In the fourth week of November, MIBEL registered the lowest prices among the main European markets thanks to solar and wind energy. In the other markets, prices were in general higher than in the previous week, although wind energy helped to push prices below €100/MWh over the weekend. Photovoltaic energy registered the production record for a November in the Iberian Peninsula and wind energy in Germany. CO2 futures reached the lowest price in the last year.

Concentrated Solar Power, photovoltaic and wind energy production

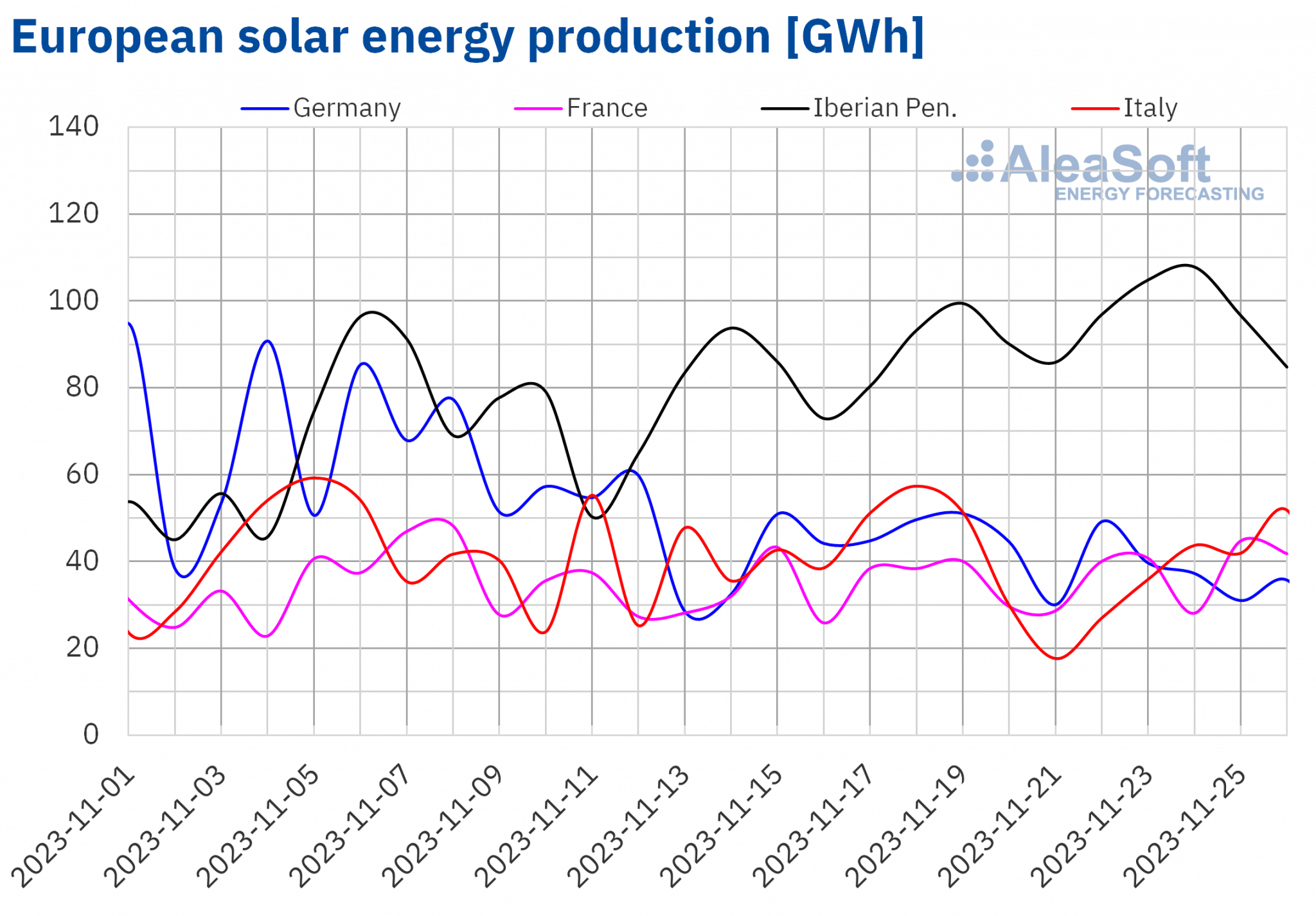

In the week of November 20, most of the main European electricity markets registered an increase in solar energy production compared to the previous week. The Portuguese, Spanish and French markets registered increases of 16%, 8.9% and 3.1%, respectively. On the other hand, production declined in the Italian and German markets. The Italian market registered the largest drop, with a 24% decline, while the German market fell by 11%.

