European electricity markets start February downwards helped by demand, renewable energy and gas.

In the first week of February, prices of most European electricity markets fell compared to the previous week, favoured by the decrease in demand in most markets, a lower weekly average price of gas, general increases in solar energy production and rises in wind energy production in most markets. On the other hand, on February 1, CO2 emission rights futures reached a settlement price of €95.45/t, the highest since August.

Solar photovoltaic and thermoelectric energy production and wind energy production

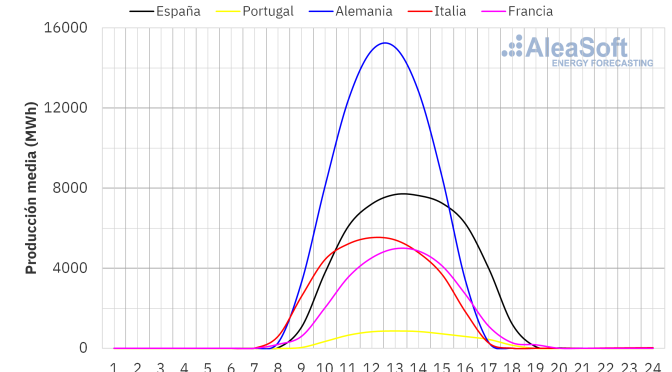

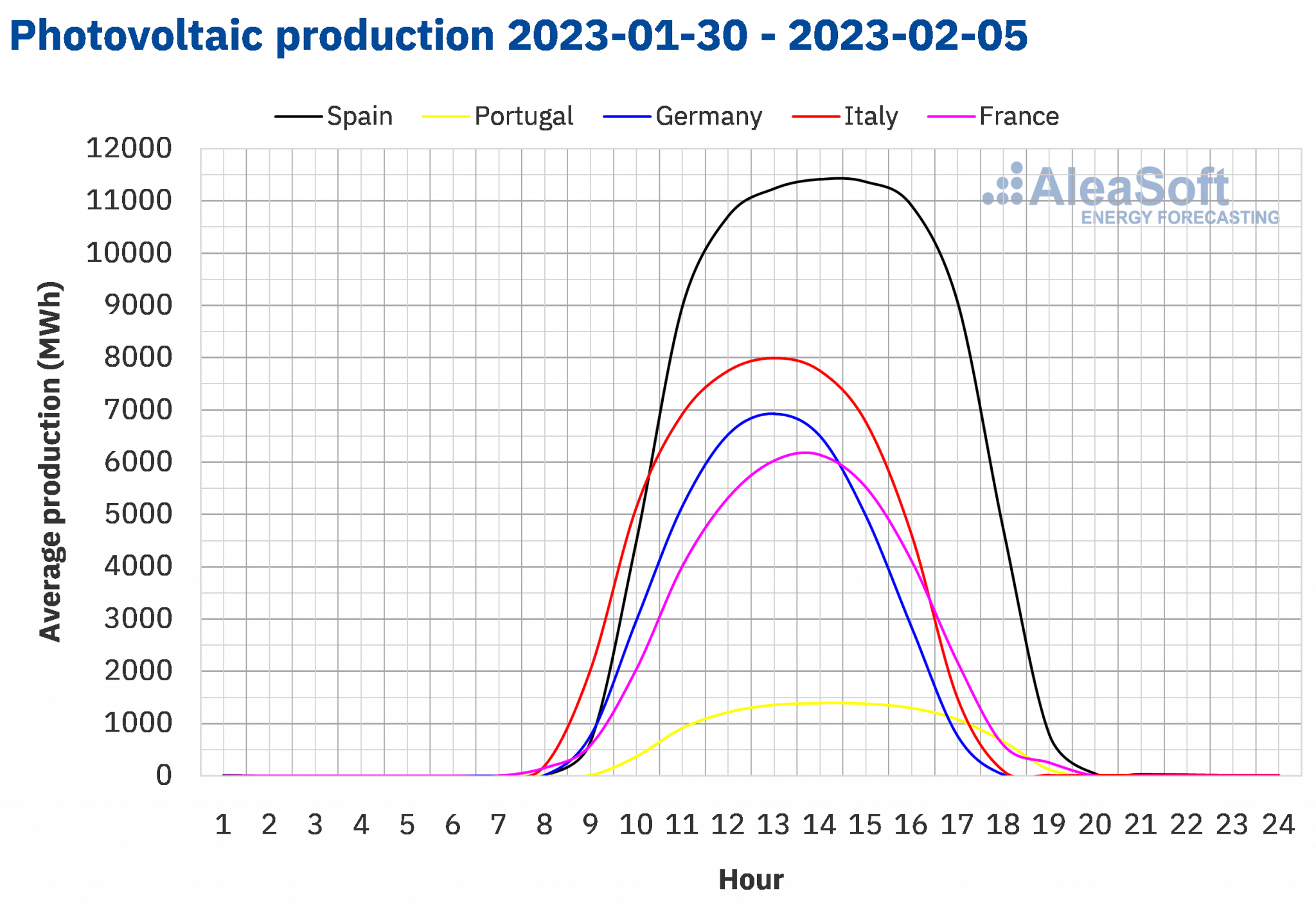

During the first week of February, the solar energy production increased compared to the previous week in all European markets analysed at AleaSoft Energy Forecasting. The largest rise was that of the German market, of 118%. In the Italian, French and Spanish markets, the increases were 54%, 52% and 43%, respectively. On the other hand, the smallest increase, of 12%, was registered in the Portuguese market.

For the second week of February, the AleaSoft Energy Forecasting’s solar energy production forecasting indicates that the production might continue to increase in Germany, while in the Spanish and Italian markets it might decrease.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

