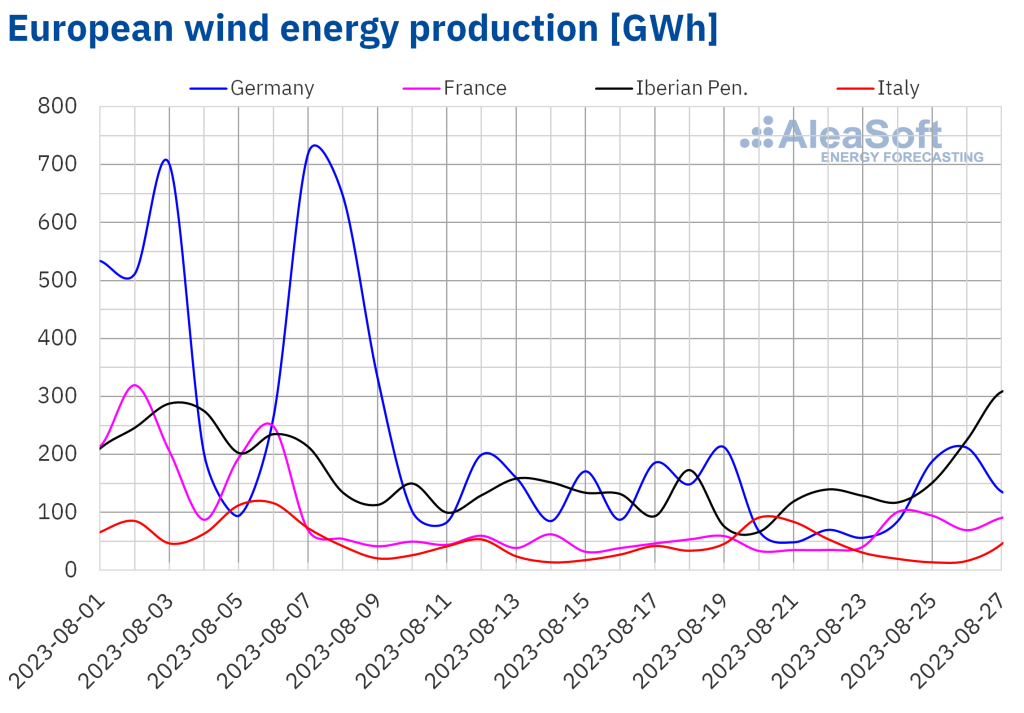

European electricity markets prices continued to rise in the fourth week of August due to low renewable energy production and increased demand. Some markets registered the highest daily prices since December 2022. Nevertheless, the MIBEL market of Spain and Portugal registered prices of €0/MWh at certain hours on Sunday, August 27, due to high wind energy production.

