In the week of April 17, European electricity markets prices increased due to the fall in wind energy production and the increment in demand. However, in the MIBEL market of Spain and Portugal, seven zero hourly prices were registered on April 23. In the markets of Belgium and Netherlands there were several negative hourly prices on April 19. On the other hand, in Italy, hourly photovoltaic solar energy production reached a record value and, in Spain, it reached the second highest production value in history.

Solar photovoltaic and thermoelectric energy production and wind energy production

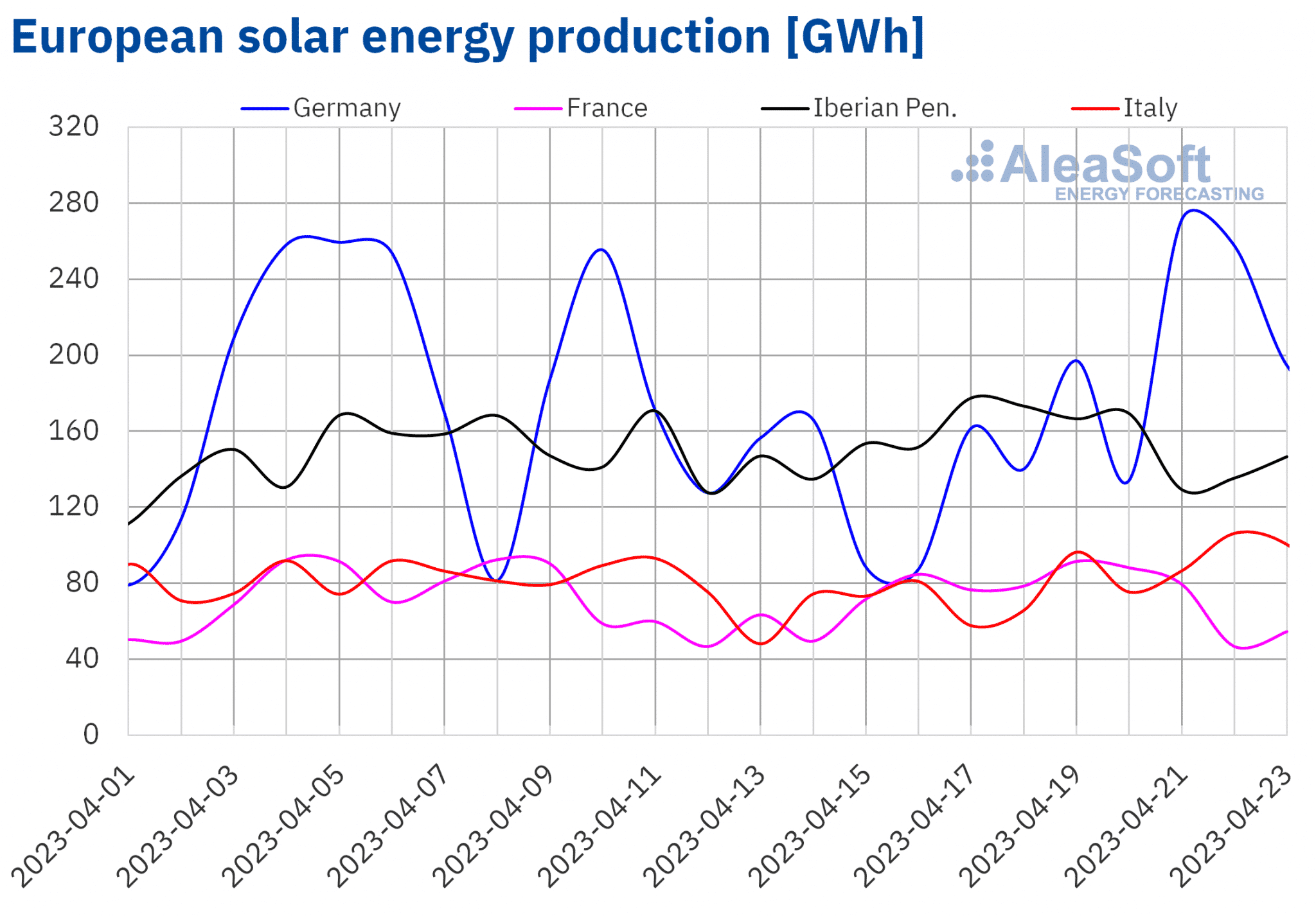

During the second week of April, the solar energy production increased in all European markets analysed in AleaSoft Energy Forecasting. The largest rise, of 29%, was that of the German market, while the smallest increase, of 0.6%, was that of the Portuguese market. In the rest of the markets, the increases were between 7.5% of the Spanish market and 19% of the French market.

