The high temperatures registered during the third week of July caused 2023 demand records in Spain and Italy on the 19th and increases in other markets. In France, the weekly photovoltaic energy production was the highest in history, but in most markets the solar and wind energy production fell. All these factors, together with the increase in CO2 prices, favoured electricity markets prices to be above those of the previous week in most markets.

Concentrated solar power, photovoltaic and wind energy production

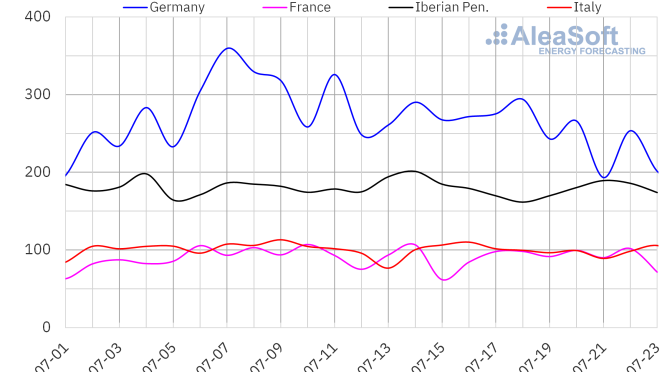

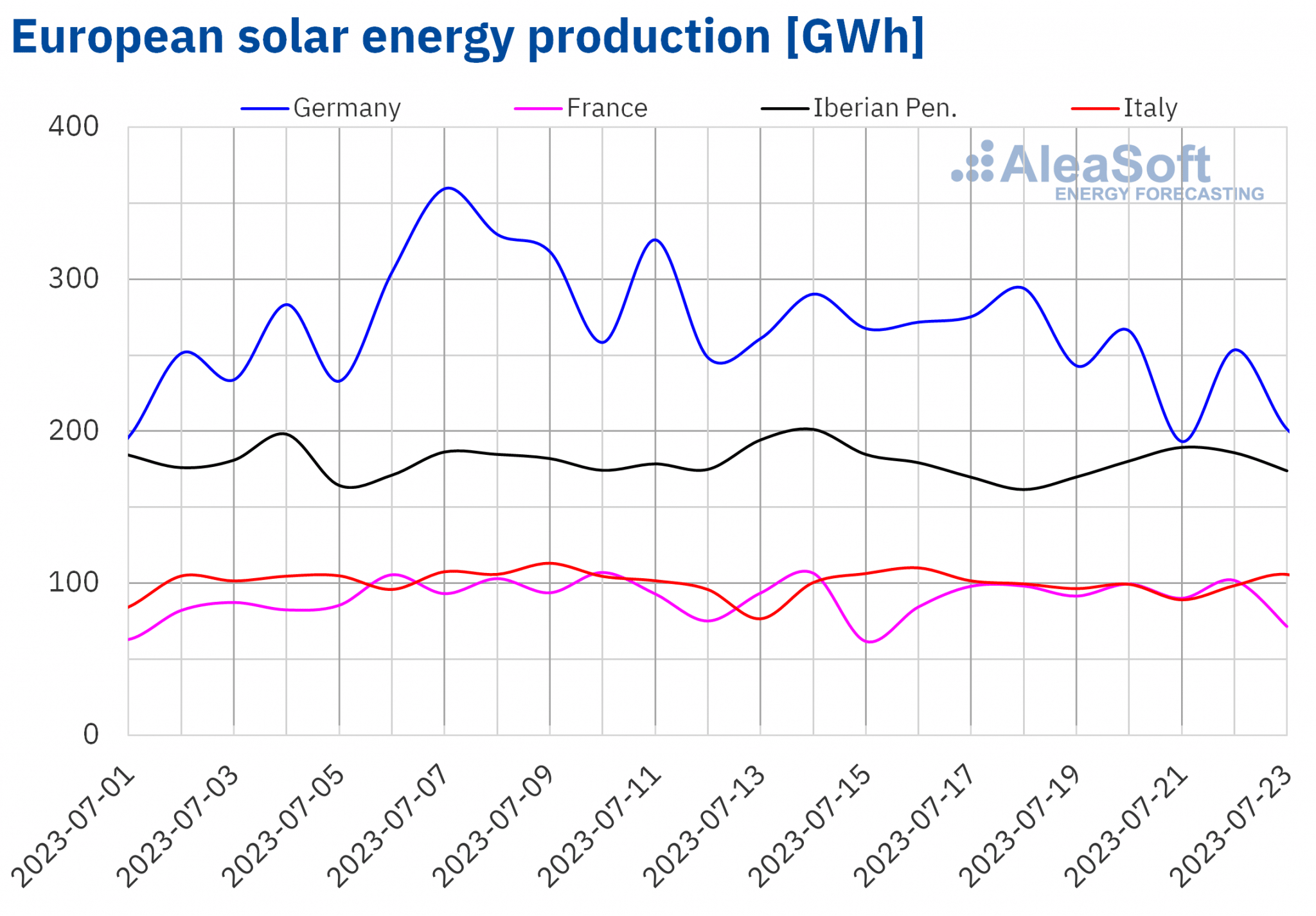

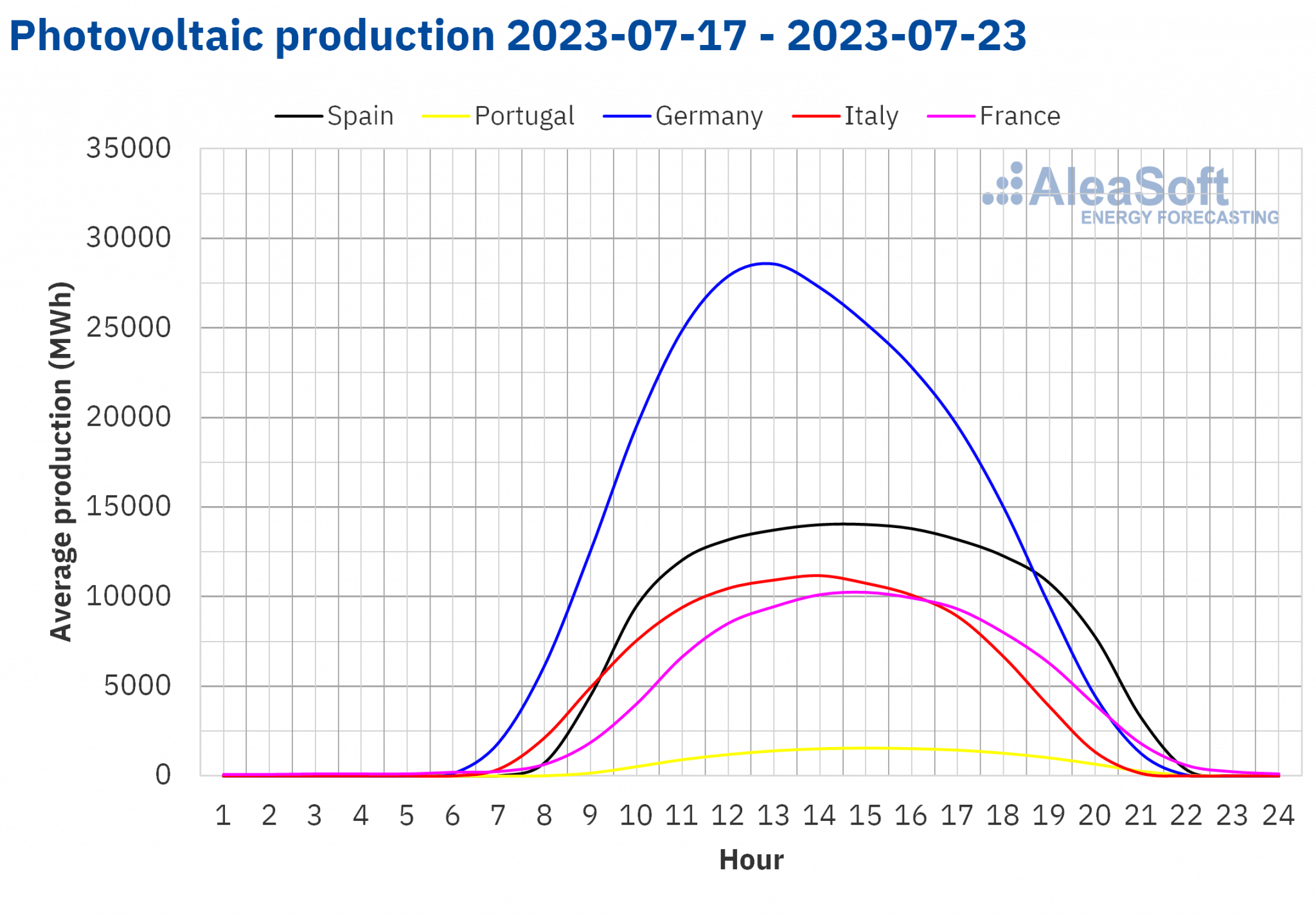

In the third week of July, the solar photovoltaic energy broke the historical record of weekly production in the French market, of 650 GWh. When comparing this value with respect to the production of the previous week, the increase was 4.7%.

In the rest of the analysed markets, the solar energy production fell, with the Italian market being the one with the lowest decrease, of 0.8%. In the markets of Spain and Portugal, the falls were 4.3% and 5.8% respectively. The largest decrease was registered in the German market, which was 10%.

For the week of July 24, the AleaSoft Energy Forecasting’s solar energy production forecasting indicates that it will increase in the Spanish market, while in the German and Italian markets it is expected to decrease.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

