In 2021 and 2022 a barrage of factors pushed up prices of clean energy equipment. The cost of inputs, such as critical minerals, soared. Logistical problems prevented shipments from clearing ports or arriving to destination on time. Russia’s invasion of Ukraine in early 2022 upended energy trade patterns as most of the world, and Europe in particularly, drastically reduced imports from Russia (one of the world’s top three crude producers) and sped up deployment of clean energy. Fossil fuel prices – a major cost for manufacturing and transport – spiked. But despite continued acceleration of clean energy deployment in many markets, these challenges eased over the first half of 2023, reversing upward price trends. Inflation is starting to slow across the world as fuel prices fall back, key component supply is increasing and global economic growth is projected to slow down.

To monitor these influences on clean energy equipment prices – a critical determinant of investment in clean energy technology and infrastructure – the IEA developed the Clean Energy Equipment Price Index (CEEPI). The index tracks price movements in a global basket of solar PV modules, wind turbines and lithium-ion batteries for electric vehicles (EVs) and energy storage, weighted by shares of investment. After a steep and steady decline until the end of 2020 – dropping by 60% between early 2014 (the start of the index) and the third quarter of 2020 (equivalent to an average compounded 13% annual reduction) – prices started to go up consistently until end-2022. Today, the index is back to its 2019 level, reflecting an easing of price pressures.

Prices of clean energy equipment are back down to 2019 levels, a positive sign for energy transitions

IEA clean energy equipment price index, 2014-2023

Open Index (2019 Q4 = 100)Q1 2014Q3 2014Q1 2015Q3 2015Q1 2016Q3 2016Q1 2017Q3 2017Q1 2018Q3 2018Q1 2019Q3 2019Q1 2020Q3 2020Q1 2021Q3 2021Q1 2022Q3 2022Q1 2023050100150200250300

Prices for solar PV modules, the largest component in the CEEPI, tell a big part of this up-and-down story. Average module prices were around 30% higher in mid-2022 compared to some of their lowest levels two years earlier. The last two years saw significant strain as demand was enormous (the technology broke a new deployment record in 2022, with net additions of nearly 220 GW, a 35% increase from 2021) and supply was affected by numerous factors, ranging from trade delays and underlying cost increases (exacerbated in 2022 by Russia’s invasion to Ukraine) to supply shortages and a commodity price rally, including key module components like silicon and wafers. Explosions in one of China’s largest producers of polysilicon in 2020 also took out around 10% of global supply, pushing up prices while the country was under strict Covid-related measures.

But cost pressures have eased since the start of 2023, and new solar manufacturing capacity is expanding supply, driven by sustained demand and supportive policies. For instance, Turkish producers now account for more than 10 GW of module capacity, and more is in the pipeline, for both modules and cells. Policy support is encouraging expansions of existing European manufacturers, albeit from a low base. The proposed European Commission’s Net Zero Industry Act (NZIA) targets up to 40% of Europe’s clean energy technology deployment needs by 2030 to be fulfilled by domestic products. Non-Chinese producers are also encouraged by the growing US market (helped by policy and tax credits introduced by the US Inflation Reduction Act) and import barriers imposed by the United States on solar products originated in the Chinese province of Xinjiang. Enel is planning to expand its production in Italy from 200 MW to 3 GW and is planning a new plant in the United States by 2024, producing at least 3 GW of bifacial PV modules and cells annually. However, most of the existing and planned production plants in Europe and the United States are still small compared with those in China.

Average prices of wind turbines, which account for about a third of the index, have also come down from recent highs. Those price increases, however, were concentrated among European manufacturers, as Chinese ones continued lowering their prices. After subsidies for onshore wind were removed in China in 2020, investor appetite receded, forcing domestic turbine makers to slash prices. While competition remains strong, increased orders have helped offset lower prices for manufacturers, who have focused on building bigger turbines, innovating and cutting costs. Outside China, market conditions in recent years have been more challenging. Among the major European manufacturers – which account for about half of the global market share – profit margins were meagre in 2021 and 2022, if not negative, with revenues hit hard by supply chain delays, inflationary pressures and losses due to Russia’s invasion of Ukraine. Average selling prices of European manufacturers have stayed relatively unchanged in the first and second quarter of 2023.