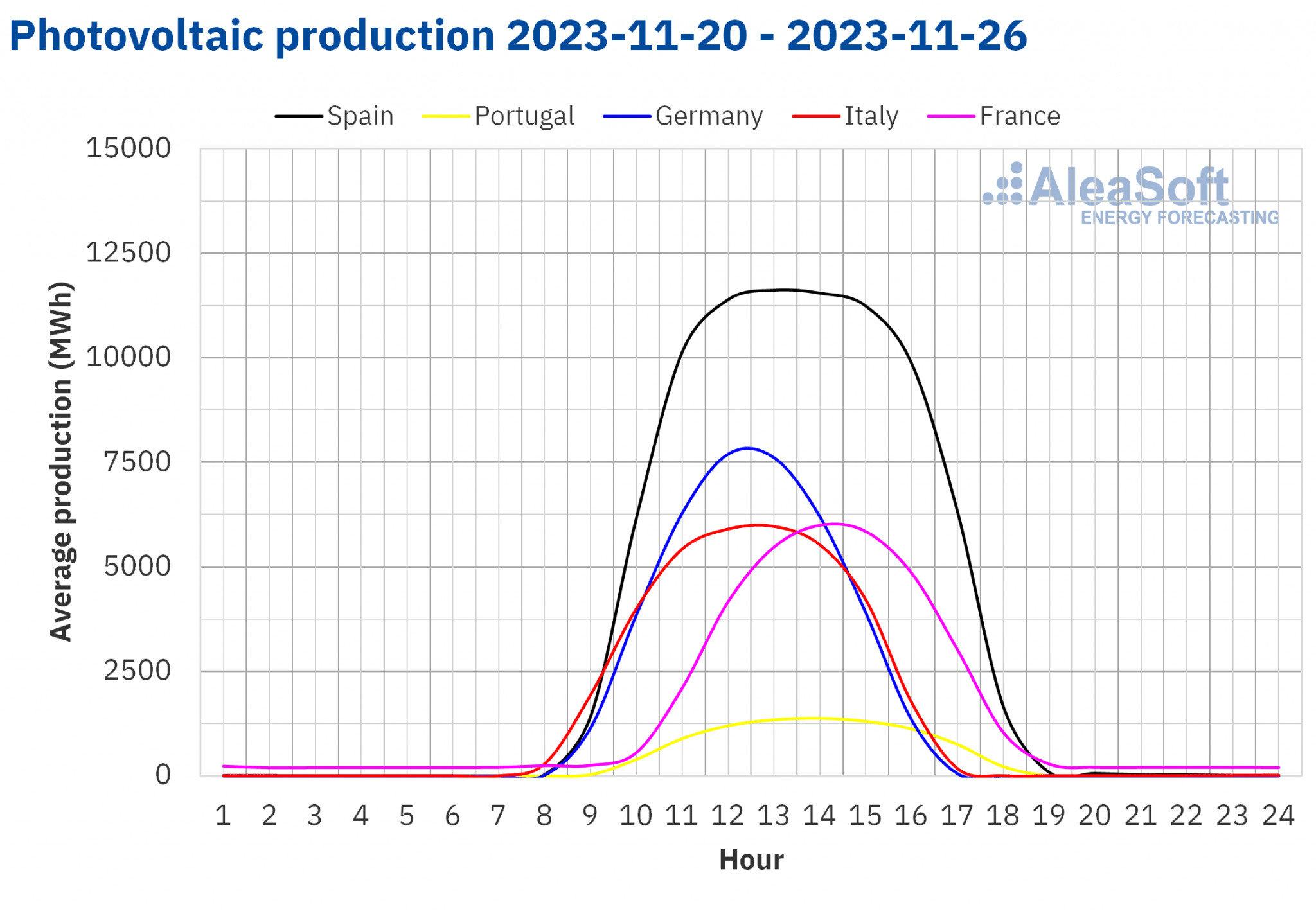

On November 24, solar photovoltaic energy produced 88 GWh in Spain, the highest value since October 21, when it generated 89 GWh. That day’s production exceeded the 84 GWh produced on November 19, making it the highest for a November in history. In Portugal, on November 24, there was also the production record for a November month, with 10 GWh of solar photovoltaic energy production.

According to AleaSoft Energy Forecasting’s solar energy production forecasts, it will decrease in Spain, Germany and Italy in the week of November 27.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

