In the second week of October, European electricity market prices rose. Some hourly prices were above €200/MWh, which was also the case on Monday, October 16. The rise was supported by higher gas and CO2 prices, which registered their highest levels since February and August, respectively. Increased demand and lower solar energy production also drove prices up, while wind energy helped prices to fall on some days.

Concentrated Solar Power, photovoltaic and wind energy production

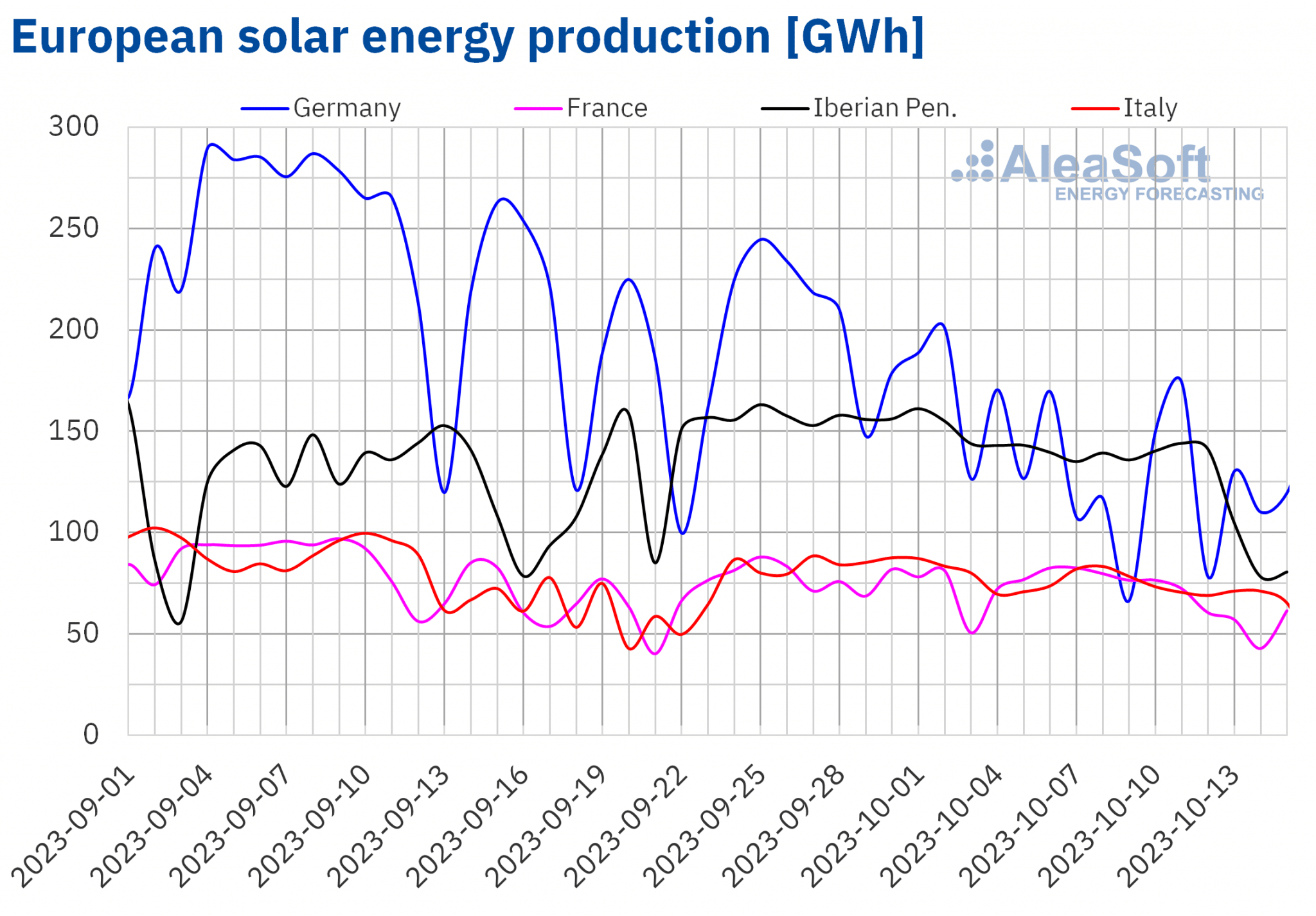

In the week of October 9, solar energy production decreased compared to the previous week in the main European electricity markets. The largest drop, 23%, was registered in the Portuguese market. In the other markets, the drop in solar energy production ranged from 19% in Germany to 8.1% in Italy.