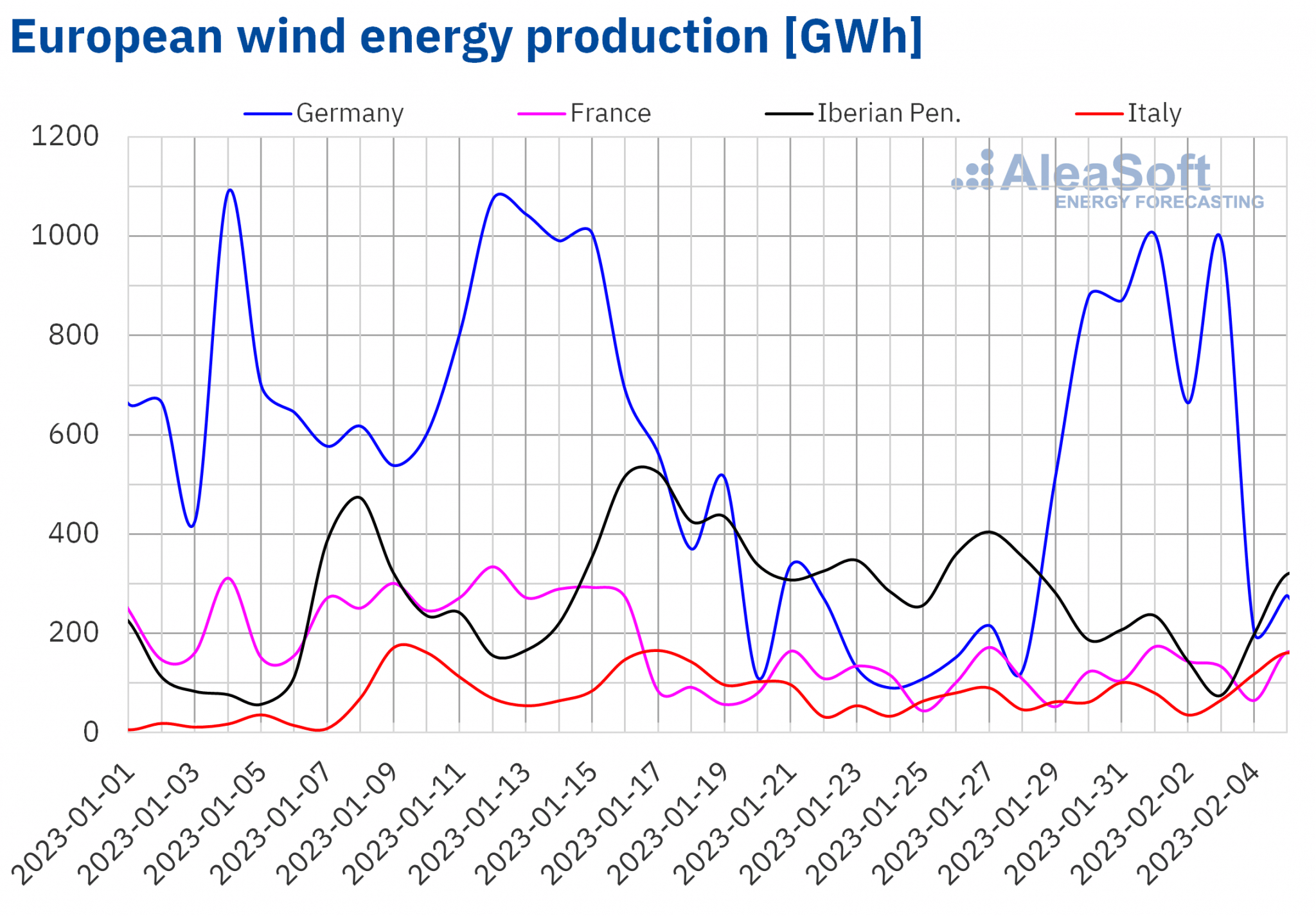

During the week of January 30, the wind energy production increased compared to the previous week in most markets analysed at AleaSoft Energy Forecasting. The largest rise, of 264%, was that of the German market. In the case of the Italian market, it grew by 44%, while in the French market it increased by 24%. However, the production with this technology decreased in the Iberian Peninsula, with decreases of 35% in Portugal and 41% in Spain.

For the week of February 6, the AleaSoft Energy Forecasting’s wind energy production forecasting indicates that the Iberian wind energy production might recover, but decreases might be registered in the German and French markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

