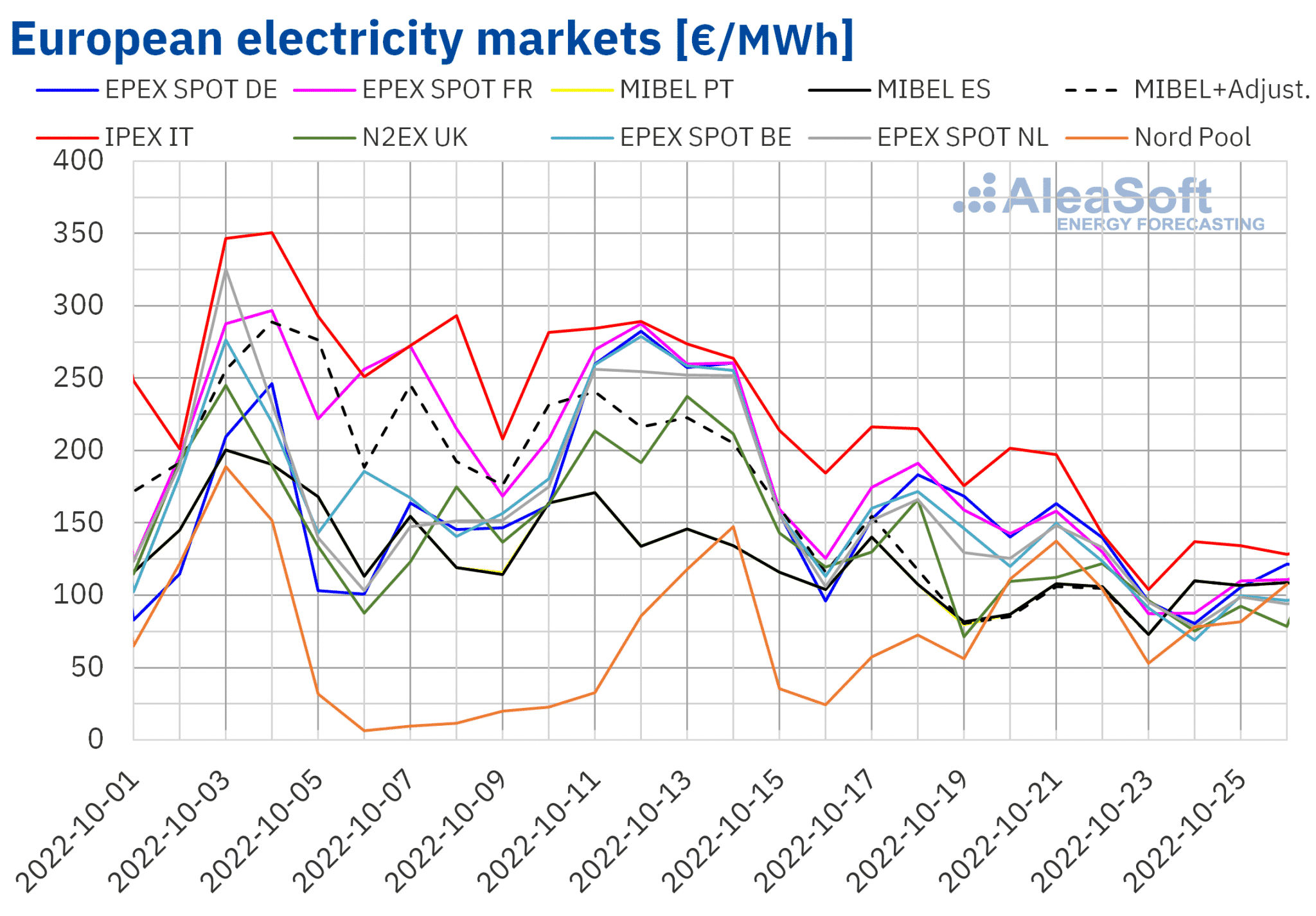

In the week of October 17, European electricity markets prices decreased compared to the previous week, except in the case of the Nord Pool market. This trend continued in the first days of the fourth week of October. The drop in gas prices and the increase in wind energy production favoured this drop in prices. As a consequence, in the considered period, the lowest daily prices in recent months were registered in some markets.

