In the third week of February, prices of almost all European electricity markets fell compared to the previous week due to the decrease in demand and gas prices, as well as the increase in wind and solar energy production in some markets. On the other hand, TTF gas futures reached the lowest settlement price since August 2021 on February 17, while on February 16 CO2 futures reached the highest value since August 2022, higher than €97.50/t.

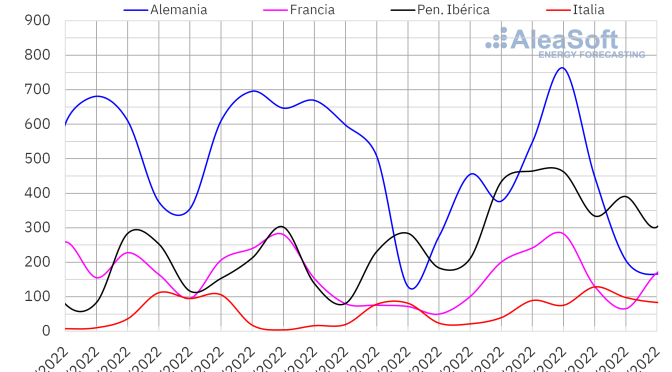

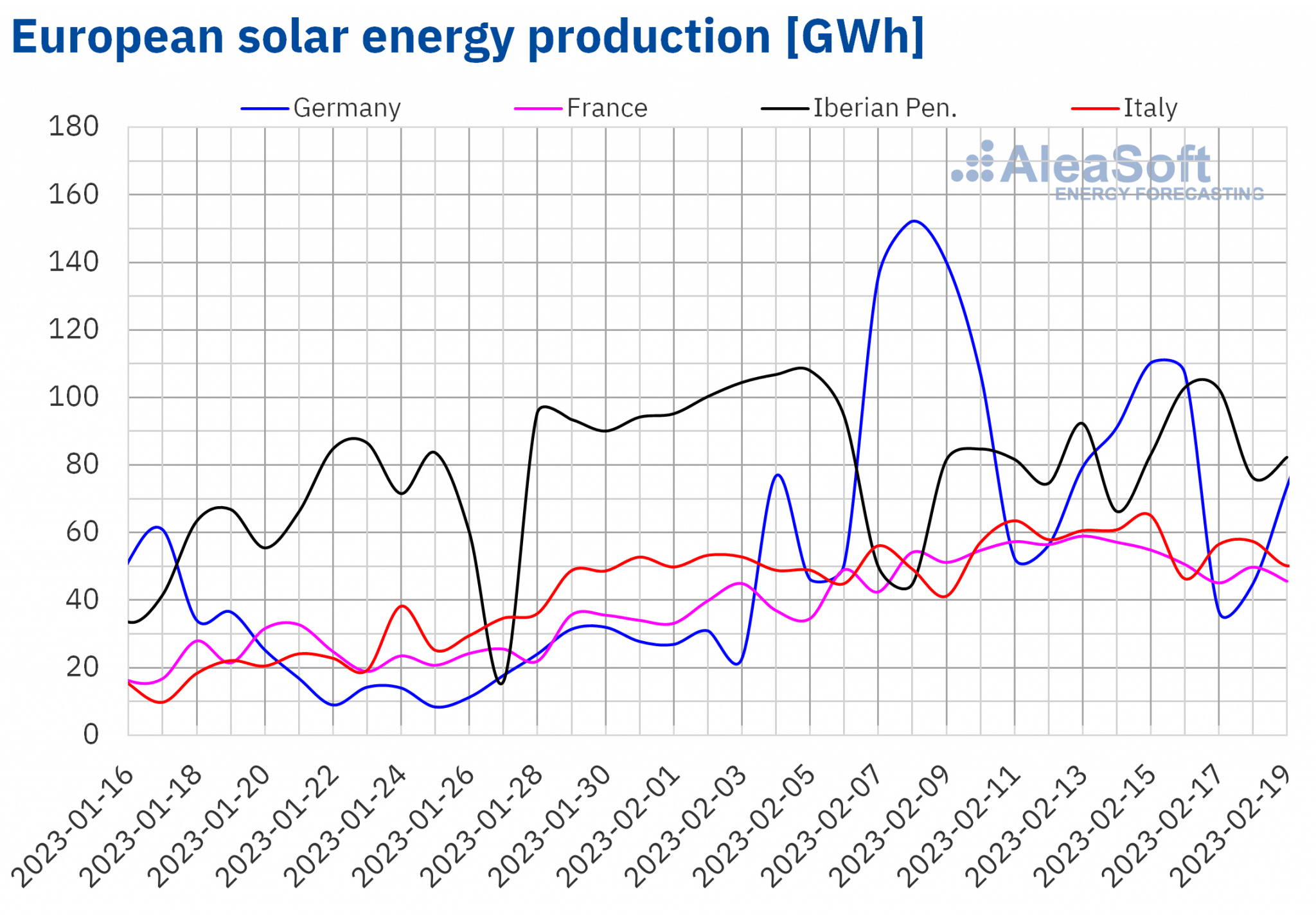

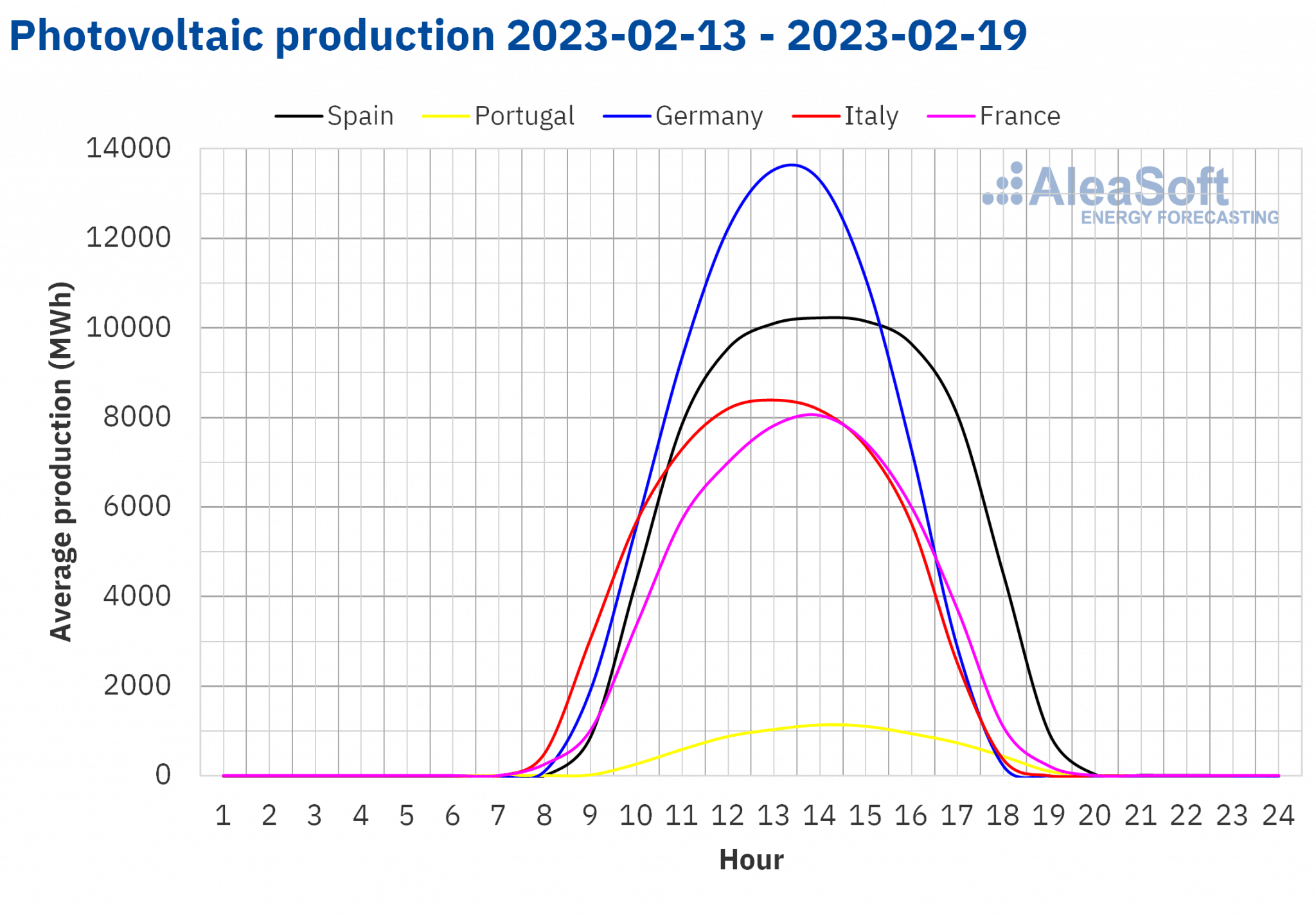

