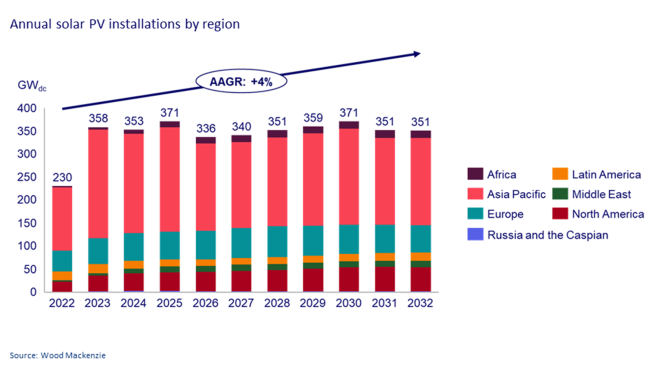

Our latest quarterly global solar PV forecast has seen a 5% upgrade, projecting over 3 TWdc of new solar PV installations between 2023 and 2032. Decarbonisation and electrification commitments at a government and corporate level, along with expanding auction plans and rooftop solar mandates, are the main drivers behind this expansion. This, along with continued improvements in solar cost-competitiveness against other generation technologies result in average annual growth of 4% over our solar forecast.

Our Global solar PV market outlook update covers the global trends and regional variations that inform our forecasts, helping the industry better understand this fast-paced sector and make more informed decisions. Fill in the form to access your complimentary extract, and read on for some key highlights.

Chart shows annual solar PV installations by region

Global solar PV is expected to grow by 56% in 2023 compared to 2022

Solar buildout is accelerating in all regions driven by increased electrification, policy support, energy economics and coal power plant retirements. Sparked by the Inflation Reduction Act (IRA), North America will increasingly make up a larger share of global installations, reaching 15% in 2032.

We project global installations will reach almost 360 GWdc by the end of the year. China alone is set to account for over half of global annual capacity additions, keeping its undisputed position as the largest solar market globally.

The lack of available grid capacity and flexibility are the main constraints on solar growth

Grid congestion is particularly acute in Europe, where transmission grids cannot keep up with the rapid expansion of solar capacity. The European Commission estimates about €600 billion of grid investment is needed per year to meet decarbonisation goals.

Similar bottlenecks are worsening in the Americas and in parts of Asia Pacific, the Middle East and Africa, with connection timelines reaching over ten years in some countries.

Retail rate volatility and third-party ownership push distributed solar PV growth in Europe and China

Increases in household and non-household retail rates continue to be a major force behind record growth for residential and for commercial and industrial (C&I) solar PV in European markets like the Netherlands, Romania and Sweden.

According to Eurostat, increases in electricity bills in the first half of 2023 compared to the first half of 2022 are up anywhere from 60% (household rates in Romania) to 950% (in the case of household rates in the Netherlands). This has driven record installation volumes for residential and C&I solar PV installations this quarter in these markets. Cumulative distributed PV in the top 12 European markets is set to triple over the next decade.

China is also seeing tremendous growth in distributed solar, where residential and C&I PV already represents more than half of total solar capacity expected to be installed by the end this year.

Lower module prices are improving the economics of distributed PV systems in China, with free-on-board Mono PERC modules now standing at US$0.15 per watt. Moreover, the adoption of third-party ownership models continues to contribute to the expansion of residential solar in the top Asian market, making solar more affordable for a broader consumer base.

Southern Europe remains one of the fastest-growing regional markets for solar

Our latest Southern Europe solar market outlook foresees cumulative solar capacity in the region will quintuple by 2032, reaching 215 GWdc. Spain and Italy alone are projected to build 92 GWdc of new solar capacity in the next ten years.

While exceptional solar production, increasing government solar targets and the REPowerEU plan all drive installed capacity expansions in the region in the 2020s, such a significant ramp-up of solar capacity will lead to increasing price cannibalisation and low capture rates, unless energy storage policy and market incentives are created.

Learn more about the global solar outlook

To find out more about global solar market trends, and gain access to charts detailing regional variations, fill out the form at the top of the page to download your complimentary extract from our Global solar PV market update.

Juan Monge

Principal Analyst, Distributed Solar, Europe