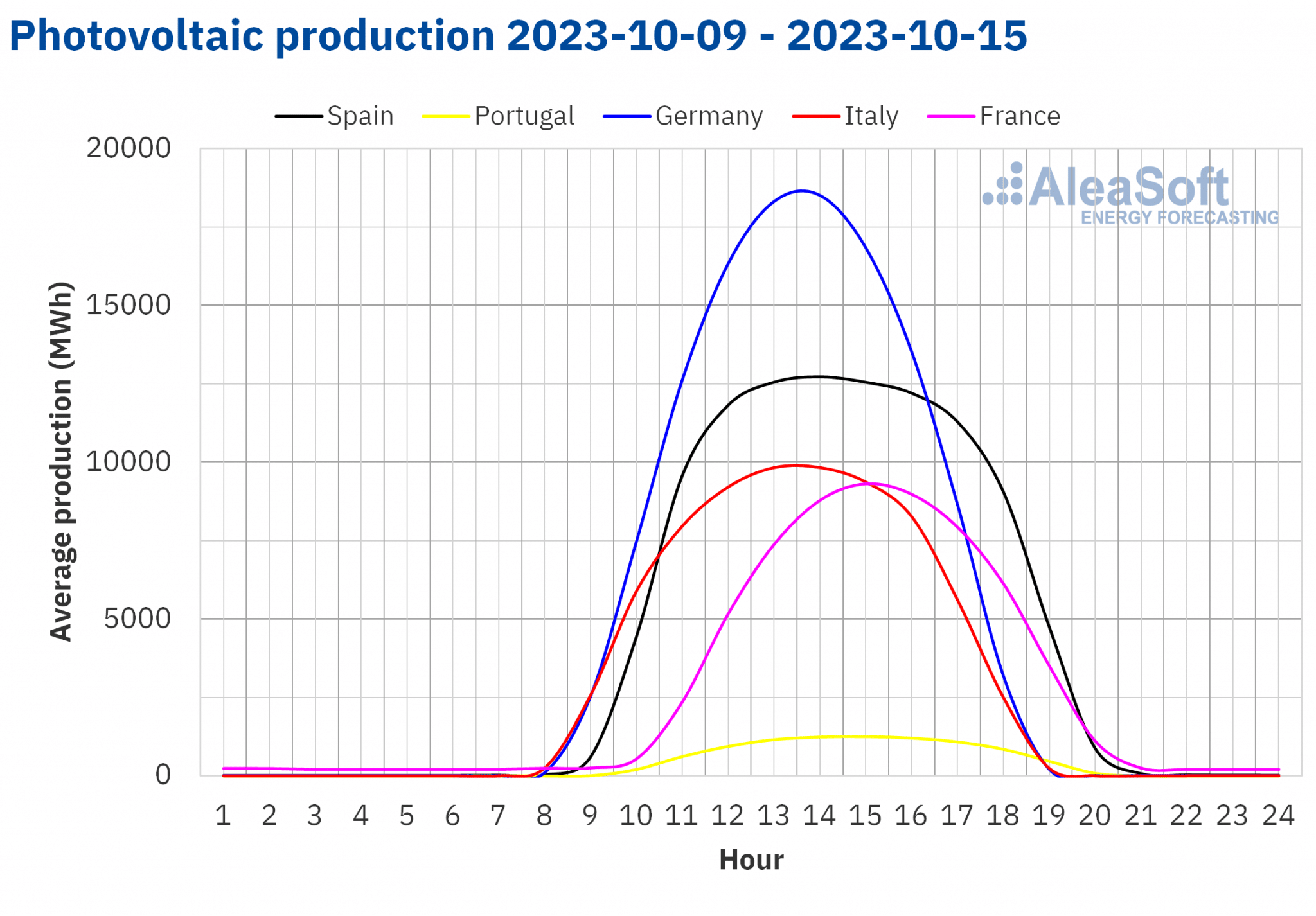

Despite the weekly drop in solar energy production related to the seasonal change, when comparing solar photovoltaic energy production in the first half of October 2023 with the same period in previous years, since 2019, the record was broken in all analyzed markets.