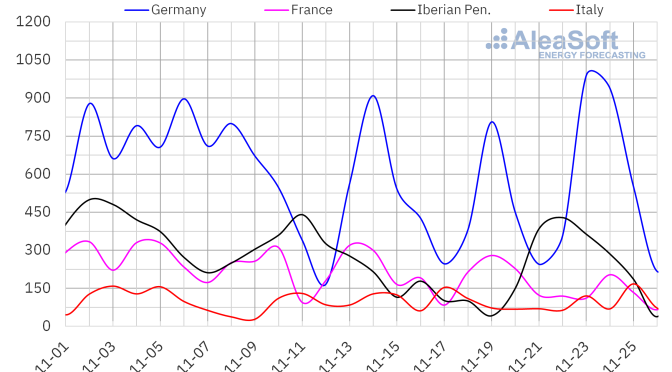

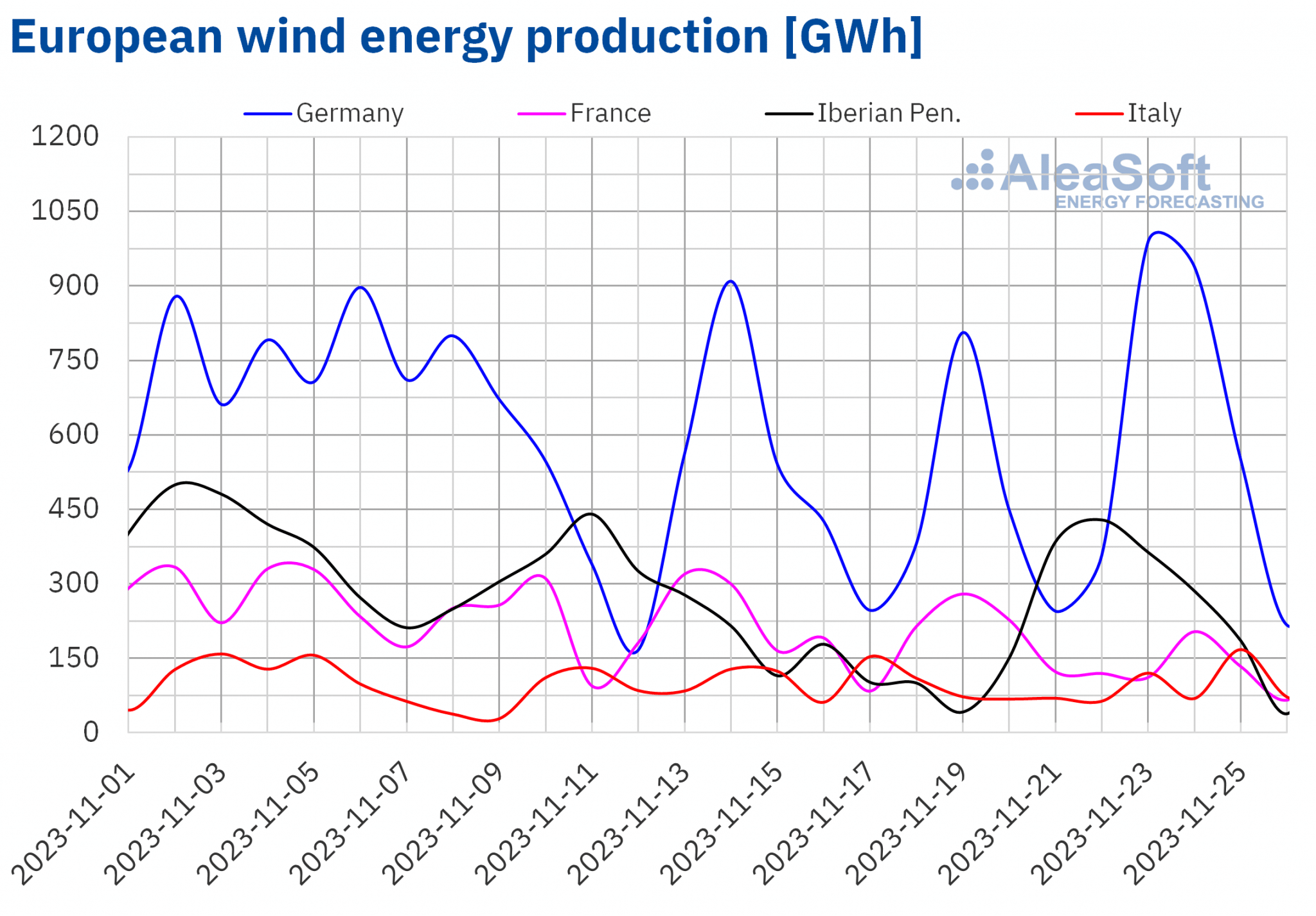

During the week of November 20, wind energy production increased in the Iberian Peninsula compared to the previous week. In the Portuguese market it rose by 115%, while in the Spanish market it increased by 74%. On the other hand, the French, Italian and German markets registered decreases in wind energy generation of 37%, 14% and 3.3% respectively.

Despite the week?on?week drop, on November 23, the German market generated 989 GWh using wind energy, the highest value since the second half of February and an all?time record for daily wind energy production for a month of November in this market. In the case of the Italian market, on November 25, the production using this technology was 168 GWh, the highest since the first fortnight of January and the second highest for a month of November, after the one reached on November 22, 2022, of 176 GWh.

According to AleaSoft Energy Forecasting’s wind energy production forecasts, there will be an increase in production using this technology in the Iberian Peninsula and Italy in the week of November 27, while it will decrease in the markets of France and Germany.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE and TERNA.

