The US Inflation Reduction Act of 2022 is widely regarded as a game-changer in the drive to net zero. As well as generous tax credits for investment in low-carbon technologies, the IRA outlined aggressive targets and incentives for domestically sourced raw materials and equipment. These promise to propel the US into the lead in the global race underway to reduce reliance on Chinese imports by building an indigenous supply chain.

Our January Horizons – ‘Boom time‘ – predicted that the IRA would spur investment in US renewables manufacturing, but was more sceptical as to how quickly the US manufacturing sector could deliver on the government’s ambitions. The prize for manufacturers is huge with the renewables development project pipeline now 438 GWac equivalent across wind, solar and storage.

On 12 May 2023 the US Internal Revenue Service (IRS) issued guidance on how project developers can earn the Domestic Content Requirement (DCR) bonus tax credit for their renewable energy projects. Our renewables team, Michelle Davis, Sylvia Leyva Martinez, Sagar Chopra and Daniel Liu, along with Prakash Sharma from our Energy Transition Service, shared their thoughts on the implications for the US and global renewables industry.

First, the DCR tax credit benefits vary by technology

The onshore wind industry is well-positioned to take advantage. Wind nacelles and hubs are already manufactured in the US, key components that will help developers meet the required DCR thresholds.

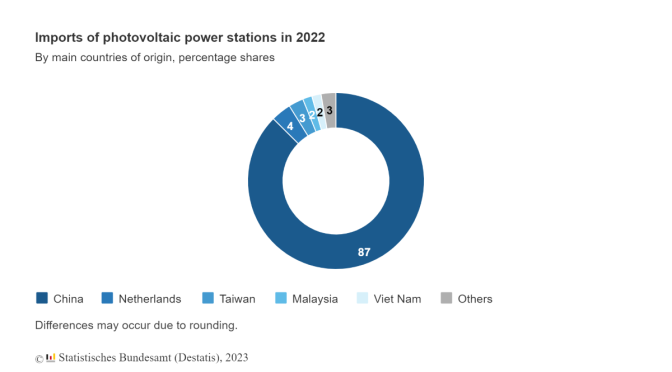

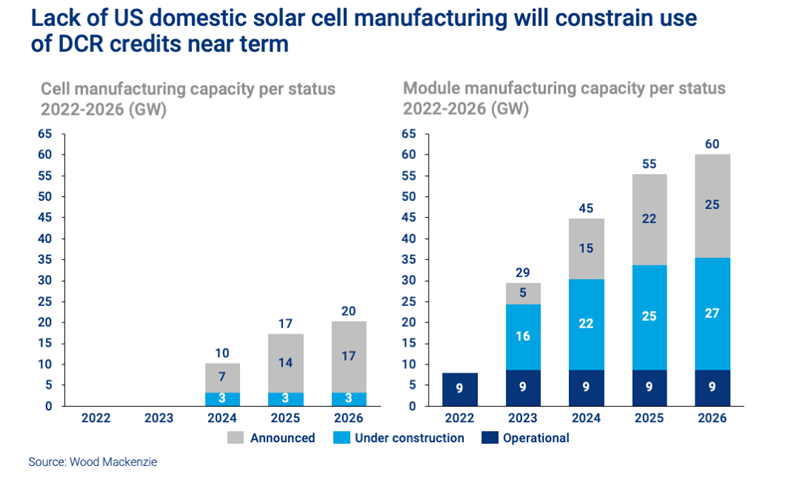

For solar, it will be much more challenging. While considerable investment is being deployed to expand module (panel) assembly capacity, existing investment for US solar cell manufacturing capacity will not be sufficient to supply domestic demand. Yet the IRS guidance dictates that a developer must procure modules with US-made solar cells.

Until cell manufacturing capacity matches module assembly capacity, imported cells will remain a key part of the panel assembly supply chain.

Absent these cells it will be extremely difficult for developers to achieve domestic content thresholds. We assess it will take at least 2-3 years to build facilities and ramp up production, longer still before solar projects qualifying for the DCR tax credit adder come online. Until cell manufacturing capacity matches module assembly capacity, imported cells will remain a key part of the panel assembly supply chain.

Second, the economic benefits of the DCR tax credit do not outweigh the higher costs of domestically made equipment

For every renewable energy technology analysed, Wood Mackenzie’s analysis shows that meeting DCR thresholds will increase overall CAPEX costs by 5% to 12%. Bonus tax credits on an NPV basis are worth a small fraction of those overall CAPEX costs and are insufficient to overcome the premium for using more expensive US-made equipment.

The duration of the available tax incentives is also unclear and may hinder investment.

Third, despite the challenges, the IRA will, in our view, stimulate investment in the US renewables manufacturing base

Project developers will want to support the build-out of a US supply chain ecosystem to hedge against the risk of disruption to the supply of imports.

Multiple trade policy issues (the Withhold Release Order, Uyghur Forced Labor Prevention Act, and the anticircumvention investigation) have snarled the US solar supply chain in the last two years. Domestically-made equipment, despite being more expensive, has a higher degree of traceability and ease of due diligence – both of which would have helped developers navigate these trade issues.

Manufacturers have instigated numerous announcements for US-located facilities and billions of dollars in potential investments, ready to take advantage of other provisions of the IRA such as the Advanced Manufacturing Production Credit.

Last, every country pursuing net zero wants to do what the US is doing – establish its own domestic low-carbon supply chain to reduce dependence on China

Most other countries may lack the low domestic energy costs that are a competitive advantage for US-based renewables manufacturers, but now that the US has thrown down the gauntlet, they have to respond.

Europe, with its aggressive targets for renewables and emerging low-carbon technologies, needs to send the right signals to equipment manufacturers. So far, the EU’s approach has been focused on sticks rather than carrots, including the Net Zero Industry Act (NZIA) that was adopted earlier this year. Carrots too are needed, and soon. These should be IRA-style tax incentives that are simple to understand and implement, ideally of long duration to underpin the sustained investment required.

The right incentives will ensure capital is invested in Europe’s renewables equipment manufacturing and reduce the risk that the money heads west across the Atlantic.

This week marks a new era for The Edge – I’ll be gathering and curating insight from fellow Wood Mackenzie analysts, bringing you new perspectives and different ideas from across the world of energy and natural resources.