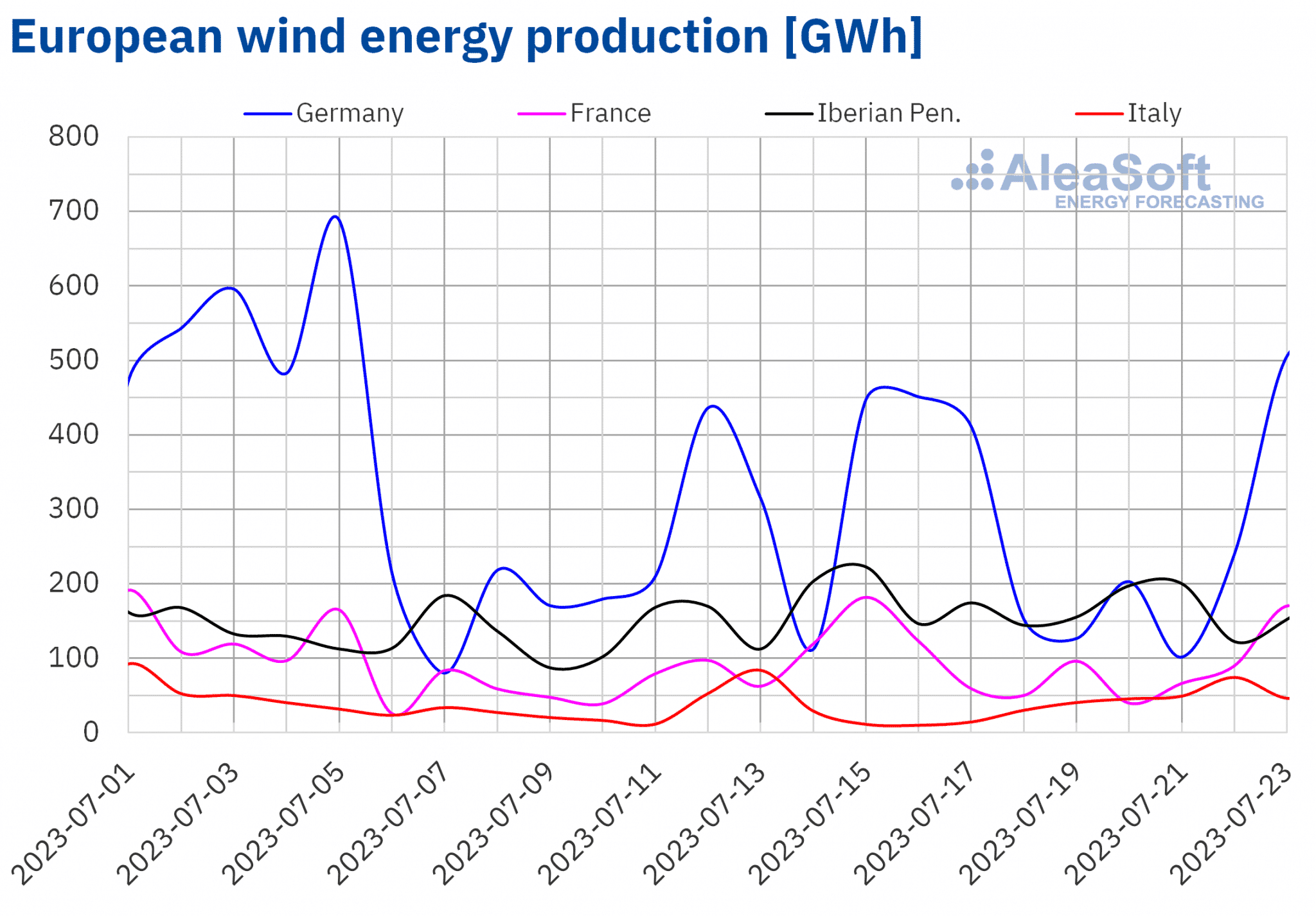

In the week of July 17, the wind energy production increased in the Italian and Spanish markets compared to the previous week. The Italian market was the one with the highest increase, of 40%, while in the Spanish market the rise was 4.9%.

On the other hand, in the markets of Germany, France and Portugal, the wind energy production decreased for the same analysed period. The largest decrease was registered in the markets of Germany and France, which was 19% in both cases. In the Portuguese market, despite the fact that the production with this technology was 11% lower than the previous week, on Thursday, July 20, the highest daily production so far in July was registered, of 45 GWh.

For the last week of July, the AleaSoft Energy Forecasting’s wind energy production forecasting indicates increases in the Italian, German and French markets. On the other hand, for the markets of Spain and Portugal, decreases in production with this technology are expected.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