Concentrated Solar Power, photovoltaic and wind energy production

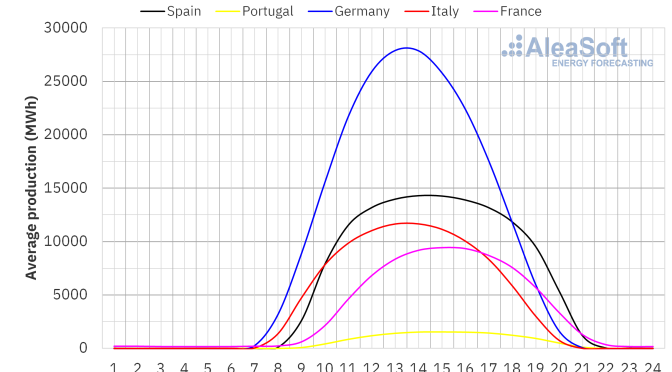

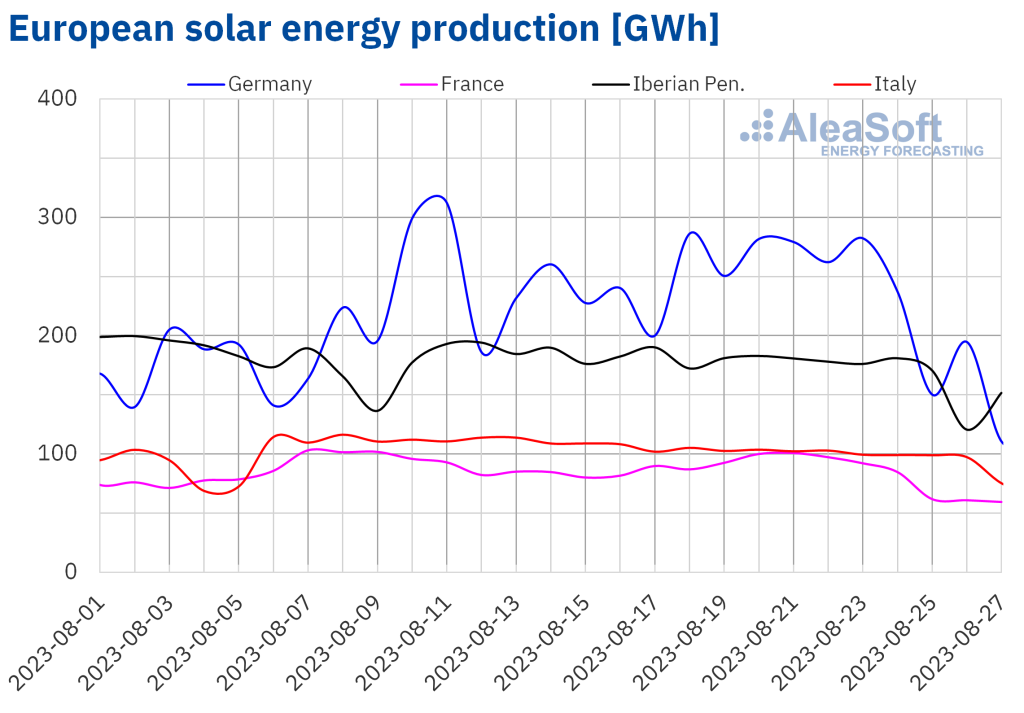

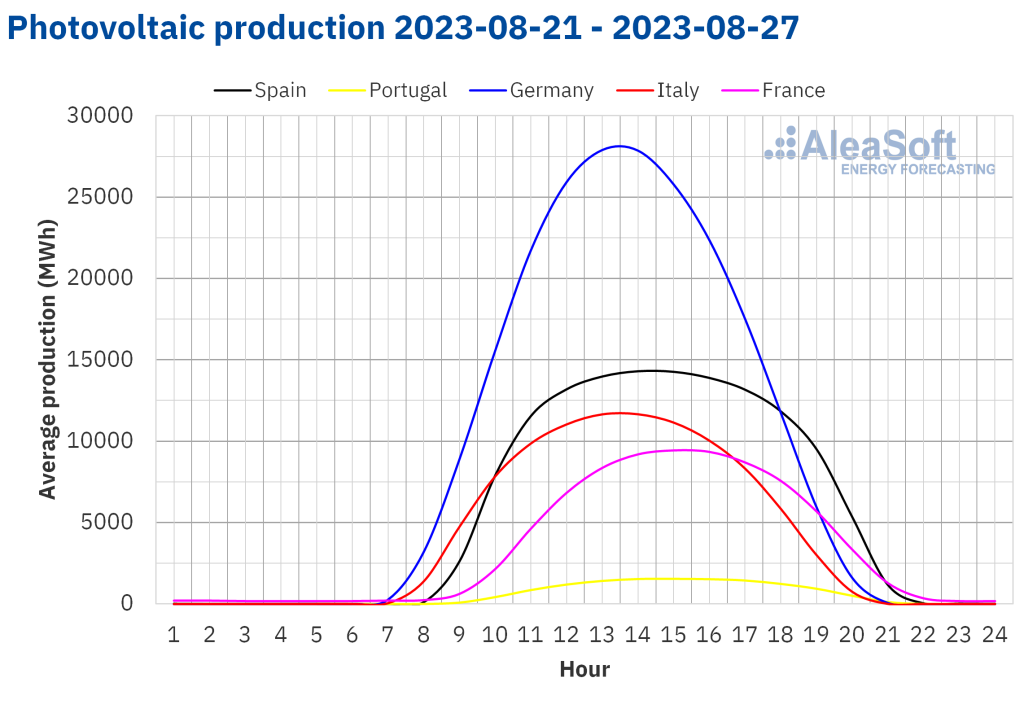

During the week of August 21, solar photovoltaic energy production decreased in all analyzed markets compared to the previous week. The largest decrease of 13% was registered in the German market, followed by the French market’s one of 10%. The Spanish market, which includes solar thermoelectric energy, fell by 9.3%, and the Italian and Portuguese markets fell by 8.7% and 7.1%, respectively.

For the week of August 28, according to the AleaSoft Energy Forecasting’s solar energy production forecasting, production is expected to continue to decline in all analyzed markets, except the Spanish market.