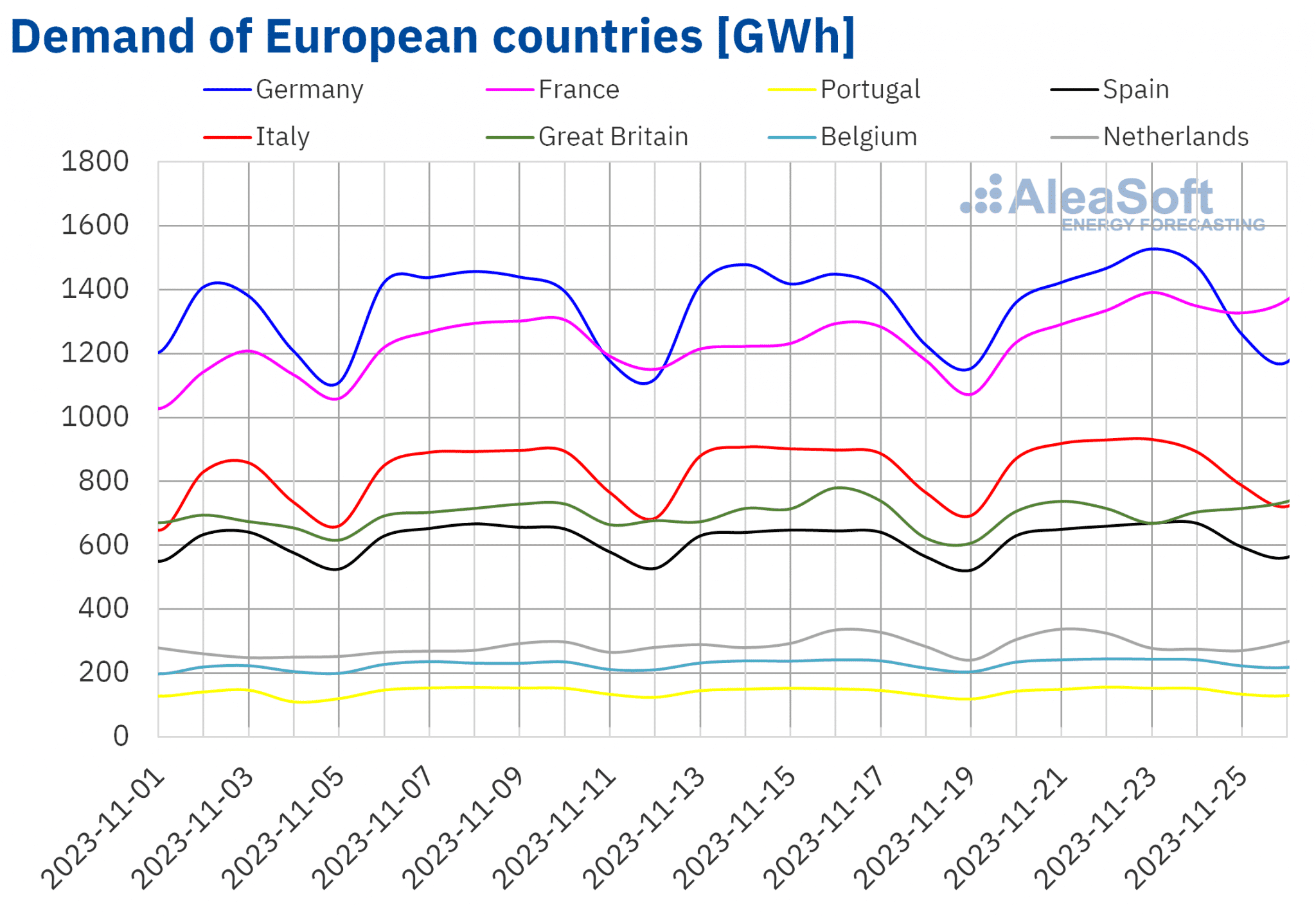

Electricity demand

In the week of November 20, electricity demand increased in the main analyzed European markets with respect to the previous week. The French market registered the highest growth, with an increase of 9.4%. The German market registered the smallest increase, 1.5%. In the remaining markets, demand rose, ranging from 2.0% in Italy and the Netherlands to 3.4% in Spain.

During the week of November 20, all analyzed markets registered decreases in average temperatures compared to the previous week. Spain had the largest drop, 4.1 °C, while the Netherlands had the smallest decrease, 1.9 °C. Elsewhere, temperatures fell between 3.8 °C of Portugal and 2.1 °C of Great Britain.

According to AleaSoft Energy Forecasting’s demand forecasts, there will be an increase in electricity demand in all analyzed markets during the last week of November.

Source: Prepared by AleaSoft Energy Forecasting using data from ENTSO-E, RTE, REN, REE, TERNA, National Grid and ELIA.