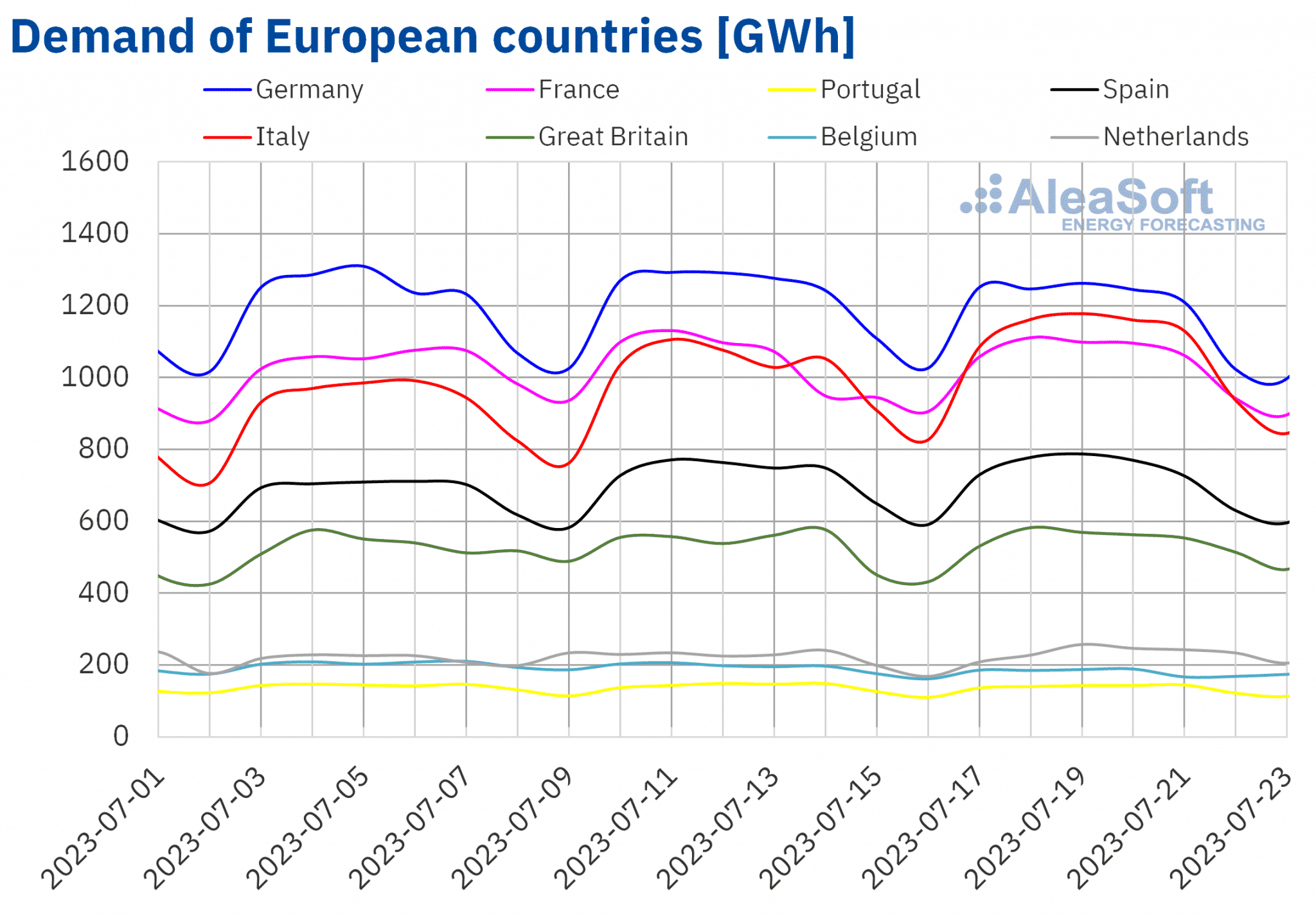

Electricity demand

In the week of July 17, the electricity demand increased in most analysed European markets with respect to the week that preceded it. The largest increase, of 6.6%, was registered in the Italian market, where, in addition, on Wednesday, July 19, the highest demand since the end of July 2015 was reached, of 1179 GWh. That day, the second highest temperature in 2023 to date was registered in Italy, after that registered the day before, on Tuesday, July 18.

The second market with the largest increase in demand was the Netherlands, with a rise of 6.3%. In the markets of Spain, France and Great Britain, the increases were between 0.4% of the Spanish market and 2.9% of the British market. In the case of Spain, the demand of Wednesday, July 19, of 787 GWh, was the highest registered at least since the end of January 2021, coinciding with the fact that this day the highest average temperature in the year so far was registered in Mainland Spain.

Although the average temperatures for the week as a whole fell in some of these markets compared to the previous week, the high temperatures registered during several days of the week favoured the increase in demand. In the case of France, the increase in demand was also related to the recovery of the labour rate after the holiday of the previous week, on Friday, July 14, French National Day.

On the other hand, in the markets of Belgium, Germany and Portugal the demand decreased during the analysed period. The largest decrease was registered in the Belgian market, which was 6.1%. In the German market and in the Portuguese market the drop in demand was 3.2% and 2.0%, respectively.

For the last week of July, according to the demand forecasts done by AleaSoft Energy Forecasting, it is expected that it will drop in most of the main European markets analysed, with the exception being the markets of Portugal, the Netherlands and Great Britain.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

