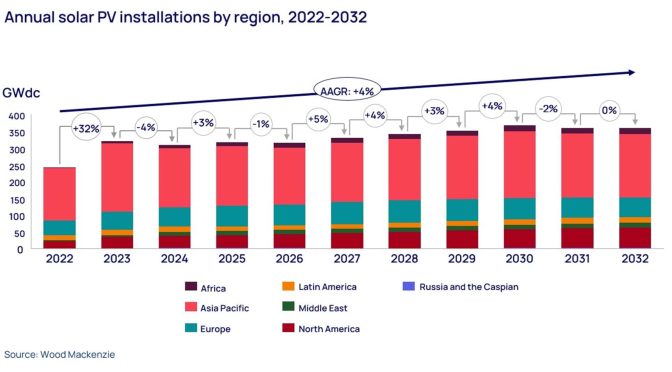

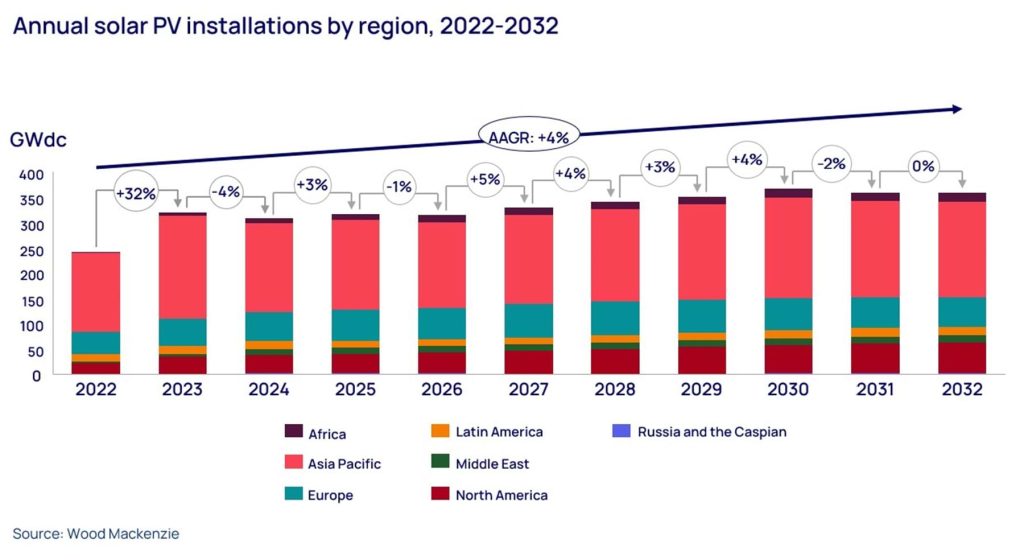

Solar energy continues its relentless penetration into the world’s energy system, driven by strong policy support, attractive pricing, and the technology’s modular nature. We expect over 320 GWdc of solar to be installed this year, which represents a 20% increase compared to our projections from last quarter. Our latest global solar forecasts have global installations rising by an annual average of 4% over the next ten years.

Our most recent Global Solar PV Market Outlook Update explores the global trends and regional variations that inform our forecasts, helping the industry better understand this fast-paced sector and make more informed decisions. Fill out the form on the right to access your complimentary extract of the report, or read on for some key highlights.

The US will see a staggering 52% yearly growth in solar installations in 2023

Following a 13% market contraction in 2022, Wood Mackenzie expects the US solar industry to grow 52% this year, reaching nearly 32 GWdc of installed capacity by the end of 2023. A record 20 GWdc will be installed over the second half of the year, surpassing every annual total prior to 2021. Modest growth is expected across distributed solar, while the utility segment is set to almost double compared to last year.

Supply chain constraints are easing as more modules are making their way through ports. And utility-scale solar developers in particular are rushing to install projects before President Biden’s moratorium on new tariffs is lifted in June 2024.

Residential solar set a quarterly record in Q2 with 1.8 GWdc of capacity installed. A record 607 MWdc was installed in California ahead of the switch from net metering to the less favourable net billing regime. Despite quarterly records in ten states, high interest rates have slowed growth in larger markets such as Arizona and Texas.

Solar installations in Europe continue to accelerate against the backdrop of the war in Ukraine

Auction activity was severely muted during 2022 due to low ceiling bid prices relative to equipment price increases. But auction participation in Europe has started to rise again. There were record subscription levels awarding 1.7 GW of solar capacity in the latest German government tender in August.

Continued tender rounds across the continent, along with PPA growth, will ensure robust capacity growth in the coming years. While PPA hubs in Spain and the Nordics will continue to incentivise buildout, emerging markets in Eastern Europe have large potential.

Meanwhile, the distributed solar segment is experiencing explosive growth since the onset of war in Ukraine. Though interest rate hikes and inflationary pressures are limiting installations slightly in some markets, system economics remain extremely attractive due to structurally higher retail energy prices.

Energy security concerns are also propelling interest in rooftop buildout. Germany will remain the undisputed leader in distributed solar this decade, installing as much residential and C&I capacity as the next three top European markets combined.

Countries are racing to localise solar technology supply chains

From EU countries to the US, India, Mexico or Indonesia, countries are strategising how to establish domestic solar technology supply chains. While the US and the EU are seeking to minimise their dependence on China, manufacturing powerhouses like India and Mexico see the opportunity to meet growing domestic and international demand for solar technology components.

The US is leading the pack in terms of solar manufacturing announcements. If all of these were to materialise, solar manufacturing output in the country will grow by tenfold in just three years.

But challenges remain

To ensure installation growth remains robust, several challenges must be overcome. Grid capacity bottlenecks are mounting across all regions. In Chile, high renewables penetration on a constrained grid has resulted in high levels of curtailment and intense wholesale market price suppression.

Similar events are mounting in Europe, with declines in capture prices (the prices that solar projects actually earn in wholesale markets) in Spain having outpaced all European markets in the first half of 2023. Record PV installation levels and limited interconnection capacity will continue to challenge project economics in the coming years.

Learn more

To find out more about global solar market trends, and gain access to charts detailing regional variations, please fill out the form at the top of the page to download your complimentary extract from our ‘Global Solar PV Market Update’.

Juan Monge

Principal Analyst, Distributed Solar, Europe

Juan covers distributed solar market developments across Europe.