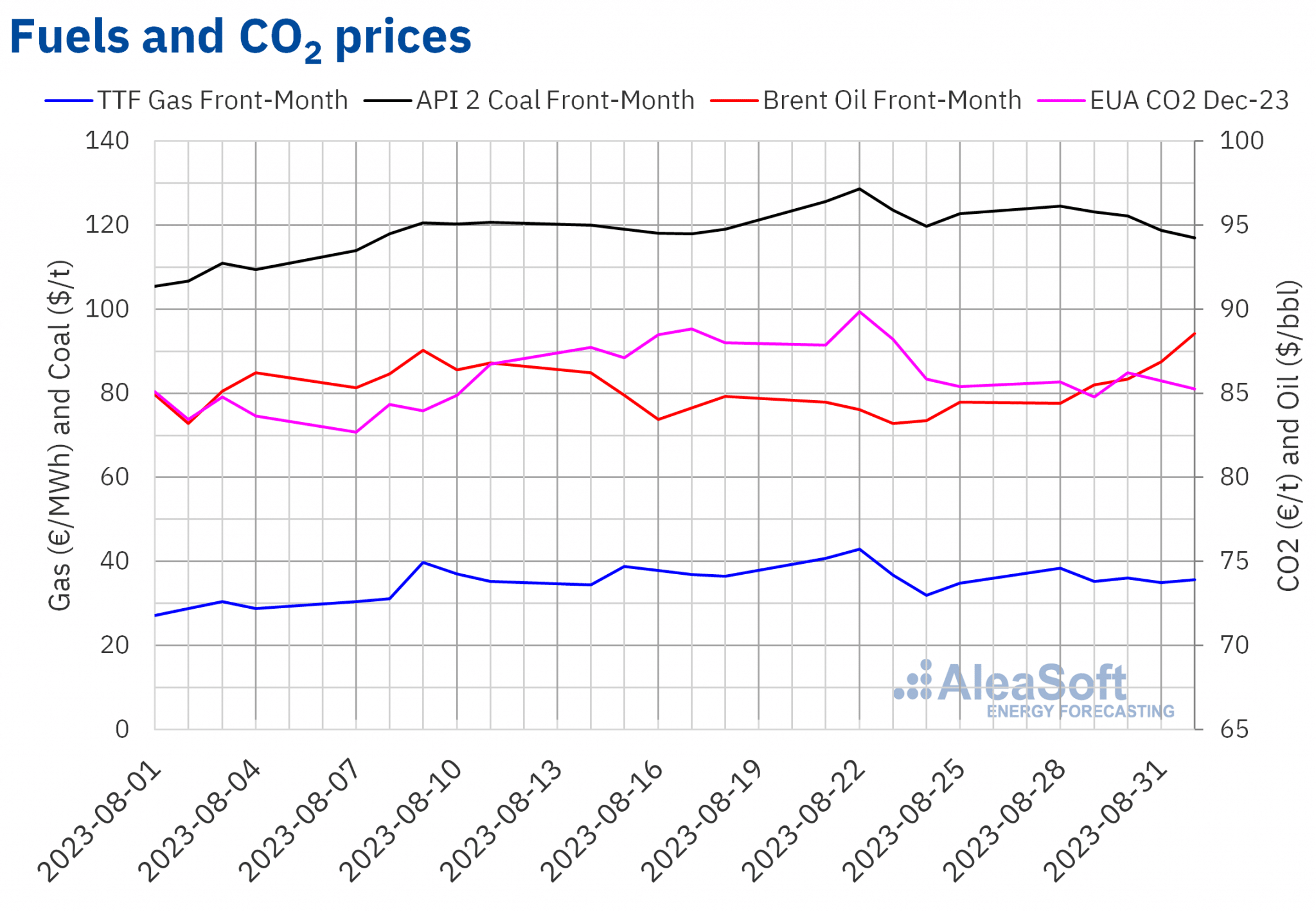

European electricity markets prices fell in the last week of August, supported by increased wind energy production combined with lower electricity demand and average temperatures. Weekly average prices for TTF gas and CO2 fell by 3.7% and 2.2% respectively, while Brent futures reached a settlement price of $88.55/bbl on September 1, the highest since November 2022.

