Energy storage is one of the vectors of the energy transition and a necessary partner in the deployment of renewable energies. In Spain, the regulatory framework for storage is expected to be approved in 2024 or early 2025. This situation represents a window of opportunity for companies that want to lead the sector or find a place throughout the value and supply chain.

The massive deployment of renewable energy has triggered a new race in the Spanish energy market: energy storage. In anticipation of a regulatory framework for storage that could be approved next year or early 2025, companies are strategically positioning themselves to be leaders in an evolving market.

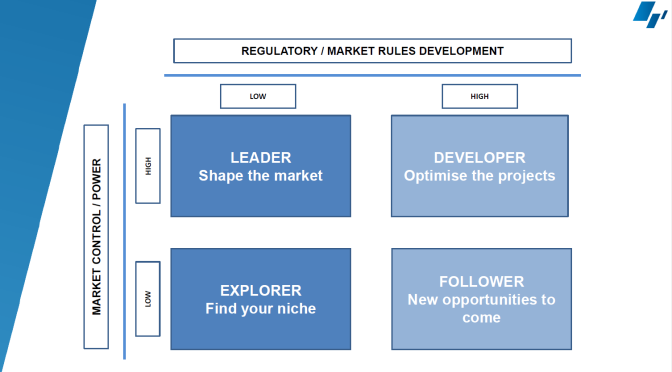

Luis Marquina de Soto, president of AEPIBAL, the Business Association of Batteries and Energy Storage, presented a McKinsey matrix relating a company’s control of a market and the regulatory state of that market in a recent webinar hosted by AleaSoft Energy Forecasting and AleaGreen on November 16. The current emerging regulatory landscape for energy storage in Spain could be an opportunity for companies with a deep understanding of this market to position themselves as leaders. This would be a good time for these companies to take a risk and shape the market, as the risk taken will be highly rewarded.

The outlook for battery storage revenue stacking presented by the president of AEPIBAL suggests that in the early years, batteries will have a significant economic impact by participating in ancillary services. This market, although not large, offers significant revenues due to the current volatility in the prices of these services. However, the entry of more competitors is expected to lead to a decrease in revenues as it is a small market.

In addition, technological innovation is emerging as a key factor in this context. Pioneering companies in the development of advanced storage technologies, such as green hydrogen storage, or new solutions based on Artificial Intelligence for efficient management of stored energy, could play a leading role in redefining the sector.

This period of incomplete regulation for energy storage also offers opportunities for companies with less knowledge of the battery market, as they could find a place in the entire ecosystem that represents the battery supply and value chain.

On the other hand, there are companies that prefer to wait until the regulations are defined. Those with extensive knowledge of the battery market could become good developers, while those less familiar with the business could wait until the regulatory landscape is clearer and an opportunity arises that allows them to get in the game.

It is undeniable that batteries, as well as energy storage in general, are strategic vectors in the energy transition. This fact underlines the importance of actively promoting their development during this period of transformation in the Spanish and European energy markets. The capacity mechanism must be implemented as soon as possible in order to economically support the deployment of batteries. Moreover, it is essential to work on the development of infrastructures for the production and distribution of green hydrogen.

The energy transition is a complex web that requires effective coordination among many parties. Although the renewable energy deployment is progressing well, it is crucial to focus on the energy storage development and to stimulate renewable energy demand in order to maintain investor interest in the renewable energy development. This comprehensive approach will consolidate the progress made so far and ensure a sustainable future in the energy landscape.