European electricity markets: bullish prices due to increases in gas and CO2, but they stabilise with decreases at the end of the week.

In the penultimate week of June, the increases in gas and CO2 prices at the beginning of the week and the increase in demand caused rising prices in the European electricity markets. Towards the end of the week, gas and CO2prices fell, helping to lower prices. Even so, in the electricity markets the weekly average remained above that of the previous week. On the 24th, the highest photovoltaic energy production of the month was registered in Portugal and the highest solar thermal energy production of the year in Spain.

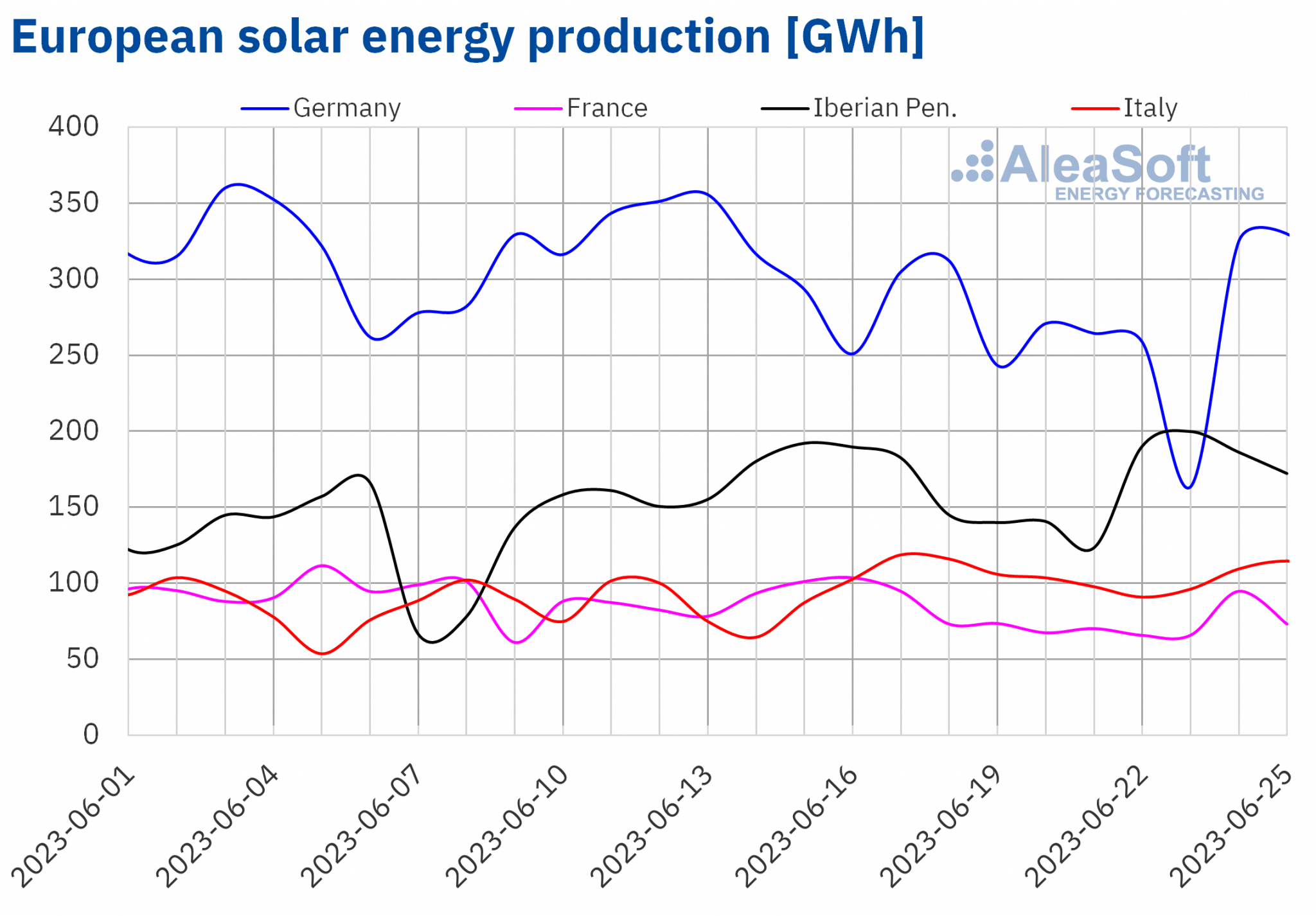

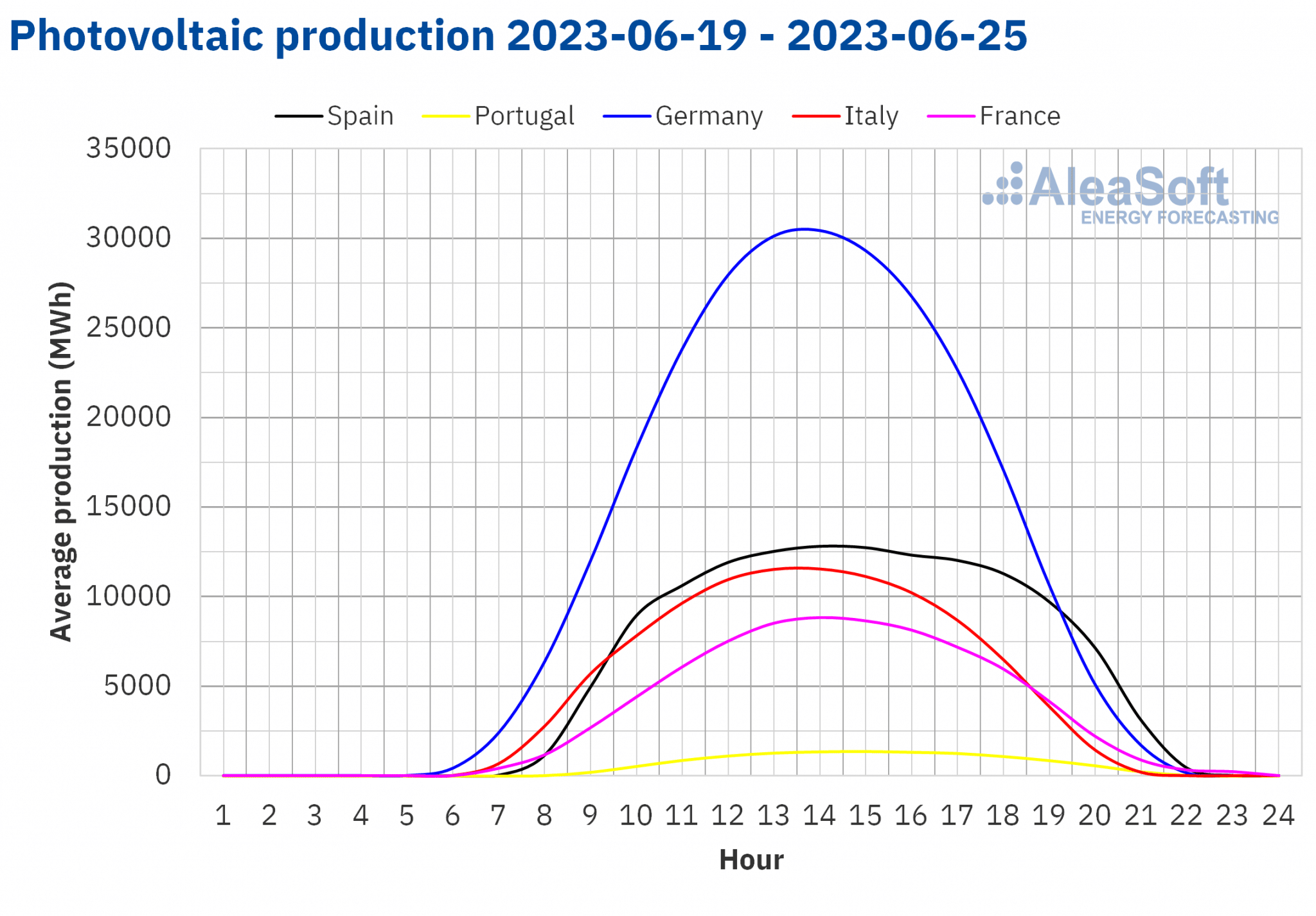

Solar photovoltaic and thermoelectric energy production and wind energy production