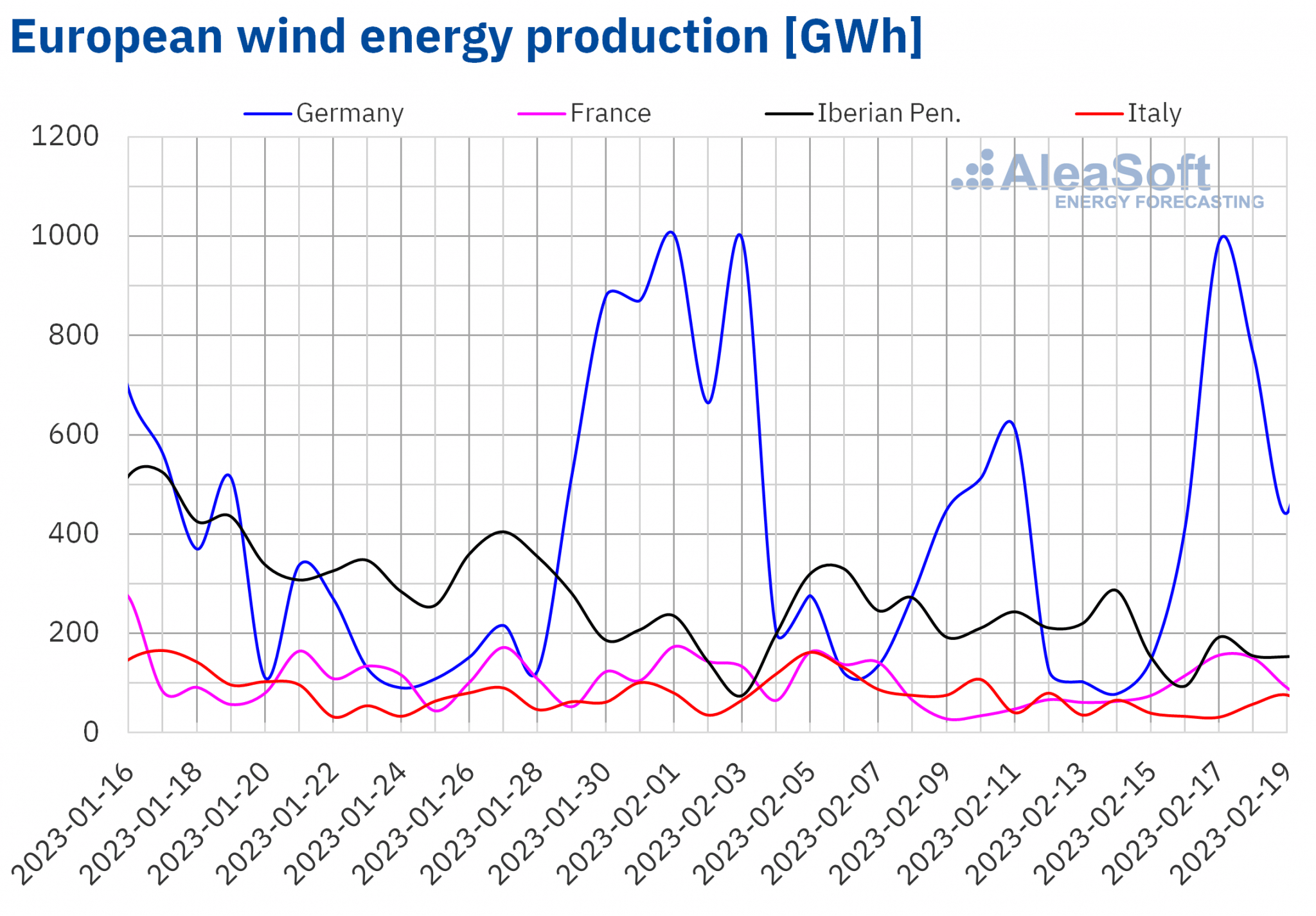

Solar photovoltaic and thermoelectric energy production and wind energy production

During the third week of February, the solar energy production increased compared to the previous week in most European markets analysed at AleaSoft Energy Forecasting. The largest rise was that of the Spanish market, of 19%, while in the Portuguese and Italian markets the increases were 16% and 7.3%, respectively. On the other hand, the solar energy production decreased by 0.9% in the French market and by 22% in the German market.

For the fourth week of February, the AleaSoft Energy Forecasting’s solar energy production forecasting indicates that the production might increase in Germany, but it might decrease in Spain and Italy.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

During the week of February 13, the wind energy production increased compared to the previous week in France and Germany. The largest rise, of 37%, was that of the French market, while in the German market it increased by 32%. However, the production with this technology decreased in Spain, Portugal and Italy by 24%, 32% and 43%, respectively.

On the other hand, when comparing the wind energy production of the first nineteen days of February with the same period of 2022, the Portuguese market stands out with an increase of 47%. Decreases were registered in the rest of the markets. But the production exceeded 1300 GWh in those markets, reaching 8315 GWh in the German market.

For the week of February 20, the AleaSoft Energy Forecasting’s wind energy production forecasting indicates that the wind energy production might increase in Germany and Spain, but decreases might be registered in the rest of the markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

