In the first week of April, record highs of solar photovoltaic energy production were reached in Spain, France and Portugal. However, European electricity markets prices increased, influenced by the increase in gas and CO2 emission rights prices, as well as by the general drop in wind energy production compared to the previous week. On the other hand, Brent oil futures prices rose after the announcement of production cuts by the OPEC+.

Solar photovoltaic and thermoelectric energy production and wind energy production

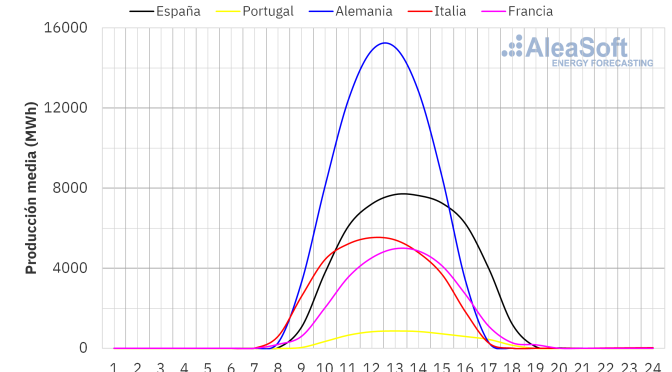

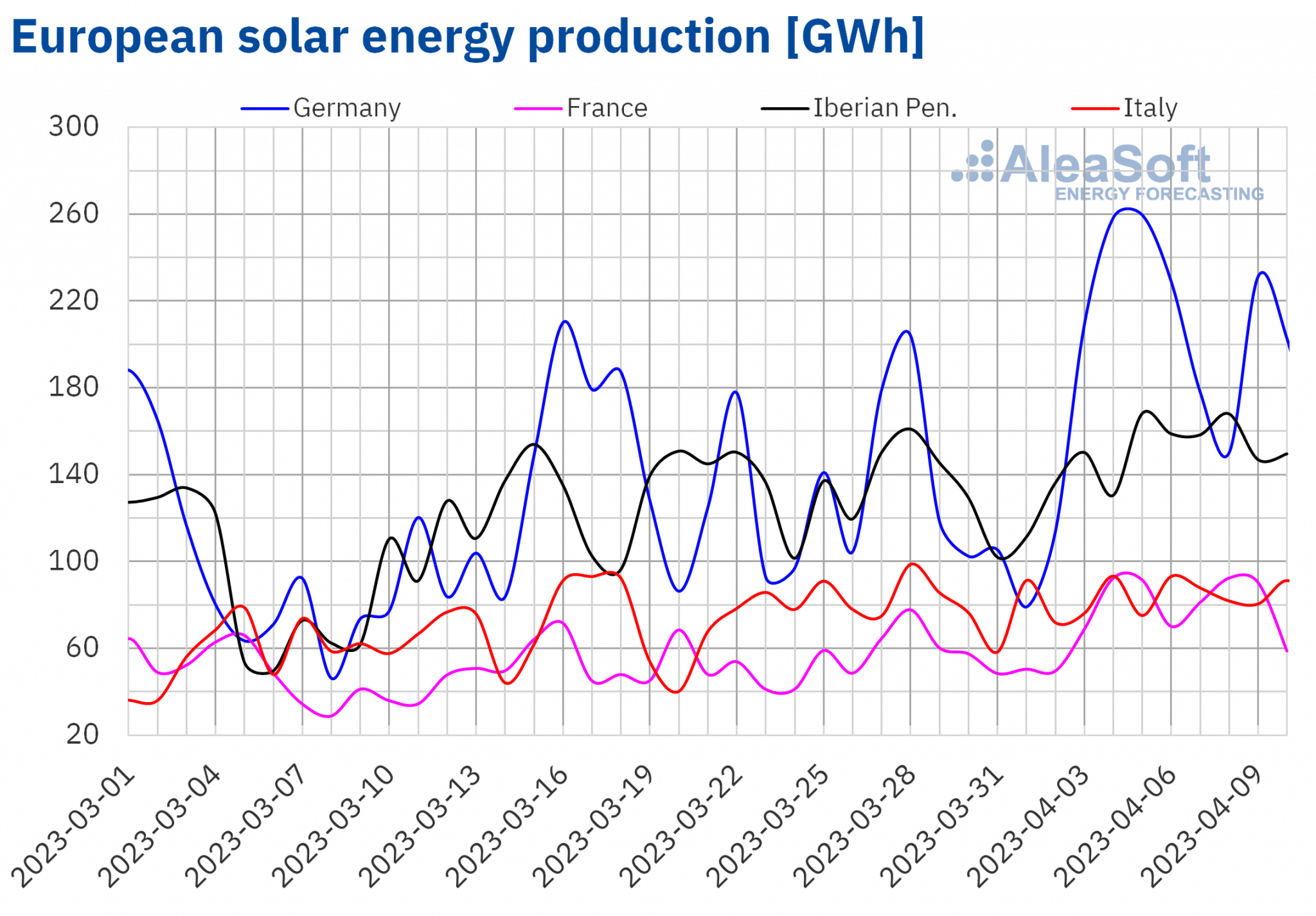