During the week of June 19, the highest solar photovoltaic energy production was registered hourly so far this month in the markets of Spain, with 14 595 MWh generated on Thursday, June 22 between 13:00 and 14:00, and Portugal, with 1 595 MWh, registered on Saturday, June 24, also between 13:00 and 14:00. Additionally, the Portuguese market registered the highest daily production so far this month, with 14.4 GWh generated on Saturday, June 24.

Regarding solar thermoelectric energy production in the Spanish market, the hourly and daily record for 2023 so far was registered on Saturday, June 24, with a production of 2 156 MWh between 18:00 and 19:00 and 30.6 GWh in the total for the day.

Compared to the previous week, solar energy production in the Italian market increased by 8.2%. However, in the rest of the main European markets, production with this technology decreased during the week as a whole. The largest decreases, of 19% and 15%, were registered in the markets of France and Germany, respectively, followed by the drop of 7.3% in Portugal and 3.3% in Spain.

For the last week of June, the AleaSoft Energy Forecasting solar energy production forecasts indicate that production will increase in Spain and that in Germany it will be similar to that registered during the previous week, while for Italy it is expected to decrease.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

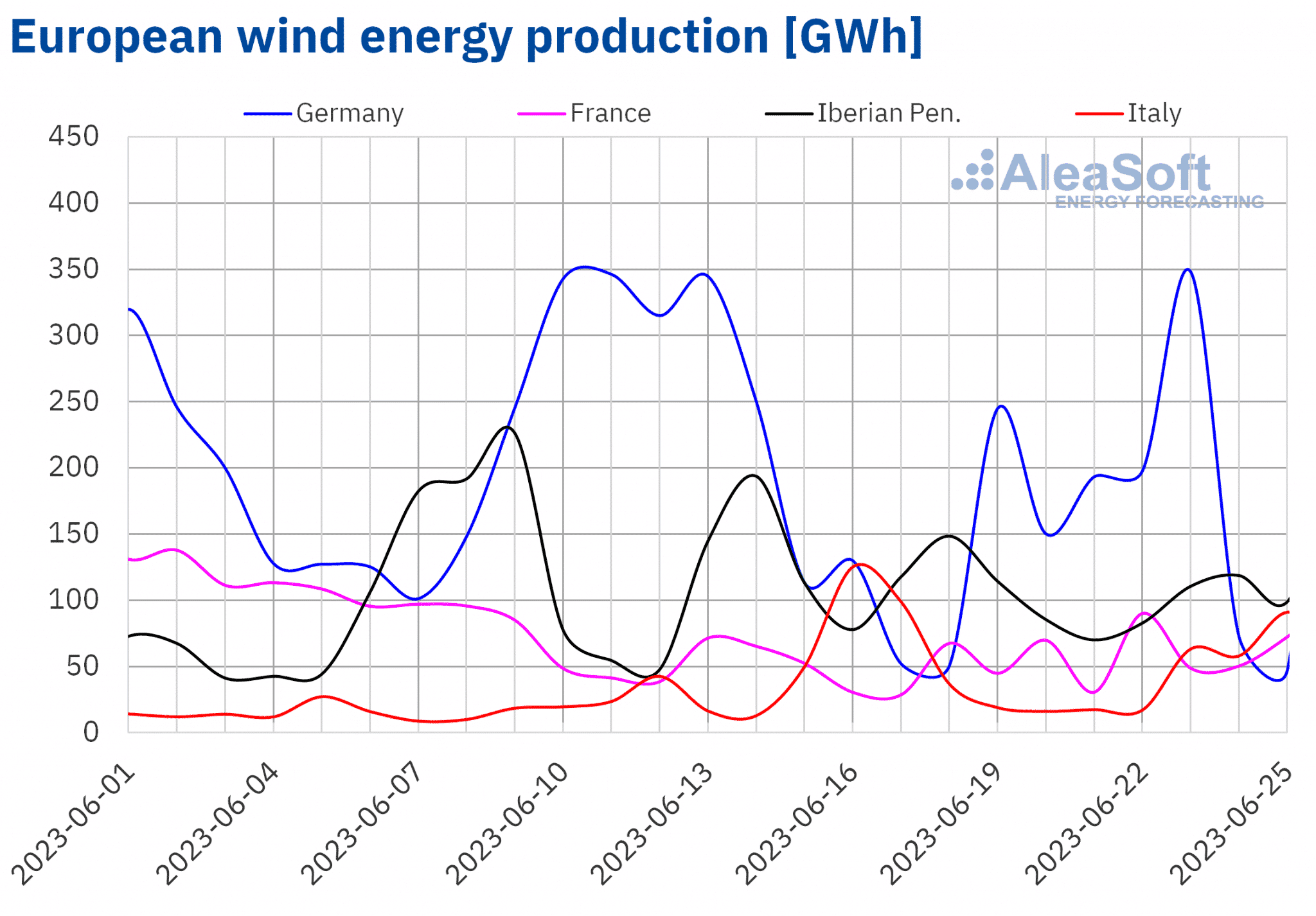

In the week of June 19, wind energy production decreased compared to the previous week in most of the main markets analysed. The exception was the French market, where production increased by 15%. On the other hand, the largest decreases were registered in the markets of Portugal and Italy, and were 29% and 26%, respectively. In the Spanish market the decrease was 18%, while in the German market the production was similar to that of the previous week, with a slight decline of 0.1%.

For the week of June 26, the AleaSoft Energy Forecasting wind energy production forecasts indicate that there will be increases in most of the main European markets analysed, except for the French market where it is expected to drop.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