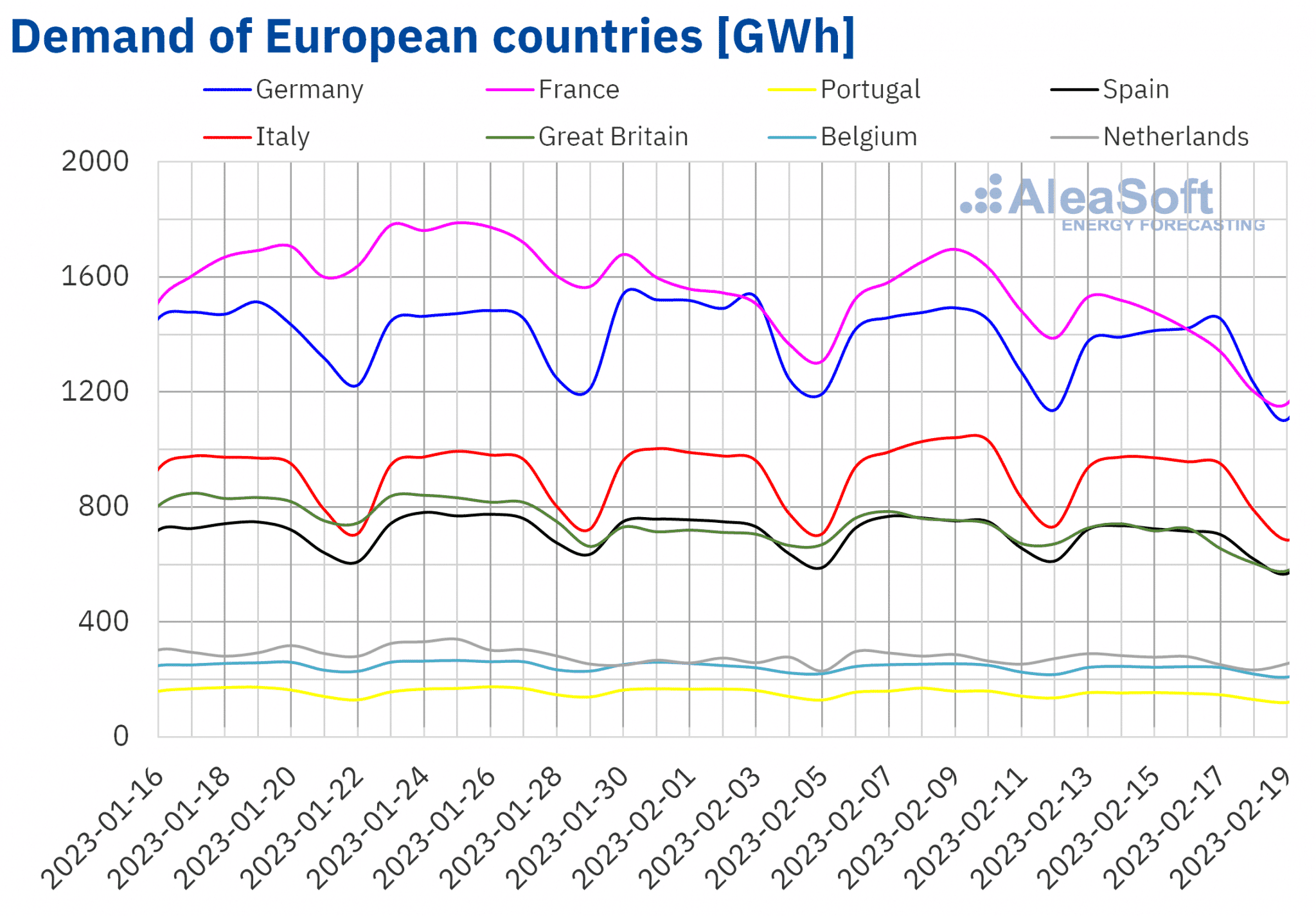

Electricity demand

In the week of February 13, the electricity demand decreased in all European markets analysed at AleaSoft Energy Forecasting compared to the previous week. The largest decrease, of 12%, was registered in the French market. In the rest of the markets, the demand decreased between 3.1% of the Belgian market and 7.7% of the British market.

In the third week of February, average temperatures increased compared to those registered during the previous week in all analysed European markets. The increases exceeded 2.5 °C, contributing to the general decline in demand. The largest increase in average temperatures, of 5.7 °C, was that of the German market, followed by the 5.1 °C increase of the Belgian market.

For the week of February 20, according to the demand forecasting made by AleaSoft Energy Forecasting, increases are expected in most analysed European markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

European electricity markets

In the week of February 13, prices of almost all European electricity markets analysed at AleaSoft Energy Forecasting fell compared to the previous week. The exceptions were the Nord Pool market of the Nordic countries, with a rise of 16%, and the MIBEL market of Portugal, with a slight increase of 0.02%. On the other hand, the largest drop in prices, of 14%, was that of the EPEX SPOT market of France, Belgium and the Netherlands. In the rest of the markets, the decreases were between 0.02% of the MIBEL market of Spain and 12% of the N2EX market of the United Kingdom.

In the third week of February, the highest average price, of €157.09/MWh, was that of the IPEX market of Italy, followed by the average of the British market, of €147.43/MWh. On the other hand, the lowest weekly average was that of the Nordic market, of €79.83/MWh. In the rest of the analysed markets, prices were between €128.64/MWh of the German market and €140.24/MWh of the French market.