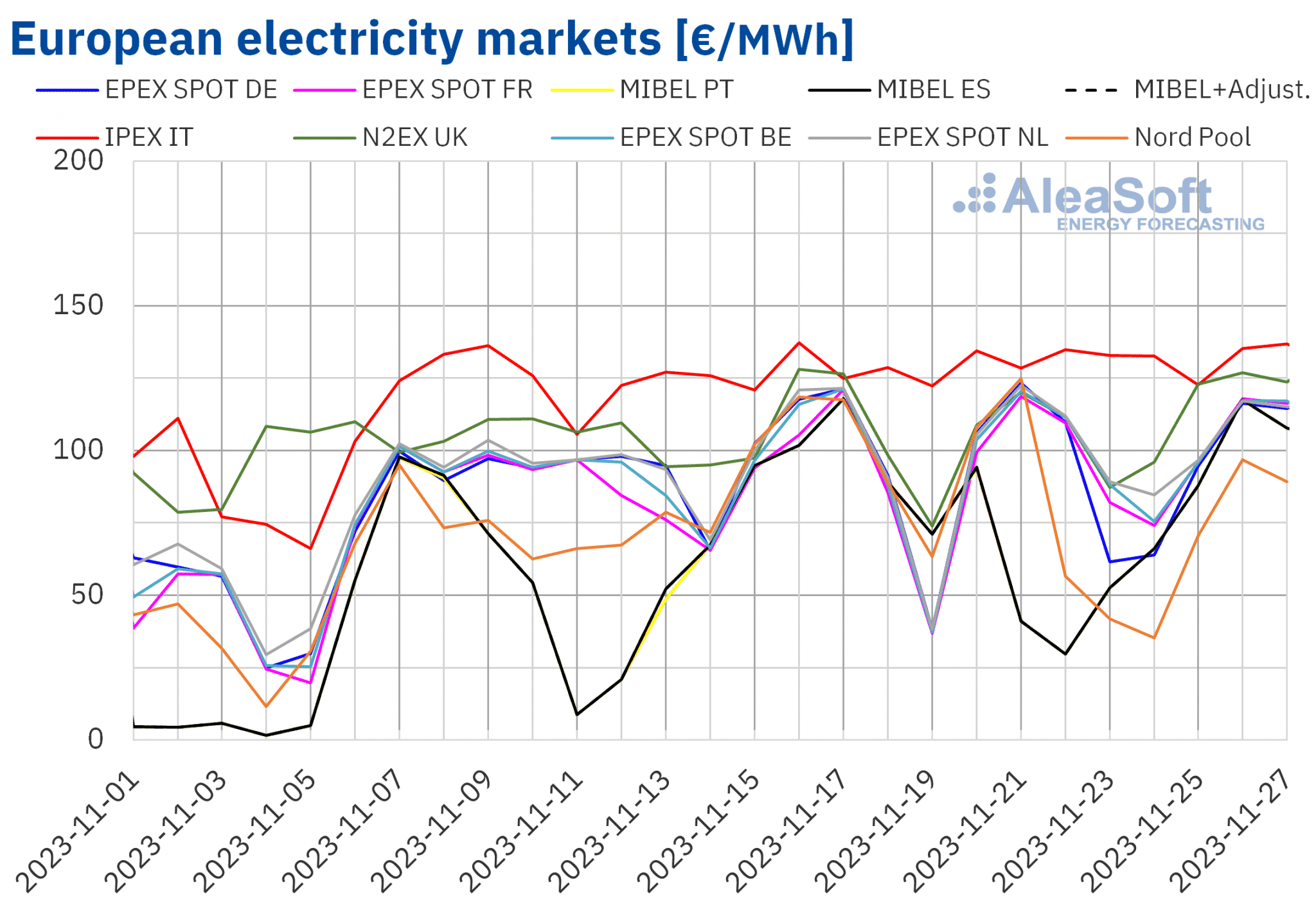

European electricity markets

From November 23 to November 25, daily prices were below €100/MWh in almost all major European electricity markets, influenced by high levels of wind energy production. However, higher prices on the remaining days of the fourth week of November resulted in weekly averages higher than those of the previous week in most of the markets analyzed at AleaSoft Energy Forecasting. The exceptions were the Nord Pool market of the Nordic countries, with a price decline of 17%, and the MIBEL market of Portugal and Spain, with declines of 17% and 18%, respectively. In the rest of the analyzed markets, prices increased between 3.8% in the IPEX market of Italy and 19% in the EPEX SPOT market of France.