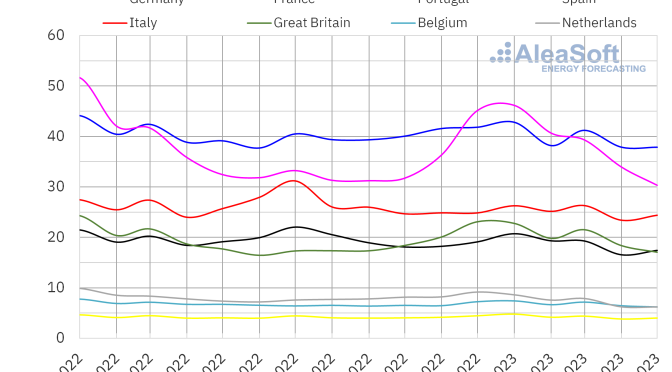

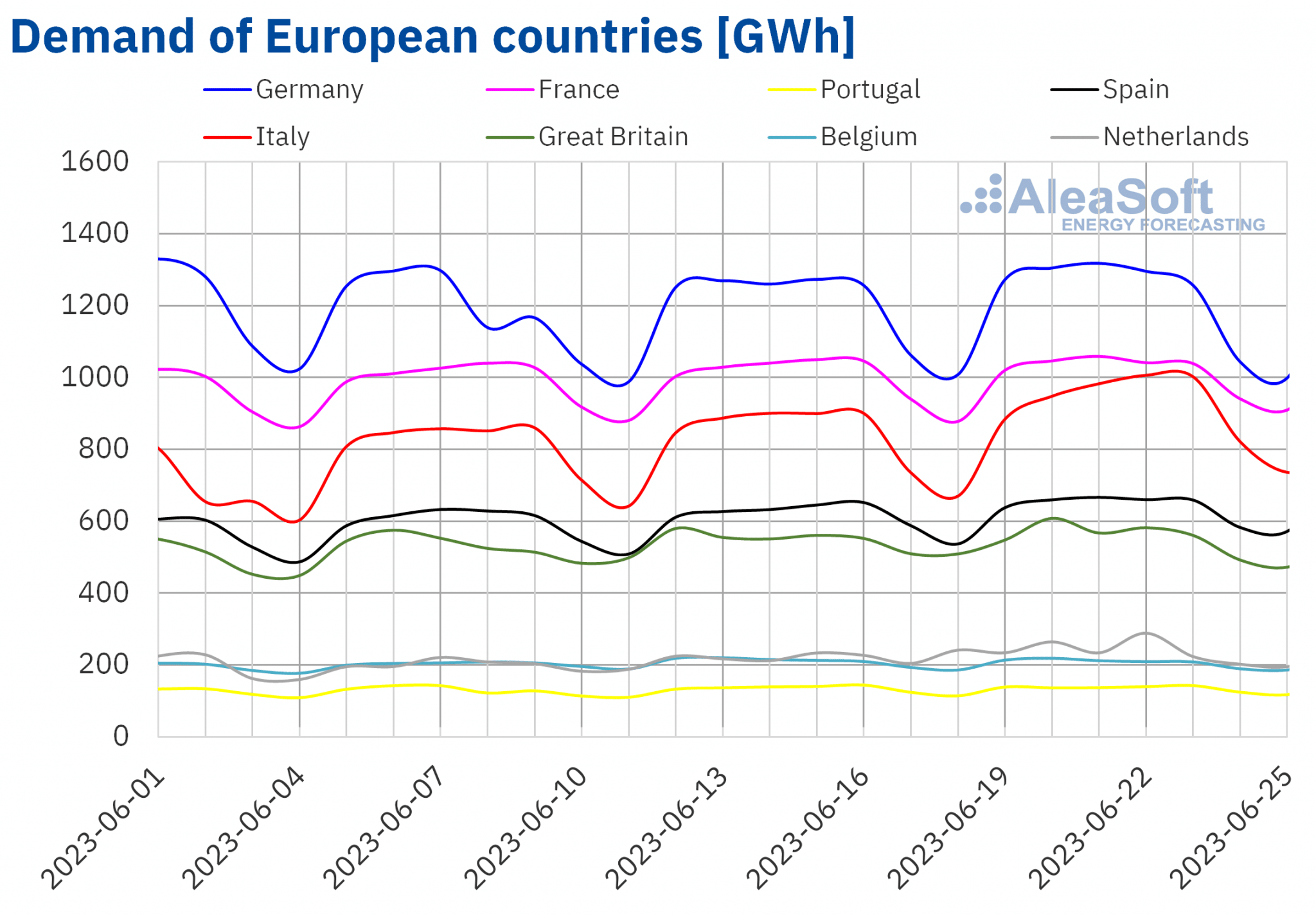

Electricity demand

In the week of June 19, electricity demand increased in most major European markets compared to the previous week. The largest rise, of 9.3%, was registered in the Italian market, followed by increases of 5.2% and 3.4% in the markets of the Netherlands and Spain, respectively. In Germany, the increase in demand was 1.3%, while in France, Portugal and Great Britain, the increase in demand did not exceed 1.0%. However, in the Belgian market demand fell by 1.2%.

Regarding the average temperatures, they increased compared to the previous week in most of the analysed markets, with increases of between 0.5 °C in Belgium and 3.3 °C in Germany. The exception was Great Britain, where average temperatures were 0.6°C lower than the previous week.