During the first half of October 2023, the highest photovoltaic energy production, 2036 GWh, was registered in the German market, an increase of 5.4% compared to the same period in 2022 and 62% compared to 2019. In Mainland Spain, photovoltaic energy production for the first fifteen days of October 2023 was 1613 GWh, an increase of 37% and 286% compared to the same period in 2022 and 2019, respectively. The lowest production, 160 GWh, was registered in Portugal, but still represented an increase of 33% compared to 2022 and 228% compared to 2019.

For the week of October 16, according to AleaSoft Energy Forecasting’s solar energy production forecasts, solar energy production is expected to decrease in the analyzed markets.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

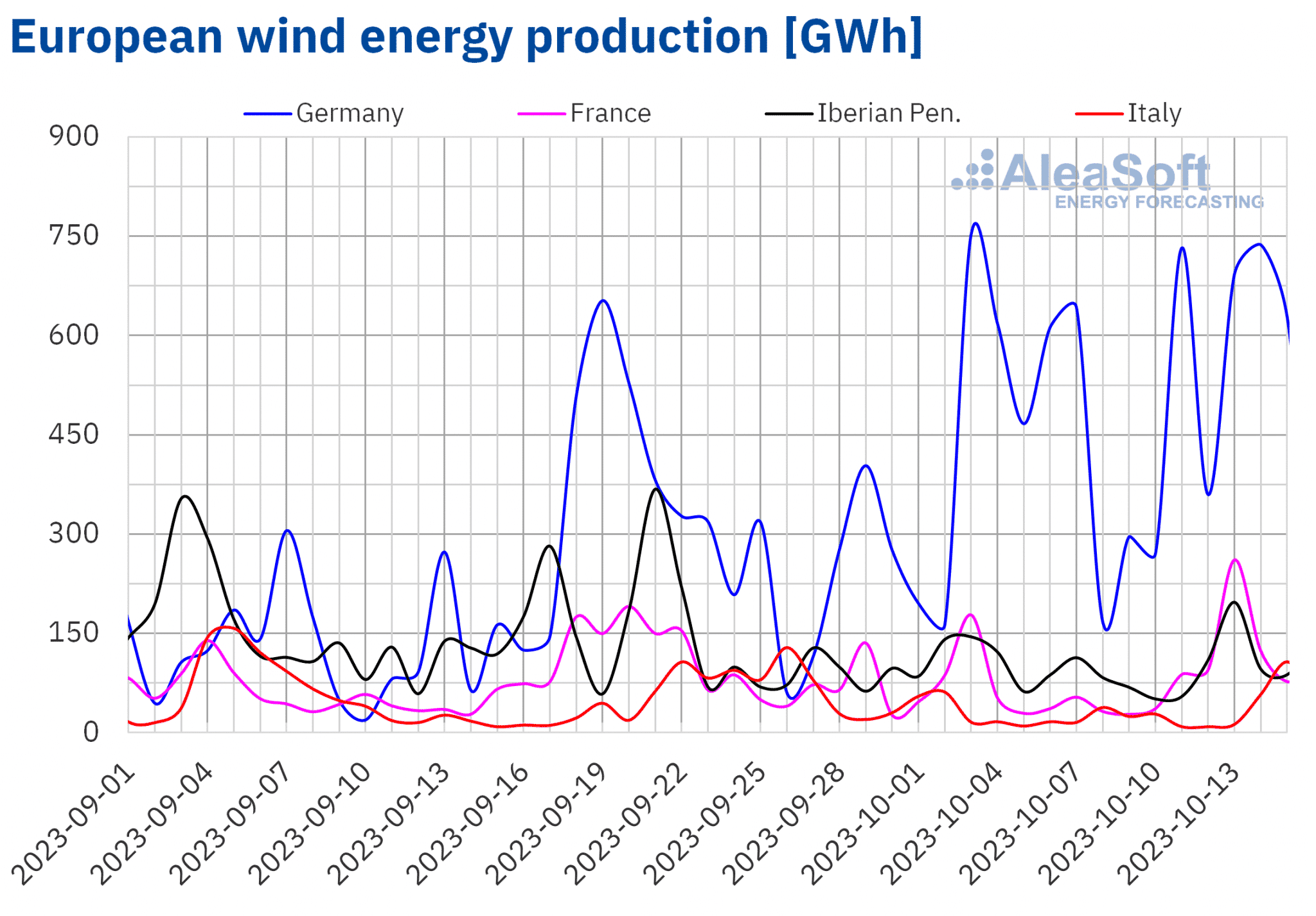

In the case of wind energy production, the week of October 9 brought a week?on?week increase in most of the markets analyzed at AleaSoft Energy Forecasting. The largest increase, 51%, was registered in the French market. In this market, 261 GWh was generated with wind energy on Friday, October 13, which is the highest value registered since the beginning of August. In the other markets, the increase ranged from 8.6% in Germany to 43% in Italy. The exceptions were the markets on the Iberian Peninsula, where overall wind energy production fell by 12% compared to the previous week.

