Despite short-term challenges, all leading wind turbine manufacturers will double their annual installed capacity over the next decade, driven by soaring wind demand.

Supply chain companies within the wind energy value chain are facing a paradox: the industry expects long-term demand growth prompted by decarbonisation ambitions but will encounter many challenges in the near term.

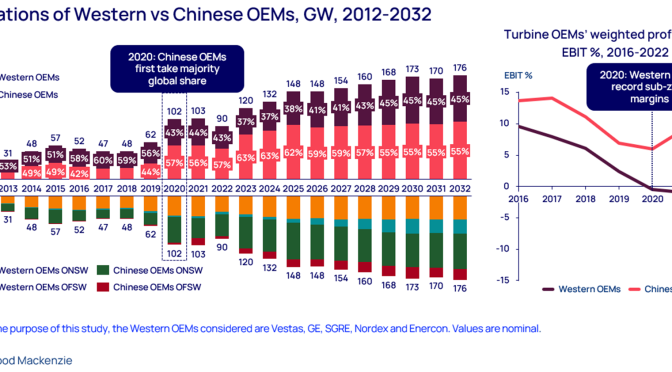

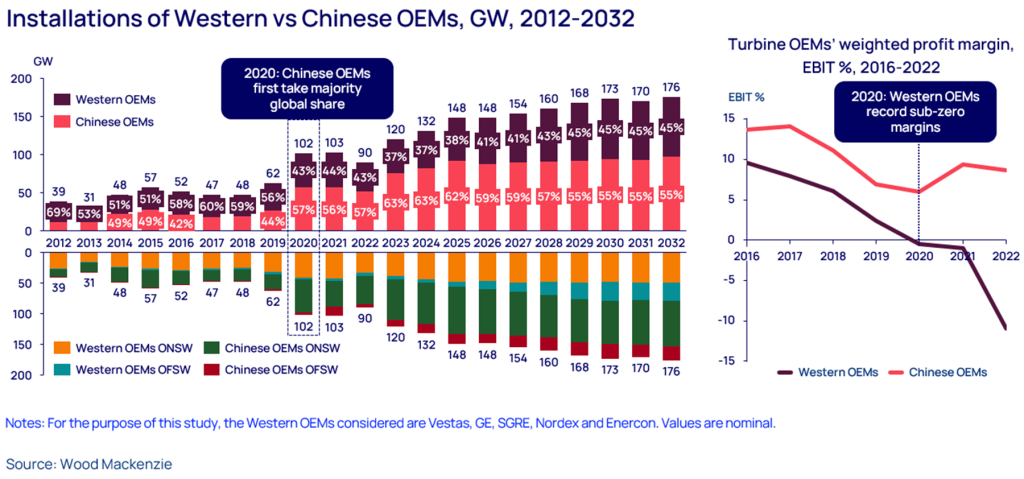

All Western turbine manufacturers (OEMs) have declared negative or low-profit margins due to unprecedented supply chain disruptions, raw material cost increases, geopolitical tensions and reliability concerns.

Western OEMs must grapple with insufficient manufacturing capacity to meet forecast global demand, while investing in new capacity expansion is difficult due to profitability pressures. Policy development in the EU, US and UK is forcing Western OEMs to prioritise their core markets, where they have healthier margins, an established presence and a competitive advantage.

Chinese OEMs see a golden opportunity to gain market shares outside China as Western OEMs seek to return to profitability. Our research into both onshore and offshore segments indicates that Chinese OEMs are leveraging their strong financial position and the massive scale of their domestic supply chain to challenge Western OEMs, particularly in emerging markets.

Fill out the form on the right to download a free extract from our ‘Global wind turbine OEMs market share forecast 2023‘, or read on for a summary of some of the key takeaways.

Chinese OEMs are gearing up for over 100 GW of cumulative international exports by 2032

Chinese OEMs are ready to capitalise on the struggles faced by Western OEMs and are forecast to maintain more than 55% of the global wind turbine market share, thanks to the domestic scale in China and the growth in exports. Chinese wind OEMs are particularly focused on emerging markets, incentivised by the Belt and Road Initiative and gigawatt-scale green hydrogen projects. Envision and Goldwind are leading the Chinese export push, thriving in the Middle East, Africa and Eastern Europe, while presenting fierce competition to Western OEMs in Latin America and the rest of Asia Pacific. The traditional western markets of the US and Europe remain strongholds for Western OEMs due to entrenched positions, energy security concerns and protectionist policies that favour domestic supply.

Three OEMs will surpass the 300 GW cumulative install mark this decade

Our analysis of 2022 market shares found that Goldwind gained the leading position, marking the first time a Chinese OEM captured the top spot in the global market share ranking. Goldwind will look to maintain its top rank for the next five years with its dominance in the Chinese market and strategic exports to selected markets.

Vestas’ global presence in over 40 markets, its mature supply chain and offshore growth will push it to recapture the top market share position in the second half of the decade. In the shorter term, Vestas will focus on maintaining commercial discipline within core markets, including Germany, Brazil, the US and Australia.

GE and Nordex will capitalise on stronger demand in the US and EU, respectively, and further increase their dependency on their home markets. Any expansions outside these markets will happen selectively but will face stiff competition from Vestas and other Chinese OEMs.

Siemens Gamesa’s (SGRE) priority will be stabilising their onshore business unit, which faces lasting reputational harm from recently announced reliability problems on the flagship SG 4/5.X platform, further exacerbating poor financial performance. We expect SGRE’s onshore market share to suffer as a result, forcing the group to rely upon its offshore leadership position, causing the offshore segment to comprise over 50% of the group’s installations during the next decade.

Finally, Envision is gearing up for both domestic and international expansion, capitalising upon a strong product portfolio and strategic relationships with major developers and dominating in the Middle East, Central Asia and India.

SGRE maintains leadership in offshore wind, adding approximately 100 GW by 2032

The three leading western wind turbine OEMs will continue to battle in the growing offshore segment as onshore markets flatten. SGRE maintains the dominant offshore market leadership but must pursue an ambitious capacity expansion plan to meet nearly 17 GW of backlog for the SG 222/236-DD turbine, which will prove problematic if financial challenges persist. Vestas will capitalise on the success of V236, which has garnered more than 12 GW of preferred supplier agreements. We anticipate that Vestas will return to profitability faster than other Western peers, providing flexibility to invest in new capacity to serve the offshore growth markets of the US, Poland and Germany. GE is executing 4.5 GW of firm orders while preparing the 18-MW version of Haliade-X. The company is concurrently preparing to ramp up its manufacturing footprint in APAC and the US.

In the Chinese offshore segment, MingYang is gearing up to become the new market leader, capitalising on the 6.5 GW firm backlog and an extended product portfolio covering both low- and high-wind-speed turbines. SEwind will lose momentum due to thin margins and intense competition, particularly from new offshore entrants Windey, CRRC and SANY. Fierce competition within China is propelling an offshore turbine arms race, with Chinese OEMs leapfrogging their Western counterparts in terms of turbine sizes. This rapid technological advancement has constrained the average pricing of 10-MW and greater offshore turbines in China by 19% in H1 2023 compared to H1 2022.

In summary, Western wind turbine manufacturers are grappling with profitability challenges and capacity constraints, creating an opportunity for Chinese companies to rapidly expand their global market share. Chinese OEMs are leveraging their strong financial position and domestic supply chain scale, poised to capture over 55% of the global wind turbine market share, particularly in emerging markets and offshore segments, challenging their Western counterparts in the foreseeable future.

Endri Lico

Principal Analyst, Global Wind Supply Chain and Technology