RWE continued to consistently pursue its ‘Growing Green’ investment and growth strategy in a very challenging year 2022, once again noticeably stepping up the pace. The company further expanded its good market position, both through organic growth in its core business and through strategic acquisitions. The acquisition of Con Edison Clean Energy Businesses (Con Edison CEB) makes RWE a top-tier renewable energy company in the fast-growing US market. With the acquisition of solar development businesses in Poland and the United Kingdom, RWE is also accelerating its growth there.

The agreement with the German federal government and the government of the state of North Rhine-Westphalia to bring forward the phase-out of coal to 2030 is also contributing to RWE’s transformation. This creates the basis for getting onto the 1.5 degree path as a company in terms of CO2 emission reductions. Apart from this, RWE helped to overcome the energy crisis last year and contributed to securing Germany’s energy supply to the greatest extent possible.

Markus Krebber, CEO of RWE AG: “At RWE, all our efforts are dedicated to setting up a climate-neutral energy supply. In 2022, we invested a total of €4.4 billion net worldwide and commissioned 2.4 gigawatts of new capacity. Further projects with a total capacity of 6 gigawatts are currently under construction. RWE is one of the international drivers of the energy transition. We now hold a leading position in all our core regions – in the EU, the UK and the US. We will continue to strengthen this position through massive investment in our green core business.”

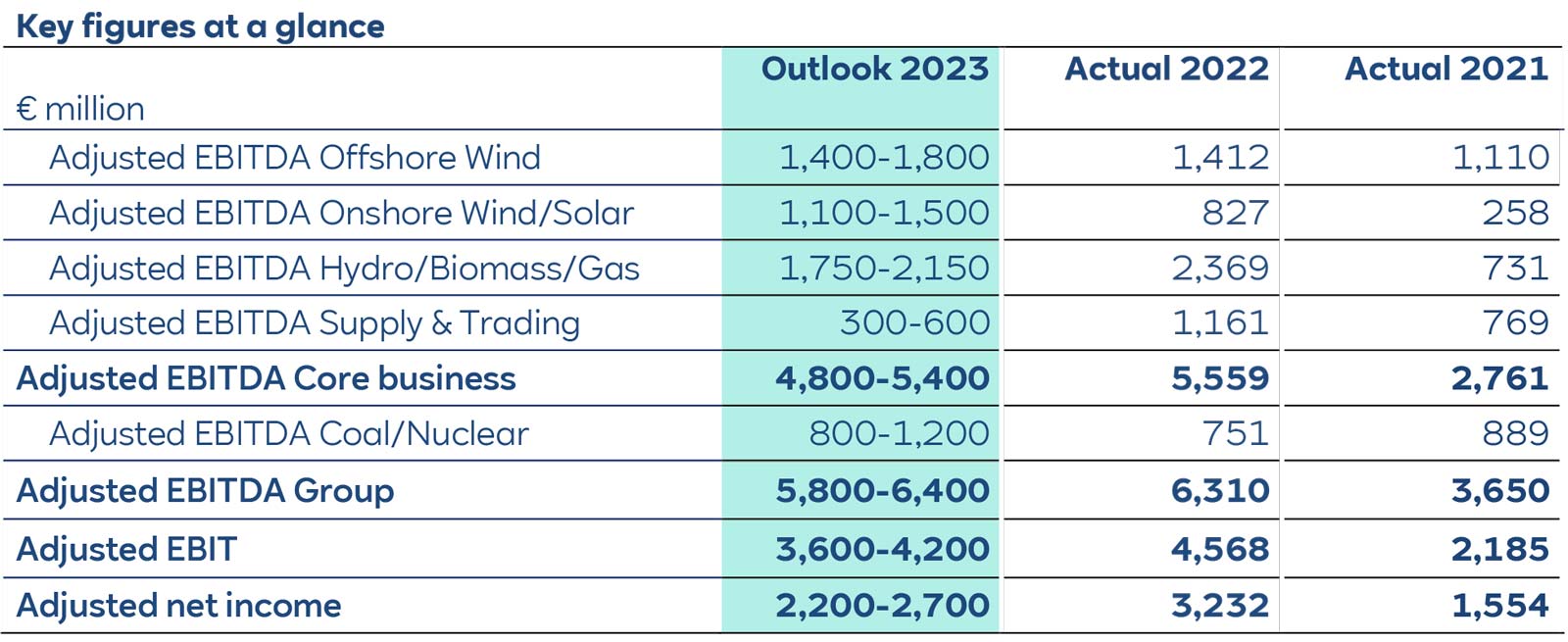

Very good performance in 2022 due to strong core business: The RWE Group’s adjusted EBITDA (adjusted earnings before interest, taxes, depreciation and amortisation) for fiscal 2022 amounted to €6.3 billion, and thus exceeded the upper end of the forecast range. Adjusted EBITDA from the core business, at €5.6 billion, also exceeded the forecast range. In addition to capacity expansion in renewable energies, improved market conditions in power generation in terms of price levels and power plant deployment as well as a very strong performance in the trading business were key drivers. RWE achieved adjusted EBIT of €4.6 billion. Adjusted net income, at € billion, also exceeded the outlook. In contrast to developments in the RWE Group’s international core business, its German coal and nuclear business contributed less to earnings than in the previous year. RWE confirms its dividend target of €0.90 per share for fiscal 2022.