For the week of October 16, AleaSoft Energy Forecasting’s wind energy production forecasts indicate that wind energy production will increase in all analyzed markets, except for Germany.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

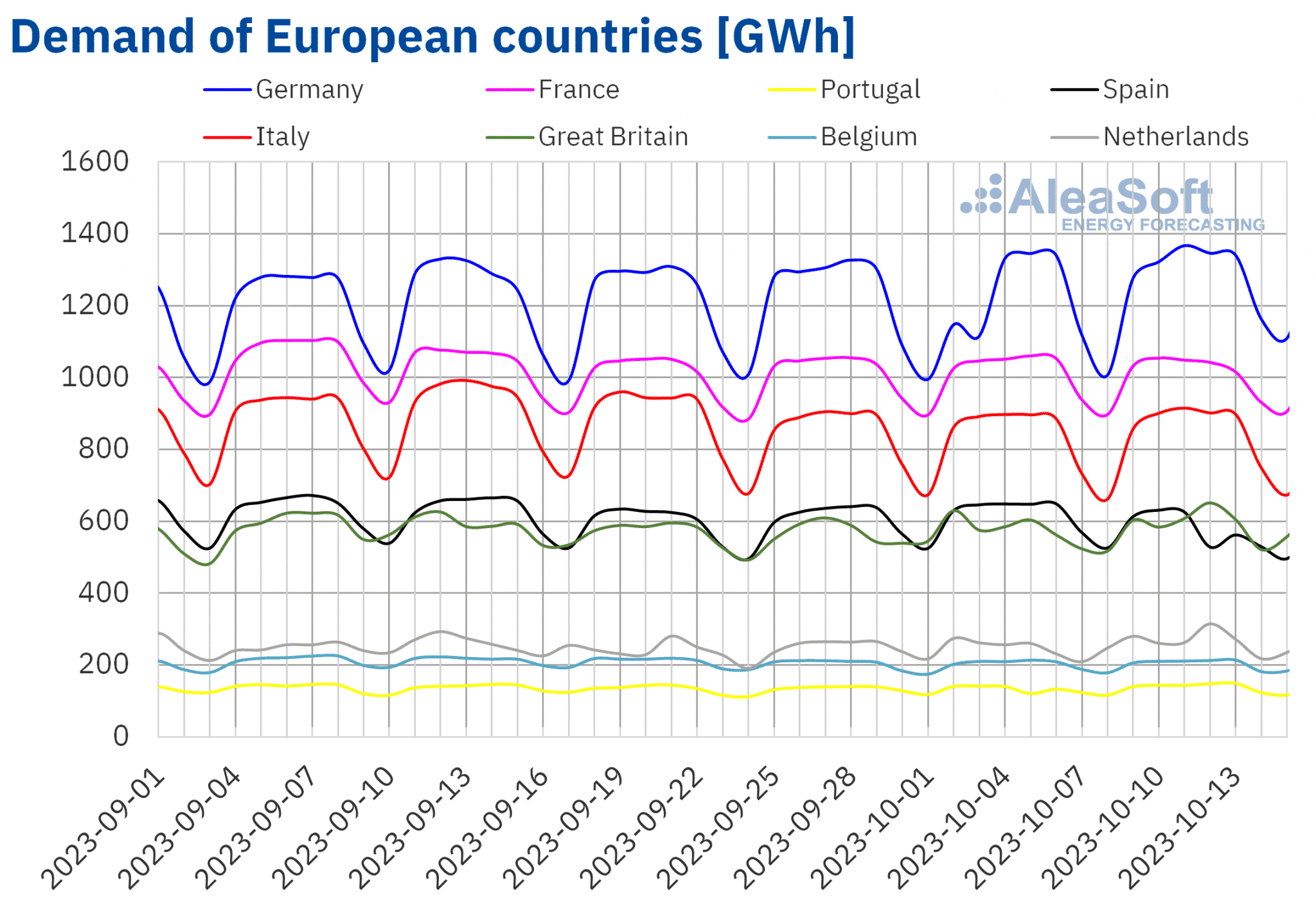

Electricity demand

During the week of October 9, electricity demand increased compared to the previous week in most of the main European markets. Increases ranged from 0.6% in the Belgian market to 6.2% in the German market. In the case of Germany, the rise was related to the recovery of the labor rate after the previous week’s celebration of Germany’s Unity Day on October 3. Something similar happened in Portugal, where Portugal’s Republic Day was celebrated on October 5, which favored a 5.3% increase in demand in that market in the second week of October.

