During the first week of August, the European electricity markets prices as a result of increased wind energy production, lower CO2 and gas prices, and lower electricity demand in some markets due to cooler average temperatures. On August 2, Spain recorded its second largest solar photovoltaic energy production to date. The Brent futures reached their highest settlement price since mid-April.

Solar photovoltaic and thermoelectric energy production and wind energy production

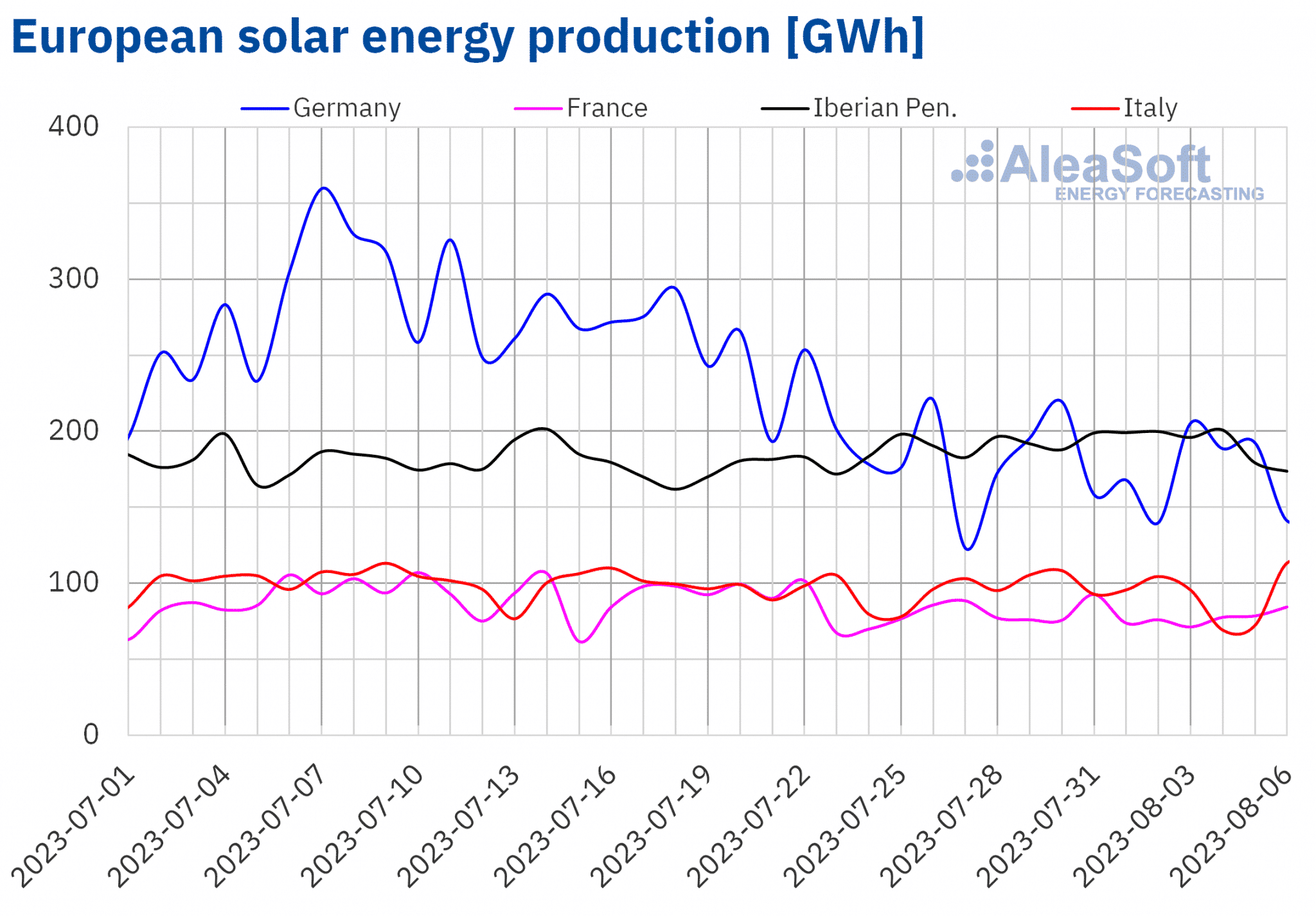

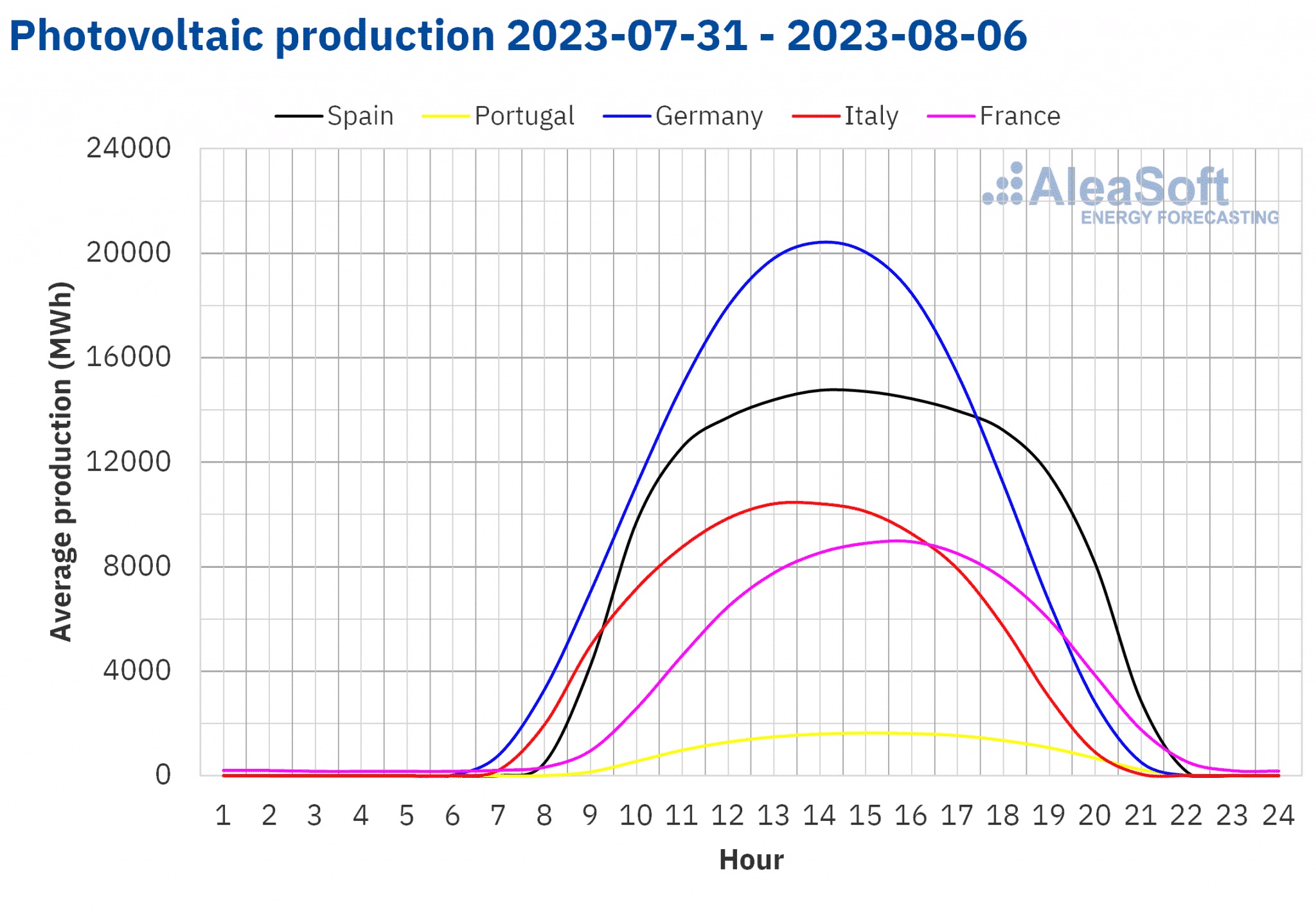

In the week of July 31, solar photovoltaic energy production reached the second highest daily value in the history so far in Mainland Spain, 158 GWh generated on August 2, a value that is allocated behind the historical record of July 14, which was 159 GWh.

Compared to the previous week, solar energy production, which in the case of Spain also includes solar thermoelectric energy, increased in the French and Iberian markets, by 0.9% and 1.3%, respectively. The opposite trend was observed in the German and Italian markets, which decreased in 7.2% and 3.4%, respectively.

