In the second week of April, European electricity markets prices fell compared to the previous week, influenced by the decrease in gas and CO2 emission rights prices, as well as by the general increase in wind energy production and the drop in demand compared to the previous week. Negative hourly prices were registered in the EPEX SPOT market and during the weekend the solar energy took several hours to zero prices in the MIBEL market.

Solar photovoltaic and thermoelectric energy production and wind energy production

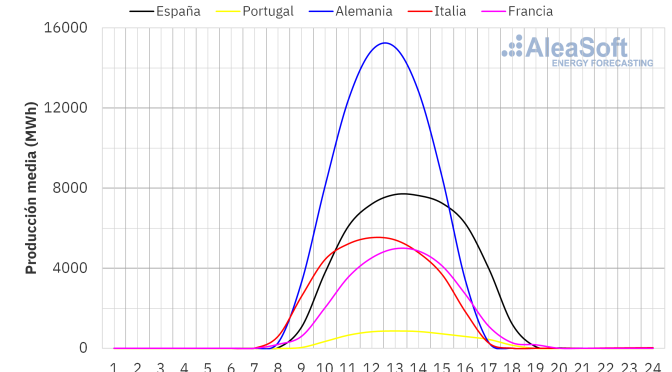

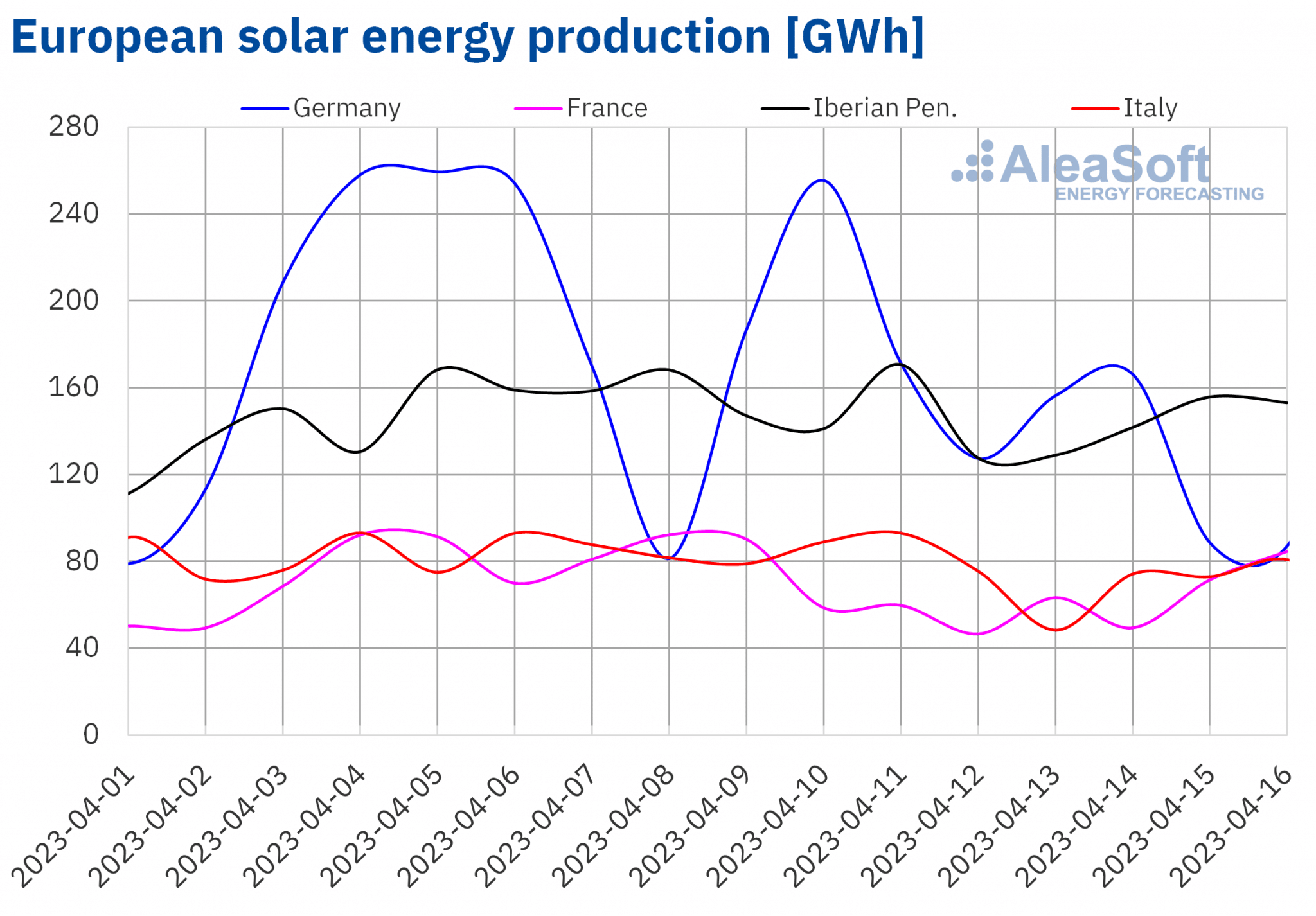

During the second week of April, the solar energy production increased by 0.2% compared to the previous week in the Portuguese market. On the other hand, in the rest of the European markets analysed at AleaSoft Energy Forecasting there were decreases, which were between 6.3% of Spain and 26% of France and Germany.