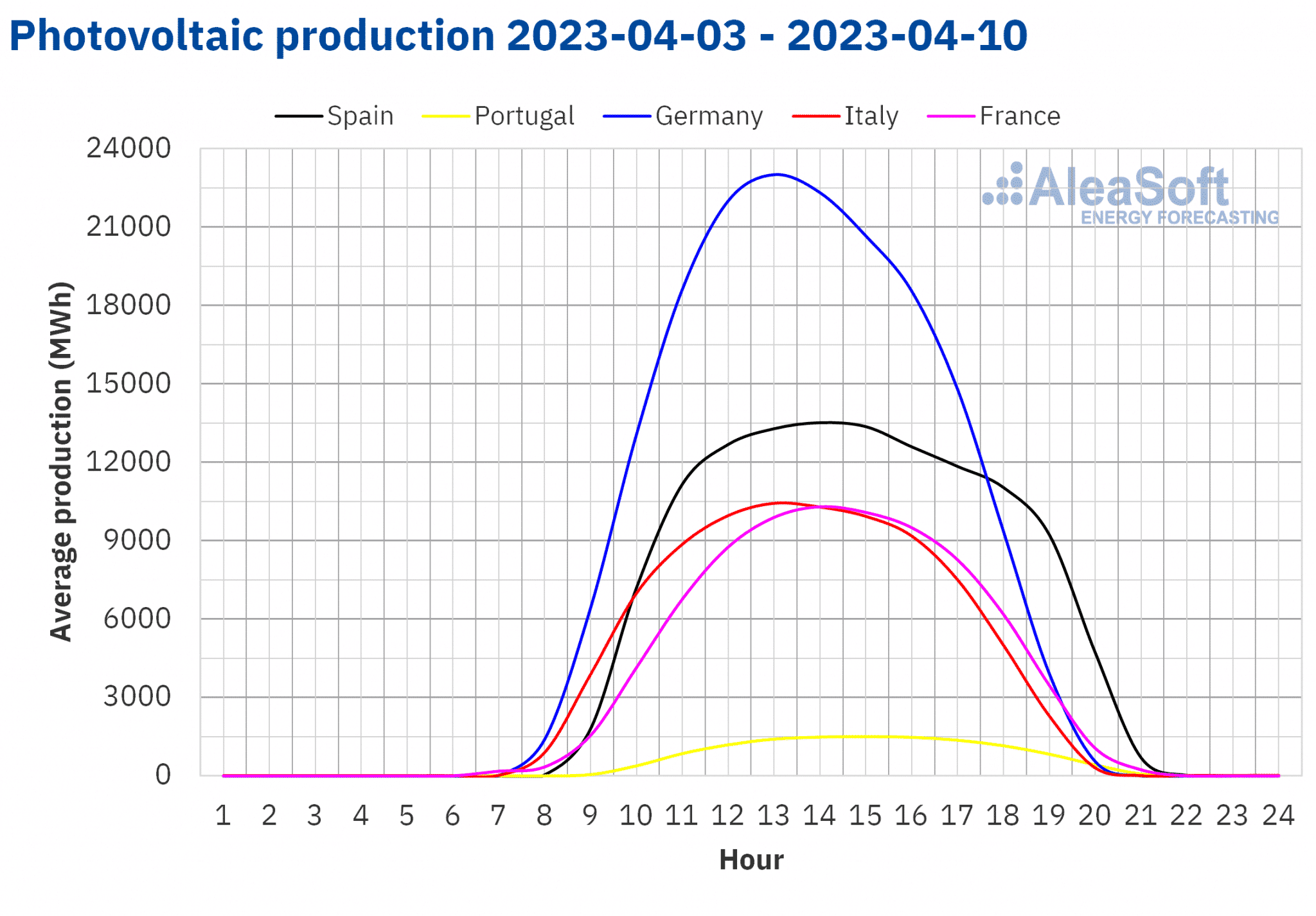

During the first week of April, the solar energy production increased compared to the previous week in all European markets analysed at AleaSoft Energy Forecasting. Among the largest increases is that of the French market, which reached 44%. On the other hand, the smallest increase, of 5.5%, was that of the Italian market.

On the other hand, on Saturday, April 8, from 12:00 to 13:00, a solar thermoelectric energy production of 2080 MWh was registered in the Spanish market, the highest since May 31, 2022, in this market. Regarding the solar photovoltaic energy production, in the first week of April record highs were reached in Spain, France and Portugal. In Spain, on Saturday, April 8, from 13:00 to 14:00, a solar photovoltaic energy production of 14 744 MWh was registered. In the same time period, on Wednesday, April 5, a record production of 11 856 MWh was registered in France and on Friday, April 7, a value of 1598 MWh was reached in Portugal.

For the second week of April, the AleaSoft Energy Forecasting’s solar energy production forecasting indicates that it might decrease in Germany, Spain and Italy.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