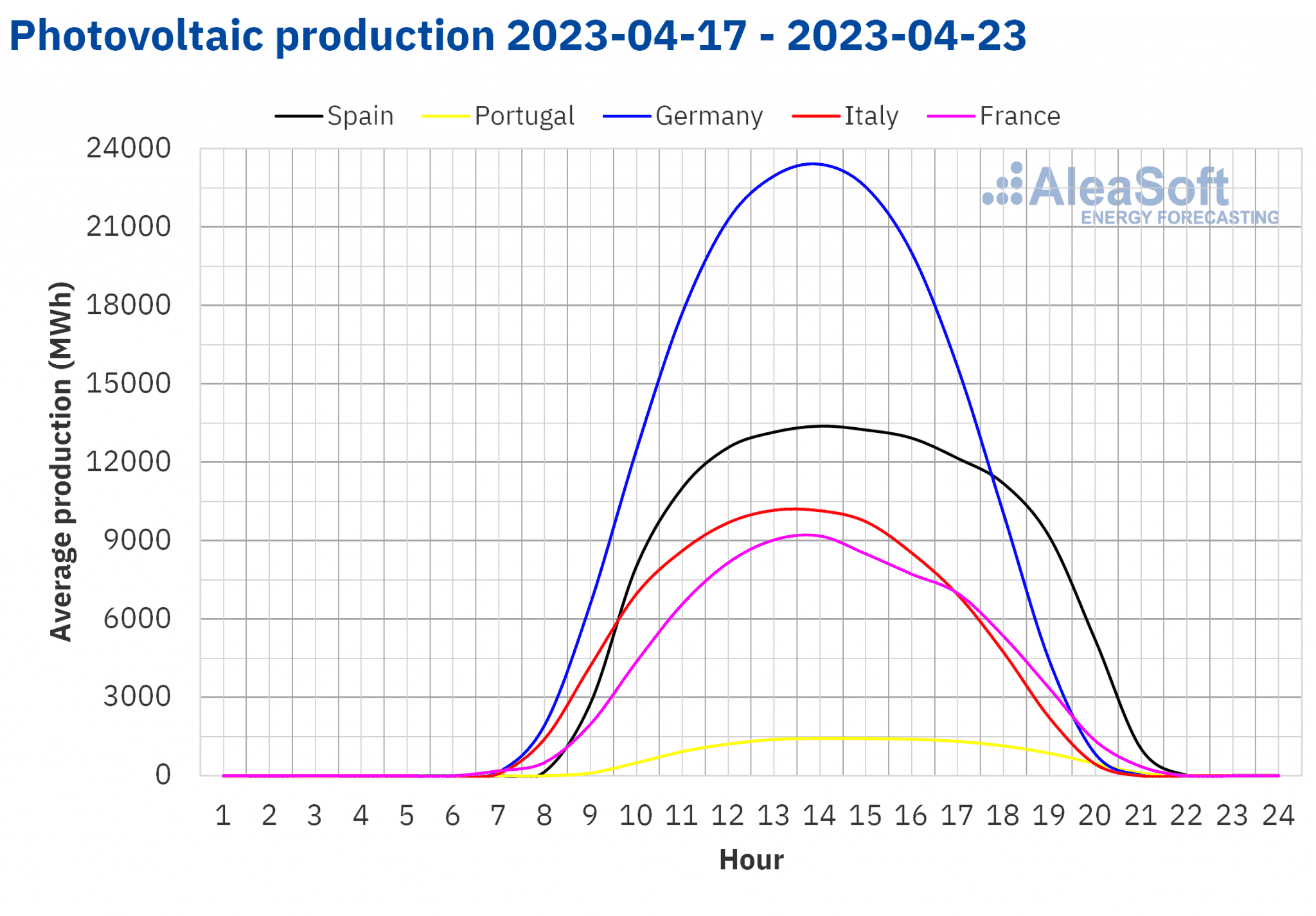

On the other hand, on Saturday, April 22, from 12:00 to 13:00, a record solar photovoltaic energy production of 12 660 MWh was registered in the Italian market. In the case of the Spanish market, the solar photovoltaic energy production reached a value of 14 580 MWh on Monday, April 17, from 13:00 to 14:00. This was the second highest value in history, after those registered on April 8. Regarding Spanish thermoelectric energy production, on Monday, April 17, from 12:00 to 13:00, a value of 2086 MWh was registered, the highest value since May 2022. Lastly, on the German market, on Friday, April 21, from 13:00 to 14:00, a solar photovoltaic energy production of 34 697 MWh was reached, the highest since August 2022 in this market.

