The fall in gas prices during the first week of September, after the rebound in August, accompanied by the increase in photovoltaic energy production, relaxed prices in most European electricity markets. However, the fall in wind and solar energy production in the Iberian Peninsula contributed to the rise in prices in the MIBEL market. It should be noted that the highest hourly prices since December were registered in the German, Belgian and Dutch markets, above €300/MWh.

Concentrated Solar Power, photovoltaic and and wind energy production

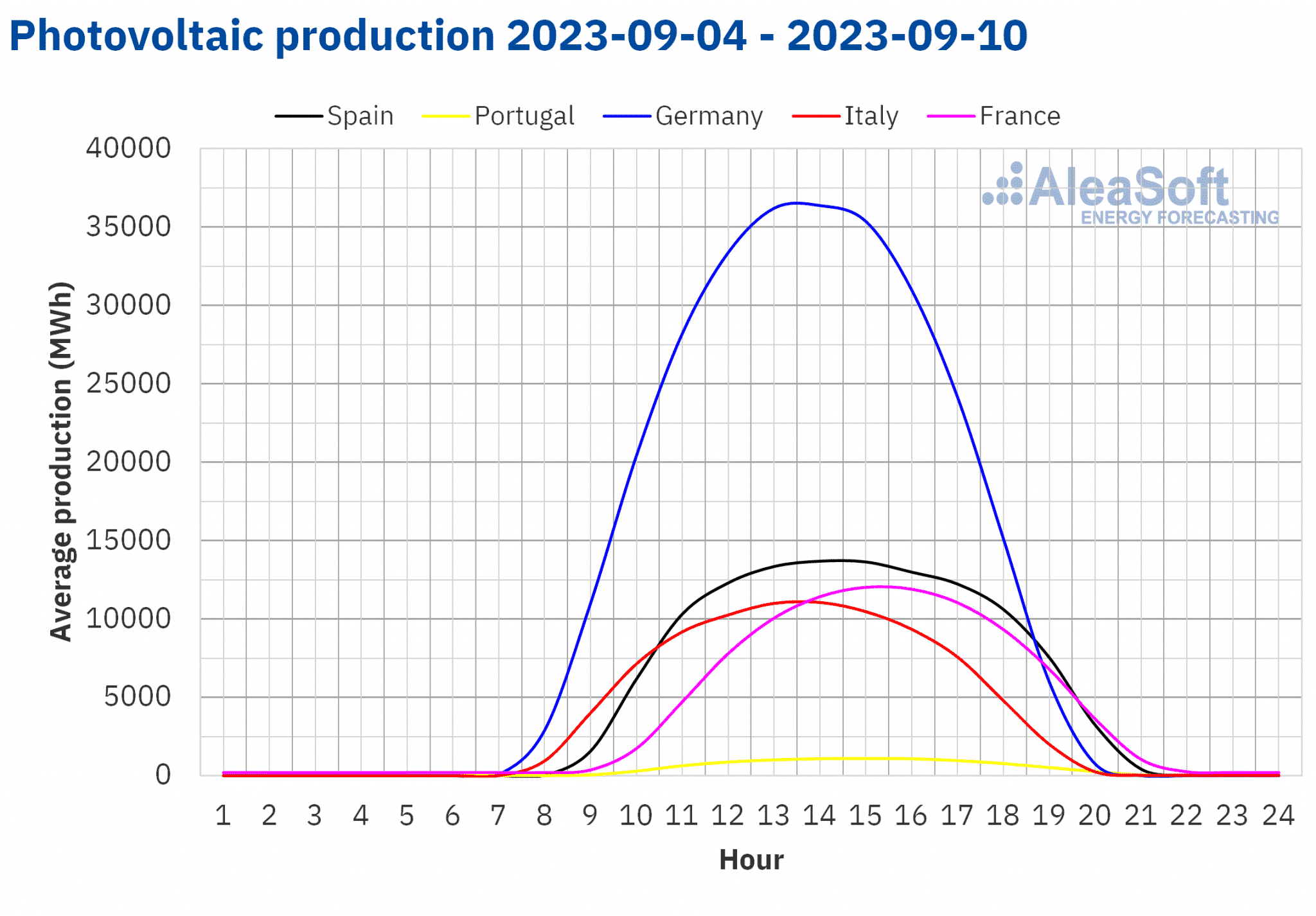

In the week of September 4, solar energy production increased in almost all analyzed markets compared to the previous week. Even though the end of summer is approaching, the German market registered a very significant increase in solar energy production (60%), with 290 GWh generated on September 4, the highest value since August 11. The French and Italian markets also registered increases in solar energy production of 25% and 6%, respectively. In contrast, solar energy production in Spain and Portugal decreased by 5.7% and 27%, respectively.

For the week of September 11, according to AleaSoft Energy Forecasting’s solar energy production forecasts, production is expected to decrease in all analyzed markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