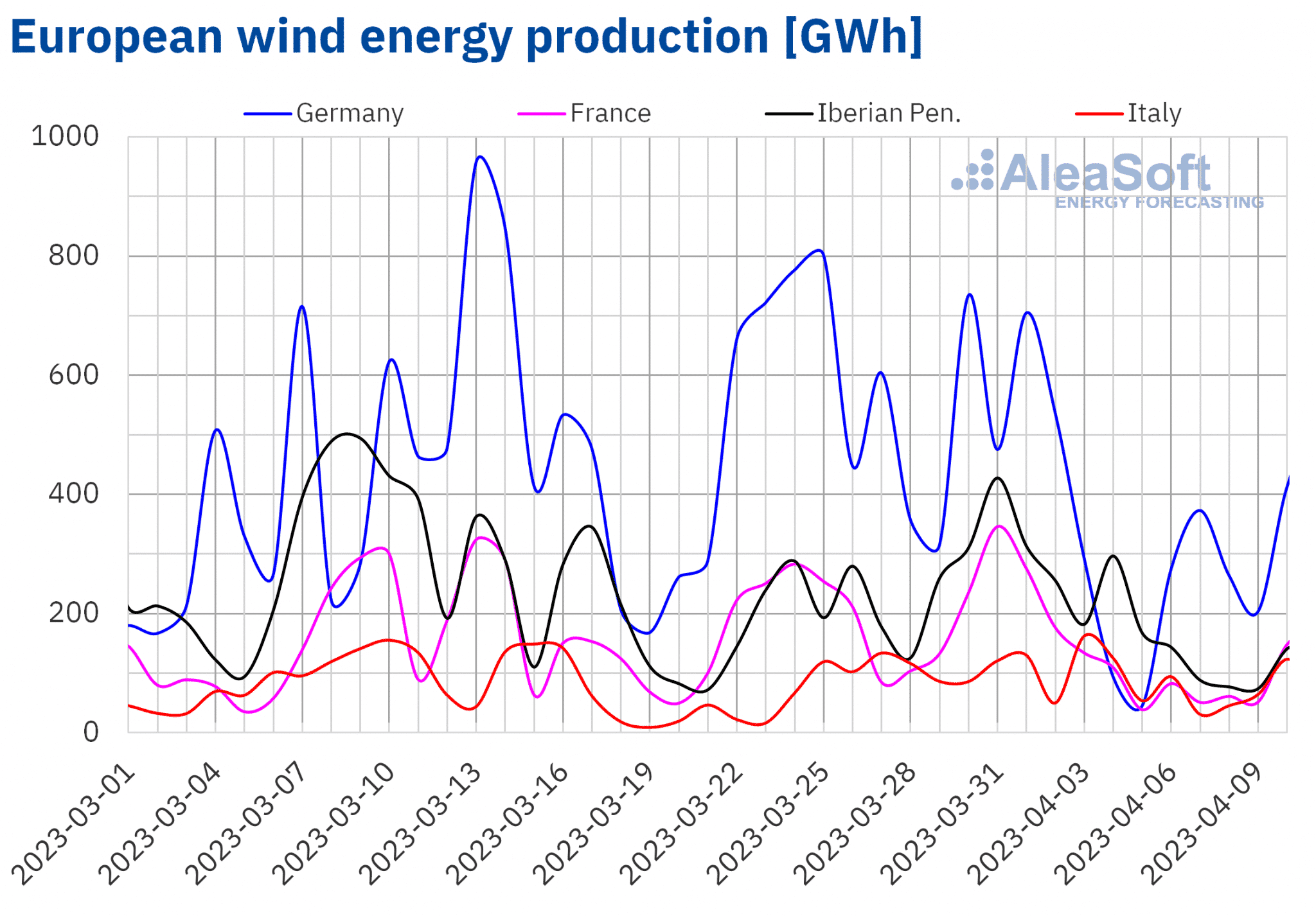

During the week of April 3, the wind energy production decreased compared to the previous week in all European markets analysed at AleaSoft Energy Forecasting. The decreases were between 20% of the Italian market and 61% of the French market.

For the week of April 10, the AleaSoft Energy Forecasting’s wind energy production forecasting indicates that the production might increase in all analysed markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