For the week of August 7, according to AleaSoft Energy Forecasting’s solar energy production forecasting, the production will increase in Germany and Italy, but will decrease in Spain.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

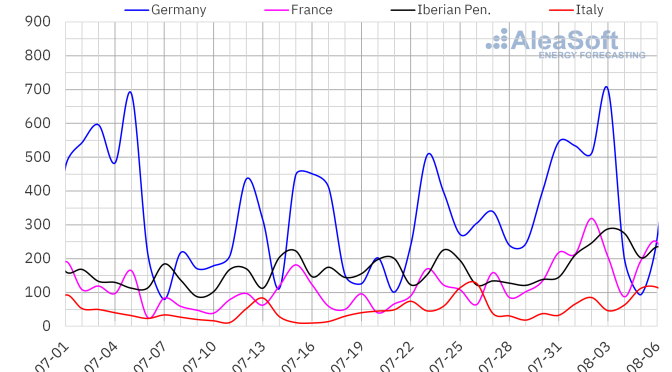

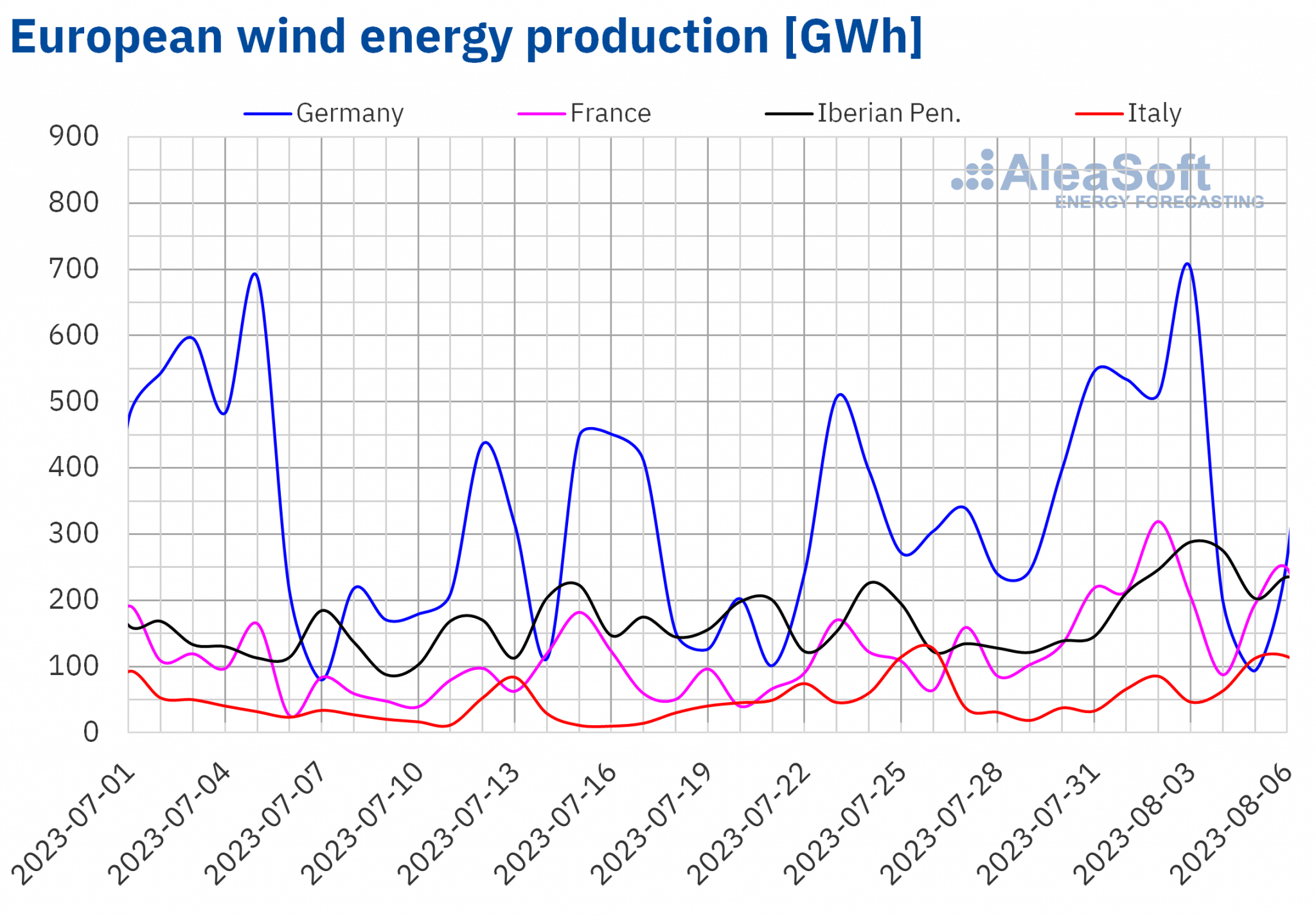

Compared to the last week of July, wind energy production increased in all analyzed markets. The largest increase, 92%, was observed in the French market. In the other markets, the increase ranged from 22% in the Italian market to 51% in the Spanish market.

For the week of August 7, AleaSoft Energy Forecasting’s wind energy production forecasting shows a decrease in production by this technology in all analyzed markets except the German market.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