During the second week of August, wind energy production increased in most of the analyzed markets. The highest increase, which was 48%, was in the Spanish market, where on Sunday, August 27, a daily wind energy production of 247 GWh was registered, the highest since May 19. The French market had the second highest increase of 43%, while the Portuguese market had an increase of 27%. On the other hand, production in the Italian and German markets decreased by 3.1% and 17%, respectively.

For the week of August 28, AleaSoft Energy Forecasting’s wind energy production forecasting indicates that production will increase in most of the analyzed markets, with the exception of Portugal and France.

Electricity demand

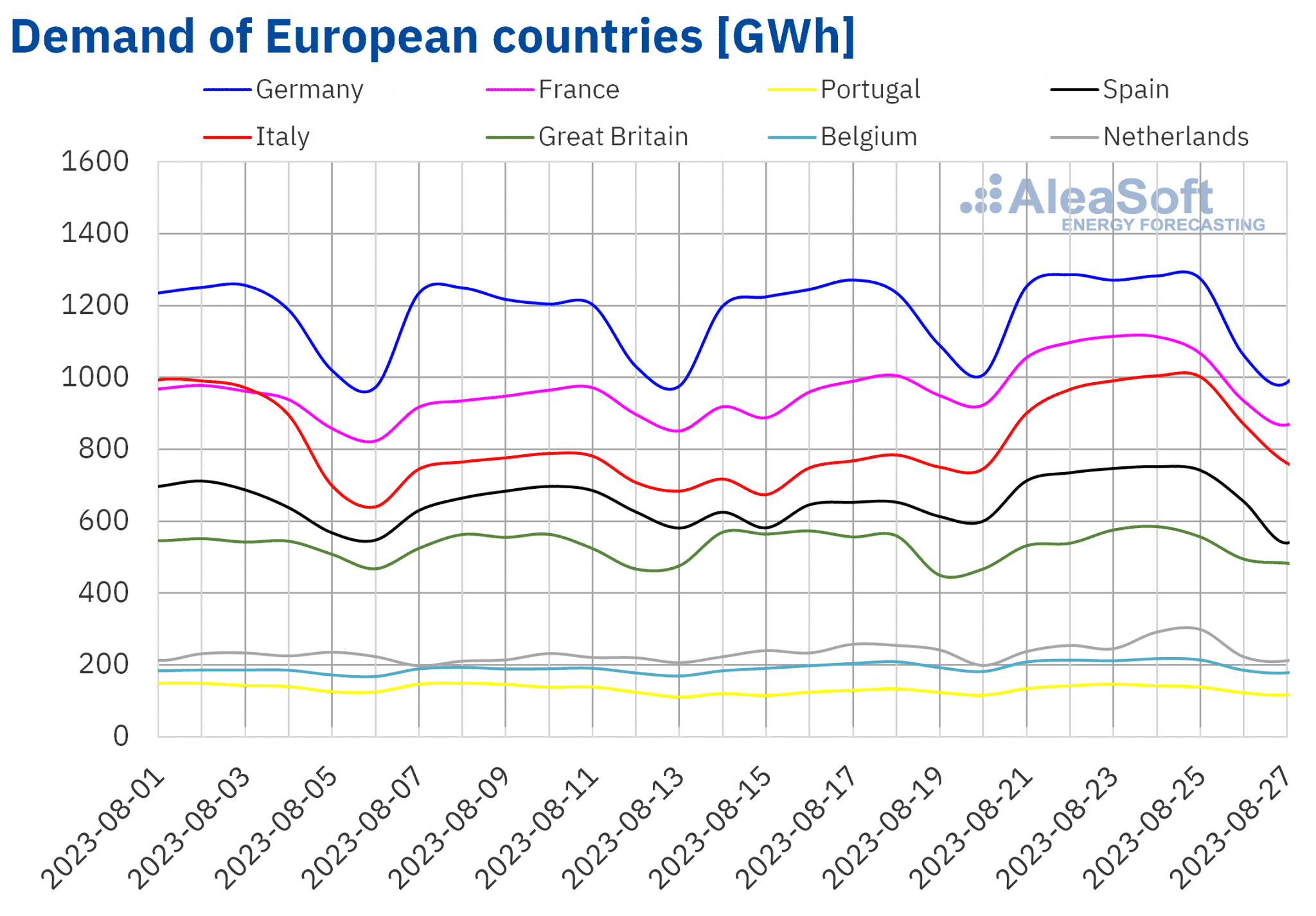

In the week of August 21, electricity demand increased compared to the previous week in all analyzed markets. The largest increase, of 25%, was registered in the Italian market, followed by a 12% increase in the Spanish market and a 9.4% increase in the Portuguese market. During this week, these three countries registered increases in average temperatures between 0.9 °C and 1.6 °C compared to the previous week. In the rest of the analyzed markets, the increase in demand ranged from 0.7% in the British market to 9.3% in the French market, while average temperatures decreased between 0.6 °C and 1.9 °C. In most European countries, the increase in demand was due to the recovery of the working hours after the public holiday of the Assumption of the Virgin Mary, which was celebrated on Tuesday, August 15.

For the last week of August, according to demand forecasts done by AleaSoft Energy Forecasting, electricity demand is expected to decrease in all European markets analyzed, with the exception of the Portuguese market.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