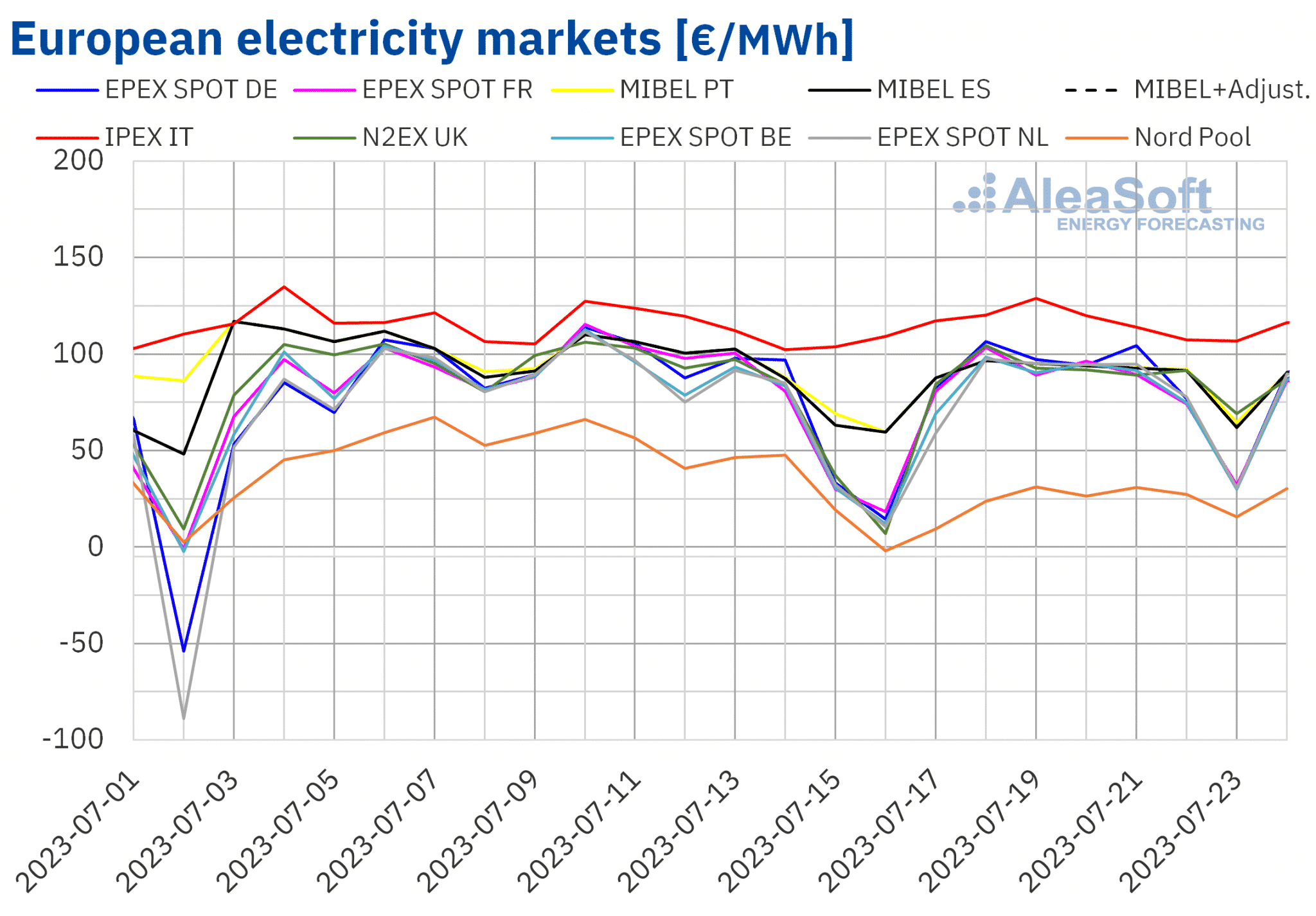

European electricity markets

In the week of July 17, prices of most European electricity markets analysed at AleaSoft Energy Forecasting increased compared to the previous week. The exceptions were the Nord Pool market of the Nordic countries, with a fall of 40%, and the MIBEL market of Spain and Portugal, with a slight downward trend that led to decreases of 1.6% and 2.1%, respectively. On the other hand, the largest price rise was that of the N2EX market of the United Kingdom, of 18%. In the rest of the markets, prices rose between 2.0% of the IPEX market of Italy and 9.2% of the EPEX SPOT market of the Netherlands.