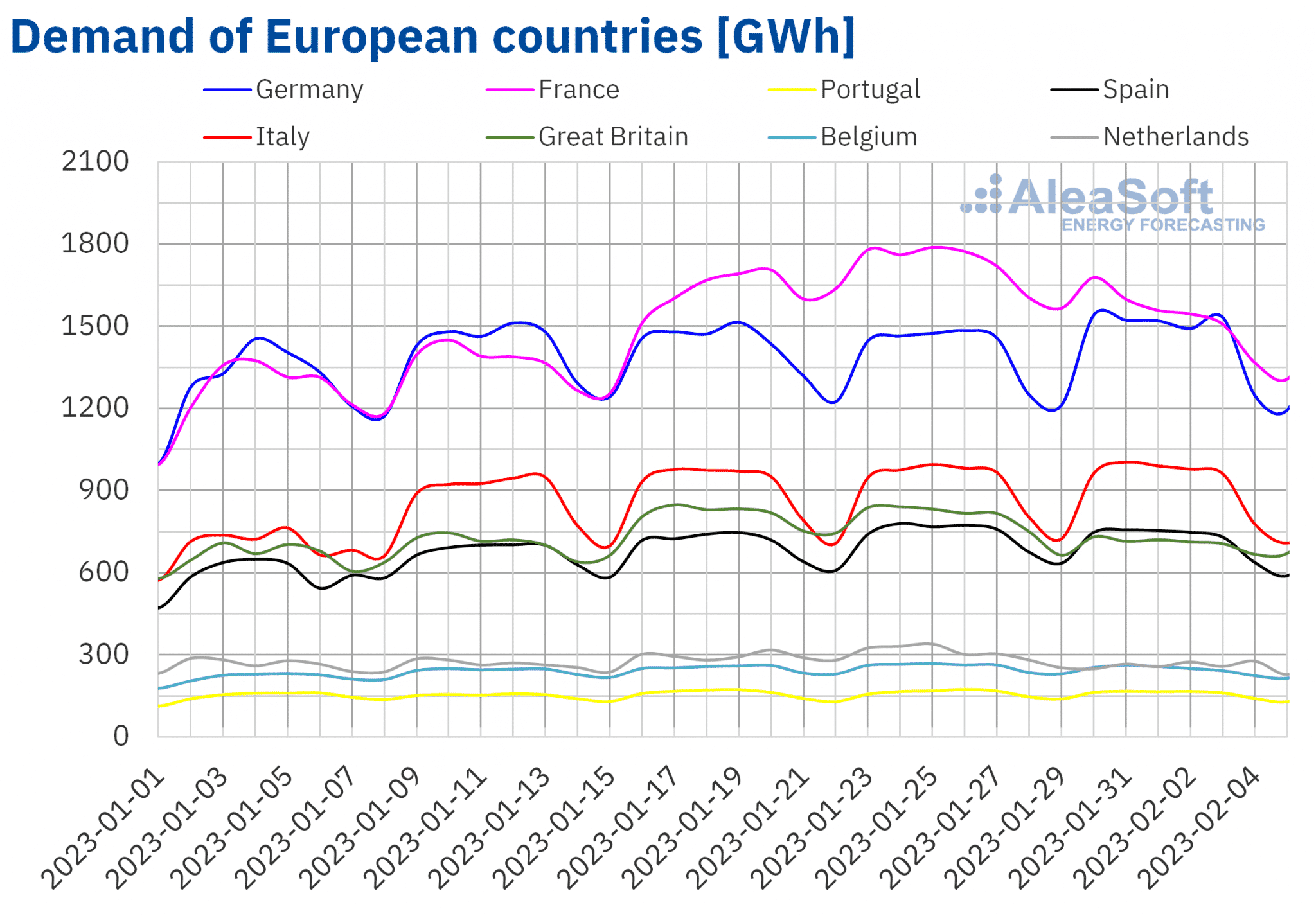

Electricity demand

In the week of January 30, the electricity demand decreased in almost all European markets analysed at AleaSoft Energy Forecasting compared to the previous week. The exception was the German market, with an increase of 2.6%. On the other hand, the largest decrease, of 15%, was registered in the Dutch market, followed by the falls of the French and British markets, of 12% and 11%, respectively. In the rest of the markets, the demand fell between 0.1% of the Italian market and 4.7% of the Belgian market.

In the first week of February, average temperatures increased compared to those registered during the previous week in all analysed European markets, contributing to the decrease in demand. Temperature increases exceeded 3.0 °C in most markets and reached 5.8 °C in the Belgian market.

For the week of February 6, according to the demand forecasting made by AleaSoft Energy Forecasting, increases are expected in most analysed European markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