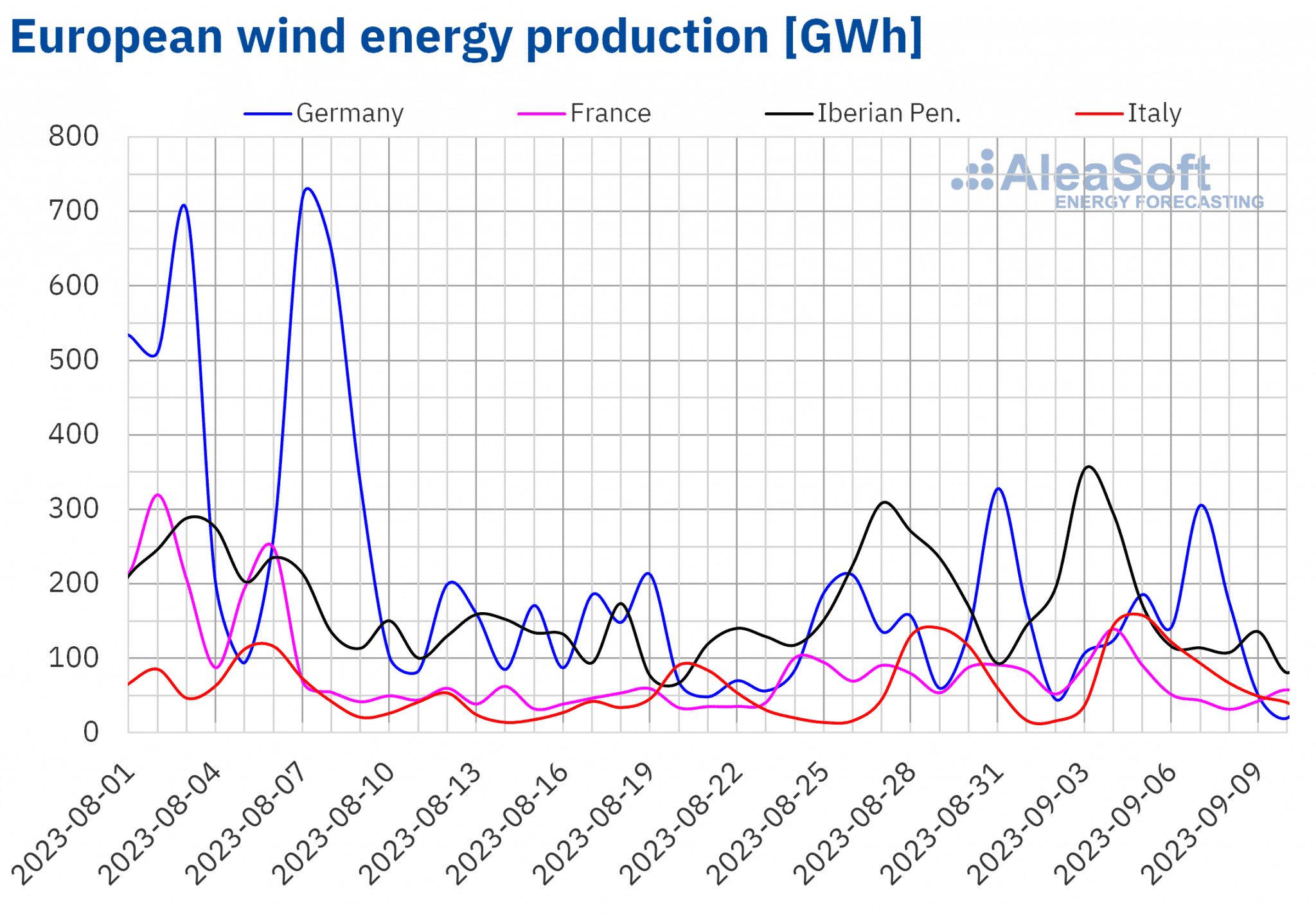

Regarding wind energy production, on Tuesday, September 5, 158 GWh of wind energy were generated in the Italian market, the highest daily value since the first week of April, in spring. A similar situation occurred in the Portuguese market, where on Monday, September 4, 84 GWh of wind energy were generated, the highest daily value since mid?March.

Unlike solar energy production, the week of September 4 brought a week?on?week decrease in wind energy production in most of the markets analyzed by AleaSoft Energy Forecasting. The drop in production ranged between the 15% observed in France and the 33% registered in Spain. Among the markets that registered an increase in production, the Italian market stands out with an increase of 30%.

For the week of September 11, AleaSoft Energy Forecasting’s wind energy production forecasts indicate a decrease in all analyzed markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