On the other hand, demand fell in only two of the main European electricity markets. In Spain, the drop was 7.6%, and it was related to the celebration of Spain’s National Day on Thursday, October 12. Demand also fell in the French market, in this case by 0.6%.

During the same period, average temperatures fell in most of the analyzed markets, ranging from 2.0 °C in Great Britain to 0.1 °C in Germany and Italy. The exception was France, where average temperatures increased by 0.4 °C compared to the first week of October.

For the week of October 16, according to AleaSoft Energy Forecasting’s demand forecasts, electricity demand is expected to increase in most of the main European markets, with the exception of Germany.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

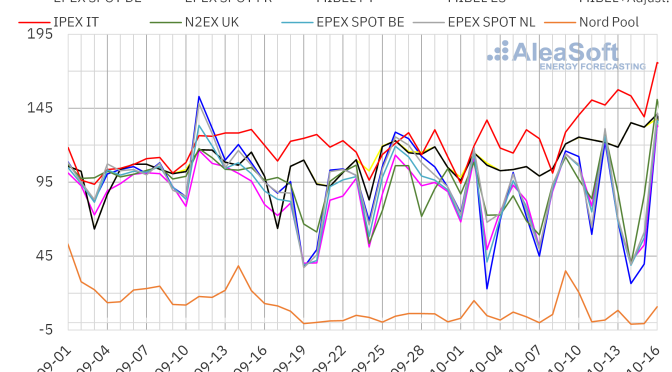

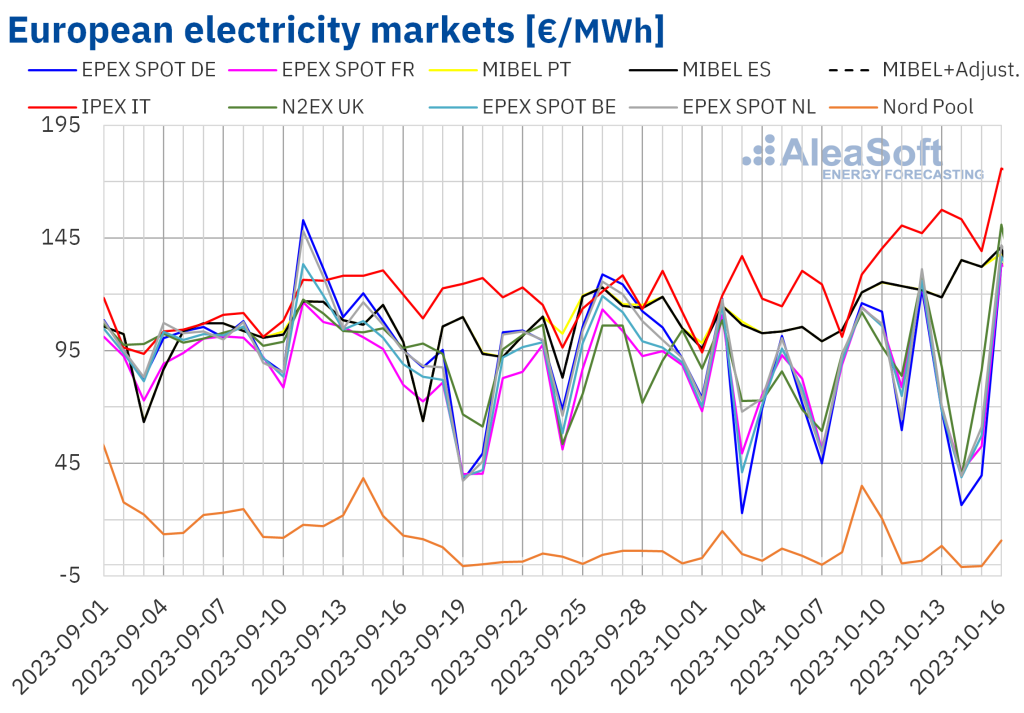

European electricity markets

During the week of October 9, prices in all European electricity markets analyzed at AleaSoft Energy Forecasting rose compared to the previous week. The largest percentage price rise, 70%, was reached in the Nord Pool market of the Nordic countries, while the smallest increase, 1.7%, was registered in the EPEX SPOT market of the Netherlands. In the other markets, prices increased between 5.0% in the EPEX SPOT market of Germany and 20% in the IPEX market of Italy.