In the fourth week of November, weekly averages were below €105/MWh in most of the analyzed European electricity markets. The exceptions were the N2EX market of the United Kingdom and the Italian market, where prices were €110.50/MWh and €131.61/MWh, respectively. In contrast, the Portuguese and Spanish markets registered the lowest averages, €69.78/MWh and €69.83/MWh, respectively. In the rest of the analyzed markets, prices ranged from €76.24/MWh in the Nordic market to €103.97/MWh in the Dutch market.

Between November 20 and 22, the MIBEL market had the lowest daily prices compared to the rest of the main European markets. Since October 26, this has been the case for 20 days.

In the case of the Portuguese market, despite registering the lowest weekly average, on Sunday, November 26, from 18:00 to 19:00, it reached its highest hourly price since October 23, €156.68/MWh. On the other hand, the German, Belgian, French and Dutch markets registered hourly prices below €2/MWh on Friday, November 24. The German market reached the lowest hourly price, €0.10/MWh.

During the week of November 20, the 3.6% increase in the average gas spot price compared to the previous week and the general increase in electricity demand exerted an upward influence on prices in European markets. In addition, the weekly average of wind energy production also declined in most markets. In the MIBEL market, the significant increase in wind energy production on the Iberian Peninsula, together with the increase in solar energy production, led to lower prices.

AleaSoft Energy Forecasting’s price forecasts indicate that in the last week of November, prices in European electricity markets might continue to rise, influenced by increased demand. In addition, in some markets such as Germany and France, wind energy production might decline, contributing to this behavior.

Source: Prepared by AleaSoft Energy Forecasting using data from OMIE, EPEX SPOT, Nord Pool and GME.