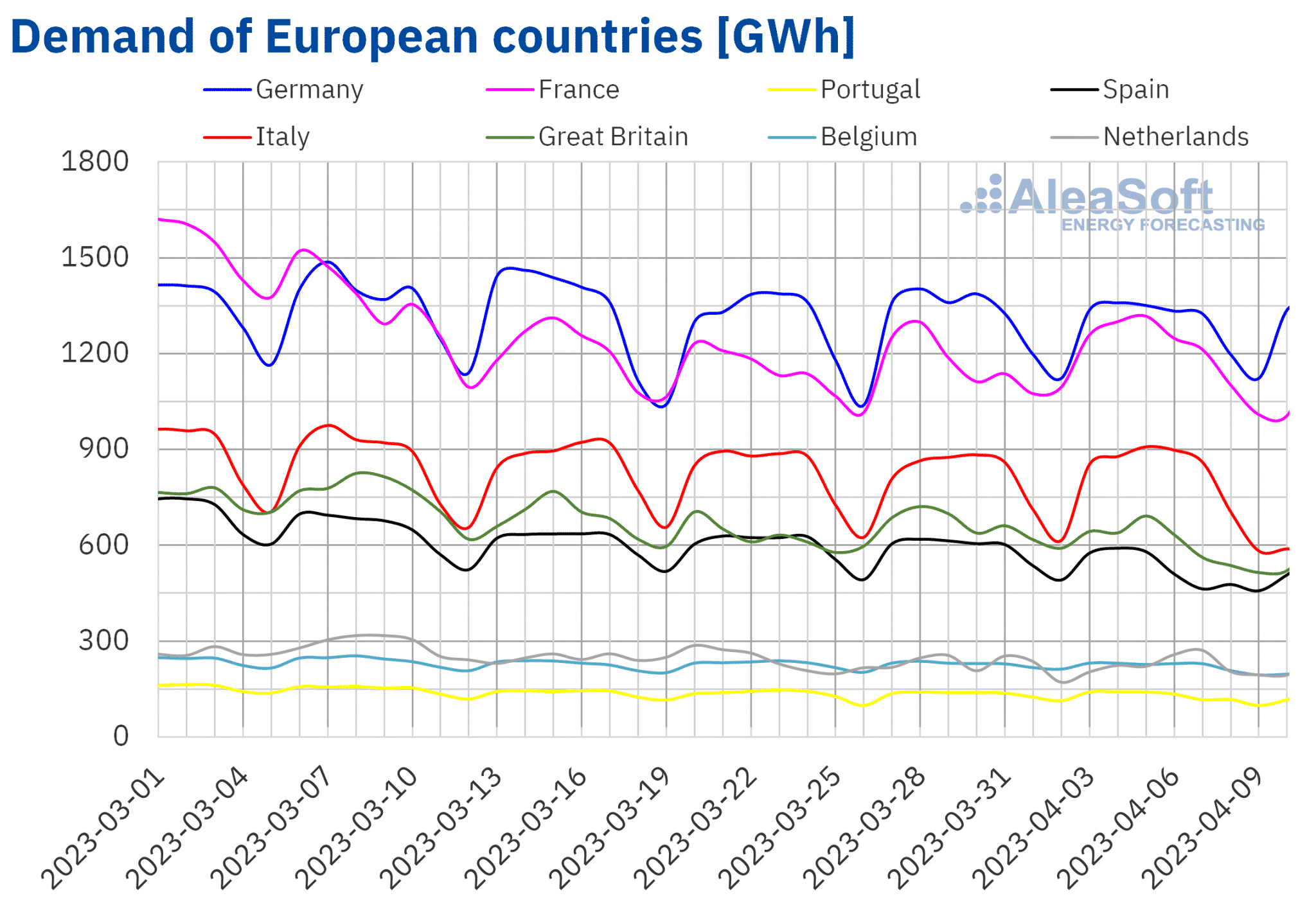

Electricity demand

In the week of April 3, the electricity demand fell in almost all European markets analysed at AleaSoft Energy Forecasting compared to the previous week. The exceptions were the Italian and French markets, with increases of 1.2% and 3.6%, respectively. On the other hand, the largest fall, of 10%, was that of the Spanish market, followed by the 8.6% drop of the British market. In the rest of the markets, the demand fell between 0.7% of the Dutch market and 4.3% of the Portuguese market.

In the first week of April, the Easter holidays favoured the drop in demand in European markets, despite the general decrease in average temperatures.

For the week of April 10, according to the demand forecasting made by AleaSoft Energy Forecasting, the demand is expected to decrease in most European markets, but it might increase in Spain and Portugal.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