Concentrated Solar Power, photovoltaic and wind energy production

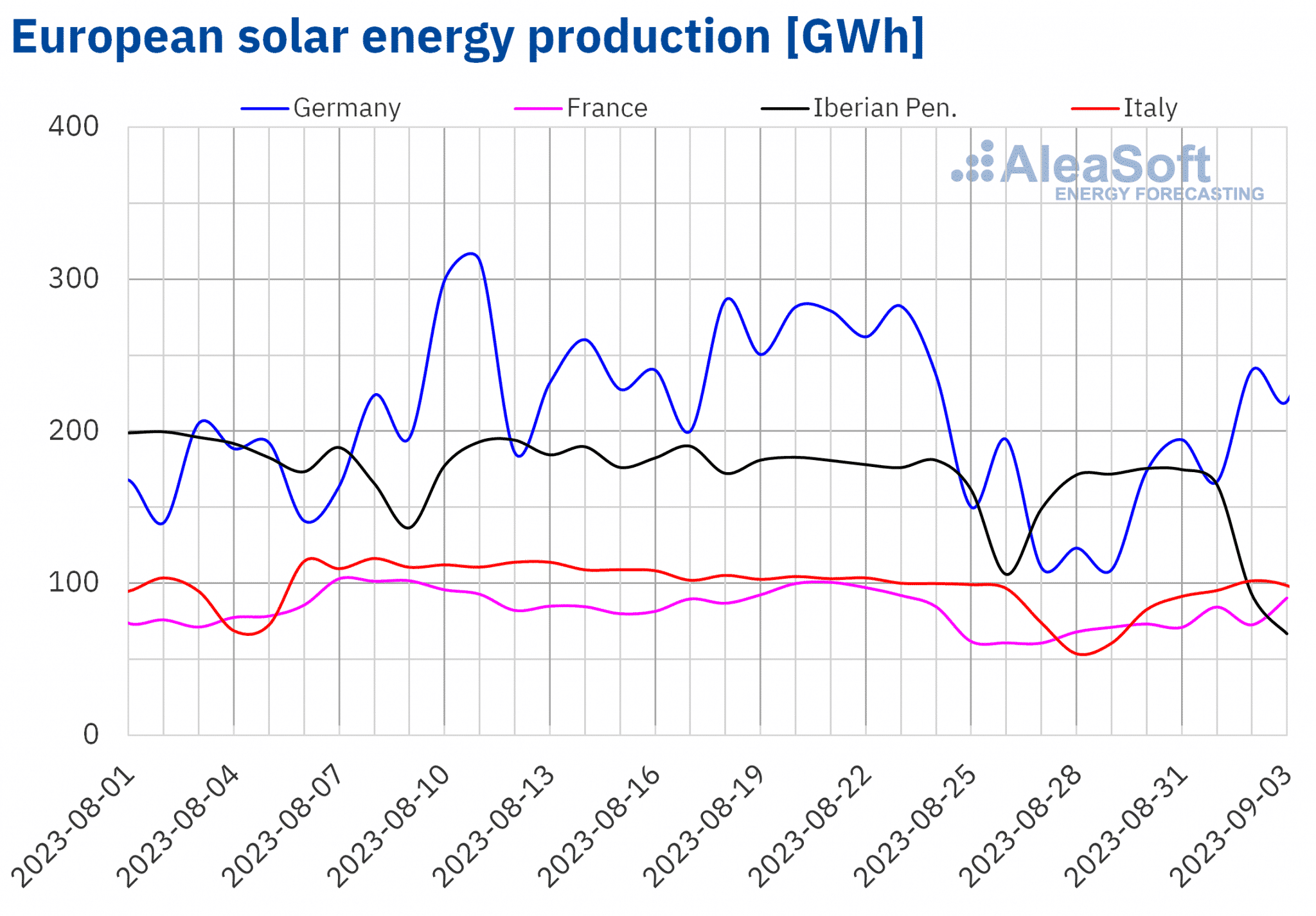

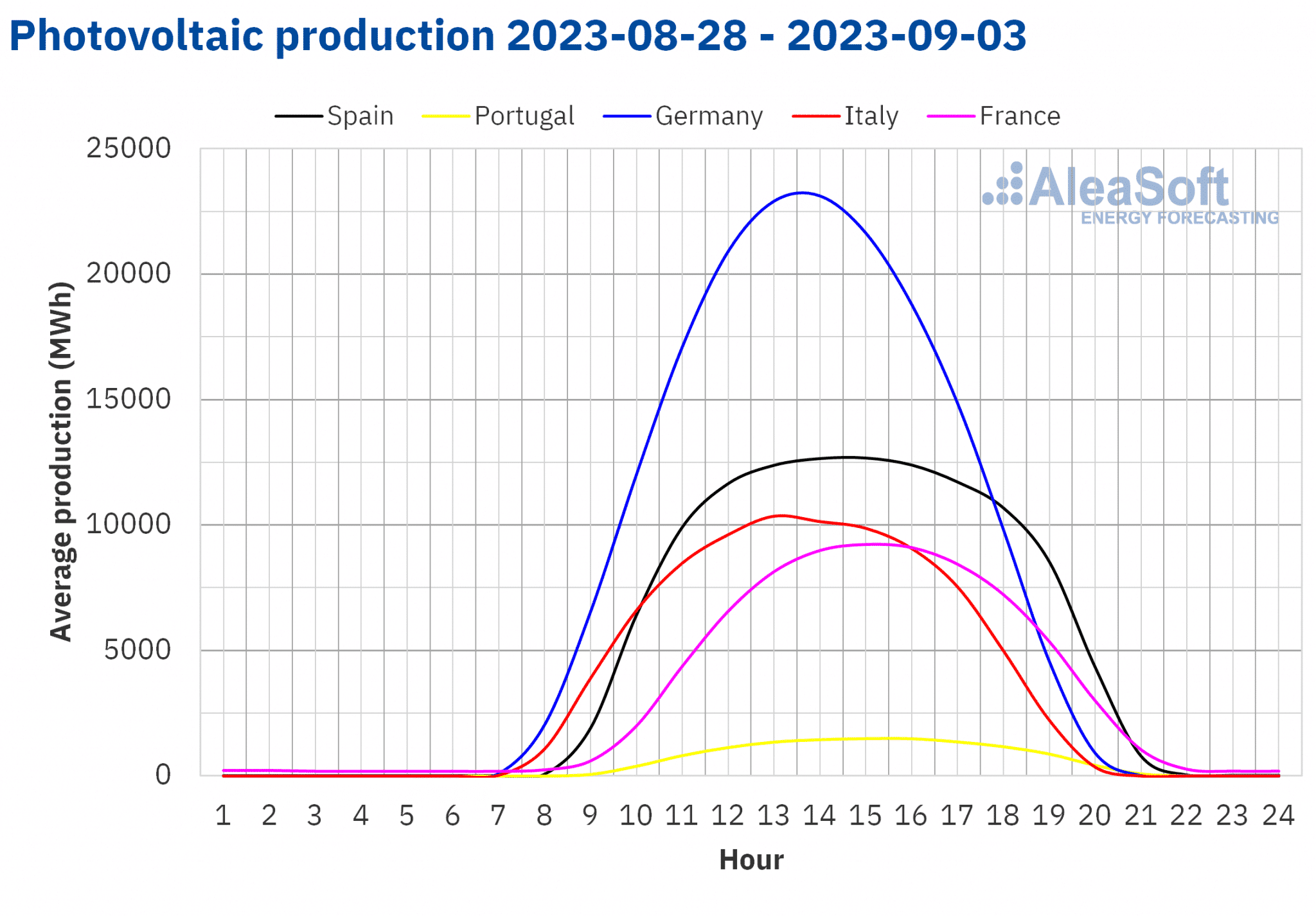

In the week of August 28, solar energy production decreased in all markets analyzed at AleaSoft Energy Forecasting compared to the previous week. The largest drop, of 19%, was registered in the German market, followed by decreases of 14% in the Italian market and 10% in the Spanish market. In the other markets, the decrease in production using this technology was 4.9% in France and 5.6% in Portugal.

According to AleaSoft Energy Forecasting’s solar energy production forecasts, it is expected to increase in all analyzed markets for the week of September 4.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