For the week of June 26, according to the demand forecasts made by AleaSoft Energy Forecasting, a decrease in demand is expected in most of the European markets analysed, except in the markets of Portugal and Spain.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

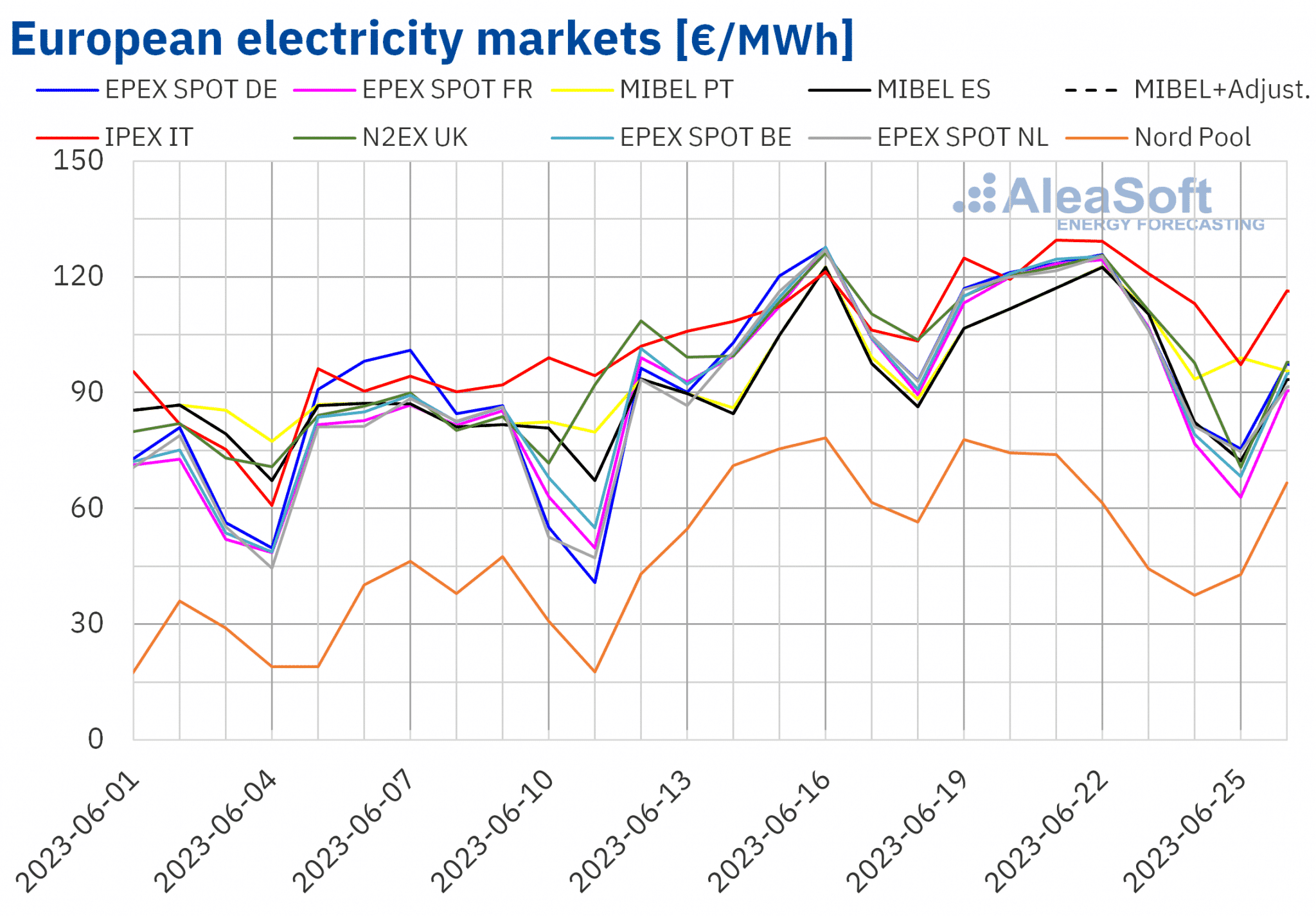

European electricity markets

In the week of June 19, prices of most European electricity markets analysed at AleaSoft Energy Forecasting registered an upward trend during the first four days of the week, until Thursday, June 22, and from Friday to Sunday prices fell, although the weekly averages remained slightly above those of the previous week. The increases compared to the previous week were lower than 3.0% in the N2EX market of the United Kingdom and the EPEX SPOT market of Germany, Belgium and France. Except for the Nord Pool market of the Nordic countries, where a decrease of 6.4% was registered, in the rest of the markets, prices increased between 3.4% of the EPEX SPOT market of the Netherlands and 11% of the MIBEL market of Portugal.