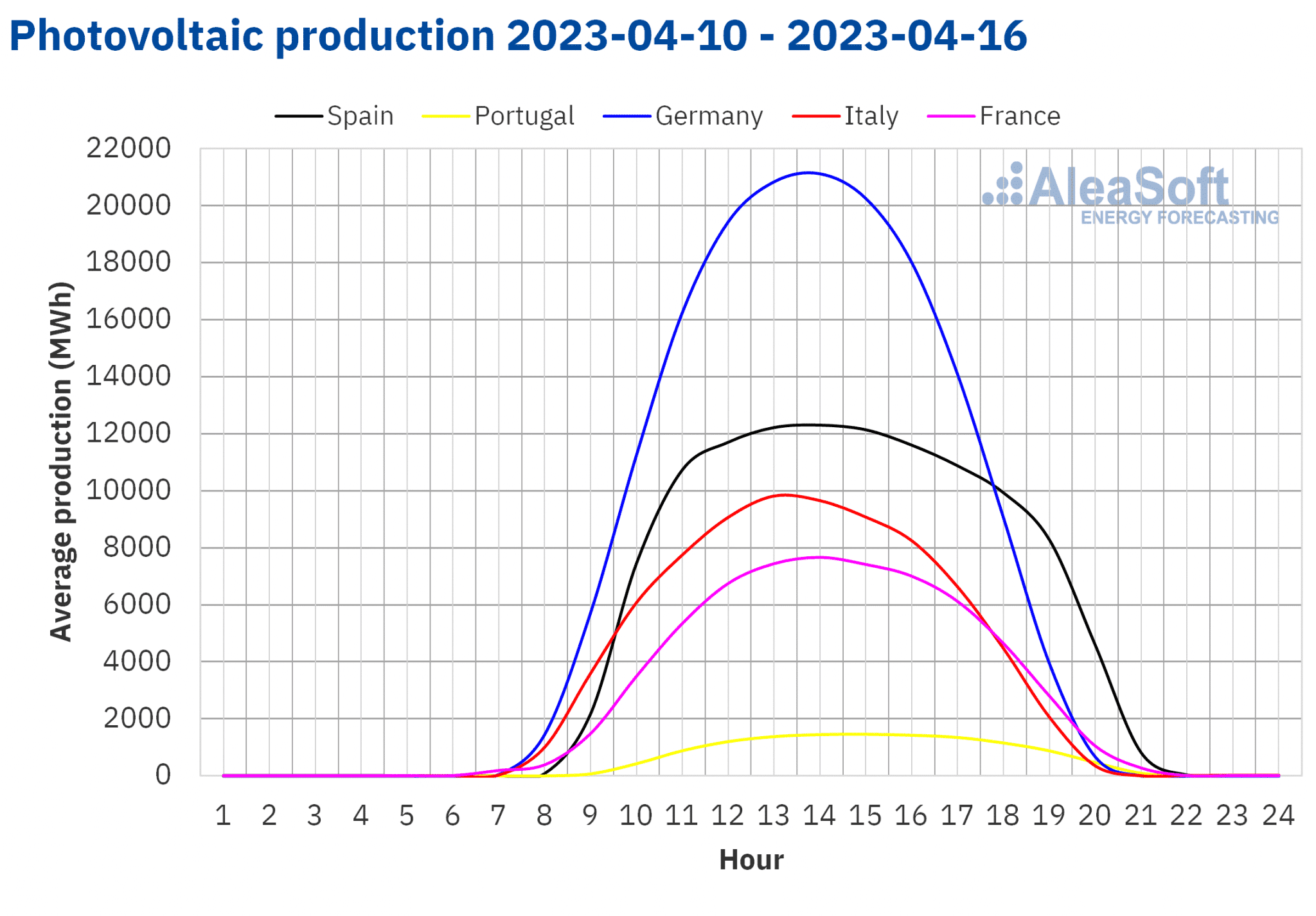

On the other hand, on Monday, April 10, from 12:00 to 13:00, a solar photovoltaic energy production of 34 383 MWh was registered in the German market, the highest since August 12, 2022 in this market. In the case of the Spanish market, the solar photovoltaic energy production reached a value of 14 498 MWh on Tuesday, April 11, from 13:00 to 14:00. This was the third highest value in history, after those registered on April 8.

For the third week of April, the AleaSoft Energy Forecasting’s solar energy production forecasting indicates that it might continue to decrease in Spain and Italy, while in Germany it might increase.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