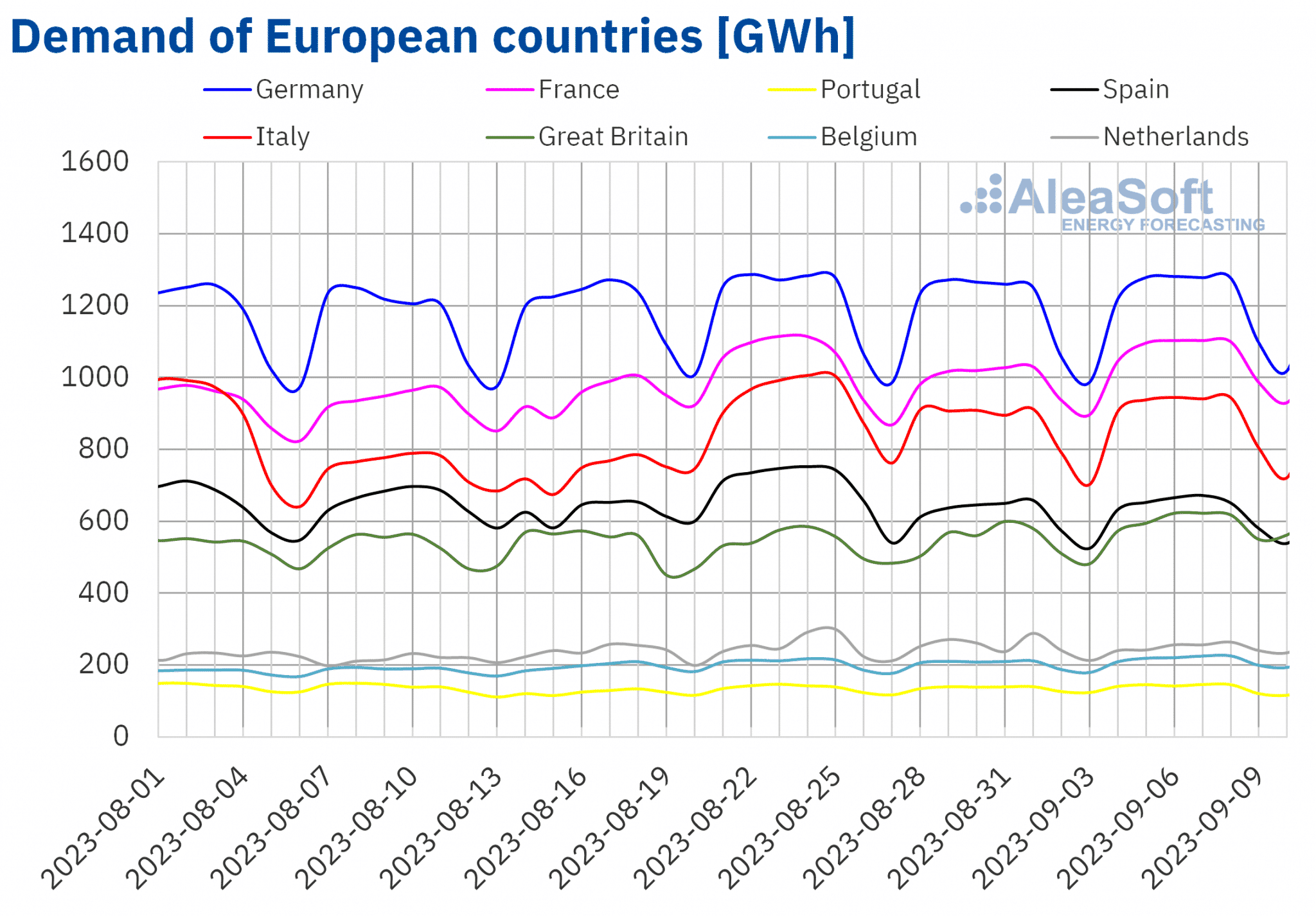

Electricity demand

In the week of September 4, electricity demand increased in almost all analyzed markets compared to the previous week. The largest rise, which was 8.9%, was registered in the United Kingdom. In addition to the British market, the French and Belgian markets were the only markets where demand increased by more than 5% (6.6% and 5.6% respectively). In the rest of the markets, the increase in electricity demand ranged between 1.5% in Germany and Portugal, and 2.8% in Italy. The exception to this upward trend in demand was the Dutch market, where demand fell by 1.7%.

During that week, the average temperature increased in all analyzed countries compared to the previous week, with the United Kingdom once again leading the list with an increase of 6.0 °C. An increase of more than 4.5 °C was also observed in Belgium, Germany, France and the Netherlands. In the Iberian Peninsula and Italy the increase in average temperature did not exceed 1.5 °C.

For the current week of September 11, according to AleaSoft Energy Forecasting’s demand forecasts, electricity demand is expected to fall in the majority of the analyzed European markets, with the exception of Italy, the Netherlands and Portugal.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