In the fourth week of June, the weekly averages exceeded €100/MWh in almost all European electricity markets. The highest average price, of €119.15/MWh, was that of the IPEX market of Italy. On the other hand, the lowest weekly average was that of the Nordic market, of €58.91/MWh. In the rest of the analysed markets, prices were between €103.28/MWh of the Spanish market and €109.01/MWh of the British market.

Regarding hourly prices, on Sunday, June 25, from 12:00 to 16:00, two hours were registered with a price of €0.00/MWh and two hours with a price of ?€0.10/MWh in the Belgian, French and Dutch markets. In the case of the German market, there was one hour with a price of €0.00/MWh, two hours with a price of ?€0.10/MWh and one hour with a price of ?€0.01/MWh. In addition, that day, from 15:00 to 16:00, a price of €0.00/MWh was also reached in the Spanish market.

During the week of June 19, the increase in average price of gas, as well as the increase in electricity demand in most markets, led to the upward trend in European electricity markets prices. In addition, the weekly average of solar and wind energy production decreased in most markets, contributing to this behaviour. However, on Sunday, June 25, a lower demand together with high values of solar energy production favoured the low hourly prices registered in some markets.

The AleaSoft Energy Forecasting’s price forecasts indicate that in the last week of June prices may decrease in most European electricity markets, influenced by increases in wind energy production, as well as by increases in solar energy production in markets such as Germany or Spain.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