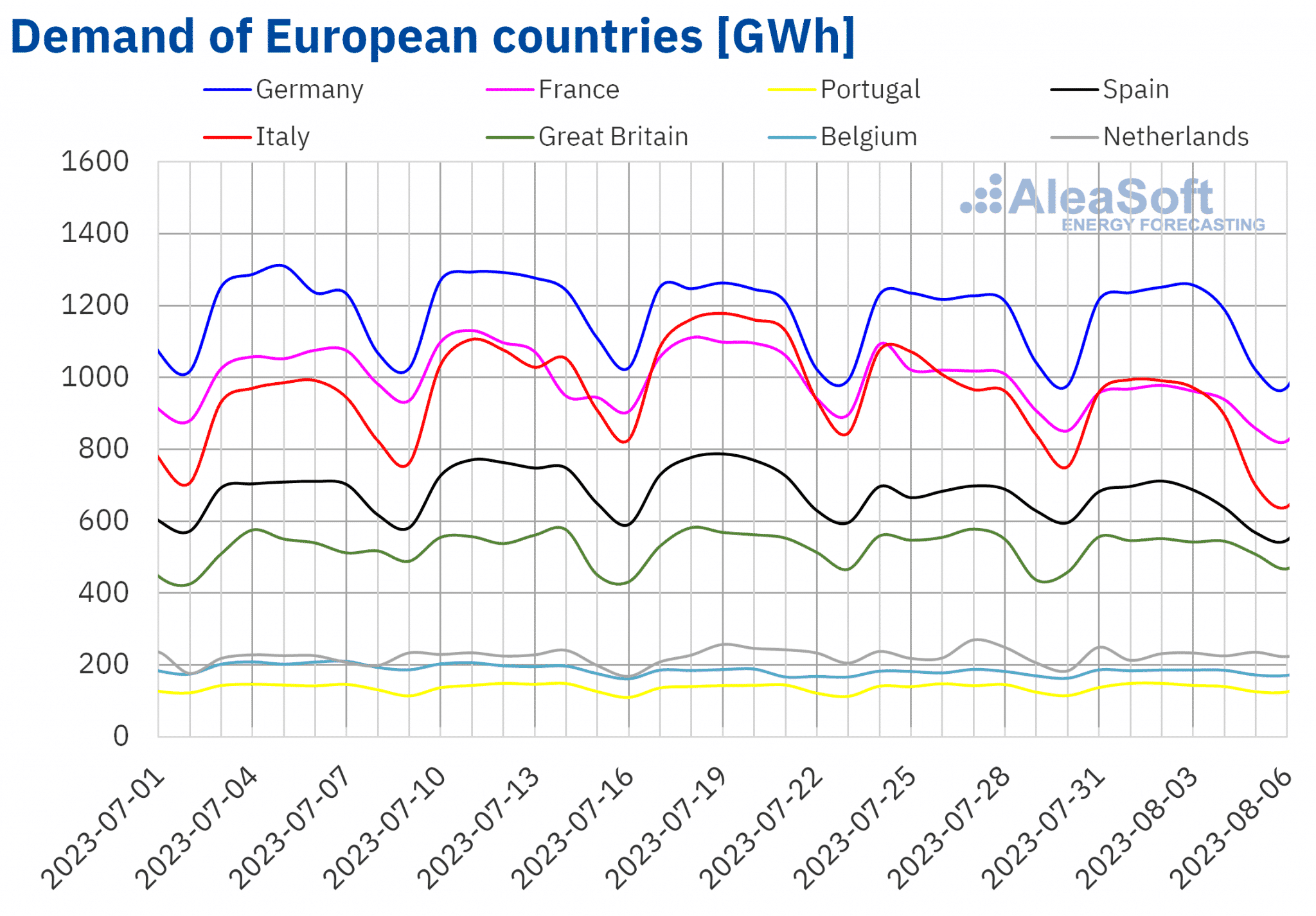

Electricity demand

In the week of July 31, the evolution of the electricity demand in the European markets analyzed by AleaSoft Energy Forecasting was varied compared to the previous week, although in most cases the demand increased or, as in the case of the German market, remain similar. Regarding the decreases, the greatest decrease was observed in the Italian market, which was 7.9%, followed by the French market, which was 6.3%, and the Spanish market, which was 2.7%. Demand increased in the rest of the markets. Increases ranged from 0.9% to 2.1% of the British and Belgian markets, respectively.

At the same time, most of the European markets analyzed fell in average temperatures compared to the previous week. The decreases ranged from 0.3°C in Netherlands to 1.4°C in Belgium. In Spain, average temperatures for the whole week decreased very slightly compared to the previous week and in Portugal they increased by 0.7°C.

For the week of August 7, according to the demand forecasts made by AleaSoft Energy Forecasting, electricity demand is expected to increase in most of the European markets analyzed. The exception will be the Italian and German markets, where the opposite trend is expected.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