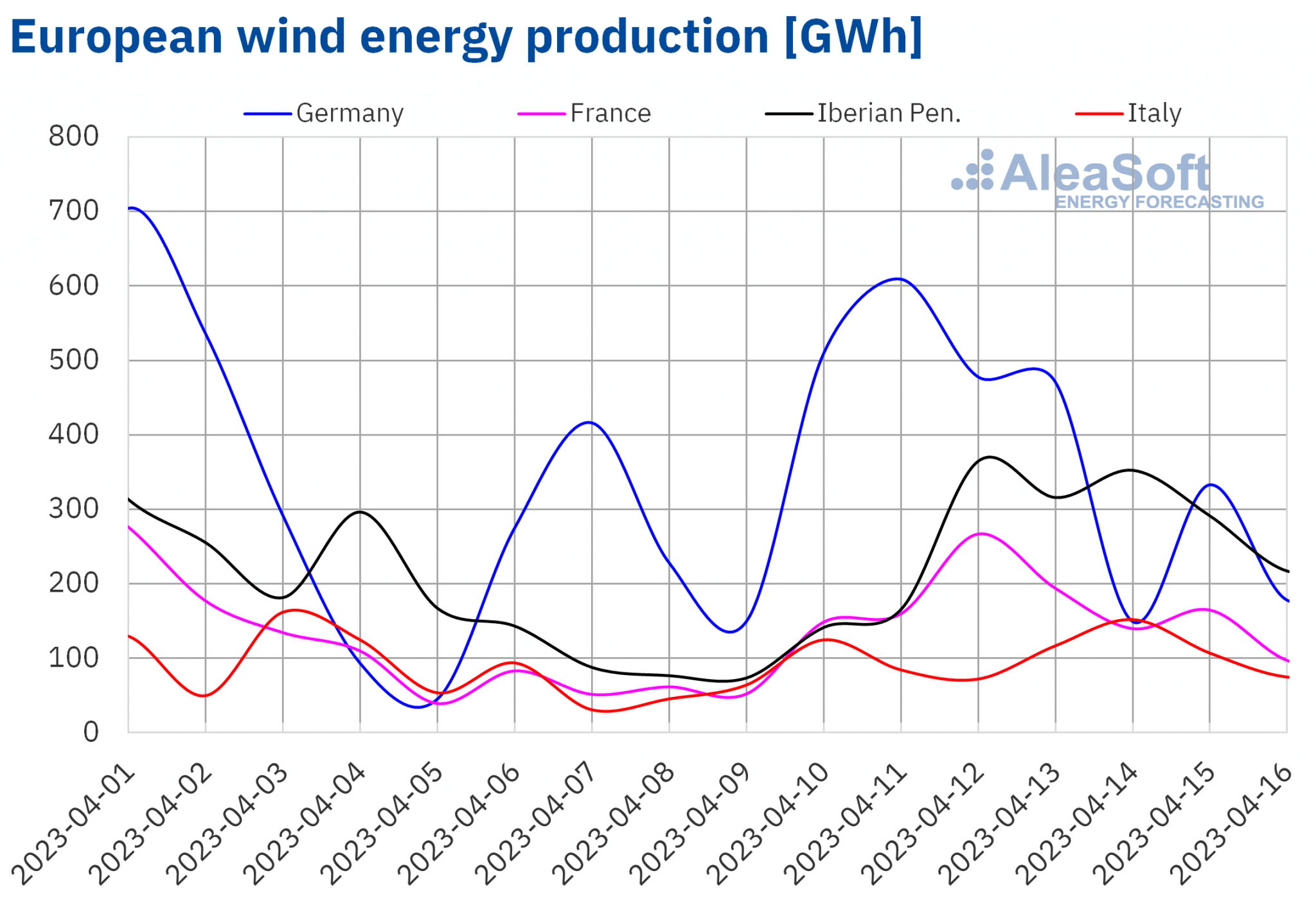

During the week of April 10, the wind energy production increased compared to the previous week in all European markets analysed at AleaSoft Energy Forecasting. The largest rise, of 146%, was that of the Portuguese market, while the smallest increase, of 27%, was registered in the Italian market. In the rest of the analysed markets, the increases were between 70% of the Spanish market and 120% of the French market.

For the week of April 17, the AleaSoft Energy Forecasting’s wind energy production forecasting indicates that the production might decrease in all analysed markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