For the fourth week of April, the AleaSoft Energy Forecasting’s solar energy production forecasting indicates that it might continue to decrease in Spain and Italy, while in Germany it might increase.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

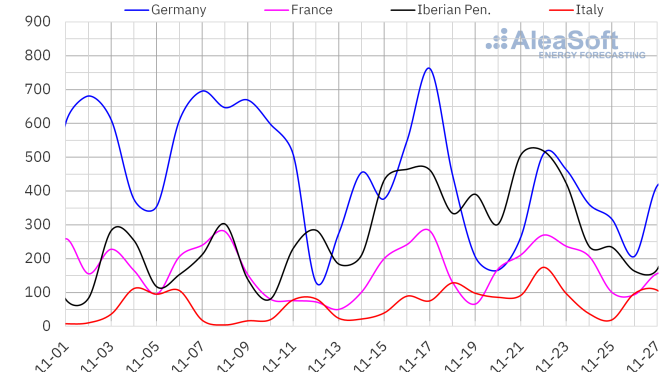

During the week of April 17, the wind energy production increased 1.7% in the German market compared to the previous week. However, decreases were registered in the rest of European markets analysed at AleaSoft Energy Forecasting, which were between 25% of the French market and 69% of the Italian market.

For the week of April 24, the Aleasoft Energy Forecasting’s wind energy production forecasting indicates that the production might increase in the Italian market and decrease in the rest of the analysed markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