In the second week of October, weekly averages were below €95/MWh in most of the analyzed European electricity markets. The exceptions were the Spanish, Italian and Portuguese markets. The Italian market reached the highest average, €145.30/MWh. In the case of the MIBEL market of Portugal and Spain, the averages were €125.39/MWh and €125.41/MWh, respectively. In contrast, the lowest average price, €9.25/MWh, was reached in the Nordic market. In the rest of the analyzed markets, prices ranged from €77.92/MWh in the German market to €90.55/MWh in the N2EX market of the United Kingdom.

Despite the increases in weekly average prices, in the second week of October, negative hourly prices were registered in the German, Belgian, British, Dutch and Nordic markets, influenced by high wind energy production values. The lowest hourly price, ?€7.10/MWh, was reached in the Dutch market on Sunday, October 15, from 14:00 to 15:00.

But in the second week of October hourly prices above €200/MWh were also registered on several occasions in most of the analyzed European markets. This was also the case on Monday, October 16 in all analyzed markets, except for the Portuguese and Nordic markets. On that day, the highest hourly prices were registered from 19:00 to 20:00 CET. In the German, Belgian, French, Italian and Dutch markets, a price of €240.00/MWh was reached. In the case of the French and Italian markets, this price was the highest since August 24. On the other hand, in the case of the Spanish market, an hourly price of €220.00/MWh was reached on October 16 from 19:00 to 20:00 CET, which was the highest price since the end of January. On the same day and hour, the British market also reached the highest hourly price since January, at £241.19/MWh.

During the week of October 9, the rise in the average price of gas and CO2 emission rights, the increase in demand in most markets and the general decline in solar energy production led to higher prices in the European electricity markets. In the case of the MIBEL market, wind energy production in the Iberian Peninsula and nuclear energy production in Spain decreased, contributing to the increase in prices.

AleaSoft Energy Forecasting’s price forecasts indicate that in the third week of October prices in most of the main European electricity markets might continue to rise, influenced by declining solar energy production and increasing demand in most markets. In the case of the German market, the decline in wind energy production might also exert an upward influence on prices.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