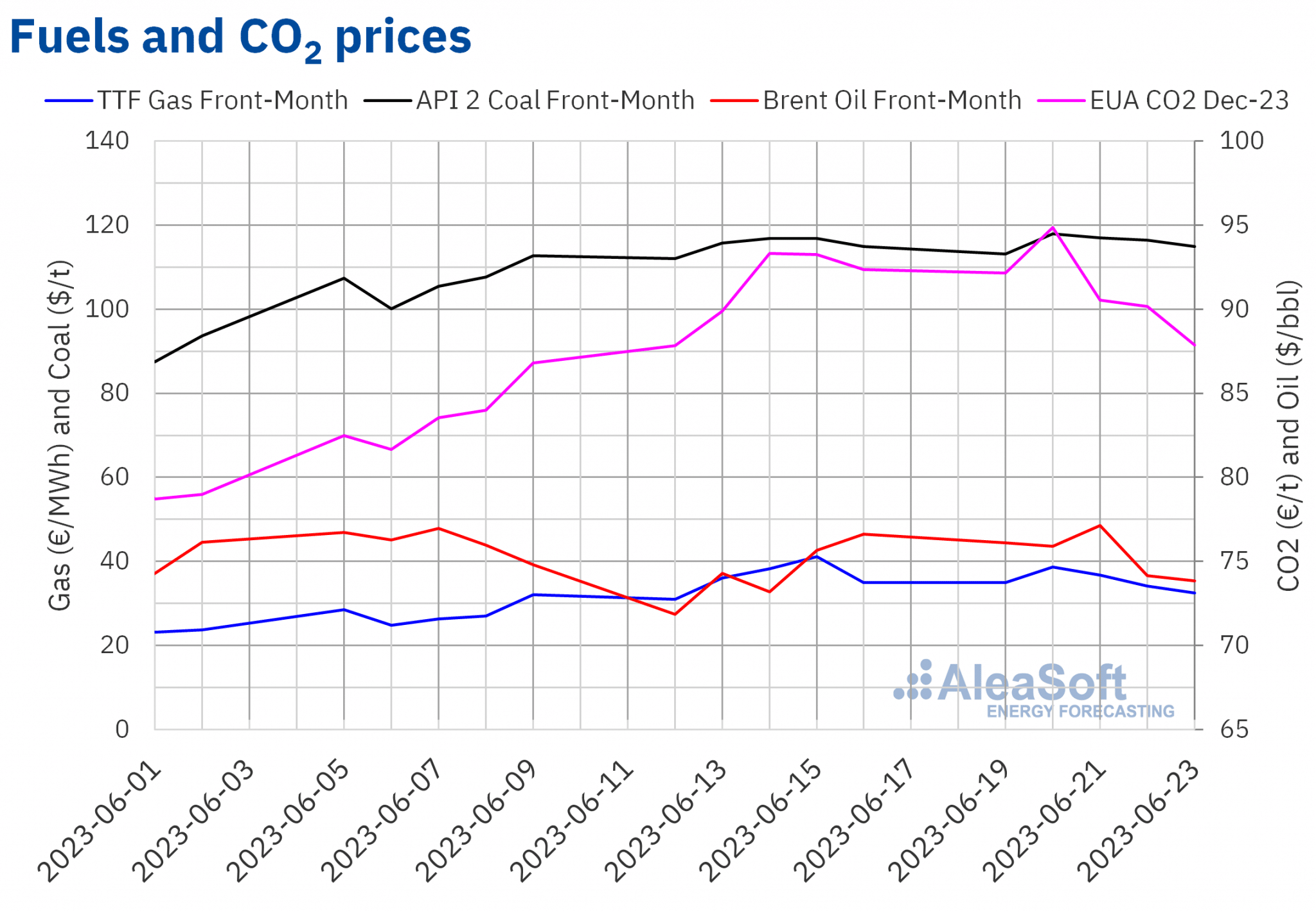

Brent, fuels and CO2

Brent oil futures for the Front?Month in the ICE market registered the weekly maximum settlement price, of $77.12/bbl, on Wednesday, June 21. This price was 5.4% higher than that of the previous Wednesday and the highest since May 24. Subsequently, prices fell. As a result, on Friday, June 23, the weekly minimum settlement price, of $73.85/bbl, was reached, which was 3.6% lower than that of the previous Friday.

In the fourth week of June, several European central banks increased their interest rates. These rises, together with the prospects for new increases in the United States, raised concerns about the evolution of the economy and oil demand. This contributed to the week ending with lower prices, despite the decline in US crude oil reserves.

As for TTF gas futures in the ICE market for the Front?Month, on Tuesday, June 20, they reached the weekly maximum settlement price, of €38.71/MWh. This price was 7.4% higher than that of the previous Tuesday. In the following sessions of the week, prices decreased until reaching the weekly minimum settlement price, of €32.51/MWh, on Friday, June 23. This price was 7.1% lower than that of the previous Friday.

In the fourth week of June, TTF gas futures prices continued to be influenced by supply concerns. These concerns increased in recent weeks due to problems affecting the flow of gas from Norway and the prospects for the closure of the largest European gas field in October.

Regarding CO2 emission rights futures in the EEX market for the reference contract of December 2023, on Tuesday, June 20, they reached the weekly maximum settlement price, of €94.85/t. This price was 5.5% higher than that of the previous Tuesday and the highest since April 18. The rest of the days of the week, prices fell. On Friday, June 23, the weekly minimum settlement price, of €87.88/t, was registered, which was 4.8% lower than that of the previous Friday.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the financing and valuation of renewable energy projects

The next webinar of the monthly webinar series of AleaSoft Energy Forecasting and AleaGreen will be held on Thursday, July 13. The topics to be analysed in the webinar include the evolution of energy markets, the financing of renewable energy projects, the use of probabilistic metrics to obtain long?term electricity markets price forecasts and the main vectors of the energy transition. Speakers from Banco Sabadell, Ecoener and Ben Oldman will participate in the analysis table of the webinar in Spanish.

On the other hand, AleaSoft Energy Forecasting developed Alea Energy DataBase, an online platform for the compilation, visualisation and analysis of energy markets data. Alea Energy DataBase includes data of the main European electricity markets, as well as fuels and CO2. In addition, the platform allows customising the visualisation of the time series, being possible to choose the data granularity or the date range.