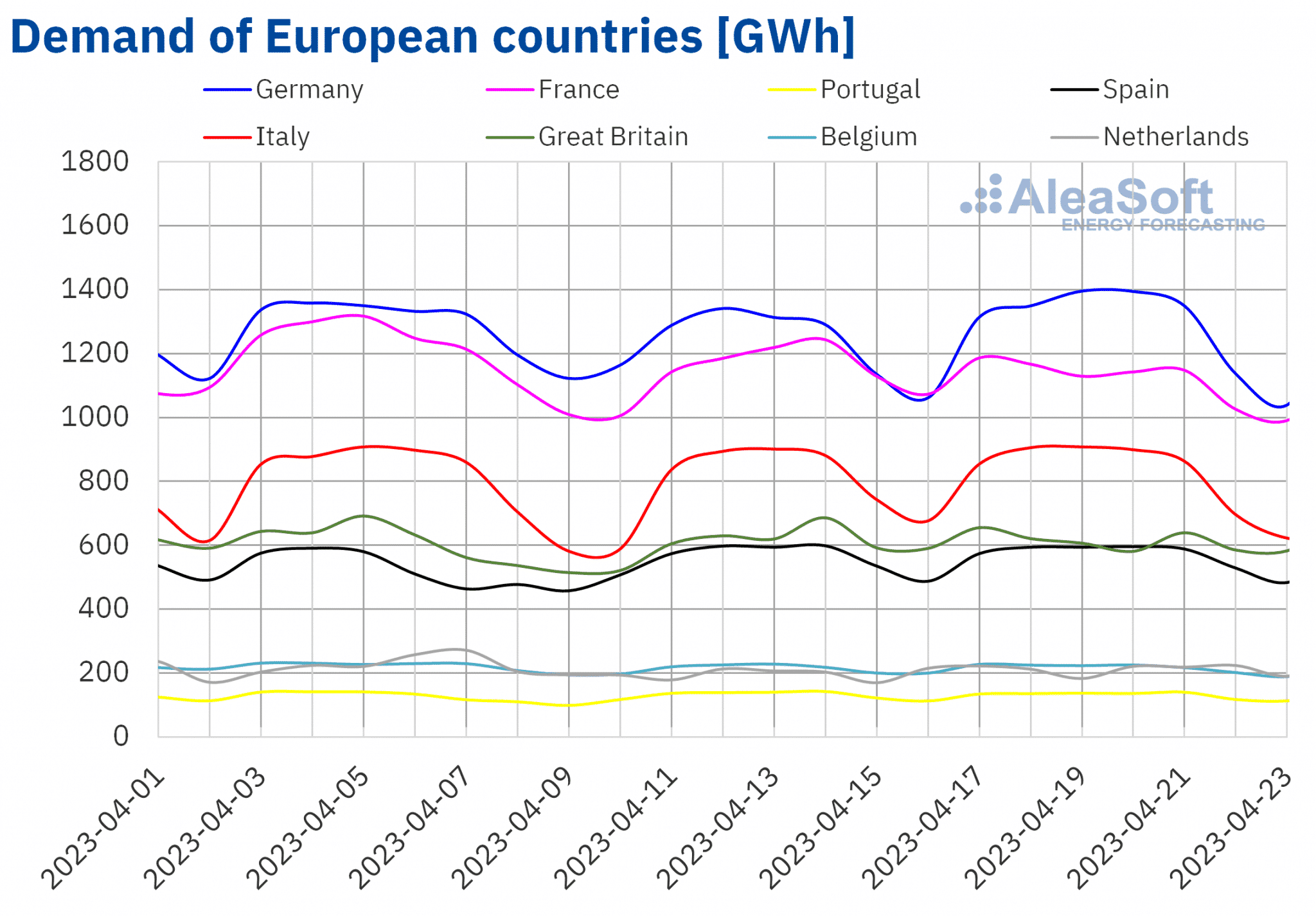

Electricity demand

In the week of April 10, the electricity demand increased in almost all European markets analysed at AleaSoft Energy Forecasting compared to the previous week. The exception was the French market, with a decrease of 2.6%. On the other hand, the largest rise, of 6.6%, was that of the Dutch market. In the rest of the markets, the demand increased between 0.5% of the Portuguese market and 4.5% of the German market.

In the third week of April, the demand recovered compared to the previous week, influenced by the holiday of Easter Monday in most markets. Also, in the Spanish and Belgian markets, slight increases were registered in average temperatures compared to the previous week.

For the week of April 24, according to the demand forecasting made by AleaSoft Energy Forecasting, the demand is expected to keep increasing in most European markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

