In the second week of March, prices of almost all European electricity markets fell compared to the previous week, influenced by the decrease in electricity demand and gas prices, as well as by the general increase in wind energy production. Regarding the production with this technology, on March 9 and 10 record hourly values were reached in Spain, France and Italy.

Solar photovoltaic and thermoelectric energy production and wind energy production

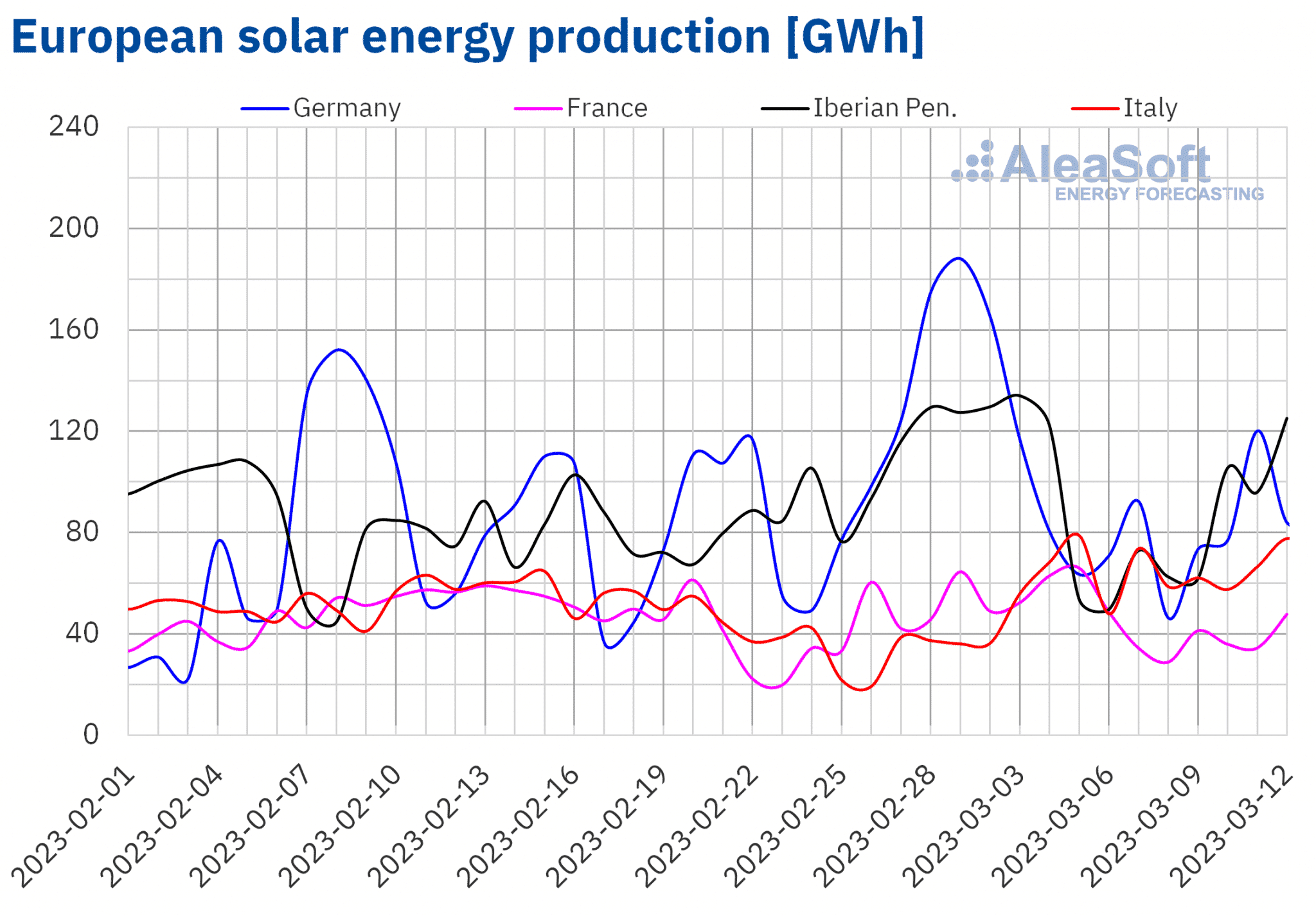