In the third week of July, weekly averages were below €90/MWh in almost all European electricity markets. The exception was the Italian market, with the highest average price, of €116.31/MWh. On the other hand, the lowest weekly average was that of the Nordic market, of €23.49/MWh. In the rest of the analysed markets, prices were between €78.37/MWh of the Belgian market and €89.00/MWh of the British market.

Regarding hourly prices, on Sunday, July 23, from 14:00 to 17:00, a price of €0.00/MWh was registered in the Spanish market. This also happened that day in the Portuguese market, from 16:00 to 17:00, and in the Nordic market, on July 17, from 14:00 to 15:00. In the case of the Belgian and Dutch markets, negative hourly prices were registered on Monday, July 17. On Sunday, July 23, negative prices were registered in the German, Belgian, French and Dutch markets, influenced by high wind and solar renewable energy production, especially in Germany, combined with the decline in demand over the weekend. The lowest hourly price, of ?€52.65/MWh, was reached on Monday, July 17, from 12:00 to 13:00, in the Dutch market. On the other hand, on Wednesday, July 19, from 19:00 to 20:00, a price of €205.00/MWh was reached in the Italian market, the highest in this market since April.

During the week of July 17, the increase in demand, the drop in wind and solar energy production in most analysed European markets and the increase in CO2 emission rights prices led to the increase in European electricity markets prices. In addition, although the average price of gas was lower than that of the previous week, during the week prices registered an upward trend.

The AleaSoft Energy Forecasting’s price forecasting indicates that in the fourth week of July prices might decrease in most European electricity markets, influenced by decreases in electricity demand in some markets and increases in wind energy production in markets such as Germany, France and Italy.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