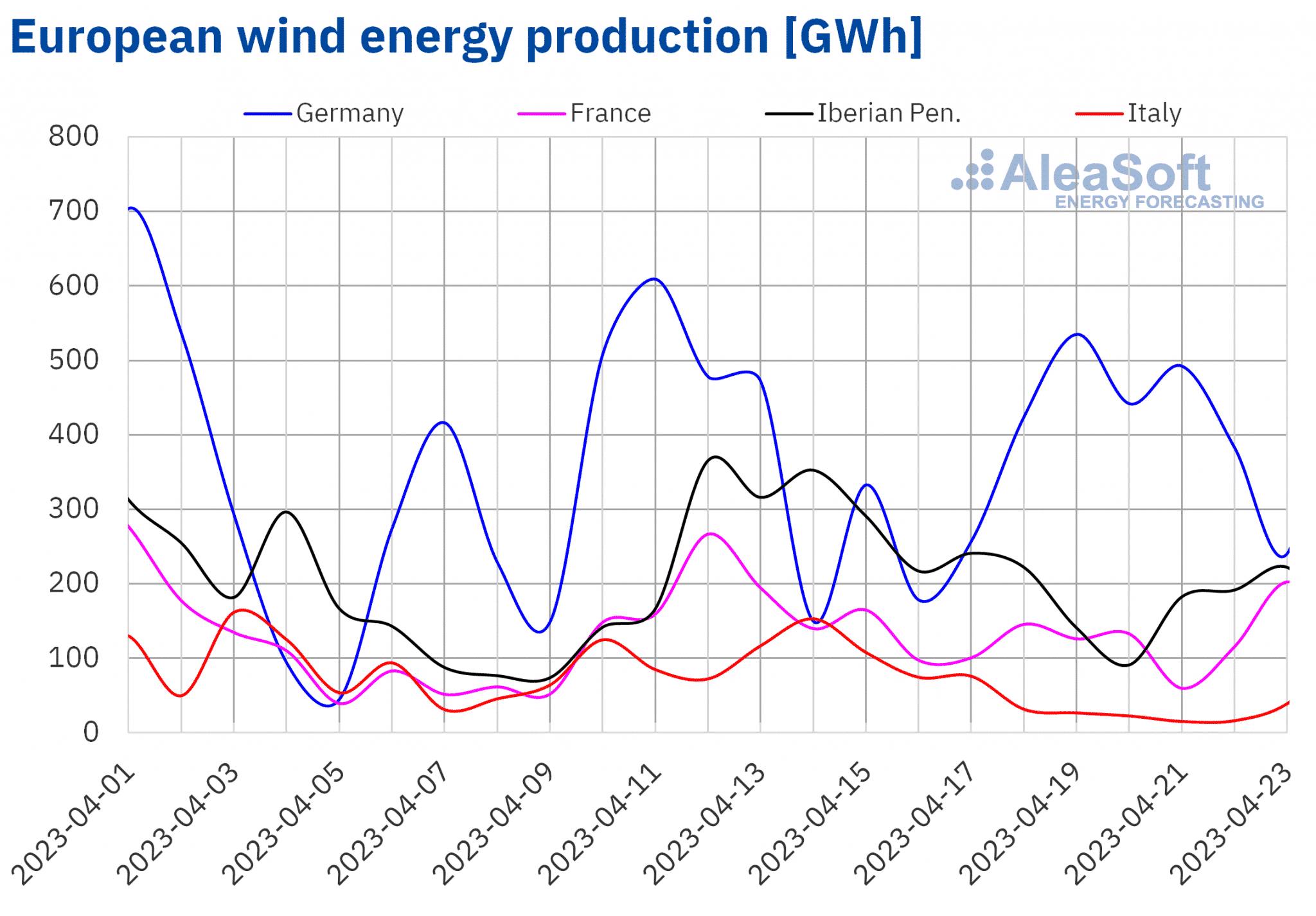

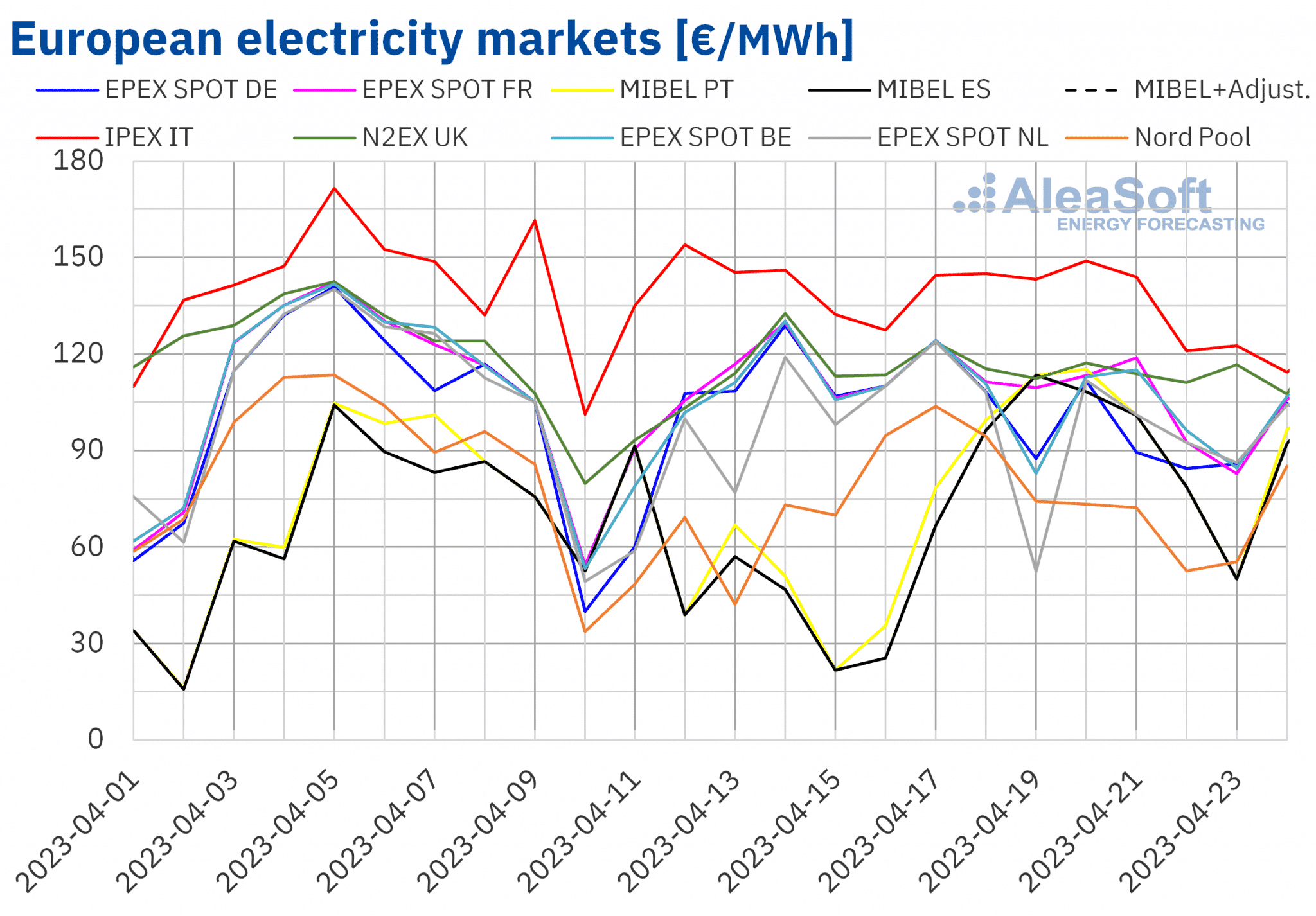

European electricity markets

In the week of April 17, prices of all European electricity markets analysed at AleaSoft Energy Forecasting increased compared to the previous week. The largest rise in prices, of 84%, was that of the MIBEL market of Spain, followed by the increase of 78% of the Portuguese market. On the other hand, the smallest increase, of 2.9%, was registered in the IPEX market of Italy. In the rest of the markets, the rises were between 4.5% of the EPEX SPOT market of Germany and 22% of the Nord Pool market of the Nordic countries.

In the third week of April, the highest average price, of €138.46/MWh, was that of the Italian market. On the other hand, the lowest weekly average was that of the Nordic market, of €75.14/MWh. In the rest of the analysed markets, prices were between €87.75/MWh of the Spanish market and €115.75/MWh of the British market.