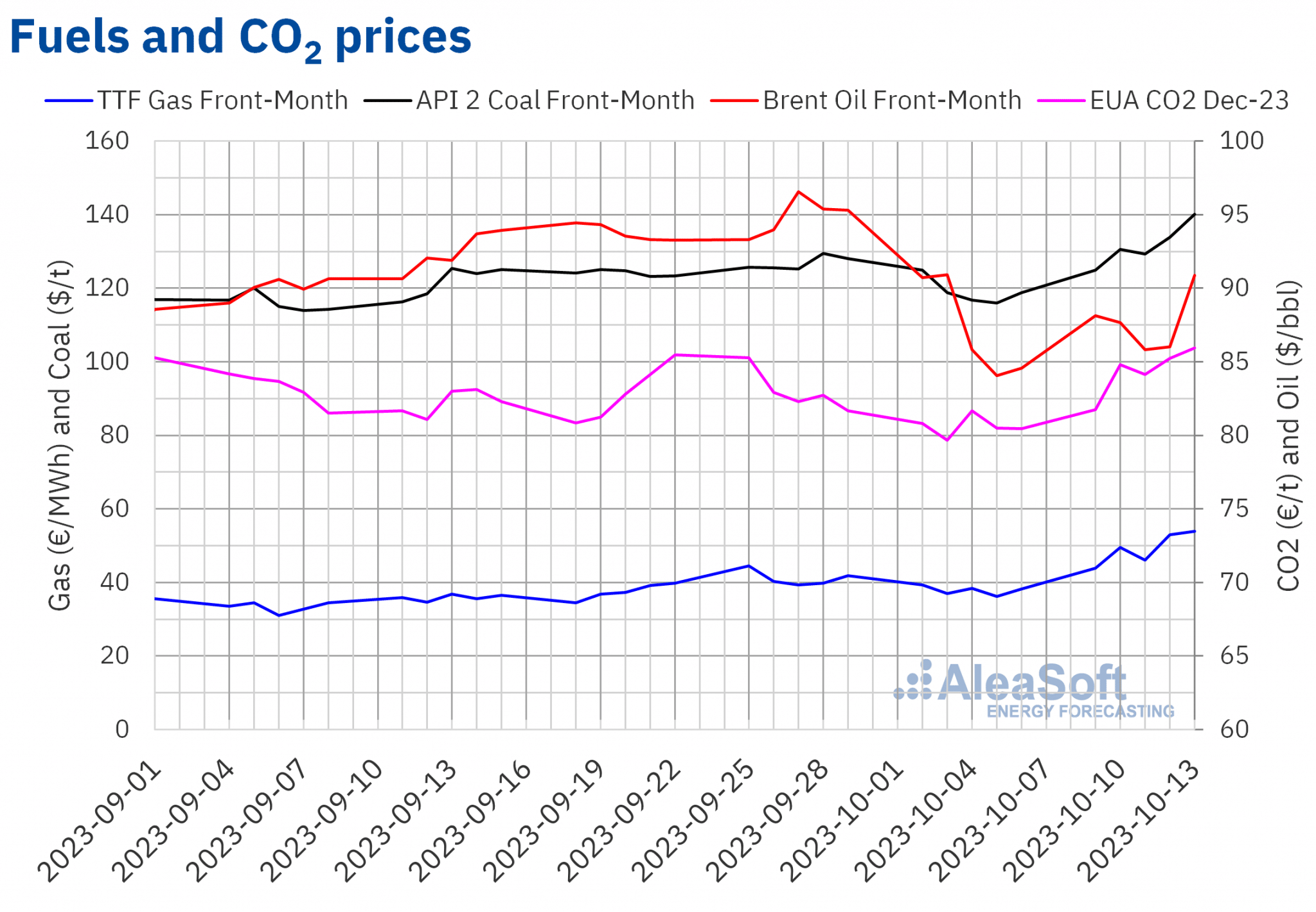

Brent, fuels and CO2

Settlement prices of Brent oil futures for the Front?Month in the ICE market remained above $85/bbl during the second week of October. The weekly minimum settlement price, $85.82/bbl, was registered on October 11. On the other hand, the weekly maximum settlement price, $90.89/bbl, was reached on Friday, October 13. This price was 7.5% higher than the previous Friday.

In the second week of October, concerns about the impact of the Middle East conflict on oil supply and OPEC’s global crude oil demand growth forecasts exerted their upward influence on Brent oil futures prices. However, data showed an increase in crude oil stocks of the United States that exerted some downward pressure. On the other hand, in the second half of the week, the United States started to impose sanctions on tanker owners carrying Russian oil at a price higher than the maximum price imposed by the G7, which might also have an impact on supply.

As for settlement prices of TTF gas futures in the ICE market for the Front?Month, they increased during the second week of October. On Monday, October 9, the weekly minimum settlement price, €43.95/MWh, was reached. This price was already 12% higher than the previous Monday. The weekly maximum settlement price, 53.98 €/MWh, was reached on Friday, October 13. This price was 41% higher than the previous Friday and the highest since mid?February.

In the second week of October, prices were influenced upward by supply concerns due to instability in the Middle East, labor disputes at Australian liquefied natural gas export facilities and a pipeline leak in the Baltic Sea. In addition, the forecast of cooler temperatures in Europe also contributed to price increases, as these would favor an increase in gas demand for heating.

Settlement prices of CO2 emission rights futures in the EEX market for the reference contract of December 2023 remained above €80/t during the second week of October. The weekly minimum settlement price, €81.75/t, was registered on Monday, October 9, and it was 1.2% higher than the previous Monday. Subsequent price increases led to a weekly maximum settlement price of €85.95/t, reached on Friday, October 13. This price was 6.8% higher than the same day of the previous week and the highest since the end of August.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the financing and valuation of renewable energy projects

This Thursday, October 19, at 10:00 CET, a new webinar in the monthly webinar series of AleaSoft Energy Forecasting and AleaGreen will be held. On this occasion, the prospects for European energy markets for the winter 2023?2024 will be analyzed. In addition, the webinar will address the financing of renewable energy projects and the importance of market price forecasting in audits and portfolio valuation. To address these topics, speakers from Deloitte will participate for the fourth time in the webinar of October.