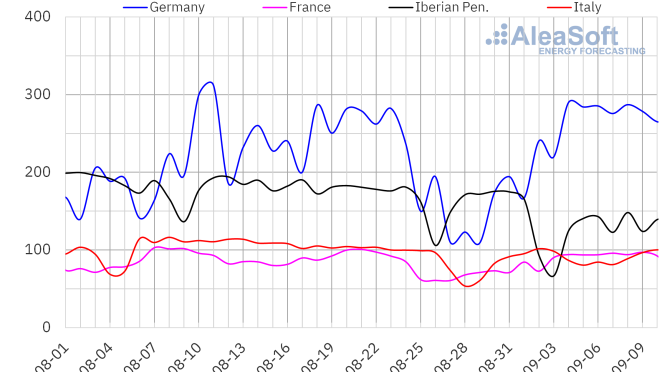

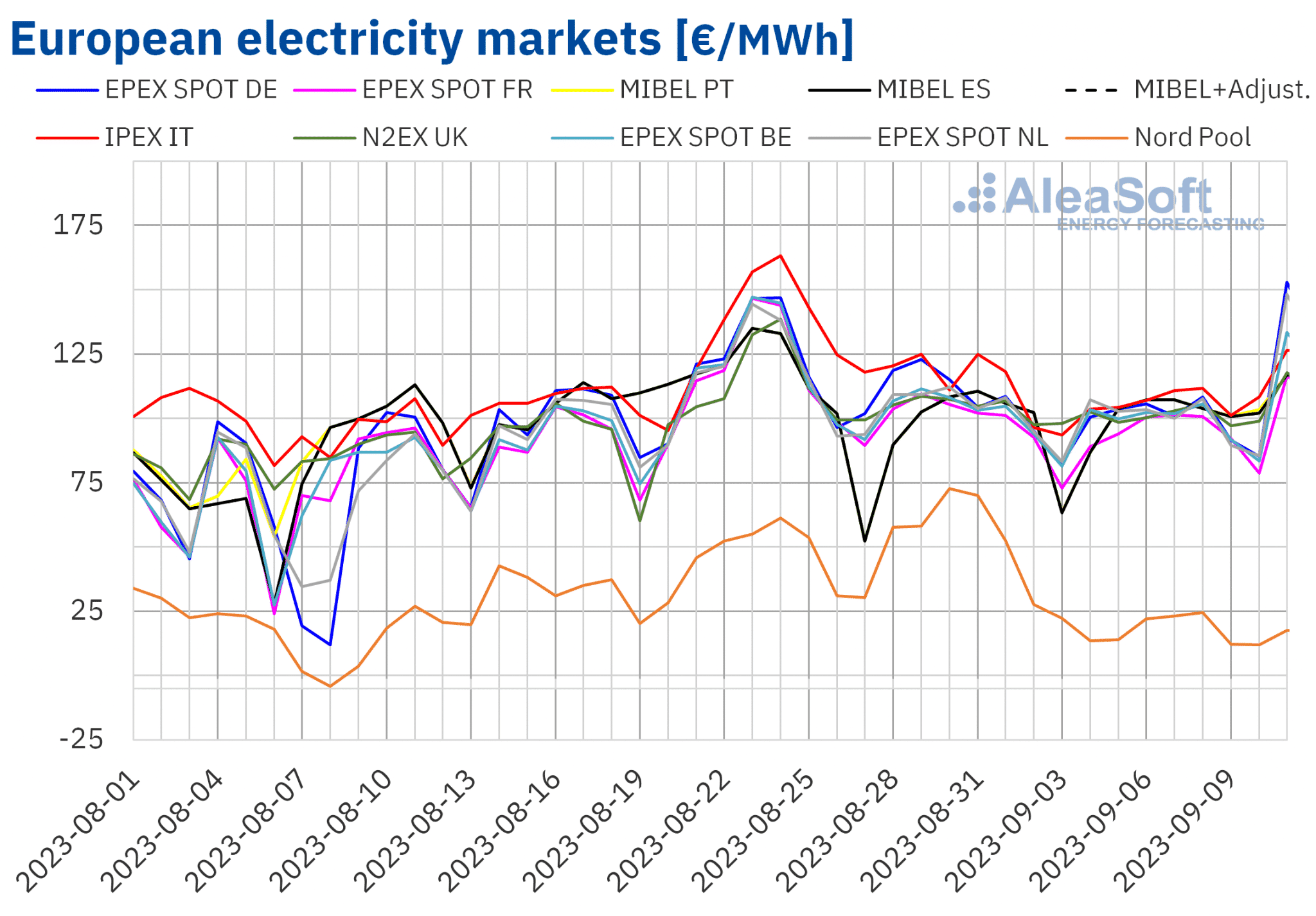

European electricity markets

In the week of September 4, prices of almost all European electricity markets analyzed at AleaSoft Energy Forecasting decreased compared to the previous week. The exception was the MIBEL market of Spain and Portugal, where prices increased by 4.2% and 4.4%, respectively. On the other hand, the largest price decrease, which was 66%, was that of the Nord Pool market of the Nordic countries, while the smallest decrease, which was 3.0%, was registered in the EPEX SPOT market of Belgium. Elsewhere, prices fell between 3.1% of the N2EX market of the United Kingdom and 6.9% of the EPEX SPOT market of Germany.