Battery prices did not escape inflation. The heaviest hit was mostly in 2022, and prices are expected to remain flat in 2023. Lithium-ion battery prices, which account for 13% of the CEEPI, were affected by the global surge in inflation and general market volatility in 2022, despite innovation and cost reductions in battery packs. Substantial increases in the prices of lithium and nickel, two important inputs for EV batteries, were a big factor in soaring battery prices. As prices of critical minerals increased over the last years, these materials assumed a larger portion of the total cost. For instance, lithium-ion batteries are composed of battery cells (with cathode material) contained in battery modules within a battery pack. The share of cathode materials in battery costs was less than 5% in the middle of the last decade, but reached over 20% in 2021 and almost 40% in 2022. When other material inputs are added in, the share of raw materials is even higher, highlighting the importance of mineral prices in defining the affordability and economic attractiveness of clean energy technologies in power generation.

Various economy-wide factors, like the cost of international shipping or inflation rates, have eased, helping to reduce pressure on clean energy equipment costs in 2023. Inflation in the United States – a key indicator given the relevance of the US Dollar in global trade and the global financial system – has been slowing, reaching 3% in June 2023, a significant decline from a peak of 9.1% in June 2022. Core inflation – which excludes energy and food prices as they are generally more volatile – was 4.8% in June, the lowest since October 2021. Easing US inflation is important as it has implications for monetary policy and whether the US Federal Reserve continues with its rapid monetary tightening or adopts slower and smaller interest rate hikes. These decisions have consequences beyond the US economy, as many countries import US inflation (through higher prices for USD-priced goods) or because the 10-year US government bond is used as a benchmark for the cost of capital of USD-denominated projects across the world.

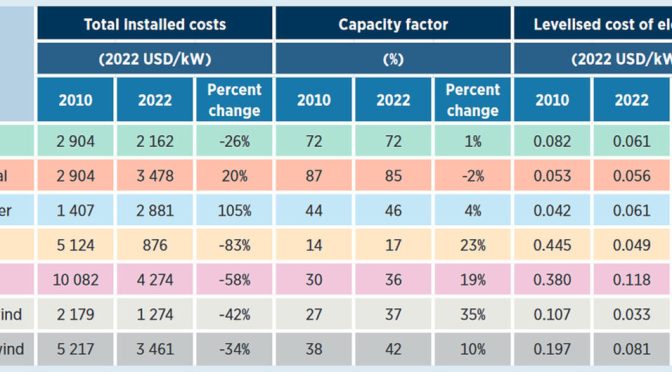

Variations in input prices are set to have a significant effect on the costs of transforming our energy systems and hence the deployment of clean energy technologies. The 2010s was a decade of strong technological innovation and learning, as well as greater economies of scale, leading to important cost reductions in clean energy assets, with solar PV modules and wind turbines front and centre. The year 2023 could be a pivotal for clean energy technologies, marking a return to the historical downward trend or a break from it. Resuming the descending tendency and doing it fast will depend on prices of critical minerals, the continuation of strong competition among markets, and the speed of innovation, especially for relatively less mature technologies like battery storage.

There is a lot of information on the costs of different clean energy technologies and components, but it is scattered and there is no single metric providing a complete and uniform picture. The IEA created the CEEPI to fill this gap. The index can be used as a benchmark indicator of price developments and supply and demand imbalances in the clean energy space. It can also be used to show whether investing in the clean energy sector, broadly speaking, is becoming more or less expensive.

The index tracks price movements of a fixed basket of clean energy equipment products. The index is weighted based on global average annual investment in the 2020-2022 period. These weights are: solar PV modules (48%), wind turbines (36%), EV batteries (13%) and utility-scale batteries (3%). We use an average over three years to “smooth” the effect of sudden jumps or reductions in investment that may occur in response to specific policies or market conditions. We use a shorter average of just the last three years to account for the rapidly growing importance of EV batteries.

To calculate the index value, we estimate the price of the basket in the current period and divide it by the price in a base period, and then multiply by 100. Prices are nominal and do not include taxes or transportation costs, similar to how producer price indexes are compiled. The basket tracks prices of clean energy equipment products – as opposed to the critical minerals used to produce them (e.g., the prices of the commodities that are required to build a solar PV module, like silicon and silver) – given its relative simplicity to calculate and interpret.

There is a more direct relationship between the prices of clean energy equipment and capital expenditure than with critical minerals. For example, solar PV investors are generally more sensitive to price changes in solar PV modules than in prices of silicon. Equipment producers generally have contracts with commodity producers, as a way of ensuring supply and hedging for price volatility in the spot market. Equipment producers may also choose to sacrifice profits at times of high commodity prices, or the opposite as prices go down. Plus, while critical minerals represent an important part of the overall total price of clean energy equipment, it is only part of it.

The index will be updated on a quarterly basis and the IEA aims to expand the number of product prices tracked, depending on data availability and the relative importance of the equipment in overall energy investment expenditures.

Lucila Arboleya, Former Investment and Finance Analyst Commentary