European electricity markets

In the week of October 17, prices of almost all European electricity markets analysed at AleaSoft Energy Forecasting fell compared to the previous week. However, prices increased in the Nord Pool market of the Nordic countries by 27%. On the other hand, the largest decrease in prices was that of the N2EX market of the United Kingdom, of 37%, while the smallest was that of the MIBEL market of Spain, of 27%.

In the third week of October, the highest average, of €178.87/MWh, was that of the IPEX market of Italy. On the other hand, the lowest weekly average was that of the Nordic market, of €84.59/MWh. In the rest of the markets, prices were between €100.11/MWh of the Portuguese market and €149.07/MWh of the EPEX SPOT market of Germany.

On the other hand, the average of the first three days of the fourth week of October was lower than the average of the same period of the third week of the month in almost all analysed European electricity markets. The exception was the Nordic market, with an increase of 44%. On the other hand, the largest fall in prices was that of the Belgian market, of 45%, while the smallest decreases were those of the Portuguese and Spanish markets, of 0.8% and 1.3% respectively. In the rest of the markets, the decreases were between 33% of the British market and 41% of the French market.

As a result, in the period from October 24 to 26, the lowest average price was that of the N2EX market, of €82.07/MWh. The averages of the Belgian, Dutch and Nordic markets were also below €100/MWh. Instead, the highest average, of €133.19/MWh, was that of the Italian market, followed by the price of the MIBEL market, of €108.35/MWh.

Regarding the hourly prices, on October 24, between 3:00 and 4:00, a price of €29.85/MWh was reached in the French market, the lowest in that market since mid May. In the case of Italy, on Sunday, October 23, from 13:00 to 14:00, the lowest price since April 18, of €71.10/MWh, was registered. That day, in the Spanish and Portuguese markets, from 15:00 to 17:00, the price was €4.11/MWh, the lowest since September 25.

In the case of daily prices, in the period from October 17 to 26, minimum prices were reached in all markets except in the Nordic one. In the British market, on October 19, the price was £62.07/MWh, the lowest since the first half of June. In the Spanish and Portuguese markets, a price of €72.84/MWh was registered on October 23, the lowest since August 7, 2021, if the historical series of electricity market prices including the adjustment due to the limitation of gas prices of the Iberian exception is taken into account. That day, in the French market, the price was €87.37/MWh, the lowest since January 2 of this year. In Italy, the price was €103.85/MWh, the lowest since the end of August 2021. In contrast, in the German, Belgian and Dutch markets, the minimum prices for the considered period were reached on October 24. In the case of the German market, the price was €80.62/MWh, the lowest since September 18. In Belgium, the lowest daily price since the first half of June, of €69.09/MWh, was registered. In the case of the Dutch market, the price of October 24, of €77.91/MWh, was the lowest since May 28.

During the week of October 17, the 38% drop in the weekly average price of TTF gas compared to the previous week exerted its downward influence on European electricity markets prices. The general increase in wind energy production also contributed to the registered price decreases. However, at the beginning of the fourth week of October, the wind energy production was lower on average than that of the previous week in the Iberian Peninsula, which contributed to the fact that the MIBEL market prices were among the highest in Europe again, even though the Iberian exception has not been applied since October 20 because gas prices in the MIBGAS market are below the reference price of €40/MWh established in the mechanism for the month of October.

The AleaSoft Energy Forecasting’s price forecasting indicates that in the whole of the fourth week of October, prices might decrease in most European electricity markets, influenced by increases in wind energy production in countries such as France and Germany. However, prices might recover in markets such as the Spanish and the Portuguese, where the weekly wind energy production is expected to decrease.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the renewable energy projects financing

Last October 20, the 26th edition of the monthly webinars of AleaSoft Energy Forecasting and AleaGreen was held, with the participation of guest speakers from Deloitte. The webinar analysed the evolution of the energy markets in recent weeks and the prospects for the coming months, especially in winter, a period that can be complicated if there are new cuts in gas supply by Russia and there are episodes of cold snaps. In addition, the current situation of the renewable energy projects financing was analysed. At this point, one of the analysed issues was whether the cap of €180/MWh proposed by the European Union on the remuneration of inframarginal energies can affect the PPA market. Likewise, the webinar highlighted the importance of having hourly price forecasts for the accounting of renewable energy projects, in which a high level of detail is needed.