European electricity markets

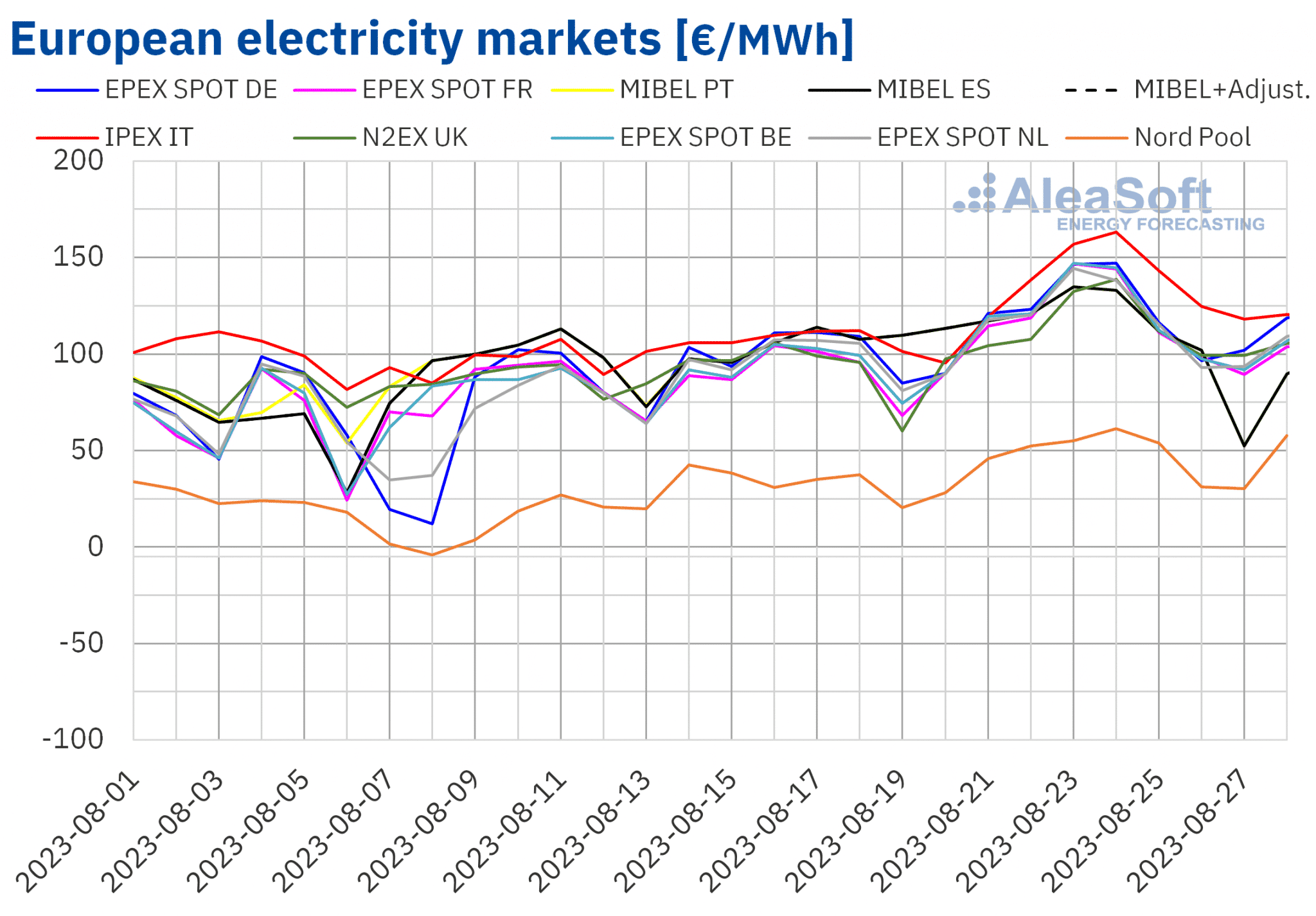

During the week of August 21, prices in all European electricity markets analyzed at AleaSoft Energy Forecasting increased compared to the previous week. The largest price rise, which was 42%, was registered in the Nord Pool market of the Nordic countries. In contrast, the MIBEL market of Spain and Portugal registered the smallest increase, of 3.8%. In the other markets, prices rose between 21% in the EPEX SPOT market of Germany and the Netherlands and 30% in the IPEX market of Italy.

In the fourth week of August, weekly averages were above €110/MWh in almost all European electricity markets. The exception was the Nordic market with the lowest average price, of €47.08/MWh, while the highest average price, of €137.67/MWh, was registered in the Italian market. In the other markets analyzed, prices ranged from €110.23/MWh in the MIBEL market of Spain and Portugal to €121.78/MWh in the German market.

Regarding hourly prices, on Wednesday, August 23, the highest prices of the week were registered in most European electricity markets. Prices exceeded €275/MWh in the German, Belgian, French and Dutch markets and were the highest hourly prices in these markets since December 2022. In contrast, prices in the Spanish and Portuguese markets were the highest since March 2023. The highest price, of €291.93/MWh, was reached in the German and Dutch markets between 20:00 and 21:00. In the British, Italian and Nordic markets, the highest hourly prices of the week were registered on Thursday, August 24. The highest hourly prices since February were registered in the N2EX market of the United Kingdom and the Italian IPEX market.

On the other hand, on Sunday, August 27, a price of €0.00/MWh was registered for six hours in the Spanish and Portuguese markets, where high values of wind energy production were reached that day. In the Dutch market, from 14:00 to 15:00, the price was €0.01/MWh.

During the week of August 21, the increase in the average price of gas and the general increase in electricity demand pushed up prices in European electricity markets. The general drop in solar energy production and the decrease in wind energy production in the German and Italian markets also contributed to this behavior.

AleaSoft Energy Forecasting’s price forecasting indicates that prices in European electricity markets might fall in the last week of August, influenced by a decrease in electricity demand in most markets and an increase in wind energy production in markets such as the German, the Spanish and the Italian.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Brent, fuels and CO2