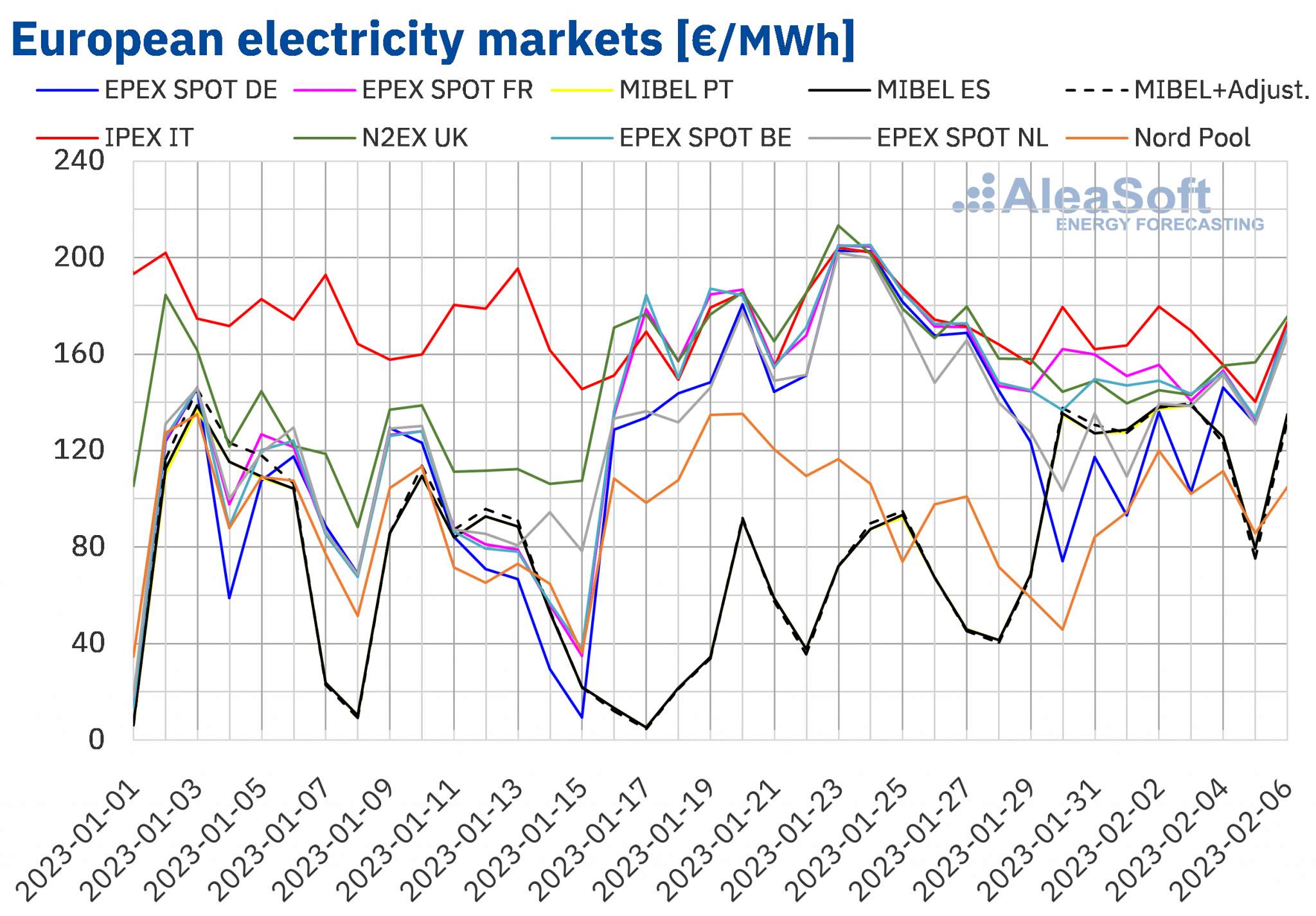

European electricity markets

In the week of January 30, prices of most European electricity markets analysed at AleaSoft Energy Forecasting fell compared to the previous week. The exceptions were the MIBEL market of Spain and Portugal and the Nord Pool market of the Nordic countries, with rises of 84%, 83% and 2.8%, respectively. On the other hand, the largest drop in prices, of 33%, was that of the EPEX SPOT market of Germany. In the rest of the markets, the decreases were between 8.6% of the IPEX market of Italy and 22% of the EPEX SPOT market of the Netherlands.

In the first week of February, the highest average price, of €164.31/MWh, was that of the Italian market, followed by the average of the French market, of €150.74/MWh. On the other hand, the lowest weekly average was that of the Nordic market, of €91.95/MWh. In the rest of the analysed markets, prices were between €114.39/MWh of the German market and €147.54/MWh of the N2EX market of the United Kingdom.