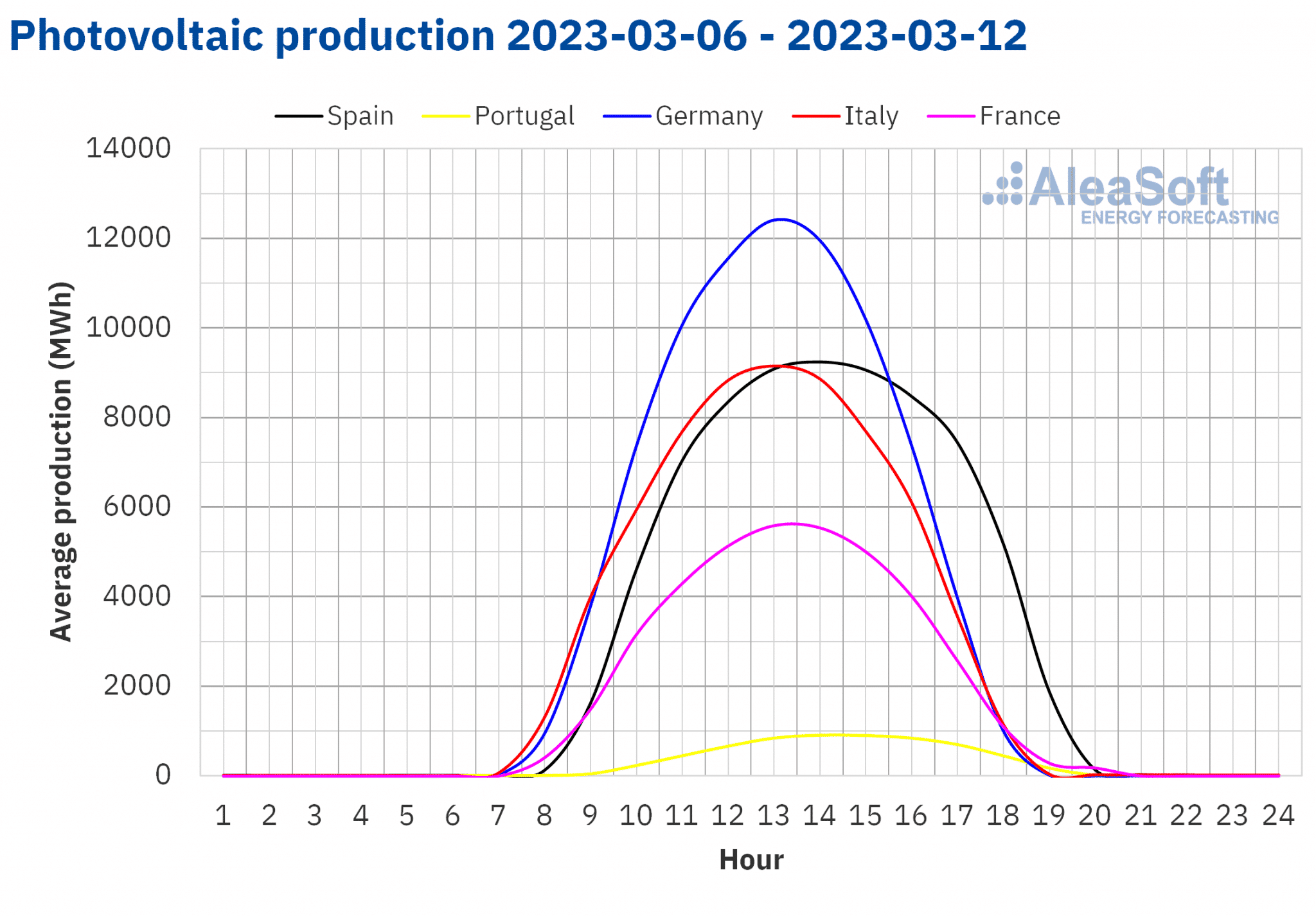

During the second week of March, the solar energy production increased by 26% compared to the previous week in the Italian market. However, in the rest of European markets analysed at AleaSoft Energy Forecasting there were decreases. The largest fall was that of the German market, of 38%. In the French and Spanish markets, the decreases were 29% and 30%, respectively. On the other hand, the smallest drop in solar energy production, of 25%, was registered in the Portuguese market.