In the case of the Spanish market, the price was €138.11/MWh, only €0.02/MWh lower than that of the previous week. Taking into account the adjustment that some consumers have to pay due to the gas price limitation in this market, in the third week of February an average of €136.12/MWh was registered.

Regarding daily prices, in the MIBEL market of Spain and Portugal, on Monday, February 13, the highest price since December 6, 2022, of €146.77/MWh, was reached. On the other hand, on Sunday, February 19, a price of €134.90/MWh was registered in the Italian market, the lowest in this market since November 6, 2022.

During the week of February 13, the decrease in gas prices compared to the previous week, as well as the drop in electricity demand in the European markets, led to a drop in prices in almost all analysed markets. This behaviour was also favoured by the rise in wind energy production in France and Germany and the increase in solar energy production in the Iberian Peninsula and Italy.

The AleaSoft Energy Forecasting’s price forecasting indicates that in the fourth week of February prices might continue to fall in European electricity markets, influenced by the drop in demand in some markets and the increase in wind energy production in markets such as the German and the Spanish. In the case of the German market, the increase in solar energy production might also contribute to this behaviour.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

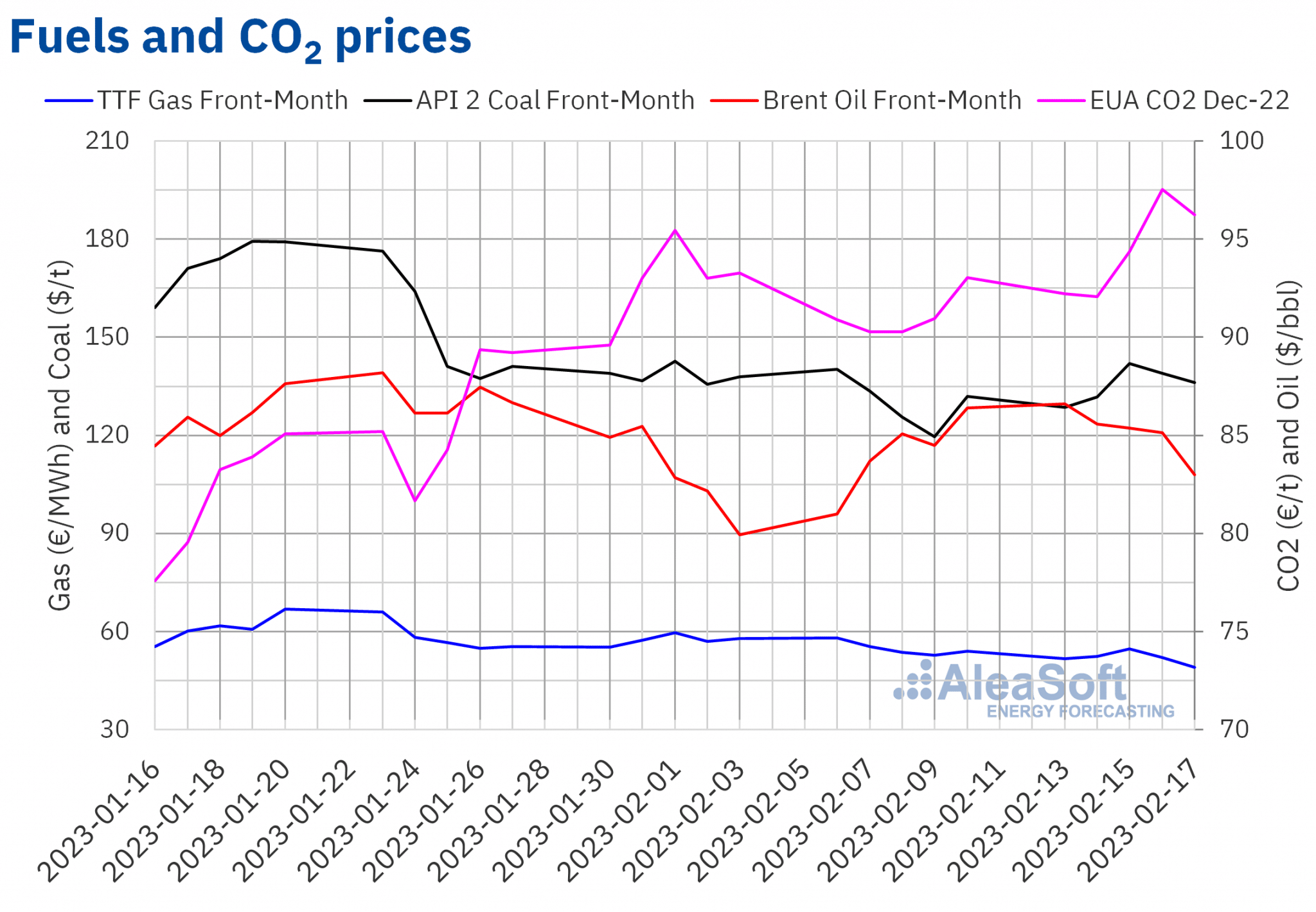

Brent, fuels and CO2

Brent oil futures for the Front?Month in the ICE market on Monday, February 13, reached the weekly maximum settlement price, of $86.61/bbl, which was 6.9% higher than that of the previous Monday. But the rest of the third week of February declines were registered. The weekly minimum settlement price, of $83.00/bbl, was registered on Friday, February 17, and it was 3.9% lower than that of the same day of the previous week.