In the case of the Spanish market, the price was €124.72/MWh. Taking into account the adjustment that some consumers have to pay due to the gas price limitation in the Iberian market, in the first week of February, a slightly lower average was registered, of €124.50/MWh.

Regarding daily prices, on Friday, February 3, a price of €138.58/MWh was reached in the MIBEL market of Spain and Portugal. This price was the highest since the beginning of January in the Spanish market and since the first half of December 2022 in the Portuguese market. In the case of the Italian market, on February 5, a price of €140.31/MWh was reached, which was the lowest since November 2022 in this market.

During the week of January 30, the drop in demand in most markets and a lower weekly average gas price than the previous week led to a drop in prices in most European electricity markets. In addition, there were general increases in solar energy production and the wind energy production increased in most analysed markets. However, in the MIBEL market, where the wind energy production fell, significant price increases were registered.

The AleaSoft Energy Forecasting’s price forecasting indicates that in the second week of February prices might increase in a generalised way in the European electricity markets, influenced by the recovery in demand in most markets. In addition, the decrease in wind energy production in markets such as the German and French and the fall in solar energy production in the Spanish and Italian markets might also contribute to this behaviour.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

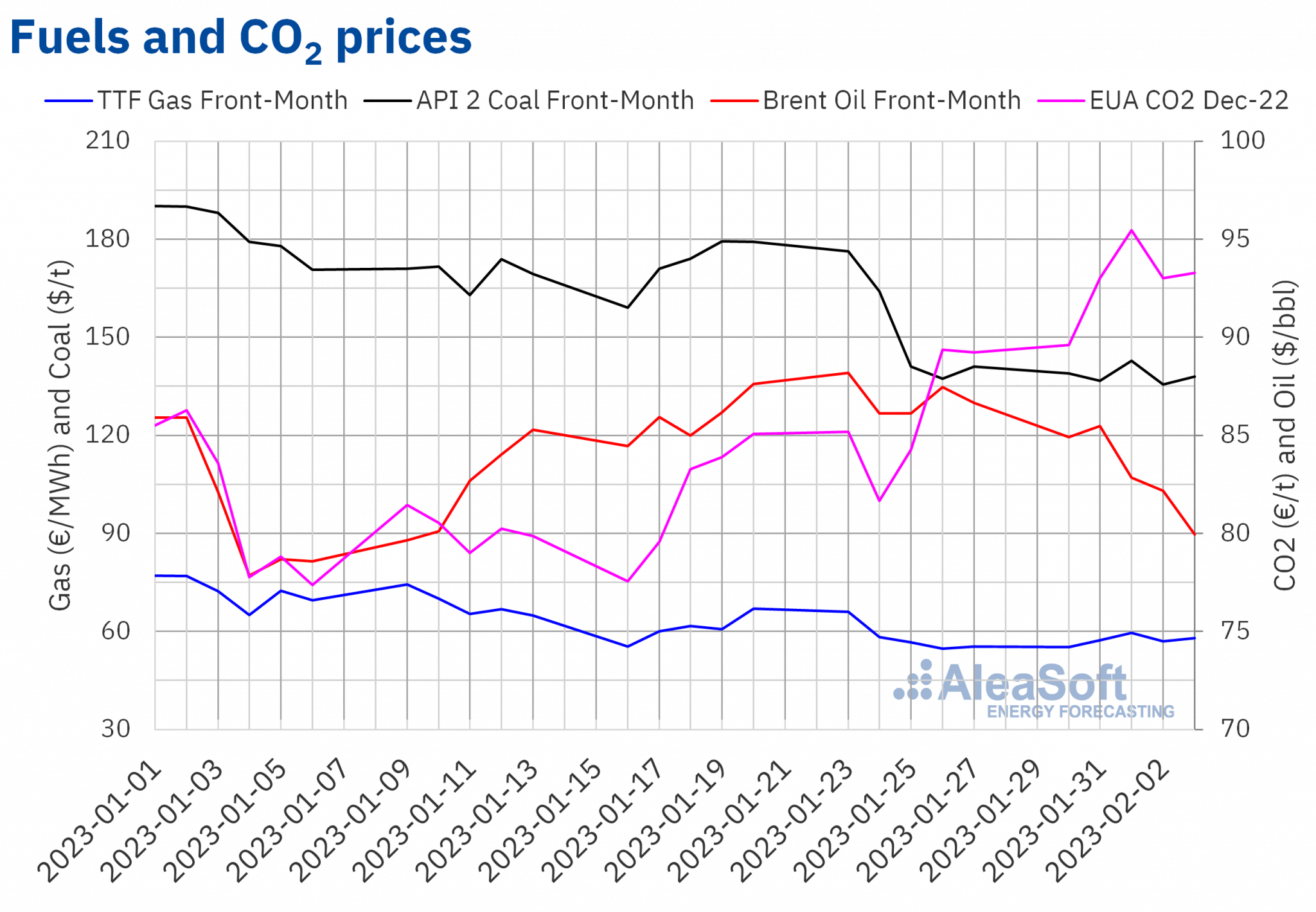

Brent, fuels and CO2

In the first week of February, Brent oil futures for the Front?Month in the ICE market registered lower settlement prices than those of the same days of the previous week. The weekly maximum settlement price, of $85.46/bbl, was reached on Tuesday, January 31, and was 0.8% lower than that of the previous Tuesday. On the other hand, the weekly minimum settlement price, of $79.94/bbl, was registered on Friday, February 3. This price was 7.8% lower than that of the previous Friday and the lowest since January 9.

In the first week of February, Brent oil futures prices continued to be influenced by concerns about the evolution of the economy. This favoured lower prices, despite expectations of a recovery in demand in China. On the other hand, on Wednesday, February 1, OPEC+ decided to keep the production quotas established for 2023 unchanged.