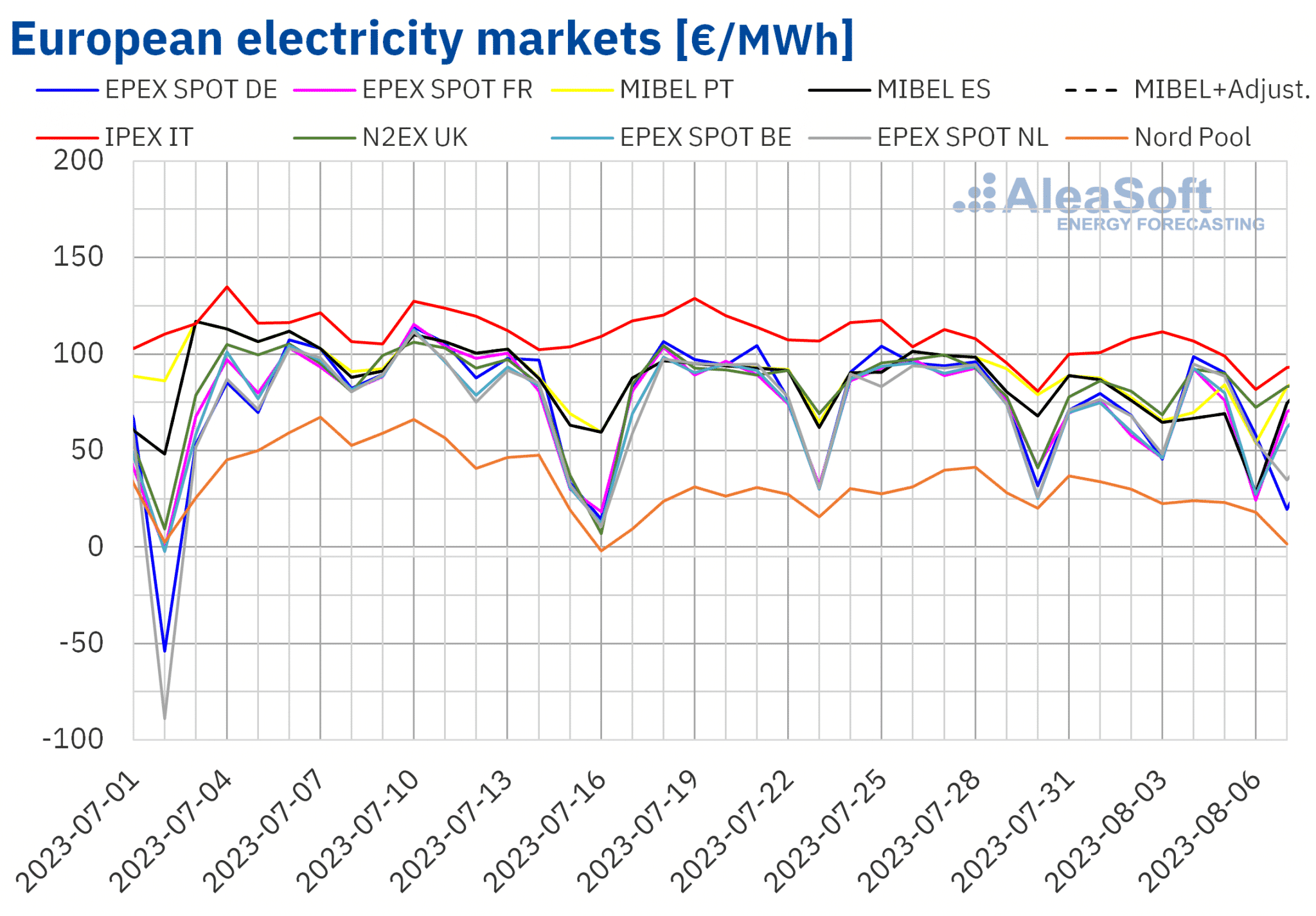

European electricity markets

In the first week of August, the average prices on all European electricity markets analyzed by AleaSoft Energy Forecasting decreased compared to the last week of July. The decreases ranged from 24% on the MIBEL market in Spain to 3.6% on the IPEX market in Italy.

In most markets, prices were lower than €75.34/MWh, which was the average for the MIBEL market in Portugal. However, there were notable exceptions in Italy, where the highest average price was €101.07/MWh, and in theN2EX market in the United Kingdom, where the average price was €81.05/MWh. As usual, the Nord Pool market in the Nordic countries recorded the lowest average price, €26.91/MWh.

Regarding hourly prices, zero or negative prices were recorded in several markets on August 6 and 7. In Spain, six hours with zero Euro prices per MWh were recorded on Sunday, August 6from 11:00 to 20:00, to the lowest daily price since April, which was €28.15/MWh. On this day, the EPEX SPOT market in France recorded zero prices from 13:00 to 17:00. The EPEX SPOT market in Belgium recorded negative prices for several hours on August 6 and 7, with the lowest price of ?€51.42/MWh being reached on August 7 at 14:00. The EPEX SPOT market in the Netherlands also recorded negative prices for several hours on these 2 days, with the lowest price of ?€41.85/MWh also being recorded on August 7 at 14:00. Likewise, the EPEX SPOT market in Germany and the Nord Pool market recorded several hours with negative prices on Monday, August 7.

The price decline in the first week of August was driven by the droop in CO2 prices, gas prices that were lower on average than the previous week, and the general increase in wind energy production. Moreover, the drop in temperatures helped to reduce electricity demand in some markets.

Nevertheless, according to AleaSoft Energy Forecasting’s price forecasting, prices are expected to increase in the second week of August compared to the first week of the month in most markets, as wind energy production will decrease in almost all markets and temperatures will recover in some cases favoring an increase in electricity demand.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