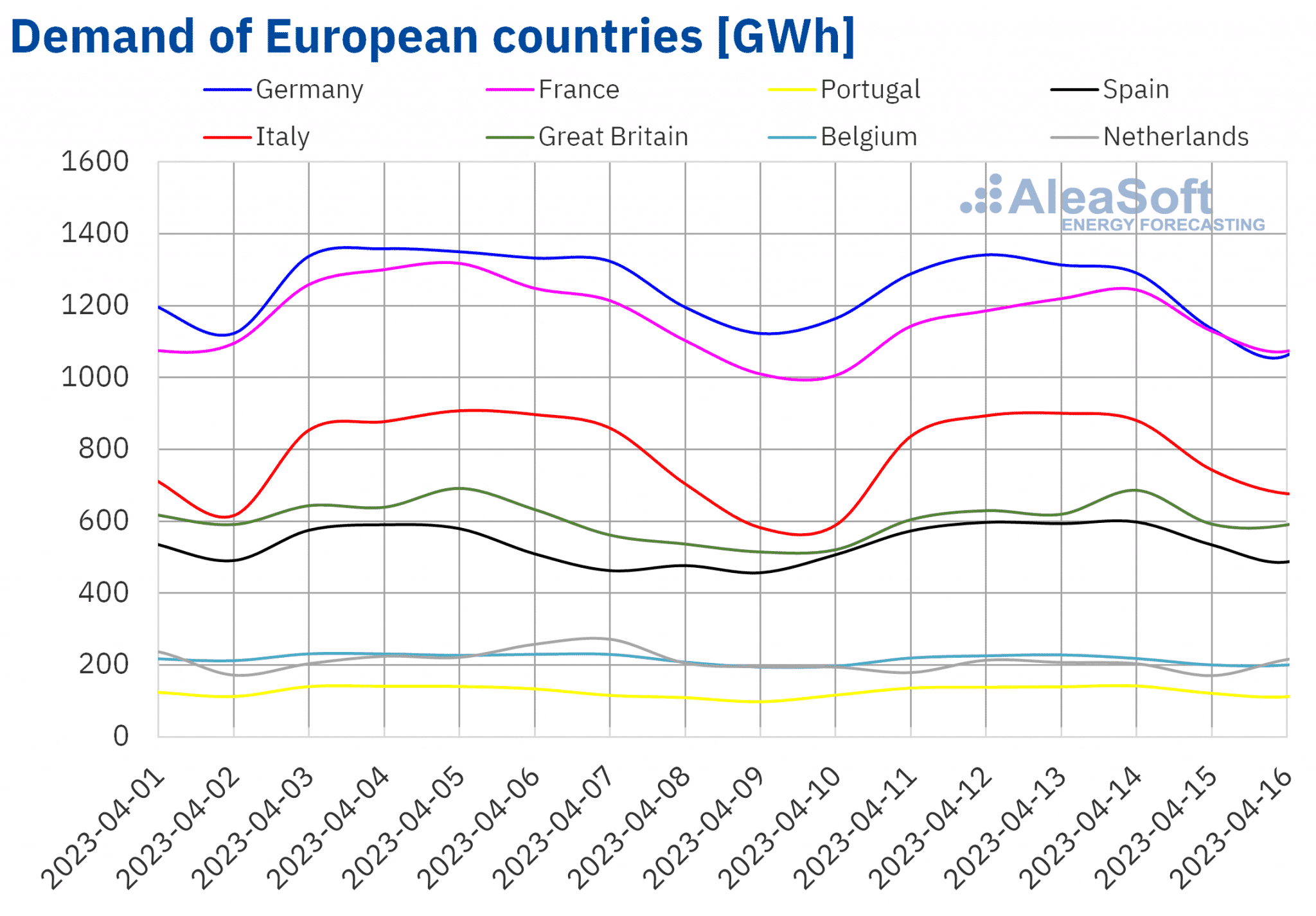

Electricity demand

In the week of April 10, the electricity demand fell in most European markets analysed at AleaSoft Energy Forecasting compared to the previous week. The exceptions were the British, Portuguese and Spanish markets, with increases of 0.6%, 3.1% and 6.5%, respectively. On the other hand, the largest fall, of 12%, was that of the Dutch market. In the rest of the markets, the demand fell between 2.8% of the Italian market and 5.3% of the French market.

In the second week of April, in addition to the holiday of Easter Monday, the general increase in average temperatures favoured the drop in demand in most markets.

For the week of April 17, according to the demand forecasting made by AleaSoft Energy Forecasting, the demand is expected to increase in the European markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