After the price increases of the previous week, in the third week of February, Brent oil futures prices were influenced downwards by the announcement that the United States government would put oil from its strategic reserves on sale. In addition, the data indicated that the commercial crude oil reserves of this country had increased during the previous week.

As for TTF gas futures in the ICE market for the Front?Month, on Monday, February 13, a settlement price of €51.71/MWh was registered, 11% lower than that of the previous Monday. Subsequently, prices increased until reaching the weekly maximum settlement price, of €54.72/MWh, on Wednesday, February 15. This price was 1.9% higher than that of the previous Wednesday. But, as of Thursday, prices fell again. The weekly minimum settlement price, of €49.05/MWh, was registered on Friday, February 17. This price was 9.1% lower than that of the same day of the previous week and the lowest since the end of August 2021.

In the third week of February, milder temperatures in Europe and still high gas reserves levels continued to drive down TTF gas futures prices.

Regarding settlement prices of CO2 emission rights futures in the EEX market for the reference contract of December 2023, during the third week of February they remained above €90/t, despite decreasing at the start of the week. The weekly minimum settlement price, of €92.06/t, was registered on Tuesday, February 14, and it was 2.0% higher than that of the same day of the previous week. As of Wednesday, prices increased and on Thursday, February 16, the weekly maximum settlement price, of €97.54/t, was reached. This price was 7.2% higher than that of the previous Thursday and the highest since August 2022. But on Friday prices fell again, registering a settlement price of €96.25/t, which was still 3.5% higher than that of the previous Friday.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe