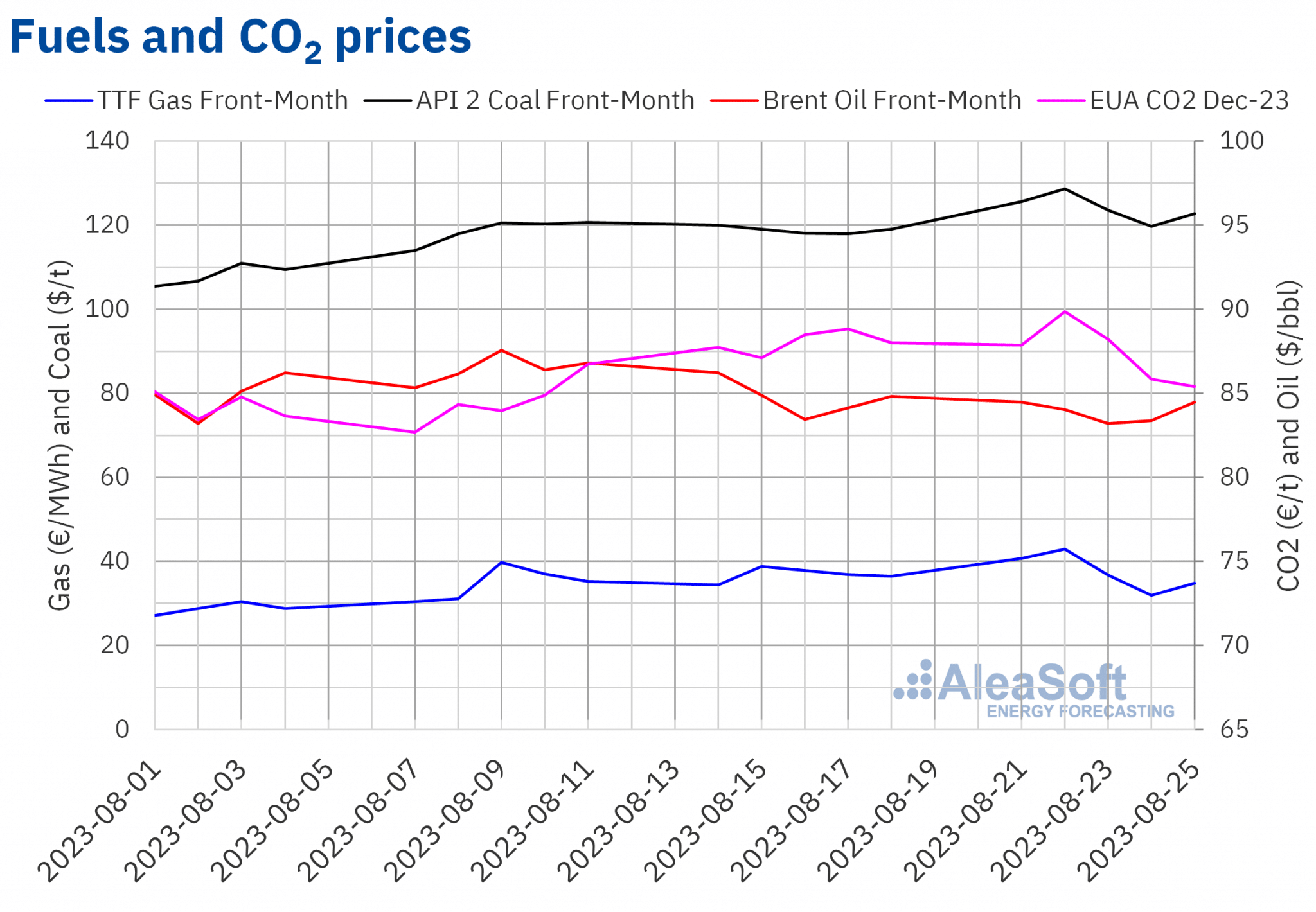

Front?Month Brent oil futures prices in the ICE market began the fourth week of August decreasing. The weekly minimum settlement price, of $83.21/bbl, was registered on Wednesday, August 23. This price was 0.3% lower than the previous Wednesday. Prices then rebounded to reach the weekly maximum settlement price of $84.48/bbl on Friday, August 25, which was still 0.4% lower than the previous Friday.

As for settlement prices of TTF gas futures in the ICE market for the Front?Month, they remained above €40/MWh during the first days of the fourth week of August. On Tuesday, August 22, the weekly maximum settlement price of €42.91/MWh was reached. This price was 11% higher than the previous Tuesday and the highest since April. However, prices then fell to reach the weekly minimum settlement price of €31.94/MWh on Thursday, August 24. This price was 13% lower than the previous Thursday and the lowest since August 8. In the last session of the fourth week of August, a rise of 8.9% was registered compared to the previous session. As a result, on Friday, August 25, the settlement price was €34.78/MWh.

In the fourth week of August, news of potential strikes at liquefied natural gas export facilities in Australia influenced the movement of TTF gas futures prices. The threat of strikes contributed to a decline in seaborne liquefied natural gas shipments to Europe, as they were diverted to Asian markets. On Friday, fears of strikes in Australia resurfaced, pushing prices higher.