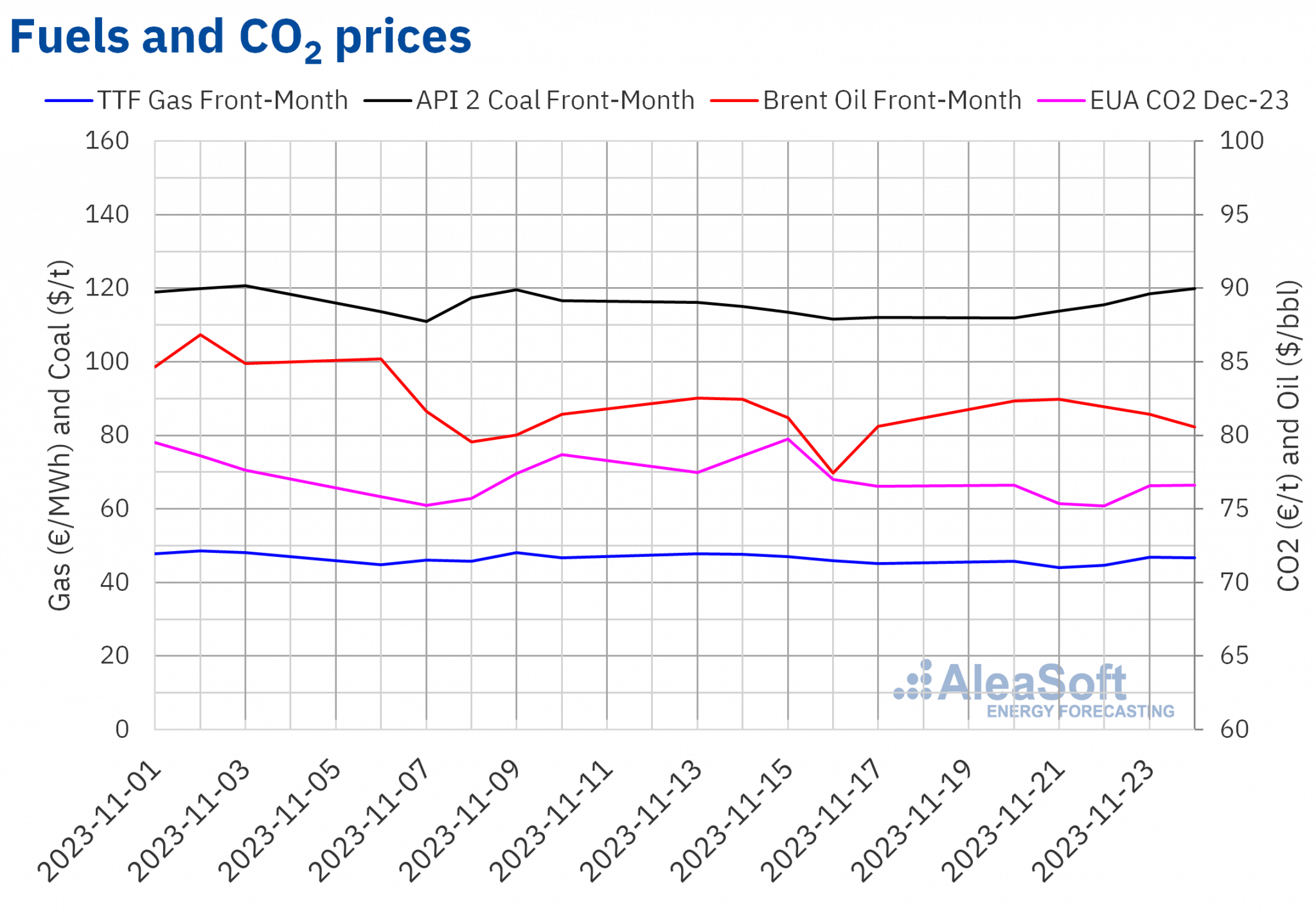

Brent, fuels and CO2

In the first sessions of the fourth week of November, Brent oil futures prices for the Front?Month in the ICE market increased. These futures registered their weekly maximum settlement price, $82.45/bbl, on Tuesday, November 21. However, on the remaining days of the fourth week of November, prices declined to reach the weekly minimum settlement price, $80.58/bbl, on Friday, November 24. This price was virtually unchanged from the previous Friday’s price, $80.61/bbl.

On Wednesday, November 22, OPEC+ announced that it postponed its next meeting until Thursday, November 30. This exerted its downward influence on Brent oil futures prices. On the other hand, high production levels, the lifting of sanctions on Venezuela and the increase in U.S. reserves also contributed to the decline in prices. As a result, despite the increases registered in the first sessions of the fourth week of November, in the last session of the week the settlement price was slightly lower than on Friday, November 17.

As for TTF gas futures in the ICE market for the Front?Month, they registered their weekly minimum settlement price, €44.06/MWh, on Tuesday, November 21. According to data analyzed at AleaSoft Energy Forecasting, this price was the lowest since the first half of October. On the other hand, after a 5.0% increase from the previous day, TTF gas futures reached the weekly maximum settlement price, €46.83/MWh, on Thursday, November 23.

During the fourth week of November, forecasts of low temperatures in Europe exerted an upward influence on prices. But high levels of European reserves and abundant supply caused these futures to reach the lowest price since October.

As for settlement prices of CO2 emission rights futures in the EEX market for the reference contract of December 2023, in the fourth week of November they were below €77/t. These futures registered their weekly minimum settlement price, €75.19/t, on Wednesday, November 22. This price was the lowest since that registered on November 22, 2022 for the reference contract of December 2022. In the last sessions of the fourth week of November, prices increased again. The settlement price of Friday, November 24, €76.60/t, coincided with the settlement price of Monday, November 20. This settlement price was the highest in the fourth week of November.

Source: Prepared by AleaSoft Energy Forecasting using data from ICE and EEX.

AleaSoft Energy Forecasting’s analysis on the prospects for energy markets in Europe and the energy transition

On Thursday, December 14, AleaSoft Energy Forecasting and AleaGreen will hold their December webinar. This webinar will analyze the prospects for energy markets in Europe for 2024. It will also address AleaSoft services for the energy sector. In addition, they are already organizing the first 2024 webinar of the monthly webinar series. The webinar will take place on January 18. The January webinar will feature speakers from PwC Spain for the fourth time.