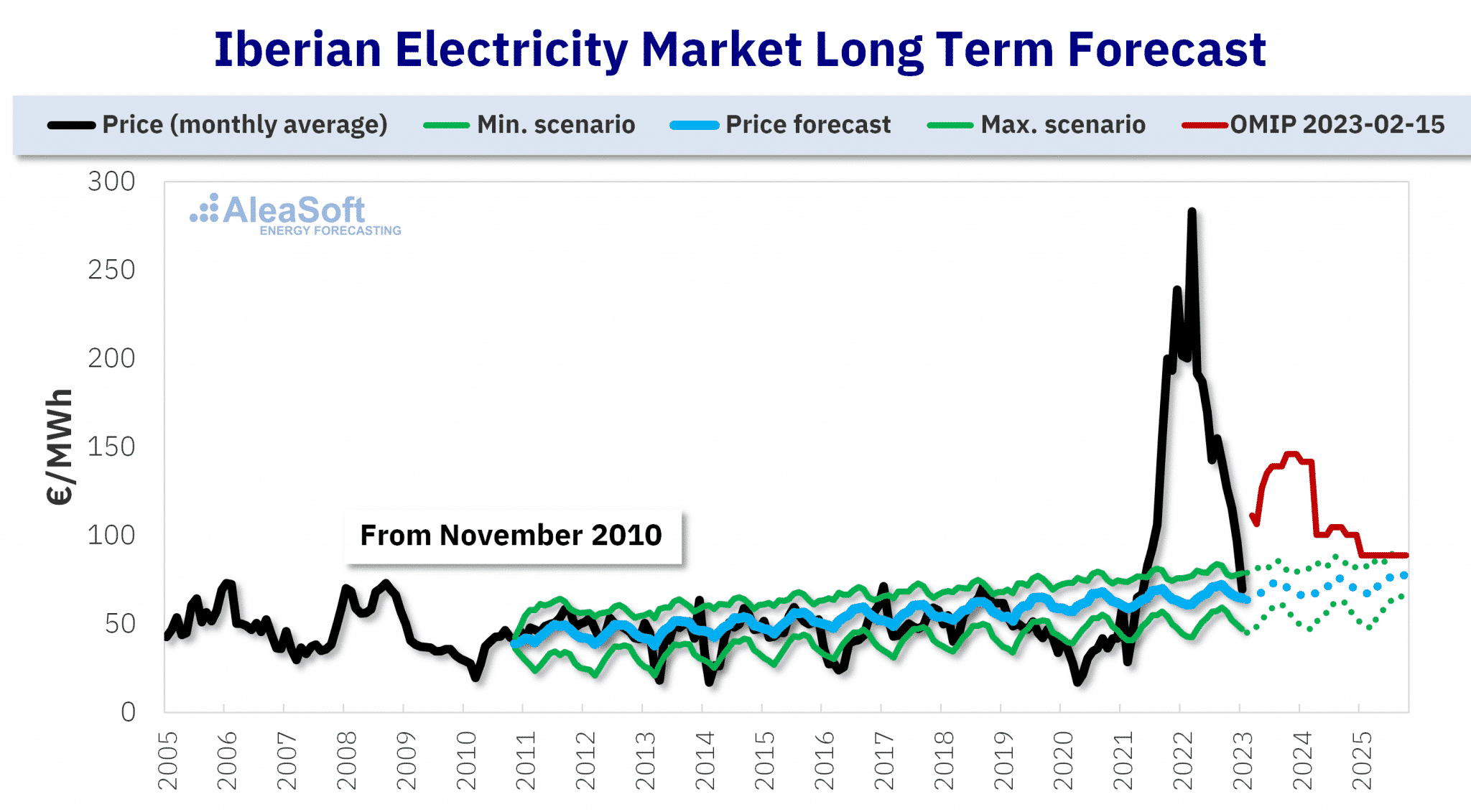

Long?term price forecasts of AleaGreen for European energy markets have hourly granularity and include confidence bands. In addition, their scientific base provides coherency and quality in the results. The following graph shows a forecast made in 2010 for the Spanish market. For January 2023, the deviation of the forecast with respect to the real value registered for that month was €4.97/MWh. From this graph it can be inferred that the marginalist market works and is predictable. In addition, the current market is in balance and self?regulates. Thus, the market should continue to be free and without price restrictions that might disrupt this balance.

Long term price forecast for the Iberian electricity market MIBEL made at the end of October 2010 by AleaSoft Energy Forecasting.

Source: AleaSoft Energy Forecasting and OMIP.

On the other hand, last Thursday, February 16, the second webinar of 2023 of the series of monthly webinars of AleaSoft Energy Forecasting and AleaGreen was held. On this occasion, the importance of forward markets for the renewable energy development was analysed, as well as the evolution and prospects of European energy markets. Alvaro Ruben Reyes Diaz, guest speaker from European Energy Exchange AG (EEX), participated in the webinar.