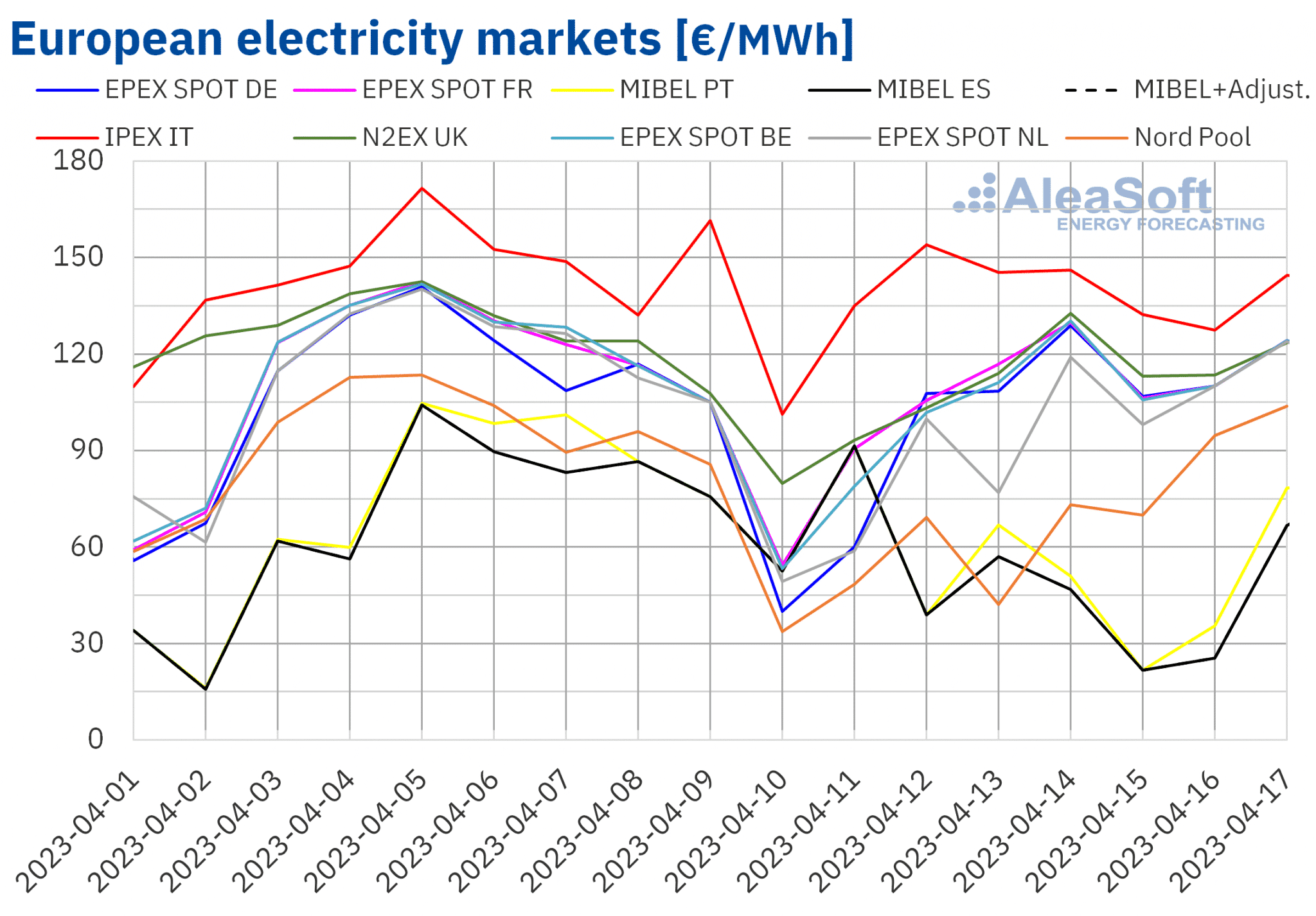

European electricity markets

In the week of April 10, prices of all European electricity markets analysed at AleaSoft Energy Forecasting fell compared to the previous week. The largest drop in prices, of 40%, was that of the MIBEL market of Spain, followed by the decreases of 38% and 39% registered in the Nord Pool market of the Nordic countries and in the Portuguese market, respectively. On the other hand, the smallest decrease, of 11%, was registered in the IPEX market of Italy. In the rest of the markets, the falls were between 17% of the N2EX market of the United Kingdom and 29% of the EPEX SPOT market of the Netherlands.

In the second week of April, the highest average price, of €134.50/MWh, was that of the Italian market. On the other hand, the lowest weekly average was that of the Spanish market, of €47.68/MWh, followed by that of the Portuguese market, of €51.12/MWh. In the rest of the analysed markets, prices were between €61.58/MWh of the Nordic market and €107.09/MWh of the British market.