For the third week of March, the AleaSoft Energy Forecasting’s solar energy production forecasting indicates that the production might increase in Germany and Spain, but it might decrease in Italy.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

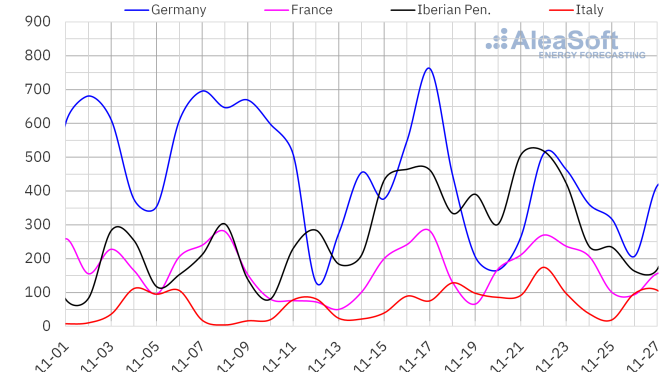

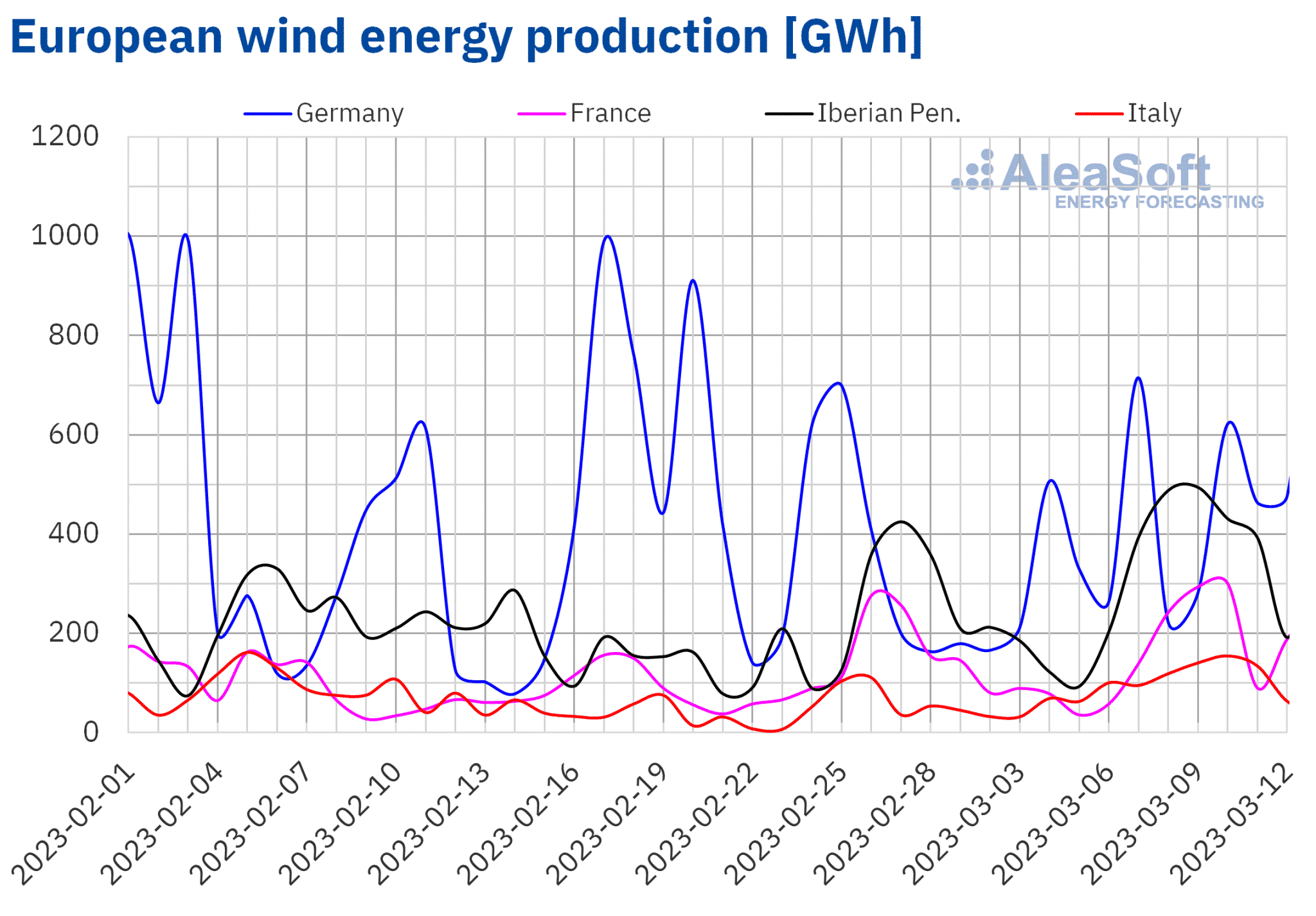

During the week of March 6, the wind energy production increased compared to the previous week in all European markets analysed at AleaSoft Energy Forecasting. The largest rise, of 169%, was that of the Portuguese market, followed by that of the Italian market, of 143%. In Germany, the production with this technology increased by 73%, while in the Spanish and French markets the increases were 51% and 56%, respectively.

On the other hand, on Friday, March 10, from 10:00 to 11:00, a record wind energy production of 16 598 MWh was reached in the French market. That day, from 17:00 to 18:00, a record production of 8 260 MWh was also registered in Italy. In the case of the Spanish market, on Thursday, March 9, from 23:00 to 24:00, the hourly production scheduled in the P48, of 20 139 MWh, was the second highest in history after that registered on November 21, 2022.

For the week of March 13, the AleaSoft Energy Forecasting’s wind energy production forecasting indicates that the production might continue to increase in the German market, but decreases might be registered in the rest of the markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