In the first week of September, weekly average prices were higher than €90/MWh in almost all European electricity markets. The exception was the Nordic market, with the lowest average, €17.37/MWh. On the other hand, the highest average price, €106.68/MWh, was that of the IPEX market of Italy. In the rest of the analyzed markets, prices were between €93.78/MWh in the French market and €101.85/MWh in the Portuguese market.

Regarding hourly prices, on Saturday, September 9, from 12:00 to 14:00, negative values were reached in the Dutch market, values that had not occurred since the first half of August. Furthermore, on Sunday, September 10, from 14:00 to 15:00, a price of €0/MWh was registered in the German, Belgian, French and Dutch markets. On the other hand, on September 11, prices exceeded €300/MWh in the German, Belgian and Dutch markets, reaching the highest values since December 2022. In the Belgian market, the highest price, €330.36/MWh, was registered from 20:00 to 21:00. In the case of the Dutch and German markets, the highest prices were €463.77/MWh and €524.27/MWh respectively, reached from 19:00 to 20:00.

During the week of September 4, the decrease in the average price of gas and CO2 emission rights, as well as the increase in solar energy production in most markets, led to the fall in European electricity markets prices, despite the increase in demand. However, the fall in wind and solar energy production in the Iberian Peninsula contributed to the increase in prices in the MIBEL market.

AleaSoft Energy Forecasting’s price forecasts indicate that in the second week of September prices might increase in the European electricity markets, influenced by the decrease in wind and solar energy production, as well as the increase in demand in some markets.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