Regarding hourly prices, in the second week of April, prices equal to or less than €0/MWh were registered in most analysed European markets. On Saturday, April 15, in the afternoon, one hour with a price of €0/MWh was registered in both the Spanish market and the Portuguese market, while on Sunday, April 16, seven consecutive hours were registered with this price in the Spanish market. On the other hand, negative prices were reached in the German, Belgian, French and Dutch markets on Monday, April 10, in the afternoon. There were also negative prices on the 11th in Germany and the Netherlands. In this last market, the negative hourly prices repeated on Thursday, April 13. The lowest hourly price, of ?€50.07/MWh, was reached on April 13, from 14:00 to 15:00, in the Dutch market. This price was the lowest in this market since July 24, 2022.

During the week of April 10, the decrease in average price of gas and CO2 emission rights led to the fall in European markets prices. The general increase in wind energy production compared to the previous week and the decrease in demand in most markets also contributed to this behaviour. In the MIBEL market, the zero prices were also favoured by the high solar energy production registered in a period of lower electricity demand such as the weekend, in which, in addition, temperatures were mild.

The AleaSoft Energy Forecasting’s price forecasting indicates that in the third week of April European electricity markets prices might increase, influenced by the increase in demand and the general decrease in wind energy production.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

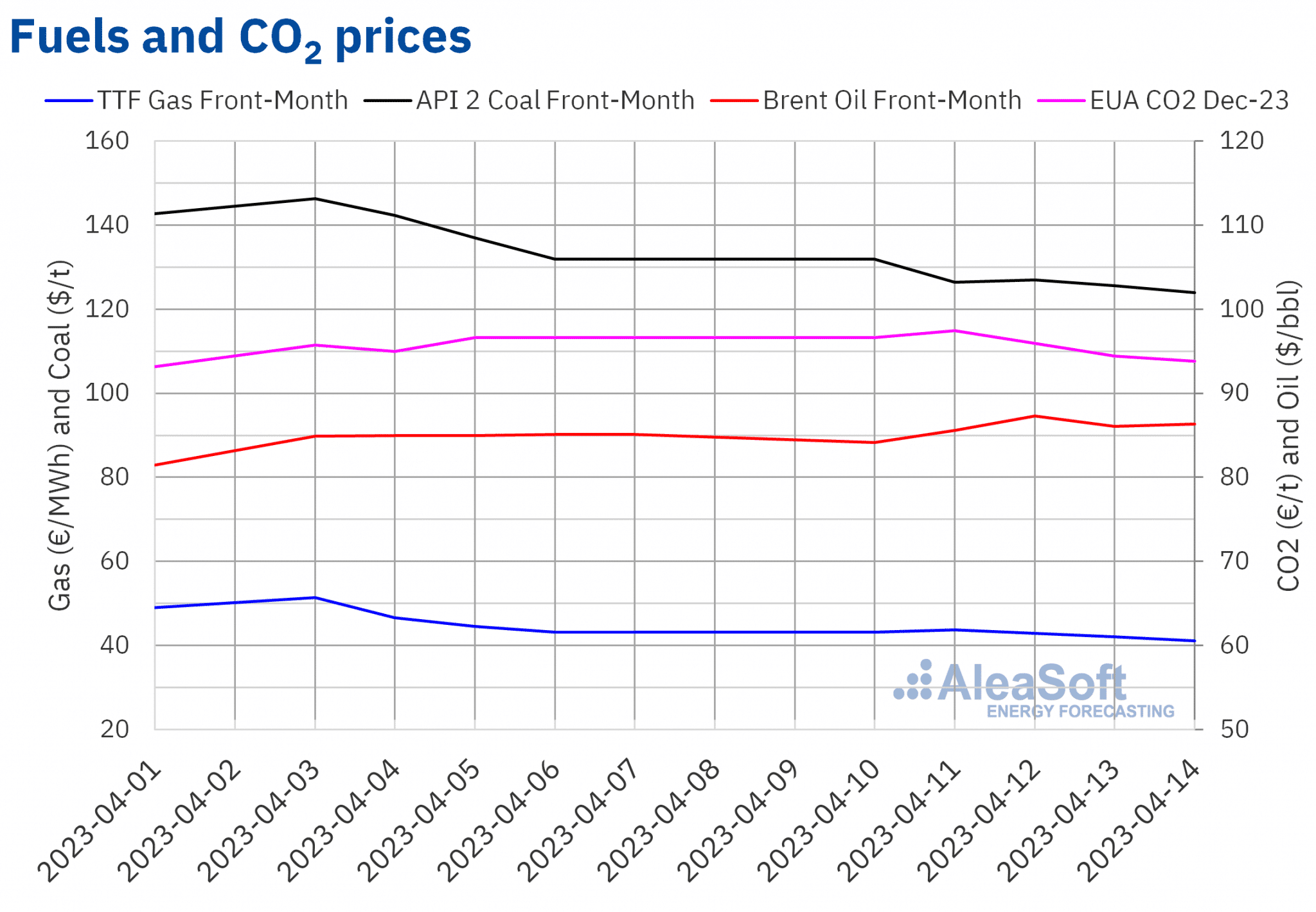

Brent, fuels and CO2

Brent oil futures for the Front?Month in the ICE market, on Monday, April 10, registered the weekly minimum settlement price, of $84.18/bbl, which was 0.9% lower than that of the previous Monday. Subsequently, prices increased until reaching the weekly maximum settlement price, of $87.33/bbl, on Wednesday, April 12. This price was 2.8% higher than that of the previous Wednesday and the highest since January 26. The settlement prices of the last sessions of the week were lower, but they remained above $86/bbl.