In the last week of August, prices might continue to be affected by news of possible strike action in Australia. In addition, supply disruptions due to maintenance in Norway might have an upward impact on prices.

Regarding CO2 emission rights futures in the EEX market for the reference contract of December 2023, on Tuesday, August 22, they reached the weekly maximum settlement price, of €89.87/t. This price was 3.1% higher than the previous Tuesday and the highest since July. But on Wednesday, prices started a downward trend. As a result, the weekly minimum settlement price of €85.39/t was registered on Friday, August 25, which was 3.0% lower than the previous Friday.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe

The next webinar in the AleaSoft Energy Forecasting and AleaGreen monthly webinar series is scheduled for September 7. The webinar will focus on the benefits of PPA for large and electro?intensive consumers and will include the participation of Pedro González, Director?General of AEGE, Association of Companies with Large Energy Consumption, in the analysis table after the Spanish version of the webinar. In addition, the evolution and prospects of European energy markets will be analyzed and AleaSoft Energy Forecasting services that contribute to risk management and energy transition will be explained.

The next webinar in the series will take place on October 19. In this case, speakers from Deloitte will participate in the webinar. The main topics to be discussed will be the prospects for European energy markets for the winter of 2023?2024, the financing of renewable energy projects, and the importance of forecasting in audits and portfolio valuation.