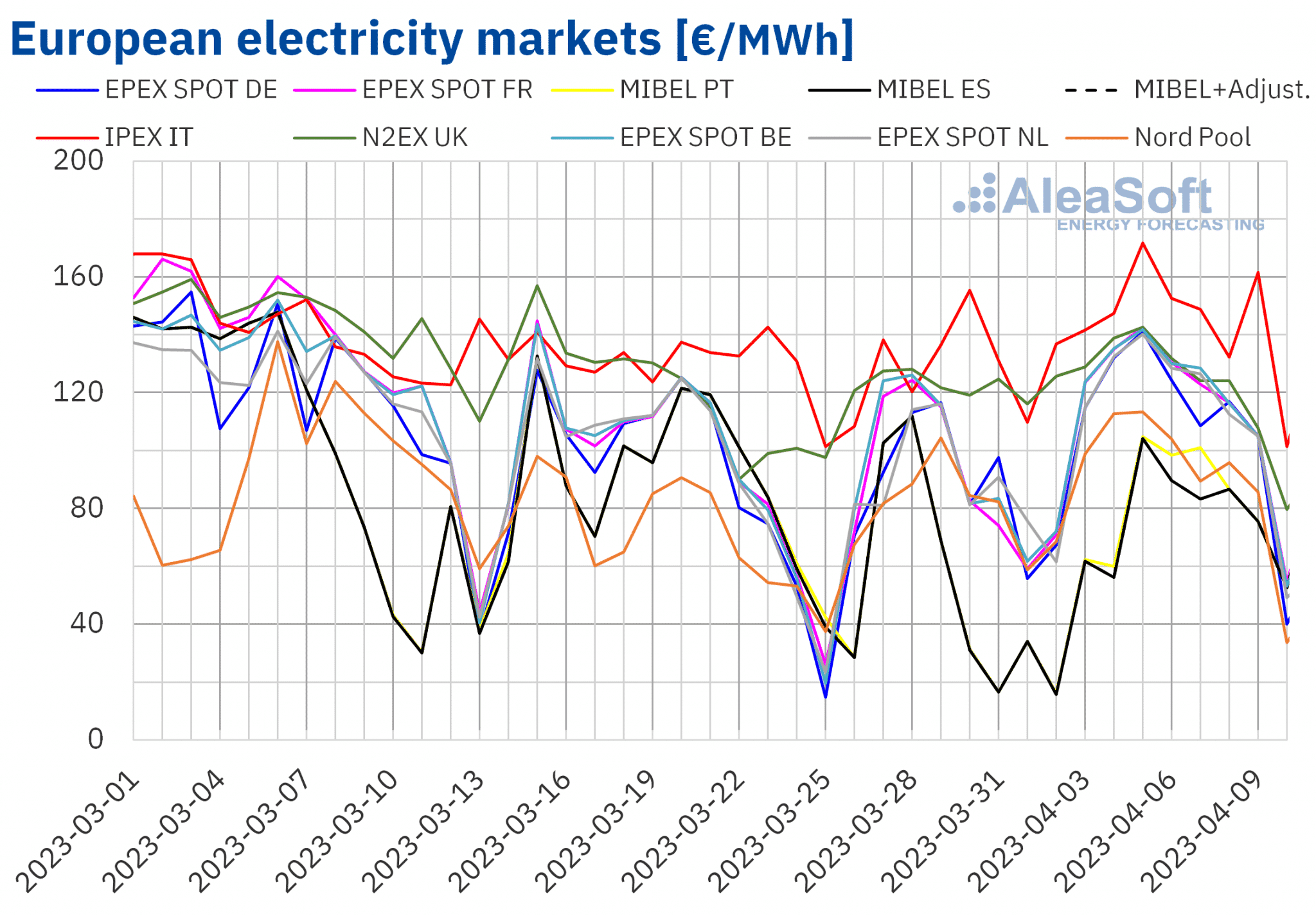

European electricity markets

In the week of April 3, prices of all European electricity markets analysed at AleaSoft Energy Forecasting rose compared to the previous week. The highest price rise, of 54%, was that of the MIBEL market of Portugal, followed by the 46% increase of the Spanish market. On the other hand, the smallest increases, of 4.1% and 14%, were registered in the N2EX market of the United Kingdom and the IPEX market of Italy, respectively. In the rest of the markets, the increases were between 23% of the Nord Pool market of the Nordic countries and 39% of the EPEX SPOT market of the Netherlands.