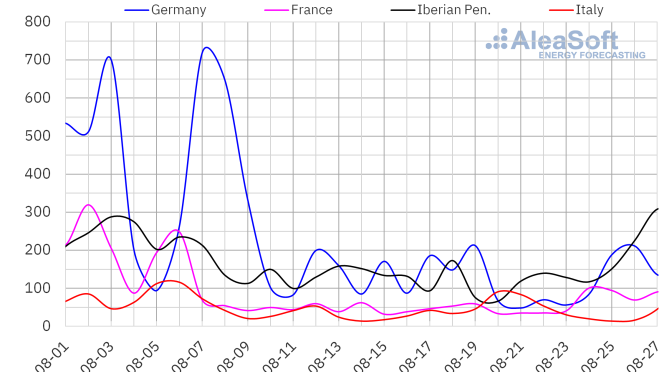

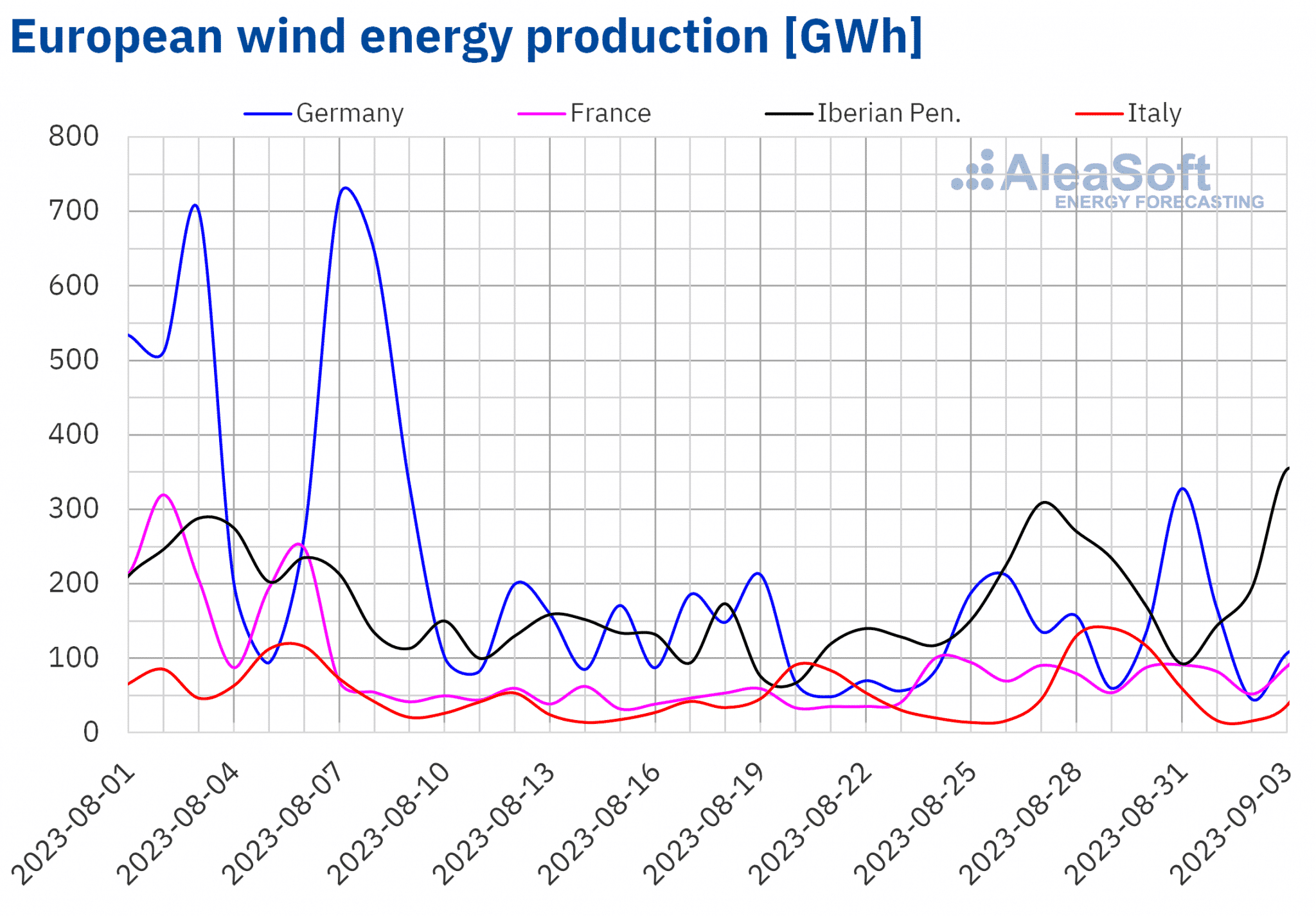

Regarding wind energy production, 141 GWh of wind energy were generated in the Italian market on Tuesday, August 29, the highest daily value since April 14, 2023. A similar behavior was registered in the Spanish market, where 289 GWh of wind energy were generated on Sunday, September 3, the highest daily value since May 18, 2023.