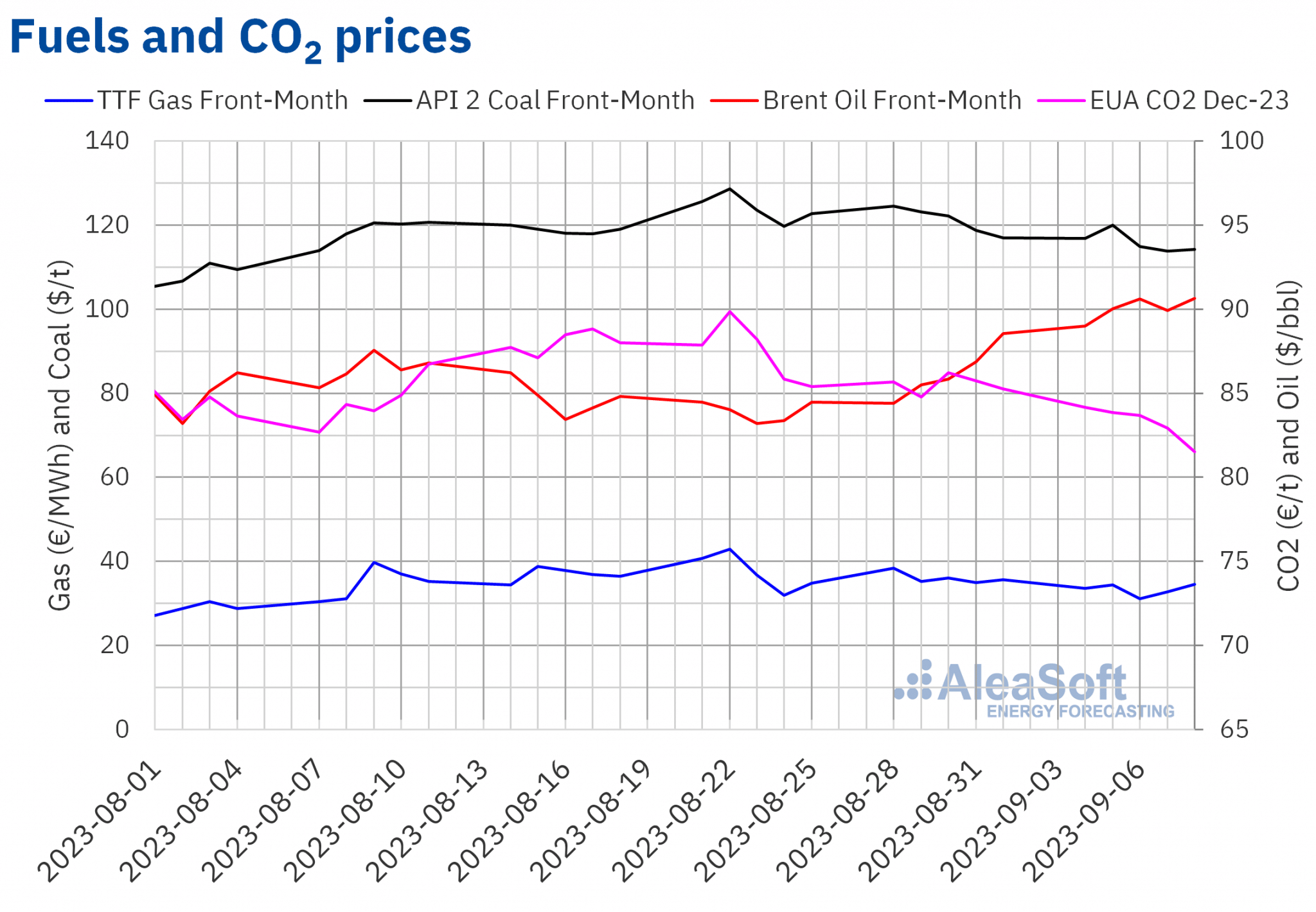

Brent, fuels and CO2

In the first week of September, settlement prices of Brent oil futures for the Front?Month in the ICE market were higher than those of the previous week, registering values around $90/bbl. On Monday, September 4, futures registered the weekly minimum settlement price of $89.00/bbl, which was 5.4% higher than the previous Monday. The weekly maximum settlement price of $90.65/bbl was reached on Friday, September 8. This price was 2.4% higher than the previous Friday and the highest since November 2022.

The production cuts announced by Saudi Arabia and Russia until the end of the year exerted their upward influence on Brent oil futures prices. In addition, data on US crude oil reserves indicated declines.

As for settlement prices of TTF gas futures in the ICE market for the Front?Month, during the first week of September they remained below €35/MWh. The weekly minimum settlement price, €31.07/MWh, was registered on Wednesday, September 6. This price was 14% lower than the previous Wednesday. Subsequently, prices increased and on Friday, September 8, the weekly maximum settlement price of €34.51/MWh was reached, which was still 3.1% lower than the previous Friday. On Monday, September 11, increases continued and the settlement price was €35.85/MWh, 6.8% higher than that of Monday, September 4.

TTF gas futures continued to be influenced by news of the labor dispute affecting Australian liquefied natural gas export plants. The evolution of the conflict, together with the decrease in supply from Norway due to maintenance work, caused prices to increase in the last sessions of the week and the beginning of the second week of September.

Regarding CO2 emission rights futures prices in the EEX market for the reference contract of December 2023, during the first week of September, the downward trend that began in the last sessions of the previous week continued. On Monday, September 4, the weekly maximum settlement price of €84.16/t was reached, which was 1.8% lower than the previous Monday. On the other hand, the weekly minimum settlement price, of €81.52/t, was registered on Friday, September 8. This price was 4.4% lower than the previous Friday and the lowest since the beginning of June.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe

On Thursday, September 7, the webinar number 36 of the monthly webinar series of AleaSoft Energy Forecasting and AleaGreen was held. The webinar analyzed the evolution and prospects of European energy markets and the benefits of PPA for large and electro?intensive consumers. In addition, AleaSoft Energy Forecasting services that contribute to risk management and energy transition were explained. Pedro González, Director?General of AEGE, and Jaime Vázquez, PPA Director at Econergy Renewables, participated in the analysis table after the Spanish version of the webinar.

The next webinar in the series will take place on October 19. Speakers from Deloitte will participate in this webinar, their fourth participation in the monthly webinars. The topics analyzed will be the prospects for European energy markets for winter 2023?2024, the financing of renewable energy projects and the importance of forecasts in audits and portfolio valuation.