In the first week of April, the highest average price, of €150.79/MWh, was that of the Italian market. On the other hand, the lowest weekly average was that of the Spanish market, of €79.59/MWh, followed by that of the Portuguese market, of €84.10/MWh. In the rest of the analysed markets, prices were between €100.00/MWh of the Nordic market and €128.28/MWh of the British market.

Regarding hourly prices, from April 9 to 11, prices below €1/MWh were registered in almost all analysed European markets, except in Italy and the United Kingdom. In addition, on Monday, April 10, negative hourly prices were registered in the German, Belgian, French and Dutch markets. On April 11, negative prices were registered in Germany and the Netherlands. The lowest price, of ?€30.00/MWh, was reached on April 11, from 14:00 to 15:00, in the Dutch market. This price was the lowest in this market since August 28, 2022.

During the week of April 3, the increase in average price of gas and CO2 emission rights, as well as the general drop in wind energy production compared to the previous week, led to the rise in prices in European markets, despite the decline in demand in most markets. However, the drop in demand during the weekend and on Easter Monday led to hourly prices below €1/MWh.

The AleaSoft Energy Forecasting’s price forecasting indicates that in the second week of April European electricity markets prices might drop, influenced by the general increase in wind energy production and the decrease in demand in most markets.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

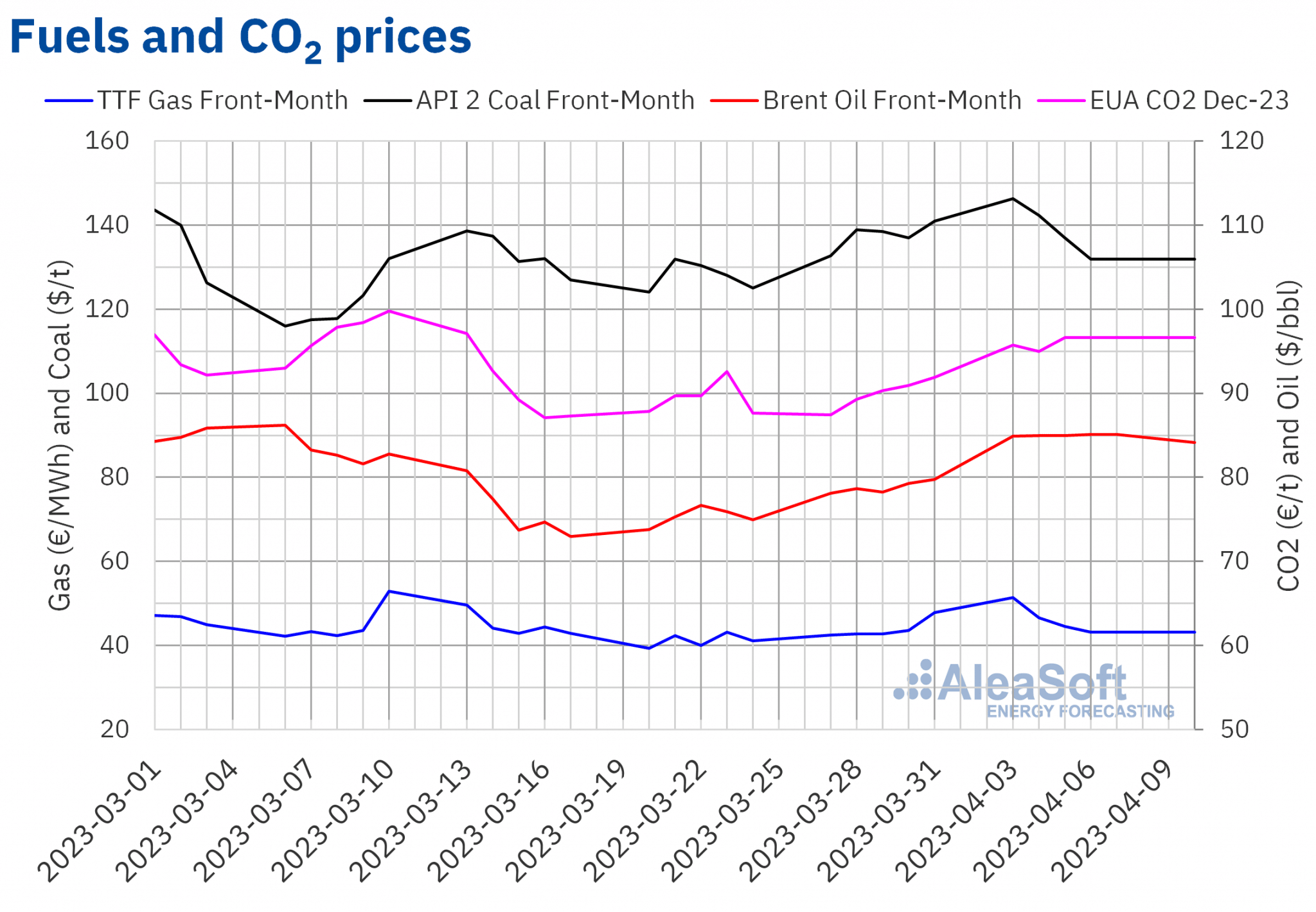

Brent, fuels and CO2

After settlement prices of Brent oil futures for the Front?Month in the ICE market remained below $80/bbl during the second half of March, in the first week of April values higher than $84/bbl were registered. On Monday, April 3, a settlement price of $84.93/bbl was registered, 6.5% higher than that of the last session of the previous week. In the following sessions of the week, prices continued to rise gently until reaching the weekly maximum settlement price, of $85.12/bbl, on Thursday, April 6. This price was 7.4% higher than that of the previous Thursday and the highest since March 6.

The announcement of production cuts by the OPEC+ starting in May, made on Sunday, April 2, favoured the increase in Brent oil futures prices of the first week of April. The decrease in US crude oil reserves also contributed to the increases registered in that week.