In contrast to solar energy production, during the last week of August, wind energy production increased in all analyzed markets compared to the previous week. The Italian market registered the largest variation, with an increase of 96%. In the rest of the markets, increases ranged from 15% in France to 32% in Portugal.

For the week of September 4, AleaSoft Energy Forecasting’s wind energy production forecasts indicate that production will decline in all analyzed markets, except in Italy.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

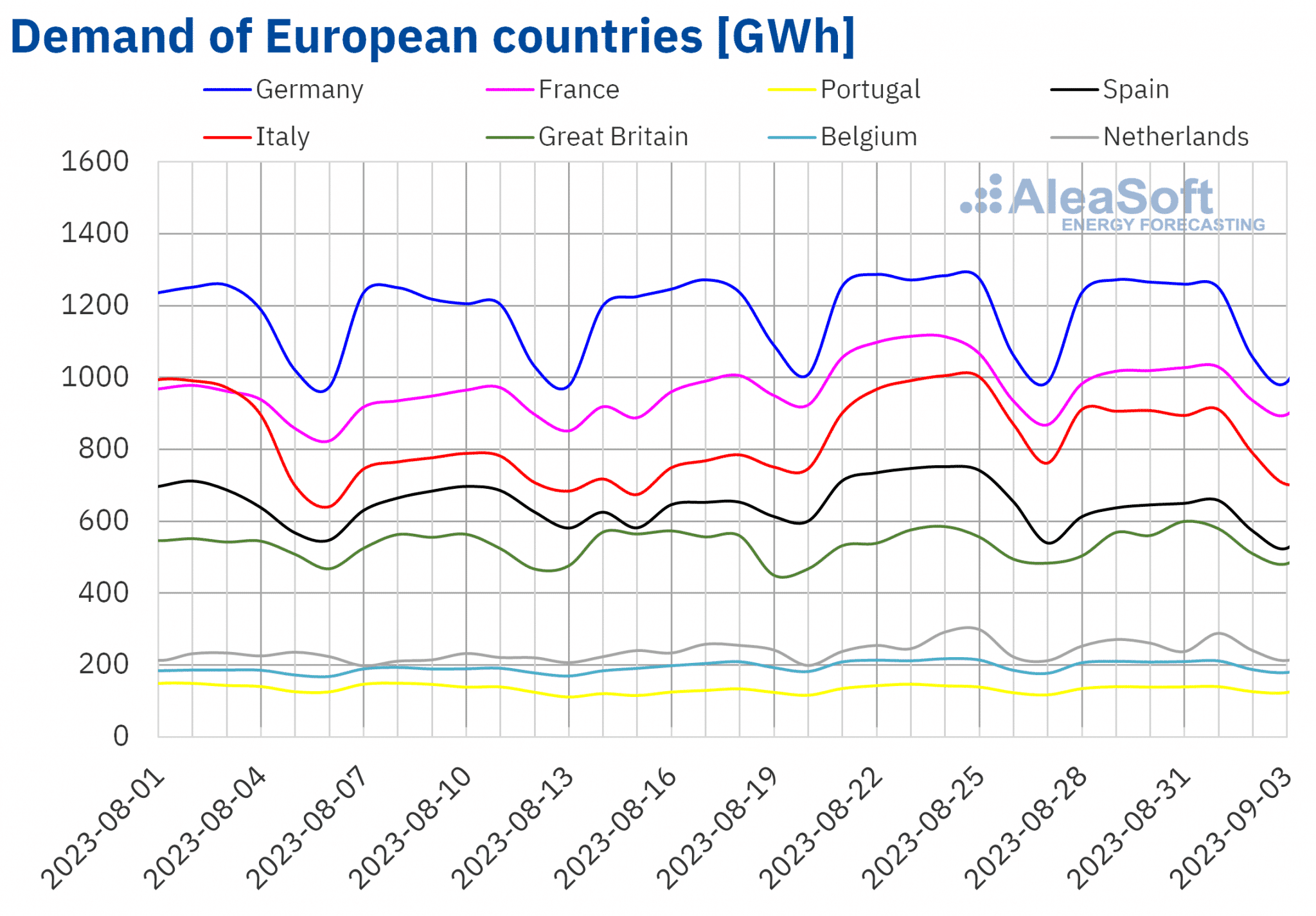

Electricity demand

In the week of August 28, electricity demand decreased in most of the analyzed markets compared to the previous week. The largest decrease, which was 12%, was observed in the Spanish market, followed by decreases of 7.3% in Italy and 4.8% in France. The smallest decline in demand, which was 0.4%, was registered in the Portuguese market, while the Dutch market remained stable. The exception was the British market, where demand increased by 1.0%.