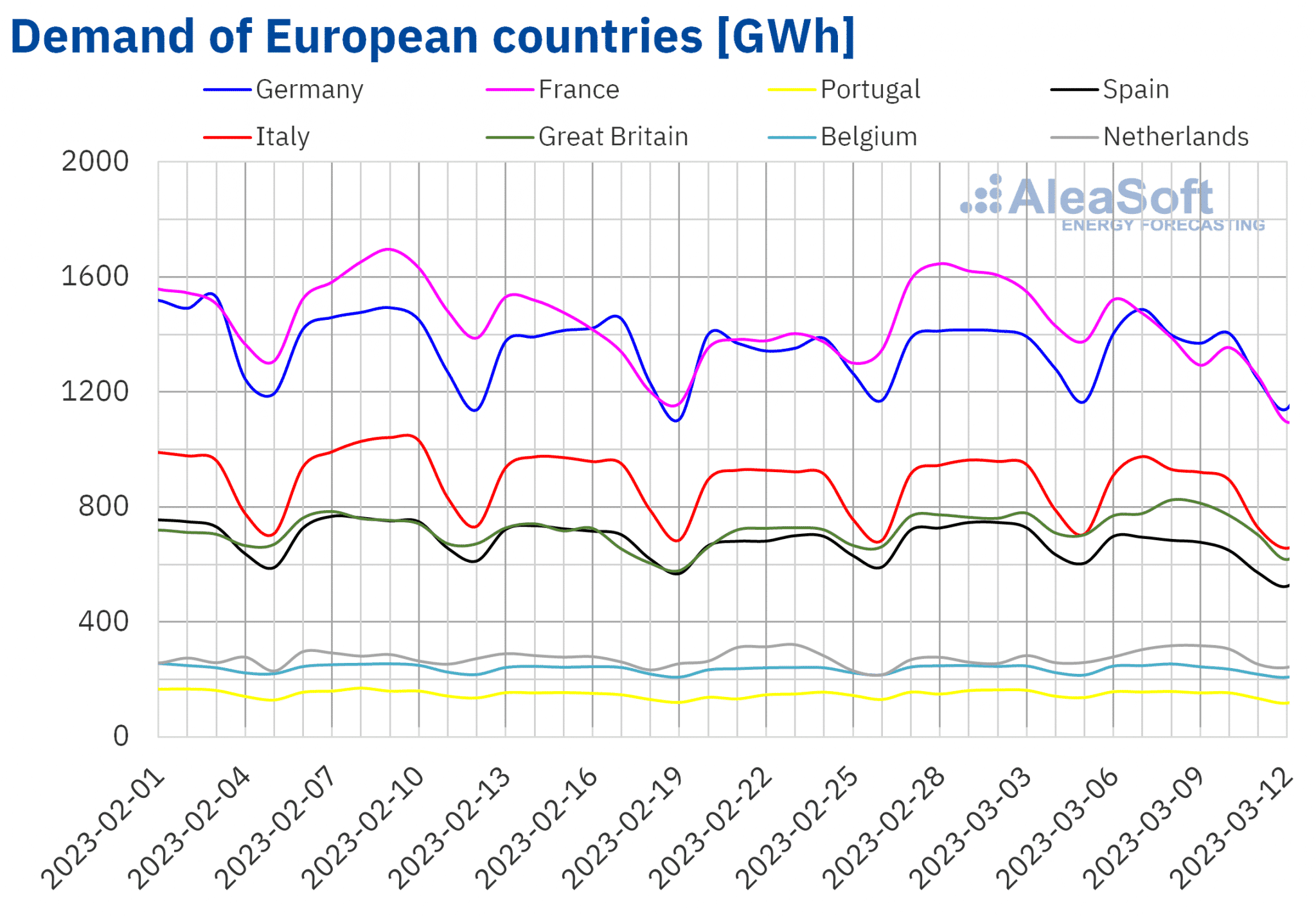

Electricity demand

In the week of March 6, the electricity demand fell in most European markets analysed at AleaSoft Energy Forecasting compared to the previous week. The exceptions were the British and Dutch markets, with increases of 0.3% and 8.4%, respectively. On the other hand, the largest decrease, of 13%, was registered in the French market. In the rest of the markets, the demand fell between 0.2% of the German market and 8.3% of the Spanish market.

In the second week of March, the increase in average temperatures contributed to the drop in electricity demand in most European markets. The largest rise in average temperatures compared to the previous week, of 9.0 °C, was registered in Spain, favouring the largest drop in demand to be registered in this market. On the other hand, in the Netherlands and Great Britain, average temperatures dropped, registering increases in electricity demand.

For the week of March 13, according to the demand forecasting made by AleaSoft Energy Forecasting, the demand might continue to fall in most European markets, influenced by the rise in average temperatures.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