Regarding hourly prices, in the MIBEL market of Spain and Portugal, on Sunday, April 23, seven zero hourly prices were registered, between 10:00 and 12:00 and between 14:00 and 19:00, due to the the combination of a high solar energy production and a Sunday with spring temperatures when demand is lower. In these markets, zero hourly prices were also registered on the previous weekend.

On the other hand, in the Belgian and Dutch markets, negative hourly prices were registered on Wednesday, April 19. In the case of Belgium, four negative hourly prices were registered, while in Netherlands, six negative hourly prices were registered. The lowest hourly price, of ?€195.41/MWh, was reached, from 14:00 to 15:00, in the Dutch market. This price was the fourth lowest in this market since the record price values of April 23.

During the week of April 17, the decrease in wind energy production and the increment in demand in most of the markets led to higher prices in European electricity markets, despite the fall in average gas and CO2 emission rights prices and the general increase in the solar energy production compared to the previous week.

The AleaSoft Energy Forecasting’s price forecasting indicates that in the fourth week of April European markets prices might increase, influenced by the decrease on the wind energy production and the increase of the demand in most of the markets.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

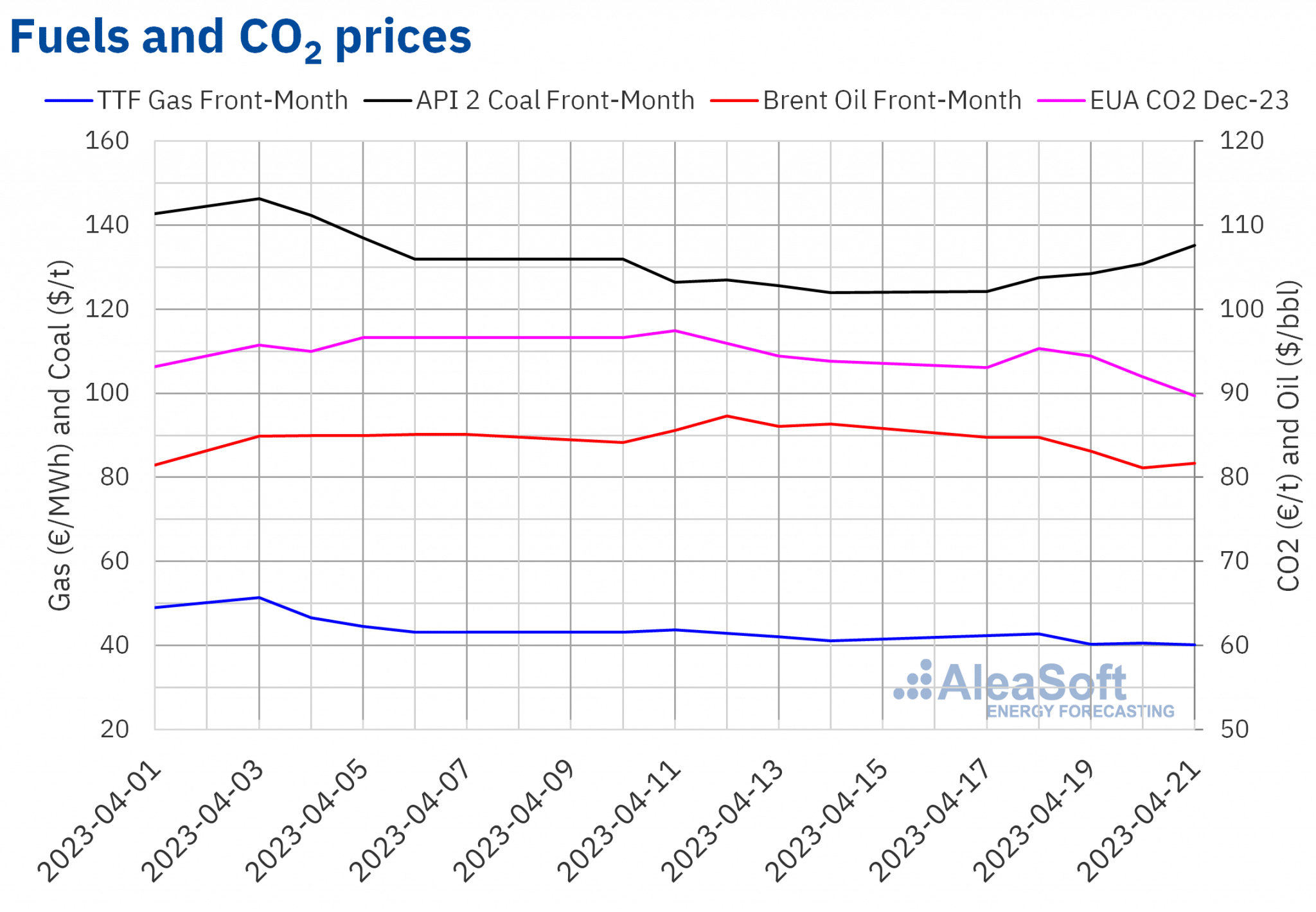

Brent, fuels and CO2

Brent oil futures for the Front?Month in the ICE market kept below $85/bbl during the third week of April. The highest weekly settlement price, of $84.77/bbl, was reached on Tuesday, April 18, and it was 1.0% lower than that of the previous Tuesday. Subsequently, prices decreased until reaching the weekly minimum settlement price, of $81.10/bbl, on Thursday, April 20. This price was 5.8% lower than that of the previous Thursday and the lowest since end of March.

In the third week of April, the fear to a decrease in demand due to a possible economy recession kept the Brent futures prices below $85/bbl. These concerns were aggravated by the unemployment data of the United States. Expectations of further interest rate increases also contributed to a decrease in prices. However, the beginning of the new production cuts performed by the OPEP+ in May might exert an upward influence in prices.