Regarding TTF gas futures in the ICE market for the Front?Month, they reached a settlement price of €51.37/MWh on Monday, April 3. This price was 21% higher than that of the previous Monday and the highest since March 10. But, during the rest of the sessions of the first week of April, prices fell. The weekly minimum settlement price, of €43.12/MWh, was registered on Thursday, April 6, and it was 1.1% lower than that of the previous Thursday.

The levels of European reserves continue to be above the usual levels for the time of year, exerting their downward influence on TTF gas futures prices. However, in the case of France, the levels are lower than those of other countries due to strikes, which affect the liquefied natural gas terminals.

Regarding settlement prices of CO2 emission rights futures in the EEX market for the reference contract of December 2023, most sessions of the first week of April they remained above €95/t. The weekly minimum settlement price was slightly lower, of €94.96/t, and it was registered on Tuesday, April 4. Even so, this price was 6.3% higher than that of the previous Tuesday. On the other hand, on Thursday, April 6, the weekly maximum settlement price, of €96.66/t, was reached, which was also 6.3% higher than that of the previous Thursday, in addition to the highest since the first half of March.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe

The next webinar of the series of monthly webinars of AleaSoft Energy Forecasting and AleaGreen is scheduled for Thursday, April 20. On this occasion, there will be the participation of Raúl García Posada, director of ASEALEN, the Spanish Association of Energy Storage. In addition, Jorge Barcelona de Pedro, Head of Sustainable Solutions at Rolls Royce Solutions Ibérica, will participate in the analysis table after the Spanish version of the webinar. The topics analysed in the webinar will be the evolution and prospects of European energy markets and the vision of the future on the energy storage.

On the other hand, at AleaSoft Energy Forecasting studies are carried out for the optimisation of hybrid systems of renewable energy with energy storage, which allow maximising their income. In addition, consultancy on the energy markets is also offered.