In the second week of April, the production cuts announced by the OPEC+ continued to favour the increase in Brent oil futures prices. But the publication of the data on the increase in crude oil reserves of the United States exerted its downward influence on these prices. At the end of the week, the publication of the demand growth forecasts of the International Energy Agency helped to keep prices above $86/bbl. In the coming days, the publication of China’s economic data for the first quarter might also influence price evolution.

As for TTF gas futures in the ICE market for the Front?Month, on Tuesday, April 11, the weekly maximum settlement price, of €43.69/MWh, was reached, which was 6.2% lower than that of the previous Tuesday. Subsequently, prices fell and the weekly minimum settlement price, of €41.15/MWh, was registered on Friday, April 14. This price was the lowest since March 24.

The abundant supply of liquefied natural gas by sea and the decrease in demand associated with higher average temperatures favoured the decrease in TTF gas futures prices in the second week of April. In addition, European reserves levels are increasing. But, in the case of France, strikes caused current levels to be low.

Regarding CO2 emission rights futures in the EEX market for the reference contract of December 2023, on Tuesday, April 11, they reached the weekly maximum settlement price, of €97.44/t. This price was 2.6% higher than that of the previous Tuesday and the highest since March 10. The rest of the week, price declines were registered. As a consequence, on Friday, April 14, the weekly minimum settlement price, of €93.84/t, was registered, the lowest since the end of March.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe

This Thursday, April 20, at 10:00 CET, the next webinar of the series of monthly webinars of AleaSoft Energy Forecasting and AleaGreen will be held. In addition to the evolution and prospects of European energy markets, the vision of the future on the energy storage will be analysed. Raúl García Posada, director of ASEALEN, the Spanish Association of Energy Storage, will participate as a speaker in this webinar. In the analysis table after the Spanish version of the webinar, there will also be the participation of Jorge Barcelona de Pedro, Head of Sustainable Solutions at Rolls Royce Solutions Ibérica.

On the other hand, until the end of April, AleaSoft Energy Forecasting is carrying out a promotion of long?term price forecasts. These forecasts are essential when negotiating PPA. They are also fundamental for the portfolio valuation, due diligences, M&A, renewable energy projects financing, hybridisation and energy storage.