Offshore Wind: Adjusted EBITDA in the Offshore Wind segment reached €1.4 billion in 2022, compared to €1.1 billion in 2021. This was partly due to the commissioning of new capacity. Although wind levels improved compared to the low levels of the previous year, they were still below the long-term average.

For the current 2023 financial year, RWE expects earnings for this segment to be between €1.4 billion and €1.8 billion. The first full year of operation of the new Triton Knoll and Kaskasi wind farms will have a positive impact. In addition, RWE expects higher deployment of its plants due to normalised wind conditions and higher realised electricity prices. This is counteracted by burdens from electricity revenue caps.

Onshore Wind/Solar: In fiscal 2022, adjusted EBITDA in the Onshore Wind/Solar segment reached €0.8 billion, compared to €0.3 billion in 2021. Here, too, additional capacity and more favourable wind conditions had a positive impact, although, as in the Offshore Wind segment, wind levels were again below expectations. In addition, the previous year’s earnings included substantial one-off burdens due to the extreme cold snap in Texas in February 2021.

For 2023, RWE expects earnings for this segment of €1.1 billion to €1.5 billion. The business of Con Edison CEB, which has been fully consolidated since 1 March 2023, as well as new-build facilities, will contribute to the increase in EBITDA. As in the Offshore Wind segment, RWE expects normalised weather conditions and higher realised electricity prices. This is counteracted by burdens from electricity revenue caps.

Hydro/Biomass/Gas: Adjusted EBITDA in this segment improved in 2022 to €2.4 billion. This was mainly the result of higher earnings from short-term power plant dispatch and higher generation margins.

Adjusted EBITDA for this segment is expected to total between €1.75 billion and €2.15 billion for 2023. During the current financial year, realised electricity prices and income from short-term optimisation of power plant dispatch are expected to be lower than the high levels seen in 2022. In addition, RWE expects burdens from electricity revenue caps. Positive effects are expected from the commissioning of the grid stabilisation plant in Biblis and the addition of the Magnum gas-fired power station.

Supply & Trading: Due to a very strong trading performance across almost all commodities and regions, adjusted EBITDA in the Supply & Trading segment reached €1.2 billion in 2022. Assuming normal business conditions, adjusted EBITDA for the segment is expected to be between €0.3 billion and €0.6 billion for 2023.

Decline in earnings in German coal and nuclear energy business: Adjusted EBITDA in the Coal/Nuclear segment in 2022 was €0.75 billion, compared to €0.9 billion in 2021. This was mainly due to power plant closures. In addition, RWE had already sold forward the majority of the electricity production from its German lignite and nuclear power stations before the onset of the current energy crisis. In 2023, adjusted EBITDA is expected to improve to between €0.8 billion and €1.2 billion due to higher margins.

Substantial investment and solid financial position: Last year, RWE invested €4.4 billion net, which was 50% more than in the previous year. The largest investment was in the German offshore wind farm Kaskasi, whose 38 turbines already feed electricity into the German grid, and the Sofia wind farm in the UK North Sea, which RWE is expecting to complete in 2026. In addition, there was the one-off lease fee for a site in the New York Bight, on which RWE intends to build offshore wind turbines as well as the investments in new onshore wind farms and solar plants. In total, RWE completed and commissioned over 30 facilities last year. More than 80% of the RWE Group’s capital expenditure was taxonomy-aligned. In 2023, RWE plans to once again invest much more than in the prior year. RWE covers the financing requirements for this strong growth mainly by cash flows from operating activities. As at the balance sheet date 31 December 2022, RWE posted net assets of €1.6 billion and an equity ratio of 21%.

Earnings in 2023 to build on previous year’s level: RWE currently expects to be able to pick up where it left off last year in terms of its earnings position. The acquisition of Con Edison CEB and the commissioning of new wind and solar farms will have a positive impact on earnings. RWE also assumes that wind volumes will reach normal levels, and that utilisation of its wind farms will therefore improve compared to 2022. Earnings from short-term optimisation of power plant dispatch and energy trading are unlikely to reach the high levels seen in 2022. Moreover, RWE expects that European and UK revenue caps may lead to earnings shortfalls.

For 2023, adjusted EBITDA at Group level is expected to be between €5.8 billion and €6.4 billion; in the core business, it is expected to be between €4.8 billion and €5.4 billion. RWE estimates an adjusted EBIT of €3.6 billion to €4.2 billion and an adjusted net income of €2.2 billion to €2.7 billion. The dividend target for fiscal 2023 is to be increased to €1.00 per share.

Michael Müller, CFO of RWE AG: “Our solid financial situation and our good performance put us in a position to continue investing heavily in RWE’s growth in 2023. We also want our shareholders to have a fair share in our success, and we therefore propose a dividend of €1 per share for the current fiscal year 2023.”