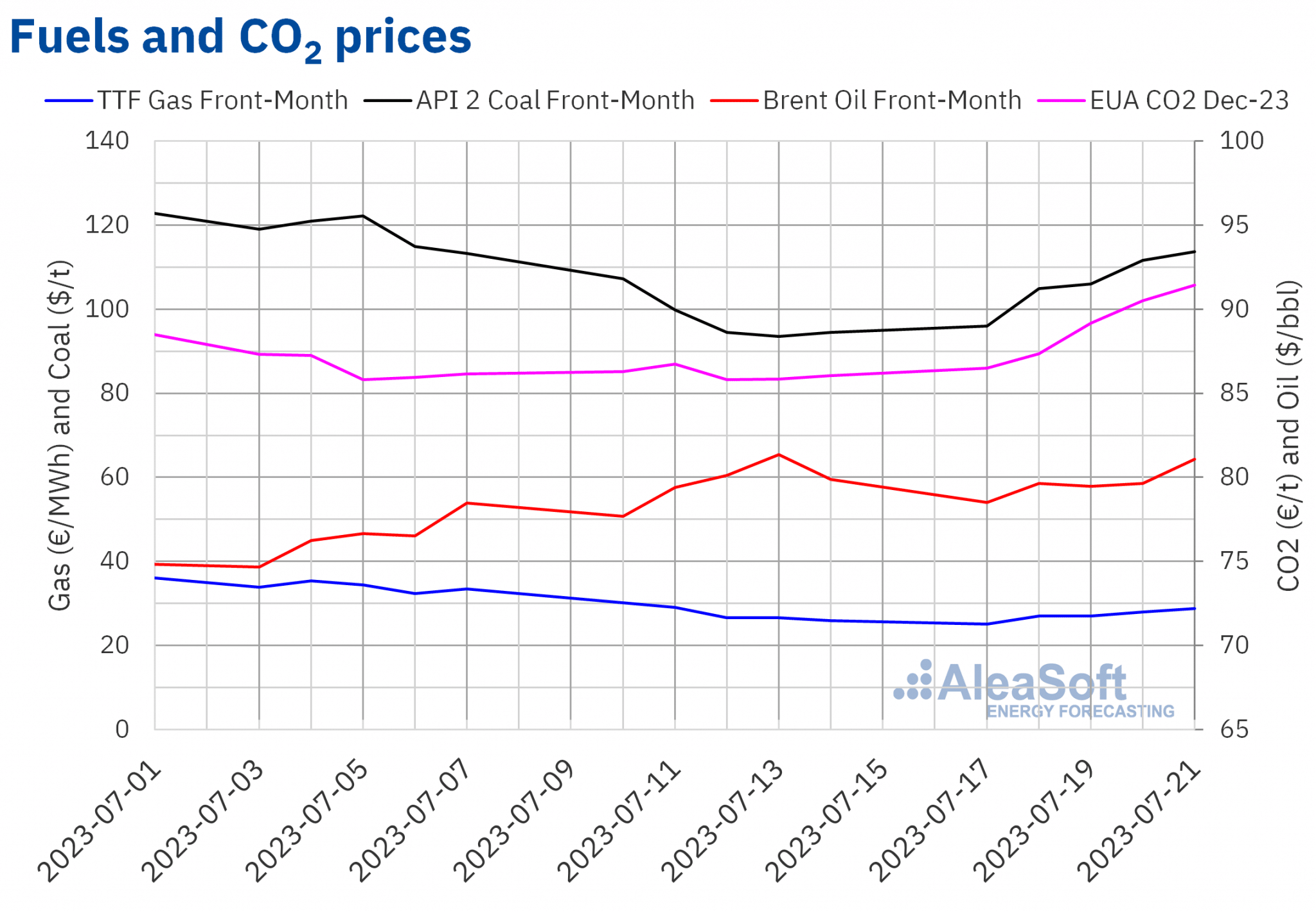

Brent, fuels and CO2

Brent oil futures for the Front?Month in the ICE market, on Monday, July 17, registered the weekly minimum settlement price, of $78.50/bbl, which was 1.0% higher than that of the previous Monday. In the following sessions of the third week of July, settlement prices were higher, but remained below $80/bbl. However, on Friday, July 21, the weekly maximum settlement price, of $81.07/bbl, was reached. This price was 1.5% higher than that of the previous Friday.

In the third week of July, expectations of lower supply levels in the coming months exerted an upward influence on Brent oil futures prices. The increase in tensions between Russia and Ukraine and the announcement of measures to promote the development of the Chinese economy also contributed to price increases. On the other hand, in the fourth week of July, the possible rises in interest rates in the United States and the European Union might exert their downward influence on prices.

As for TTF gas futures prices in the ICE market for the Front?Month, on Monday, July 17, they continued the downward trend of the previous week and the weekly minimum settlement price, of €25.10/MWh, was registered. This price was 17% lower than that of the previous Monday and the lowest since June 6. But most sessions of the third week of July registered price increases. As a consequence, on Friday, July 21, the weekly maximum settlement price, of €28.85/MWh, was reached. This price was 11% higher than that of the previous Friday. However, the average for the third week of July was still 1.8% lower than that of the previous week.

The increase in demand for electricity production, due to the high temperatures and the decrease in wind energy production, exerted its upward influence on TTF gas futures prices in the third week of July. However, European reserve levels are high and gas supply from Norway increased after completion of maintenance work.

Regarding CO2 emission rights futures in the EEX market for the reference contract of December 2023, on Monday, July 17, the weekly minimum settlement price, of €86.49/t, was registered, which was 0.2% higher than that of the previous Monday. In the third week of July, prices of these futures registered an upward trend. As a consequence, on Friday, July 21, the weekly maximum settlement price, of €91.43/t, was reached. This price was 6.3% higher than that of the previous Friday and the highest since the fourth week of June. Expectations of a lower offer in the auctions of August exerted their upward influence on prices in the third week of July.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the financing and valuation of renewable energy projects

In PPA negotiation, renewable energy projects financing or risk management, the long?term price forecasting of electricity markets is essential. The long?term price forecasts of AleaSoft Energy Forecasting and AleaGreen include scientifically?based probabilistic metrics, which provides them with coherency and quality. These forecasts have a 30?year horizon and hourly granularity. Long?term price forecasting reports are available for the main European markets, as well as for some American markets. In the case of price forecasts for European markets, they are currently on promotion.