During the week mentioned before, average temperatures decreased in all analyzed countries compared to the previous week. Germany and Italy registered the largest drop, of 5.5 °C. In Spain, France and Portugal, average temperatures decreased by 4.9 °C, 4.3 °C and 4.1 °C, respectively. On the other hand, in the Netherlands, Belgium and Great Britain, average temperatures fell by less than 2.5 °C.

According to AleaSoft Energy Forecasting’s demand forecasts, electricity demand is expected to increase in the first week of September in all European markets analyzed, with the exception of Germany and Great Britain.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

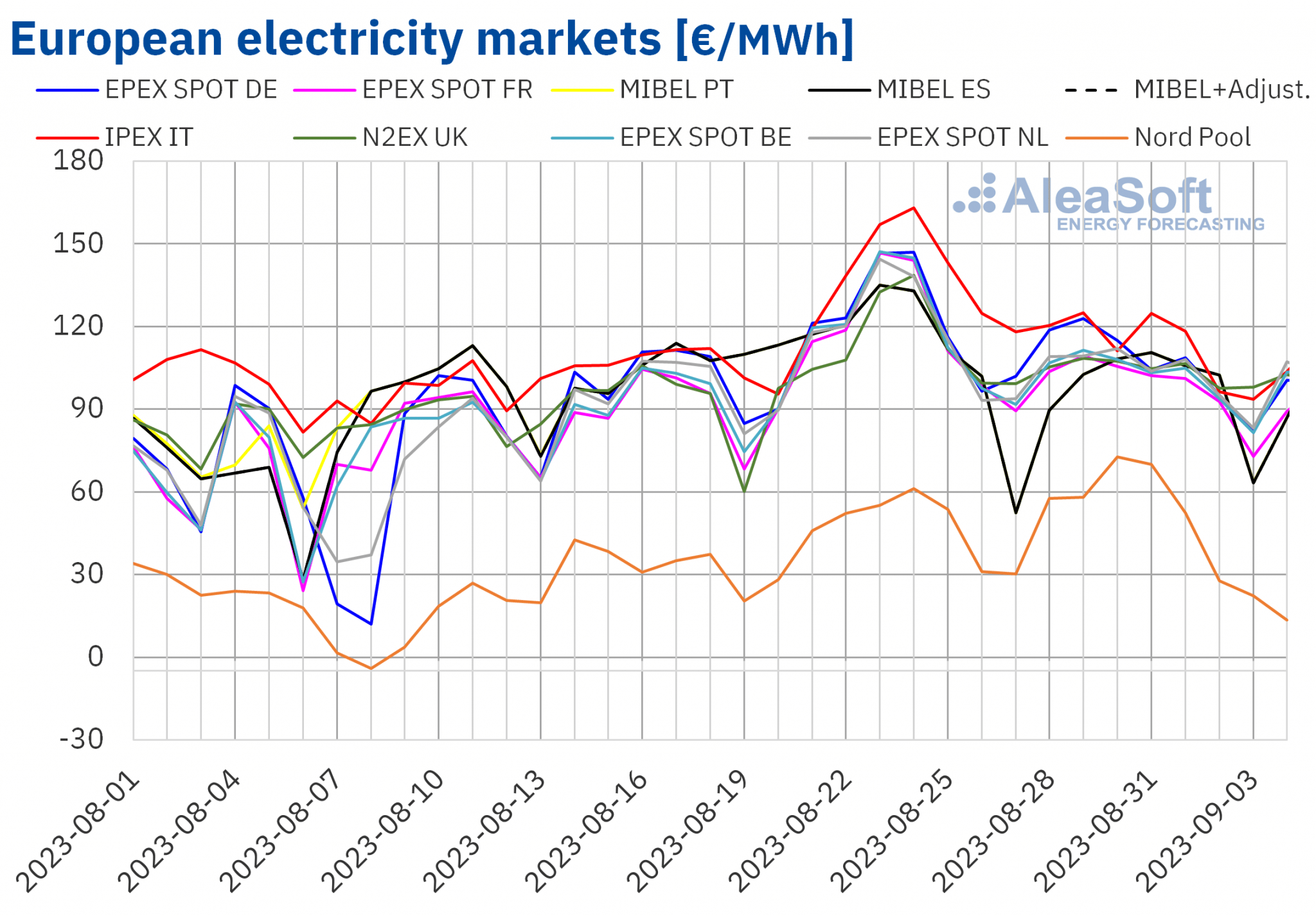

European electricity markets

During the week of August 28, prices in almost all European electricity markets analyzed at AleaSoft Energy Forecasting decreased compared to the previous week. The exception was the Nord Pool market of the Nordic countries with an increase of 9.5%. On the other hand, the IPEX market of Italy registered the largest price decrease of 18%. In contrast, the smallest decrease of 8.3% was registered in the N2EX market of the United Kingdom. Elsewhere, prices fell between 12% on the EPEX SPOT market of Germany and the Netherlands and the MIBEL market of Spain and Portugal, and 16% on the EPEX SPOT market of France.

In the last week of August, weekly averages were above €95/MWh in almost all European electricity markets. The exception was the Nordic market with the lowest average of €51.55/MWh. On the other hand, the highest average price of €112.78/MWh was registered in the Italian market. In the rest of the analyzed markets, prices ranged from €97.52/MWh in the Spanish market to €106.74/MWh in the German market.

In terms of daily prices, the highest price since the end of June in the Nordic market, €72.61/MWh, was registered on Wednesday, August 30. However, in the last week of August, the highest daily price in the analyzed markets, €124.97/MWh, was registered in the Italian market on Tuesday, August 29.

During the week of August 28, the decrease in the average price of gas and CO2 emission rights, the general increase in wind energy production and the decrease in demand in most markets led to a fall in European electricity markets prices.

AleaSoft Energy Forecasting’s price forecasts indicate that prices might continue to fall in the first week of September on most European electricity markets. However, prices might increase in the MIBEL market, where a significant decrease in wind energy production is expected.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

Brent, fuels and CO2