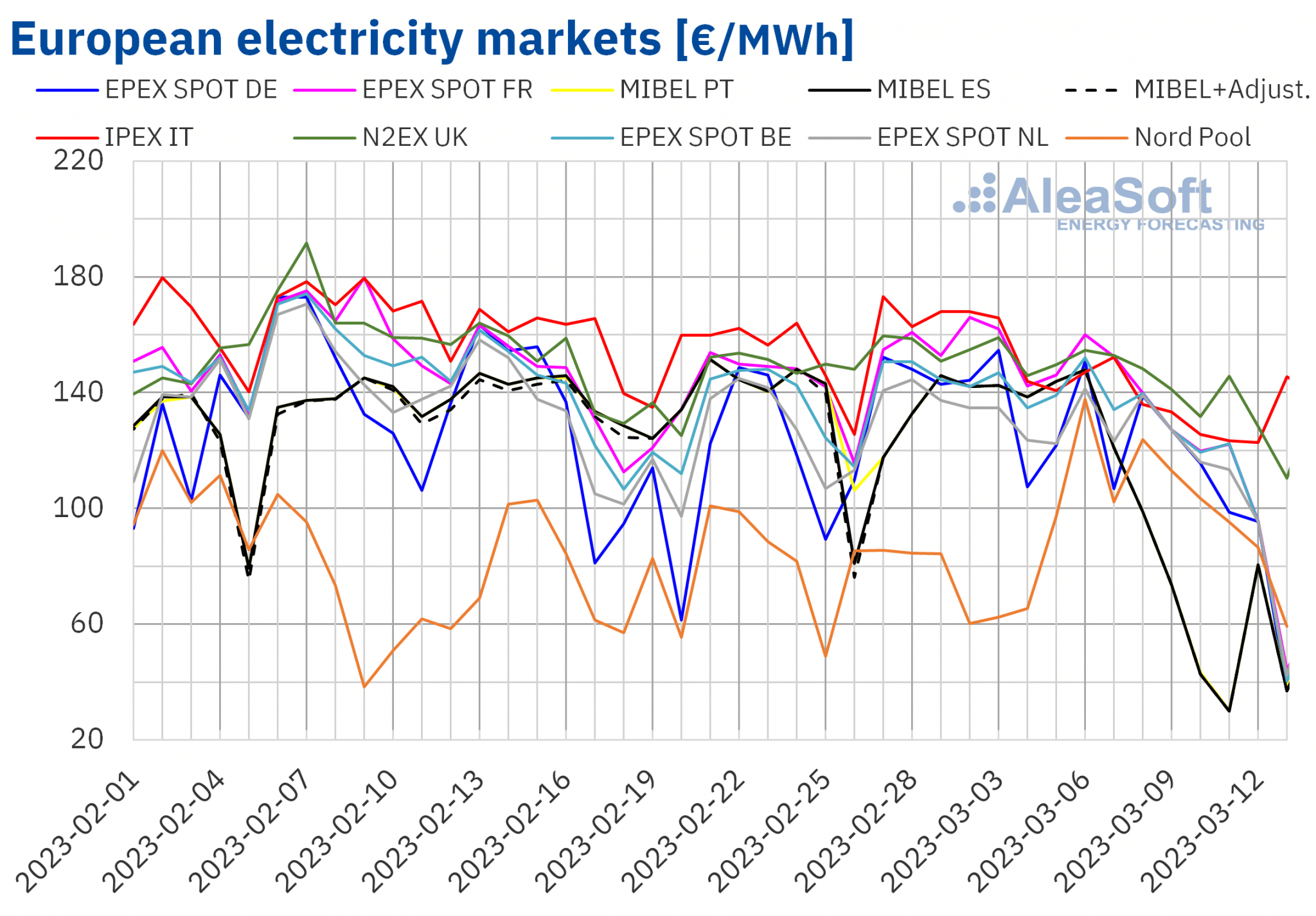

European electricity markets

In the week of March 6, prices of almost all European electricity markets analysed at AleaSoft Energy Forecasting fell compared to the previous week. The exception was the Nord Pool market of the Nordic countries, with a rise of 41%. On the other hand, the largest drop in prices, of 38%, was that of the MIBEL market of Spain and Portugal. In the rest of the markets, the decreases were between 7.0% of the N2EX market of the United Kingdom and 16% of the IPEX market of Italy.

In the second week of March, the highest average price, of €143.24/MWh, was that of the British market, followed by that of the Italian market, of €134.30/MWh. On the other hand, the lowest weekly average was that of the Spanish market, of €84.95/MWh, followed by the average of the Portuguese market, of €85.06/MWh. In the rest of the analysed markets, prices were between €108.84/MWh of the Nordic market and €131.07/MWh of the EPEX SPOT market of France.