As for settlement prices of TTF gas futures in the ICE market for the Front?Month, during the first week of February, they remained below €60/MWh. On Monday, January 30, the weekly minimum settlement price, of €55.16/MWh, was registered. This price was 16% lower than that of the previous Monday. On Tuesday and Wednesday, prices increased until reaching the weekly maximum settlement price, of €59.53/MWh, on the first day of February. This price was 5.1% higher than that of the same day of the previous week. After falling on Thursday, on Friday, February 3, prices recovered, registering a settlement price of €57.89/MWh, 4.4% lower than that of the previous Friday.

Milder temperatures and the high levels of European reserves, as well as expectations of increases in liquefied natural gas supply from the United States, favoured TTF gas futures prices to be below €60/MWh during the first week of February.

Regarding settlement prices of CO2 emission rights futures in the EEX market for the reference contract of December 2023, they began the first week of February with increases and remained almost the entire week above €90/t. The weekly maximum settlement price, of €95.45/t, was reached on Wednesday, February 1. This price was 13% higher than that of the previous Wednesday. In addition, it was the highest since the prices registered in August 2022 for the reference contract of December of that year. On the other hand, on Thursday the price fell. But on Friday, February 3, the upward trend was recovered and a settlement price of €93.29/t was registered, 4.6% higher than that of the previous Friday.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe

The next webinar of the monthly webinars series of AleaSoft Energy Forecasting and AleaGreen will be held on Thursday, February 16. In this webinar, Alvaro Ruben Reyes Diaz, guest speaker from European Energy Exchange AG (EEX), will participate. In addition to the evolution and prospects of European energy markets, the webinar will analyse the importance of forward markets for the renewable energy development.

On the other hand, the webinar of March, entitled “Prospects for energy markets in Europe. Spring 2023”, will be held on the 16th. For the third consecutive year, guest speakers from EY will participate. The topics to be discussed on this occasion include the prospects for European energy markets for spring 2023, the main novelties in the regulation of the Spanish energy sector, the financing of renewable energy projects, the importance of PPA and self?consumption, as well as the main considerations to take into account in the portfolio valuation.