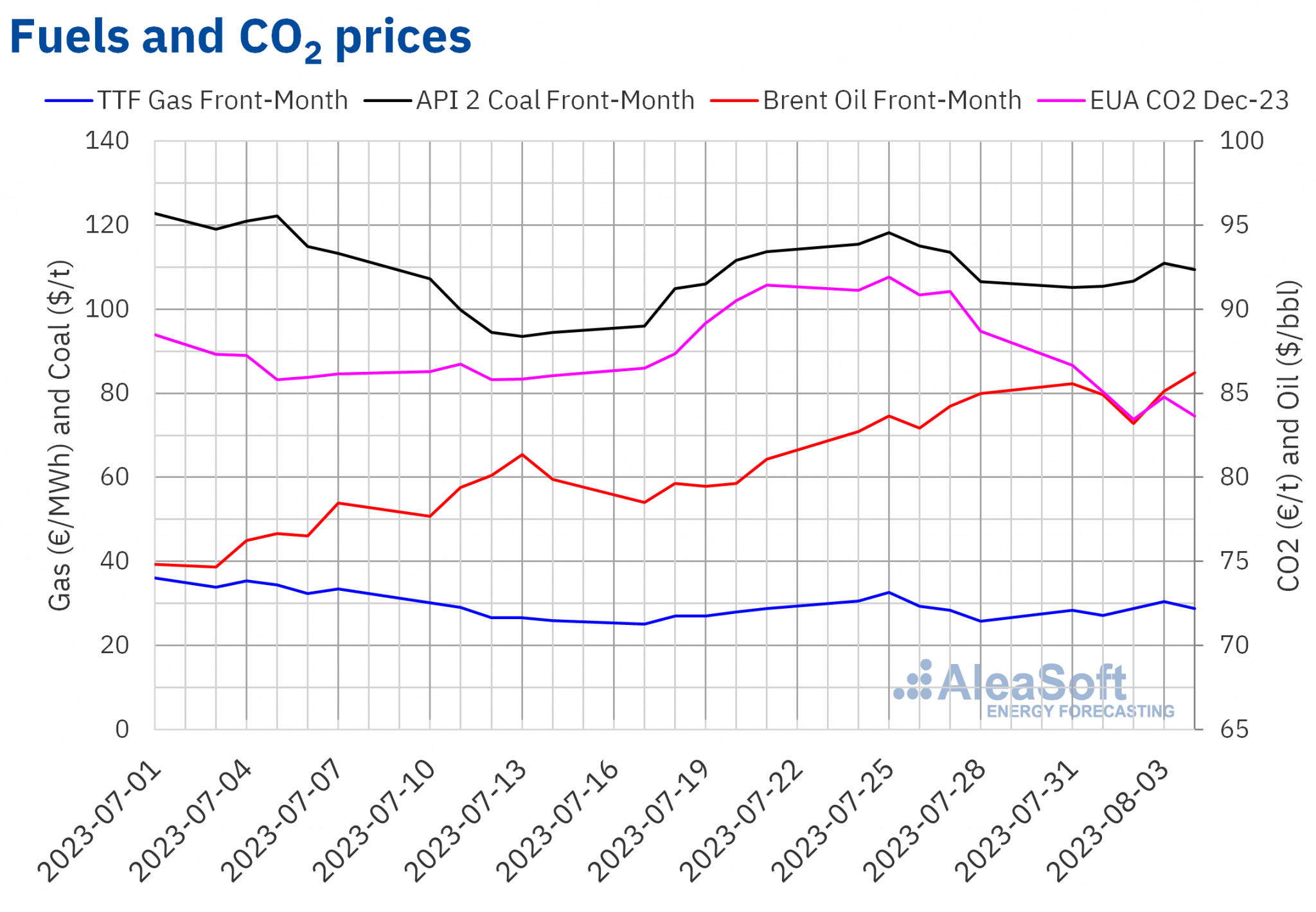

Brent, fuels and CO2

During the first week of August, the average settlement price of Front-Month Brent oil futures on the ICE market was 1.6% higher than the previous week’s average. In general, the barrel settlement price was around 85 dollars, except on Wednesday, August 2, when the lowest value of the week was recorded, which was $83.20/bbl, and on Friday, August 4, when $86.24/bbl was reached, the highest value since April 15 this year. This rise in prices in the first week of August confirms the upward trend in the price of the barrel that began in late June and registered a small pause in mid-June.

In the first week of August, TTF gas futures on the ICE market for the Front-Month recorded settlement prices between €27.12/MWh on August 1 and €30.47/MWh on August 3. The weekly average was 2.2% lower than the last week of July. The minimum gas price of €25/MWh remained unchanged since early June. Slight approaches have been recorded in the last weeks, but prices continue to bounce.

The average settlement prices of CO2 emission rights futures on the EEX market for the reference contract of December 2023in the week beginning on July 31were down 6.6% compared to the previous week. On Wednesday, August 2, they recorded their lowest settlement price since June 7 at €83.45/t. This setback took CO2 prices well away from the historical highs close to €100 per ton, although volatility remains high, so the possibility of prices approaching the highs again is not ruled out.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the financing and valuation of renewable energy projects

AleaSoft Energy Forecasting and AleaGreen are already organizing the next webinars of their monthly webinar series, which will take place on September 7 and October 19.

The September webinar will analyze the benefits of PPA for large and electro-intensive consumers. In addition, the usual analysis of the evolution and prospects of the European energy markets will be made and AleaSoft Energy Forecasting services that contribute to risk management and energy transition will be explained. On the other hand, Pedro González, Director-General of AEGE, Association of Large Energy Consumption Companies, will participate in the analysis table of the webinar which will be conducted in Spanish in the second part of the webinar.

The October webinar will feature, speakers from Deloitte for the fourth time. In this webinar, prospects for the European energy markets for the winter of 2023-2024, the financing of renewable energy projects and the importance of forecasting in audits and portfolio valuation will be analyzed.