As for TTF gas futures in the ICE market for the Front?Month, the week began with an increase in prices and, on Tuesday, April 18, they reached the weekly maximum settlement price, of €42.72/MWh, although this price was 2.2% lower compared to the previous Tuesday. In the rest of the week settlement prices kept below €41/MWh. The weekly minimum settlement price of €40.16/MWh was registered on Friday, April 21. This price was 2.4% lower than that of the previous Friday and the lowest since March 22.

In the third week of April, abundant supplies of liquefied natural gas allowed European stock levels to continue to rise. A lower demand than in previous years also contributed to the decrease in TTF gas futures prices.

Regarding CO2 emission rights futures in the EEX market for the reference contract of December 2023, they kept above €90/t most of the third week of April. On Tuesday, April 18, the maximum weekly settlement price of €95.31/t was reached. But this price was 2.2% lower than that of the previous Tuesday. In the rest of the week, price decreases were registered. As a consequence, on Friday, 21 April, the weekly minimum settlement price, of €89.72/t, was registered. This price was 4.4% lower than that of the previous Friday and the lowest since March 28.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe

On past April 20, the April webinar organised by AleaSoft Energy Forecasting and AleaGreen was held. In addition to the evolution and prospects of European energy markets, the vision of the future on the energy storage was analysed. Raúl García Posada, director of ASEALEN, the Spanish Association of Energy Storage, participated as a speaker in this webinar. In the analysis table after the Spanish version of the webinar, there was also the participation of Javier Gebauer, Direct Sales Manager at Rolls?Royce Solutions Berlin.

The next webinar of the series of monthly webinars of AleaSoft Energy Forecasting and AleaGreen is scheduled for May 11. In this case, the topics to be discussed will be the evolution and perspectives of the European energy markets, as well as the future vision of the energy sector. In the analysis table after the Spanish version of the webinar we will count with the participation of Luis Atienza Serna, who was Minister of Agriculture, Fisheries and Food in Spain during the last government of Felipe González.