On Monday, August 28, Brent oil futures for the Front?Month in the ICE market registered the weekly minimum settlement price of $84.42/bbl. This settlement price was very similar to that of the same day of the previous week of $84.46/bbl and that of the last session of the previous week of $84.48/bbl. But the following days of the last week of August prices increased. As a result, on Friday, September 1, the weekly maximum settlement price of $88.55/bbl was reached. This price was 4.8% higher than the previous Friday and the highest since November 2022.

Expectations of further production cuts in the coming months contributed to the rise in Brent oil futures prices during the last week of August.

As for TTF gas futures in the ICE market for the Front?Month, the weekly maximum settlement price of €38.41/MWh was reached on Monday, August 28. This price was already 5.8% lower than the previous Monday. In the rest of the sessions of the last week of August, settlement prices remained below €36/MWh. The lowest weekly settlement price of €35.03/MWh was registered on Thursday, August 31. However, this price was 9.7% higher than the previous Thursday.

In the last week of August, news of negotiations to avert strikes at Australian liquefied natural gas export facilities, combined with high European inventories, allowed prices to remain below €36/MWh for most of the week, despite the decrease in supply from Norway due to maintenance.

Regarding CO2 emission rights futures in the EEX market for the reference contract of December 2023, all sessions in the last week of August registered lower settlement prices than on the same days of the previous week. On Tuesday, August 29, the weekly minimum settlement price of €84.77/t was reached. This price was 5.7% lower than on the previous Tuesday. On the other hand, the weekly maximum settlement price of €86.24/t was registered on Wednesday, August 30 and it was 2.2% lower than on the previous Wednesday. In the last sessions of the week, prices fell again. As a result, on Friday, September 1, the settlement price was €85.27/t.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe

This Thursday, September 7, the next webinar in the AleaSoft Energy Forecasting and AleaGreen monthly webinar series will be held. The webinar will feature the usual analysis of the evolution and prospects of energy markets in Europe. Another topic of the webinar will be AleaSoft Energy Forecasting services that contribute to risk management and energy transition. In addition, the benefits of PPA for large and electro?intensive consumers will be analyzed. Pedro González, Director?General of AEGE, Association of Companies with Large Energy Consumption, will participate in the analysis table after the Spanish version of the webinar to share the vision of energy intensive companies on the subject. Jaime Vázquez, PPA Director at Econergy Renewables, will also participate in the analysis table.