The European Union’s ambitious renewable energy target mandates at least 42.5% of EU energy consumption to come from renewable sources by 2030. For that to happen, developers need positive returns on their renewables investments. With technology costs not evolving as hoped, where will the sources of project profitability come from instead?

Our latest insight analyses current cost dynamics in European renewables markets, assessing the impact of supply chain influences, financing costs and auction prices on wind, solar, and storage technology valuations. Fill out the form to download an extract, or read on for an overview.

Against expectations, the cost of renewable generation is rising

Costs to deploy renewables have risen significantly in 2023. As an example, we’ll look at single-axis tracker (SAT) photovoltaic-based solar generation (a common form of solar array that employs technology to adjust the position of a photovoltaic panel to follow the sun’s position and maximise efficiency).

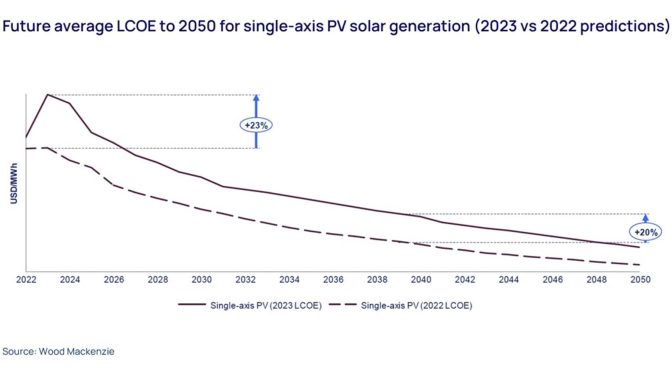

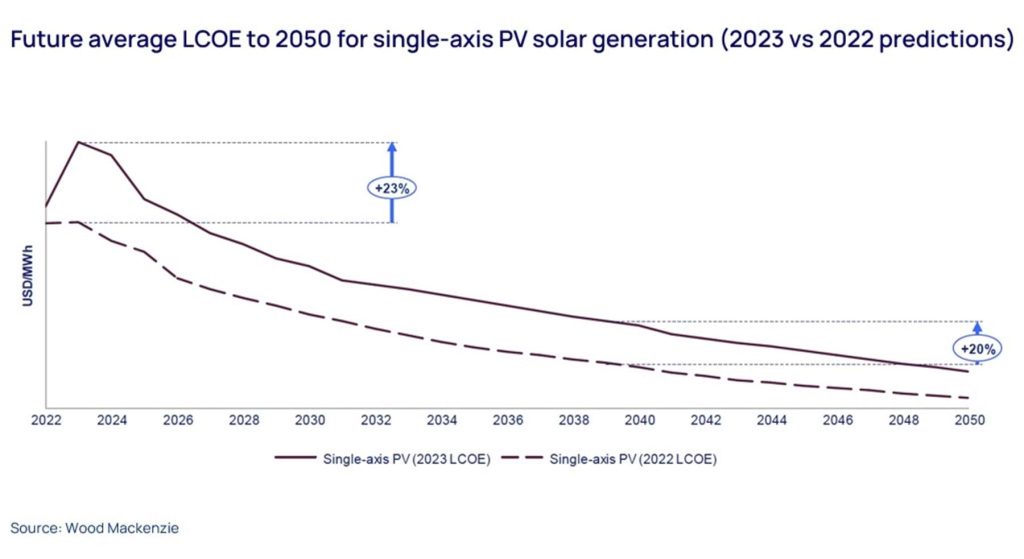

The average levelized cost of electricity (LCOE) for SAT PV generation in Europe has increased by 23% year-on-year from 2022 to 2023. While costs are expected to decline, we forecast they will now be 20% higher in real dollar terms through to 2050 (see chart below).

Supply chain dynamics aren’t developing as hoped

A key factor increasing costs pressures on renewables development is that supply chain costs aren’t evolving as developers had hoped.

Having spiked between 2020 and 2022, generation equipment costs have dropped. They are likely to experience a bump in 2025 as the industry transitions from the current standard mPERC cells to TOPCon cells, which require a higher silver content, before continuing to decline in the second half of the decade.

However, with net-zero policy driving a surge in demand for engineering, procurement and construction and project development expertise, overall system project costs have risen sharply from 2022 benchmarks. Our analysis shows that overall system costs will not reach 2020 levels until the second half of this decade. Domestic content requirement policies will also push up costs, since locally sourced equipment is considerably pricier than imports from Chinese and other foreign manufacturers.

Higher financing costs are eating into profits

Adding to developer’s woes, higher interest rates increase financing costs for new projects. Operational debt interest rates vary between countries within Europe, but have increased significantly year-on-year in all leading markets. As a result, total debt repayments as a percentage of net present value have noticeably increased for countries including Spain, the UK, France and Italy.

Low bid ceiling prices are unsustainable

Historically, bid ceiling prices in Europe have trended down in order to foster price competitiveness in renewables. With costs rising, bid ceiling prices in the last year have been untenable for many developers, leading to significant undersubscription in many recent auction tenders. Spain in particular has been affected –out of nearly 4 GW on offer in the last auction round, almost no bids were offered.

In response, many policymakers in Europe have had to significantly raise bid ceiling prices in order to incentivise market participation in their latest auction rounds.

To achieve healthy returns, developers must be smarter

The good news is that despite increasing cost pressures, positive project returns are still achievable. However, developers will need to focus on efficiency in all aspects of their operational and development strategy. Improvements in equipment procurement cost, generation performance, asset management and cost-of-capital efficiency will be the difference between a profitable and unprofitable project. The difference between a good strategy and a bad strategy can swing project returns around by as much as 4%.

Daniel Liu

Head of Asset Commercial Performance

Daniel’s knowledge of technical, operational and financial aspects of wind and solar power informs his research.