Regarding hourly prices, in the Nordic market, on Monday, March 6, from 18:00 to 19:00, a price of €180.13/MWh was reached, the highest since December 2022. On the contrary, in the MIBEL market of Spain and Portugal, on Saturday, March 11, from 15:00 to 16:00, a price of €1.49/MWh was registered, the lowest since January. On the other hand, on Monday, March 13, from 13:00 to 15:00, negative hourly prices were reached in the Dutch and German markets, which were the lowest in these markets since the first day of the year. In the case of the Belgian market, on March 13, from 15:00 to 16:00, a price of €0.90/MWh was registered, the lowest since January 2023.

During the week of March 6, the decrease in average price of gas compared to the previous week and the drop in electricity demand in most European markets led to the decrease in prices in almost all analysed markets. The general increase in wind energy production also exerted its downward influence on prices. In the case of the Italian market, the increase in solar energy production also contributed to this behaviour.

The AleaSoft Energy Forecasting’s price forecasting indicates that in the third week of March prices might continue to fall in most European electricity markets, influenced by decreases in demand in most analysed markets, as well as by the increase in renewable energy production in some markets.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Brent, fuels and CO2

On Monday, March 6, Brent oil futures for the Front?Month in the ICE market registered the weekly maximum settlement price, of $86.18/bbl, which was 4.5% higher than that of the previous Monday. Subsequently, prices fell until reaching the weekly minimum settlement price, of $81.59/bbl, on Thursday, March 9. This price was 3.7% lower than that of the previous Thursday. On Friday, the settlement price rose slightly to $82.78/bbl, but it was still 3.6% lower than that of the previous Friday.

In the second week of March, statements about possible interest rate increases by the Federal Reserve of the United States favoured decreases in Brent oil futures prices. However, the decline in oil reserves of the United States and the publication of employment data in this country allowed the downward trend to stop at the end of the week.

As for TTF gas futures in the ICE market for the Front?Month, on Monday, March 6, they registered the weekly minimum settlement price, of €42.15/MWh. This price was 11% lower than that of the previous Monday and the lowest since August 23, 2021. The following three days, settlement prices were also lower than those of the same days of the previous week, remaining below €44/MWh. However, on Friday, March 10, prices rose by 21% compared to the previous day and the weekly maximum settlement price, of €52.86/MWh, was reached. This settlement price was 18% higher than that of the previous Friday and the highest since mid?February.

Milder temperatures and higher wind energy production exerted their downward influence on prices in the second week of March. However, the strikes in France, which affected plants importing liquefied natural gas, favoured the recovery of TTF gas futures prices at the end of the second week of the month. In addition, the news about the problem detected in a French nuclear reactor and its consequences on the country’s nuclear energy production also contributed to the recovery of prices.

Regarding settlement prices of CO2 emission rights futures in the EEX market for the reference contract of December 2023, during the second week of March, they reversed the trend of the previous week and registered increases in all sessions. As a result, on Friday, March 10, the weekly maximum settlement price, of €99.79/t, was reached, which was 8.3% higher than that of the previous Friday.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe

This Thursday, March 16, at 10:00 CET, the third webinar of 2023 of the series of monthly webinars of AleaSoft Energy Forecasting and AleaGreen will be held. In this webinar, the third with invited speakers from EY, prospects for European energy markets for the spring of 2023, the update of the regulation of the Spanish energy sector and perspectives of the European Union electricity market reform will be analysed. Other topics that will also be addressed are the financing of renewable energy projects, the importance of PPA and self?consumption, as well as the main considerations to take into account in the portfolio valuation.

On the other hand, AleaGreen’s long?term price forecasts are especially useful both in the assets valuation for the renewable energy projects financing and in the negotiation of PPA. These price forecasts have a 30?year horizon, hourly granularity and confidence bands. Available electricity markets include the main European, American and Asian markets.